What numbers are involved in calculating depreciation using the straight-line method?

Linear is the method of calculating depreciation of an asset, which allows its value to be evenly transferred to the cost of finished products (work performed, services rendered).

To calculate the monthly depreciation amount using this method, you will need two figures:

- the initial cost of the asset (determined by the norms of clause 8 of PBU 6/01 “Accounting for fixed assets”, Article 257 of the Tax Code of the Russian Federation);

- useful life (established according to the rules of paragraph 4 of PBU 6/01, paragraph 1 of Article 258 of the Tax Code of the Russian Federation).

A distinctive feature of this method is equal monthly depreciation charges. That is, having calculated this indicator once, you will not need to make additional calculations if you do not plan to change the depreciation method.

Accrual procedure

Deductions are made from the first day of the month following the date the asset is registered.

This process is completed only in two cases:

- after full transfer of cost to finished products;

- disposal of an object from the enterprise’s property as a result of sale, theft, breakdown and other cases.

In this case, depreciation charges cease to be accrued from the first day of the month following the date of exclusion of the asset from the organization’s property.

Accrual may be temporarily suspended if:

- the object is mothballed for a period of more than three months;

- the property has been under reconstruction or modernization for over a year.

Once the assets are returned to production, deductions should be resumed. The annual depreciation amount must be calculated taking into account the replacement cost.

Sometimes the assets of an enterprise include assets that were used in other organizations. Such objects include:

- contributions to the authorized capital;

- fixed assets acquired after reorganization;

- assets purchased are not new.

For such objects, the rules, calculation and procedure for calculating depreciation are exactly the same as for new ones. However, it is worth considering the length of their stay in another company. For current accounting, it is necessary to subtract the time of its actual operation from the useful life period. All accumulated depreciation for this object in another company is taken together with the book value of the asset.

Accounting for depreciation is carried out using contra account 02. In the course of its activities, the enterprise records with postings all cases of movement of the accumulated amount. For example:

| Operation | Debit | Credit |

| Depreciation accrued | 20 (23, 25, 26, 29, 44) | 02 |

| Write-off upon disposal of fixed assets | 02 | 01/select |

| Markdown when revising the cost of fixed assets | 02 | 84 (91.2) |

| Overestimation of depreciation | 83 (91.1) | 02 |

All these entries are entered into the transaction journal based on the depreciation calculation sheet. The cost of fixed assets is subject to transfer to finished products on a monthly basis .

The amount of depreciation, additional accruals and markdowns as a result of the revision of the value of assets should be promptly entered into the inventory card of the object.

Divide the cost of the asset by the months of use (calculation example)

If the useful life (LPI) of an asset is expressed in months, the formula for calculating the monthly straight-line depreciation amount (SA) is as follows:

SA = PSA / SPI,

where PSA is the initial (replacement) cost of the asset.

Let us use an example to show the calculation of depreciation using the linear method.

PJSC North Wind has established a straight-line depreciation method for purchased technological equipment in 2021. The cost of its purchase and commissioning, excluding VAT, is RUB 7,498,224. The useful life of the asset is 36 months. In January 2021, work was completed to prepare the equipment for operation and it began to be used.

The monthly depreciation amount was:

CA = 7,498,224 / 36 = 208,284 rub./month.

The SA indicator can be calculated using another formula (clause 2 of Article 259.1 of the Tax Code of the Russian Federation):

SA = PSA × 1 / SPI × 100%

Let’s substitute the data from the example into it and calculate linear depreciation:

CA = 7,498,224 × 1 / × 100% = 208,284 rub./month.

The calculation result using both formulas is the same.

How are calculations made in practice?

The primary cost of the object will be the basis for calculation. It is easy to determine - sum up all the costs of purchasing or constructing a particular object.

The replacement cost indicator is used if the value of the property has been revalued.

The classification list of fixed assets will help determine the operational period of the objects. It is here that they are divided into a certain number of groups.

But the organization itself can set operational deadlines if it is not on this list.

In this case, the calculation goes to:

- Operating conditions in the near future.

- Physical wear and tear, its estimated value.

- Predicted time of use.

For calculations, the formula is usually used:

K=(1:n)*100

N – designation of service life, in annual equivalent.

K – depreciation rate for the year.

The result obtained is divided by 12 if it is necessary to determine the monthly norm.

As for the linear method of calculating depreciation costs, in this case the formula looks slightly different:

A=C*K/12

K – Symbol of depreciation rate.

C – Data on the property, its original cost.

A – Depreciation group of deductions by month.

Dividing by 12 becomes unnecessary if depreciation deductions are calculated for the year.

An example of calculating depreciation using the straight-line method

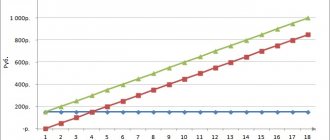

A fixed asset worth 1,000,000 rubles was added to the company’s balance sheet in March. The accountant determined that its operational life, according to differentiation by depreciation groups, will be 10 years.

The procedure for calculating depreciation using the straight-line method for this example:

- We determine the annual depreciation rate: K = 1/10*100% = 10%.

- The monthly depreciation rate will be: 10%/12 = 0.83%.

- We determine the amount of monthly depreciation charges:

1,000,000*10%/12 = 8333 rubles.

- The amount of depreciation charges for the year of operation is:

1,000,000 rubles /10 years = 100,000 rubles.

Thus, using the straight-line method, depreciation must be calculated from April in the amount of 8,333 rubles per month.

Versatility and computational simplicity are not the only advantages of the method

The linear method has two main advantages:

- universality - the absence of differences between the algorithms for accounting and tax accounting and calculation of depreciation, which eliminates the need to reflect differences according to PBU 18/02 “Accounting for calculations of corporate income tax”;

- simplicity of calculation - when choosing the linear method of calculating depreciation, complex and regular calculations of depreciation are not needed; a simple formula is used when putting the asset into operation.

In addition, two more features of the method can be mentioned that distinguish it from nonlinear algorithms for calculating depreciation:

- Uniform inclusion of depreciation in costs. A uniform write-off of depreciation will be an advantage of the linear method if it is more profitable and convenient for the company to transfer costs in the amount of depreciation to the cost evenly. For example, when putting an object into operation, it is planned that it will generate the same profit throughout the entire period of use. If the greatest profit is expected to be received in the first months of operation of the asset and there is an interest in writing off the largest amounts of depreciation during this period, a non-linear accrual method should be chosen.

- Accounting accuracy. Unlike non-linear methods, where depreciation is calculated for a group of objects in a depreciation group, the linear method allows you to track the amount of accumulated depreciation and the residual value for each specific object. To do this, it is enough to build competent analytical accounting for accounts 01 “Fixed assets” and 02 “Depreciation of fixed assets”.

What is this method?

The straight-line method is an accrual method in which the cost of fixed assets is transferred to finished products evenly throughout the entire period of operation .

The basis for such calculations is the initial cost. It is the sum of all costs spent on purchasing the asset, its delivery, installation and commissioning.

If the company revalued its property, then the replacement cost is used in the calculations.

Calculating the amount of depreciation is impossible without establishing the duration of the service life. It is recommended that its duration be determined in accordance with the state-developed classification of fixed assets. However, it is possible to independently forecast the period of operation of the property. To do this, the following factors are analyzed:

- physical wear and tear, which is associated with the mode and working conditions;

- possible period of use corresponding to the power of the equipment;

- regulations and other legal restrictions on the time of use of the asset.

The positive aspects of using this method include the following:

- simplicity of calculations, no need to do lengthy calculations and understand complex formulas;

- the value of the property is transferred evenly to the finished product;

- depreciation is calculated for each object;

- this method is used in tax accounting;

- no regular recalculations are required;

- suitable for calculating depreciation of real estate.

Along with the advantages, there are also a number of disadvantages due to the peculiarities of production:

- the deterioration of the original condition of the equipment over time is not taken into account;

- obsolescence is not taken into account;

- not suitable for large organizations that use equipment unevenly, that is, when some machines are idle;

- the load on the means of production is not taken into account.

The negative consequences of using the linear method are inferior to the advantages. That is why the vast majority of enterprises choose it for accounting.

Technological progress and the linear method

The advantage of straight-line write-off of depreciation, which underlies the straight-line method, completely disappears if the company's assets are subject to rapid obsolescence.

These could be cars, machine tools, exclusive rights to computer programs and other non-financial assets, the use of which becomes ineffective due to the emergence of new, more advanced models and designs.

Real estate can also become obsolete if it no longer meets modern requirements for ergonomics, quality and volume of services provided.

If technological progress and changing requirements influence the rapid obsolescence of an asset, the feasibility of using non-linear methods should be considered when choosing a depreciation model.

In this case, straight-line depreciation does not provide a sufficient concentration of resources necessary to replace the asset. For those companies that plan to quickly update production assets, it is more profitable to use non-linear methods of calculating depreciation.

Accrual stages

The depreciation process must be carried out in accordance with established rules and requirements. They apply to all methods, including linear.

Basic Rules:

- Depreciation charges are introduced from the month following the date of commissioning and putting the object on the balance sheet.

- Calculated monthly deductions are made regardless of profit or other financial results.

- Deductions are subject to accounting in the corresponding tax period.

- If the facility is not in use for more than 3 months or is under repair for more than 1 year, deductions are suspended.

- If property rights are lost, written off due to wear and tear, or completely removed from the balance sheet, depreciation will stop accruing from the next month.

It must be taken into account that the linear calculation is carried out for each OS object separately. At the same time, the initial (or replacement) cost of the object is a constant factor.

Therefore, having calculated the annual and monthly depreciation rates, these indicators do not change until decommissioning.

conclusions

The linear method of calculating depreciation assumes that physical wear and tear of the property occurs evenly throughout the entire operational period. This mainly applies to stationary structures, which do not wear out and become obsolete as quickly as equipment.

If it is impossible to accurately determine the rate of depreciation of property, then the linear method will be the most convenient and simplest. This method is also suitable if the company purchases property for a long period of use and does not plan to quickly replace it.

Sources

- https://www.klerk.ru/buh/articles/481913/

- https://FBM.ru/bukhgalteriya/linejjnyjj-sposob-dlya-nachisleniya-amort.html

- https://investolymp.ru/linejnyj-metod-nachisleniya-amortizaczii.html

- https://sovetkadrovika.ru/spravochnik/raschet/amortizacii-linejnym-sposobom.html

- https://nalog-nalog.ru/nalog_na_pribyl/rashody_nalog_na_pribyl/linejnyj_metod_nachisleniya_amortizacii_osnovnyh_sredstv_primer_formula/

- https://PravoDeneg.net/buhuchet/linejnyj-sposob-rascheta-amortizatsii.html

- https://ZnayDelo.ru/buhgalteriya/nachislenie-amortizacii-linejnym-sposobom.html

- https://www.audit-it.ru/terms/accounting/lineynyy_metod_amortizatsii.html

- https://praktibuh.ru/buhuchet/vneoborotnye/os/amortizatsiya/provodki-schet-02.html

Accounting for depreciation of fixed assets

Depreciation is a monetary unit of wear and tear. That is, this is part of the cost of an asset, which is included monthly in the cost of products, services, and goods.

Through depreciation, there is a gradual transfer of the value of a fixed asset, at which it is listed in accounting, to products and goods.

Ultimately, the money spent on the acquisition of operating systems is returned to the company after receiving payment from buyers and clients for the purchased values.

This process is gradual and continues throughout the entire useful life. To account for it, the accountant makes monthly entries in specially designated accounting accounts.

As long as the fixed asset is listed on the balance sheet of the enterprise, the accountant must make monthly depreciation deductions. This procedure is carried out until complete wear and tear, write-off due to unsuitability, breakdown or transfer to other persons.

The process of depreciation accumulation is suspended only in two cases:

- The OS is under conservation, provided that its duration exceeds 3 months.

- Restoration, modernization, reconstruction of an object, if this process takes more than a year.

If a decision is made to sell an object or write it off, the accountant determines the residual value of the asset. To do this, the depreciation accrued for the entire period is written off by posting to account 01, where the residual parameter is determined.

If during the operation of equipment or another object the initial cost changes due to revaluation, then depreciation accumulations are also recalculated and the necessary entries are made.

Thus, the accountant is faced with the need to reflect entries for accounting for depreciation of fixed assets in the following cases:

- making monthly depreciation payments;

- changes in accumulated deductions due to revaluation of the value of fixed assets (may either increase or decrease);

- write-off of a depreciable object as unnecessary (physical or moral wear and tear, breakdown, irreparable defects);

- disposal of fixed assets to third parties (sale, donation, contribution to the authorized capital of other enterprises).

How is the excess accrued amount for the previous period reflected?

If depreciation for the previous period was accrued incorrectly in an excessive amount, then the errors must be corrected. It is important in what period they were admitted - the current year or the past.

The mechanism for correcting accounting errors is prescribed in PBU 22/2010.

If the amount of depreciation has been excessively accrued, then it is necessary to reverse the excess accruals using red entries for those accounts for which incorrect entries were made.

If an error was made in the current year

Depreciation is corrected until accounts 20 or 44 are closed (depending on where savings are taken into account):

Posting reversal: Dt 20 (44) Kt 02 - for the amount of excess depreciation.

Correction after closing account 20 (or 44):

You also need to adjust account 90 to reflect expenses that are not accepted for tax accounting.

Posting reversal: Dt 90.3 Kt 20 for the overcharged amount.

If the excess accrual occurred in the year ended

Adjustments must be made to account 91 - posting: Dt 02 Kt 91.

How to work with property that has been used?

Organizations often operate objects that have already been used . Among them:

- Fixed assets received by an enterprise through succession when a legal entity was reorganized.

- Property received as a contribution to the authorized capital.

- Objects whose condition was not new already during the acquisition process

For such objects, depreciation is calculated in exactly the same way as for fixed assets. The only difference is that the service life is calculated slightly differently.

To determine it, we subtract from the period established by the former owners the time during which the equipment was actually used.

The main thing is to remember that the results of financial activities should not be affected by the absence or presence of these deductions at a particular enterprise. They are necessarily included in expenses for the tax period to which they relate.

It is acceptable to use non-linear methods of depreciation calculations, but it is the linear method that will be convenient, for example, for buildings or structures. And for other objects that are not directly used in production processes.

Methods for calculating depreciation of fixed assets: