Property tax

Not all property that meets the criteria of being depreciable can be depreciated.

Exceptions to the general rule are established by paragraph 2 of Article 256 of the Tax Code of the Russian Federation. The cost of such property is not taken into account when calculating income tax (except for books, brochures and other publications, the cost of which is included in other expenses associated with production and sales). The list of assets for which depreciation cannot be calculated is given in the table. Situation: is it possible to charge depreciation on external improvement objects (sidewalks, external lighting, flower beds and flowerpots) in tax accounting?

No you can not.

The concept of “object of external improvement” is not defined in tax legislation. The regulatory authorities explain that external improvement objects mean objects that:

- not related to the commercial activities of the organization;

- do not relate to any industrial buildings and structures;

- are designed to create a comfortable, aesthetically designed space on the territory of the organization.

Expenses associated with the improvement of the territory (including depreciation deductions for external improvement objects) do not meet the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation, and therefore they do not reduce the tax base for income tax. This is stated in letters of the Ministry of Finance of Russia dated October 18, 2011 No. 03-07-11/278, dated October 30, 2007 No. 03-03-06/1/745, UMNS of Russia for the Moscow Region dated December 8, 2003. No. 04-24/AA885.

In letters dated January 30, 2008 No. 03-03-06/1/63, dated May 30, 2006 No. 03-03-04/1/487, dated April 25, 2005 No. 03-03-01-04 /1/201 The Russian Ministry of Finance denies the possibility of calculating depreciation on such external improvement objects as:

- paved areas around shops and industrial enterprises;

- loading and unloading areas;

- parking for trucks and cars;

- sidewalks and pedestrian paths;

- external electric lighting (including installations of external lighting);

- lawns, flower beds, trees and shrubs;

- stairs, decorative fountains, sculptures, flowerpots, etc.

The financial department argues its position by the fact that the initial cost of fixed assets with the construction of which these objects are associated, the costs of their arrangement do not increase. Consequently, such objects do not meet the criteria of fixed assets (clause 1 of Article 257 of the Tax Code of the Russian Federation), but are independent types of depreciable property that are not subject to depreciation.

It should be noted that in some business situations, the Russian Ministry of Finance agrees with the possibility of depreciation of external improvement objects or with the inclusion of improvement costs in the initial cost of other fixed assets. In particular, the financial department allows the calculation of depreciation on objects that have signs of external improvement objects, but at the same time meet the criteria of a fixed asset (clause 1 of Article 257 of the Tax Code of the Russian Federation).

For example, this is possible in organizations whose activities are related to the organization of recreation (sanatoriums, boarding houses, etc.), exhibitions and cultural events. Such organizations can qualify expenses for improvement and landscaping of their territory as expenses directly related to ensuring normal recreational conditions, that is, with activities aimed at generating income.

When calculating income tax, these costs are included in other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). If in the course of improvement work objects are created that meet the criteria of fixed assets (for example, sports grounds, tennis courts, car parking lots, etc.), the cost of these objects can be depreciated on a general basis.

In addition, depreciation of external improvement objects or inclusion of the costs of their creation in the initial cost of other fixed assets is possible if these objects are created due to legal requirements, as well as regulatory and technical documents in the field of industrial safety. In certain sectors of the economy, the formation of such objects is directly the responsibility of organizations.

Therefore, they can also be depreciated (letter of the Ministry of Finance of Russia dated June 19, 2008 No. 03-03-06/1/362). Arbitration practice confirms this conclusion (see, for example, decisions of the FAS Moscow District dated April 10, 2008 No. KA-A40/2263-08, dated September 27, 2007 No. KA-A40/9456-07, dated March 20, 2006 No. KA-A40/1706-06, Volga-Vyatka District dated October 22, 2008.

Advice: there are arguments that allow you to depreciate external improvement objects in some other situations. But to use these arguments, the organization will most likely have to go to court.

Sometimes landscaping costs are inextricably linked with the construction of fixed assets. This situation may arise if the building construction project initially included the creation of external improvement facilities. For example, when external landscaping is an element of the unified design of the building being built or when the contract stipulates that the contractor, during the construction of the building, must asphalt the adjacent area.

Such expenses do not lead to the creation of independent external improvement objects, but are included in the initial cost of buildings, structures, etc. being erected. After these objects are put into operation, the organization’s expenses for improvement will gradually reduce taxable profit through depreciation.

In addition, sometimes the calculation of depreciation on external improvement objects is considered legal due to the ambiguous wording contained in subparagraph 4 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation. Based on its literal interpretation, we can conclude that it is prohibited to depreciate only forestry and road facilities built with the involvement of budgetary (targeted) funding, as well as specialized shipping facilities and other similar objects.

Since the Tax Code of the Russian Federation does not contain other restrictions regarding the depreciation of external improvement objects, some courts make decisions in favor of organizations precisely for this reason (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated October 12, 2010 No. KA-A40/12233-10 , dated April 2, 2010

Situation: is it possible in tax accounting to charge depreciation on objects such as asphalt (concrete, sidewalk) pavements that were created without attracting budgetary (targeted) funding?

Yes, it is possible if the arrangement of such facilities is required by law.

As a general rule, regardless of the sources of financing, asphalt (concrete, sidewalk) coatings are classified as external improvement objects, and, therefore, depreciation is not accrued on them (subclause 4, clause 2, article 256 of the Tax Code of the Russian Federation). This point of view is reflected in letters from the Russian Ministry of Finance dated January 30, 2008.

We invite you to read: Collection of legal penalties

At the same time, for certain sectors of the economy, the arrangement of production sites with asphalt and other types of coatings near production facilities is mandatory by virtue of legislation, as well as regulatory technical documents in the field of industrial safety. In such cases, the organization can charge depreciation on them. This conclusion was made in the letter of the Ministry of Finance of Russia dated June 19, 2008 No. 03-03-06/1/362.

Advice: there are arguments that allow depreciation to be calculated on asphalt (concrete, sidewalk) pavements created without the involvement of budgetary funds, regardless of whether their arrangement is stipulated by legal norms or not. They are as follows.

Asphalt (concrete, sidewalk) coatings are classified as road facilities. A literal reading of subclause 4 of clause 2 of Article 256 of the Tax Code of the Russian Federation allows us to conclude that if budgetary or other targeted funding was not used during the construction of road facilities, then depreciation can be calculated on such facilities.

The main thing is that the development of such facilities is connected with activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). In arbitration practice there are examples of court decisions that confirm the legality of this approach (see, for example, the decisions of the Federal Antimonopoly Service of the North-Western District dated June 1, 2009

No. A56-33207/2008, dated January 14, 2008, No. A56-4910/2007, dated July 18, 2005, No. A56-11749/04 and dated October 25, 2004, No. A56-32626/03, Volga-Vyatka District dated October 22, 2008 No. A28-1630/2008-43/29, Moscow District dated July 23, 2008 No. KA-A40/6654-08, Ural District dated June 26, 2008 No. Ф09-4500/08-С3 , Volga District dated June 13, 2012 No. A55-19091/2011).

In addition, an organization can include the following objects (worth more than 100,000 rubles) as part of depreciable property:

- as capital investments in leased fixed assets.

Hard decorative coatings can be taken into account as structures for the following reasons. Firstly, they improve access to the organization, help attract additional customers, and therefore have a positive effect on increasing sales. Secondly, the presence of a hard surface allows you to reduce loading and unloading time, which also increases business efficiency.

It follows from this that the hard surface is used in activities related to generating income and corresponds to the definition of depreciable property specified in paragraph 1 of Article 256 of the Tax Code of the Russian Federation. The basis for calculating depreciation in this case is paragraph 1 of paragraph 1 of Article 256 of the Tax Code of the Russian Federation.

The procedure for forming the value of fixed assets for tax accounting purposes

In the process of carrying out economic activities, organizations regularly acquire property necessary for their normal functioning. This includes quite expensive property with a long service life.

The procedure for recognizing expenses for the acquisition of such property, both in the accounting and tax accounting of an organization, depends on:

- on the functionality of such property,

- property value,

and also on how you plan to use it.

For tax accounting purposes, in accordance with the provisions of Article 256 of the Tax Code of the Russian Federation, depreciable property is:

- property,

- results of intellectual activity,

- other objects of intellectual property,

which are owned by the taxpayer (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation), are used by him to generate income and the cost of which is repaid by calculating depreciation.

Depreciable property is the property:

- with a useful life of more than 12 months,

- with an initial cost of more than 40,000 rubles.

Expenses incurred by the organization for the acquisition of depreciable property are repaid gradually by calculating depreciation.

Accounting of property is carried out in accordance with the Accounting Regulations.

Thus, in accordance with PBU 6/01 “Accounting for fixed assets”, an asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

- the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

- the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

- the organization does not intend the subsequent resale of this object; the object is capable of bringing economic benefits (income) to the organization in the future.

At the same time, fixed assets do not include assets (clause 3 of PBU 6/01):

- Machinery, equipment and other similar items listed as finished products in the warehouses of manufacturing organizations, as goods - in the warehouses of organizations engaged in trading activities.

- Items delivered for installation or to be installed and in transit.

- Capital and financial investments.

For the purposes of correctly determining depreciation expenses in NU, it is necessary to correctly estimate the amount of expenses that make up the initial cost of the depreciable property, which is the basis for calculating depreciation.

The article will discuss the provisions of the current legislation on the procedure for forming the actual initial cost of depreciable property in tax accounting.

We will also look at some of the nuances of accounting for the costs of acquiring and creating depreciable property for income tax purposes.

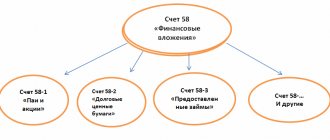

Depreciable property for tax accounting purposes

First, it is necessary to determine which property is depreciable for NU purposes, and which property is not subject to depreciation, despite meeting the general requirements for the price and period of use of the property.

In accordance with the provisions of Article 256 of the Tax Code, depreciable property for income tax is recognized as:

- property,

- results of intellectual activity,

- other objects of intellectual property,

owned by the taxpayer:

1. On the right of ownership (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation),

2. Used by him to generate income.

3. The cost of which is repaid by depreciation.

property tax base, one should be guided by the provisions of Chapter 30 of the Tax Code of the Russian Federation.

The following are recognized as depreciable property:

- property with a useful life of more than 12 months,

- with an initial cost of more than 40,000 rubles.

Depreciable property is recognized as:

1. Capital investments, leased fixed assets in the form of inseparable improvements made by the lessee with the consent of the lessor .

2. Capital investments in fixed assets provided under a gratuitous use agreement in the form of inseparable improvements made by the borrowing organization with the consent of the lending organization.

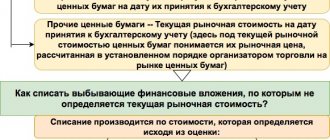

The following are not subject to depreciation in accordance with clause 2 of Article 256 of the Tax Code of the Russian Federation:

- Earth*,

- other environmental management objects (water, subsoil and other natural resources),

- inventories,

- goods,

- objects of unfinished capital construction,

- securities,

- financial instruments of derivatives transactions (including forwards, futures contracts, option contracts).

*Expenses for the acquisition of rights to land plots for income tax purposes are taken into account in accordance with the provisions of Article 264.1 of the Tax Code of the Russian Federation.

In addition, are not subject to depreciation , namely property:

1. Budgetary organizations, with the exception of property acquired in connection with business activities and used to carry out such activities.

2. Non-profit organizations, received as earmarked proceeds or acquired at the expense of earmarked proceeds and used to carry out non-commercial activities.

3. Acquired (created) using budget funds for targeted financing.

This rule does not apply to property received by the taxpayer during privatization.

4. External improvement objects:

- forestry facilities,

- road facilities,

- the construction of which was carried out with the involvement of sources of budgetary or other similar targeted funding,

- specialized navigation facilities) and other similar facilities.

5. Purchased publications:

- books,

- brochures,

- other similar objects,

- works of art.

In this case, the cost of purchased publications and other similar objects, with the exception of works of art, is included in other expenses associated with production and sales in full at the time of acquisition of these objects.

7. Acquired (created) using funds received:

7.1. In the form of property received by the taxpayer as part of targeted financing (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

7.2. In the form of the cost of reclamation and other agricultural facilities received by agricultural producers (including on-farm water pipelines, gas and electric networks), built at the expense of budgets of all levels (clause 19, clause 1, article 251 of the Tax Code of the Russian Federation).

7.3. In the form of property received free of charge by state and municipal educational institutions, as well as non-state educational institutions that have licenses to conduct educational activities, to conduct statutory activities (clause 22, clause 1, article 251 of the Tax Code of the Russian Federation).

7.4. In the form of OS received by organizations included in the structure of DOSAAF of Russia (when transferred between two or more organizations included in DOSAAF), used for the training of citizens:

- in military specialties,

- military-patriotic education of youth,

- development of aviation,

- technical and military applied sports

in accordance with the legislation of the Russian Federation (clause 23, clause 1, article 251 of the Tax Code of the Russian Federation).

7.5. In the form of property received from gratuitous assistance (assistance) in the manner established by law dated May 4, 1999. No. 95-FZ (clause 6, clause 1, article 251 of the Tax Code of the Russian Federation).

7.6. In the form of OS and intangible materials received free of charge in accordance with international treaties of the Russian Federation, as well as in accordance with the legislation of the Russian Federation by nuclear power plants to improve their safety, used for production purposes (clause 7, clause 1, article 251 of the Tax Code of the Russian Federation).

8. Acquired rights to the results of intellectual activity and other objects of intellectual property, if, under an agreement for the acquisition of these rights, payment must be made in periodic payments during the term of the said agreement.

In accordance with clause 3 of Article 256 of the Tax Code of the Russian Federation, fixed assets are excluded :

1. Transferred (received) under contracts for free use.

Due to the fact that the taxpayer does not incur expenses for obtaining such property, he has nothing to write off through depreciation.

2. Organizations transferred by decision of management to mothballing for a period of more than three months.

The start date of conservation of property is determined by the date specified in the order of the head on conservation of objects.

When an asset is re-mothballed, depreciation is accrued on it in the manner that was in effect before its mothballing, and the useful life is extended for the period that the asset is mothballed.

3. Organizations that, by decision of the management, are undergoing reconstruction and modernization for a period of more than 12 months.

The dates of reconstruction and modernization are also confirmed by orders of the organization’s management.

4. Vessels registered in the Russian International Register of Ships for the period they are in the Russian International Register of Ships.

The procedure for forming the value of depreciable property for tax accounting purposes

The procedure for determining the initial cost of fixed assets for tax accounting purposes is regulated by the provisions of Article 257 of the Tax Code.

The initial cost of a fixed asset is determined as the amount of expenses for it:

- acquisition,

- construction,

- manufacturing,

- delivery,

- bringing it to a state in which it is suitable for use,

excluding VAT and excise taxes (except for cases where the inclusion of these taxes in the cost of fixed assets is provided for by the provisions of the Tax Code of the Russian Federation).

If the asset was received free of charge or identified as a result of an inventory, its initial cost is determined:

- as the amount at which such property is valued in accordance with clause 8 and clause 20 of Article 250 of the Tax Code.

When a taxpayer uses OS objects of his own production, the initial cost of such objects is determined:

- as the cost of finished products, calculated in accordance with clause 2 of Article 319 of the Tax Code of the Russian Federation, increased by the amount of the corresponding excise taxes for fixed assets that are excisable goods.

In accordance with clause 2 of Article 257 of the Tax Code of the Russian Federation, the initial cost of fixed assets changes in the following cases:

- completions,

- retrofitting,

- reconstruction,

- modernization,

- technical re-equipment,

- partial liquidation of relevant facilities,

- on other similar grounds.

For work on:

- completion,

- retrofitting,

- modernization

include work caused by a change in the technological or service purpose of equipment, a building, structure or other object of depreciable fixed assets, increased loads and (or) other new qualities.

For income tax purposes, reconstruction includes:

- reconstruction of existing fixed assets associated with improving production and increasing its technical and economic indicators and carried out under the project for the reconstruction of fixed assets in order to increase production capacity, improve quality and change the range of products.

Technical re-equipment includes:

- a set of measures to improve the technical and economic indicators of fixed assets or their individual parts based on the introduction of advanced equipment and technology, mechanization and automation of production, modernization and replacement of obsolete and physically worn out equipment with new, more productive ones.

Some nuances of accounting for expenses on depreciable property and recommendations of the Ministry of Finance

When forming the initial cost of fixed assets in tax accounting, the taxpayer may have questions about including certain expenses in this cost.

When deciding which expenses should and should not be included in the initial cost of fixed assets, in cases where the Tax Code does not contain direct instructions, one should be guided by the interests of the company.

For one organization, the best solution is to recognize as much of the expense as possible in the current period, while for another, paying off expenses through depreciation is preferable.

In order to avoid disagreements with tax authorities, the chosen policy of including (or not including) specific expenses in the initial cost of fixed assets should be enshrined in the company's accounting policies for tax accounting purposes.

It is also recommended to adhere to a unified approach when forming the initial cost of all operating systems entering the organization.

Below we will consider the features of including in the cost of fixed assets certain types of expenses incurred during their acquisition, which are not directly mentioned in the Tax Code of the Russian Federation.

1. Government duty

In accordance with paragraph 1 of Article 131 of the Civil Code, the right of ownership and other real rights to immovable things , restrictions on these rights, their occurrence, transfer and termination are subject to state registration.

Accordingly, the acquisition of real estate by an organization cannot take place without paying a state fee for registering property rights.

Based on the above, such an expense will increase the initial cost of the OS.

This is precisely the opinion that the Ministry of Finance adheres to in its Letter of 08/12/2011. No. 03-03-06/1/481:

“In our opinion, the state duty levied in accordance with the legislation on taxes and fees for state registration of rights to real estate and transactions with it is an expense directly related to the acquisition of a fixed asset and the possibility of its use.

Thus, on the basis of Art. 257 of the Code, the paid state duty for state registration of rights to real estate and transactions with it is subject to inclusion in the initial cost of fixed assets. When commissioning the specified fixed assets, the amount of the state duty is subject to write-off through the depreciation mechanism established by Art. Art. 256 - 259.3 of the Code."

At the same time, payment of the state duty may not be directly related to the acquisition of depreciable property, bringing it to a state suitable for use.

In this case, the costs of the state duty can be taken into account in the income tax expenses in accordance with paragraphs 1 and paragraph 49 of paragraph 1 of Art. 264 Tax Code.

However, in accordance with clause 40 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include payments:

- for registration of rights to real estate and land, transactions with these objects,

- payments for providing information about registered rights,

- payment for services of authorized bodies and specialized organizations for property assessment, production of cadastral and technical registration (inventory) documents of real estate.

2. Labor costs and insurance premiums

In some cases, when creating and purchasing OS, companies use the services of individuals whose responsibilities include performing work directly related to the acquisition (creation) of OS.

Payment for services to these individuals can be made both under an employment contract and under a civil process agreement.

Insurance premiums are calculated on the amount of remuneration.

Labor costs are taken into account for tax accounting purposes in accordance with the provisions of Article 255 of the Tax Code.

Expenses under GPC agreements relate to labor costs in accordance with clause 21 of Article 255 of the Tax Code of the Russian Federation.

At the same time, in accordance with clause 5 of Article 270 of the Tax Code of the Russian Federation, when determining the tax base, expenses for the acquisition and (or) creation of depreciable property, as well as expenses incurred in the following cases, are not taken into account:

- completions,

- retrofitting,

- reconstruction,

- modernization,

- technical re-equipment

OS objects.

This paragraph does not differentiate between direct and indirect costs associated with the acquisition or creation of OS.

In accordance with paragraph 4 of Article 252 of the Tax Code of the Russian Federation, if some costs can be assigned simultaneously to several groups of expenses with equal grounds, the taxpayer has the right to independently determine which group he will assign such expenses to.

Thus, the taxpayer independently chooses the method of accounting for labor costs. The chosen method must be fixed in the accounting policy for tax accounting purposes.

According to the opinion of the Ministry of Finance, expressed in the Letter dated March 15, 2010. No. 03-03-06/1/135, wage costs for employees involved in the creation of an operating system must be included in the initial cost of depreciable property:

“Thus, expenses in the form of wages of workers involved in the construction of fixed assets, as well as in the form of insurance contributions for compulsory pension insurance, compulsory social insurance and compulsory health insurance increase the initial cost of depreciable property created by the organization in an economic way.”

Suspension of depreciation

Some types of fixed assets may be temporarily excluded from depreciable property. Depreciation should be suspended in the following cases:

- when transferring (receiving) fixed assets for free use;

- when transferring fixed assets to conservation for a period of more than three months by decision of the organization’s management;

- during reconstruction and modernization of fixed assets lasting more than 12 months;

- for the period of registration of ships in the Russian International Register of Ships.

Such rules are established by paragraph 3 of Article 256 of the Tax Code of the Russian Federation.

Situation: is it possible to calculate depreciation in tax accounting on property that has been under repair for more than 12 months?

Yes, you can.

If the work was not accompanied by modernization or reconstruction of the fixed asset (its original cost did not increase), charge depreciation regardless of the duration of the repair. Depreciation deductions are terminated only in the cases established by paragraph 3 of Article 256 of the Tax Code of the Russian Federation. This point of view is reflected in the letter of the Ministry of Finance of Russia dated October 5, 2004 No. 03-03-01-04/1/66.

Situation: is it possible to take into account depreciation on idle property when calculating income tax?

Yes, it is possible if the downtime is associated with the peculiarities of the technological process or a temporary suspension of production, with the inability to use the property in income-generating activities.

During the period of downtime (if the transfer of fixed assets for conservation is not formalized), do not interrupt the calculation of depreciation. This is due to the fact that the list of cases in which a fixed asset item is excluded from depreciable property is closed. Downtime of property is not included in it, therefore, there are no grounds for stopping depreciation of the property.

As for the inclusion of accrued depreciation as an expense when calculating income tax, an organization does not always have such an opportunity.

If the downtime is related to the peculiarities of the technological process or a temporary suspension of production (for example, due to the lack of orders for a particular product), continue to write off depreciation as expenses when calculating income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation). At the same time, if equipment is idle, the depreciation of which is a direct expense, take into account depreciation charges as the products are sold (clause 2 of Article 318 of the Tax Code of the Russian Federation).

This position is reflected in letters of the Ministry of Finance of Russia dated April 9, 2010 No. 03-03-06/1/246, dated March 13, 2009 No. 03-03-06/1/141, dated February 27, 2009 No. 03- 03-06/1/101, dated September 6, 2007 No. 03-03-06/1/645, dated April 21, 2006 No. 03-03-04/1/367. It is confirmed by arbitration courts (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated July 14, 2008 No.

No. 8483/08, resolution of the Federal Antimonopoly Service of the Ural District dated March 6, 2008 No. Ф09-184/08-С3, West Siberian District dated June 24, 2009 No. Ф04-3695/2009(9227-А67-15), Ф04- 3695/2009(10057-A67-15), Northwestern District dated March 10, 2009 No. A56-10179/2008, Volga District dated September 23, 2008 No. A55-3042/08).

At the same time, the reason for downtime may be the impossibility (inexpediency) of using a fixed asset item in activities aimed at generating income. In this case, the idle object is not excluded from the depreciable property. That is, depreciation for this object must be calculated in the same manner (letter from the Ministry of Finance of Russia dated February 28, 2013.

Depreciation of fixed assets. Changes since 2013

Depreciation of fixed assets (FA) is the transfer of part of the cost of a fixed asset to a newly created product. There have been changes regarding the calculation of depreciation since January 1, 2013.

Mobilization capacities are depreciated in accordance with the generally established procedure. Mobilization capacities are reserves and capacities to ensure the deployment of military and other industries, the repair of military equipment, the deployment in wartime of work to restore roads (railway, highway), sea and river ports, communication lines and structures, energy and water supply systems, transport and communications , provision of medical care.

Before 2013, if an organization acquired or created fixed assets as part of modernization work, depreciation was not charged on them. This was indicated by the Ministry of Finance in its letter dated September 26, 2012 No. 03-03-10/115. Since January 1, 2013, a new version of clause 1 of Article 256 of the Tax Code of the Russian Federation has been in effect, according to which mobilization property is depreciated in the generally established manner. In order to start depreciating a property, you do not need state registration of the right to this property. Real estate objects are depreciated starting from the 1st day of the month following the month in which the real estate object was put into operation.

From January 1, 2013, clause 11 of Art. 258 of the Tax Code of the Russian Federation, on the basis of which rights to real estate objects were subject to state registration and real estate objects could be included in the depreciation group from the moment of written confirmation of the fact of filing documents for registration of these rights (that is, from the date in the Receipt for receipt of documents by the registering authority).

Restoration of depreciation bonus. In the case of the sale of a fixed asset for which a depreciation premium was applied, it is necessary to restore the depreciation bonus only if the fixed asset was sold to an interdependent party (in accordance with Article 105.1 of the Tax Code of the Russian Federation).

Previously, it was established that it was necessary to restore the depreciation bonus if the sale of a fixed asset occurred before the expiration of 5 years from the date of putting the fixed asset into operation.

The increasing coefficient, which is applied to the basic depreciation rate for fixed assets used to work in an aggressive environment and depreciated according to linear depreciation rates, is applied only to those fixed assets that were registered before January 1, 2014.

The residual value of the fixed asset is determined taking into account the accrued depreciation premium. Since 2013, instead of the initial cost indicator, the cost indicator at which these objects are included in depreciation groups has been used. In its letter dated October 9, 2012 No. 03-03-06/1/527, the Ministry of Finance previously gave such clarifications.

Thus, taxpayers, when selling a fixed asset to which a depreciation bonus was previously applied, calculate the residual value of the sold fixed asset as the difference between the original cost, the depreciation bonus and accrued depreciation.

If you have any questions, please contact us by phone (812) 309-18-67 or through the feedback form.

The concept of depreciable property

Such objects include low-value items (industrial inventory), fixed assets and intangible assets, which serve for quite a long time and monthly transfer part of their value into the price of the manufactured product. Thus, the property wears out, i.e., depreciates. This is where the term “depreciable property” comes from.

In connection with the adopted legislative changes regarding the tax accounting of fixed assets and intangible assets, starting from 2021, the objects of depreciable property at the enterprise are assets involved in production, sales of manufactured products, general management of the company and meeting the following criteria (clause 1 of Article 256 of the Tax Code of the Russian Federation):

- unit cost excluding VAT is more than 100 thousand rubles;

- Productive service life is over 1 year.

How to keep tax records of depreciable property

- method of depreciation of fixed assets and intangible assets (except for buildings, structures, transmission devices included in the eighth to tenth depreciation groups) (clause 1 of article 259 of the Tax Code of the Russian Federation);

- the procedure for applying the “depreciation bonus” is the write-off of no more than 10 percent (30% in relation to fixed assets included in the third to seventh depreciation groups) of the initial cost of the fixed asset, as well as the costs of its completion, additional equipment, reconstruction, modernization, technical re-equipment ( clause 9 of article 258 of the Tax Code of the Russian Federation);

- the procedure for applying increasing coefficients to depreciation rates for fixed assets (clauses 1 and 2 of Article 259.3 of the Tax Code of the Russian Federation);

- application of reduced depreciation rates (voluntary) (clause 4 of Article 259.3 of the Tax Code of the Russian Federation);

- the procedure for determining the depreciation rate for fixed assets that were in operation (clause 7 of article 258 of the Tax Code of the Russian Federation).

When drawing up an accounting policy for tax purposes, keep in mind that some of the rules can only be established in relation to all objects at the same time, and some - to a specific list of objects at the organization’s choice. For example, reduced depreciation rates may apply to items selected by the manager.

Dear readers! Our articles talk about typical ways to resolve tax and legal issues, but each case is unique.

We invite you to read: Amendments to the terms of the agreement

If you want to find out how to solve your particular problem, please contact the online consultant form on the left or call ext. 479 (Moscow) ext. 122. It's fast and free!

Apply the selected methods of tax accounting for depreciable property throughout the entire tax period (year). It is possible to change the tax accounting of depreciable property in the middle of the year only if the legislation on taxes and fees has changed. This procedure is provided for in paragraph 6 of Article 313 of the Tax Code of the Russian Federation.

The procedure for determining the residual value for fixed assets for which bonus depreciation was applied

In accordance with Law No. 206-FZ, paragraph 1 of Article 257 of the Tax Code of the Russian Federation was supplemented with the following paragraph:

“When determining the residual value of fixed assets in respect of which the provisions of paragraph two of paragraph 9 of Article 258* of this Code were applied, instead of the initial cost indicator an indicator of the cost at which such objects are included in the corresponding depreciation groups (subgroups).”

*Based on paragraph 2 of clause 9 of Article 258 of the Tax Code of the Russian Federation, the taxpayer has the right to include in the expenses of the reporting period expenses for capital investments in the following amount:

- No more than 10% (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of the initial cost of fixed assets (except for fixed assets received free of charge).

- No more than 10% (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of expenses incurred in the following cases:

- completions,

- retrofitting,

- reconstruction,

- modernization,

- technical re-equipment,

- partial liquidation

fixed assets and the amounts of which are determined in accordance with Article 257 of the Tax Code of the Russian Federation.

Until January 1, 2013, taxpayers were guided by the provisions of clause 1 of Article 257 of the Tax Code of the Russian Federation, regardless of whether they applied bonus depreciation or not:

- The residual value of fixed assets put into operation after the entry into force of this chapter is determined as the difference between their original cost and the amount of depreciation accrued over the period of operation .

At the same time, the provisions of the Tax Code of the Russian Federation did not provide for a special procedure for companies using bonus depreciation.

This circumstance often led to disputes with tax authorities related to the determination of the residual value of fixed assets sold before 5 years from the date of putting such fixed assets into operation.

At the same time, in the latest recommendations, the Ministry of Finance adheres to the point of view that the residual value of fixed assets should be determined as its original cost minus the depreciation premium and the amount of depreciation accrued over the period of operation.

This position is set out, for example, in the Letter of the Ministry of Finance dated 10/09/2012. No. 03-03-06/1/527:

“Thus, in the opinion of the Department, the residual value of a depreciable property is determined as the difference between the original cost of the object minus the specified expenses in the form of capital investments (10% or 30%) and the amount of depreciation accrued over the period of operation.”

Groups of depreciable property

Each fixed assets and intangible asset effectively serves for a certain period of time, called its useful life. The useful life of depreciable property (SPI) for a particular asset of an organization is different. For example, a machine operating in a workshop wears out within 3-5 years, and a workshop building can be used for up to 100 years. Those.

The PF Classifier, valid since January 1, 2017, divides them into 10 groups (clause 3 of Article 258 of the Tax Code). It is a table, in each group of which the names of OS objects, their main characteristics, the corresponding OKOF codes and the amount of monthly depreciation are listed. Accrual of depreciation for an object of depreciable property begins on the 1st day of the month following the month of its commissioning.

Changing the depreciation method

An organization has the right to change the established method for calculating depreciation of an object of fixed assets (intangible assets) from the beginning of the next tax period. At the same time, you can switch from a non-linear method of calculating depreciation to a linear one no earlier than five years after the start of its application (clause 1 of Article 259 of the Tax Code of the Russian Federation).

An organization has the right to change the established method for calculating depreciation of an object of fixed assets (intangible assets) from the beginning of the next tax period. At the same time, you can switch from a non-linear method of calculating depreciation to a linear one no earlier than five years after the start of its application (clause 1 of Article 259 of the Tax Code of the Russian Federation).

Changing the price limit for depreciable property items

| Object cost | Asset acquisition | |

| Until 2021 | From 2021 | |

| Up to 40 thousand rubles. | Referred to as inventory (inventory) and written off in full immediately after capitalization | Written off immediately after capitalization in full |

| From 40 to 100 thousand rubles. | Depreciation is calculated | Written off immediately after capitalization in full |

| Over 100 thousand rubles. | Depreciation is calculated | Depreciation is calculated |

There have been no such changes in accounting, and depreciable property includes property worth more than 40 thousand rubles. As a result, differences arise between the indicators of accrued depreciation in tax and accounting.

Organization of tax accounting

- about the initial cost of the property;

- about the useful life;

- on the date of acquisition and commissioning;

- on depreciation of fixed assets (intangible assets) accrued for the entire period of operation of the facilities - using the straight-line method of calculating depreciation;

- about depreciation and the total balance of each depreciation group (subgroup) - with a non-linear method of calculating depreciation;

- on the residual value of depreciable property upon its disposal from the depreciation group;

- about sales (date, sales price and sales costs), etc.

A complete list of information that analytical accounting of depreciable property should provide is given in Article 323 of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation provides for two options for maintaining tax accounting:

- use of accounting registers;

- use of tax accounting registers specially developed by the organization.

This is stated in Article 313 of the Tax Code of the Russian Federation.

- on depreciation of fixed assets (intangible assets) accrued for the entire period of operation of the facilities - using the straight-line method of calculating depreciation;

- about depreciation and the total balance of each depreciation group (subgroup) - with a non-linear method of calculating depreciation;

- about sales (date, sales price and sales costs), etc.

Tax accounting of fixed assets in 1C:Enterprise 8

The article describes various difficulties in calculating temporary and permanent differences in the accounting of fixed assets. At the beginning, the various requirements of accounting and tax legislation are given and the variety of differences that arise between accounts is shown.

The following briefly describes the implementation of tax accounting of fixed assets (FPE) in 1C accounting programs (“1C: Accounting 8” and “1C: Manufacturing Enterprise Management 8”) and provides algorithms for calculating permanent and deferred tax assets and liabilities. Various examples show algorithms for calculating temporary and permanent differences for all possible cases of asset accounting. Methods for checking calculations according to PBU 18/02 and accounting nuances that are not implemented in 1C programs are shown, and approaches to their implementation are also given. Legislative requirements

Accounting for fixed assets of organizations is regulated by PBU 6/01 “Accounting for fixed assets” in accounting and Articles 256-260, 268 of the Tax Code of the Russian Federation in tax accounting for corporate income tax. Organizations using a general taxation system should also be guided by PBU 18/02 “Accounting for income tax calculations.” There are a lot of complexities in tax accounting for fixed assets and it is difficult to consider all of them in one article, so we will focus on the accounting conditions that are found in most organizations. We will consider accounting for organizations that apply the general taxation system and PBU 18/02. We will not consider the specifics of the acquisition of fixed assets and therefore we will not consider how the initial cost of fixed assets was formed in accounting and tax accounting. Let only the linear depreciation method be used in accounting, and linear in tax accounting, and it is possible to use an acceleration factor. PBU 18/02 regulates the accounting of differences between accounting profit (loss) and taxable profit (loss) of the reporting period resulting from the application of different rules for recognizing income and expenses in accounting and tax accounting. Differences are divided into permanent (for income and expenses taken into account in only one of the accounts) and temporary (for income and expenses taken into account in both accounts, but in different reporting periods). Within the framework of the assumptions proposed above, differences may arise in the following cases:

- Constant When forming the initial cost (for example, capitalization of normalized expenses when calculating interest on a loan)

- When calculating depreciation (if tax accounting does not calculate depreciation)

- When calculating depreciation due to permanent differences in original cost

- When forming the initial cost (for example, capitalization of normalized expenses for paying interest on a loan)

All of these differences should be classified as permanent tax liabilities (PLT) or assets (PTA) (permanent differences) and as deductible or taxable temporary differences. For temporary differences, deferred tax assets (DTA) and liabilities (DTA) should be calculated depending on the type of differences. The procedure for accounting for temporary differences is described as follows in PBU 18/02: “Information on permanent and temporary differences is generated in accounting either on the basis of primary accounting documents directly from the accounting accounts, or in another manner determined by the organization independently. In this case, permanent and temporary differences are reflected separately in accounting. In analytical accounting, temporary differences are taken into account differentiated by the types of assets and liabilities in the valuation of which the temporary difference arose.” As will be shown below, although to satisfy the requirements of PBU 18/02 it is sufficient to keep records of temporary differences by type of assets and liabilities, in fixed asset accounting this is not enough to classify temporary differences into deductible and taxable. Although the calculation of differences in fixed asset accounting itself is quite complex, when conducting it, other aspects may arise that complicate the accounting structure:

- It is necessary to ensure reconciliation of data between OS accounting, tax accounting for income tax and accounting according to PBU 18/02 for the purposes of the company’s internal accounting;

- It is necessary to ensure data reconciliation for external users (tax audits and auditors);

- Sometimes it is necessary to break down assets and liabilities into short-term and long-term.

Implementation of tax accounting of fixed assets in 1C programs

The general concept of tax accounting and accounting according to PBU 18/02 To solve these problems, in its programs “1C: Accounting 8” and “1C: Manufacturing Enterprise Management 8”, it proposed maintaining parallel accounting of tax accounting data for tax on profit of organizations (NU) and data on temporary differences (TD) and permanent differences (PD) on a separate chart of accounts with the formation of separate transactions. The chart of accounts was taken almost similar to the self-supporting chart of accounts, with the same analytics of accounts. And for each accounting entry (AC), one or more entries are automatically generated according to the tax chart of accounts so that for each account the equality is satisfied: BU = NU + PR + VR (1) Moreover, the amounts are determined as follows: BU - amount according to the accounting accounting; NU - the amount accepted for tax accounting is usually specified in the document itself or can be calculated by the system based on reference data using special algorithms. The difference is further classified. If it (or part of it) is classified as permanent, then it (or part of it) is recorded as an entry with the PR accounting type. The remaining part of the difference is classified as BP and entries are made so that equality (1) is satisfied. At the end of the tax period, turnover for the period in accounts 90 and 91 is analyzed by type of PR accounting and entries are generated to reflect permanent tax assets and liabilities. Turnovers for the period are also analyzed for all accounts except 90 and 91 for the BP accounting type and entries are generated to reflect deferred tax assets and liabilities. Analytical accounting for accounts 09 and 77 is carried out by type of assets and liabilities.

Implementation of the OS block in 1C In the accounting software system on the 1C:Enterprise 8 platform, parallel OS accounting is implemented for accounting and tax accounting purposes. Methods and parameters for calculating depreciation are specified separately. The tax chart of accounts includes accounts 01, 02, 03, 08, similar to the accounts in the self-supporting chart of accounts. All operations with fixed assets are implemented in separate documents; the algorithms for their implementation include automatic calculation of permanent and temporary differences. To calculate ONA and ONO, the balance and turnover are used according to the type of accounting BP for accounts: 01, 02, 03. For each OS the following are determined:

- Final consolidated balance (CCB) as the difference (final balance on debit accounts – final balance on credit accounts);

- Consolidated opening balance (SCH) as the difference (the initial balance on the debit of accounts - the initial balance on the credit of accounts);

- Consolidated turnover (CO) as a difference (SSK-SSN).

Next, SHE and IT are calculated according to compliance:

| CCH | CO | SSK | Dt 09 | Kt 09 | Dt 77 | Kt 77 |

| > 0 | > 0 | 0 | 0 | 0 | CO | |

| > 0 | = 0 | 0 | 0 | 0 | 0 | |

| > 0 | < 0 | < 0 | — SSK | 0 | CCH | 0 |

| > 0 | < 0 | ≥ 0 | 0 | 0 | — SO | 0 |

| ≤ 0 | < 0 | — SO | 0 | 0 | 0 | |

| ≤ 0 | = 0 | 0 | 0 | 0 | 0 | |

| ≤ 0 | > 0 | > 0 | 0 | -SSN | 0 | SSK |

| ≤ 0 | > 0 | ≤ 0 | 0 | CO | 0 | 0 |

Examples

Let's look at several examples of calculating differences in depreciation of fixed assets in various situations:

- Example 1 – differences in depreciation calculations arise only due to differences in original cost;

- Example 2 – there are no differences in the initial cost, but accounting and accounting systems have different methods for calculating depreciation;

- Example 3 – differences arising during modernization, in fact, this is a variant of the differences in the method of calculating depreciation;

- Example 4 - a combination of Examples 1 and 2 - differences in depreciation calculations arise due to differences in historical cost and differences in the method of calculating depreciation;

- Example 5 - Example 4 is further complicated by the fact that the date of acceptance for accounting does not coincide with the date of commissioning.

These examples show that even for the most complex situations, all differences can be calculated according to 3 rules:

- Permanent differences in the calculation of depreciation can be calculated if we take the PR in the original cost and depreciate them according to accounting rules.

- If there are BP in the cost of fixed assets, temporary differences in the calculation of depreciation can be calculated by taking the BP in the original cost and depreciating them according to accounting rules.

- To calculate temporary differences in the assessment of depreciation that arise due to differences in depreciation methods in accounting and accounting, you should take the original cost according to accounting, depreciate it according to accounting rules and subtract the amount of depreciation of accounting in the same period.

1. Differences in the initial cost

Let's consider an asset whose initial cost in accounting is equal to 100,000 rubles, the cost of acquisition costs in accounting was 20,000 rubles, the difference is classified as permanent (5,000 rubles) and temporary (15,000 rubles). The method of calculating depreciation in both BU and NU is linear, the useful life periods coincide and are equal to 6 months (in this example and subsequent ones, to simplify the perception of calculations, short depreciation periods are taken; we also do not consider rounding errors). Permanent differences in the calculation of depreciation can be calculated if we take the PR in the original cost and depreciate according to the accounting rules. If there is BP in the cost of fixed assets, temporary differences in the calculation of depreciation can be calculated if we take BP in the original cost and depreciate according to accounting rules.

| depreciation | |||||||

| Price | 1 | 2 | 3 | 4 | 5 | 6 | |

| BOO | 100 000 | 16 667 | 16 667 | 16 667 | 16 667 | 16 667 | 16 667 |

| WELL | 80 000 | 13 333 | 13 333 | 13 333 | 13 333 | 13 333 | 13 333 |

| ETC | 5 000 | 833 | 833 | 833 | 833 | 833 | 833 |

| VR | 15 000 | 2 500 | 2 500 | 2 500 | 2 500 | 2 500 | 2 500 |

2. Difference in the depreciation method

Let's consider an asset whose initial cost in accounting is equal to 800,000 rubles, the cost of acquisition costs in accounting was 800,000 rubles, there are no differences. The method of calculating depreciation in both BU and NU is linear, the useful life in BU is 4 months, and in NU a special coefficient of 0.5 is applied. As a result of different depreciation methods, permanent differences cannot arise, because all methods imply a complete write-off of the cost of the operating system as expenses, the difference is in the time of write-off, that is, any differences will be temporary. To calculate temporary differences, you should subtract from the depreciation amount of the cost of the NU according to the accounting rules for a given month, the amount of depreciation of the NU.

| depreciation | |||||||||

| Price | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| BOO | 800 000 | 200 000 | 200 000 | 200 000 | 200 000 | ||||

| WELL | 800 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| VR | 0 | 100 000 | 100 000 | 100 000 | 100 000 | -100 000 | -100 000 | -100 000 | -100 000 |

3. Modernization

Let's consider an OS whose initial cost in accounting is 100,000 rubles, the cost of acquisition costs in accounting is 100,000 rubles, there are no differences. The method of calculating depreciation in both BU and NU is linear, the useful life in BU and NU is 8 months. In the 6th month of use, modernization was carried out in the amount of 10,000 rubles in both the used and the NU. The expiration date has not changed. As a result of modernization, temporary differences arise, because The subsequent calculation of depreciation in BU and in NU is defined differently. In accounting, the amount of monthly depreciation is calculated as (residual value of fixed assets / residual depreciation period). In NU, the amount of monthly depreciation is calculated as (new cost of fixed assets / full depreciation period). Those. at the end of the depreciation period in the NU, part of the modernization amount will not be written off as expenses; this amount is added in the month following the last month of depreciation in the NU. The calculation of temporary differences is carried out similarly to the previous example.

| Depreciation 1 | Depreciation 2 | |||||||||

| Price | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| BOO | 100 000 | 12 500 | 12 500 | 12 500 | 12 500 | 12 500 | 12 500 | 17 500 | 17 500 | 0 |

| WELL | 100 000 | 12 500 | 12 500 | 12 500 | 12 500 | 12 500 | 12 500 | 13 750 | 13 750 | 7 500 |

| VR | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 750 | 3 750 | -7 500 |

4. Differences in both the cost and the method of calculating depreciation

Let us consider an asset whose initial cost in accounting is equal to 900,000 rubles, the cost of acquisition costs in accounting was 800,000 rubles, the difference is classified as temporary (100,000 rubles). The method of calculating depreciation in both BU and NU is linear, the useful life in BU is 4 months, and in NU a special coefficient of 0.5 is applied. As described in example 1, the monthly difference in depreciation arising due to the difference in cost will be RUB 100,000 / 4 months = RUB 25,000 As described in example 2, the monthly difference in depreciation resulting from the difference in method depreciation will be the difference between the depreciation of the amount of NU according to the accounting rules - 800,000 rubles / 4 months = 200,000 rubles and the amount of depreciation in NU.

| depreciation | |||||||||

| Price | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| BOO | 900 000 | 225 000 | 225 000 | 225 000 | 225 000 | ||||

| WELL | 800 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| VR | we stand | 25 000 | 25 000 | 25 000 | 25 000 | ||||

| VR | depreciation | 100 000 | 100 000 | 100 000 | 100 000 | -100 000 | -100 000 | -100 000 | -100 000 |

| VR | 100 000 | 125 000 | 125 000 | 125 000 | 125 000 | -100 000 | -100 000 | -100 000 | -100 000 |

5. The difference in the start dates of depreciation

Let’s consider an asset whose initial cost in the accounting book is equal to 100,000 rubles, the cost of acquisition costs in the accounting book was 80,000 rubles, the difference is classified as permanent (5,000 rubles) and temporary (15,000 rubles). The method of calculating depreciation in both accounting and accounting records is linear, the useful life in accounting accounting is 6 months, and a special coefficient of 3 is used in the accounting records. The fixed asset was put into operation a month later than it was accepted for accounting.

| depreciation | |||||||

| Price | 1 | 2 | 3 | 4 | 5 | 6 | |

| BOO | 100 000 | 16 667 | 16 667 | 16 667 | 16 667 | 16 667 | 16 667 |

| WELL | 80 000 | 40 000 | 40 000 | ||||

| ETC | 5 000 | 833 | 833 | 833 | 833 | 833 | 833 |

| VR | we stand | 2 500 | 2 500 | 2 500 | 2 500 | 2 500 | 2 500 |

| VR | depreciation | 13 333 | -26 667 | -26 667 | 13 333 | 13 333 | 13 333 |

| VR | 15 000 | 15 833 | -24 167 | -24 167 | 15 833 | 15 833 | 15 833 |

Unrealized points

The concept of tax accounting, which forms the basis for depreciation calculations in the programs “1C: Accounting 8” and “1C: Production Enterprise Management 8”, allows you to calculate depreciation in all the above examples. Moreover, all transactions will be generated automatically; the user only needs to describe business transactions in the fixed assets accounting documents.

However, there are features in the calculation of permanent and deferred tax assets and liabilities that lead to interesting results.

Temporary differences Calculation of IT and ONA in the 1C program is carried out according to the table given in the description of the tax accounting concept.

Let's consider example 4, namely the determination of ONA and ONO in the first month of depreciation. We see that the amount of temporary differences amounted to RUB 125,000. What postings should be made to accounts 09 and 77?

1. In the standard “Enterprise Accounting” configuration, the calculation will be made according to the correspondence table:

Initial consolidated balance = 100,000 rubles (according to the debit of account 01) Final consolidated balance = -25,000 rubles (100,000 for Dt 01, 125,000 for Kt 02) Consolidated turnover = -125,000 rubles From the table we see that the postings should be made: Dt 77 Kt 68.04.2 in the amount of 100,000*0.24 = 24,000 rubles Dt 09 Kt 68.04.2 in the amount of 25,000*0.24 = 6,000 rubles

2. Now let's define the entries based on the fact that temporary differences are formed from differences in the original cost and in the method of calculating depreciation.

For BP due to differences in cost: Initial consolidated balance = 100,000 rubles Final consolidated balance = 75,000 rubles Consolidated turnover = -25,000 rubles Posting: Dt 77 Kt 68.04.2 in the amount of 25,000 * 0.24 = 6,000 rubles

For BP due to differences in depreciation: Initial consolidated balance = 0 rub. Final consolidated balance = -100,000 rub. Consolidated turnover = -100,000 rub. Posting: Dt 09 Kt 68.04.2 in the amount of 100,000 * 0.24 = 24,000 rubles

Note that next month the postings will be as follows:

- Dt 09 Kt 68.04.2 in the amount of 125,000*0.24 = 30,000 rubles

- Dt 77 Kt 68.04.2 in the amount of 25,000 * 0.24 = 6,000 rubles

Dt 09 Kt 68.04.2 in the amount of 100,000 * 0.24 = 24,000 rubles Thus.

Although the tax base does not change, the financial statements are distorted. This is due to the fact that temporary differences in fixed assets that arise for various reasons are taken into account for the purposes of PBU 18/02 collectively according to accounting accounts. Permanent differences A similar problem arises in accounting for permanent differences. To calculate PNO and PNA, turnover on accounts 90 and 91 is used according to the type of PR accounting. So, to calculate PNA, debit turnover on accounts 90 and 91 is used, and to calculate PNA, credit turnover is used. This is incorrect, because. permanent differences are taken together, and, for example, negative amounts may appear in the debit entries of account 91. Such amounts should be treated similarly to credit turnover on 91 accounts. That is, if we have a posting on the debit of account 91 according to the PR accounting type in the amount of -10,000 rubles, then we should create not a PNA in the amount of -2,400 rubles, but a PNA in the amount of +2,400 rubles. Negative amounts in transactions began to appear in 2008 due to changes in PBU 3/2006. For example, if a fixed asset is purchased from a foreign supplier with an advance payment, then the exchange rate differences arising in the accounting system are treated as permanent and are included in the initial cost of the fixed asset. Exchange rate differences can take any sign, so permanent differences can turn out to be negative. When depreciating such fixed assets, these permanent differences will fall into account 90 or 91 with a minus sign.

Comparison of VR and BU data

Organizations often face the problem of reconciling data on temporary differences and postings to accounts 09 and 77. The following questions may be asked regarding the compliance of BP and BU:

- Accountant: how to check whether temporary differences and accounting entries have been calculated correctly?

- Tax inspector: how are the entries for accounts 09 and 77 calculated? give reasons.

- CFO: break down account balances 09 and 77 into short-term (<1 year) and long-term (>1 year).

Within the framework of standard accounting in 1C programs, it is not always possible to fully answer these questions. Let's look at why:

- The first question can be answered this way.

“If the initial data on the operating system is entered correctly, then the program calculates both temporary differences and transactions for 09 and 77 accounts correctly. To check, you can look at the following correspondence. If we take the consolidated balance of fixed assets accounting accounts by type of accounting BP and multiply by 0.24, then it should coincide with the consolidated balance of accounts 09 and 77 by type of asset “fixed assets”. If an error was made in the initial OS data, it will certainly manifest itself either in a violation of this compliance, or account 68.04.2 (Calculation of income tax) will not be closed at the end of the tax period.” In the program, in the documents “Month Closing” (“1C: Accounting 8”) and “Calculations for Income Tax” (“1C: Manufacturing Enterprise Management 8”) there is a calculation certificate for generating transactions for 09 and 77 accounts in the context of accounting objects . In it you can see both information about the differences and information about the calculation of SHE and IT. As described above, in some cases the program incorrectly identifies accounts 09 and 77, although it does the postings according to 68.04.2 correctly. Such cases are almost impossible to detect during a routine check, so we can assume that the answer to the first question has been given.

- This question is more difficult to answer. Firstly, we can provide a description of the tax accounting methodology distributed in articles on ITS disks. Since 2008, a description of the accounting methodology according to PBU 18/02 can be recorded in the accounting policy of the organization and it makes sense to formulate an accounting policy that corresponds to the 1C methodology.

Secondly, you can consider several typical examples of operating systems with temporary differences, check them manually and compare them with a reference calculation for the differences. The same certificate can be attached as justification for the correctness of the calculation.

- In the current implementation of OS accounting in 1C programs, such a division cannot be made for a number of reasons. Firstly, accounts 09 and 77 are not broken down into individual fixed assets, and it is possible to determine over what period of time a tax asset (liability) will be written off only using the accounting data of a specific fixed asset. Secondly, even if we know which fixed asset this amount belongs to, say, in account 77, its repayment period depends not just on the remaining depreciation period of the fixed asset, but on the relationship between the fixed asset depreciation parameters in accounting and tax accounting.

Conclusion

Let's see how we can solve the difficulties described above.

Incorrect identification of accounts 09 and 77 can be resolved by changing the algorithm for calculating ONA and ONO for fixed assets. It would be possible to consider not the consolidated balances and turnovers for accounts 01 and 02, but to take separately the differences in the original cost and the depreciation method, but for this it would be necessary to change the algorithm for calculating temporary differences. Now in the 1C program, time differences are found arithmetically. Those. The depreciation amounts are calculated separately for BU, NU, PR, and from them the amount of BP is found from the ratio: BP = BU - NU - PR. If we replace the calculation with the one given in examples 1 and 2 and assign the BP amounts not to the general account 02.01, but to subaccounts 02.01.1 and 02.01.2, depending on the type of differences, then it would be possible to organize the correct calculation of ONA and ONO.

With constant differences everything is even simpler. Here it is enough to change the algorithm for the formation of PNA and PNO - take not debit turnovers for PNA for accounts 90 and 91, but positive debit and negative credit turnovers. Likewise for PNA.

But by dividing into short-term and long-term debts on accounts 09 and 77, everything is much more complicated. There may be two approaches.

- The first approach can be applied in organizations in which there are not many causes of temporary differences and they are all of the same type. It is necessary to introduce additional analytics on OS objects on accounts 09 and 77 and modify the algorithm for generating SHE and IT so that these analytics are filled out. Next, for each type of difference, reports should be developed to compare the balances of accounts 09 and 77 and the depreciation parameters of fixed assets to divide into short-term and long-term debt.

- This approach is universal, but requires an order of magnitude more complex accounting. It is necessary to develop a calculation of depreciation amounts “forward” until the end of depreciation for each fixed asset and for each accounting section. Those. calculate all amounts of BU, NU, PR, VR (broken down by reasons of occurrence), ONA and IT on a monthly basis for each fixed asset object for the entire time ahead. Data on the amounts of IT and IT, when broken down by month and by fixed assets, should be stored in a table and this calculation should be used to break down the debt.

Thus, on the one hand, the programs “1C: Accounting 8” and “1C: Manufacturing Enterprise Management 8” do not implement all the nuances of tax accounting for fixed assets, on the other hand, they allow you to maintain full accounting in most cases, and the methodology embedded in them is open to expand for more complex accounting options.

Depreciation bonus

In addition to the amount of monthly depreciation, the company has the right to charge a one-time depreciation premium (AP) in the amount of up to 30% of the cost of the object and attribute it to expenses that reduce income tax. The amount of this one-time accrual is limited; its maximum size depends on the depreciation group (AG) to which the object belongs (clause 9 of Article 258 of the Tax Code of the Russian Federation).

| Maximum AP size | AG | Base for calculating AP |

| 10% | I, II, VII-X | Initial item of OS (except for those received free of charge), costs incurred during reconstruction, modernization, retrofitting, technical re-equipment |

| 30% | III - VII |

The depreciation bonus applies exclusively to fixed assets; it cannot be used in relation to intangible assets. The depreciation bonus reduces the cost of fixed assets used to calculate depreciation (clause 9 of article 258 of the Tax Code of the Russian Federation). That is, a 30-cent depreciation bonus applied to an asset will lead to the fact that depreciation will subsequently be calculated from the cost of the asset equal to 70% of its original value.

The depreciation bonus is included in the costs of the period when the fixed asset begins to depreciate.

Sale of fixed assets for which bonus depreciation was used by a related party

As mentioned above, in accordance with paragraph 9 of Article 258 of the Tax Code of the Russian Federation, if the asset in respect of which the depreciation bonus was applied was sold earlier than five years from the date of its putting into operation to a person who is interdependent with the taxpayer, the amounts of expenses previously included in the expenses of the next reporting period in accordance with paragraph 2 of clause 9 of Article 258 of the Tax Code of the Russian Federation are subject to:

- inclusion in non-operating income in the reporting (tax) period in which such sale was made.

At the same time, since 2013, Law No. 206-FZ has amended subparagraph 1 of paragraph 1 of Article 268 of the Tax Code.

In the new edition, paragraph 1, paragraph 1, Article 268 of the Tax Code of the Russian Federation is supplemented with the following paragraph:

“If the taxpayer sold a fixed asset earlier than five years from the date of its putting into operation to a person who is interdependent with the taxpayer, and in relation to such fixed asset the provisions of paragraph two of paragraph 9 of Article 258 of this Code were applied, the residual value upon sale the specified depreciable property increases by the amount of expenses included in non-operating income in accordance with paragraph four of paragraph 9 of Article 258 of this Code"

This means that when selling fixed assets for which a depreciation bonus was applied to a related party within 5 years from the date of putting such fixed assets into operation, the selling company must not only take into account the amount of this premium in income, but also has the right:

- increase the residual value of such fixed assets for income tax purposes by the amount of the depreciation bonus.

Thus, the amount of the depreciation bonus taken into account in income will be “overlaid” by the amount of the restored depreciation bonus, which increases the residual value of the fixed assets reflected in expenses.

Accordingly, the amount of income from the sale of fixed assets sold in such a situation to an interdependent person will not differ from the amount of income that would be subject to income tax in the absence of interdependence of the parties to the transaction.

The difference is that in the absence of interdependence, the amount of the depreciation bonus is not taken into account either in the income or in the expenses of the taxpayer-seller.

Filling registers

Fill out tax accounting registers in chronological order. Tax registers can be maintained in the form of special forms: development tables, statements, journals. Do this on paper (machine) or electronically.

We invite you to familiarize yourself with: Inclusion of property in the inheritance estate, judicial practice

Situation: how to reflect in tax accounting a fixed asset that is fully depreciated (residual value is zero), but which continues to be used?

A fully depreciated fixed asset item is not reflected in tax accounting.

If a fixed asset is fully depreciated, then its cost is fully included in expenses. After the residual value in tax accounting becomes equal to zero, this fixed asset does not participate in the formation of expenses for income tax. Therefore, do not reflect it in tax accounting, since the object of tax accounting is the expenses accepted when calculating income tax (paragraph 4 of Article 313 of the Tax Code of the Russian Federation).

Reflect such an object of fixed assets only in accounting, since control of the availability of assets, including property, is ensured with the help of accounting (Articles 2 and 11 of the Law of December 6, 2011 No. 402-FZ).

An example of compiling a tax register for accounting for expenses for depreciation of fixed assets

On June 2, the organization purchased a computer for 60,000 rubles. On June 15, the main facility was put into operation. The useful life of a computer for accounting and tax accounting is 36 months. Depreciation is calculated using the straight-line method.

According to the accounting policy for tax purposes, when purchasing a fixed asset, the organization writes off 10 percent of its cost as part of depreciation charges. Therefore, depreciation in tax accounting is calculated from the original cost reduced by the amount of the depreciation bonus. It is 54,000 rubles. (60,000 rubles – 60,000 rubles × 10%). The organization’s accountant took into account the depreciation bonus in the month in which depreciation on the computer began to be calculated, that is, in July.

Due to differences in the initial cost of the fixed asset and the use of bonus depreciation, the monthly amount of depreciation in tax and accounting will be different:

- in accounting – 1667 rubles/month. (RUB 60,000 36 months);

- in tax accounting – 1500 rubles/month. (RUB 54,000 36 months).

The organization's accountant reflected the depreciation charge on the purchased computer for tax accounting purposes in the depreciation calculation register

Situation: how to reflect in tax accounting a fixed asset that is fully depreciated (residual value is zero), but which continues to be used?