02/13/2015 129 196 49 Reading time: 12 min. Rating:

Author

: Konstantin Bely

Today I will tell and show you how to easily and quickly calculate interest on a deposit using a formula, as well as how to calculate interest on a deposit with capitalization using a formula and in MS Excel. What is it for?

Firstly, in order to find out exactly what you will get in monetary terms from placing a deposit in a bank and draw a conclusion about whether such a deposit is suitable for you or not. To be able to compare the conditions of different banks.

Secondly, in order to check the bank: is it charging you interest on your deposit correctly and is it using the correct calculation principle? Of course, now this happens automatically, but a failure can always occur, and interest will be calculated incorrectly, most likely not in your favor. If you don’t notice this, then the bank even less so. In my practice, this happened once.

So, let's look at how to calculate interest on a deposit in different cases.

Encyclopedia of solutions. Interest receivable and payable (lines 2320 and 2330)

Interest receivable and payable (lines 2320 and 2330)

Line 2320 “Interest receivable” of the Statement of Financial Results (hereinafter referred to as the Report) indicates the income due to the organization in the form of interest:

- for loans issued to other persons;

- on deposits placed in banks for the purpose of generating income;

— on bonds and other securities (for example, financial bills);

— accrued by the bank based on the balance of funds on the organization’s current account (clause 7 of PBU 9/99 “Income of the organization”, hereinafter referred to as PBU 9/99).

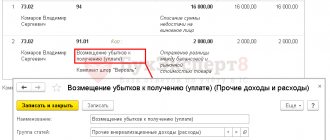

Such income is taken into account as part of other credit account 91 “Other income and expenses” in correspondence with account 76 “Other debtors and creditors” (when providing a loan to an employee with account 73) (clause 7 PBU 9/99, clause 34 PBU 19 /02 “Accounting for financial investments”).

Thus, line 2320 of the Report reflects the credit turnover in account 91, subaccount “Other income” in terms of accounting for interest receivable

Income in the amount of interest due is reflected on line 2320 only if it is included in the organization’s other income (clause 7 of PBU 9/99). If receiving this kind of income is one of the main activities of the organization, their amount is entered not in line 2320, but in line 2110 “Revenue” of the Report (clause 4 of PBU 9/99).

According to clause 16 of PBU 9/99, interest received for the provision of funds to an organization for use is recognized in a manner similar to that provided for in clause 12 of PBU 9/99. In turn, clause 12 of PBU 9/99 determines that income is recognized in accounting when the following conditions are met:

a) the organization has the right to receive it, arising from a specific agreement or confirmed in another appropriate manner;

b) the amount of income can be determined;

c) there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the organization. Such assurance exists when the entity has received an asset as payment or there is no uncertainty regarding receipt of the asset.

At the same time, in accounting, interest is accrued for each expired reporting period in accordance with the terms of the agreement (clause 16 of PBU 9/99).

Line 2330 “Interest payable” indicates the amount of interest that the organization must pay, in particular:

— for all types of debt obligations (loans, credits) (clause 11 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99);

— issued bills or bonds (clauses 15, 16 PBU 15/2008 “Accounting for expenses on loans and credits”).

The procedure for recognizing such expenses is regulated by PBU 10/99.

Expenses are recognized in accounting only if the conditions listed in clause 16 of PBU 10/99 are met, namely:

— the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

— the amount of expense can be determined;

- there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization.

In this case, expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of expenditure (monetary, in-kind and other) (clause 17 of PBU 10/99).

In accounting, interest payable is reflected in the debit of account 91 “Other income and expenses”, subaccount “Other expenses”:

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Positive factor

If the indicator decreases

Negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- V. CURRENT LIABILITIES Section V. Current liabilities is the fifth section of the balance sheet. At the same time, it is also the third section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- I. NON-CURRENT ASSETS Non-current assets are property used in the activities of an enterprise for more than a year. Its value is transferred in parts to the cost of finished products. A sign of assets is the ability to generate income for the organization.…

- IV. LONG-TERM LIABILITIES Section IV. Long-term liabilities are the fourth section of the balance sheet. At the same time, it is also the second section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- Absolute economic indicators of an enterprise's activity Absolute economic indicators of an enterprise's activity are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses...

- Key performance indicators of an enterprise Key performance indicators of an enterprise are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses About ...

- II. CURRENT ASSETS Current assets are property used in the activities of an enterprise for less than a year or used in one production cycle, which also does not exceed one year. Its entire cost...

- III. CAPITAL AND RESERVES Section III Capital and Reserves is the third section of the balance sheet. But what is more important is the first section of financial sources, that is, the liability side of the balance sheet. By this he...

- Balance sheet liability The balance sheet liability is the second part of the balance sheet. It contains a list of those financial resources that were used to acquire property, that is, assets that...

- Financial analysis of budgetary organizations online for free: state (municipal) institutions and... This is a new free analysis service taking into account changes in reporting for 2021 and beyond. For earlier reporting, the analysis is here: analysis of data from a budgetary organization...

- Horizontal and vertical analysis of the balance sheet and income statement (profit and loss) Good afternoon, my dear reader. In this article we will consider such a topic as horizontal and vertical analysis of the balance sheet and financial results statement (income and...

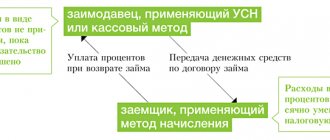

Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual. A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity).

Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

Formula for calculating simple interest

To calculate, you will need to know some quantities:

- C – the initial amount of money invested in a bank or borrowed.

- P – profit, which represents accrued interest.

- D – number of days for which interest is calculated.

- % – annual interest rate specified in the agreement.

- 365 (or 366) – depending on whether the year is a leap year, this is the number of calendar days in a year.

Then, for the year that C’s money is on deposit, the following amount is accrued: (C/100) * %

In terms of an arbitrary number of days D, the formula will take the form: P = (C/100)*%*(D/365)

Or, otherwise, to calculate the accrued interest, you need to multiply the amount by the interest rate and the number of days the deposit was placed, and divide the result by the number 36500 (or 36600 when the year is a leap year).

Interest on a loan issued - postings

Funds issued as a loan, subject to the accrual of interest on them by the transferring party, are always taken into account as part of financial investments, i.e. in account 58. The issue is recorded by posting Dt 58 Kt 51 (50, 52).

IMPORTANT! An interest-free loan will not be shown on account 58, since it does not correspond to the very idea of financial investments (to generate income). Its amount should be shown on account 76 (Dt 76 Kt 51 (50, 52)).

At the same time, in transactions for calculating interest on a loan issued, another account will be used - 76. Its use will lead to the appearance of a transaction - interest accrued on a loan issued - with correspondence Dt 76 Kt 91 (90). The choice of account in the credit part of this record will determine which types of activities for the lender include issuing a loan: other (in which case account 91 will be used) or ordinary (in this case account 90 will be used).

Interest calculations by organizations are carried out monthly on the last date of this period (clauses 12, 16 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n).

Neither the loan amount itself nor the interest on it are subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation), i.e., there will be no postings regarding this tax on the debit of account 91 (90). If the lender has any costs associated with issuing a loan (for example, a fee to the bank for funds transfer services), then during the period of their implementation they will be debited to account 91 (90).

The receipt of interest payments will be expressed by posting Dt 51 (50, 52) Kt 76.

Simple and compound interest, what is the difference?

In mathematics, one percent is one hundredth of a number. Speaking about bank interest, we usually mean an amount of money accrued according to certain rules and accumulated by a specific date.

All conditions for calculating interest must be specified in the agreement between the parties. The following factors matter:

- annual interest rate,

- capitalization of interest,

- contract term,

- interest payment procedure.

In addition to the size of the rate, i.e. the amount of interest accrued per year, the final amount is significantly affected by the presence or absence of interest under the terms of the capitalization agreement.

Interest capitalization is the process of constantly adding charges to the principal amount.

This leads to the fact that the same interest accrued in the first period is always less than in the subsequent period - after all, the base for calculating interest grows over time. This interest is called compound interest.

In deposits and loans, where the base for calculating interest does not change over time and always remains equal to the original amount, the calculation is made using the simple interest formula.

Interest accrued on the loan received - postings

The recipient of the borrowed funds will have their receipt recorded either in account 66 (if the loan is short-term - up to a year) or in account 67 (if the funds are taken for a period exceeding 12 months). The wiring will be as follows: Dt 51 (50, 52) Kt 66 (67).

The accrued interest will be credited to these same accounts, separating them in the accounting analytics from the amount of the principal debt. That is, in the entry for calculating interest on a loan received in the credit part there will be an account 66 or 67. The choice of the account that falls into its debit part will determine the fact of use or non-use of the funds received when creating an investment asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Interest amounts on a loan that is not related to the creation of an asset regarded as an investment (it has a long period of creation and high cost) should always be taken into account in other expenses - Dt 91 Kt 66 (67), accruing the corresponding amounts monthly (clause 6 of PBU 15/2008).

If borrowed funds are involved in expensive long-term investments, then the interest on them will form the cost of property (fixed assets or intangible assets) created with the participation of the corresponding investments: Dt 08 Kt 66 (67). During a long (more than 3 months) break that arose in the process of making investments, and upon completion of investments in the object, the continuing accrual of interest on the loan should be included in other expenses (clauses 11, 13 of PBU 15/2008).

Definition

Interest receivable

– income received in connection with the provision of debt financing to third parties, namely:

interest due to the organization on loans issued by it;

interest and discount receivable on securities (for example, bonds, bills);

interest on commercial loans provided by transfer of advance payment, prepayment, deposit;

interest paid by the bank for the use of funds located in the organization’s current account, etc.

Interest receivable is (clause 4 of PBU 9/99):

an independent type of income – if, in accordance with the company’s activities, such income is classified as other;

component of sales revenue, if, in accordance with the company’s activities, such income is recognized as income from ordinary activities.

Rules and procedure for filling out the Other income and expenses section

The conditional income tax expense (income) is equal to the value determined as the product of the accounting profit generated in the reporting period by the profit tax rate in effect on the reporting date, and is taken into account in accounting in a separate subaccount of account 99 for accounting for conditional expenses (conditional income) for income tax. Under the item “Interest receivable” (line 060)

income is reflected in the amount of interest due in accordance with agreements on bonds, deposits, government securities, etc., for the provision of funds to the organization for use, for the use by a credit organization of funds held in the organization’s account with this credit organization. If errors were discovered in previous reporting periods that do not affect the current income tax of the reporting period, then the amounts of adjustments should be reflected in a separate item in the income statement after the current income tax item. No changes are made to the accounting data of previous periods. At the same time, the tax return is adjusted for the amount of such errors.

It is clarified for the period to which the identified errors relate, that is, changes are made to the declaration for the previous period. Subject to the foregoing, the amount of income tax adjustments associated with the discovery of errors relating to prior reporting periods does not affect the current income tax. Line amount 100

income statement is equal to the debit turnover of account 91. 2 “Other expenses” for the corresponding items of analytical sections.

This should also include the amounts of valuation reserves created by the organization, which are accounted for in accounts 14 “Reserves for the reduction in the value of material assets”, 59 “Reserves for the impairment of investments in securities” and 63 “Reserves for doubtful debts”.

How is interest receivable calculated?

Interest receivable is recognized as income in accordance with the terms of the agreements on the basis of which financing was provided to third parties, and the terms of the issue of securities (clause 16 of PBU 9/99).

Interest receivable is taken into account (Instructions for using the Chart of Accounts):

on the credit of account 91 “Other income and expenses”, subaccount “Other income” in correspondence with account 76 “Settlements with various debtors and creditors” - if, in accordance with the areas of the company’s activities, such income is classified as other;

on the credit of account 90 “Sales”, subaccount “Revenue” in correspondence with account 76 “Settlements with various debtors and creditors” - if, in accordance with the areas of the company’s activities, such income is recognized as income from ordinary activities.

Reflection of interest receivable in financial statements

Interest receivable is reflected:

on line 2320 “Interest receivable” of the Statement of Financial Results - if, in accordance with the areas of the company’s activities, such income is classified as other;

on line 2110 “Revenue” of the Statement of Financial Results - if, in accordance with the areas of the company’s activities, such income is recognized as income from ordinary activities.

Still have questions about accounting and taxes? Ask them on the accounting forum.

3.2.8.1. What is related to interest receivable?

Interest receivable by the organization includes (clause 7 of PBU 9/99, Instructions for the use of the Chart of Accounts):

- interest due to the organization on loans issued by it;

— interest and discount receivable on securities (for example, bonds, bills);

— interest on commercial loans provided by transferring an advance, prepayment, or deposit;

— interest paid by the bank for the use of funds located in the organization’s current account.

Interest is recognized as income for the expired reporting period in accordance with the terms of contracts (clause 16 of PBU 9/99).