Home — Articles

Calculation and payment of tax payments are the most important responsibility of any business entity. Timely fulfillment of this obligation allows the organization to optimize its tax burden and avoid additional financial losses in the form of penalties. However, a fairly common situation is when an organization, due to objective reasons, has arrears in tax payments . If the tax authorities forcefully collect the specified arrears, the taxpayer can protect his interests . Let's consider these possibilities.

Legal regulation

In accordance with Art. 23 of the Tax Code of the Russian Federation, taxpayers are obliged to pay legally established taxes. According to paragraph 1 of Art. 45 of the Tax Code of the Russian Federation, the taxpayer independently fulfills the obligation to pay tax, unless otherwise provided by the legislation on taxes and fees (hereinafter referred to as tax legislation). This obligation must be fulfilled within the period established by tax legislation. Article 11 of the Tax Code of the Russian Federation provides that arrears are the amount of a tax or fee not paid within the period established by tax legislation. It is formed if the taxpayer has not transferred the taxes due to the budget or has made a partial transfer. Control over taxpayer compliance with tax legislation is carried out by the tax authority through tax control measures, for example, desk and field tax audits (Article 87 of the Tax Code of the Russian Federation). Based on the results of consideration of the materials of the tax audit, during which violations of tax legislation were revealed, a decision is made to hold the taxpayer accountable, and measures are taken to enforce the taxpayer’s obligation to pay taxes. It is necessary to pay attention to the fact that if the taxpayer has not fulfilled his obligation to pay taxes voluntarily, then the tax authorities are obliged to collect the arrears forcibly (Article 39 of the Tax Code of the Russian Federation). Tax legislation provides for two methods of enforcing the obligation to pay taxes (fees), other obligatory payments and sanctions: indisputable (extrajudicial) and judicial procedures .

Both procedures have procedural features.

Undisputed procedure for collecting arrears

The moment of the beginning of this process should be considered the date the tax authority sent the taxpayer a request for payment of taxes . The requirement is a document of the established form containing a notification to the taxpayer about the unpaid amount of tax, as well as about the obligation to pay it within the specified period (Article 69 of the Tax Code of the Russian Federation). The request must also contain information about: - the amount of tax debt; — the amount of penalties accrued at the time the claim was sent; - the deadline for paying the tax established by the legislation on taxes and fees (This period is of great procedural importance, since it determines the deadline for the tax authority to make a decision to collect the arrears, as well as the deadline for the tax authority to file an application to the court to collect the arrears (Article 46 of the Tax Code of the Russian Federation )); — deadline for fulfilling the requirement (the requirement must be fulfilled within 8 working days from the date of its receipt, unless a different deadline is specified); — measures to collect tax and ensure the fulfillment of the obligation to pay tax, which are applied in the event of failure to comply with the requirement by the taxpayer.

The request must be sent to the taxpayer within 10 days from the date of entry into force of the audit decision (if the arrears were identified during a desk or field tax audit or within 3 months from the date of its discovery (if the arrears were not identified during a tax audit). In the latter In this case, the tax authority draws up a document identifying arrears from the taxpayer (the form of the document is approved by Order of the Federal Tax Service of Russia dated December 1, 2006 N SAE-3-19 / [email protected] ) The date of drawing up the specified document, from the point of view of the tax authorities, should be taken into account when determining period for issuing a claim. A similar opinion is expressed, in particular, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated December 20, 2007 N A26-3314/2007. Note that this approach to determining the date of identification of arrears is at least not controversial. Arrears can only be identified after the taxpayer has submitted a declaration with the amount of tax due or has missed the deadline for paying the tax. The tax authority becomes aware that the tax has not been paid the next day after the deadline for payment. Consequently, at the same time he learns about the amount of arrears. This position is also reflected in court decisions (see, for example, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 08/06/2009 N A82-14902/2008-27). It is logical to assume that the discovery by the tax authority of data in its internal documents cannot indicate either the actual presence of arrears or the presence of overpayments, since such data completely depend on the actions of its employees, i.e. are subjective. In this situation, a taxpayer who has allowed arrears to arise can be recommended to reconcile settlements with the tax authorities. In this case, the date of the reconciliation report may indicate the timing of the discovery of the arrears. The current legal norms of tax legislation do not answer the question whether the deadline for sending a demand for tax payment is preemptive, i.e. whether the corresponding demand submitted in violation of the specified period is invalid. When resolving this issue, it is advisable to pay attention to the existing arbitration practice. The point of view of the judicial authorities is contained, for example, in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 22, 2006 N 25, as well as in the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 N 71 and is that violation of the deadline for issuing a claim does not entail a change in the deadline to an indisputable collection of arrears. Thus, the period for collecting arrears in case of violation of the deadline for issuing a claim will be calculated in the same way as if the claim had been submitted on time (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 19, 2006 N KA-A40/6689-06-P). The requirement to pay tax can be submitted to the head of the organization (its legal or authorized representative) in person against signature, sent by registered mail or transmitted electronically via telecommunication channels. If the specified request is sent by registered mail, it is considered received after 6 days from the date of sending the registered letter. It is necessary to pay attention to the fact that when sending a request by registered mail, unpleasant situations for the taxpayer may arise. Thus, the demand can be sent to the legal address of the organization, and not to its actual location. In addition, the request may be received by an employee of the organization who is in the office at the time the correspondence is received, and does not inform the manager about it. In these cases, the organization's management may not be aware that the procedure for forced collection of arrears has begun. It is important to remember that the deadline for fulfilling the requirement is calculated from the date of its receipt by the organization, and not from the date of its preparation. The postal stamp on the envelope or the date indicated in the notification of delivery of a registered letter to the addressee will allow you to correctly determine the date of receipt of the request when sending it by mail. If an organization has not received a demand sent by mail, then in defending its rights, including in court, it has the right to demand from the tax authorities to prove the fact of mailing and the date of the specified mailing.

What claim must a taxpayer file?

Legal proceedings that will lead to the write-off of hopeless arrears can be initiated not only by tax authorities, but also by taxpayers. The commented resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation states which statement of claim needs to be filed. This is a statement to recognize amounts, the possibility of forced collection of which has been lost, as hopeless for collection and the obligation to pay them has been terminated.

Other options are also possible. In particular, in a situation where the Federal Tax Service issued a certificate on the status of settlements with the budget, and did not indicate the impossibility of collecting a hopeless arrears, the taxpayer’s actions will be different. First, you need to contact the inspectorate in writing with a request to make an appropriate note on the certificate. And in case of refusal, appeal in court against the inaction of the tax authorities.

If the inspectors count off the uncollectible arrears against the overpayment of other taxes, then an application must be filed with the court to invalidate the decision to carry out the offset. This can be done within three months from the date of receipt of this decision (clause 4 of article 198 of the Arbitration Procedure Code of the Russian Federation).

But filing a lawsuit demanding that bad debts be excluded from the personal account is pointless. Judges do not satisfy such demands, since, in their opinion, an entry on a personal account about the presence of arrears does not violate the rights of the taxpayer. This conclusion was made, in particular, in the ruling of the Supreme Arbitration Court of the Russian Federation dated August 12, 2009 No. VAS-9893/09.

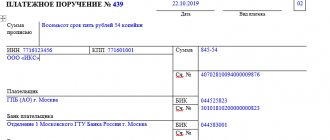

Collection of arrears at the expense of taxpayer funds

If the taxpayer has not repaid the arrears within the period specified in the request, then the tax authorities, within two months after the specified period, have the right to make a decision to collect the amount of the debt from the taxpayer’s bank account . Moreover, collection can be applied to funds located in the current account, even if these funds are received from the budget for specific purposes under government contracts (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2009 N 8580/09). The judicial body, in support of its position, noted that, as a general rule, foreclosure on funds from the budgets of the budget system of the Russian Federation is not carried out. But in the case under consideration, the collection is carried out not at the expense of budgetary funds, but at the expense of the taxpayer’s own funds, which are funds received to the organization’s current account from the budget recipient. The decision on collection is brought to the attention of the taxpayer within 6 days after the decision is made. If it is impossible to deliver the decision on collection to the taxpayer against receipt or transfer it in another way indicating the date of its receipt, the decision on collection is sent by registered mail and is considered received after six days from the date of sending the registered letter. It is necessary to pay attention to the fact that a decision made after missing the specified period is invalid and, therefore, cannot be executed by employees of credit institutions. The tax authority's order to transfer tax amounts to the budget is sent to the bank in which the taxpayer's accounts are opened, and is subject to unconditional execution by the bank in the order established by the civil legislation of the Russian Federation. At the same time, the deadline for sending this order to the bank has not currently been established. In relation to situations that arose before September 2, 2010, the deadline for sending the specified order to the bank was equal to one month from the date of the decision to collect the arrears. Often, a decision to collect tax from funds in bank accounts is made by the tax authority before the expiration of the period specified in the request for tax payment. In this case, the rights of the organization are violated and funds that it planned to use to fulfill its obligations to counterparties may be debited from its account. The specified cash flow planning may take into account the deadline for payment of arrears specified in the requirement and not lead to a violation of the law. There is no uniform arbitration practice regarding the legality of such a decision of the tax authority. On the one hand, the decision is illegal, since the procedure for collecting arrears goes through several interrelated stages. For each stage, which has independent legal significance, tax legislation provides for a certain procedure and terms for the forced collection of taxes (penalties), failure to comply with which entails legal consequences in the form of declaring a non-normative act of the tax authority invalid (Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 23, 2010 N A46 -21966/2009). On the other hand, the decision is legal, since tax legislation does not contain such a basis for unconditionally recognizing the decision to collect debt as illegal, such as failure to comply with the deadline for voluntary fulfillment of the requirement (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 20, 2010 N F03-9322/2010). A relevant issue is related to the possibility of tax authorities issuing a repeated collection order , for example, if the taxpayer closes the account in the bank to which the collection order was sent and opens an account in another credit institution. Tax legislation does not regulate the issue of issuing a repeated order. An analysis of arbitration practice has shown that in most cases, judicial authorities recognize the right of tax authorities to these actions (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated January 14, 2009 N F04-8140/2008(18774-A81-34), FAS Volga District dated December 25, 2008 N A65-10152/2008). The court indicated that the legislation does not contain a prohibition on issuing a repeated collection order. The opposite position is set out in the Resolution of the Federal Antimonopoly Service of the Central District dated October 25, 2010 N A09-3231/2010. The court found that the tax authority, after the bank returned the collection order in connection with the closure of the current account, issued a new order to write off funds from the taxpayer’s account in another bank. The court indicated that, having begun the procedure for indisputable collection, the tax authority is obliged to complete it, including making a decision to collect the tax at the expense of other property of the taxpayer. The bank's return of a collection order is not grounds for re-issuing a new order.

Issuing a court order: possible consequences

A court order is an order issued through writ proceedings. This document officially allows an authorized entity (for example, a certain government body) to collect from a specific debtor - a legal entity or a citizen - a clearly designated amount of money, referring to the requirements of the concluded agreement or the norms of the legislation in force in the Russian Federation.

If the authorized entity is the fiscal authority (FTS), then we will be talking about collecting the tax debt from the payer - an individual or, alternatively, an organization. It should be noted that in this area of legal relations, the current norms of Russian legislation regulating the procedure for conducting administrative proceedings are applied.

Characteristic features of legal proceedings carried out by order:

- The claim is considered by the court quite quickly.

- For judicial consideration of the case, the participation of the plaintiff (creditor, authorized entity) and the defendant (debtor, obligated entity) is not required.

- A ruling (instruction) is made by the court if the fact of the existence of outstanding obligations of the defendant to the plaintiff is clearly confirmed by indisputable, obvious evidence. The grounds for presenting and satisfying specific claims may be clauses of an agreement signed by both parties, or, alternatively, certain norms of the legislation in force in the Russian Federation.

Collection of timely outstanding debt is often carried out in practice by authorized employees of the Federal Bailiff Service (FSSP), who in their law enforcement activities will be guided precisely by the court order. You should know, however, that an order to recover a tax debt issued in the writ proceedings mode is valid for any debt of the defendant to the budget.

In other words, the amount of overdue obligations does not affect the legality of issuing a court order allowing the fiscal authority (FTS) to collect the tax debt from the obligated entity. In this circumstance, a court order to recover unpaid taxes differs from the verdict that is usually issued by a court in a civil proceeding.

We suggest you read: Road tax for families with many children in Moscow

As is known, for civil legal relations, a court order for the forced fulfillment of financial obligations is used exclusively in cases where the amount of the stated claim in the claim is a maximum of 500 (five hundred) thousand rubles. If the amount of the overdue debt (claim) exceeds half a million rubles, the case of collection of such debt will be considered by the court in the framework of ordinary civil proceedings, that is, on the merits of the claim filed by the creditor against the debtor.

The decision will most likely be made in favor of the creditor (plaintiff), if the court considers the evidence presented by the plaintiff to be convincing and legitimate, and the objections and arguments of the debtor (defendant) to be insufficient. A satisfied claim of the creditor in this case will become a legal basis for the collection of debt by FSSP employees from the obligated entity (debtor).

As for administrative proceedings, in this area of legal relations there are no above-mentioned restrictions characteristic of civil proceedings. However, the administrative process still allows for a number of typical situations in which an obligated entity with a tax debt has the right to actively defend its own interests.

It has already been said that a court order is a legal basis for the claimant - an entity that has received the appropriate powers - to apply to the bailiffs from the FSSP in order to forcibly collect the debt. For the situation with tax debts, the entity that has received the necessary powers upon issuance of a court order is the Federal Tax Service - a specific government agency directly responsible for taxation.

How is tax debt collected by court order? The use of a court order for the above purposes is a right rather than an obligation of the Federal Tax Service. Of course, the likelihood of the fiscal authority exercising this right is very high. However, the legal consequences of a court order occur for the taxpayer-debtor not based on the fact that the court issues this order, but on the fact that the tax service uses this document for its intended purpose.

In other words, the issuance of a corresponding order by a court does not automatically lead to any legal consequences for the obligated person - the taxpayer. Having a court order, the Federal Tax Service has the right to contact the debtor’s bank or the FSSP over a three-year period in order to forcefully collect the tax debt.

Meanwhile, the taxpayer (defendant) has the legal opportunity to take advantage of available legal mechanisms to delay the onset of the above-mentioned legal consequences. The debtor, officially recognized as an obligated entity, has the right to submit his objections to the application of the court order.

This must be done within a twenty-day period from the date of receipt of a copy of the relevant order. If the taxpayer manages to timely send these objections to the magistrate court, which previously considered the claim from the Federal Tax Service, then the court order will be canceled by a court ruling. The issue of collecting tax debt can now be considered through the general procedure of legal proceedings carried out within the framework of the administrative process for resolving relevant disputes.

Read also: What happens if property taxes are not paid: fine, penalty

Collection of arrears at the expense of other property of the organization

If there are insufficient or absent funds in the taxpayer’s accounts, as well as in the absence of information about the taxpayer’s accounts, the tax authority has the right to collect tax at the expense of other property of the taxpayer. The specified recovery is carried out by decision of the head (deputy head) of the tax authority by sending, within three days from the date of such decision, the corresponding resolution to the bailiff (Article 47 of the Tax Code of the Russian Federation). Tax legislation does not contain legal norms obliging the tax authority to notify the taxpayer of the adoption of a decision and resolution regarding the collection of tax at the expense of property. The taxpayer will be notified by the bailiff after the initiation of enforcement proceedings. This point of view is confirmed in Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 22, 2006 N 25. The decision on collection must be made within one year after the expiration of the deadline for fulfilling the requirement to pay the tax. A decision made after the expiration of the specified period is considered invalid and cannot be executed. At the same time, the question remains unsettled as to whether the decision to collect tax from property has legal force if the inspectorate did not send the taxpayer a decision to collect tax from funds in bank accounts. If such a situation arises, the organization has the right to challenge the legality of the actions of the tax authority. The existing arbitration practice on this issue is ambiguous. In particular, in the Resolution of the Federal Antimonopoly Service of the West Siberian District dated March 16, 2009 N F04-1029/2009 (1032-A45-49), the court found a violation of the law in the actions of the tax authority. However, in the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated July 31, 2008 N F08-4387/2008, the court determined that, subject to other requirements of tax legislation, this circumstance in itself cannot be a basis for canceling the decision to collect arrears at the expense of other property of the taxpayer. It is necessary to pay attention to the fact that the legality of the decision on collection is not made by the judicial authorities dependent on the following circumstances: - the tax authority did not revoke the previously issued collection order to repay the arrears at the expense of the organization’s funds in the bank (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 19, 2005 N 853/05); - the taxpayer did not receive the decision of the tax authority sent to him on the collection of arrears at the expense of the organization’s funds in the bank (Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 13, 2008 N A33-6337/07-03AP-1556/07-F02-1863/08). Enforcement actions must be carried out within two months from the date of receipt of the specified resolution. The obligation to pay tax is considered fulfilled from the moment the taxpayer’s property is sold and his debt to the budget is repaid.

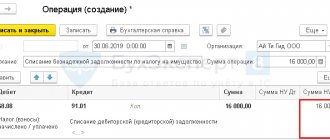

The further fate of arrears, unrealistic for collection

If the Federal Tax Service missed the above deadlines and did not apply for their restoration (or applied, but was refused), then the arrears become impossible to collect. This means that tax authorities will no longer be able to forcibly collect this money, and de facto the debt to the treasury has been cancelled.

But de jure taxes, penalties and fines that are unrealistic to collect are still listed as debt to the budget. The reason is that although the inspectors lost the opportunity to collect the arrears, the taxpayer’s obligation to pay them did not cease. This is emphasized by the Plenum of the Supreme Arbitration Court of the Russian Federation in the commented resolution. As a result, the arrears continue to appear on the taxpayer’s personal account and are indicated in the certificate of the status of settlements with the budget.

However, in the certificate issued, the inspectorate must indicate that the tax authority missed the deadline and lost the opportunity to collect the arrears. As stated in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation, such wording is necessary to maintain a balance of private and public interests and reflect objective information.

Judicial procedure for collecting arrears

If the tax authority does not exercise the right to collect the arrears at the expense of the taxpayer’s funds out of court, then he has the right to file a claim in court to collect the said arrears (Article 46 of the Tax Code of the Russian Federation). At the same time, the tax legislation does not directly regulate the question of whether the tax authority has the right to apply for judicial protection with an application for the collection of tax amounts if it had previously made a timely decision to collect it. There is no official position on this issue. An analysis of arbitration practice allows us to conclude that the tax authority does not have the right to go to court, but must independently complete the procedure for indisputable collection, namely send a collection order to the bank, and also, if necessary, make a decision to collect the tax at the expense of other property of the taxpayer (Resolutions FAS of the West Siberian District dated 03/12/2010 N A45-10407/2009, FAS of the North-Western District dated 01/13/2009 N A05-6505/2008). The application can be filed with the court within 6 months after the expiration of the deadline for fulfilling the requirement to pay the tax. A deadline for filing an application missed for a valid reason may be reinstated by the court. Neither the Tax Code of the Russian Federation nor the Arbitration Procedure Code of the Russian Federation contain a list of valid reasons. Therefore, in each specific case, the court, analyzing the specific circumstances of the case, determines whether the relevant reason is valid.

Example 1. The reason for missing the deadline is a large amount of work and a lack of specialists at the tax authority. The court granted the request of the tax authority (Resolution of the Federal Antimonopoly Service of the North-Western District dated 05.02.2009 N A13-3227/2008). The court refused to satisfy the request of the tax authority (Resolution of the Federal Antimonopoly Service of the East Siberian District dated July 23, 2008 N A19-15231/07-F02-3485/08).

Example 2. The reason for missing the deadline is the tax authority reconciling settlements with the taxpayer. The court refused to satisfy the request of the tax authority (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 12, 2009 N F03-717/2009).

In relation to arrears that are overdue for collection, two circumstances must be noted. Firstly, the tax authority does not have the right to charge a penalty . This point of view is contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 29, 2009 N 5838/09. In support of its opinion, the Supreme Arbitration Court of the Russian Federation noted that the fulfillment of the obligation to pay penalties cannot be considered in isolation from the fulfillment of the obligation to pay tax. Therefore, after the expiration of the deadline for collecting tax debt, a fine cannot serve as a way to ensure the fulfillment of the obligation to pay tax and is not accrued from that moment on. The Russian Ministry of Finance takes the same position on this issue (Letter dated October 29, 2008 N 03-02-07/2-192). Secondly, the tax authority does not have the right to offset any other tax paid in excess . If the tax authority has missed the deadline for forced collection of arrears, then it is obliged, at the request of the organization, to return to it the overpayment incurred for another tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 15, 2009 N 6544/09). If the tax authority does not exercise the right to collect the arrears at the expense of other property of the taxpayer out of court, then he has the right to file a claim in court to collect the said arrears (Article 47 of the Tax Code of the Russian Federation). The application may be filed with the court within two years from the date of expiration of the deadline for fulfilling the requirement to pay the tax.

Under what circumstances will tax authorities write off arrears?

There are several grounds for excluding arrears from a taxpayer’s personal account: liquidation of a company, bankruptcy of an entrepreneur, death of an individual and liquidation of a problem bank in which taxes, penalties, or fines are “stuck”.

If these circumstances are absent, then the only way to write off the arrears is on the basis of a judicial act confirming that the inspectors have lost the opportunity to collect the arrears due to the expiration of the collection period. This follows from the Procedure for writing off debts on taxes, penalties, fines and interest**, and this is confirmed by the Plenum of the Supreme Arbitration Court.

The commented resolution explains what judicial acts are being discussed. So, to write off a hopeless arrears, a solution to any tax dispute is suitable. The main thing is that it concludes that the inspectors have lost the opportunity to collect arrears due to the expiration of the collection period. Such a conclusion may be contained, among other things, in the reasoning part of the court decision.

In addition, a judicial act that allows the arrears to be written off is the refusal of the tax authorities to restore the missed deadline for filing an application for collection.

In the presence of any of such judicial acts, inspectors are obliged to exclude the arrears from the personal account immediately after the entry into force of this act.

We would like to add that it is better for taxpayers to bring a copy of the court decision to the Federal Tax Service, and thereby speed up the write-off process (read more about this in the article “How tax authorities will write off debts on taxes, penalties, fines and interest”).