Deregistration of a cash register is necessary if the cash register is no longer needed (for example, due to the closure of an individual enterprise), is transferred to another legal entity or individual entrepreneur, is stolen or lost.

There are three ways to deregister a cash register: submit an application in person at the tax office, on the Federal Tax Service portal or in the personal account (PA) of the fiscal data operator. Users of Kontur.OFD can deregister the cash register from the tax office independently in their personal account.

Before deregistering the cash register, generate a report on closing the fiscal accumulator (FN) at the cash register. If the Federal Tax Service is broken and the report has not been generated, you can deregister the cash register only through the Federal Tax Service. You can close the FN using a utility for registering a cash register on your computer.

If the cash register is stolen or lost, file a statement with the police and receive a certificate of registration of the statement. This certificate is needed when re-registering a cash register through a branch of the Federal Tax Service.

Submit an application to deregister the cash register within one working day from the date of receipt of the police certificate. When transferring the cash register to another user, also submit an application no later than one business day. (Federal Law No. 54, clause 5, article 4.2)

In other cases, it is recommended to submit your application as quickly as possible.

If you apply online, no supporting documents are needed.

Causes

The online cash register must be deregistered from the tax office directly by its owner. That is, to the person to whom it is documented and who was involved in registering the device. But in some cases, the Federal Tax Service handles the procedure without the participation of the businessman.

The owner deregisters the cash register on the following grounds:

- the cash register becomes the property of another person, which often happens in the case of sale, lease or other similar consequences;

- the online cash register is lost or stolen;

- The CCP has lost its functionality as a result of a breakdown and cannot be repaired.

Situations forcing tax authorities to deregister a cash register without the participation of a businessman:

- non-compliance of the device with established requirements, as a result of which its use is contrary to legal norms;

- the period of validity of the FN ended more than a month ago, and the owner of the cash register did not replace the drive in a timely manner;

- the business entity ceased its activities, which was recorded in the state registers of individual entrepreneurs or legal entities.

When a cash register is deregistered unilaterally, the owner is notified of this by mail or online (a notification is sent through the user's personal account on the Federal Tax Service website).

If the fiscal drive fails, while the functionality of the cash register is maintained, as evidenced by the normal operation of another FN installed in the device, deregistration of the cash register is not expected. A damaged drive must be replaced, followed by re-registration of the cash register.

Filling out an application for deregistration of KKM in 2021 - step-by-step instructions

The individual entrepreneur will also need to submit a well-written application to the inspectorate (according to KND form 1110021).

Step 1. Entering information into the title fields

When entering data into the title page, the individual entrepreneur must indicate his TIN and inspection code - 4 characters (for example, 6165 and 6166).

Types of documents: when deregistering a cash register, you need to enter the numbers in this order - 3/2_2_2_2_2. In this case, the number “3” means deregistration, and “2” means the answer “no” to all other questions.

Then you need to fill out the code - OKVED, in accordance with the occupation of the individual entrepreneur. The meaning of this code is indicated in the Unified State Register of Individual Entrepreneurs. Next you need to write your personal phone number

Item “Application submitted”: the entrepreneur must write the number “3”.

If the individual entrepreneur submits an application not himself, but through his representative, then he will need to write about this in the fields provided.

At the end of the page, the individual entrepreneur must indicate information about the cash register equipment - all information about the device is available in the registration card (EKLZ, cash register number).

Step 2. Entering data into “Section No. 1” - sheet 2

In this section you need to provide information about the cash register.

Lines 010-050: The individual entrepreneur must write the series, account number, model and year of manufacture of the cash register.

Line 060: The individual entrepreneur must leave this column blank.

Line 070: the entrepreneur must write the tape number - EKLZ and count the number of its digits (except for the first).

The number can be found under the barcode on the registration certificate of the cash register.

Line 080: in this field the individual entrepreneur fills in the EKLZ registration number. This information can be found on the additional sheet to the equipment data sheet.

Line 090: you need to write the number “2”, and in lines 100-120 you do not need to indicate any data if the cash register does not have a payment terminal.

Line 130-150: The individual entrepreneur must take information from the cash register maintenance agreement.

When filling out the fields, the taxpayer indicates the agreement number on the title, and the individual tax number (TIN) and validity period on the outer sheet.

Line 160-180: information about 2 numbers of the cash register seal. It can be seen on the equipment (the individual number is indicated on top of the cash register, and the registration number is indicated on the bottom).

Then you need to find a hologram (7-digit number) with maintenance. On them, the individual entrepreneur can find information about the number and date of manufacture of the cash register.

In addition, abbreviations are indicated on the equipment - GR (state register) and SO (service in technical service).

Step 3. Entering information in “Section 2” - sheet 3

On the outer sheet you need to fill out information about the location of the cash register equipment. Moreover, if the cash register worked in a rented office, then you need to fill out information about the lease agreement.

If the workroom is owned by an individual entrepreneur, then information about the contract does not need to be indicated.

The entrepreneur must also indicate the individual tax number (TIN) in the upper fields of the sheets.

How to deregister an online cash register owner

Let's look at how to deregister an online cash register. The action algorithm is as follows:

- 1. Formation of the corresponding application for the purpose of sending it to the Federal Tax Service. The application is submitted in paper or electronic form. The regulatory authority has not established strict rules regarding the form of this document.

- 2. Creating a report on closing a financial fund. The drive is not used at another cash register, so it is considered already “used material”. Data from the report on closing the FN archive is submitted to the tax office along with the application. Exceptions are cases when it is impossible to remove the report (the drive is lost or out of order).

- 3. Receiving a card about deregistration of the device.

Each stage is discussed in more detail below.

What is needed to deregister a cash register with the tax authorities?

Important! Before deregistering cash registers from tax registration, you need to check:

- Have all reports for the current period been submitted to the Federal Tax Service on time?

- Are there any debts to the tax authorities?

- Have all invoices received from the organization servicing the cash register been paid?

- Was the information entered correctly into the cashier-operator's journal?

- Is the cash register maintenance log filled out correctly?

Documents and costs

Before checking, prepare a complete package of documents.

So, when the preliminary check has been carried out, the necessary evidence can be compiled. The main package of documents for cash withdrawal is as follows:

- The applicant's passport (or a power of attorney issued by the owner for his representative).

- Application for withdrawal.

- Cash book (for LLC) or book of income and expenses (for individual entrepreneurs).

- The card that was issued earlier when registering the device at the Federal Tax Service office.

- Technical passport of KKM and passport of the EKLZ unit.

- Logs of the cashier-operator (here they will make a note about the withdrawal of the cash register and affix a stamp) and registration of calls from specialists from the organization providing maintenance.

- A copy of a document from the tax office, which indicates the balance of an individual entrepreneur or legal entity for the previous reporting period (must be certified).

From employees servicing equipment, tax authorities need:

- A receipt with a fiscal report for the entire period of using the cash register.

- Act on taking readings from cash register meters.

- A report on every three years (last) of using cash register equipment.

- Monthly fiscal reports for the same three-year period.

- Receipt for closing the ECLZ and a report on the memory block.

- An act reflecting that the EKLZ was transferred for storage (to verify, the memory block is stored for at least 5 years from the date the cash register was deregistered).

So, when all the documentation from the business owner and maintenance workers has been transferred, and the cash register has been deregistered from the tax authorities, you can deal with the cash register at your own discretion. But only until this model is deleted from the state register. After this, its use is considered illegal, and the cash register can be safely thrown away.

Checking the device

The inspection is carried out by a specialist from the control center. His task is to inspect the device and remove the fiscal receipt, which is later attached to the rest of the documents.

After completing the tax procedure, the owner of the enterprise receives a card confirming the fact that the device has been deregistered with the Federal Tax Service.

Filing an application

The first stage of deregistration of a cash register is the formation of a corresponding application. As mentioned above, it can be in electronic or paper form.

The application can be submitted:

- through your personal account on the Federal Tax Service website;

- upon a personal visit to the nearest branch of the Federal Tax Service;

- in your OFD personal account.

To certify an electronic document, an electronic digital signature is used, which was issued to the owner of the cash register or his authorized representative.

Submitting an application in your personal account on the Federal Tax Service website

Since May 29, 2017, Federal Tax Service Order No. ММВ-7-20/ [email protected] , approving the application form.

The application shall indicate the following information:

- name of the company (as in the constituent documents) or full name. Individual entrepreneur, if he is the owner of the cash register;

- TIN;

- CCT model;

- number assigned to the equipment at the manufacturer’s plant;

- reason for deregistration of equipment.

The application includes a section where data from the report on closing the financial fund is indicated. It is filled in after the corresponding procedure has been completed.

Paper application form

Applications for deregistration of the cash register with the tax office can be found here (KND form 1110062).

If the reason for deregistration of the cash register is its transfer to another owner, the application is generated within 1 business day from the moment the transaction is concluded. The same period is given if the fact of theft or loss of the device is discovered. If there is a breakdown of the cash register or financial register, an application for deregistration is submitted within the next 5 working days.

Deregistration of equipment in 2021 - procedure

When deregistering equipment in 2021, the individual entrepreneur must perform the following actions:

- prepare the necessary package of documents;

- contact the central service center for the participation of specialists in this process;

- come to the inspection.

The entire sequence of actions to deregister this equipment is simple, and the procedure itself does not take long.

If the individual entrepreneur is lucky, a trip to the inspection will take 15 minutes, and he will be able to continue working. Otherwise, if the registration department of the Federal Tax Service does not want to work as it should, then the individual entrepreneur needs to wait 5 days.

After deregistration, the individual entrepreneur can do whatever he wants with the cash register, since he no longer needs it. If an entrepreneur leases it out so that a new KKM tenant can work on it in the future, or to specialists in a central service center, this will not be considered a tax offense.

But this rule applies only to those cash registers that are still in the state register. In this case, the individual entrepreneur must put a new memory card at the checkout and put it into operation.

After deregistration, you cannot use cash register equipment that has reached the end of its depreciation period (equal to 7 years).

To avoid problems with the inspection during the inspection, the entrepreneur must store the ECLZ unit for 5 years after removal from the state register.

Generating a report on closing a financial fund

Before deregistering the cash register, the user generates a report on the closure of the financial fund. The data contained in it is transferred to the Federal Tax Service along with the application.

If it is impossible to generate a report on closing a financial fund because it is out of order or the cash register was stolen (lost), providing such data is not required. Also, the reason for the lack of performance of the drive may be a manufacturing defect. In this case, it is also not always possible to read data from it.

Confirmation of the loss of functionality of the FN is a document from the manufacturer, to whom the device is sent for examination. Its results must be ready no later than 30 working days from the date of receipt of the drive by the manufacturer. He transfers them both to the user himself and to the tax authorities through the cash register office.

If the ability to read data from the device’s memory is confirmed, the user must transfer it to the Federal Tax Service within 60 days from the date of generating an application to deregister the cash register. The examination is carried out by the manufacturer free of charge if the cause is defective products.

If the fiscal drive is operating normally, a report on its closure is generated according to the following scheme:

- 1. Make sure that the OFD of all checks based on the results of cash transactions is sent. If not all data is transferred to the operator, an error will be displayed when archiving information on the FN. You can view the number of untransmitted fiscal documents in the shift closing report or in the cash register service settings (depending on the model). The number should be “0”.

- 2. Generate a report by selecting the close archive command (detailed instructions can be found in the user manual developed for a specific model).

- 3. Extract the FN after generating the check.

Why deregister a cash register: is it necessary?

It is imperative to deregister the cash register, otherwise you may receive a large fine!

Federal Law No. 54 clearly states that individual entrepreneurs and legal entities engaged in commercial activities and paying clients in cash and non-cash can use cash register machines (abbr. KKM).

It is necessary to deregister the cash register with the tax office, regardless of the reason that prompted the owner to stop using it. The tax database contains information about each cash register and fiscal registrar used by legal entities and individuals. The law stipulates that devices must undergo regular maintenance. Plus, you need to promptly replace the old EKLZ (memory block in which information about all operations is stored) with a new one.

If you do not deregister the cash register and continue to use it, there is a risk of receiving a large fine in the event of a sudden tax audit. Inspectors periodically check whether receipts are issued correctly for the purchase of goods and services.

Individual entrepreneurs are most exposed to this risk, since it is easiest for inspectors to contact them directly (when registering with the Federal Tax Service, they indicate their actual place of residence). The worst thing is if the business owner or representative cannot explain to tax officials where the cash register is located, which is registered with a specific company or individual entrepreneur.

Card on deregistration of cash registers

The cash register is considered deregistered from the day the tax authority generates a deregistration card certified by an enhanced CEP. It is sent to the device owner electronically within 10 days from the date of application.

It contains the following information:

- name of the organization, and if the user of the cash register is an individual entrepreneur, then his full name. fully;

- TIN;

- model name;

- number assigned to the equipment at the manufacturer's factory;

- date of deregistration of the cash register.

Upon request, the Federal Tax Service is obliged to provide the card in electronic form, and if the entrepreneur expresses a desire, then on paper.

We remove cash register equipment from registration: reasons

The need to completely deregister cash registers with the tax authorities or re-register them may arise under a variety of circumstances. It could be:

- liquidation of a legal entity (enterprise or organization) as well as closure of an individual entrepreneur;

- voluntary replacement of the cash register with a more functional and new model;

- forced replacement of outdated cash register equipment due to the fact that it was deleted from the list of the state register. The cash register can be used for no more than 7 years from the date of its release ;

- theft of cash register equipment. In this case, in addition to the application to deregister the cash register, the tax specialist will need to present a police certificate;

- leasing, donating, or selling to another company or individual entrepreneur;

- force majeure (fires, floods, destruction of buildings, etc.);

- changes in the relevant part of the legislation;

- in cases where the cash register is not used for any reason. This is especially important if its further use is also not planned, but at the same time, both company employees and outsiders have access to it. To avoid unauthorized and uncontrolled use of the cash register, it must be deactivated.

Removing the cash register from tax registration

If a cash register is deregistered without the participation of its owner, the application is not submitted. The Federal Tax Service sends a notification to the user, and he, in turn, generates a report on the closure of the financial fund. The data is transmitted to the supervisory authority within 60 working days from receipt of the notification. An exception is the situation with the detection of inconsistencies in CCP FZ-54. In this case, the businessman will have to seize and present the drive itself after 30 days. Federal Tax Service specialists will independently read the information.

The cash register is considered deregistered from the day the corresponding card is generated. The owner of the cash register receives it no later than 5 working days from the date of creation.

Procedure - step-by-step instructions

Briefly, the procedure for deregistering a cash register is as follows:

- The owner determines the reason why it was decided to remove the device and begins to collect the necessary package of documents.

- Next, he consults with a service center employee about the completeness of the documentation and checking the cash register.

- The owner or his representative goes to the tax office, draws up an application to deregister the cash register and attaches all the necessary evidence.

If the documents are completed correctly and checked, the device can be deregistered within a few hours.

Removing a cash register from registration in Multikas

Thanks to the specialists of the Multikas company, you can remove the cash register from the tax office in 1 day without visiting the Federal Tax Service.

Comprehensive service includes:

- closing the drive archive;

- filing a corresponding application with the Federal Tax Service;

- generating a report on closing the financial fund;

- clearing registration information from the cash register memory.

If you do not have an electronic signature, you can also obtain it using the Multikas company. Qualified specialists with extensive experience will perform their work efficiently and quickly.

The FN must be kept by the user for 5 years, starting from the date of completion of use. This requirement does not apply to cases of loss or theft of the device along with the fiscal drive.

Need help deregistering your cash register?

Don’t waste time, we will provide a free consultation and deregister your online cash register with the Federal Tax Service.

Tax accounting of online cash register with the Federal Tax Service

11.11.2019 Before you start working with an online cash register, you must register it. It is important for an entrepreneur to know how and when to register a cash register, as well as cases in which it is necessary to deregister a cash register.

Registering an online cash register with the Federal Tax Service

Registration of an online cash register is a mandatory procedure that precedes the start of work on a cash register. 54-FZ allows entrepreneurs to register cash register equipment both in person, during a visit to the tax office, and remotely (online).

If the owner of an online cash register prefers to work the old fashioned way, he can come to the Federal Tax Service in person, fill out application form No. 1110061 and give it to a tax inspector. It is also allowed to send the application by mail (letter with a list of attachments).

Before filling out the application, you must directly purchase an online cash register, a fiscal drive and select a fiscal data operator. Next, you need to fill out an application in which you need to indicate:

- information about CCP;

- use of CCT;

- information about the OFD;

- information about fiscal documents.

When filling out the “Information about CCP” section, you must be extremely careful, since it is necessary to indicate the CCP and FN numbers (these are quite long sets of numbers). The entrepreneur must indicate the address where the cash register will be used (with an index). For online stores, the website address is indicated.

The section “Information about the OFD” will require knowledge of the tax data operator’s TIN and its full name. The section is not completed for cash registers that will be used offline.

The document may only be filled out in blue or black ink. Errors and corrections are not allowed. Each page of the application is printed on a separate sheet; double-sided printing is not allowed. Do not use staples or paper clips to secure pages together. If an entrepreneur wishes to register several cash registers, a separate application must be filled out for each cash register.

The online application is an electronic form No. 1110061. You must log in to your personal account on the Federal Tax Service website and fill out all fields of the form. The form is certified by an enhanced qualified electronic signature.

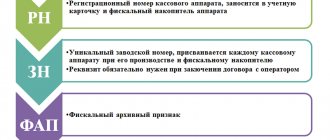

The Federal Tax Service issues the registration number of the cash register. It must be entered into the cash register and the process of fiscalization of the cash register itself must be carried out. A registration report will be generated at the checkout. The data from this report will need to be entered into your personal account with the Federal Tax Service. The tax office will check the correctness of the submitted data and issue a cash register registration card. Only after receiving the registration card is it possible to use the cash register.

When do you need to deregister a cash register?

Entrepreneurs should remember that the processes of re-registration of a cash register and its deregistration are two different operations. The first is needed when, for example, the validity period of the FN has expired, the entrepreneur has replaced it and is going to continue working at this cash register, or the address of the cash register installation has changed. There is no need to deregister the cash register for re-registration.

At the initiative of the businessman, the cash register must be deregistered in the following cases:

- the cash register is not in use and will be sold to another entrepreneur;

- the cash register is broken and cannot be repaired;

- the cash register was lost or stolen;

- cash register is not required due to business closure.

To deregister a cash register, you will need to fill out the appropriate application. The application must indicate the details of the cash register. If an entrepreneur sells his cash register, or does not plan to use it further, then he is obliged to generate a report on the closure of the financial tax at the cash register and submit it to the Federal Tax Service. If the cash register was lost or stolen and it is impossible to create a report, then the tax office requires you to indicate this in the application. You can submit the application in person at the tax office (paper version) or through your personal account on the Federal Tax Service website online.

After 5 days, the tax office will send a card confirming the deregistration of the cash register. The Federal Tax Service sends it to the entrepreneur’s personal account on the website nalog.ru.

Removal of online cash registers from tax registration without an application from the owner

It is worth remembering that the tax inspectorate has the authority to independently initiate the deregistration of the cash register. A statement from the owner is not required. This happens in the following cases:

- the entrepreneur has ceased his activities (an entry has appeared in the Unified State Register of Legal Entities or Unified State Register of Legal Entities);

- the fiscal attribute key in the FN has expired;

- Violations related to the implementation of 54-FZ were discovered.

An entrepreneur who finds himself in a similar situation will receive a tax card from the tax office indicating that the online cash register has been deregistered. The responsible authority sends such cards to the entrepreneur’s personal account on the tax website.

Moreover, in the event of deregistration of the cash register, the user has an obligation within 60 days to transfer to the Federal Tax Service the data that is in the memory of the Federal Tax Service and was not sent to the Federal Tax Service according to calculations that took place before the deregistration of the cash register.

Deregistering a cash register online

Deregistering a cash register online is very convenient, since you don’t need to waste time filling out a paper application, visiting the tax office or going to the post office. First, you need to log in to your personal account and go to the “Cash Accounting” section. Next, you need to fill out an application for deregistration. It states:

- company name or individual entrepreneur data;

- TIN;

- model and serial number of the cash register;

- the reason for deregistration, information about theft or loss (if any).

If possible, you must attach a report on the closure of the fiscal drive to the application. Such a report is not generated if the cash register is broken or missing. For cash registers that worked offline, it is also necessary to download information from the fiscal drive. The application is certified by an electronic signature.

Return to list

Important points

Remove the cash register in the same department in which you registered!

The procedure for deregistering a cash register with the Federal Tax Service should reveal:

- Does the information from the cash journal match those stored in fiscal memory?

- Has the device been deactivated in accordance with established requirements?

At the end, the ECLZ data is withdrawn and transferred to the tax authority for storage. The standard period for transferring the cash register and documentation to the territorial office of the Federal Tax Service is 3 days.

This operation does not have strict regulation at the federal level, so the procedure for deregistering a cash register may differ depending on the specific region and subject. It is advisable to first check with your local tax office what requirements apply when withdrawing cash registers.

Important! The withdrawal is carried out in the same department in which the device was previously registered.

It happens that the tax office requires that fiscal reports be taken from cash registers only in the personal presence of a representative. Then you will need to agree in advance with the employees of the Federal Tax Service on the date by which an engineer from the technical service center should visit the branch, having in hand all the documentation and the cash register itself.

Other inspection departments are less strict about the procedure for removing cash registers. They only pay attention to the documentation provided. Mainly - on the correctness of registration and the presence of a resolution from a certified technical center.