1. For the purposes of this chapter, income is recognized in the reporting (tax) period in which it occurred, regardless of the actual receipt of funds, other property (work, services) and (or) property rights (accrual method), unless otherwise provided for in paragraph 1.1 of this article.

1.1. Taxpayers specified in subparagraph 1 of paragraph 1 of Article 275.2 of this Code recognize income from activities related to the production of hydrocarbons in a new offshore hydrocarbon field in the tax (reporting) period in which they occurred, regardless of the time of actual receipt cash, other property (work, services) and (or) property rights (accrual method), but not earlier than the date of allocation of a new offshore hydrocarbon deposit on the subsoil plot or in the cases provided for in paragraph 8 of Article 261 of this Code, the date of the taxpayer’s decision on the completion of work (part of it) for the development of natural resources on a specified subsoil plot or on the complete cessation of work on a subsoil plot due to economic infeasibility, geological futility or for other reasons.

If more than one new offshore hydrocarbon deposit is allocated on a subsoil plot, the amount of income up to the date of allocation of new offshore hydrocarbon deposits on a subsoil plot related to activities related to the production of hydrocarbon raw materials at a new offshore hydrocarbon deposit carried out at each new deposit on this subsoil plot is determined taking into account the provisions of paragraph 3 of Article 299.3 of this Code.

The income specified in this paragraph, expressed in foreign currency, for tax purposes is recalculated into rubles at the official rate established by the Central Bank of the Russian Federation on the dates corresponding to the dates of recognition of similar types of income in accordance with paragraphs 3 - 6 of this article, without taking into account the provisions of paragraph one of this paragraph.

2. For income relating to several reporting (tax) periods, and if the relationship between income and expenses cannot be clearly defined or is determined indirectly, income is distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses.

For industries with a long (more than one tax period) technological cycle, if the terms of the concluded contracts do not provide for stage-by-stage delivery of work (services), income from the sale of the specified work (services) is distributed by the taxpayer independently in accordance with the principle of formation of expenses for the specified work (services) ).

3. For income from sales, unless otherwise provided by this chapter, the date of receipt of income is the date of sale of goods (work, services, property rights), determined in accordance with paragraph 1 of Article 39 of this Code, regardless of the actual receipt of funds (other property (works, services) and (or) property rights) in payment for them. When selling goods (work, services) under a commission agreement (agency agreement) by the taxpayer-committent (principal), the date of receipt of income from the sale is recognized as the date of sale of the property (property rights) belonging to the committent (principal), indicated in the notice of the commission agent (agent) about the sale and (or) in the report of the commission agent (agent).

The date of sale of real estate is the date of transfer of real estate to the acquirer of this property under a transfer deed or other document on the transfer of real estate.

The date of sale of securities owned by the taxpayer is also recognized as:

date of termination of obligations to transfer securities by offsetting similar counterclaims;

the date of actual receipt by the taxpayer of the amounts of partial repayment of the nominal value of the security during the period of its circulation, provided for by the terms of issue.

For the purposes of this chapter, requirements for the transfer of securities of the same issuer, one type, one category (type) or one mutual investment fund (for investment units of mutual investment funds) with the same volume of rights are recognized as homogeneous.

In this case, the offset of counter homogeneous claims must be confirmed by documents in accordance with the legislation of the Russian Federation on the termination of obligations to transfer (accept) securities, including reports of the clearing organization, persons engaged in brokerage activities, or managers who, in accordance with the legislation of the Russian Federation, provide clearing, brokerage services or carry out trust management in the interests of the taxpayer.

4. For non-operating income, the date of receipt of income is recognized as:

1) the date of signing by the parties of the act of acceptance and transfer of property (acceptance and delivery of work, services) - for income:

paragraph excluded. — Federal Law of May 29, 2002 N 57-FZ;

in the form of property (work, services) received free of charge;

for other similar income;

2) the date of receipt of funds to the taxpayer’s current account (cash) - for income:

in the form of dividends from equity participation in the activities of other organizations;

in the form of gratuitously received funds;

in the form of refunds of contributions previously paid to non-profit organizations that were included in expenses;

in the form of interest accrued on the amount of claims of the bankruptcy creditor in accordance with the legislation on insolvency (bankruptcy);

in the form of other similar income;

2.1) the date of receipt of real estate under a transfer deed or other document on the transfer (confirming the transfer) of real estate, the date of transfer of ownership of other property (including securities) - for income in the form of dividends received in non-monetary form;

3) the date of making payments in accordance with the terms of concluded agreements or presenting to the taxpayer documents serving as the basis for making calculations, or the last day of the reporting (tax) period - for income:

from leasing property;

in the form of license payments (including royalties) for the use of intellectual property;

in the form of other similar income;

4) the date of recognition by the debtor or the date of entry into legal force of the court decision - for income in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage), unless otherwise provided by subparagraph 15 of this paragraph;

5) the last day of the reporting (tax) period - for income:

in the form of amounts of restored reserves and other similar income;

in the form of income distributed in favor of the taxpayer with his participation in a simple partnership;

on income from trust management of property;

for other similar income;

6) date of identification of income (reception and (or) discovery of documents confirming the existence of income) - for income of previous years;

7) the date of transfer of ownership of foreign currency and precious metals when carrying out transactions with foreign currency and precious metals (including on unallocated metal accounts), as well as the last day of the current month - for income in the form of a positive exchange rate difference on property and claims ( liabilities), the value of which is expressed in foreign currency (except for advances), and a positive revaluation of the value of precious metals and claims (liabilities) expressed in precious metals, carried out in the manner established by regulations of the Central Bank of the Russian Federation;

7) excluded. — Federal Law of May 29, 2002 N 57-FZ;

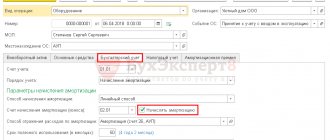

the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements - for income in the form of materials received or other property during the liquidation of depreciable property being taken out of service;

the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements - for income in the form of materials received or other property during the liquidation of depreciable property being taken out of service;

9) the date when the recipient of the property (including funds) actually used the specified property (including funds) for other purposes or violated the conditions under which they were provided - for income in the form of property (including funds ) specified in paragraphs 14, 15 of Article 250 of this Code;

10) the date of transfer of ownership of foreign currency for income from the sale (purchase) of foreign currency;

11) the date of receipt of income in the form of the cash equivalent of property transferred to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” and returned to the donor or his legal successors, the date of crediting funds to the taxpayer’s current account is recognized;

12) the date of receipt of income in the form of profit of a controlled foreign company is recognized as December 31 of the calendar year following the tax period in which the end date of the period falls for which, in accordance with the personal law of such a company, financial statements for the financial year are prepared, and in the absence of in accordance with the personal law of such a company, the obligation to prepare and submit financial statements is December 31 of the calendar year following the tax period that falls on the end date of the calendar year for which its profit is determined;

13) the date of submission to the tax authority of the excise tax return regarding the transactions specified in paragraph 24 of part two of Article 250 of this Code;

14) date of payment of interest for income in the form of interest under the loan agreement:

provided for by a loan agreement concluded by a specialized developer with an authorized bank for the provision of a targeted loan in accordance with Federal Law of December 30, 2004 N 214-FZ “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation” Federation";

established when changing the terms of the loan agreement in accordance with the Federal Law of April 3, 2021 N 106-FZ “On Amendments to the Federal Law “On the Central Bank of the Russian Federation (Bank of Russia)” and certain legislative acts of the Russian Federation regarding the specifics of changing the terms of the loan agreement, loan agreement";

provided for by the loan agreement specified in paragraph 62.2 of Article 217 or subparagraph 21.4 of paragraph 1 of Article 251 of this Code;

15) the date of receipt of funds (property, property rights) for income in the form of amounts of compensation for losses or damages recognized by the debtor or payable by the debtor in favor of the credit organization on the basis of a court decision that has entered into legal force, caused by the actions (inaction) of persons controlling a credit institution in respect of which measures to prevent bankruptcy have been (are being implemented) with the participation of the Central Bank of the Russian Federation or the state corporation “Deposit Insurance Agency”, provided for by Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”.

4.1. Funds in the form of subsidies, with the exception of those specified in Article 251 of this Code or received within the framework of a remunerative agreement, are recognized as part of non-operating income in the following order:

subsidies received to finance expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account as expenses actually incurred from these funds are recognized;

subsidies received to finance expenses associated with the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights are taken into account as expenses actually incurred using these funds are recognized. When selling, liquidating or otherwise disposing of the specified property, property rights, subsidies received that are not included in income are recognized as non-operating income on the last date of the reporting (tax) period in which the sale, liquidation or other disposal of the specified property, property rights took place;

subsidies received to compensate for previously incurred expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, or lost income are taken into account at a time on the date of their enrollment;

subsidies received to compensate for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account at a time on the date of their enrollment in the amount corresponding to the amount of accrued depreciation for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights. The difference between the amount of subsidies received and the amount included in income on the date of their crediting is reflected in income in a manner similar to the procedure provided for in paragraph three of this paragraph.

In case of violation of the conditions for receiving subsidies provided for in this paragraph, the amounts of subsidies received are reflected in full as part of the income of the tax period in which the violation was committed.

Funds received from the grantor under a concession agreement, as well as funds received from a public partner under a public-private partnership agreement, municipal-private partnership agreement, are recognized in the manner prescribed by this paragraph for accounting for subsidies.

4.2 - 4.4. No longer in force on January 1, 2015. — Federal Law of December 29, 2014 N 465-FZ.

5. When a financial agent sells financing services against the assignment of a monetary claim, as well as the sale of financial services by a new creditor who has received the specified claim, the date of receipt of income is determined as the day of the subsequent assignment of this claim or the debtor’s fulfillment of this claim. When a taxpayer - seller of goods (works, services) assigns the right to claim a debt to a third party, the date of receipt of the assignment of the right of claim is determined as the day the parties sign the act of assignment of the right of claim.

6. Under loan agreements or other similar agreements (including debt obligations issued by securities), the validity of which falls on more than one reporting (tax) period, for the purposes of this chapter, income is recognized as received and is included in the corresponding income at the end of each month of the corresponding reporting (tax) period, regardless of the date (terms) of its payment stipulated by the agreement, with the exception of the income specified in subparagraph 14 of paragraph 4 of this article.

If a loan agreement or other similar agreement (including debt obligations issued by securities) stipulates that the fulfillment of an obligation under such an agreement depends on the value (or other value) of the underlying asset with the accrual of a fixed interest rate during the validity period of the agreement, income accrued based on this fixed rate, are recognized on the last day of each month of the corresponding reporting (tax) period, and income actually received based on the current value (or other value) of the underlying asset is recognized on the date of fulfillment of the obligation under this agreement.

In the event of termination of the agreement (repayment of a debt obligation) during a calendar month, income is recognized as received and is included in the corresponding income on the date of termination of the agreement (repayment of a debt obligation).

The provisions of this paragraph do not apply to income in the form of interest accrued on the amount of claims of the bankruptcy creditor in accordance with the legislation on insolvency (bankruptcy).

Regardless of the provisions of paragraphs one through three of this paragraph, income in the form of interest accrued under a loan agreement to finance a foreign geological exploration project and not recognized for tax purposes for the period from the date of issuance of such a loan to the last day of the month on which the date of the decision on such foreign geological exploration project are taken into account for tax purposes in one of the following ways:

in the event of termination of obligations under a loan agreement to finance a foreign geological exploration project in full without satisfying the property claims of the taxpayer in connection with the completion of work on the specified foreign geological exploration project and recognition of such a project as economically inexpedient and (or) geologically unpromising, they are not taken into account for the purposes of taxation;

in the event that a loan agreement for financing a foreign geological exploration project does not comply with one of the conditions specified in paragraph 11 of Article 261 of this Code, it is taken into account in full on the 1st day of the month following the month in which such a condition was violated;

in other cases, they are taken into account evenly over two years, starting from the month following the month in which the decision was made on a foreign geological exploration project.

The date of decision-making on a foreign geological exploration project is the earliest of the following dates:

the date the taxpayer made a decision on the success of the foreign geological exploration project;

the date of termination of obligations under a loan agreement to finance a foreign geological exploration project in full without satisfying the property claims of the taxpayer in connection with the completion of work on the specified foreign geological exploration project and the recognition of such a project as economically infeasible and (or) geologically unpromising;

date of termination (partial termination) of obligations under a loan agreement to finance a foreign geological exploration project;

the date on which one of the conditions specified in paragraph 11 of Article 261 of this Code was violated in relation to the loan agreement for financing a foreign geological exploration project;

the last day of the month in which seven consecutive calendar years expire from the date of issuance of a loan to finance a foreign geological exploration project.

The recognition of a foreign geological exploration project as successful or economically inexpedient and (or) geologically unpromising is carried out by the taxpayer independently in a manner similar to the procedure established by paragraph 10 of Article 261 of this Code in relation to the decision specified in paragraph five of paragraph 11 of Article 261 of this Code.

Income in the form of interest actually received (both in cash and in kind, including by offsetting counterclaims and obligations) by the taxpayer under a loan agreement to finance a foreign geological exploration project in the period from the date of issuance of such a loan to the last day of the month , on which the date of decision-making on such a foreign geological exploration project falls, are recognized on the date of their receipt, determined in the manner established by paragraph 2 of Article 273 of this Code.

7. Lost power. — Federal Law of April 20, 2014 N 81-FZ.

8. Income expressed in foreign currency is recalculated for tax purposes into rubles at the official rate established by the Central Bank of the Russian Federation on the date of recognition of the relevant income, unless otherwise established by this paragraph.

Claims (obligations), the value of which is expressed in foreign currency, property in the form of currency values are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of transfer of ownership of the specified property, termination (fulfillment) of claims (obligations) and (or) on the last day of the current month, depending on what happened earlier.

If, when recalculating the value of claims (obligations) expressed in foreign currency (conventional monetary units) payable in rubles, a different foreign exchange rate is applied, established by law or by agreement of the parties, the recalculation of income, claims (obligations) in accordance with this paragraph is carried out according to this course.

In the case of receiving an advance or deposit, income expressed in foreign currency is recalculated into rubles at the official rate established by the Central Bank of the Russian Federation on the date of receipt of the advance or deposit (in the part attributable to the advance or deposit).

Claims, the value of which is expressed in foreign currency, under a loan agreement to finance a foreign geological exploration project (including arrears on accrued interest) are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of the decision on the foreign geological exploration project, determined in the manner established by paragraph 6 of this article.

Income in the form of a positive exchange rate difference arising as a result of the recalculation of claims under a loan agreement to finance a foreign geological exploration project on the date of the decision on the foreign geological exploration project is recognized as part of non-operating income in one of the following ways:

in the event of termination of obligations under such a loan agreement in full without satisfaction of the property claims of the taxpayer in connection with the completion of work on the specified foreign geological exploration project and recognition of such a project as economically inexpedient and (or) geologically unpromising, they are not taken into account for tax purposes;

in the event that a loan agreement for financing a foreign geological exploration project does not comply with one of the conditions specified in paragraph 11 of Article 261 of this Code, it is taken into account in full on the date when such a condition was violated;

in other cases, they are taken into account evenly over two years, starting from the month following the month in which the decision was made on a foreign geological exploration project.

Starting from the day following the date of the decision on a foreign geological exploration project, the recalculation of claims, the value of which is expressed in foreign currency, under the corresponding loan agreement for financing a foreign geological exploration project into rubles is carried out in the general manner established by paragraphs one through four of this point.

- Article 270. Expenses not taken into account for tax purposes

- Article 272. Procedure for recognizing expenses using the accrual method

Uniform distribution

At the same time, in the cases established by the Tax Code of the Russian Federation, income is distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses. Thus, the distribution of income taking into account the principle of uniform recognition of income and expenses is provided for in Art. 271 of the Tax Code of the Russian Federation in the following cases: - if income relates to several reporting (tax) periods; - if the relationship between income and expenses cannot be clearly defined or is determined indirectly; - if the production has a long (more than one tax period) technological cycle, in the case where the terms of the concluded contracts do not provide for the phased delivery of work (services). Each of these circumstances is an independent basis for the taxpayer’s distribution of income in tax accounting, taking into account the principle of uniform recognition of income and expenses. The issue of the procedure for recognizing income from the sale of products when applying the accrual method is discussed in Letter of the Ministry of Finance of Russia dated September 24, 2010 N 03-03-06/1/615. As the financial department explained, the Tax Code of the Russian Federation provides for an even distribution of income from the sale of work and services. At the same time, when producing products (goods) with a long production cycle, distribution of income from their sales is not carried out. Thus, the main principle of distribution of income from sales between reporting (tax) periods is the principle of formation of expenses. The tax authorities support the opinion of the Russian Ministry of Finance on this issue (see, for example, Letter of the Ministry of Taxes and Taxes of Russia dated September 15, 2004 N 02-5-10/54). The prevailing judicial practice overwhelmingly uses the same position (see, for example, Resolution of the Federal Antimonopoly Service of the Central District dated May 31, 2006 in case No. A36-4182/2005). Therefore, in a situation where, say, an organization has entered into an agreement to perform work in the period from 12/10/2010 to 02/24/2011 and payment is made on 02/24/2011, income under this agreement is distributed in proportion to the expenses incurred. The position of the tax authority, which believes that the taxpayer’s income should be distributed evenly between tax periods, is incorrect.

Accrual principle

One of the fundamental principles. All transactions in accounting should be reflected at the time of their completion, and not when the expected action from this transaction occurs. For example, you shipped goods to a buyer. This operation must be reflected in accounting at the time of shipment, and not when the expected profit arrives.

Continuity principle

Accounting can only be carried out at an enterprise that sees itself operating in the foreseeable future and does not intend to cease operations.

Principle of intelligibility

Accounting must be kept in such a way that its data is understandable to the user of the information. For this purpose, a unified procedure for recording transactions has been developed.

Materiality principle

Accounting information is of great value, so when maintaining records, care should be taken to ensure that it is presented to the point and is of interest to the user.

The principle of significance

This principle complements the previous one - all accounting information should not only be presented on its merits, but be useful and significant for the management, assessment and analysis of financial, operational, and business activities.

The principle of reliability and truthfulness

Accounting information must be presented without bias and may not contain errors.

Principle of objectivity

Without exception, all operations taking place at the enterprise must be reflected in accounting records and be documented.

Principle of prudence

The assessment in the accounting process should be carried out with caution - income and assets cannot be overstated, and expenses and liabilities cannot be understated.

The principle of completeness

The operation displayed in accounting must be logically completed and presented in full.

Comparability principle

Because accounting must be useful for the management and analysis of activities, its data must be displayed from period to period so that they can be compared. For this purpose, unified reporting forms and accounting policies at the enterprise are being developed.

The principle of consistency

Despite the fact that financial statements have established deadlines: month, quarter, decade, six months and a year, they must be consistent from year to year, from the beginning to the end of the enterprise’s activities. Thus, as when applying the principle of comparability, it is possible to monitor the dynamics of the enterprise’s development and make the necessary management decisions based on the information received.

Principle of unity of measurement

Despite the fact that in the process of conducting business, information is received in monetary, natural and labor measures, its comparison and analysis can only be carried out using monetary indicators. This is how other principles important for decision-making are implemented - the principles of comparability and consistency.

Principle of confidentiality

Accounting data is a trade secret. If exceptions are possible, they are discussed with the accountant in advance. Violation of this principle in the Russian Federation provides for administrative and criminal liability.

The regulatory and legislative framework of the Russian Federation in this area is built on the above principles of accounting.

5.The subject of accounting and the scope of its application.

The subject of accounting is the reproduction of the social product, which includes production, distribution, exchange and partial consumption of the social product. Accounting is characterized by the generalization of information into cost indicators, which are complemented by detailed analytical indicators expressed in natural and labor measures. Thus, the subject of accounting is the reproduction process in that part that can be represented by information in a single monetary measure, that is, the state and use of funds in the course of economic activity, as well as business transactions as the primary elements of this process. The subject of accounting is the property of the enterprise , in the form of funds and liabilities; movement of this property through business transactions occurring in the sphere of supply, production and sales of products; as well as the result of the enterprise’s activities, expressed in monetary value, that is, the enterprise’s funds used by it in carrying out economic activities.

The property of an enterprise, its obligations, sources of formation of this property (own and borrowed), economic processes are the object of economic accounting.

Important accounting objects at an enterprise include: intangible assets (patents, trademarks, licenses), fixed assets (buildings, machines), materials, inventory, monetary assets that the enterprise has, its legal relations with the state (taxes), with other enterprises , finished products and their sales, credit and settlement operations, financial results, as well as business transactions, as a result of which these values and relationships change.

At the same time, accounting objects represent economic assets used by the enterprise to carry out business activities.

The composition of the enterprise's property is quite diverse. It is determined by the content, industry specifics and volume of economic activity of the enterprise. The company's assets have a value and are called economic assets.

Long technological cycle

Based on clause 2 of Art. 271 of the Tax Code of the Russian Federation for industries with a long (more than one tax period) technological cycle, if the terms of the concluded contracts do not provide for the stage-by-stage delivery of work (services), the taxpayer distributes income from the sale of the specified work (services) independently in accordance with the principle of generating expenses for the specified works (services). According to the position of the tax authorities, production with a long cycle for the purpose of calculating income tax should be understood as production, the start and end dates of which fall on different tax periods, regardless of the number of days of production. The above applies only to cases of concluding contracts that do not provide for the stage-by-stage delivery of work and services (regardless of the duration of the stages) (see, for example, Letter of the Ministry of Taxes and Taxes of Russia dated September 15, 2004 N 02-5-10/54).

Accrual principles

The accrual principle (method) is that all income and expenses received or incurred in the reporting period are considered income and expenses of the reporting period, regardless of the actual time of receipt or payment of funds.

Income and expenses not related to the reporting period are not recognized as income and expenses of this period, even if money for them was received or transferred in this period. The accrual method of accounting for income and expenses allows “to reflect the financial consequences for the company of emerging facts of economic life in those periods when these facts occurred, and not when the company receives or pays money.

The method includes two steps:

- 1) statement - recognition of income at the time of their receipt and expenses at the time of their occurrence;

- 2) transformation of accounts.

Deferral - expenses or income of future periods. It is necessary: in case of costs that can be attributed to two or more reporting periods.

For example, the cost of the building, auxiliary materials, insurance paid in advance.

The transformation affects asset accounts (credited) and expense accounts (debited); in case of income that must be attributed to two or more reporting periods.

For example, receiving an advance commission for services that will be provided subsequently. The transformation affects the liability account (debited) and the income account (credited).

Accrual is a statement of expenses or income that no longer occurs, but has not yet been registered and posted to the cash register.

Accrual required:

in case of income due, but not recorded and not received. For example, commissions earned but not yet received and not yet invoiced to clients. The transformation affects the asset account (debited) and the income account (credited);

in case of incurred, but unregistered and not incurred expenses. For example, employee wages for the current reporting period, but paid in the next reporting period. The transformation affects the expense account (debited) and the liability account (credited).

Firms often incur costs that have a beneficial effect on financial results in more than one reporting period. These costs are usually charged entirely to asset accounts. At the end of a given accounting period, amounts relating to that period are usually transferred from asset accounts to expense accounts.

The two most important types of expense deferrals include entries for advances (advances paid) expenses and depreciation of buildings, structures, and equipment.

Advance expenses are paid in advance and relate to the future. These include rent, insurance payments, and the purchase of supplies.

That part of the expenses that went to carry out current operations of a given period is considered as expenses of this period, and that part that has not yet found its application in this reporting period is considered as expenses of future periods.

If at the end of the month no corrective entries are made to allocate advance expenses, then both the balance sheet and the profit and loss account are considered to be compiled incorrectly. In this case, assets will be overvalued and expenses will be undervalued. The consequence of this will be an overstatement of capital on the balance sheet and net profit on the income statement.

Separate Revenue Recognition

As stated in Letter of the Ministry of Finance of Russia dated November 13, 2010 N 03-03-06/2/197, in relation to fines, penalties and (or) other sanctions for violation of contractual or debt obligations, the date of receipt of income by the credit institution will be recognized as the date of recognition by the debtor or the date entry into force of a court decision. In Letter dated 04.04.2011 N 03-03-06/4/27, the Ministry of Finance of Russia came to the conclusion that for profit tax purposes, the date of receipt of income in the form of subsidies is the date of their crediting to the taxpayer’s current account. Income in the form of accounts payable , for which the statute of limitations has expired, is taken into account as part of non-operating income on the last day of the reporting period in which the statute of limitations expires. This follows from Letter of the Ministry of Finance of Russia dated December 27, 2007 N 03-03-06/1/894. The provisions of the Tax Code of the Russian Federation do not establish the procedure for determining the date of sale of the leased asset . As follows from the explanations given in Letter of the Ministry of Finance of Russia dated June 10, 2004 N 03-02-05/2/35, the amount of the redemption value of the property is reflected in the lessor’s income as these payments are received. There is no uniform position on this issue in judicial practice. Some courts support such conclusions (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated March 21, 2007 in case No. A55-10628/06). However, there is another position on this issue, according to which the lessor’s income, which constitutes compensation for the cost of the property that is leased, is included in the tax base for corporate income tax at the time of transfer of ownership of this property (see, for example, the Resolution of the FAS North -Western District dated November 23, 2006 in case No. A05-5133/2006-31). If the organization does not require buyers to pay penalties, and the debtors, in turn, do not take actions indicating recognition of the debt in the form of penalties, and there are no court decisions on the collection of penalties that have entered into legal force, the taxpayer has no grounds for recognition the amount of penalties as part of non-operating income that reduces taxable profit. The validity of such conclusions is confirmed by arbitration practice (see, for example, Resolutions of the FAS of the Ural District dated 09.12.2005 N F09-3932/05-S7, FAS of the Central District dated 04.15.2005 N A64-5748/04-11). In practice, the question may arise as to whether it is legal to include in non-operating income amounts of penalties or compensable losses only in connection with the presence of these conditions in the contract, regardless of the claims made by taxpayers to counterparties, and in the absence of objections from the debtor. Judicial practice proceeds from the fact that the moment of recognition of such income is the date of signing the document agreeing to penalties (see, for example, Decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2003 N 8551/03, Resolution of the Federal Antimonopoly Service of the North-Western District dated October 19, 2007 in the case N A56-56889/2005). As follows from the Letter of the Ministry of Finance of Russia dated October 7, 2009 N 03-03-06/1/651, deposited wages are taken into account in income after the expiration of the limitation period, which is equal to three months. At the same time, the Federal Tax Service of Russia, in Letter dated October 6, 2009 No. 3-2-06/109, explained that the period for an employee to submit a request for payment of deposited wages to the employer is not limited by law. If the employer refuses to satisfy this requirement and the employee goes to court in compliance with certain Art. 392 of the Labor Code of the Russian Federation, within a three-month period, the court can make a decision to satisfy the claim if the general one has not expired, i.e. three-year statute of limitations. Consequently, disputed accounts payable are included in income if the deposited wages have not been claimed by the employee within three years.

Advantages of the Accrual Method of Accounting

The remaining 12,240 rubles. will be recognized as expenses in December.

According to the principles of the accrual method described in IFRS (in particular, IAS 19 “Employee Benefits”), the bank’s expenses for the payment of vacation pay will be recognized as the employee “earns” the right to vacation, that is, monthly, simultaneously with the accrual of the employee’s salary. Therefore, by November, when the employee goes on vacation, the expenses will already be recognized in previous periods, in the periods when economic benefits were received from them.

Similar distortions will occur when taking into account other expenses associated with supporting the activities of a credit institution.

Thus, the Draft requires taxes and fees to be reflected no later than the deadlines established for their payment. In practice, these dates fall within other reporting periods. In IFRS, taxes must be calculated on the last day of the tax period.

Travel and entertainment expenses, according to the Project, are reflected on the date of approval of the advance report. In IFRS, transactions are reflected at the time they are completed, and not documented, so these expenses will be recognized at the time of their actual implementation, regardless of the date of approval of the expense report.

With regard to the requirements for recognition of depreciation on the last day of the period and legal costs at the date of award, in the Project they correspond to the accrual method under IFRS.

Thus, it is obvious that the accrual method proposed in the Project only formally corresponds to the accrual principle in the Western sense. In practice, the use of such a “Russified” method will certainly lead to distortion of reporting indicators prepared in accordance with IFRS.

At the same time, direct copying of the IFRS accrual method is not possible today due to a number of objective reasons: the construction of Russian accounting on the basis of primary documentation (often the date of preparation of the document and the date of the transaction refer to different periods), the requirements of other branches of legislation (for example , the Labor Code of the Russian Federation, which establishes the procedure for calculating and accruing vacation pay and compensation), the lack of a concept of professional judgment of an accountant and the legal force of this judgment, etc.

At the same time, for example, there are no barriers to calculating taxes on the last day of the period, that is, as prescribed by IFRS.

International Financial Reporting Standards are a system of standards that provide a comprehensive understanding of business and a reliable reflection of a bank’s activities in financial statements. Distortion of the fundamental assumptions of IFRS will undoubtedly lead to the generation of reporting, the qualitative characteristics of which will not meet the requirements of IFRS.

In order for the principles of IFRS in the Western sense to begin to work effectively in the domestic banking system, it is extremely important to correctly identify their essence in the regulatory documents of the Bank of Russia.

S.V.Manko

Financial Director

LLC "PROMOTING"

An important difference between Russian accounting standards and IFRS is the approach to reflecting income and expenses in the latter on an accrual basis. This method is basic in International Financial Reporting Standards.

Continuing contracts

According to the Russian Ministry of Finance (see, for example, Letter No. 03-03-05/3/59 dated July 14, 2004), expenses are subject to distribution only under contracts that provide for the receipt of income over several periods. At the same time, as follows from the Letter of the Federal Tax Service of Russia for Moscow dated March 14, 2006 N 20-12/19599, the tax authorities believe that the taxpayer is obliged to take into account expenses evenly for any ongoing contracts, and not only for those that provide receipt of income over several periods.

Determining the date of receipt of income

In paragraph 7 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 N 98 “Review of the practice of resolving cases by arbitration courts related to the application of certain provisions of Chapter 25 of the Tax Code of the Russian Federation” the following is explained. Based on clause 3 of Art. 271 of the Tax Code of the Russian Federation, when applying the accrual method, the date of receipt of income from the sale of goods is recognized as the date of sale, determined in accordance with clause 1 of Art. 39 of the Tax Code of the Russian Federation as the date of transfer of ownership of the goods . In the situation considered by the court, the parties did not ensure compliance with the terms of the agreement to retain ownership of the goods by the seller. The specified agreement of the parties, not reflecting their actual relations and real financial and economic results of activity, cannot be taken into account for tax purposes. In the case under consideration, this means that when taking into account income from the sale of goods for tax purposes in accordance with Art. 39, paragraph 3, art. 271 of the Tax Code of the Russian Federation should not take into account the provisions of the agreement on the retention of ownership rights by the company until full payment for the goods. Therefore, the court agreed with the decision of the tax authority, which was based on the conclusion that it was necessary to take into account income in the period in which the company handed over the goods to the carrier for delivery to the buyer .

Accrual method in IFRS

According to the Framework for the Preparation and Presentation of Financial Reporting in IFRS format (“History of the Framework”, IASB, 2001), accrual accounting assumes that the results of transactions and other events are recognized when they occur (regardless of the time when cash or cash equivalents received or paid) and relate to the reporting period in which the transaction occurred.

The accrual method is based on two principles: the matching principle (for expenses) and the accrual principle (for income), according to which costs are always contrasted with revenue received, and vice versa. Thus, according to the accrual method, only those expenses that led to income for that period are taken into account in the reporting period.

In some cases, it is quite difficult to determine whether income has led to expenses, so according to the attribution principle, if expenses:

- lead to current benefits, they are reflected in the income statement as expenses of the period (cost is recognized only after revenue is recognized);

- lead to future benefits (benefit over several periods), they are reflected as assets (for example, non-current assets);

- do not result in benefits, they are immediately recognized as losses.

If it is not possible to determine the relationship between costs and revenue (for example, when it comes to administrative expenses), then costs are tied to the period in which they arose. Thus, labor costs for management personnel are recognized in the period when the employees actually provided services, that is, at the end of the month.

Thus, if costs can be charged to cost, then they are taken into account as revenue from sales is recognized, otherwise costs are recognized in the period when economic benefits are received from them.

Change in revenue recognition method

The provisions of the Tax Code of the Russian Federation do not provide for a special procedure for accounting for the income and expenses of an organization when switching from one method of recognizing income to another. As follows from the position of the Ministry of Finance of Russia, set out in Letter No. 03-03-04/1/854 dated December 21, 2006, income is recognized on the date of transition. At the same time, the Moscow Office of the Federal Tax Service of Russia, in Letter No. 20-12/89146 dated October 10, 2006, explained that the rules of Art. Art. 271 and 272 of the Tax Code of the Russian Federation. Moreover, for transactions that the taxpayer carried out before switching to the accrual method, income for profit tax purposes during the period of application of the accrual method will be recognized as payment is received in any prescribed manner.

“Russified” accrual method

The accrual method described in the draft instruction “On introducing amendments and additions to the Regulations of the Bank of Russia dated December 5, 2002 N 205-P” (hereinafter referred to as the Draft) can be considered as an assumption of temporary certainty of the facts of economic activity. According to clause 1.12.2 of the Project, this principle means that the financial results of transactions are reflected in accounting upon the fact of their completion, and not upon receipt or payment of cash (their equivalents), income and expenses are reflected in the period to which they relate .

The formulation of the principle is consistent with IFRS, but the Draft does not say a word about the rule of relationship and correspondence of income and expenses on which the accrual method in IFRS is based. In light of this, in practice, the moment of recognition of transactions in accrual accounting in IFRS and RAS formats will not always coincide.

Let's look at the differences using the example of accounting for expenses associated with supporting the activities of a credit institution.

According to clause 5.11 contained in Draft Appendix 15 to the Rules for Accounting in Credit Institutions, expenses associated with supporting the activities of a credit institution are reflected depending on the type of expenses according to the corresponding symbols in Section. 7 “Expenses associated with supporting the activities of a credit organization” of the Chart of Accounts in the following order:

- Labor costs are recognized as accrued.

- Depreciation is reflected monthly no later than the last working day of the corresponding month.

- Taxes and fees are reflected no later than the deadlines established for their payment.

- Travel and entertainment expenses are reflected on the date of approval of the advance report.

- Legal and arbitration costs are reflected in the amounts awarded by the court (arbitration) as of the date of the award.

Let's consider labor costs and equivalent payments, in particular the costs of paid vacations.

For example, a bank employee whose salary is 20,000 rubles is entitled to 28 days of vacation for the previous 12 months of work: from November 20 to December 18, 2006. The amount of accrued vacation pay is 19,040 rubles, of which for 10 days of November - 6,800 rubles. ., for December - 12,240 rubles, personal income tax (13%) - 2,475 rubles.

According to the cash method (which is currently used in banks), in November the employee will be paid 16,565 rubles. (19,040 - 2465 = 16,565) and recognized as part of the bank's expenses 19,040 rubles.

According to the accrual method, the application of which the Project assumes, in November the employee will receive the entire amount of vacation pay (minus personal income tax), 6,800 rubles will be recognized as part of the bank's expenses for November.