Returnable packaging in 1C 8.3

In this article, we will consider the issue of accounting for returnable packaging in 1C Accounting 3. Returnable packaging is reusable packaging that the buyer must return to the supplier according to the contract. The functionality of the program allows you to reflect the operations of transfer, return, and receipt from the supplier. Before you start registering business transactions in the information system, you need to make sure that the appropriate setting is enabled. To do this, go to the “Main” section of the program and select the “Functionality” item. Next, go to the “Inventory” tab.

This setting will apply to all organizations that are in the infobase. Let's consider an example when we receive milk powder worth 80 thousand rubles. Plastic canisters with a total cost of 20 thousand rubles are used as containers.

The first step is to issue the “Payment Order” document. You can access it through the “Bank and cash desk” section. In the “Type of operation” field, set the value to “Payment to supplier” and fill in all the necessary details. The payment amount in our example will be 100 thousand rubles.

After filling out, we issue a payment order. Also, in our example, we do not issue a separate payment order for the amount of the deposit for our packaging, which is 20 thousand rubles. Accordingly, 80 thousand rubles is payment for the goods themselves. In the order form, click on the “Create based on” button to select the document “Write-off from current account”. Using the “Split payment” link, we will split the payment into these two amounts. For the deposit amount we will indicate the accounting account 76.05. It should also be noted that all our operations are carried out within the framework of one agreement.

Then we run the document and look at the generated transactions.

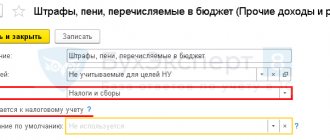

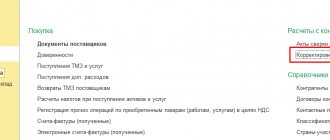

Next, we will arrange the receipt of powdered milk along with plastic canisters. Open the “Purchases” section and select the “Receipts (acts, invoices)” item. In the next window, click “Receipt” and select the transaction type “Goods, services, commission”. We fill in all the necessary fields and indicate the goods in the tabular section in the amount of 80 thousand rubles, which we received. VAT will be included in the amount.

Let's go to the “Returnable containers” tab. Add items, indicate quantity and price. In our example, 20 thousand rubles. The account was filled by default on 03/41.

After that, we post the document and register the invoice received for receipt using the corresponding button at the bottom of the document.

The next step is to create a “Return of goods to supplier” document. This item can also be found in the “Purchases” section. We are interested in the type of operation “Purchase, commission”. We fill in the details in the header and fill out the tabular part on the “Returnable containers” tab. Filling can be done according to the receipt document; for this, you need to click on the “Fill out” button and select a previously completed document.

Next we carry out the document. In this case, there is no need to issue an invoice. The next operation will be to return the deposit on our packaging from the counterparty using the document “Receipt to the current account”. To do this, go again to the “Bank and Cash Office” section and select the “Bank Statements” item. In the “Type of transaction” field, set “Return from supplier”, and also adjust the invoices by indicating 76.05. We will deposit the amount of 20 thousand rubles and select the VAT rate “Without VAT”.

Packaging in 1C: Trade Management 11.4. Setting up and working with containers

Content:

Returnable packaging in 1C, setting UT 11.4

To functionally set up accounting for returnable packaging in 1C: Trade Management edition 11.4 (11.4.5.71),

you need to go to the

“Master data and administration” section and in the “Set up master data and sections” list group go to the “Nomenclature” option

.

In the drop-down list of item settings, we check for the following enabled flags:

You can also set up an operating mode in which the user will be given a reminder about the need to fill out container information if it is determined for a product that it is supplied in reusable containers. To do this, you need to set the flag “Offer to supplement documents with reusable packaging”.

This completes the configuration of the program functionality.

2. As in 1C: Trade Management edition 11.4, you can enter information that the packaging in which the goods are accepted or shipped must be returned

Packaging that must be returned to the supplier or returned by the client is additionally registered as packaging. Additional configuration of the functionality of the 1C: Trade Management program edition 11.4

we have already produced.

Let's move on to practical examples. Bottles of sparkling water are supplied in plastic cases. Each box holds 20 bottles. The boxes are placed on metal pallets. One pallet holds 50 boxes. All packaging can be returned: metal pallets, plastic boxes and glass bottles.

The order of entering information should be as follows: Let’s go to the “Nomenclature” directory:

And then call the “create” submenu and select an option from the “Item type” list as shown below:

To the reference book “Types of nomenclature”

a type of item is added, in which the type

“Container” is indicated.

In the reference book "Nomenclature" in 1C: Trade Management edition 11.4

Information about three types of containers is recorded: “Bottle”, “Box” and “Pallet (metal)”. To do this, in the list of types and properties, you must select the “Container” option, and then use the “Create” command for a new item:

Since any carbonated water is shipped in identical packages, we will add the “Water Packages” set of packages to the list of package sets in the already familiar reference book “Nomenclature Classifier”:

Since, according to the conditions of our example, we must return all containers (bottles, boxes, pallets), we define a nesting system for packages. We need this in order to understand how many containers and what type are needed when shipping goods.

For each product package, we determine the container that corresponds to it:

The packaging card also contains information about how the reusable container will be used if the quantity of containers placed is less than the specified minimum.

For example, in our case it is indicated that a metal pallet is required for transportation if eighteen or more boxes of bottles are received (shipped). And boxes are needed if fifteen or more bottles are received (shipped).

The goods can be accepted and shipped in any packaging. Regardless of the packaging in which the goods will be accepted (shipped), when filling out the container information, information about all types of reusable containers will be filled in.

Let's go to the "Purchases" section and register the purchase (receipt) of goods from the supplier to the warehouse.

To fill in information about the container, execute the command “Fill” – “Add with container”:

As we can see, the system prompts us to fill out information on packaging in the document “Purchase of goods and services” in accordance with what we previously entered for product packaging. In our case, when supplying 1,000 bottles of lemonade, the program will offer to supplement the document with information about the packaging: 1,000 bottles, 50 boxes and one pallet.

If the flag for automatically adding containers to the tabular part of the document is set in the settings, you will be prompted to enter information about the container when posting the document.

If the container must be returned to the supplier, then on the “Additional” tab the “Return reusable container” flag must be set and the return date must be indicated:

If the supplier transfers the container on the terms of payment of its deposit value, then the flag “Deposit for container is required” is set:

The collateral value of the container is determined by the price that is determined for the container in the tabular part of the document. The collateral value will be taken into account in mutual settlements with the supplier.

Information that the container must be returned, the return period and the need for a deposit can be specified in the agreement with the supplier. When drawing up a document under such an agreement, this information will be filled in automatically.

Similarly in 1C: Trade Management edition 11.4

Documents are drawn up when shipping containers to customers on return terms.

If the container should not be returned, then the “Return reusable container”

not stated in the document. In this case, payments for containers are made similarly to calculations for the purchase (sale) of goods.

Information about which containers must be returned and within what time frame can be found in the relevant work areas:

■ Accepted returnable packaging (you must go to the “Purchases” section and in the “Returns” list group go to the “Return and redemption of packaging” option):

■ Transferred returnable packaging (you must go to the “Sales” section and in the “Returns and Adjustments” list group go to the “Return and redemption of packaging” option):

Using these workstations, you can issue a return of packaging (command “Organize return of packaging”):

And if the container is damaged, then using the “Redeem container redemption” command it is redeemed:

The deposit value of the container is paid in advance. The payment document is drawn up on the basis of the document “Purchase of goods and services”. After this, a document “Repurchase of containers” is drawn up, which records the fact that the containers were purchased from the supplier. After the redemption of the container is recorded, the container itself can be written off in the usual way, like an ordinary product.

To analyze accepted and transferred returnable packaging in 1C: Trade Management version 11.4, various reports are used, which can be viewed in the “Purchases” and “Sales” sections:

Or

Specialist

Anastasia Shokova.

Step-by-step instruction

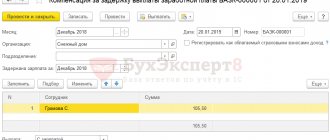

On March 12, the Organization paid the supplier:

- drinking water in the amount of 10 pcs. for the amount of 120 rubles. (including VAT 20%);

- reusable deposit container - 19 liter water bottle in the amount of 1 pc. for the amount of 250 rubles. (without VAT).

On the same day, the supplier delivered 1 bottle of water.

According to the terms of the agreement, the bottle is a returnable collateral container.

The accounting policy stipulates that the program keeps records of collateral and other people's property in off-balance sheet accounts.

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer of advance payment to the supplier | |||||||

| March 12 | 60.02 | 51 | 1 200 | 1 200 | Transfer of advance payment to the supplier | Debiting from the current account - Payment to the supplier | |

| 76.05 | 51 | 250 | 250 | Transfer of deposit to supplier | |||

| Accounting for the amount of collateral on the balance sheet | |||||||

| March 12 | 009.01 | — | 250 | Accounting for the amount of collateral in an off-balance sheet account | Manual entry - Operation | ||

| Purchasing water | |||||||

| March 12 | 60.01 | 60.02 | 120 | 120 | 120 | Advance offset | Receipt (act, invoice, UPD) - Goods |

| 10.01 | 60.01 | 100 | 100 | 100 | Acceptance of materials for accounting | ||

| 19.03 | 60.01 | 20 | 20 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| March 12 | — | — | 120 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 20 | Acceptance of VAT for deduction | ||||

| — | — | 20 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Receipt of returnable reusable packaging | |||||||

| March 12 | 002 | — | 250 | Accounting for containers on an off-balance sheet account | Manual entry - Operation | ||

| Write-off of water for general household needs | |||||||

| March 12 | 26 | 10.01 | 100 | 100 | 100 | Write-off of materials | Requirement - invoice |

Accounting for returnable packaging from the buyer

Packaging is reflected in the prices specified in the contract. It often stipulates the payment of the deposit on the terms of a refund after the container is returned. There is a mandatory requirement (clause 174) to record information about returnable packaging in the accompanying documents as a separate line and at the prices reflected in the contract.

If the agreement does not provide for payment of the deposit, then an off-balance sheet account is used to account for returnable packaging. 002 “Inventory and materials accepted for storage.” If payment of a deposit is mandatory, then the cost of the packaging in which the goods were received for subsequent sale is recorded on the balance sheet account. 41 subaccounts "Tara". And reusable packaging used when delivering goods for the buyer’s business needs is reflected in the account. 10 subaccount “Tara”. The write-off of packaging in the accounting records of the acquiring company is recorded by a reverse entry, crediting the account in which the receipt was recorded.

Purchasing water

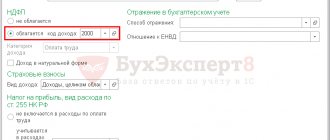

Costs for ensuring normal working conditions (including the purchase of drinking water) can be taken into account when calculating income tax (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation 03/23/2020 N 03-03-07/22134) .

VAT on such expenses is accepted for deduction in the usual manner (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Filling out a document is no different from the usual receipt of materials.

Postings

According to FSBU 5/2019, drinking water does not belong to reserves, therefore, to reduce the number of operations in the program, you can take it into account at the time of receipt in expenses, bypassing account 10:

- create a directory element Nomenclature for water with the Type of nomenclature Services ;

- create a document Receipt (act, invoice, UPD) document type Services (act, UPD) .

Then you will not need to fill out a demand invoice.

To register an incoming invoice, indicate its number and date at the bottom of the document form Receipts (acts, invoices, UPD) - Goods (invoice, UPD) and click the Register .

The document is filled in automatically.

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

Receipt of returnable reusable packaging

Returnable packaging does not meet the definition of inventory (clauses 3, 5 of FSBU 5/2019). Ownership of it does not pass to the buyer, therefore it is recorded on the balance sheet in account 002 “Inventory assets accepted for safekeeping” at the cost indicated in the acceptance documents.

Reflect the security deposit behind the balance sheet using the document Transaction entered manually ( Transactions - Transactions entered manually ).

Fill in the information about the supplier, the quantity and cost of the deposit containers according to the invoice.

Reflect the return of the deposit container to the supplier with a return entry.

Accounting for returnable packaging at the supplier

The supplying company, as a rule, reflects the cost of packaging in actual prices, based on the amount of costs of its acquisition or production. Large specialized companies with a large turnover of various types of packaging simplify the accounting of returnable packaging by using accounting prices and assigning the difference with actual prices to other expenses. The right to choose the reflection of value is enshrined in “Methods for accounting for inventory items” No. 119n (clauses 166.176).

Accounting for containers for goods sold is carried out on the account. 41 subaccounts "Tara". Only expensive special packaging is considered a non-current asset and is accounted for on the account. 01 “OS” with depreciation.