For a detailed step-by-step calculation of advance payments and simplified tax system, you can use this free online calculator directly on this website.

To correctly calculate the tax, you need to know that on the simplified tax system:

- The tax

period is considered to be a calendar year; - reporting

periods are 1st quarter, half a year and 9 months; - the tax is calculated on an accrual basis

from the beginning of the year (for example, income (expense) for 9 months will include income (expense) for half a year and the first quarter).

To pay the simplified tax system in full you need:

- during

the year (no reporting required); - next

year pay tax according to the simplified tax system minus previously paid advance payments (submit a declaration according to the simplified tax system).

It is worth noting that many individual entrepreneurs and organizations that do not want to independently calculate the simplified tax system use special programs.

Free tax consultation

Deferment of the simplified tax system due to coronavirus

Due to the COVID 19 pandemic, the payment and reporting deadlines for the simplified tax system have been changed. LLCs must submit a return for 2021 by April 6, 2020 inclusive. The individual entrepreneur’s reporting remains unchanged – April 30, 2020.

A 6-month deferment has been introduced for payment of the tax itself. LLCs must pay tax for 2021 by September 30, 2021, and individual entrepreneurs by November 2, since October 31 is a day off. The advance payment for the first quarter of 2021 must be made by October 26.

The payment terms for six months, 9 months and a year remain unchanged.

When to pay tax according to the simplified tax system in 2021

For simplicity, regardless of the chosen base, the reporting periods are quarter, six months and nine months. Based on their results, an advance payment must be transferred to the budget. The deadline for payment is the 25th day of the month following the reporting period. In 2021 this is:

- April 25 - for the quarter;

- July 25 - for the half year;

- October 25 - 9 months in advance.

The tax period is a year. Based on its results, you need to calculate and pay the remaining tax to the budget after paying all advance payments. The deadlines are different for individual entrepreneurs and LLCs. Organizations submit a declaration and pay tax by March 31 of the year following the reporting period. The deadline for individual entrepreneurs has been moved forward a month - until April 30.

Individual entrepreneurs and organizations using the simplified tax system pay advance payments by the 25th day of the month following the reporting period. Organizations pay tax at the end of the year until March 31, and individual entrepreneurs - until April 30.

The procedure for calculating the simplified tax system

For the simplified tax, as for other payments, a tax period is established. It is equal to a year and is divided into reporting periods, determined quarterly by adding the duration of the next quarter to the previous period (Clause 2 of Article 346.19 of the Tax Code of the Russian Federation).

At the end of the year, simplified taxation reporting (declaration) is submitted and the final tax payment is made. Interim reporting is not provided. But based on the results of each reporting period, the amount of the advance payment to be paid is necessarily calculated (clause 3 of Article 346.21 of the Tax Code of the Russian Federation).

The calculation of advances and taxes for the year is done according to the same algorithm (the base, calculated on an accrual basis, is multiplied by the rate). Then, to determine the amount of payment actually payable for the last quarter of the period, the amount of advances accrued for the previous period is subtracted from the resulting amount. The last provision does not apply when calculating the advance payment under the simplified tax system for the 1st quarter.

Note! From 01/01/2021, the Treasury details for making tax payments have changed. The period from 01/01/2021 to 04/30/2021 is a transition period, and payments with old details will be processed correctly. From 05/01/2021, taxes transferred to old details will be included in outstanding payments.

The presence of two different objects of taxation (“income” with a rate of 1% to 6% and “income minus expenses” with a rate of 5% to 15%) causes differences in the determination procedure:

- the base to which the relevant rate applies;

- the final amount of tax due for payment (the “income” object allows for its direct reduction by a number of paid expenses, and for the “income minus expenses” object a limit has been established below which tax payable cannot be accrued).

The rule for postponing tax payment deadlines under the simplified tax system from weekends and holidays

If the payment deadline falls on a holiday or weekend, it is postponed to the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation). Because of this, the deadlines for paying the simplified tax system do not always coincide with the date specified in the law. Here are the deadlines for paying the simplified tax in 2021:

| Reporting period | OOO | IP |

| for 2021 | March 31, 2020 | April 30, 2020 |

| for 1st quarter 2020 | April 27, 2020 | April 27, 2020 |

| for the first half of 2020 | July 27, 2020 | July 27, 2020 |

| for 9 months 2020 | October 26, 2020 | October 26, 2020 |

| for 2021 | March 31, 2021 | April 30, 2021 |

Individual entrepreneurs and LLCs must submit a simplified declaration once a year at the same time as they pay the annual tax. That is, individual entrepreneurs - until April 30, and LLCs - until March 31. If the activity on the simplified tax system is terminated earlier, then the declaration must be submitted along with the payment of tax. The declaration form can be downloaded from the official website of the Federal Tax Service.

We calculate the simplified taxation system advance for the 1st quarter of 2021

Let's look at the calculation of the simplified tax system advance using examples.

Example 1

An individual entrepreneur working on the simplified tax system, who chose the “income” object and has no employees, received an income of 835,000 rubles during the 1st quarter of 2021. In the region of its activity, the simplified tax system is subject to a 6% rate. In March, he paid insurance premiums totaling RUB 35,000.

The amount of tax payable for individual entrepreneurs will be:

835,000 × 6% - 35,000 = 15,100 rubles.

Example 2

Stimul LLC, when applying the simplified tax system with the object “income minus expenses,” received an income of 1,314,000 rubles for the 1st quarter of 2021. Accepted expenses for this period amounted to RUB 917,000. The simplified tax rate applied in the region is 15%.

The amount of tax payable will be equal to:

(1,314,000 - 917,000) × 15% = 59,550 rub.

Special cases of paying tax according to the simplified tax system

We told you what time frame the tax office expects for tax payments from organizations and individual entrepreneurs that operate as usual. But there are two situations when the date of payment of the simplified tax changes.

Voluntary termination of activities on the simplified tax system

LLCs and individual entrepreneurs refuse to continue working under the simplified tax system for various reasons: from closing a business to switching to a different taxation regime. For example, people switch to OSNO to work with government orders or large contractors. They are switching to other special regimes to reduce the tax burden.

The deadline for filing an application for refusal to apply the simplified tax system depends on the reason why the business is doing it. Option two:

1. The simplifier is changing the taxation system. The tax regime can only be changed from the beginning of the new tax period, that is, from January 1. Notification must be submitted in Form 26.2-3 by January 15. If you are late, you will remain on the simplified tax system until next year

There may be a misunderstanding about when to pay. When changing the regime from the beginning of the year, the standard procedure applies: LLCs pay tax until March 31, and individual entrepreneurs - until April 30.

2. The simplifier closed the business or changed the type of activity. An application must be submitted to the Federal Tax Service within 15 days from the date of termination of activity. The application is submitted in form 26.2-8. If you voluntarily stop working for the simplified tax system, pay the tax by the 25th day of the month following the month in which you stopped working

So, if you stopped working on March 20, but filed an application on April 3, then the tax must be paid by April 25.

Loss of the right to use the simplified tax system

If an individual entrepreneur or organization violates the working conditions on the simplified tax system, they are automatically transferred to OSNO. In 2021, the reason for losing the right to simplified taxation may be:

- revenue over 150 million rubles per year;

- number of employees more than 100 people;

- residual value of fixed assets is more than 150 million rubles;

- the emergence of a branch of the LLC;

- the start of an activity where the simplified tax system cannot be applied (for example, the production of cigarettes, alcoholic beverages, gambling business);

- in the LLC the share of participation of other legal entities exceeded 25%.

Tax authorities must be notified of violations of the conditions of the simplified tax system using form 26.2-2. The right to use the simplified procedure will be lost from the 1st day of the quarter, when the limits are no longer observed. In such a situation, you need to pay tax according to the simplified tax system before the 25th day following the quarter in which the right to use the simplified tax system was lost.

So, if you received 151 million rubles in the fourth quarter of 2020, you will be required to pay tax by January 25 of the next year.

The tax payment day is considered the day when the taxpayer submitted a payment order to the bank. You can generate a payment order on the Federal Tax Service website.

How to calculate and pay an advance under the simplified tax system?

According to Art. 346.21 of the Tax Code of the Russian Federation, an advance payment under the simplified taxation system (simplified taxation system) for the 1st quarter of 2021 is paid no later than April 26, 2021 (April 25 is a Sunday, a day off). If you do this later, you will have to pay a penalty for each day of delay.

The advance is calculated in different ways, depending on the object of taxation: “income” or “income minus expenses.” Let's take a closer look at each option.

Calculation of advance payment according to the simplified tax system with the object “income”

For the taxable object “Income” we calculate the amount of the advance payment as follows:

- Step 1.

We calculate the amount of the advance payment as the product of the tax rate specified in the settings of taxes and reports (in “1C” this is located along the path

“Main” - “Taxes and reports” - “STS”

) and the amount of income actually received for the first quarter according to the accumulation register data “Book of accounting of income and expenses (section I).”Let's call it S.

- Step 2.

We calculate the total amount of expenses that reduce the amount of the advance payment. These are paid insurance premiums, expenses for the payment of temporary disability benefits, etc., listed in Art. 346.21 Tax Code of the Russian Federation.

Let's call it R.

The amount calculated in step 1 is reduced by the amount calculated in step 2.

Limitation:

we reduce within 50% of the amount calculated in step 1, however, for individual entrepreneurs without employees, the 50% limit does not apply.

The result is the amount of the advance payment for the first quarter.

Advance payment amount = S – R, but not more than 0.5xS

When paying the trade fee, we calculate the amount of the advance payment for the taxable object “Income” as follows:

- Paragraph 1.

We separately calculate the amount of advance payments under the simplified tax system from income from activities for which the trade fee is paid for the first quarter, according to the data of the accumulation register “Book of Income and Expenses (Section I)”. Multiply by the tax rate.

Let's call the result ST.

- Point 2.

We separately calculate the amount of advance payments from income from other types of activities for which trade fees are not paid. Multiply by the tax rate.

Let's call the result SNT.

- Point 3.

We separately count expenses (paid insurance premiums, expenses for payment of temporary disability benefits, etc., listed in Article 346.21 of the Tax Code of the Russian Federation), which reduce the amount of the advance payment for the first quarter, from activities subject to trade tax according to the accumulation register “Income and Accounting Book”. expenses (section IV).”

Let's call the result RT.

- Point 4.

We separately count expenses (paid insurance premiums, expenses for payment of temporary disability benefits, etc., listed in Article 346.21 of the Tax Code of the Russian Federation), which reduce the amount of the advance payment for the first quarter, from activities not subject to trade tax according to the accumulation register “Income and Accounting Book”. expenses (section IV).”

Let's call the result RNT.

The amount calculated in step 1 is reduced by the corresponding amount calculated in step 3 (within 50% of the amount calculated in step 1; for individual entrepreneurs without employees, the 50% limit does not apply).

Additionally, we reduce it by the amount of the trade tax paid in the first quarter to the budget of the same constituent entity of the Russian Federation to which the tax is paid according to the simplified tax system (let's call it TS).

We get the sum 1 (let's call it S1).

S1 = (ST – RT, but not more than 0.5xST) – TS

The amount calculated in step 2 is reduced by the corresponding amount calculated in step 4 (within 50% of the amount calculated in step 1; for individual entrepreneurs without employees, the 50% limit does not apply).

We get the sum 2 (let's call it S2).

S2 = SNT – RNT, but not more than 0.5xSNT

Now we add both sums. The result is the amount of the advance payment due for the first quarter.

Advance payment amount = S1 + S2

Why don’t KUDiR include the expenses we need? What to do?

Expenses in KUDiR are recognized if they:

- economically justified;

- documented and paid for;

- aimed at generating income

A limited list of expenses that can be accepted to reduce the tax base is listed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

- Check the tax settings in the program, in particular, the moment of recognition of expenses.

- Be sure to follow a clear sequence of documents; the sequence must be followed according to the chronology of business transactions.

- Carefully fill out the analytics so that mutual settlements, for example, are completely closed.

- Do not use manual operations to reflect expenses of the simplified tax system. This may correct the situation here and now, but will affect subsequent periods.

- It’s better to contact us so that we can figure out together why the program did not take into account this or that expense and correct the situation. The consultant will check the program settings, analyze the situation, correct the discrepancy, show and tell what was wrong, and teach how to keep records correctly.

Order services

An example of calculating an advance under the simplified tax system with the object “income” Situation

Individual entrepreneur Georgy Vasilievich Vasnetsov earned 450,000 rubles in 2021. In February, the businessman paid fixed contributions in the amount of 23,153 rubles from his bank account. By this amount, an individual entrepreneur can legally reduce tax and advances on it.

Wherein:

The income of individual entrepreneurs for the 1st quarter amounted to 20,000 rubles. The income of the individual entrepreneur for the six months amounted to 150,000 rubles. The income of the individual entrepreneur for 9 months amounted to 250,000 rubles. The income of the individual entrepreneur for 12 months amounted to 450,000 rubles.

Sequence of actions of an accountant

The accountant keeping records of individual entrepreneurs calculated the advance payment using the formula: for the 1st quarter: 20,000 x 6% = 1,200 rubles. At the same time, the accountant has the right to reduce the tax by the amount of fixed contributions paid in the 1st quarter, i.e. by 23,153 rubles. Since they significantly exceed the advance amount, there is no need to transfer anything to the tax office in the first quarter. Accordingly, no tax should be charged; there will be no postings.

For half a year:

150,000 x 6% = 9,000 rubles, minus 23,153 rubles. – again there is no tax to pay.

For 9 months:

250,000 x 6% = 15,000 rubles, minus 23,153 rubles. – the paid contributions exceed the accrued tax, which means we do not pay it.

For 2021 the following picture emerges:

450,000 x 6% = 27,000 rubles, minus 23,153 rubles. Tax remains to be accrued and paid = RUB 3,847.

How to pay an advance under the simplified tax system with the object “income”?

Fill out the payment order in accordance with the sample below (see Figure 1). For ease of orientation, we have provided the layout of the fields of the payment order (see Figure 2).

Explanations for filling:

- In field 104 of the payment order, indicate BCC. In 2021, KBK 182 1 0500 110 is in effect for tax under the simplified tax system on the object of income.

- In field 102, organizations put checkpoints. Entrepreneurs do not have a checkpoint, so leave the field blank. Enter 0 if you pay tax yourself and not on demand.

- In field 21, when paying tax, indicate payment priority 5.

- In field 105, write OKTMO at your address. Check if your code has changed on the Federal Tax Service website.

- In field 106, write “TP”, since you are transferring the current payment.

- In field 107, enter the period for which you are paying tax. Since you are transferring an advance for the 1st quarter of 2021, indicate “Q.01.2021”.

- Field 108 will be “0” if you pay current tax. If you are transferring an amount according to a demand or deed, indicate the document number. In field 109, enter 0. In field 110, do not enter anything.

- In field 24, write down the purpose of the payment - “Advance payment under the simplified tax system “income” for the 1st quarter of 2021.”

How to calculate an advance payment in 1C without errors?

Get practical skills in calculating advance payments in 1C - sign up for the course “Account keeping when applying a simplified taxation system.”

You will become familiar with the functionality of the 1C: Enterprise Accounting configuration and learn how to use them to solve accounting problems under the simplified tax system in 1C: Enterprise 8.

Submit your application

Calculation of an advance under the simplified tax system with the object “income minus expenses”

For the tax object “Income minus expenses”, the amount of the advance payment payable is determined as follows:

The amount of income actually received for the 1st quarter is determined according to the accumulation register “Book of Income and Expenses (Section I)”.

The amount of actual expenses incurred for the 1st quarter is determined according to the accumulation register “Book of Income and Expenses (Section I)”. The amount of paid trade tax is taken into account as expenses in the same way as other taxes and fees on the basis of paragraphs. 22 clause 1 art. 346.16 Tax Code of the Russian Federation.

The difference between the amount of income actually received and the amount of expenses actually incurred is determined (the difference in the amounts in paragraphs 1 and 2).

The product of the tax rate specified in the settings of taxes and reports (section: Main - Taxes and reports - simplified tax system) and the amount received in paragraph 3 is calculated. The result is the amount of the advance payment payable for the 1st quarter.

Note! According to paragraph 6 of Art. 346.18 of the Tax Code of the Russian Federation, the simplified minimum tax with the object “income minus expenses” is calculated only based on the results of the tax period, that is, the calendar year.

Example of calculating an advance using the simplified tax system with the object “income minus expenses”

Situation

According to the reporting documents, Topol LLC managed to earn 120,000 rubles in the 1st quarter of 2021, while expenses amounted to 75,000 rubles.

Sequence of actions of an accountant

Having made the calculation, the accountant received a value of 6,750 rubles ((120,000 - 75,000) x 15% (At the same time, regional laws may establish differentiated tax rates according to the simplified tax system)). It is for this amount that you need to draw up a payment order, indicating in the purpose “advance payment for the simplified tax system for the 1st quarter of 2021.”

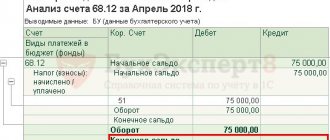

Debit 99 Credit 68 6,750 rubles - advance payment accrued for the 1st quarter of 2021;

Debit 68 Credit 51 6,750 rubles - advance payment transferred to the Federal Tax Service.

How to pay an advance under the simplified tax system with the object “income minus expenses”?

Explanations for filling

In field 104 of the payment order, indicate the BCC for the simplified tax system with the object “income minus expenses.” In 2021, KBK 182 1 0500 110 is in effect. Fill out the remaining fields in the same order as for the simplified tax system with the object “income”.

Which BCCs to indicate when paying tax according to the simplified tax system

The correct KBK is the key to ensuring that your money goes where it needs to go. If the code is incorrect, the tax office will not see the payment. This will be followed by fines and account blocking until the circumstances are clarified.

BCCs depend on the tax base. For convenience, we grouped them into a table.

| Article | Income | Income minus expenses |

| Advance payments and the tax itself | 18210501011011000110 | 18210501021011000110 |

| Fines according to the simplified tax system | 18210501011013000110 | 18210501021013000110 |

| Penalties according to the simplified tax system | 18210501011012100110 | 18210501021012100110 |

In the article “KBK for individual entrepreneurs and LLCs on the simplified tax system in 2021,” we talked about whether the codes of organizations and entrepreneurs differ, where to indicate the codes and how to correct errors.