What applies to monetary documents?

Cash documents are paid:

- coupons for petroleum products;

- food stamps;

- health resort vouchers;

- aviation, railway, travel tickets;

- express payment cards for cellular communications and Internet;

- notifications received for postal transfers;

- stamps (including postage stamps, state duty stamps, etc.);

- stamped envelopes.

The institution must keep monetary documents accounted for in account 0 201 35 000 “Cash Documents” in the cash register. Accounting for transactions with monetary documents is carried out on separate sheets of the Cash Book (f. 0504514) with the entry “Stock” placed on them, as well as in the Journal for other transactions (f. 0504071) on the basis of documents attached to the cashier’s reports (paragraph 3 p. 170, paragraph 172 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

Analytical accounting of monetary documents is carried out according to their types in the Funds and Settlements Accounting Card (f. 0504051) (clause 171 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

GLAVBUKH-INFO

Reception, storage and expenditure of cash are carried out through the organization's cash desk. Cash transactions include operations related to receiving and spending cash directly from the organization's cash desk. In addition to cash, the organization’s cash desk may also contain monetary documents, such as postage stamps, bill of exchange stamps, paid air tickets, etc.Work at the organization's cash desk is assigned to the cashier.

The hiring of a cashier is formalized by order (instruction) of the head of the organization. After issuing an order to appoint a cashier to work, the head of the organization is obliged, against receipt, to acquaint him with the job description, the above-mentioned Procedure for conducting cash transactions in the Russian Federation and conclude an agreement with the cashier on full individual financial responsibility.

In organizations that are small businesses (hereinafter referred to as small enterprises) that do not have a cashier position on staff, the latter’s duties can be performed by the chief accountant or another employee on the written order of the head of the organization, subject to the conclusion of an agreement with him on full individual financial responsibility.

Orders for the hiring of employees (including cashiers) must be issued using unified forms of primary accounting documentation for personnel records.

The job description provides for the following main responsibilities of a cashier.

- carrying out operations for receiving, accounting, issuing and storing funds with mandatory compliance with the rules ensuring their safety;

- delivery of cash in excess of established limits to a bank institution;

- maintaining a cash book based on incoming and outgoing documents;

- registration of documents and receipt, in accordance with the established procedure, of funds from bank institutions for the issuance of wages and bonuses, payment of travel and other expenses;

- reconciliation of the actual availability of cash amounts with the book balance;

- preparation of cash reports.

To properly perform job duties, a cashier must know:

- governing and regulatory documents (decrees, instructions, orders, instructions, etc.) relating to the conduct of cash transactions;

- forms of cash and bank documents; rules for receiving, issuing, accounting and storing funds;

- procedure for processing incoming and outgoing documents;

- the cash balance limit established for the organization and the rules for ensuring its safety;

- the procedure for maintaining a cash book and preparing cash reports;

- rules for operating electronic computer equipment;

- basics of labor organization, internal labor regulations, rules and regulations of labor protection, safety precautions, industrial sanitation and fire protection.

The cashier, in accordance with the current legislation on the material liability of workers and employees, bears full financial responsibility for the safety of all valuables accepted by him and for damage caused to the organization, both as a result of intentional actions and as a result of a negligent or dishonest attitude towards his duties.

Written agreements on full financial liability can be concluded by an organization with employees who have reached the age of 18 and hold positions or perform work directly related to the storage, processing, sale (release), transportation or use in the production process of the valuables transferred to them.

The list of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual or collective (team) financial responsibility, as well as standard forms of agreements on full financial responsibility, were approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85 (currently time - Federal Service for Labor and Employment).

In accordance with this resolution, an agreement on full individual financial responsibility must be concluded with the cashier.

The completed standard form of an agreement on full individual liability, recommended for use by this resolution, is given on the next page.

hereinafter referred to as the “Employee”, on the other hand, have entered into this Agreement as follows:

1) The Employee assumes full financial responsibility for the shortage of property entrusted to him by the Employer, as well as for damage incurred by the Employer as a result of compensation for damage to other persons, and in connection with the above undertakes:

a) treat with care the property of the Employer transferred to him for the implementation of the functions (responsibilities) assigned to him and take measures to prevent damage;

b) promptly inform the Employer or immediate supervisor about all circumstances that threaten the safety of the property entrusted to him; —

c) keep records, draw up and submit in the prescribed manner commodity-money and other reports on the movement and balances of the property entrusted to him;

d) participate in the inventory, audit, and other verification of the safety and condition of the property entrusted to him,

2) The employer undertakes:

a) create for the Employee the conditions necessary for normal work and ensuring the complete safety of the property entrusted to him;

b) familiarize the Employee with the current legislation on the financial liability of employees for damage caused to the employer, as well as other regulatory legal acts (including local ones) on the procedure for storage, reception, processing, sale (release), transportation, use in the production process and implementation other transactions with the property transferred to him;

c) carry out inventory, audits and other checks of the safety and condition of property in the prescribed manner.

3) Determination of the amount of damage caused by the Employee to the Employer, as well as damage incurred by the Employer as a result of compensation for damage to other persons, and the procedure for their compensation are made in accordance with current legislation.

4) The employee does not bear financial liability if the damage is caused through no fault of his own.

5) This Agreement comes into force from the moment of its signing.

This Agreement applies to the entire period of work with the Employer’s property entrusted to the Employee.

6) This Agreement is drawn up in two copies of equal legal force, one of which is kept by the Employer, and the second by the Employee.

7) Changes in the terms of this Agreement, addition, termination or termination of its validity are carried out by written agreement of the parties, which is an integral part of this Agreement. In organizations that have a large number of divisions or are serviced by centralized accounting departments, wages, payments of social insurance benefits, scholarships can be made by written order of the head of the organization by persons other than cashiers,

Agreements on full individual financial responsibility are also concluded with these persons and they are subject to all the rights and obligations established for cashiers.

The heads of organizations are obliged to equip a cash register in an isolated room intended for the reception, issuance and temporary storage of cash, and to ensure the safety of money in the cash register premises, as well as when delivering money from the bank and depositing it in the bank.

In cases where, through the fault of the heads of organizations, the necessary conditions were not created to ensure the safety of funds during their storage and transportation, they bear responsibility in the manner prescribed by law.

All cash and monetary documents are stored, as a rule, in fireproof metal cabinets, and in some cases - in combined and ordinary metal cabinets, which at the end of the working day are locked with a key and sealed with a cashier's seal.

The keys to metal cabinets and seals are kept by the cashier, who is prohibited from leaving them in designated places, transferring them to unauthorized persons, or making unaccounted for duplicates.

Access to the cash desk premises by persons not related to its work is prohibited.

| Next > |

Coupons for fuel and lubricants

Under the agreement, a certain amount of gasoline of the appropriate brand is paid, and the institution receives coupons with which drivers will refuel cars at the gas station. The received coupons on the basis of the supplier’s shipping documents (waybill, invoice, etc.) are received as monetary documents at the institution’s cash desk, and in the receipt order you must indicate the brand of gasoline, the series and numbers of these coupons, the denomination of the coupons in liters and the cost coupon in rubles (based on the cost of gasoline specified in the contract and invoice).

As a rule, for control purposes, a special accounting book is opened in which the movement of coupons is recorded.

The fuel received using coupons is accounted for as the institution’s inventory after the submission of an advance report by the accountable person with supporting documents from the gas station that sold the fuel in exchange for the coupon.

- Coupons for fuel and lubricants were received at the cash desk of the institution Dt 0 201 35 510 Kt 0 302 34 730

- Coupons issued from the cash register to the accountable person Dt 0 208 34 560 Kt 0 201 35 610

- The accountable person submitted an advance report on used coupons Dt 0 105 33 340 Kt 0 208 34 660

Rules for storing money in the cash register

To make cash payments, organizations must have a cash register and maintain a cash book in the prescribed form.

To store funds, each organization must be equipped with a cash desk - an isolated room designed for receiving, issuing and temporary storage of cash. The cash register should be in the central office, and in each pharmacy the functions of the cash register are performed by the manager's office or a material room in which there is a safe for temporary storage of cash. The safe stores cash during the working day, and the cash limit is also locked in the safe at night. In addition to revenue, the safe stores cash for change (change). Cash must be stored in a fireproof safe, and the cashier does not have the right to store valuables that do not belong to the organization in the cash register of the organization. The keys to the safe and cash drawer are kept only by the cashier and cannot be given to anyone. Upon completion of work, safes are locked with a key and sealed with the cashier's seal. If, during a tax audit, it turns out that the amount in the cash register exceeds the amount shown in the documents, then in this case the organization will face a fine.

Limit

An organization, when selling goods to the public, receives proceeds from sales mainly in cash, which are accepted at the cash desk and then subject to delivery to the bank for subsequent crediting to the organization’s account. The amount of cash that an organization can leave in the cash register at the end of the working day is limited. This restriction is called the cash balance limit at the cash register; the size of the limit is set annually by the manager; all pharmacy managers are familiar with the order if there are several pharmacies in the organization. Organizations, regardless of the general public fund and the field of activity, are required to store available funds in banks; they can have cash in their cash registers within the limit of the cash balance in the cash register.

Every year, to ensure the normal operation of the organization, taking into account the average daily revenue and cash consumption, the head of the pharmacy organization sets a limit on the amount of money in the cash register, as well as the procedure and timing for depositing proceeds into the bank. The limit on the balance of money in the cash register is approved by order, the document is stored in the organization. After setting a limit on the balance of money in the cash register, the organization sends a notification about this to the bank in which it has accounts.

Letter No. 18 of the Central Bank of Russia: enterprises are required to keep available funds in banks (revenue is deposited daily for collection). The bank issues the organization a document “Calculation for establishing a cash balance limit for the enterprise.” The amount of the cash limit is not established by law; it is determined based on the characteristics of the organization’s work; for one organization it is enough to have a limit of 500 rubles, and for another 10,000 rubles.

All cash coming into the organization must be deposited at the bank at the end of the day. There should be no excess amounts in the cash registers. If necessary, cash register limits are revised.

Enterprises can have cash in their cash registers within limits (a certain amount), which is established by the manager. To make cash payments, each enterprise must have a cash register and maintain a cash book. In this case, the cash book is kept in the office by the chief accountant.

Storing money in the cash register in excess of the limit for issuing salary is carried out for the regions of the Far North for 5 days, and for other regions for 5 days, after which the unissued salary is returned to the bank.

Businesses are required to hand over to the bank all cash in excess of established limits. The bank does not accept banknotes of less than 100 rubles.

The procedure for registration, storage, destruction of the control cash tape

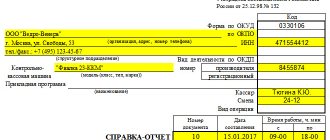

In addition, a control tape must be used on all cash registers, and a cashier-operator’s log certified by the tax authority must be kept for each cash register.

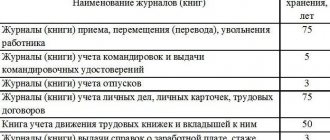

Control tapes, cashier-operator’s journal and other documents confirming,

carrying out cash settlements with buyers (clients) must be stored for the periods established for primary accounting documents, but not less than 5 years. The head of the organization is responsible for ensuring the storage of these documents. Violations of the above obligations identified during inspections may result in significant penalties.

According to the Regulations on the use of cash registers, checks, control tapes and other documents provided for by technical requirements and printed using cash registers in fiscal mode must have a distinctive feature specified in the technical requirements for fiscal (control) memory.

TOPIC 3. PROCEDURE FOR CONDUCTING CASH OPERATIONS

Lecture No. 2. Incoming and outgoing cash transactions. The procedure for conducting cash transactions. Return of goods by the public

Postage stamps and stamped envelopes

Postal services also remain widespread and in demand. The organization of postal shipments is impossible without purchasing stamps and marked envelopes, which, according to Instruction No. 157n, must be taken into account as monetary documents and, as necessary, issued for reporting to the persons responsible for sending correspondence. The supporting document for the advance report may be a register of sent correspondence, and in case of damage, a damaged envelope attached to the report.

- Receipt of stamps and marked envelopes to the institution's cash desk Dt 0 201 35 510 Kt 0 302 21 730; 0 208 21 660

- Issuance of stamps and marked envelopes for reporting Dt 0 208 21 560 Kt 0 201 35 610

Accounting press and publications

“Modern accounting”, N 4, 2004

PROCEDURE FOR ENSURING THE SECURITY OF FUNDS

IN THE ORGANISATION

The requirements for storing cash in organizations are established by the Procedure for conducting cash transactions in the Russian Federation, approved by the Decision of the Board of Directors of the Central Bank of Russia on September 22, 1993 N 40 (hereinafter referred to as the Procedure for conducting cash transactions).

In accordance with paragraph 3 of this Procedure, in order to make cash payments, each enterprise must have a cash desk. In this regard, enterprise managers are required to equip a cash register (an isolated room intended for receiving, issuing and temporary storage of cash) and ensure the safety of money in the cash register premises, as well as when delivering it from a bank institution and depositing it with the bank (clause 29 of the Procedure) .

Let us outline the requirements imposed by current legislation on the cashier, as well as the requirements for the equipment of the cash register and the safety of funds during their storage and transportation.

Requirements for a cashier

Cashiers, controllers, cashier-controllers (including senior ones), as well as other employees performing the duties of cashiers (controllers) are included in the List of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for a shortage of entrusted property, approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 N 85. This Resolution also approved the standard form of an agreement on full individual financial liability (shown in the appendix to the article).

According to clause 32 of the Procedure for conducting cash transactions, after issuing an order (decision, resolution) on the appointment of a cashier to work, the head of the enterprise is obliged, against receipt, to familiarize him with the Procedure for conducting cash transactions in the Russian Federation, after which an agreement on full financial responsibility is concluded with the cashier (standard form the agreement on full liability is given in the appendix).

The procedure for conducting cash transactions establishes that:

- the cashier, in accordance with the current legislation on the financial liability of workers and employees, bears full financial responsibility for the safety of all valuables accepted by him and for damage caused to the enterprise both as a result of intentional actions and as a result of a negligent or dishonest attitude towards his duties (clause 33 );

— the cashier is prohibited from entrusting the work assigned to him to other persons (clause 34);

- in enterprises that have one cashier, if it is necessary to temporarily replace him, the duties of a cashier are assigned to another employee by written order of the head of the enterprise (decision, resolution). An agreement on full financial responsibility is concluded with this employee (clause 35);

- in the event of a cashier suddenly leaving work (illness, etc.), the valuables under his account are immediately recalculated by another cashier, to whom they are transferred, in the presence of the head and chief accountant of the enterprise or in the presence of a commission of persons appointed by the head of the enterprise. An act signed by the indicated persons is drawn up on the results of the recalculation and transfer of valuables (clause 35);

- in enterprises that have a large number of divisions or are serviced by centralized accounting departments, wages, payments of social insurance benefits, scholarships can be made by written order of the head of the enterprise (decision, resolution) by persons other than cashiers with whom an agreement on full financial responsibility is concluded and who are subject to all rights and obligations established by the Procedure for conducting cash transactions for cashiers (clause 36);

- in small enterprises that do not have a cashier on staff, the latter’s duties can be performed by the chief accountant or another employee on the written order of the head of the enterprise, subject to the conclusion of an agreement with him on full financial responsibility (clause 36).

According to clause 31 of the Procedure for Conducting Cash Operations, before opening the cash register premises and metal cabinets, the cashier is obliged to inspect the safety of locks, doors, window bars and seals, and make sure that the security alarm is in working order. In case of damage or removal of the seal, breakage of locks, doors or bars, the cashier is obliged to immediately report this to the head of the enterprise, who reports the incident to the internal affairs bodies and takes measures to protect the cash register until their employees arrive.

Clause 29 of the Procedure for Conducting Cash Transactions also establishes that during transactions the cashier must lock the doors to the cash register. Access to the cash desk premises by persons not related to its work is prohibited. It is also prohibited to store cash and other valuables that do not belong to the enterprise in the cash register.

Requirements for cash register equipment

Appendix No. 3 to the Procedure for Conducting Cash Transactions contains the Unified requirements for technical strength and alarm equipment for cash register premises of enterprises. According to clause 3 of these Requirements, to ensure the reliable safety of cash and valuables, the cash desk premises must meet the following requirements:

— be isolated from other service and utility rooms;

- located on intermediate floors of multi-story buildings. In two-story buildings, ticket offices are located on the upper floors. In one-story buildings, the windows of the cash register are equipped with internal shutters;

- have solid walls, solid floor and ceiling ceilings, reliable internal walls and partitions;

- close to two doors: an external one, opening outwards, and an internal one, made in the form of a steel lattice, opening towards the internal location of the cash register;

— be equipped with a special window for issuing money;

- have a safe (metal cabinet) for storing money and valuables, which must be firmly attached to the building structures of the floor and wall with steel pipes;

- have a working fire extinguisher.

Clause 29 of the Procedure for Conducting Cash Operations also establishes that all cash and securities at enterprises are stored, as a rule, in fireproof metal cabinets, and in some cases - in combined and ordinary metal cabinets, which at the end of the working day are locked with a key and sealed with a seal. cashier. Keys to metal cabinets and seals are kept by cashiers, who are prohibited from leaving them in designated places, transferring them to unauthorized persons, or making unaccounted for duplicates.

Accounted duplicates of keys in bags, boxes, etc., sealed by cashiers, are kept by the managers of the enterprises. At least once a quarter, they are checked by a commission appointed by the head of the enterprise, the results of which are recorded in a report.

If the key is lost, the head of the enterprise reports the incident to the internal affairs authorities and takes measures to immediately replace the lock of the metal cabinet.

Requirements for the safety of funds

during their storage and transportation

In order to ensure the safety of funds during their storage and transportation, organizations must follow the Recommendations given in Appendix No. 2 to the Procedure for Conducting Cash Transactions.

According to these Recommendations, heads of enterprises, when hiring and appointing to positions related to cash transactions, maintenance of fire alarm systems, security and transportation of funds, or periodically involving persons in the above work, are recommended to contact internal affairs bodies and medical institutions to obtain information about these persons, bearing in mind that the following persons are not allowed to conduct cash transactions, maintain fire alarm systems, guard and transport funds:

- previously brought to criminal liability for intentional crimes, whose criminal record has not been expunged or not removed in the prescribed manner;

- those suffering from chronic mental illness;

— systematically violating public order;

- people who abuse alcohol or use drugs without a doctor’s prescription.

When transporting cash and valuables from banking institutions or depositing them in them, the head of the enterprise must provide the cashier with security and, if necessary, a vehicle.

When transporting money, the cashier, accompanying persons and the driver of the vehicle are prohibited from:

- disclose the route of travel and the amount of money and valuables being delivered;

- allow persons not appointed by the head of the enterprise for their delivery into the vehicle interior;

- travel on foot, by car or by public transport;

— visit shops, markets and other similar places;

- carry out any instructions and in any other way be distracted from delivering money and valuables to their destination.

Documentation requirements

cash transactions

To a certain extent, ensuring the safety of funds is facilitated by the current procedure for documenting cash flows. Clause 22 of the Procedure for Conducting Cash Transactions establishes that all receipts and withdrawals of cash must be recorded by the cashier in the cash book immediately after the transaction is completed. Moreover, each enterprise maintains only one cash book, which must be numbered, laced and sealed. The number of sheets in the cash book is certified by the signatures of the manager and chief accountant of the enterprise. Erasures and unspecified corrections in the cash book are not permitted. The corrections made are certified by the signatures of the cashier, as well as the chief accountant of the enterprise or the person replacing him. The correctness of maintaining the cash book is controlled by the chief accountant of the organization.

Cash is accepted by cash registers of enterprises according to cash receipt orders signed by the chief accountant or a person authorized to do so by written order of the head of the enterprise.

The issuance of money from the cash register is carried out strictly according to expense orders or properly executed other documents (payment (settlement and payment) statements, applications for the issuance of money, accounts, etc.) with the imposition on these documents of a stamp with the details of the cash expense order. Documents for the issuance of money must be signed by the manager, chief accountant of the enterprise or persons authorized to do so, as well as by the person who received the money. According to clause 27 of the Procedure for Conducting Cash Operations, the issuance of money from the cash register, which is not confirmed by the recipient’s receipt in the cash receipt order or other document replacing it, is not accepted as justification for the balance of cash in the cash register. This amount is considered a shortage and is collected from the cashier.

The cashier issues money only to the person indicated in the cash receipt order or a document replacing it. If the issuance of money is made by power of attorney, executed in the prescribed manner, in the text of the order after the last name, first name and patronymic of the recipient of the money, the accounting department indicates the last name, first name and patronymic of the person entrusted with receiving the money. If money is issued according to a statement, before the receipt of money, the cashier writes the following inscription: “By power of attorney.” When issuing money under an expenditure cash order or a document replacing it to an individual, the cashier requires the presentation of a document (passport or other document) identifying the recipient, writes down the name and number of the document, by whom and when it was issued, and selects the recipient’s receipt.

Acceptance and issuance of money under cash orders can only be carried out on the day they are drawn up.

When receiving cash receipts and debit orders or documents replacing them, the cashier is required to check:

- presence and authenticity of the signature of the chief accountant on the documents, and on the cash receipt order or a document replacing it - the authorization inscription (signature) of the head of the enterprise or persons authorized to do so;

— correctness of documents;

— availability of applications listed in the documents.

If one of these requirements is not met, the cashier returns the documents to the accounting department for proper processing.

Responsibility for violation of storage procedures

Money

According to clause 38 of the Procedure for Conducting Cash Operations, the founders of enterprises, higher-level organizations (if any), as well as auditors (audit firms), in accordance with concluded agreements, when carrying out documentary audits and checks at enterprises, audit the cash register and check compliance with cash discipline. In this case, special attention should be paid to the issue of ensuring the safety of money and valuables.

Compliance by enterprises with the requirements of the Procedure for conducting cash transactions is systematically checked by banks.

The technical strength of cash registers and cash points, ensuring conditions for the safety of money and valuables at enterprises are checked by internal affairs bodies within the limits of their competence.

According to clause 39 of the Procedure for conducting cash transactions, responsibility for compliance with this Procedure rests with the heads of enterprises, chief accountants and cashiers.

In accordance with Article 15.1 of the Code of the Russian Federation on Administrative Offenses, violation of the procedure for working with cash and the procedure for conducting cash transactions, expressed in the implementation of cash settlements with other organizations in excess of the established amounts, non-receipt (incomplete receipt) of cash to the cash desk, non-compliance with the procedure for storing free cash, as well as the accumulation of cash in the cash register in excess of established limits, entails the imposition of an administrative fine on officials in the amount of 40 to 50 times the minimum wage; for legal entities - from 400 to 500 times the minimum wage.

Application

Standard form of an agreement on full

individual financial liability

_____________________________________________________________________________

(name of company)

hereinafter referred to as the “Employer”, represented by the manager _________________________

(Full Name)

or his deputy ______________________________, acting on the basis

(Full Name)

_________________________________, on the one hand, and _______________________

(charter, regulations, power of attorney) (position title)

_____________________________________________________________________________

(Full Name)

hereinafter referred to as the “Employee”, on the other hand, have entered into this Agreement as follows.

1. The Employee assumes full financial responsibility for the shortage of property entrusted to him by the Employer, as well as for damage incurred by the Employer as a result of compensation for damage to other persons, and in connection with the above undertakes:

a) treat with care the property of the Employer transferred to him for the implementation of the functions (responsibilities) assigned to him and take measures to prevent damage;

b) promptly inform the Employer or immediate supervisor about all circumstances that threaten the safety of the property entrusted to him;

c) keep records, draw up and submit in the prescribed manner commodity-money and other reports on the movement and balances of the property entrusted to him;

d) participate in the inventory, audit, and other verification of the safety and condition of the property entrusted to him.

2. The employer undertakes:

a) create for the Employee the conditions necessary for normal work and ensuring the complete safety of the property entrusted to him;

b) familiarize the Employee with the current legislation on the financial liability of employees for damage caused to the employer, as well as other regulatory legal acts (including local ones) on the procedure for storage, reception, processing, sale (release), transportation, use in the production process and implementation other transactions with the property transferred to him;

c) carry out inventory, audits and other checks of the safety and condition of property in the prescribed manner.

3. Determination of the amount of damage caused by the Employee to the Employer, as well as damage incurred by the Employer as a result of compensation for damage to other persons, and the procedure for their compensation are made in accordance with current legislation.

4. The employee does not bear financial responsibility if the damage is caused through no fault of his own.

5. This Agreement comes into force from the moment of its signing. This Agreement applies to the entire period of work with the Employer’s property entrusted to the Employee.

6. This Agreement is drawn up in two copies of equal legal force, one of which is kept by the Employer, and the second by the Employee.

7. Changes in the terms of this Agreement, addition, termination or termination of its validity are carried out by written agreement of the parties, which is an integral part of this Agreement.

Addresses of the parties to the Agreement: Signatures of the parties to the Agreement:

Employer ________________________ ________________________________

Worker ____________________________ ________________________________

Date of conclusion of the M.P. Agreement

K.I.Kovalev

Journal consultant

"Modern accounting"

Signed for seal

06.04.2004

—————————————————————————————————————————————————————————————————— ———————————————————— ——