The ABC method is widely used due to a number of advantages over traditional accounting methods, which imply that resources for all types of products are consumed in proportion to their output volumes. However, it has some disadvantages; it is not a panacea for all accounting and reporting problems.

What are cost drivers

The ABC (activity based costing) cost calculation method is the calculation of costs for individual types of activities, in accordance with their actual consumption. To attribute costs to manufactured products, cost carriers are used, which are also called cost drivers.

A cost driver is a factor that will cause a change in the costs of a given activity. There are two types of drivers:

- Resource Cost Driver: This is the amount of resources that must be consumed by an activity. Used to estimate the cost of electricity resources, staff salaries, advertising, etc.

- Activity cost driver: their value depends on the intensity of customer demand. This driver is used to determine costs by activity or by customer. Such costs include, for example, costs for ordering materials, machine setup, inspection and testing, material handling and storage, etc.

A clear and simple example of using the ABC method would be the distribution of total rental expenses between departments based on the area they occupy.

In this case, the occupied area will be the driver. The method can be used to target overhead reduction. Information on costs, detailed by type of activity and business processes, has practical benefits for the company and can be used in benchmarking and business process reengineering.

Algorithm for calculating cost using the ABC method

The procedure for calculating cost using the ABC method is as follows:

1) Determine the main activities of the organization or products for which costs need to be calculated.

2) Next, identify the types of costs that will be distributed. This is the most important step in the entire process, since the scale and detail of the calculations will depend on the resulting list of costs. There is no need to make this list very large, complicating the calculations. For example, if you plan to determine the total cost of a distribution channel, then the advertising and warehousing costs associated with this channel will be taken into account, but the costs associated with research will be ignored since they are associated with products, not channels.

3) Collect costs for each medium into cost groups by type of activity. For example, the cost group for the cost of a distribution channel will include advertising and warehousing costs associated with this channel.

4) Determine the factors that determine the amount of costs by type of activity, they are called carriers (or drivers) of costs.

Cost drives are any factor that affects the amount of costs for a particular type of activity. Any type of activity can have many cost carriers associated with it and, thus, affect the amount of required resources (see Table 1).

Table 1

. Examples of cost objects

| Expenses | Cost Objects |

| Purchase cost | The number of orders |

| Order fulfillment cost | Number of orders |

| Cost of materials processing | Number of production cycles |

| Production scheduling cost | Number of production cycles |

| Cost of dispatch service | Number of submissions |

5) Calculate the cost driver ratio by dividing the total overhead costs in each cost pool by the total cost drivers. For example, the total material handling cost is divided by the total number of production runs to obtain the material handling cost driver ratio.

This coefficient is used when calculating costs by activity to calculate the amount of overhead and indirect costs. For costs that depend on the level of production, volume-related cost units such as machine hours and man hours are used. For example, the cost of oil used as lubricants for a machine tool will end up being added to the cost of production based on machine hours, since the oil will be used every hour of the production cycle.

Overhead costs associated with organizing and managing production vary by activity, not by volume of production. Therefore, they should be tracked by media such as the production cycle or the number of orders received.

6) Calculation and cost accounting. Multiply the driver coefficient by the number of cost drivers.

7) Formulate reports. The results of the ABC system are converted into reports for management analysis. For example, if the system was originally designed to accumulate information about overhead costs by geographic sales region, then the revenue generated in each region, all direct costs, and overhead expenses received from the ABC system should be reported. This will give management a complete understanding of the costs and results achieved in each region.

Management actions based on the information received. The most common management response to the ABC statement is to reduce the number of activity factors used by each cost object. This should reduce the amount of overhead used.

Management actions based on the information received. The most common management response to the ABC statement is to reduce the number of activity factors used by each cost object. This should reduce the amount of overhead used.

Also, from the reports, managers can see which operating factors need to be reduced in order to reduce the corresponding amount of overhead costs. For example, if the cost of one purchase order is 1,000 rubles, based on employee time spent, managers can focus on allowing the production system to automatically place orders or scheduling less frequent orders as options to reduce purchasing costs. Either solution will result in fewer orders and therefore lower costs for the purchasing department.

Methods for accounting for production cost elements

Such methods of accounting for production costs include the order method. It involves accounting for costs as part of the enterprise’s sequential assembly of orders in several stages. This method makes it possible to correctly classify individual cost elements for specific production processes and analyze their effectiveness, taking into account the specifics of local tasks at a certain stage of production.

Another effective method here is functional cost analysis. It allows you to determine which specific elements of production costs are priority from the point of view of giving the product basic consumer qualities and therefore cannot be reduced, and which are secondary, not significantly affecting the consumer qualities of the product.

Above we looked at the strategic cost analysis (SCA) method, which at first glance is similar in meaning. However, the fundamental difference between these two methods is that SCA allows you to determine the key factors of consumer interest (for example, a powerful processor, large smartphone memory, a specific brand, a certain version of Android), and functional-cost analysis allows you to determine the characteristics necessary to give the smartphone consumer qualities (any competitive processor, at least an average amount of RAM, not the oldest Android) so that in principle it can be sold.

Accounting

In accounting practice, the cross-cutting method is used in different ways. There are two options for calculating cost: semi-finished and unfinished.

Non-semi-finished cross-cutting method

Separate accounting of semi-finished products is not always justified. If they are consumed exclusively within production, without being sold externally, accounting consists of summing up the costs that took place in this process.

For each stage, costs are calculated separately. The cost of the semi-finished product from the previous stage is not included in the costs of the subsequent stage. The cost of finished products is obtained by summing the costs for each stage.

Semi-finished cross-cutting method

Applies if the company sells semi-finished products as finished products in whole or in part. For each processing stage, the released semi-finished product represents a completed product. It is reflected in accounting at the cost of the processing stage, which already includes the cost of the semi-finished product from the previous processing stage. With this cost, he moves on to the next stage. The cost of the product accumulates from processing to processing.

Expenses

Each processing stage reflects direct costs (including raw materials and their processing in the initial phase) and indirect costs. The cost of the semi-finished product, which was established at the previous stage of processing, is added.

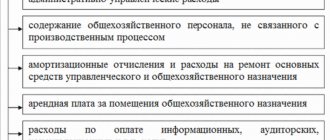

Indirect expenses include general production expenses (OPR) and general economic expenses (OCH). OPD is collected in the context of divisions, in which there are several processing stages (for example, a processing stage is “attached” to a unit, there are several of them in a workshop), or the workshop is a processing stage. Accordingly, they will be fully attributed to the cost of one semi-finished product or distributed among several products, in one of the following ways, proportionally. Traditionally, the salary of the main workers is taken as the basis, but other options can be provided for in accounting policies.

OCR includes the cost of semi-finished products, distributing the monthly amount proportionally, according to the same methodology as OPR. Another method may be fixed in the accounting policy: without inclusion in the cost price, immediately with inclusion in Dt 90/2 “Cost of sales”.

Costs (for each stage) = work in progress (WIP) at the beginning of the month + actual costs for the month - work in progress at the end of the month.

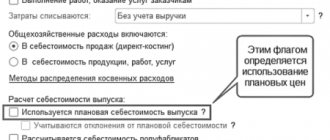

If accounting was carried out at planned prices, the basis for the calculation is the amount of costs according to the norms, which is adjusted (+ or -) by the amount of actual deviations for the month. The “work in progress” at the beginning and end of the month is also taken into account.

One way to calculate the actual cost of work in progress at the end of the month is according to the standard: work in progress km = work in progress km standard +/- deviations.

The movement of semi-finished products during the production process is taken into account using an account. 21 “Semi-finished products of own production” or reflected by internal movements on the account. 20.

Basic principles of organizing production cost accounting

When organizing production cost accounting - regardless of the specific type of its methods - it is necessary to follow the following principles:

- the use of methods that are fully consistent with the specifics of business operations in a specific area of economic activity;

- implementation of effective cost classification;

- assessment and timely revision of cost accounting methodology;

- detailed regulation of procedures reflecting cost accounting.

Let's study the specifics of common cost accounting methods common in Russia and abroad.

Results

Using production cost accounting methods developed by Russian and foreign experts, it is possible to analyze the effectiveness of production costs in a variety of aspects. For example, assess production factors, the role of auxiliary production, conduct an analysis of cost accounting, as well as the importance of individual elements of costs for the production of goods.

You can learn more about the use of various cost accounting methods in production in the articles:

- “ABC cost accounting method - how to apply?”;

- “Marginal cost accounting method - how to apply?”;

- “Custom method of cost accounting and cost calculation.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for costs of production of products (works and services): basic methods

The methods by which the costs of producing goods, providing services or work can be accounted for can be conditionally classified:

1. In traditional Russian:

- normative,

- process-by-process

- transverse,

- custom.

These methods have actually been used since the times of socialist farming: the specifics of their application are reflected in many regulations of the USSR.

2. To those that were developed in Western countries:

- functional cost analysis,

- strategic cost analysis,

- activity-based costing.

This, of course, is not an exhaustive list of “Western” approaches to assessing cost accounting, but they can be considered one of the most common in Russia.

Each of these methods of accounting for production costs has its own advantages. They can be identified according to different criteria. So, for example, you can consider these advantages in the context of the applicability of the corresponding methods for the purposes of:

- cost accounting for specific production factors;

- accounting for expenses within auxiliary production;

- analytical cost accounting;

- accounting for individual elements of production costs.

These goals are relevant both for many Russian industrial enterprises and foreign ones operating in the Russian Federation.

Distinctive features of process costing

The process-based method of calculating product costs has the following distinctive features.

- Cost per unit of production is determined as an average, that is, by dividing the total cost by the number of units of production.

- All units of production are considered identical in accounting.

- Determination of the cost of products, the processing of which was not fully completed in the reporting period, is made on the basis of equivalent units of production.

The use of equivalent units of completed output is a key feature in the preparation of process costing. The introduction of the concept of equivalent products is necessary to assess the cost of units of production accounted for in work in progress at the end of the period, and products that were rejected based on the results of intermediate quality controls (before completion of processing).

Important!

The equivalent unit of completed products is a conditional indicator that allows you to determine the cost of production, taking into account the degree of completion of its processing. In simple terms, it shows how many units of output would be completed completely at a given level of cost.

Example

Let's assume that at the end of the reporting period, 3,500 units of production were taken into account in work in progress. At the same time, processing for basic materials was completed by 87%, and in terms of labor costs of main production workers and production overhead costs (POC) by 65%. Manufacturing overhead is allocated in proportion to the number of hours worked by key production workers.

In this case, the number of equivalent units of production for basic materials will be 3,045 (3,500 × 87%), and for labor costs of main production personnel and commissioning work - 2,275 (3,500 × 65%). In other words, 3,045 fully completed units of output could have been produced from the main materials actually used in production, and 2,275 units could have been fully completed in the time actually worked by the main production personnel.

Important!

Equivalent units of completed output are calculated separately for each process costing item.

What methods are effective when accounting for costs by factors of production?

Such methods can rightfully include the strategic cost analysis method, which is actively used today. It involves considering the activities of an enterprise as a process of giving a product some consumer value for which people are willing to pay. The key production factor influencing the establishment of this value, as well as other factors influencing consumer interest, are determined.

One such factor may be whether the product being marketed is equipped with some useful option. If this is, for example, a mobile device, then this option could be a large and bright monitor or a new operating system. As a result, the costs predetermined by the need to install appropriate structural components in manufactured devices can be considered strategic, and it is undesirable to reduce them. In turn, the less significant a production factor is from the point of view of ensuring consumer interest, the more likely it may be to reduce costs within the corresponding area of production.

The term “factor of production” can also be considered in the context of the active-based costing method (determining costs by type of activity). This method involves determining production factors that affect the cost of production of goods. For example, this could be the presence of a conveyor: its installation can significantly reduce the cost of 1 product (but at the same time it will only be economically feasible for large-scale production).