Document type: Supply Agreement

To save a sample of this document to your computer, follow the download link.

Document file size: 15.4 kb

You should begin drawing up this type of contract by indicating personal information and data from each party. The next point will need to indicate the main purpose of signing the agreement. The document regulates the relationship between two parties, one of which undertakes to deliver products on time, and the second - to receive it and make payment.

In accordance with the specification, which is a mandatory application, the goods are shipped and accepted. This document states:

- the entire list and range of products;

- delivery schedules;

- price and quantity.

Other Important Terms

Delivery of a batch or part thereof is carried out only after receipt of advance payment. The supplier issues an invoice, which the other party must pay. After receiving the funds, the Supplier notifies the Buyer by any means that shipment is possible.

The goods can also be delivered without receiving advance payment. Then, after accepting the goods, the Buyer undertakes to pay within the specified period. These conditions are specified in the contract.

The agreement comes into effect from the moment it is signed by representatives of both parties and has legal force. If controversial situations arise, they are resolved by representatives of the parties to the negotiations.

Download the Supply Agreement with prepayment for the supplied goods

Supply contract with prepayment for the supplied goods No.

SUBJECT OF THE AGREEMENT

1.1. In accordance with this Agreement, the Supplier undertakes to deliver the Goods to the Buyer in accordance with the Specification (Appendices No. 1, which are an integral part of this agreement), and the Buyer undertakes to accept and pay for it.

1.2. The name, assortment, quantity, price of the goods, delivery times are agreed upon by the Parties and are determined in the Specifications (Appendices), which are an integral part of the Agreement.

PRICE AND AMOUNT OF THE AGREEMENT

2.1. The Goods supplied under the Contract are paid for at the price agreed upon by the parties in accordance with the Specifications (Appendices) and the tender protocol.

2.2. The total amount of the contract is determined as the total cost of all Goods delivered to the Buyer in accordance with the Specifications (Appendices) for the entire period of validity of the Contract.

2.3. The price for the goods is set in rubles and includes VAT-18%, other taxes and fees, cost of packaging, packaging, labeling and delivery to the Buyer’s warehouse.

PAYMENT PROCEDURE

3.1. Payments for the Goods are made on the condition of % prepayment within banking days from the date of issuing the invoice for payment by transferring funds to the Supplier's bank account. Final payment within working days from the moment of signing the delivery note (transfer and acceptance certificates).

3.2. The moment of payment is the receipt of funds to the Supplier's bank account.

3.3. If the Goods are shipped by the Supplier to the Buyer before making an advance payment, then payment for the delivered Goods is made by the Buyer within banking days from the date of issuance of the invoice by the Supplier.

DELIVERY ORDER

4.1. The method and terms of delivery are agreed upon by the Parties and are determined in the Specifications (Appendices) to the Agreement.

4.2. The Buyer undertakes to take all appropriate measures to ensure acceptance of the Goods delivered by the Supplier in accordance with the terms of the Agreement, both directly to the Buyer and to the addresses of the recipients specified by the Buyer in the application.

4.3. Upon receipt of the delivered Goods from the carrier, the Buyer or the recipient, on his behalf, undertakes to check the compliance of the Goods with the information specified in the shipping documents, as well as to accept these Goods from the carrier in compliance with the procedure and rules provided for by the regulatory documents governing the activities of the carrier.

4.4. The delivery date is the date of receipt of the Goods by the Buyer, recorded by a mark in the delivery note.

4.5. Ownership of the Product, as well as the risk of its accidental destruction, deterioration, loss, damage passes to the Buyer from the moment of its receipt in accordance with the invoices.

QUALITY AND COMPLETENESS

5.1. The quality of the supplied Goods must comply with the specifications and GOSTs approved by the legislation of the Russian Federation.

5.2. Acceptance of the Goods in terms of quantity and quality is carried out in accordance with the instructions for the acceptance of products in terms of quality and quantity, approved by the Resolutions of the USSR Civil Code dated 06/15/65 No. P-6 and dated 04/25/66 No. P-7, and acceptance of the 5th VP of the Ministry of Defense of the Russian Federation.

5.3. In the event of a discrepancy between the Goods in terms of quantity and quality, a call to the Supplier's representative is required within hours from the date of receipt of the Goods by the Buyer.

5.4. If the Supplier's representative fails to appear, the Buyer accepts the Goods independently, drawing up a report on the established discrepancies in quantity and quality upon acceptance of the Goods.

5.5. If the call of the Supplier's representative turns out to be unfounded, the expenses incurred by the Supplier in connection with the visit to the Buyer will be reimbursed by the latter.

RESPONSIBILITY OF THE PARTIES

6.1. The obligations of the parties must be fulfilled properly, on time and in accordance with this Agreement and current legislation.

6.2. A Party to the Agreement whose property interests are violated as a result of non-fulfillment or improper fulfillment of obligations under the Agreement by the other Party has the right to demand full compensation for losses caused to it.

6.3. For failure to fulfill or improper fulfillment of the terms of the Agreement, the Parties are liable in accordance with the current civil legislation.

6.4. A party that has not fulfilled or improperly fulfilled its obligations under the Agreement while fulfilling its terms shall be liable unless it proves that proper fulfillment of obligations was impossible due to force majeure (force majeure), that is, extraordinary and unavoidable circumstances, under specific conditions specifically period of time. The Parties to this Agreement included the following as force majeure circumstances: natural phenomena (earthquake, flood, lightning strike, volcanic eruption, mudflows, landslide, tsunami, etc.), temperature, wind force and precipitation level at the place of fulfillment of obligations under the Agreement, excluding normal life activities for a person; moratorium of authorities and management; strikes organized in accordance with the procedure established by law and other circumstances that may be determined by the Parties to the Agreement as force majeure for the proper fulfillment of obligations.

SETTLEMENT OF DISPUTES

7.1. The parties will strive to resolve all disputes that may arise during the execution of the terms of the Agreement through negotiations, exchange of letters, clarification of the terms of the agreement, drawing up the necessary protocols, additions and changes, exchange of telegrams, faxes, etc.

7.2. If it is impossible to resolve disagreements through negotiations, they are subject to judicial review at the location of the defendant.

OTHER CONDITIONS

8.1. This agreement is a standard agreement, any changes to this agreement are made only by the Buyer; if you disagree with any terms of the agreement, the Supplier draws up a protocol of disagreements.

8.2. All changes and additions to this Agreement are made in writing and are an integral part of this Agreement.

8.3. This Agreement comes into force from the date of its signing by the parties and is valid in terms of mutual settlements until they are fully executed.

8.4. The Agreement may be terminated early by agreement of the parties, as well as at the request of one of the Parties in the event of violation by the other party of the obligations provided for in the Agreement.

8.5. If one of the parties changes its legal address, name, bank details, etc., it is obliged to notify the other party in writing within days.

8.6. A facsimile copy of the Agreement and its annexes have equal legal force until the original documents are submitted.

8.7. This Agreement is drawn up and signed in two copies having equal legal force, one copy for each of the parties.

We formulate conditions for prepayment

The settlement period in a supply agreement with prepayment is set either by a specific date or by a time period, but always occurs before the delivery of the goods. If an advance payment is specified in the transaction, but its term is not defined, then:

- Payment for products must be made within 7 days from the moment such a demand is made by the supplier (Part 2 of Article 314 of the Civil Code of the Russian Federation).

What risks does the buyer bear if the contract stipulates advance payment for the goods, but the deadline for making it is not defined, find out in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

- The penalty for late payment can be calculated only from the date of delivery of the goods (post. FAS Volga District dated November 17, 2011 in case No. A12-2943/2011).

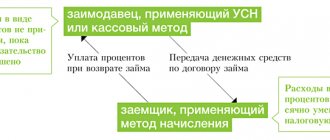

- When shipping products before prepayment, the buyer is obliged to pay on the day of delivery or immediately after it (Clause 1, Article 486 of the Civil Code of the Russian Federation). Otherwise, interest will be charged on the amount under Art. 395 of the Civil Code of the Russian Federation, the period is counted from the moment of shipment plus from 2 to 5 business days required for a bank transfer (clause 16 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 22, 1997 No. 18).

In addition, paragraph 4 of Art. 487 of the Civil Code of the Russian Federation makes it possible to establish in a supply contract with prepayment the seller’s obligation to pay a percentage of the prepayment amount as a fee for using a commercial loan (clause 13 of the post of the Plenum of the Supreme Court of the Russian Federation No. 13, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of October 8, 1998). If the transaction does not determine the amount and procedure for paying interest, then the first condition is calculated in accordance with the refinancing rate (clause 2 of Article 823, clause 1 of Article 809 of the Civil Code of the Russian Federation), and interest is transferred monthly (clause 2 of Article 809 of the Civil Code RF).

With a mixed prepayment, it is recommended, in the interests of the buyer, to stipulate in the text of the contract that for the second half of the payment, in accordance with clause 1 of Art. 317.1 of the Civil Code of the Russian Federation, interest is not accrued for using the deferment amount. It is also advisable, when making partial prepayment or supplying goods in batches, to determine what part of the product is paid in advance if the parties to the transaction are VAT payers.

You can enter the agreement using the link below.

DELIVERY AGREEMENT

SUBJECT OF THE AGREEMENT

1.1. In accordance with this Agreement, the Supplier undertakes to deliver the Goods to the Buyer in accordance with the Specification (Appendices No. 1, which are an integral part of this agreement), and the Buyer undertakes to accept and pay for it.

1.2. The name, assortment, quantity, price of the goods, delivery times are agreed upon by the Parties and are determined in the Specifications (Appendices), which are an integral part of the Agreement.

PRICE AND AMOUNT OF THE AGREEMENT

2.1. The Goods supplied under the Contract are paid for at the price agreed upon by the parties in accordance with the Specifications (Appendices) and the tender protocol.

2.2. The total amount of the contract is determined as the total cost of all Goods delivered to the Buyer in accordance with the Specifications (Appendices) for the entire period of validity of the Contract.

2.3. The price for the goods is set in rubles and includes VAT-18%, other taxes and fees, cost of packaging, packaging, labeling and delivery to the Buyer’s warehouse.

PAYMENT PROCEDURE

3.1. Payments for the Goods are made on the condition of % prepayment within banking days from the date of issuing the invoice for payment by transferring funds to the Supplier's bank account. Final payment within working days from the moment of signing the delivery note (transfer and acceptance certificates).

3.2. The moment of payment is the receipt of funds to the Supplier's bank account.

3.3. If the Goods are shipped by the Supplier to the Buyer before making an advance payment, then payment for the delivered Goods is made by the Buyer within banking days from the date of issuance of the invoice by the Supplier.

DELIVERY ORDER

4.1. The method and terms of delivery are agreed upon by the Parties and are determined in the Specifications (Appendices) to the Agreement.

4.2. The Buyer undertakes to take all appropriate measures to ensure acceptance of the Goods delivered by the Supplier in accordance with the terms of the Agreement, both directly to the Buyer and to the addresses of the recipients specified by the Buyer in the application.

4.3. Upon receipt of the delivered Goods from the carrier, the Buyer or the recipient, on his behalf, undertakes to check the compliance of the Goods with the information specified in the shipping documents, as well as to accept these Goods from the carrier in compliance with the procedure and rules provided for by the regulatory documents governing the activities of the carrier.

4.4. The delivery date is the date of receipt of the Goods by the Buyer, recorded by a mark in the delivery note.

4.5. Ownership of the Product, as well as the risk of its accidental destruction, deterioration, loss, damage passes to the Buyer from the moment of its receipt in accordance with the invoices.

QUALITY AND COMPLETENESS

5.1. The quality of the supplied Goods must comply with the specifications and GOSTs approved by the legislation of the Russian Federation.

5.2. Acceptance of the Goods in terms of quantity and quality is carried out in accordance with the instructions for the acceptance of products in terms of quality and quantity, approved by the Resolutions of the USSR Civil Code dated 06/15/65 No. P-6 and dated 04/25/66 No. P-7, and acceptance of the 5th VP of the Ministry of Defense of the Russian Federation.

5.3. In the event of a discrepancy between the Goods in terms of quantity and quality, a call to the Supplier's representative is required within hours from the date of receipt of the Goods by the Buyer.

5.4. If the Supplier's representative fails to appear, the Buyer accepts the Goods independently, drawing up a report on the established discrepancies in quantity and quality upon acceptance of the Goods.

5.5. If the call of the Supplier's representative turns out to be unfounded, the expenses incurred by the Supplier in connection with the visit to the Buyer will be reimbursed by the latter.

RESPONSIBILITY OF THE PARTIES

6.1. The obligations of the parties must be fulfilled properly, on time and in accordance with this Agreement and current legislation.

6.2. A Party to the Agreement whose property interests are violated as a result of non-fulfillment or improper fulfillment of obligations under the Agreement by the other Party has the right to demand full compensation for losses caused to it.

6.3. For failure to fulfill or improper fulfillment of the terms of the Agreement, the Parties are liable in accordance with the current civil legislation.

6.4. A party that has not fulfilled or improperly fulfilled its obligations under the Agreement while fulfilling its terms shall be liable unless it proves that proper fulfillment of obligations was impossible due to force majeure (force majeure), that is, extraordinary and unavoidable circumstances, under specific conditions specifically period of time. The Parties to this Agreement included the following as force majeure circumstances: natural phenomena (earthquake, flood, lightning strike, volcanic eruption, mudflows, landslide, tsunami, etc.), temperature, wind force and precipitation level at the place of fulfillment of obligations under the Agreement, excluding normal life activities for a person; moratorium of authorities and management; strikes organized in accordance with the procedure established by law and other circumstances that may be determined by the Parties to the Agreement as force majeure for the proper fulfillment of obligations.

SETTLEMENT OF DISPUTES

7.1. The parties will strive to resolve all disputes that may arise during the execution of the terms of the Agreement through negotiations, exchange of letters, clarification of the terms of the agreement, drawing up the necessary protocols, additions and changes, exchange of telegrams, faxes, etc.

7.2. If it is impossible to resolve disagreements through negotiations, they are subject to judicial review at the location of the defendant.

OTHER CONDITIONS

8.1. This agreement is a standard agreement, any changes to this agreement are made only by the Buyer; if you disagree with any terms of the agreement, the Supplier draws up a protocol of disagreements.

8.2. All changes and additions to this Agreement are made in writing and are an integral part of this Agreement.

8.3. This Agreement comes into force from the date of its signing by the parties and is valid in terms of mutual settlements until they are fully executed.

8.4. The Agreement may be terminated early by agreement of the parties, as well as at the request of one of the Parties in the event of violation by the other party of the obligations provided for in the Agreement.

8.5. If one of the parties changes its legal address, name, bank details, etc., it is obliged to notify the other party in writing within days.

8.6. A facsimile copy of the Agreement and its annexes have equal legal force until the original documents are submitted.

8.7. This Agreement is drawn up and signed in two copies having equal legal force, one copy for each of the parties.

How to draw up a supply agreement with prepayment

— sample Delivery agreement with prepayment — a sample of it is presented for downloading in this article. It is one of the most popular options for formalizing supply-related relationships. The nuances of such agreements will be disclosed in this article.

Sample supply agreement with prepayment.doc The concept of supply agreement is given in Art. 506 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

According to this norm, this agreement is concluded between the supplier (seller), who is an entrepreneur, and the buyer, who will use the supplied property to make a profit or for other purposes not related to personal needs.

Basic nuances of drafting

The completed paper should include the following points:

- the amount of the prepayment and the deadline for making it;

- on what conditions and why part of the money is transferred in advance;

- procedure for returning money in case of refusal of either party from the transaction.

The preliminary transfer of money can be issued in two different qualities: advance and deposit. Both options have different legal consequences:

- the deposit is transferred before the main agreement is signed, the advance payment is transferred after signing, that is, under predetermined conditions;

- if the party that issued the deposit fails to fulfill its obligations, the recipient has the right to keep it;

- if the seller (performer) is the violator, he returns the deposit in double amount.

The contract itself must stipulate the condition under which the refund is made: in case of refusal of the transaction or violation of its terms. In case of termination of the agreement, the money may remain with the recipient until the document is officially canceled.

As part of the main contract

If it is decided to stipulate the obligation of prepayment in the main agreement, then it contains the basic information about the transaction:

- name of each party (seller/buyer (supplier) or customer/performer);

- the subject of the agreement (quality and comprehensiveness, description of what is to be transferred - indicating the quantity, quality and characteristics of the service or property) and the amount of payment;

- obligations and rights of counterparties;

- responsibility of counterparties and the procedure for resolving disputes that arise;

- the procedure for mutual settlements (indicating the moment at which payment and prepayment are officially considered to be made);

- procedure for delivery of goods (transfer of property);

- other conditions (description of the drawn up agreement, documents attached to it, etc.);

- information about each party;

- signatures of the parties.

In the section with the payment procedure, the conditions for transferring the advance payment (a certain amount or a percentage of the final transaction amount) and the remaining funds are prescribed. Both stages are described in detail:

- by what date the money should be transferred;

- in what way (cash, transfer, etc.);

- on what basis (from the moment of transfer of goods or documents, etc.).

If we are talking about goods, then the quality characteristic must usually comply with the standards of a specific GOST. In the case of property, the recipient will require its integrity and transfer in the agreed form.

Separate document

If you have prepared an additional agreement, it should also stipulate:

- basic information about the parties;

- the procedure and amount of prepayment;

- procedure for returning funds by the recipient.

Since this paper will later be attached to the main agreement, you need to put a reference to it in the text - its number and name.

Thus, if controversial situations arise, the court will look in detail at the terms of the transaction in the agreement.

Prepayment on account

The conditions for using an invoice for payment are not defined by law. All organizations themselves draw up an invoice for making a preliminary payment under the contract, so the form of the document may vary. However, it must include the following mandatory details:

- information about the person who issued the invoice;

- INN and KPP of the supplier (seller);

- date and number of the bank account, details of the bank where it is opened;

- name and description of the subject of the transaction, which is provided as a result of the agreement;

- the cost of the transaction and the amount paid as an advance payment (written in numbers and in words);

- supplier's signature and seal.

Documents for download (free)

- Prepayment agreement (sample)

- Supply contract with prepayment condition (sample)

- Prepayment invoice (sample)

Agreement for the supply of goods with prepayment

SUBJECT OF THE AGREEMENT 1.1. In accordance with this Agreement, the Supplier undertakes to deliver the Goods to the Buyer in accordance with the Specification (Appendices No. 1, which are an integral part of this agreement), and the Buyer undertakes to accept and pay for it. 1.2. The name, assortment, quantity, price of the goods, delivery times are agreed upon by the Parties and are determined in the Specifications (Appendices), which are an integral part of the Agreement.

2.1. The Goods supplied under the Contract are paid for at the price agreed upon by the parties in accordance with the Specifications (Appendices) and the tender protocol.

2.2. The total amount of the contract is determined as the total cost of all Goods delivered to the Buyer in accordance with the Specifications (Appendices) for the entire period of validity of the Contract.

Amounts of advance payments under contracts, GPC agreements

Until recently, the legislation of the Russian Federation did not limit budgetary institutions in the amount of advance payments they established in contracts (agreements) for the performance of work, provision of services, and supply of goods.

The contract (agreement) could specify any amount of advance payments (20, 30, 50, 80, 100%).

After Resolution No. 266[1] came into force, the situation changed. We will talk about the amounts of advance payments that budgetary institutions are required to provide for in the contracts (agreements) they conclude in this material.

Paragraph 36 of Resolution No. 1456 establishes the amount of advance payments that recipients of federal budget funds are required to provide when concluding agreements (government contracts) for the supply of goods, performance of work and provision of services within the limits of the corresponding limits of budget obligations brought to them in the prescribed manner.

Refund of prepayment

You can return previously issued funds:

- if the terms for the provision of services or transfer of property were not met;

- if the goods or service received do not meet the required quality, or if other property is provided that is not the subject of the transaction.

You can return not only the deposited funds, but also request (Article 395 of the Civil Code of the Russian Federation):

- penalty;

- interest on the use of transferred funds (Article 823 of the Civil Code of the Russian Federation);

- compensation for damage (material and moral) resulting from a violation of the agreement.

If the document does not state that the penalty is collected for failure to make an advance payment, then the court will refuse to collect the money, in accordance with the provisions of the agreement.

Agreement for the supply of goods with prepayment

1. SUBJECT OF THE AGREEMENT 1.1. In accordance with this Agreement, the Supplier undertakes to deliver the Goods to the Buyer in accordance with the Specification (Appendices No. 1, which are an integral part of this agreement), and the Buyer undertakes to accept and pay for it. 1.2. The name, assortment, quantity, price of the goods, delivery times are agreed upon by the Parties and are determined in the Specifications (Appendices), which are an integral part of the Agreement.

2.1. The Goods supplied under the Contract are paid for at the price agreed upon by the parties in accordance with the Specifications (Appendices) and the tender protocol. 2.2. The total amount of the contract is determined as the total cost of all Goods delivered to the Buyer in accordance with the Specifications (Appendices) for the entire period of validity of the Contract.

Payment Methods

Dear clients, we draw your attention to the fact that our company has accepted several payment methods that do not contradict the legislation of the Russian Federation. At the request of the client, and if the equipment is in stock.

You pay the first 50% within 3 banking days from the date of receipt of the invoice for payment, the remaining 50% is paid after our notification that the equipment is undergoing customs clearance or is in our warehouse. Payment 30/70% (regular customers) The first 30% is paid within 3 banking days from the receipt of the invoice for payment, the remaining 70% is paid after our notification that the equipment is undergoing customs clearance or is in our warehouse.

Determining the advance amount

Typically, the parties themselves determine the amount of the advance payment. But there are typical cases:

- for property transactions for large sums (purchase of an apartment, car, land) they contribute 5-15%;

- when applying for a loan, they usually require an advance payment of 3-15%;

- The full cost of the transaction is paid when purchasing goods or ordering services with a low cost (for example, when purchasing in online stores), as well as when ordering items according to strictly individual parameters that do not allow the goods to be put on free sale.

The conditions for advance payments when ordering services are more diverse. The standard option is “50% now, 50% later” after completion (if the work does not include many stages). Options for staged payment for certain services are possible. Then the funds are awarded after approval of the work done (for completing a specific task within a specified period of time).

If the agreement does not indicate the deadline for making an advance payment, then the money must be transferred within the next 7 days from the date of presentation of demands for an advance payment (Article 487 of the Civil Code of the Russian Federation).

Payment of the remaining amount must also be recorded in a separate act or other document. Funds received as advance payment must be declared by the recipient in tax reporting.