This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8. All operations related to modernization are considered, as well as its consequences (in particular, changes in the useful life of fixed assets, the procedure for calculating depreciation in tax and accounting). The second part of the article is devoted to reflecting the costs of modernization, completion and additional equipment of fixed assets when applying a simplified taxation system with the object of taxation “income reduced by the amount of expenses.”

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and Methodological guidelines for accounting of fixed assets (approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), and when reflected in tax accounting - Chapter 25 of the Tax Code of the Russian Federation.

According to the rules established by the listed acts, changes in the initial cost of fixed assets at which they are accepted for accounting are allowed in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction may increase the initial cost of fixed assets of such an object if, as a result of modernization and reconstruction, the initially accepted standard performance indicators (useful life, power, quality of use, etc.) of such fixed assets are improved (increased). Similar rules are established for tax accounting.

The useful life in accounting must be revised if, as a result of reconstruction or modernization, there has been an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset item. If the useful life of a fixed asset in accounting increases, it can also be increased for tax accounting purposes, but only within the limits established for the depreciation group in which such a fixed asset was previously included.

In the 1C: Accounting 8 program, the “OS Modernization” document is used to reflect the increase in the initial cost of fixed assets for accounting and tax accounting, as well as to change their useful life. Let's consider the method of reflecting an increase in the value of a fixed asset using an example.

Example 1

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 60 months. Depreciation is calculated using the straight-line method in both accounting and tax accounting. In May of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization expenses (both for accounting and tax purposes) amounted to 1,500 rubles. (excluding VAT). This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company. The useful life did not change as a result of modernization.

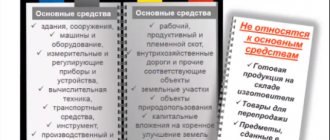

Construction objects

Before increasing the cost of a fixed asset, it is necessary to first collect the costs associated with its modernization at the construction site. To accumulate such costs, account 08.03 “Construction of fixed assets” is intended, which allows you to conduct analytics on construction projects, cost items and construction methods. In our case, we should create a construction object for which the costs of upgrading the computer will be collected. It is convenient to enter the name of the construction project the same as that of the fixed asset for which costs are accumulated. This will make it easier to find and increase the visibility of analytical information.

Collection of modernization costs

Goods purchased from third-party suppliers are registered using the document “Receipt of goods and services” with the transaction type “purchase, commission”. In our example, on the “Products” tab of this document, you should fill in information about the memory module being registered. Since the module is intended for equipment modernization, it can be taken into account on account 10.05 “Spare parts” (see Fig. 1).

Rice. 1

Services for installing a memory module can be reflected in the same document, on the “Computer” tab. This can be done using the “Demand-invoice” document (see Fig. 2).

Rice. 2

As a cost account, you need to specify the construction project accounting accounts with the corresponding analytics for accounting and tax accounting. In our example, this will be invoice 08.03 with the same analytics that were used when registering services for installing a memory module:

- Construction objects: Computer;

- Cost items: cost accounting item for modernization of fixed assets;

- Construction methods: Contract.

When posting the document, a posting will be made relating the cost of the memory module from the credit of account 10.05 to the debit of account 08.03. As a result, all costs for upgrading the computer will be collected in account 03/08.

Increase in initial cost

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document, with the help of which the amount of such costs will be transferred from the construction site to the fixed asset.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset. The selected event when posting a document is entered into the information register “Events with fixed assets”. Using this register, you can obtain information about all events that occurred with the fixed asset by setting up the appropriate selection. The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized. To do this, it is convenient to use the “Selection” button located in the command panel of the tabular section. In our example, the main tool “Computer” is being upgraded (see Fig. 3).

Rice. 3

After selecting fixed assets in the “OS Modernization” document, you can automatically fill in the remaining columns of the tabular section based on the program data. To do this, click on the “Fill” button in the command panel of the tabular part of the document, and select “For OS list” in the drop-down menu.

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site. After the accounting accounts for construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button in the “OS Modernization” document and the corresponding fields will be filled in automatically by the program.

After filling out the document, you can print out the acceptance certificate for repaired, reconstructed, modernized fixed assets (form No. OS-3).

When posting, the “OS Modernization” document transfers the amount of costs from the credit of the construction projects accounting account to the debit of the fixed assets accounting account. In our example, the following postings will be made:

Debit 01.01 Credit 08.03 - in the amount of 1,500 rubles.

The corresponding entry will be generated in tax accounting.

Features of calculating depreciation after modernization...

...for accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows - see diagram.

Scheme

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

...for tax accounting purposes

The procedure for calculating depreciation after modernization for tax accounting purposes differs from how it is accepted in accounting. The rules for calculating depreciation in tax accounting are established by Article 259 of the Tax Code of the Russian Federation.

Starting from the month following the month in which the modernization was carried out, the changed original cost and useful life are used to calculate depreciation.

In our example, starting from June 2005, the amount of depreciation deductions for tax accounting purposes will be 358.33 rubles. (21,500.00: 60).

It remains to add that after the expiration of its useful life, the cost of the computer in tax accounting will not be fully repaid, since over 60 months the depreciation amount will be 21,399.80 rubles. (333.33 x 4 + 358.33 x 56).

The remaining 100.20 rubles. will be included in the depreciation amount calculated in the 61st month of using the computer.

What is modernization?

The concept of modernization (for tax accounting purposes) is established by paragraph 2 of Article 257 of the Tax Code of the Russian Federation and implies work to change the functionality of equipment, while reconstruction is understood as a set of measures to increase existing capacities and improve their quality. Needless to say, modernization requires additional costs for the acquisition of new technological elements, spare parts, and payment for modification services. Let us dwell in detail on the basic components of the modernization process.

Reflection of modernization costs in tax accounting

Opinion of the Ministry of Finance

If an organization has modernized a fixed asset that is fully depreciated and the residual value of which is zero, then, in the opinion of the Ministry of Finance, set out in Letter No. 03-03-06/1/16234 dated March 25, 2015 , after the modernization it follows:

- add the amount of costs for its implementation to the initial cost of the operating system;

- use the depreciation rates that were initially determined when the fixed asset was put into operation.

Let's explain this with an example.

Example 1

In 2015, the organization carried out the modernization of a fixed asset, which, in accordance with the OS Classification [2] to the fourth depreciation group (useful life - over five years to seven years inclusive).

The initial cost of the fixed asset at the time of its commissioning (January 2008) was 480,000 rubles. The useful life is determined as 80 months. The depreciation rate is 1.25% (1/80 month).

Depreciation was accrued from February 2008 to September 2014. Thus, by the time of modernization, the fixed asset was completely depreciated.

In March 2015, work on upgrading the OS was completed. The cost of work (excluding VAT) amounted to 360,000 rubles.

From April 2015, the organization will begin to take into account modernization costs for purposes of calculating income tax as follows.

The initial cost of the OS after modernization is 840,000 rubles. (480,000 + 360,000). The depreciation rate will be the same as at the time of putting the operating system into operation - 1.25%. Accordingly, the amount of monthly depreciation is 10,500 rubles. (RUB 840,000 x 1.25%).

The costs of modernization will be written off over 34 months at 10,500 rubles. (total 357,000 rubles), in the 35th month - a “tail” in the amount of 3,000 rubles. (360,000 - 357,000).

Let's assume that the organization has exercised its right (it is provided for in clause 9 of Article 258 of the Tax Code of the Russian Federation ) to apply a depreciation premium. Then the reflection of modernization expenses in tax accounting will look like this.

The depreciation bonus can be applied not only to expenses associated with the acquisition of fixed assets, but also to expenses incurred in cases of modernization of fixed assets and the amounts of which are determined in accordance with Art. 257 Tax Code of the Russian Federation . The size of the bonus is no more than 30% of capital investment costs for the 3rd – 7th depreciation groups and no more than 10% for the remaining depreciation groups (1st, 2nd, 8th – 10th).

In accordance with paragraph 3 of Art. 272 of the Tax Code of the Russian Federation, expenses in the form of bonus depreciation are recognized as expenses of the reporting (tax) period on which the start date of depreciation ( date of change in the original cost ) of fixed assets in respect of which capital investments were made falls. Note that this formulation indicates two different dates: the start of depreciation and changes in the original cost.

As follows from paragraph 4 of Art. 259 of the Tax Code of the Russian Federation , the start date of depreciation for an object of depreciable property is the 1st day of the month following the month in which this object was put into operation. The date of change in the initial cost is the date of completion of capital investments (putting them into operation) (see Resolution of the AS ZSO dated August 18, 2014 in case No. A75-4980/2013 ).

Thus, from paragraph 3 of Art. 272 of the Tax Code of the Russian Federation it follows that when making capital investments in existing fixed assets, the depreciation bonus is recognized as expenses in the month of change in their initial cost , that is, in the month when the capital investments were completed and put into operation, which is confirmed by the relevant document, for example an act on the acceptance and delivery of reconstructed or modernized fixed assets (see letters of the Ministry of Finance of Russia dated May 28, 2013 No. 03-03-06/1/19228 , dated December 4, 2009 No. 03-03-06/1/788 ).

Example 2

Let's use the data from example 1 with the only difference being that the organization applied a depreciation bonus for the costs incurred when upgrading the OS in the amount of 30%.

The depreciation bonus will be taken into account as part of other expenses in March 2015 (in the period in which the date of change in the original cost falls). The amount of the depreciation bonus is 108,000 rubles. (RUB 360,000 x 30%).

The organization will begin to take into account modernization costs for income tax purposes as follows.

The initial cost of the object after modernization (minus the depreciation bonus) is 732,000 rubles. (480,000 + 360,000 - 108,000).

The depreciation rate will be the same as at the time of putting the operating system into operation - 1.25%. Accordingly, the amount of monthly depreciation will be 9,150 rubles. (RUB 732,000 x 1.25%).

The costs of modernization will be written off over 39 months at RUB 9,150. (total 356,850 rubles), in the 40th month - a “tail” in the amount of 3,150 rubles. (360,000 - 356,850).

So, according to the Ministry of Finance, the costs of upgrading an OS, which has been fully depreciated and whose residual value is zero, increase the initial cost of the OS. To calculate depreciation, the same rate is applied that was initially established when the fixed asset was put into operation. One letter ( No. 03‑03‑06/1/16234 ) has already been mentioned above. A similar opinion was expressed in letters dated April 5, 2012 No. 03-03-06/1/181 , dated November 3, 2011 No. 03-03-06/1/714 , dated September 23, 2011 No. 03-03-06/2/146 . Thus, officials have not changed their opinion on this issue for several years, which cannot but please taxpayers.

The application of these recommendations by organizations in practice is also supported by arbitrators. For example, the Resolution of the Federal Antimonopoly Service of the Moscow Region dated April 23, 2012 in case No. A40-24244/11‑75‑102 [3] states the following. The issue of attributing expenses to expenses in a situation where the useful life of a fixed asset has expired, but the taxpayer nevertheless carried out its reconstruction (modernization), is not directly regulated by the Tax Code of the Russian Federation. However, this does not mean that the taxpayer in this case is generally deprived of the right to account for such expenses if they meet the general criteria established in Art. 252 Tax Code of the Russian Federation . Since, as a result of the modernization of such an operating system, it continues to remain a fixed asset, when determining the amount of depreciation, the same rate that was established when it was put into operation should be applied.

Similar conclusions were made in the Resolution of the Federal Antimonopoly Service of the Eastern Military District dated February 17, 2011 in case No. A29-6272/2007 .

Purchase of equipment

Let's assume that in January of this year the company purchased equipment for the production of cream with an initial cost of 5.0 million rubles with a useful life of 20 years (240 months).

Fig.1 Purchase of equipment

Document movements:

Fig.2 Document movements

With the same document, the fixed asset was accepted for accounting and put into operation. Every month, starting from February 2021, depreciation was charged on it - 20,833.33 rubles = 5,000,000.00/240 months.

In April 2021, company analysts calculated that it was much more profitable to sell ice cream than cream; a decision was made to modernize cream production equipment in order to start producing ice cream. A contract was concluded with Tensor LLC for the purchase of additional spare parts and equipment modification services in the amount of 2.0 million rubles.

Collecting costs

To begin, the organization should collect all documents confirming the fact of modernization and calculate the costs.

Modernization can be carried out either with the involvement of third-party organizations or in-house. In the first case, documentary evidence of the costs incurred will be a bilateral acceptance certificate signed by the contractor.

When modernizing a fixed asset on your own, supporting documents will be requirements-invoices for the transfer of materials to the relevant department, acts for writing off materials, work orders. In this case, upon completion of the work, the organization must draw up an acceptance certificate (in one copy), which must indicate the full cost of the work performed and the date of completion.

Purchase of spare parts for modernization

We will reflect the purchase of spare parts for modernization at a cost of 1.5 million rubles. To do this, go to the “Purchases” menu, select “Receipts (acts, invoices)”.

Fig.3 Purchase of spare parts for modernization

Let's create a new document “Receipt” with the type of operation “Construction objects”.

Fig.4 Construction objects

You can add (create) a new construction object directly from the tabular part of the document “Receipts (acts, invoices)” or enter this object in advance into the “Construction objects” directory. This reference book is not always displayed in the interface. You can add a directory to the interface from the “Directories-Navigation Settings” menu.

Fig.5 Navigation settings

Next, in the left window we find “Construction objects” and using the “Add” and “OK” buttons we move it to the right window.

Fig.6 Construction objects

Next, we proceed to register the receipt of spare parts for modernization. In the new document “Receipts (acts, invoices)” with the type of operation “Construction objects”, we consistently fill in the details - the name of the counterparty and the contract. Next, we set up a construction project “Modernization of equipment for the production of cream” and indicate its cost - 1.5 million rubles.

Fig.7 Modernization of cream production equipment

Don’t forget to indicate account 08.03 “Construction of fixed assets”.

Go to the “Services” tab.

Fig.8 Services

We enter the item “Installation Services” in the amount of 500.0 thousand rubles, in the cost account we indicate invoice 08.03 and we fill out all sub-accounts, since we need to take into account the costs of modernization on one account and for one construction project. We check the transactions generated by posting this document.

Fig.9 Checking the wiring

Thus, all modernization costs are reflected in account 08.03 for the construction project “Modernization of cream production equipment.” If you have any questions about the process of purchasing equipment and spare parts for modernization, please contact our 1C support service. We will be happy to answer your questions.

If the SPI has been increased...

If the useful life of a fixed asset after modernization is increased, the organization has the right to charge depreciation at a new rate, calculated based on the current SPI of this object. This is exactly what they think in the financial department (see letters dated March 22, 2019 No. 03-03-06/1/19397, dated October 23, 2018 No. 03-03-06/1/76004, dated November 24, 2017 No. 03-03-06 /1/77968, etc.). True, in other comments, the Ministry of Finance indicates that the company in the situation under consideration should act only this way, and no other way (letters dated 08/30/2019 No. 03-03-06/1/66957, dated 03/26/2018 No. 03-03-06/1 /18750).

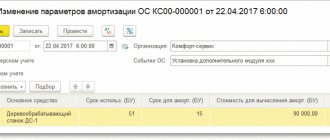

Example 2. The SPI of the modernized OS has increased. Let's use the conditions of example 1, but assume that after the modernization it was decided to increase the service life of the woodworking machine to 84 months (for the 4th amogroup this is the limit). The accountant added modernization costs to the initial cost of the object and received 530,000 rubles. (420,000 + 110,000). Thus, the amount of depreciation charges after the OS upgrade amounted to 6,310 rubles. (RUB 530,000 / (80 + 4) months). Its remaining useful life is 24 months (80 – 60 + 4). During this period, the company will accrue depreciation in the amount of 151,440 rubles. (RUB 6,310 x 24 months). The final amount of depreciation during the SPI is 466,440 rubles. (315,000 + 151,440). Part of the changed initial cost remained outstanding - 63,560 rubles. (530,000 – 466,440). The company will continue to accrue depreciation for another 11 months. In the last of them she will write off a “tail” equal to 460 rubles. (RUB 63,560 – (RUB 6,310 x 10 months)).

However, there was a period when financiers thought differently. They indicated that the company has the right to increase the SPI of the asset after modernization, however, a change in the depreciation rate is not provided for by the Code (see letters dated July 10, 2015 No. 03-03-06/39775, dated February 11, 2014 No. 03-03-06/1 /5446). A similar point of view is expressed by some arbitrators (Resolution of the Arbitration Court of the Ural District dated February 21, 2019 No. F09-391/19). For the organization, it is more profitable, since it makes it possible to write off depreciation faster (unless, of course, the company has the goal of minimizing “profitable” expenses, for example, in order to avoid a loss). However, the likelihood of claims from inspectors when using this option will increase.

The Supreme Court of the Russian Federation abolished the norm for accelerated depreciation of fixed assets

Read more…

As we see, the situation is ambiguous. Therefore, many experts advise, in any case, to leave the SPI of the modernized object unchanged. Then the question of whether to revise the depreciation rate will disappear by itself. However, this approach is fraught with its dangers. Controllers may claim that the company should have increased the object’s SPI, but it did not. It is possible that fiscal officials will even refer to the results of the examination. But the judges emphasize: increasing the service life of the OS after modernization is the right of the organization (see Resolution of the AS of the West Siberian District dated September 1, 2016 No. F04-3528/2016). However, the justification for why the legal entity has not increased the SPI is still present in the case (upgrading access nodes using additional modules increases the speed of the node, its throughput, production capacity, but does not increase the service life due to the increased load on this object ). Therefore, you shouldn’t turn a blind eye to the technical side of the issue.

Differences between modernization and repair

Modernization is part of reconstruction, their action is aimed at improvement, so there are no differences between them, and other two concepts, such as repair and modernization, are often confused.

Repair is different in that with the help of it the equipment starts working, malfunctions are eliminated, its indicators do not change and nothing new happens to it, for example, a button in a cash register is broken, replacing it is the repair, but if you bought something for the cash register a fiscal drive for transferring data to the tax office, this is already a reconstruction that entails changes in work.

How is the modernization of fixed assets carried out?

Improvement can be accomplished in two ways: economically, when the organization copes on its own or with the help of hired employees.

It is worth noting that if the organization did not incur any costs during the update and it was done free of charge, then accordingly the initial cost will not change.

In some cases, after modernization, the technical characteristics of the object changed so much that it began to correspond to the new code of the all-Russian classifier. In this case, you have a new main tool. This means that its initial cost must be determined again according to the rules of the Tax Code.

To carry out modernization, it is necessary to issue an order, appoint responsible persons, set a deadline and reasons.

Postings for modernization and reconstruction

It is reflected as follows:

| Debit | Credit | Operation |

| 08 | 60 | The cost of modernization work by third-party organizations is reflected |

| 19 | 60 | VAT allocated |

| 68 | 19 | VAT deductible |

| 08 | 10 | Write-off of materials |

| 08 | 70 | Salary for employees who carried out the improvement |

| 08 | 69 | Insurance premiums for workers |

| 08 | 23 | Expenses of auxiliary production |

| 01 | 08 | Increased cost of OS after reconstruction |