| A busy schedule prevents you from attending professional development events? We found a way out! |

Consultation provided on September 16, 2015.

The organization purchased a car that will be used by the director for work trips. The director is the only founder and the only employee in the organization.

What documents confirm the costs of major car repairs in tax accounting, provided that the repairs are carried out by a third-party company and the organization uses the accrual method?

Can the waybill have a free form containing all the necessary details?

Insurance: wiring for car repairs

In accounting, an organization's costs for repairing fixed assets, including cars, are included in its expenses for ordinary activities on the date of repairing the car on its own or accepting the work performed from the contractor. This is precisely the conclusion that can be drawn from the provisions of paragraphs 5, 7 and 16 of PBU 10/99 (approved by Order of the Ministry of Finance of May 6, 1999 N 33n).

The amount of insurance compensation due to the company that owns the car is included in its other income on the date the insurance company makes a decision to pay insurance compensation. Deductions from an employee of an enterprise or recovery from a third party responsible for an accident are taken into account in the same way. This is stated in paragraphs 7, 10.2 and 16 of PBU 9/99, approved by Order of the Ministry of Finance dated May 6, 1999 N 32n.

An example of a posting with a deduction from an employee of the enterprise.

On August 9, 2011, due to the fault of the company’s driver, an accident occurred, as a result of which only the company’s car was damaged. The cost of its repair at a car service was 21,240 rubles (including VAT - 3,240 rubles). Since the car was insured only under MTPL , damages from the accident are recovered from the at-fault employee. Note that his salary for the last 12 months is 28,000. Since the amount of damage caused does not exceed the average monthly salary, compensation occurs by deducting the amount of damage from the employee’s salary based on the order of the general director of the company. According to Article 138 of the Labor Code, the total amount of deductions is 20 percent of wages paid in person.

In August 2011, the following entries will be made in accounting: Debit 20 Credit 60 - 18,000 rubles. = (RUB 21,240 - RUB 3,240) - reflects the cost of repairs performed by a car service center; Debit 19 Credit 60 - 3240 rub. — reflects the amount of VAT presented by the car service center https://www.voltag.ru for the repair of starters and generators; Debit 60 Credit 51 - 21,240 rub. — paid for car repairs at a service station; Debit 73-1 “Calculations for compensation of damage” Credit 91-1 - 21,240 rubles. - the total amount of damage is attributed to the guilty person; Debit 91-2 Credit 19 - 3240 rub. — the amount of “input” VAT is charged to the compensation received; Debit 20 Credit 70 - 28,000 rub. — the driver’s salary was accrued for August 2009; Debit 70 Credit 68-1 “Calculations for personal income tax” - 3640 rubles. (RUB 28,000 x 13%) - personal income tax withheld; Debit 70 Credit 73-1 - 4872 rub. ((28,000 rub. - 3,640 rub.) x 20%) - part of the amount of damage is withheld from the salary of the person responsible for the accident.

In September 2011 and in subsequent months (until the entire amount of damage is paid off), the following entries will be made in accounting: Debit 20 Credit 70 - 28,000 rubles. — the driver’s salary was accrued for September 2011; Debit 70 Credit 68-1 “Calculations for personal income tax” - 3640 rubles. (RUB 28,000 x 13%) - personal income tax withheld; Debit 70 Credit 73-1 - 4872 rub. ((28,000 rub. - 3,640 rub.) x 20%) - part of the amount of damage is withheld from the salary of the person responsible for the accident.

An example of accounting for repairs to an insured vehicle.

In July 2011, the company insured the car under MTPL for a period of one year. As a result of an accident that occurred on August 12, 2011, the car was damaged. A third party (not the organization’s driver) was found to be at fault. The decision to pay the insurance compensation was made by the insurance company on August 22, 2011. The insurer, based on the results of an independent examination of the car, paid 35,000 rubles. The car was repaired at a car service center, the acceptance certificate for the work performed was signed by the organization on September 10, 2011. The cost of repairs and spare parts amounted to 49,560 rubles, including VAT - 7,560 rubles. Insurance compensation was received on September 2, 2011.

On August 23, 2011, the following entry will be made in accounting: Debit 76-1 (“Calculations for property and personal insurance”) Credit 91-1 - 35,000 rubles. — the insurance payment is recognized as part of other income. On April 10, 2009, the following entries will be made in accounting: Debit 20 Credit 60 - 42,000 rubles. = (RUB 49,560 - RUB 7,560) - reflects the cost of repairs performed by a car service center; Debit 19 Credit 60 - 7560 rub. — the amount of VAT presented by the car service is reflected; Debit 60 Credit 51 - 49,560 rub. - paid for car repairs; Debit 91-2 Credit 19 - 5338.98 rub. ((7560 rub.: 49,560 rub.) x 35,000 rub.) - the amount of VAT presented by the car service center is written off against the insurance compensation; Debit 68 Credit 19 - 2221.02 rub. (RUB 7,560 - RUB 5,338.98) - claimed for deduction of VAT on services paid for from the organization’s own funds.

On September 3, 2011, the following entry will be made in accounting : Debit 51 Credit 76-1 - 35,000 rubles. — insurance compensation has been received from the insurance company.

Source

Why choose accounting services at Uchet.pro

- Concentration on core business processes. Management can fully focus on those components of the company's work that directly generate income.

- Cost savings. In many cases, our accounting services will cost less than maintaining full-time specialists. We will tell you more about the prices below.

- Qualifications of employees. If the manager himself does not understand accounting, then it is difficult for him to assess the level of training of applicants. At Uchet.pro, the selection of candidates is carried out by professionals, so your accounting will be handled by high-level specialists. In addition, our employees regularly undergo certification and improve their skills at various courses.

- Quality control. The director does not always have the time and opportunity to check the work of the accountant. At Uchet.pro, internal control is carried out constantly.

- Reducing the tax burden. Accounting services also include measures to optimize mandatory payments. All measures we take are fully consistent with the law and current clarifications of regulatory authorities. Therefore, a businessman can be sure that in the event of an inspection he will not have any problems. But in most cases, a competent tax optimization system is built in such a way that it does not come to an audit at all.

- Compensation for losses. If tax authorities do find violations and the company has to pay a fine, then the ability to compensate for it at the expense of employees is very limited. In general, the limit of a specialist’s financial liability does not exceed his monthly salary. As part of our accounting services, we guarantee full compensation for the customer’s losses if they occurred through our fault.

Features of car repair accounting

Current and major repairs, passing periodic technical inspections of cars are an urgent need to maintain the property in a condition suitable for use in order to make a profit. During these activities, expenses arise that must be reflected in tax and accounting records. Such expenses include the purchase of spare parts, repair work by service station technicians, repair shops, and preventive inspections of equipment.

Question: How to reflect in the accounting of the lessee organization the costs of routine repairs of a vehicle received under a bareboat rental agreement, carried out by the organization’s auxiliary production? The cost of current car repairs amounted to 40,000 rubles. (including materials, employee wages, insurance premiums). In the month of completion of repair work, materials used cost 24,000 rubles. paid in full, and salaries and insurance premiums are paid next month. The car is used in the main production of the organization. The organization did not create a reserve for the repair of fixed assets (FPE) for profit tax purposes. The organization prepares interim financial statements on the last day of each calendar month. View answer

Our clients can take advantage of other types of services:

- Restoring accounting records, for example, after loss of documents.

- Partial accounting services, i.e. maintaining any section of accounting separately. This could be payroll or settlements for foreign economic activity.

- Construction of a tax optimization system.

- Interaction with regulatory authorities:

— checking the permissible level of tax burden and recommendations for its adjustment;

— reconciliation of calculations;

— support of desk and field inspections;

- representation in court.

- Consultations on certain issues of application of accounting, tax, labor and other categories of legislation related to doing business.

The occurrence of car expenses and their current accounting

The organization operating the car can carry out repairs on its own, or it can outsource maintenance and repair work to specialists. In tax accounting, such expenses are classified as other expenses in accordance with clause 1 of Art. 260 Tax Code of the Russian Federation. They should be recognized in the period in which they were implemented. Accounting is carried out on the basis of primary documents confirming expenses incurred.

Let's look at accounting for repairs using OSNO as an example.

Question: An organization on OSN purchased a car on lease. In January, an accident occurred through no fault of the lessee, as a result of which the car could not be repaired. Is it possible to take into account leasing payments from January to July before the end of the leasing term as part of income tax expenses? View answer

Third Party Repair and Maintenance

The legislation does not provide for an exhaustive list of documents. Practice has developed the following procedure for processing work:

- concluding an agreement with a service station or service center, usually for a year;

- drawing up a repair request with a list of work and necessary spare parts;

- certificate of acceptance and transfer of the car for repair with a description of defects and problem areas;

- drawing up a work order with a detailed description of the work and its cost;

- work acceptance certificate after completion;

- invoice (if necessary);

- act of acceptance and transfer of the car in kind.

Question: How to reflect in the accounting records of a dealer organization the warranty repair of cars sold (purchased from a distributor), if the repair costs are reimbursed by the distributor in the amount of expenses incurred? The organization recognizes an estimated liability in connection with the need for warranty repairs in accounting, but it has already been fully used earlier, and the costs incurred are not covered by it. In tax accounting, a reserve for warranty repairs is not created. The cost of the warranty repairs was 52,000 rubles. (including the cost of spare parts - 20,000 rubles (excluding VAT), the amount of VAT previously accepted for deduction when purchasing them - 4,000 rubles). A report on the cost of work performed and spare parts used is sent to the distributor. Reimbursement was received to the bank account in the reporting period in which the warranty repair was performed. View answer

Let Zvezdochka LLC decide to contact a third-party organization to repair the KamAZ vehicle. The cost of the work, according to the invoice, amounted to 175,000 rubles, including VAT.

The postings will look like this:

- Dt 25 Kt60 - 175,000.00 rub. Service station debt;

- Dt 19 Kt 60 — 26694.92 rub. VAT reflected;

- Dt 60 Kt 51 - 175,000.00 rub. Paid to the service station for the work;

- Dt 68 Kt 19 — 26694.92 rub. Submitted for VAT deduction.

To what extent can a lessor organization take into account for income tax purposes the costs of repairing an insured car leased out (clause 1 of Article 260 of the Tax Code of the Russian Federation)?

In-house repair and maintenance

As a rule, the following documents are used within the organization to record and confirm repairs:

- repair plan;

- defective statements;

- applications from persons responsible for the condition of the fleet for the purchase of spare parts, primary invoices, invoices and other documents;

- invoice requirements for the issuance of spare parts;

- acts for writing off spare parts and materials for repairs;

- inventory cards and books with notes on repairs.

Let Zvezdochka LLC repair KamAZ on its own. The cost of spare parts was 75,000 rubles, and the wages of workshop workers involved in repairs were 25,000 rubles.

The postings will be like this:

- Dt 25 Kt 10/5 - 75,000.00 rub. Spare parts written off for repairs;

- Dt 25 Kt 70 - 25,000.00 rub. Salary accrued;

- Dt 25 Kt 68.69 - 7500 rub. Deductions to funds from wages.

Creating a reserve for repairs

Reserving funds for future repairs is the right of the organization, not its responsibility. It is necessary to specify the need for such a reserve in the accounting policy. The calculation of contributions to the reserve is based on the data of defective statements, the cost of the car, its service life and technical characteristics. An annual estimate for vehicle repairs and maintenance is drawn up.

Let the estimated cost for the year be 360,000.00 rubles, for the month - 30,000.00 rubles.

The postings and calculations used are as follows: Dt 25 Kt 96 RUB 30,000.00.

Zvezdochka LLC repaired a KamAZ truck at a service station in January for the amount of 75,000 rubles, including VAT of 11,440.68 rubles. The reserve amounted to RUB 30,000.00. Amount excluding VAT RUB 63,559.32:

- Dt 60 Kt 51 - 75000.00 rub. Service station repairs were paid for;

- Dt 96 Kt 60 - 30000.00 rub. Repairs at the expense of the fund.

63779,32 — 30000,00 = 33779, 32

- Dt 97 Kt 60 — 33779.32 rub. The remaining amount is included in deferred expenses;

- Dt 19 Kt 60 - 11440.68 rub. VAT included;

- Dt 68 Kt 19 - 11440.68 rub. VAT is claimed for deduction.

It should be said about the features of accounting for repairs in cases where a car is rented or taken under a leasing agreement.

Car for rent

There are two types of car rental agreement:

- without crew;

- with crew (temporary charter).

In the first case , according to Art. 642 of the Civil Code of the Russian Federation, the tenant receives the right to temporarily use the car, including driving it, and maintaining it in proper condition. The lessor receives a fee for using his car. Further, in accordance with the provisions of Art. 644 of the Civil Code of the Russian Federation, current and major repairs of the car are required to be carried out by the lessee. He also maintains the proper technical condition of the car, recognizing the costs according to the law.

How can you organize accounting?

According to the law, the director is responsible for organizing accounting in the company. He can choose one of several options:

- Do everything yourself. However, this method is only available to managers of small and medium-sized companies. In addition, the director, even in the smallest organization, has many other concerns.

- Create an accounting department within the company. This is a very common method, but it has a number of disadvantages:

— significant costs: maintenance of premises, purchase of office equipment, salaries, social benefits, etc.

— risks associated with employee illness, sudden dismissal, etc.

- Conclude an agreement with a freelance accountant. The costs in this case, of course, will be lower than when creating your own accounting department. But in this case, the entire financial management of the company will depend on one person. This is very risky - a specialist’s illness or a conflict situation can actually paralyze the business.

- Switch to accounting services from a specialized company. This option is the most preferable in many cases. We'll tell you why later.

Car on lease

According to Law No. 164-FZ dated 10/29/98, which deals with issues of leasing (financial lease), the lessee is obliged to repair, perform maintenance, and protect the property accepted by him under the contract. Unless otherwise stated in the contract, the provisions of Art. 17-1 Federal Law 164 are the basis for including these costs in calculations for tax purposes. This rule is also confirmed by the instructions of Art. 260 of the Tax Code of the Russian Federation (clauses 1.2). In this case, it does not play a significant role whether the car is on the balance sheet of the lessor or the lessee - as a general rule, the costs for it lie with the organization that received the property.

Attention! Primary documents and accounting data must not only confirm the fact of expenses for the car, but also contain an indication of the use of this car for production purposes, to generate income for the organization, and confirm the economic justification of the expenses.

Source

Who is our accounting service intended for?

We work not only in Moscow and the Moscow region, but also in other regions of the Russian Federation. Accounting services will be useful to companies of any size operating in all areas of business. Our services are already successfully used by businessmen in the following areas:

- Production: food, cosmetics, clothing, furniture.

- Trade: from individual retail outlets to online stores and wholesale companies.

- Construction: from project development to the construction of apartment buildings and office centers.

- Public catering: from street food and burger joints to restaurants.

- Services: transportation, advertising, brokers, trainings, event agencies.

- IT sphere: web studios, hosting, SEO, application development.

- Non-profit organizations: cooperatives, associations of lawyers and notaries, homeowners' associations, public organizations.

Accounting services have been our main activity for many years. We will be glad to cooperate with you!

Current, medium, major repairs

Depending on the volume and frequency of work performed, three types of repairs are distinguished: current, medium and major.

The main task of current repairs is preventative. It is carried out to protect vehicles from premature physical wear and tear. Typically, such repairs are carried out systematically, for example once a quarter.

Medium repairs are needed to prevent vehicles from breaking down prematurely. The difference between an average repair and a current one is that it is performed less frequently, for example once a year. In this case, some of the main parts in the car being repaired are replaced.

If the engine is disassembled, base and body parts are repaired, or they are replaced with new ones, then such repairs are considered major. How often major repairs need to be done depends on how intensively the vehicle is used. As a rule, such repairs are carried out no more than once every few years or due to failure of components or parts.

Car repairs must be carried out in accordance with a plan that is developed in advance taking into account the technical characteristics of the car, its operating conditions and other reasons. The plan records what exactly needs to be repaired, what parts will be replaced, and indicates the total amount of expenses. It must be taken into account that the plan is drawn up based on the system of scheduled preventive maintenance, approved by order or directive of the head of the organization. This system should determine the procedure for servicing vehicles, carrying out their current or medium repairs, as well as major and particularly complex repairs of individual objects. The repair plan is approved by order or directive by the head of the organization.

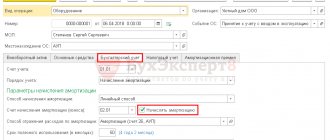

When a car is put in for major repairs, its inventory card in the file cabinet must be transferred to the “Fixed assets in repair” group.

When accepting a vehicle from a repair shop, it is necessary to draw up an Acceptance and Transfer Certificate in Form N OS-3. It must indicate all parts and assemblies that were restored or replaced.

Form N OS-3 was approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

Any repair is done for one purpose: to maintain fixed assets in working condition. At the same time, neither current, nor average, nor even major repairs in any way improve the technical characteristics, do not change the purpose or impart new qualities to the repaired vehicles. If this does happen, then we are no longer talking about repairs, but about completion, additional equipment, modernization and reconstruction of the facility. For example , replacing a domestic engine in a Volga with an imported one is no longer a major overhaul, but a modernization with all the ensuing tax consequences.

This is very important to remember, because the cost of upgrading a vehicle should be included in the initial cost of the improved items. This rule applies both in accounting (clause 14 of PBU 06/01) and in tax accounting (clause 2 of Article 257 of the Tax Code of the Russian Federation). Repair costs do not change the original cost of vehicles.

We repair the car ourselves

If the repairs are carried out in an economic way, that is, by the organization itself, then the primary documents on the basis of which records are made will be:

- invoice from the spare parts supplier;

- repair estimate;

- defective vehicle repair report;

- act of acceptance of completed work;

- act on write-off of used spare parts, etc.

These documents are necessary for the economic justification of repair costs.

VAT deduction on spare parts and assemblies that are used to repair a vehicle is made as they are capitalized, regardless of when the repairs will actually be performed, provided that all the requirements established by Art. 171 Tax Code of the Russian Federation.

Example 2 . In 2006, Kuznets LLC repaired a passenger car on its own. For this purpose, spare parts worth 5,480 rubles were issued from the warehouse. (without VAT).

The wages of workers for carrying out repairs amounted to 2,000 rubles. The amount of the accrued UST is 520 rubles.

The following entries were made in the accounting records of Kuznets LLC:

Credit 10, subaccount “Spare parts”

5480 rub. — spare parts written off for repairs;

Debit 25 Credit 70

2000 rub. — wages accrued for repairs;

Debit 25 Credit 68, 69

520 rub. — the amount of unified social tax has been accrued;

Debit 20 Credit 25

8000 rub. (5480 + 2000 + 520) - the cost of repairing a passenger car is included in expenses.