What is the report about?

The cash flow statement is prepared according to the rules set out in the PBU 23/2011 of the same name (approved by order of the Ministry of Finance dated February 2, 2011 No. 11n).

It reveals the movement of cash and cash equivalents in 3 directions - current, investment and financial activities.

Cash is the money that is in the current accounts and in the cash register of the organization.

Cash equivalents are short-term financial investments that can be quickly exchanged for money (bank deposits, highly liquid bonds).

How to fill out a cash flow statement in 2018?

You must fill out the report form from the header of the form. In the lines located on the left side are written:

- Business name;

- type of economic activity of the organization;

- organizational and legal form of the enterprise;

- form of ownership of the organization.

The following are entered into the table on the right:

- date of the report;

- enterprise code according to OKPO;

- TIN of the organization;

- enterprise activity code according to OKVED;

- OKFS codes;

- code of units of measurement according to EKEI (rubles or millions).

When filling out the main part of the report, all cash flows are distributed in three directions:

- Current activities (fields 4110-4129 and 4100). These are cash flows that arise in the normal course of business of an enterprise, for example, receiving payment for goods/services, paying rent for premises and equipment, purchasing materials, ordering work, paying wages, etc.

- Investment activity (fields 4210-4219 and 4200). This area includes cash flows that arise during the creation, purchase, and disposal of non-current assets of the organization. This is, for example, profit from the sale of non-current assets, interest on loans, dividends from participation in other enterprises, etc.

- Financial activities (fields 4310-4319 and 4300). These are cash flows that change the structure and size of an organization's capital and its borrowings. This area includes, for example, receiving interest on cash deposits, proceeds from the issue of shares and debt securities, obtaining loans and their repayment, etc.

In field 4400 the balance of cash flows at the end of the reporting year is entered. 4450 and 4500 indicate cash/equivalent balances at the beginning and end of the reporting period, respectively. If necessary, field 4490 is also filled in, showing the impact on the organization’s cash flows from changes in the foreign currency exchange rate to the ruble.

For each cash flow, data for the reporting year and for the previous year are entered into the report. If there were no flows for any item, a dash is placed in the corresponding column. Indicators of expenditure transactions are indicated in the report form in parentheses. All data is provided in the form in rubles. If the transaction was carried out in foreign currency, the equivalent amount in rubles is given at the exchange rate of the Central Bank of the Russian Federation at the time of receipt/debit of funds.

Cash flows associated with receipts to the organization from customers of services, buyers of goods, as well as payments to contractors and suppliers are indicated without excise taxes and VAT.

The completed report is submitted to the head of the enterprise for signature. If the organization uses a seal, it is affixed to the form. The cash flow report is prepared in two copies - one is submitted to the tax office, and the second is stored at the enterprise.

When is the cash flow statement submitted to the tax authorities?

The report is submitted to the territorial tax authorities along with other documentation included in the financial statements of the enterprise. It must be provided within 3 months from the end of the reporting period, that is, until the end of March next year.

KUB is the simplest and most convenient way to conduct financial analytics

With CUBE you will learn:

- Where does your money go?

- How to reduce costs without losses.

- How much did you earn last month?

- What brings you profit and what brings you losses.

- How effective are your employees?

- Which of your clients are the most reliable?

Start using the CUBE right now 14 days FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Current Operations

Cash flows from current operations include revenues and payments for the ordinary activities of the organization. That is, the main source of income is money received from buyers and customers.

Read in the berator “Practical Encyclopedia of an Accountant”

Cash flows from current activities

What subtleties need to be taken into account?

- The paid wages are reflected in the same section, along with deductions (personal income tax, writs of execution, etc.) (see letter of the Ministry of Finance dated January 29, 2014 No. 07-04-18/01). Also, on line 4211 “in connection with the remuneration of employees,” you need to include the amount of insurance premiums (letter of the Ministry of Finance dated January 22, 2021 No. 07-04-09/2355).

- Current operations include interest from the bank for the use of funds credited to the organization’s account under a bank account agreement (see letter of the Ministry of Finance dated January 19, 2021 No. 07-04-09/2694).

- Income tax is shown separately in line 4124 “Organizational income tax.” Other taxes (except for VAT, excise taxes and personal income tax) are shown in total on a separate line (“Other taxes and fees”).

Using Form 4

Usually, financial statements mean information about profits and losses, about the state of the organization at a certain point in time. Reporting documents are prepared and submitted at the end of the reporting period.

Form 4 is used in commercial organizations. The only organizations that do not use it are those that are budget-funded or work in the insurance or lending industries. For these organizations, separate forms of reporting documents and separate accounting rules are used.

Form 4 with the signatures of the head and chief accountant of the organization is submitted to the Federal Tax Service inspection. They are the ones who are responsible to the regulatory authorities for the authenticity and reliability of the information contained in the financial statements.

Investment operations

Cash flows from investment transactions include the purchase and sale of:

- various assets - equipment, vehicles, unfinished capital construction projects, etc.;

- shares (participatory interests) in other organizations, debt securities.

Read in the berator “Practical Encyclopedia of an Accountant”

Cash flows from investment operations

The data for filling out this section is taken from debit turnover on accounts 50, 51, 52, 58 subaccount “Cash equivalents” (minus received VAT) in correspondence with accounts 62 “Settlements with buyers and customers” or 76 “Settlements with various debtors and creditors "

What should you pay attention to?

- Receipts in the form of dividends and interest on debt financial investments also belong to investment activities.

- Interest payments are shown as part of investment transactions if the company includes them in the cost of investment assets. If not included, they are reflected as part of current operations.

Structure, components and content of sections

The main purpose of Form 4 is to provide any interested party with information about the positive/minus cash flows of a business entity for the analyzed years (reporting, previous).

The document also shows the organization's cash balances at the beginning and end of the analyzed periods.

In the report for the past 2021, all numerical indicators demonstrating the movement of money are presented for the reporting year 2021 and the previous year 2021. This allows you to analyze relevant information over time.

Like other documents of annual financial statements, the considered Form 4 consists of a title (introductory) part and a tabular (main) part.

The title part of the form reflects the main information about the legal entity (its name, key details, designations, codes), the reporting period, as well as the date of preparation.

The tabular part shows the plus/minus cash flows for the financial activities of the organization, the scope of its investment operations, as well as the current work of the business entity for the analyzed years (reporting, previous).

When developing a report demonstrating real cash flows, the following movements of financial resources are not indicated:

- transfers of non-cash funds between various bank accounts belonging to a legal entity;

- mutual conversion of cash equivalents;

- cash flow between the organization’s cash desk and its current account (receipt, delivery);

- exchange transactions carried out with different currencies.

Methodology and technology of compilation - direct and indirect methods

A statement of cash flows of a business entity can be generated using both direct and indirect methods.

It should be noted that different countries of the world adhere to either the first or second method. In the jurisdiction of the Russian Federation, for reporting form 4, the direct method of reporting is considered generally accepted.

The essence of the direct method is to simply calculate the amounts of income/expenses of a legal entity according to primary documentation, organizational information, bank statements and other papers/registers.

The direct method best corresponds to the cash approach to recording cash receipts/payments. Direct counting allows you to structure all items of incoming/outgoing flows.

The indirect method can be successfully used to verify the results of the direct method.

The indirect approach involves determining the operating cash flow as the sum of the net profit of a legal entity and its depreciation charges, adjusted (that is, reduced/increased) for the corresponding changes that have occurred in the structure of current assets (excluding money) and short-term liabilities (excluding interest payments) for analyzed period.

How to fill out form 4 line by line - formation order

Filling out the title (introductory) part of the report involves correctly entering the following data:

- reporting period (for example, 2021);

- code of the reporting form according to the OKUD register (for this document – 0710004);

- date of document preparation;

- the full name of the business entity indicating its OKPO code;

- digital TIN code for the reporting company;

- type of economic activity carried out with OKVED code;

- organizational and legal form of a legal entity (for example, LLC) with OKOPF code;

- form of ownership of the organization (for example, private) with OKFS code;

- the unit of measurement used for the cost indicators of the report (selected in thousands/millions of Russian rubles).

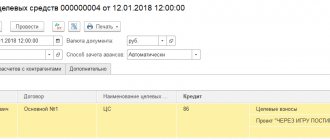

In the main (tabular) part of the report under consideration, quantitative indicators are entered line by line, demonstrating positive/minus movements of money for the reporting year (for example, 2018) and the previous year (2017, respectively).

It is noteworthy that each line in this table is assigned a specific numeric code, which ensures unambiguous identification of the corresponding indicator.

All payments (outgoing flows) are symbolically indicated in rounded brackets, since their values are negative when calculating the balance.

Receipts/payments of an economic entity are structured according to individual areas of its activity.

Current activity

Lines from 4110 to 4129 inclusive must be completed. Balance – on line 4100.

The positive/minus flows generated during normal business operations (production/sale of products, purchase/sale of goods, implementation of work, provision of various services) are considered.

Receipts from the sale of products (services), resale/sale of financial investments, receipt of royalties, rental and other similar payments, and other receipts are recorded.

Actual payments to suppliers for materials/services, salary expenses, debt interest, income tax, and other cash costs are shown.

Investment activities

Fields from 4210 to 4229 inclusive must be filled in. The balance of movements is recorded on line 4200.

The section indicates all cash flows associated with the formation and change of conditions for obtaining future income.

These are movements caused by the purchase/sale of any non-current assets and various securities, the provision of loans to other entities and the subsequent repayment of such cash loans, the receipt of dividend/interest income from various financial investments, the payment of interest on existing liabilities taken into account in the price of the investment instrument ( asset).

In addition, other receipts/write-offs in the context of investment activities are recorded.

Financial activities

Lines from 4310 to 4329 inclusive must be completed. The balance is calculated on line 4300.

All cash flows adjusting equity and debt are reflected.

Income from attracting loans/credits, making cash deposits by the owners of the organization, issuing various securities, increasing corporate participation shares, and other types of income are demonstrated.

Shown are payments due to the repurchase of corporate shares from the owners of a legal entity, transfer of dividends, distribution of profits between owners, redemption of issued securities of a debt nature, repayment of loans/credits taken, and other types of payments made.

Final indicators

In the main (tabular) part, the following indicators are separately calculated and presented:

- total balance of all cash flows (line 4400);

- initial cash balance (line 4450);

- final balance of money (line 4500);

- an indicator that evaluates the impact of exchange rate dynamics of foreign currency relative to RUB (line 4490).

Who signs?

Accounting statements prepared in 2021, including the cash flow statement, are signed only by the head of the organization.

The chief accountant does not have to sign the statements.

Who submits the form and when?

Form 4-reserves at the end of the month no later than the 2nd day of the next period is submitted by commercial and non-profit organizations of all forms of ownership and their separate divisions, if they are consumers of fuel and petroleum products (Resolution of the State Statistics Committee of the Russian Federation No. 25 of April 12, 2002).

The form must be filled out and submitted by fuel supply organizations that supply fuel to the population and social facilities. Starting in 2021, organizations that ship biofuels must also fill out the form.

What to pay attention to when filling out the form

Check the provided data for last year. If the form based on the results of November 2021 indicates the amount of fuel remaining in November 2021 (column 5), then this information must match the data submitted last year in November 2021. If there are discrepancies in the data, the reasons for the discrepancy will have to be explained.

Heads of organizations and their separate divisions bear responsibility established by law for violation of the procedure for submitting state statistical reporting.

If an enterprise simultaneously produces and consumes fuel, the report includes only reserves intended for its own energy, technological and household needs.

How to fill out the form

If during the reporting period the organization underwent a reorganization or changed its structure, fill out the form based on data from the new structure of the legal entity.

The head of the organization appoints someone responsible for collecting information, filling out the form and sending it to the statistical authorities. This function is usually performed by an accountant.

Data for form 4-inventory is formed from accounting or warehouse information. All information in the report is indicated in tons, in whole numbers.

In the address part of the form, indicate the full name of the organization, as indicated in the constituent documents, and the short name in brackets. In the address line, write the name of the territory and the legal address of the organization, indicating the postal code.

The code part is filled in as indicated in the information letter from Rosstat authorities on the inclusion of the enterprise in the Unified State Register of Industrial Organizations.

In columns 4 and 5, indicate the actual reserves of coal and fuel oil as of 0 o'clock on the 1st day of the month.

In column 6, show your actual fuel consumption for the past month.

In lines 01 to 07 of the form, indicate the balances for each type of fuel. Fuel that is used in all types of production, operational areas, for municipal and domestic needs, for sale to the public, workers and employees of the organization is subject to accounting. In the report, include fuel located in all warehouses, as well as fuel that remained unused at the end of the month, regardless of where it was stored.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

General rules

The following rules for submitting financial statements are legally approved:

- The reporting period for which documentation must be submitted is one year. Form 4 should be submitted to the Federal Tax Service no later than three months after the end of the reporting period.

- If the time allotted for submitting reporting documents ends with a holiday or weekend, then this time is extended until the next working day.

- For violation of the rules established by law, the director and chief accountant of the enterprise are punished with a fine.

Form 4 is the name of only one of the documents. In addition to this, the following are also available:

- Form 1 (completed balance sheet);

- Form 2 (financial performance statement, formerly known as the profit and loss statement);

- Form 3 (statement of changes in capital).

Where to submit form 4-inventory

The organization must submit the completed form to its territorial body of Rosstat. If an organization has a separate division, it submits the form at its location. If an organization is registered in one territory, but operates in another region or city, it submits the form to the statistical authorities where the activities actually take place.

If an organization has subsidiaries and dependent business entities, they submit reports themselves on a general basis, and the parent organization submits information to the statistical authorities without taking into account the data of these divisions.