The need to confirm the zero VAT rate arises for the seller when goods are sold for export. In this case, no value added tax is paid (in accounting terms, “taxed at a rate of 0%”).

True, you need to collect a package of documents confirming the legality of this operation. Note that these documents are not registered in 1C; they are presented to the tax office along with the VAT return.

There is a certain period for preparing all necessary documentation - 180 days.

If the documents are not collected during this time, VAT will have to be paid.

Let's consider the sequence of actions in 1C Accounting 8.3 to confirm the zero VAT rate:

- Set up accounting policy

- Correctly register goods intended for export

- Correctly register the sale of goods for export

- Generate a document “Confirmation of zero VAT rate”

- Create a purchase book

VAT settings

First of all, let's set the program settings for VAT.

In the menu “Main - Settings - Taxes and reports” go to the “VAT” tab

Check the box “Separation of incoming VAT by accounting methods is maintained.”

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the functionality settings, on the “Trade” tab, check the “Export of goods” checkbox.

Finally, in the chart of accounts settings, we will enable VAT accounting by accounting methods.

How to reflect in 1C the export of goods at a VAT rate of 0%?

Send this article to my email

In the article we will look at how to register the export of goods at a 0% VAT rate in the 1C configuration. The organization receives confirmation of such a rate if the goods are intended to be exported. A zero rate means that in this case the organization does not pay VAT. It should be noted that registration of the fact of such operations has its own specifics.

I will set up your 1C. Experience since 2004. Read more →

To confirm this operation, it is necessary to collect a number of documents and then present them along with the VAT return to the Federal Tax Service. The period for preparing documents is limited and is no more than 180 days. If the documents were not provided within this period, the organization will be required to pay VAT.

Before you begin registering transactions in the 1C: Accounting program, you need to set up your accounting policies. We open the “Main” section of the program and then we will be interested in the “Accounting Policy” item. If there are several organizations in the database, then select the one you need in the header and then follow the hyperlink at the bottom of the “Setting up taxes and reports” form.

In the settings window that opens, we will be interested in the “VAT” tab. Here you need to check the boxes “Separate accounting of incoming VAT” and “Separate accounting of VAT by accounting methods”. On the right there is a “question mark” symbol, clicking on which you can call up a hint. Next, select the month from which the setting will be applied and click “OK”.

The next step in reflecting the export of goods in 1C is document registration. Let’s go to the “Purchases” section and then select the “Receipts (acts, invoices)” item. We are processing new arrivals of goods. In the standard way, fill out the header of the document, indicating the organization, warehouse, counterparty and agreement. Calculations in our example under the contract are carried out in EUR. In the tabular part, select the desired item item and in the “VAT accounting method” column, select a value from the list “Blocked until confirmation of 0%”.

After that, we post the document and click on the “Register” button in the footer of the document to register the invoice. After that, a hyperlink to the document will appear in place of the button.

Next, you can register the sale of the received goods. To do this, go to the “Sales” section and select the “Sales (acts, invoices)” item. Let's create an implementation in our example based on a completed receipt. Click “Create based on” in the header and select an implementation. In the next window, select the document form “Goods (invoice)”. The last method is convenient because the document is created partially already filled out.

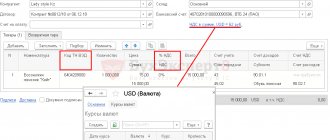

All that remains is to indicate the buyer and the contract, and, if necessary, change the data in the table. parts. The contract in our example is for sale in USD.

Next, we will consider the situation when a set of documents is collected on time and export is confirmed. Go to the “Operations” section and select the “VAT routine operations” item. We create a new document with the type “confirmation of zero VAT rate”. We indicate the organization according to our example and click the “Fill” button. Then in the tab. Part of the created implementation document will appear, and in the “Event” column the value “0% rate confirmed” will be displayed. All that remains is to process the document.

Next, at the end of the month, you must accept input VAT for deduction. To do this, you should create a purchase book that will reflect the amount of VAT to be deducted.

If we did not manage to submit the document on time, then in the “Event” column we should set “0% rate not confirmed”, and also indicate in the “Item of other expenses” field the value “VAT write-off for other expenses”. In this case, an invoice will be created automatically.

Next, a purchase book and its additional items are also formed. sheets.

EVERYONE MUST DO THEIR JOB! TRUST THE 1C SETUP TO A PROFESSIONAL. MORE →

Discuss the article on the 1C forum?

Receipt of goods

Let’s create the document “Receipts (acts, invoices)” with the operation “Goods (invoice)”.

An important feature is that in the “VAT Accounting Method” field the option “Blocked until 0% is confirmed” is available. It is used in the sale of export goods.

We will also indicate the commodity nomenclature code (HS). It determines whether a commodity is a commodity, which means that a commodity can be sold at a 0% rate.

Let's go through the document and look at the postings.

We also register an invoice and pay the goods to the supplier.

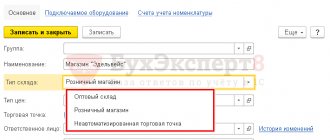

Registration of receipt and sale of goods

After enabling the checkboxes in the Receipt of goods and services documents, the “VAT Accounting Method” column appears. In our case, we select the “Blocked until 0% confirmation” option (Fig. 2). The choice of this method is the main feature when registering the receipt of goods intended for resale for export.

Fig.2

Don’t forget to register the supplier’s invoice and check the postings of the invoice (Fig. 3).

Fig.3

When purchasing a product from a supplier, we pay not only for the product itself, but also pay tax (VAT), which we have the right to claim for deduction in the future (i.e., reduce the amount of VAT on sales that we pay to the budget). In our case, “hereinafter” means “upon confirmation of the zero rate.”

Fig.4

VAT is still blocked in all registers (Fig. 4).

We register in 1C the sale of goods with a zero rate (Fig. 5).

Fig.5

You must select a currency in the contract. In this example, calculations are carried out in USD (Fig. 6), the price in the invoice is also indicated in foreign currency.

Fig.6

Sales of goods

We will sell goods using the document “Sales (acts, invoices)” with the operation “Goods (invoice)”.

In the document we indicate the VAT rate of 0%. We select an agreement with the buyer in a currency, in this case in dollars.

Confirmation of zero VAT rate

To perform this operation, go to the menu “Operations - Closing the month - Regular VAT operations”.

And we will create the corresponding document.

We fill out the document automatically using the “Fill” button.

Our implementation is included in the document. Then, in the “Event” field, select whether the 0% rate is confirmed or not confirmed.

Save the changes. The document does not make postings, but generates movements in VAT registers.

Cash sales

Another common question is filling out a tax return, in particular Section 9, as well as a sales book when an organization sells goods at retail for cash. The taxpayer does not issue an invoice; he registers primary documents in the sales book, and the data from the sales book is reflected in section 9 of the declaration. According to the letter of the Ministry of Finance of the Russian Federation dated March 23, 2015 No. 03-07-09/15737, when selling goods, performing work, providing services to the public, the indicators of CCP control tapes (Z-report), strict reporting forms are recorded in the sales book:

- in column 3 “Number and date of the seller’s invoice” of the sales book, the number and date of the CCP control tape (Z-report) is indicated, which corresponds to lines 020 of the sales book “Seller’s invoice number” and 030 “Date of the seller’s invoice” section . 9 VAT return;

- in columns 7 “Name of buyer” and 8 “TIN/KPP of buyer” of the sales book - dashes;

- Column 8 “TIN/KPP of the buyer” of the sales book corresponds to line 100 of section. 9 VAT return;

- in column 2 of the sales book, the transaction type code is indicated - 26 “Drawing up primary accounting documents for the sale of goods (work, services), property rights to persons who are not taxpayers of value added tax, and to taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax"; Column 2 of the sales book is reflected in line 010 of section. 9 tax return.

Book of purchases

To fill out the purchase book, we will create the document “Creating purchase book entries.” It is on the list of VAT regulated operations.

Check the box “Submitted for deduction of VAT 0%” and fill out the document. We check that the “Status” field is set to “0% implementation confirmed” and save the document.

In the postings we see that VAT is accepted for deduction.

Customs declaration

The program allows you to create a customs declaration. Based on it, the report “VAT Register: Appendix 05” is filled out.

To do this, go to the menu “Sales - Customs declarations (export)”.

We select our implementation as the basis document and fill out the document manually.

Now, in the list of regulated reports, we create the report “VAT Register: Appendix 05”.

The report is filled out automatically based on the customs declaration data.

Discrepancies identified in the declaration

If the tax authorities sent a request indicating errors or discrepancies in the VAT return, it is necessary, firstly, to respond to it. Otherwise, tax authorities have the right to block the organization’s account. This can be done in any form or in accordance with the recommendations of the Federal Tax Service (see letter dated 04/07/2015 No. ED-4-15/5752). The response is given 5 working days, starting from the next day after sending an electronic receipt of receipt of the request from the tax office.

After the deadline for filing the declaration, that is, after 04/27/2015, many need to send an updated declaration for the first quarter. It includes all sections that were presented in the first quarter (Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/ [email protected] ). The corrected information is shown in additional sheets of the sales and purchase books, which will be the basis for filling out Appendix 1 to sections 8 and 9. Line 001 of these appendices indicates sign 0, and line 001 of sections 8 and 9 shows sign 1. The canceled deduction is reflected in Appendix 1 to Section 8 with a minus. And additional implementation is in Appendix 1 to Section 9 plus.

Often the need to submit an updated declaration arises due to an error in the received invoice, which does not allow identifying the seller or buyer, the name or cost of goods, works, services, the VAT rate or its amount. When submitting an updated declaration for the quarter in which an error was made:

- in section 3, the indicator of the corresponding line is reduced for the entire amount of the deduction stated in the erroneous invoice;

- in section 8: on the first page in line 001 the sign 0 is put, and on other pages of the section line 001 is crossed out;

- information from section 8 of the primary declaration is copied into the section, the data from the erroneous invoice is indicated in it without changes, as well as the total amount of the deduction on line 190 of the section;

- on all pages there is a dash in line 001;

If the zero rate is not confirmed

In this case, in the document “Confirmation of zero VAT rate” we indicate the event “0% rate not confirmed”. When posting a document, an “Invoice issued” is created.

VAT is written off against other expenses. The invoice itself will appear in the Sales Book on an additional sheet.

In the document “Creating purchase ledger entries” the status will be “Not confirmed sales 0%”.

An additional sheet is filled out in the Purchase Book.

Methodology for accounting for VAT on exports

On the issue of reflecting VAT in accounting when exporting goods, the Department of Accounting Methodology and Reporting of the Ministry of Finance issued the only clarification - Letter dated May 27, 2003 No. 16 00 14/177. What accounting entries are recommended for the export of goods?

For the amount of VAT calculated in accordance with clause 9 of Art. 165 of the Tax Code of the Russian Federation after 180 days, entries are made: Debit 68 “Settlements with the budget”, subaccount “VAT for reimbursement” Credit 68 “Settlements with the budget”, subaccount “VAT for accrual”, and, accordingly, Debit 68 “Settlements with the budget ”, subaccount “VAT accrued” Credit 51 “Cash accounts” when transferring VAT to the budget.

Amounts of VAT subject to return (reimbursement) to the organization in accordance with Art. 176 of the Tax Code of the Russian Federation, are reflected in accounting by posting Debit 51 “Settlements” (68 “Settlements with the budget”) Credit 68 “Settlements with the budget”, subaccount “VAT for reimbursement”.

If the taxpayer does not confirm the validity of applying a tax rate of 0%, the VAT amount is written off by posting Debit 91 “Other income and expenses” Credit 68 “Calculations with the budget”, subaccount “VAT refundable”