What is reflected in the account 75

It is used to summarize data on all types of settlements with the founders and participants of the organization. These can be shareholders of a joint stock company, participants in a general partnership, members of a cooperative, etc. Account 75 reflects the following transactions:

- on contributions to the authorized (share) capital of the organization;

- for payment of income (dividends), etc.

Unitary enterprises - state unitary enterprises and municipal unitary enterprises - use this account to account for all types of settlements with government agencies and local governments authorized to create them.

Rules and procedure for calculating and paying dividends to the founder of an LLC - postings, terms, nuances

If a legal entity is created and operates as an LLC, the profits earned must be distributed among its owners (founders, participants) properly.

We are talking about the calculation and subsequent payment of dividends due to the co-owners of the organization.

For an LLC, all aspects of profit distribution are regulated by the twenty-eighth article of 14-FZ.

It is necessary to understand when and under what conditions dividends are paid to the co-owners of the LLC, and how earned profits are distributed among the founders.

The article describes typical situations. To solve your problem, write to our consultant or call for free:

Moscow - CALL

+7 St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

In addition, it is important to clarify the mechanism for calculating and paying dividends to LLC shareholders, as well as those situations when the founders of a legal entity do not have the right to share net profit.

Correct accounting of accrued and paid dividends deserves special attention, since it is of great importance for a legal entity organized as an LLC.

Account characteristics

In the balance sheet, account 75 “Settlements with founders” is active-passive. That is, it all depends on the type of debt on this account. It admits the presence of debt on both its debit and credit.

Example: The founders’ debt for contributions to the authorized capital is reflected according to Dt 75, and the organization’s debt to pay income to participants is reflected according to Kt 75.

That is (order of the Ministry of Finance dated July 2, 2010 No. 66n):

- in the first case, the balance under Dt 75 in the balance sheet will be reflected in the asset on line 1230 “Accounts receivable”;

- in the second, the credit balance of the account is 75 - in the liability on line 1520 “Accounts payable”.

Legal restrictions

At the time of registration of the organization, shareholders are required to pay 75% of their share, the balance of the debt must be repaid within a year. The law provides for a minimum amount of authorized capital. It depends on the type of property, is calculated in accordance with the minimum wage and is indexed every year. You can register an enterprise if the amount of capital is at least:

- limited liability company - 10 thousand rubles,

- closed joint-stock company - 100 minimum wage,

- open joint-stock company - 1000 minimum wage,

- municipal organization - 1000 minimum wage,

- state enterprise - 5000 minimum wage.

Subaccounts

To record settlements with the founders, you can open sub-accounts. For example:

- 75-1 “Calculations for contributions to the authorized (share) capital”;

- 75-2 “Calculations for payment of income”, etc.

Next, we will reveal each sub-account along with standard entries for accounting for settlements with founders and participants.

Accounting for settlements with founders (participants) for contributions to the authorized (share) capital

This is a 75-1 sub-account.

When creating a joint stock company according to Dt 75, in correspondence with account 80 “Authorized capital”, the debt for payment for shares is taken into account.

When the founders’ contributions in the form of cash are actually received, entries are made according to Kt 75 in correspondence with the cash accounts.

Deposits in the form of material and other assets (except money) are recorded using entries according to Kt 75 in correspondence with the accounts:

- 08 “Investments in non-current assets”;

- 10 "Materials";

- 15 “Procurement and acquisition of material assets”, etc.

In a similar manner, they reflect settlements on contributions to the authorized (share) capital with the founders (participants) of organizations of other organizational and legal forms. In this case, an entry under Dt 75 - Kt 80 is made for the entire amount of the authorized (share) capital declared in the constituent documents.

When an organization’s shares are sold at a price exceeding their par value, the resulting difference between the sale and par value is included in Kt 83 “Additional capital”.

Unitary enterprises use subaccount 75-1 to account for settlements with state or local authorities regarding property transferred to their balance sheet under the right of economic management or operational management. It happens:

- when creating an enterprise;

- replenishment of its working capital;

- seizure of property.

These enterprises call this subaccount “Settlements for allocated property.” Accounting for it is made in the general manner.

Accounting for settlements with founders (participants) for the payment of income to them

This is a sub-account of 75-2.

The accrual of income from participation in the organization is reflected in Dt 84 “Retained earnings (uncovered loss)” and Kt 75. At the same time, the accrual and payment of income to employees of the organization who are among its founders (participants) is taken into account in account 70 “Settlements with personnel for payment labor."

Payment of accrued income is reflected according to Dt 75 in correspondence with cash accounts.

When paying income from participation in an organization with its products (works, services), securities, etc., entries are made in accounting according to Dt 75 in correspondence with the accounts accounting for the sale of the relevant valuables.

Tax on income from participation in an organization, subject to withholding at the source of payment, is taken into account according to Dt 75 - Kt 68 “Calculations for taxes and fees”.

Subaccount 75-2 is also used to reflect calculations for the distribution of profit, loss and other results under a simple partnership agreement. The accounting records for these transactions are similar to the general procedure.

HIGHLIGHTS OF THE WEEK

05/24/20213:39 Business organization

The rules for issuing passports are changing - from July 1

24.05.202115:11

Personnel

We calculate salaries and advances for May 2021, taking into account non-working days

24.05.202113:33

Business organization

Will compensation be paid for damage during forced evacuation of a car?

24.05.202110:00

Personnel

Foreign worker: when is a patent not needed?

26.05.202111:04

Personnel

New rules for calculating sick leave will be introduced - from 2022

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Is it necessary to punch a receipt when issuing gifts for bonuses?

05/29/2021 If, in order to receive bonuses, a loyalty program participant must perform certain actions, then...

Is it possible to reinstate the deadline for filing a cassation appeal missed due to Covid restrictions?

05/29/2021 The company petitioned to restore the missed deadline for filing an appeal to the Supreme Court. She referred...

How are dividends taxed after a company is reorganized in the form of a merger?

05/28/2021 A zero income tax rate is applied if the organization receiving dividends…

‹Previous›Next All comments

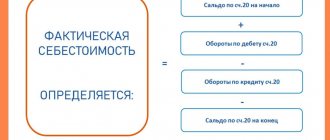

An example of calculating the actual value of a share

Determining the actual value of a participant’s share upon leaving the LLC can be considered using a separate example. To calculate the ADI, information is taken from the balance sheet for the reporting period before the founder leaves the company (Table 1).

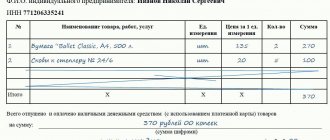

Table 1.

Based on these data, the actual value of the shares of the founders of the enterprise is calculated. An example is presented below (Table No. 2).

Table 2.

The paid share is taken into account when calculating the personal income tax of the participant - an individual, in the next tax period.

How to draw up minutes of a meeting?

The legislation does not establish any specific strict rules for the form of minutes of the meeting of founders or shareholders. The document is drawn up in free form, provided that it contains all the necessary details (number and date of the document, place of its preparation, what issues were considered, decisions on issues, signatures of those present).

If the organization has only one founder, then instead of the minutes of the meeting of founders, a participant’s decision on the need to pay dividends is drawn up. There are also no specific requirements for the form of the document, except for maintaining the necessary details. There is no need to show a detailed individual calculation of dividends for an individual recipient in the protocol or decision; it is enough to reflect the amount of the enterprise’s net profit that will be paid to the founders or shareholders.

The calculation of dividends for each participant is carried out in the accounting certificate. Its form should be developed at the enterprise, and the document should be fixed in the accounting policy. The issuance of dividends from the cash register is formalized by a cash receipt order, and when transferred from a current account - by a payment order.

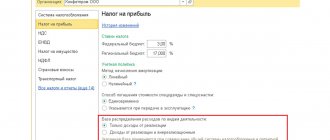

Tax calculation

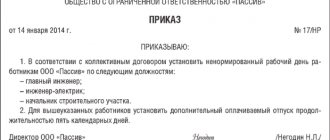

Based on the minutes of the meeting (or the decision of the participant), the head of the legal entity issues an order for payment. It will already contain the amounts due to each recipient. When calculating them, it is advisable to immediately determine the amounts of withholding taxes, for the payment of which an extremely limited time is allotted (no later than the first business day following the day of payment of dividends):

- for personal income tax (payments to individuals) - according to clause 6 of Art. 226 Tax Code of the Russian Federation;

- for income tax (payments to legal entities) - clause 4 of Art. 287 Tax Code of the Russian Federation.

Taxes on payments made in 2017–2018 are calculated at the following rates:

- Personal income tax - 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) for individuals with Russian citizenship, and 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation) for foreign citizens;

- income tax - 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation) for companies established in the Russian Federation, and 15% (subclause 3, clause 3, article 284 of the Tax Code of the Russian Federation) for legal entities of foreign origin; when calculating tax on a legal entity that has owned more than half the share in the capital of the dividend payer for at least a year, a 0% rate can be applied (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts intended for payment and received dividends (clause 2 of article 214 and clause 2 of article 275 of the Tax Code of the Russian Federation).

For more information about calculating tax on dividends, read the article “How to correctly calculate tax on dividends?”

For information on how to return tax to a foreigner who has become a resident, read the material “If a foreigner received dividends and then became a resident of the Russian Federation, the personal income tax refund is issued by the tax office.”

Possible difficulties

The Federal Law “On LLC” prescribes a method for calculating net assets and the actual value of a share based on accounting data.

balance. However, participants who submitted an application to leave the LLC may not agree with the received ADI value. For example, the assessment of the book value of real estate or other assets held by an enterprise may have been carried out many years ago. For this reason, the value according to accounting documents may differ greatly from the market valuation. In this case, the participant who has declared his withdrawal from the LLC may challenge the amount of the actual value of the share. In such situations, you can turn to independent experts to conduct an objective assessment of the market value of the company's assets. Law No. 135-FZ states that the term “actual value” in its content corresponds to the concept of “market value”. Based on this provision, a participant leaving the LLC may demand an objective assessment of assets with the involvement of an independent expert organization.

When are participants paid?

A legal entity (LLC) pays dividends to shareholders if it actually carries out activities that result in a positive financial result (profit) over a certain period of time.

As mentioned earlier, profit to be distributed among the founders of a legal entity can be recorded in reporting not only for the year, but also for interim periods (meaning a quarter, half a year).

Consequently, a decision on dividend payments can be made by a meeting of participants once a year, once every six months, or, alternatively, once a quarter, as provided for in Article 28 (twenty-eight) of Article 14-FZ.

Is monthly issuance possible or not?

Payment of dividends for shorter periods (for example, a month) is not permitted.

The procedure for making dividend payments is regulated by the charter of the LLC, taking into account current legal requirements.

The final result of net profit is determined for the past year, which has already completed.

It is recommended to make any interim payments when there is confidence in obtaining the required amount of profit for the entire year.

How to get - ways to get

Payment of dividends is carried out either by decision of the sole owner of the legal entity, or on the basis of the minutes of the general meeting of co-owners.

In order to make the necessary decisions, it is necessary to generate LLC reports for the appropriate period of time and convene a meeting of shareholders - the owners of the LLC.

The verdict must contain the following information:

- specific payment period;

- part of the earned profit directed by the co-owners of the legal entity for dividend payment;

- form and schedule of dividend repayment (the final date for making these payments is indicated).

It is not at all necessary to indicate the distribution procedure in the protocol, since dividends are usually paid to the founders in proportion to their shares of participation, unless a different algorithm is stipulated by the charter of the LLC.

You can limit yourself to indicating the total amount of dividends to be paid.

If the decision has already been made by the general meeting of shareholders of the LLC, it must be finally executed within 60 (sixty) days, unless another period for the implementation of such payments is provided for by the charter of the legal entity.

Procedure for accrual and payment

There is a certain procedure in accordance with which dividends are accrued and paid to the founders of a business company (LLC).

This procedure provides for the sequential implementation of the following stages:

- Determination of the current amount of net assets of a legal entity. The calculation formula is regulated by the norms of current legislation.

- The actual value of the LLC's net assets must be greater than the sum of the current values of its authorized capital (AC) and reserve fund (RF). If this requirement is not met, dividends will not be payable.

- The final verdict on the distribution of profits between the participants is made. The meeting of co-owners decides how to manage the net profit - pay dividends to shareholders or, alternatively, use it for the development of the company. If you still decide to pay dividends, you need to clarify how much of the net profit should be distributed among the founders. In addition, you should decide exactly how the profit will be distributed among shareholders (for example, in proportion to the current shares).

- The decision is approved by a majority and documented in the minutes of the general meeting. The protocol reflects the name of the legal entity, a list of current participants indicating their shares, a list of issues for discussion, the verdict rendered, as well as the amount, terms and method of payment. If the period is not specified in the protocol, dividends are paid to the founders within sixty days from the date of the appropriate verdict.

- The head of a business company issues an order instructing the chief accountant or other authorized person to ensure the execution of the verdict passed by the general meeting of shareholders and documented in the appropriate minutes. This order is usually drawn up by a secretary or clerk. The minutes of the meeting of shareholders are the basis for issuing this order and an appendix to it.

- The amounts of dividends paid are calculated using the selected algorithm. The most common option is that the total amount of net profit to be distributed is multiplied by the percentage share of each participant. Taxes are immediately withheld from the obtained values (for example, personal income tax for citizen shareholders), which are transferred directly to the budget. Dividends (without tax amounts) can be paid either by non-cash transfer from a current account or in cash from the cash register.

- The necessary reports are compiled and submitted to the tax service in compliance with the established deadlines. For example, for each of the citizen founders, 2-NDFL and 6-NDFL are issued and submitted.

Prerequisites for dividend payments

Dividends (part or the entire amount of net profit) are paid to shareholders (in a JSC) or participants (in an LLC) at quarterly, semi-annual or annual intervals according to a decision made by the general meeting of the company. The adoption of such a decision and its subsequent execution are possible subject to the following conditions (letter of the Ministry of Finance of the Russian Federation dated September 20, 2010 No. 03-11-06/2/147, Article 43 of the Law “On Joint-Stock Companies” dated December 26, 1995 No. 208-FZ and Art. 29 of the Law “On LLC” dated 02/08/1998 No. 14-FZ):

- according to the accounting data for the payment period, there is a net profit;

- The management company has been paid in full;

- the amount of net assets exceeds the sum of the charter capital and the reserve fund (and for a joint-stock company also the amount of the excess of the value of preferred shares over the par value), and this ratio will not change after the issuance of dividends;

- there are no signs of bankruptcy, and they will not appear after the payment of dividends;

- the repurchase of shares was completed according to the existing requirements of shareholders - for JSC;

- the withdrawing participant is fully paid his share - for an LLC;

- the necessary sequence is observed in determining payments: first for preferred shares with advantages, then for other preferred shares and finally - for ordinary shares for the joint-stock company.

The meeting, making a decision on payment and documenting it in minutes, establishes the following:

- the amount intended for payment;

- form and timing of funds issuance;

- the amount of payments for each type of shares - in the joint-stock company;

- the date on which the list of shareholders will be compiled - in the joint-stock company.

Based on these data, the amounts allocated to each participant are determined depending on:

- the type and number of shares he has - in the joint-stock company;

- the size of his share (if there is no other distribution formula in the charter) - in an LLC.

If a legal entity has a single participant, the minutes of the meeting replace its sole decision.

The preferred form of issuance is cash, because the permitted property form is equated to sale (letter of the Ministry of Finance of the Russian Federation dated December 17, 2009 No. 03-11-09/405) and is extremely unprofitable from a taxation perspective.

The issuance period should not exceed:

- in JSC - 10 (for nominal holders and trustees) and 25 (for other shareholders) working days from the date on which the list of shareholders was compiled;

- in LLC - 60 days from the date of the decision.

If for some reason a participant has not received his share on time, then he has the opportunity to demand payment within 3 years (or 5 years if specified in the charter) from the date:

- decision-making - in the joint-stock company;

- completion of the 60-day period - in an LLC.

After a 3- or 5-year period, unclaimed amounts are returned to the legal entity’s net profit.