Cash settlement limits between legal entities and individuals in 2021 fall within the sphere of influence of the Central Bank of Russia. Establishing restrictions on the volume of funds passing in the form of settlements between counterparties through the cash desk is necessary to ensure the transparency of purchase and sale transactions. Turnovers in bank accounts of legal entities are easy for regulatory authorities to check, and cash payments are classified as difficult to track. The transfer of large transactions to the non-cash sphere allows for maximum control over the legality of the activities of enterprises.

What is the cash payment limit for legal entities in 2021?

Cash payments between legal entities in 2021 are limited by a limit. This is the maximum amount of money in which cash payments can be made between legal entities and individual entrepreneurs. What you cannot spend cash proceeds on, see the article >>>

In 2021, the limit for legal entities within one contract is 100 thousand rubles. If the amount specified in the agreement exceeds the settlement limit, the balance must be transferred to the counterparty's account by bank transfer.

The question arises: is it legal for an organization to make payments on the same day with the same counterparty under several contracts, the total amount of which exceeds the established limit? Yes, it is legal if the individual amount for each agreement does not exceed 100 thousand rubles.

Please note that when concluding an agreement with an individual, the organization has the right not to comply with the limit.

For individual entrepreneurs, the limit is also 100 thousand rubles. If a company has entered into an agreement with an individual entrepreneur, then for both of them there is a cash payment limit of 100,000 rubles. Cash payments between individual entrepreneurs and individual entrepreneurs are also limited to this amount.

There are no restrictions on cash payments with individuals. Please note that from October 1, simplified customers will have to switch to mandatory card payments. The algorithm of actions is here >>>

Articles about small business cash transactions:

What restrictive measures on payments through the cash register are provided for organizations?

The limit for cash payments between legal entities in 2021 is at the level of 100,000 rubles. It is used for transactions:

- between counterparties-enterprises;

- with the participation of two individual entrepreneurs;

- with a composition of participants from a legal entity and individual entrepreneurs.

The restriction applies to transactions in foreign and national currencies (conversion into ruble equivalent is carried out at the officially established rate valid on the day of payment). The limit is valid for payment within one transaction secured by contractual relations. Businesses can make multiple cash payments with a total overdraw, but under different contracts and subject to the restrictions of individual agreements.

In the case of cash flow between the organization and its branches, the limit does not apply. The list of exceptions includes transactions for the payment of salaries with accountable funds and amounts to an individual entrepreneur for use for personal purposes of a non-commercial nature.

It is allowed to spend from the proceeds posted to the cash desk for the purpose of:

- payments of money to enterprise personnel in the form of salaries and social payments;

- cash expenses in favor of the entrepreneur to cover personal expenses;

- reimbursement of accountable funds;

- refund of previously paid amounts, taking into account the limit introduced by the Central Bank.

In other cases, cash payments are made according to the following algorithm:

- Transfer of available proceeds to the bank.

- Withdrawing money from an account to pay a counterparty.

- Making payments in cash.

The given sequence of actions is relevant for paying rent, issuing (repaying) loans, repaying accrued interest on loans, and issuing dividends.

The disadvantage of the above mechanism is the need to pay interest for the delivery of proceeds to a financial institution and its withdrawal. The purpose of introducing such a rule was to provide an additional measure of state control over the movement of funds between business entities and to suppress money laundering.

Limit per contract

The introduced restrictive limit is linked to the conditions and number of transactions between counterparties. The limit is set for each contract. In the context of one agreement, an enterprise can pay (or accept as payment) a maximum of 100,000 rubles. But it is allowed to make payments with a similar limit for other transactions with the same counterparties.

Cash payments between legal entities in 2021 require compliance with a number of features at the stage of concluding an agreement:

- the subject of the transaction can be any service or product - from payment for goods to processing a loan;

- the amount of cash deposited during the term of the agreement cannot exceed the limit established by the Central Bank;

- the limitation on the amount of cash payments applies to a specific agreement even after the end of its validity period;

- splitting payments into parts, using installments does not allow increasing the limit, the accumulated amount of cash payment under the agreement is taken into account;

- if the transaction amount exceeds the permitted threshold, part of the funds (within the legally established limit) is paid through the cash desk, the remaining funds are transferred by bank transfer.

Limit of cash payments when issuing money on account

The organization has the right to issue any amount to its employee on account. And the employee has the right to spend this amount without taking into account the limit. For example, for travel expenses.

If an organization issues an accountable amount to pay for goods, work or services under contracts concluded by the organization itself, the cash payment should not exceed 100 thousand rubles.

The same approach applies to the situation when an employee makes payments on behalf of the organization by proxy.

Accountable amounts

The amounts issued from the cash register for reporting to the employees of the enterprise are not limited by limits. This applies to cases of payment of daily allowances and reimbursement of expenses for advance reports of seconded employees.

If an employee is given money to pay for goods or services under an agreement between an organization and its counterparty (registered enterprise or individual entrepreneur), then the one hundred thousand limit must be observed (taking into account all previous cash payments under a specific agreement).

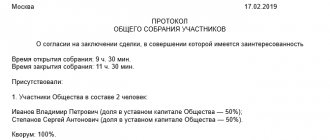

Is there a limit on cash settlements when paying dividends?

Founding organization. Joint stock companies do not have the right to issue dividends in cash from the cash register.

As for LLCs, they can pay dividends in cash, but not from trading proceeds.

The company pays dividends based on the minutes of the founders' meeting. Since the cash settlement limit applies only to settlements between counterparties within the framework of an agreement concluded between them, we can conclude that this rule does not apply to the payment of dividends.

However, as practice shows, during on-site tax audits, tax inspectors may think differently and fine the company for issuing dividends from the cash register in excess of 100 thousand rubles.

Therefore, it is safer to pay dividends either in non-cash form or within the limit.

The founder is an individual. If the founder is an individual, dividends can be paid to him from the cash register without restrictions on the amount.

For what purposes can legal entities spend cash proceeds?

All of the above operations can be carried out only from funds received by the organization’s cash desk as a result of the sale of goods, performance of work or provision of services.

For what purposes can legal entities spend cash received at the cash desk from their current account?

The organization does not have the right to spend trade proceeds generated in the organization’s cash desk for these purposes.

For what purposes can legal entities spend money from the cash register without restrictions?

All other purposes for spending cash are limited by a limit.

The nuances of making payments through the cash register between legal entities

Organizations with individual entrepreneurs, if they wish to pay bills in cash, must be guided by the provisions of the Directive dated 10/07/2013 under registration number 3073-U , issued by the Central Bank of Russia. The norms of the document establish a range of restrictions when conducting cash transactions between different categories of payers and recipients of funds, and form the basis of cash discipline for enterprises.

Directive of the Central Bank dated March 11, 2014, number 3210-U, regulates the following issues:

- execution of transactions using cash resources;

- calculating and creating cash limits for institutions;

- documentary evidence of the movement of funds at the cash desk using standardized accounting forms.

The Central Bank of Russia focuses on the mandatory execution of relevant documents when receiving money or leaving it. Data from primary documentation is entered into the columns of the cash book. A simplified procedure for conducting cash transactions is being introduced for individual entrepreneurs without the obligation to fill out the relevant primary documentation.

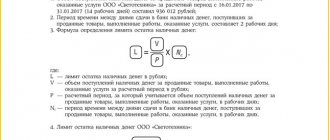

At the end of working hours, at the cash desk of any enterprise it is allowed to leave the amount of money within the limit approved by order of the manager; excess funds must be credited to the current account in the bank.

When performing calculations it is necessary:

- Availability of an agreement signed by both parties for the provision of the relevant service or purchase of goods.

- Compliance with the rules of cash flow and registration of the fact of transfer and receipt of money.

- Adhere to the maximum limit for the amount of cash received.

Fines for non-compliance with cash discipline

If the limit for cash payments between legal entities is exceeded, liability falls on both the seller and the buyer.

The fine provided for by the administrative code of the Russian Federation for this offense will cost the company in the amount of 40 to 50 thousand rubles.

For the manager - from 4 to 5 thousand rubles.

For what purposes can/cannot cash proceeds be spent in 2018?

Memo: What you can/cannot spend cash on

Features of cash payments between enterprises and citizens

Individuals can make payments to the cash desks of enterprises or individual entrepreneurs under agreements concluded with them without reference to the amount on the account. The previously developed and announced bill on introducing restrictions on cash payments for Russian citizens not engaged in commercial activities was not approved.

It is not allowed to make cash payments between legal entities and individuals in 2021 if the source of funds for payment is money posted by the cashier in the form of revenue:

- in relation to transactions with shares, bonds and bills;

- in relation to payment for rent of real estate;

- if a loan agreement has been drawn up (in cases of issuance or repayment of debt and interest on it);

- for actions related to gambling activities.

To pay for the listed list of activities in cash, an organization can only use money cashed by check from a current account.

Limits on cash payments between legal entities, as well as between individual entrepreneurs

The maximum amount of cash payments is RUB 100,000. under one contract.

This cash payment limit applies to payments between firms, organizations and individual entrepreneurs, as well as only between individual entrepreneurs. It will continue to operate under the same contract even after the contract expires. For example, a tenant company’s lease agreement has expired, it has vacated the premises, but it has a debt to the landlord. So, even after the expiration of this agreement, the company will be able to repay the debt in cash only within 100,000 rubles.

In addition, the limit is 100,000 rubles. It does not need to be used for issuing funds to employees on account, paying wages and other social benefits, as well as for spending money on personal (consumer) needs by entrepreneurs.

What are the consequences of violating the cash payment limit?

If the limit established by the Central Bank for accepting cash in the context of individual transactions between individual entrepreneurs and enterprises is exceeded, Article 15.1 of the Code of Administrative Offenses of the Russian Federation provides for the application of penalties:

- for institutions, the financial penalty is a fine in the range of 40-50 thousand rubles;

- 4-5 thousand rubles will be collected from the official.

A violation is also the deliberate splitting of a large contract with one supplier or contractor for similar products into several agreements that fit within the limit for cash payment. The identity of commercial products and the coincidence of terms, methods of payment and delivery are grounds for declaring illegal the fact of dividing a transaction into different contracts.

Punishment is imposed taking into account the statute of limitations when brought to forms of administrative liability - before the expiration of a period of two months counted from the date of the commission of the unlawful act (Part 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). The date of detection of non-compliance with standards is not taken into account. The exception is ongoing violations. If the company has exhausted the limit on cash payments under the agreement and continues to deposit or accept money through the cash register as part of this transaction, the statute of limitations is counted from the day the offense was discovered.

Responsibility lies with both parties - payers and recipients of cash. Article 23.5 of the Code of Administrative Offenses involves the consideration of cases of violations during cash payments by tax inspectors.

When making cash payments to legal entities and individual entrepreneurs, it is necessary to check each contribution for its legality by correlating the accumulated amount of payments under the agreement with the limit established by the Central Bank of Russia. An additional criterion for assessing the legality of a transaction is whether the category of spending money from the cash desk corresponds to the source of origin of cash resources. Otherwise, there is a high probability of violations of cash discipline, which will entail the imposition of fines on the enterprise and responsible officials.

Violation of the cash payment limit: about the rules for bringing to responsibility

Author's column by Artem Barseghyan, an expert from the Legal Consulting Service GARANT

Artem Barseghyan , an expert at the GARANT Legal Consulting Service, talks about the practice of holding entrepreneurs accountable for failure to comply with the cash payment limit .

In accordance with clause 6 of the Bank of Russia Directive No. 3073-U dated October 7, 2013 “On cash payments” (hereinafter referred to as the Directive), cash payments in Russian currency and foreign currency between participants in cash payments (individual entrepreneurs and legal entities) in within the framework of one agreement concluded between these persons, can be made in an amount not exceeding 100 thousand rubles. or an amount in foreign currency equivalent to 100 thousand rubles. at the official exchange rate of the Bank of Russia on the date of cash payments (hereinafter referred to as the maximum amount of cash payments) (clause 2 of the Directive). In this case, neither the duration of the agreement nor the number of one-time payments made for its execution, each of which may be less than 100 thousand rubles, are of no importance.

According to Part 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, violation of the procedure for working with cash and the procedure for conducting cash transactions, expressed, in particular, in the implementation of cash settlements with other organizations in excess of the established amounts, entails the imposition of an administrative fine on officials in the amount of 4 to 5 thousand rubles; for legal entities – from 40 to 50 thousand rubles. The specified norm is also applied in cases where the limit of settlements between organizations and individual entrepreneurs is exceeded.

The Code of Administrative Offenses of the Russian Federation does not contain a direct answer to the question of which party (making the payment, receiving it, or both) is responsible for this violation. Judicial practice on this issue is contradictory. In some cases, the courts proceed from the fact that the person making the payment must bear responsibility (resolution of the FAS Moscow District dated May 22, 2006 No. KA-A40/4070-06, resolution of the FAS Volga District dated October 30, 2003 No. A55-4572 /03-3, resolution of the Twentieth Arbitration Court of Appeal dated July 18, 2012 No. 20AP-3327/12, resolution of the Eighteenth Arbitration Court of Appeal dated July 19, 2012 No. 18AP-6510/12). At the same time, in arbitration practice there are numerous decisions confirming the presence of an administrative offense also when receiving cash in excess of the established maximum (resolution of the FAS Volga-Vyatka District dated February 18, 2010 No. A28-16681/2009, resolution of the FAS Volgo-Vyatka district dated September 22, 2008 No. A79-1817/2008, resolution of the Second Arbitration Court of Appeal dated February 21, 2014 No. 02AP-80/14, resolution of the Eleventh Arbitration Court of Appeal dated August 13, 2013 No. 11AP-11902/13, Resolution of the Eleventh Arbitration Court of Appeal dated November 14, 2012 No. 11AP-13384/12).

The Code of Administrative Offenses of the Russian Federation provides for a two-month statute of limitations for bringing to administrative responsibility from the date of commission of the offense. However, when the offense is qualified as ongoing, the statute of limitations begins to be calculated from the date of its discovery (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

As a rule, courts do not recognize exceeding the maximum amount of cash payments as a continuing offense (resolution of the Second Arbitration Court of Appeal dated August 29, 2014 No. 02AP-5605/14, resolution of the Seventh Arbitration Court of Appeal dated August 22, 2014 No. 07AP-7323/14 ), however, depending on the specific circumstances of the case, this offense may be recognized as such (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 30, 2010 in case No. A28-2959/2010, resolution of July 27, 2010 in case No. A28-1778 /2010).

There is not a single regulatory legal act authorizing any government body (including tax authorities) to exercise control over compliance with the rules of the Directive. At the same time, according to Part 1 of Art. 23.5 of the Code of Administrative Offenses of the Russian Federation, cases of violation of the procedure for working with cash and the procedure for conducting cash transactions (Article 15.1 of the Code of Administrative Offenses of the Russian Federation) are considered by the tax authorities.

In accordance with Part 1 of Art. 28.3 of the Code of Administrative Offenses of the Russian Federation, protocols on administrative offenses are drawn up by officials of bodies authorized to consider cases of administrative offenses within the competence of the relevant body.

Thus, if violations of the established procedure for cash payments are detected, the tax authorities have the right to make a decision to bring the organization, its officials or individual entrepreneur to administrative liability. In this case, an offense can be discovered both during a tax audit (resolution of the Seventh Arbitration Court of Appeal dated August 22, 2014 No. 07AP-7323/14), and during an inspection of compliance with legislation on the use of cash register equipment (resolution of the Federal Antimonopoly Service of the Volga Region dated October 12, 2010 in case No. A65-6852/2010).

| Related documents: | Related news: |

|

|