Since its publication, the Federal Law of December 6, 2011 No. 402-FZ “Accounting” (hereinafter referred to as Law No. 402-FZ) has undergone many changes and clarifications. Paragraph 1 of Article 30 of Law No. 402-FZ establishes that until the approval of federal and industry standards provided for by Law No. 402-FZ, the rules for maintaining accounting and preparing financial statements approved earlier, that is, before January 1, 2013, apply. For this reason, the Russian Ministry of Finance publishes new up-to-date clarifications for organizations - Information of the Russian Ministry of Finance No. PZ-3/2015 “On a simplified accounting system and financial reporting” (hereinafter referred to as PZ-3/2015), published on the website of the Russian Ministry of Finance on June 3, 2015 . A similar document had already been issued earlier - Information of the Ministry of Finance of Russia dated November 1, 2012 No. PZ-3/2012 “On a simplified accounting system and financial reporting for small businesses” (hereinafter referred to as PZ-3/2012). There are not many significant changes, but there is something to understand.

What is simplified accounting and who can conduct it?

The possibility of small enterprises using simplified accounting is indicated by the main regulatory document - the Law “On Accounting” dated December 6, 2011 No. 402-FZ (clause 4 of Article 6). He also states the following:

- accounting is the responsibility of any organization (with the exception of certain cases specified by law);

- simplified accounting is a right granted to small businesses (SMB).

It follows from this that for SMEs there is a legally established right to choose - to conduct accounting in a generally established manner or to apply simplified accounting and reporting algorithms.

Find out who belongs to small and medium-sized businesses in the Typical Situation from ConsultantPlus. Learn the material by getting trial demo access to the K+ system for free.

Simplified accounting is a system for generating documented, systematized information about accounting objects, freed from individual elements of generally accepted accounting. Such elements will be discussed in one of the following sections.

ATTENTION! To exercise the right to use simplified algorithms in accounting, a business entity must meet the criteria specified in Law No. 209-FZ dated July 24, 2007 on the development of small and medium-sized businesses in Russia. Read more about the criteria for classifying firms as small enterprises here.

Let's take a closer look at Art. 4 of Law No. 209-FZ (new edition), which talks about the categories of emergency services.

According to this article, SMP include:

- business entities and partnerships;

- production and consumer cooperatives;

- Peasant farms (peasant farms);

- IP.

In this case, the above subjects:

- must be legally registered; And

- meet certain conditions listed in clause 1.1 of Art. 4 of Law No. 209-FZ.

What simplified methods of accounting are provided for commercial organizations (including small enterprises that are not subject to mandatory audit and are not microfinance organizations)? For the answer to this question, see the guide to annual reporting in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The conditions are not identical for all specified entities - this will be discussed in the next section.

Organizations using simplified methods report “in full” during the transition period

By Order of the Ministry of Finance of Russia dated April 6, 2015 No. 57n, regulatory legal acts on accounting were brought into compliance with Law No. 402-FZ. In accordance with it, all organizations from January 1, 2013 are required to maintain accounting records and prepare financial statements. Since it reflects data for the previous three years, the transition period ends this year.

Thus, organizations using simplified methods are required to submit annual financial statements to the tax authority by March 31, 2021, consisting of:

1. Balance sheet

2. Statement of financial results

3. Report on the intended use of funds

These forms are presented in Appendix No. 5 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Now these documents are signed only by the head of the organization.

Commented document:

Information of the Ministry of Finance of the Russian Federation No. PZ-3/2015 dated 06/03/2015 “On the simplified system of accounting and financial reporting”

M.S. Podchufarova

, for the magazine “Regulatory Acts for Accountants”

Regulatory acts with comments

Professional comments on letters from ministries and departments, expert answers to the most difficult questions, updates every day. Find out more >>

If you have a question, ask it here >>

When is simplified accounting not available for small businesses?

Simplified accounting becomes unavailable for use when the mandatory conditions of Art. 4 are not observed. Let's consider these conditions in more detail.

To recognize an SSE as a business entity or partnership, at least one of the following requirements must be met:

- The rule “25 and 49” must be observed: the total share of participation of the state, charitable and other foundations in the authorized capital of an LLC cannot exceed 25%, and the total share of participation of foreign legal entities and (or) non-SME legal entities cannot exceed 49%;

- the condition for “high-tech” shares must be met: shares of a PJSC (a joint stock company whose shares are traded on the organized securities market) must be classified as shares of the innovative (high-tech) sector of the economy - the procedure for such classification is established by the Government of Russia;

- the merchant is an “innovation company”: it practically uses the results of intellectual activity (computer programs, databases, etc.), the exclusive rights to which belong to the founders of these companies - budgetary or autonomous scientific (or educational) institutions;

- the subject must have the status of a “Skolkovo member” (be a participant in this project);

- the founder is a legal entity included in the special list approved by the Government of Russia (support for innovative scientific and technical activities).

The SMP status will also be unavailable if, having fulfilled one of the above conditions, the merchant exceeds the NSR indicator (the average number of employees for the previous year).

Law No. 209-FZ establishes the following “average” restrictions:

- for medium-sized companies and individual entrepreneurs, the HR indicator ranges from 101 to 250 people;

- for small companies in Czech Republic up to 100 people;

- for micro-firms Czech Republic up to 15 people.

The material “How to calculate the average number of employees?” will help you avoid making mistakes in calculating the number of employees.

However, fulfilling the above conditions and numerical restrictions is also not sufficient to obtain the status of an SMP. We will talk about another restrictive threshold in the next section.

Limiting criterion - income instead of revenue

If the “numerical” parameters and conditions of clause 1.1 of Art. 4 of Law No. 209-FZ, an applicant for SME status needs to check one more indicator - business income for the previous calendar year. If it exceeds the value established by the Government of the Russian Federation, it will not be possible to obtain NSR status.

ATTENTION! On 08/01/2016, Russian Government Decree No. 265 dated 04/04/2016 came into force, establishing the maximum values for business income that allows one to obtain the status of SSE:

- micro-firms - 120 million rubles;

- small companies - 800 million rubles;

- medium enterprises - 2 billion rubles.

The previously effective decree of the Russian Government (dated July 13, 2015 No. 702) operated with the same digital thresholds, however, instead of income, revenue from the sale of goods (work, services) excluding VAT was taken as the indicator being compared.

Learn the nuances of accounting for revenue and VAT with materials from our website:

- “IFRS No. 18 Revenue - application features (nuances)”;

- “Basic rules when an organization without VAT works with an organization with VAT”.

Revenue and income are not identical concepts. Income from business activities is a broader aggregate indicator that includes not only revenue, but also other income received by the merchant (for example, penalties collected from counterparties, bank interest received for placing a deposit, etc.).

The articles posted on our website will tell you about the nuances of determining entrepreneurial income:

- “If the creditor does not require payment of penalties provided for in the contract, should they be included in income?”;

- “What income is non-operating?».

Procedures and algorithms that simplified accounting does without

SMP has the right to waive the following generally accepted accounting standards:

- forget about the accrual method and determine income and expenses using the cash method;

- apply a simplified system of accounting registers;

- refuse to maintain accounts 09 and 77, intended for accounting for deferred tax assets and liabilities (do not keep records of permanent and temporary differences);

- use one synthetic account instead of a group of accounts (for example, account 20 “Main production” instead of accounts 23, 25 and 26);

- do not form reserves;

- do not apply certain PBUs (for example, for construction SMP - PBU 2/2008 “Accounting for construction contracts”, approved by Order of the Ministry of Finance of Russia dated October 24, 2008 No. 116n);

- do not overestimate fixed assets and intangible assets, do not reflect the depreciation of intangible assets and financial investments in accounting;

- recognize commercial and administrative expenses in the cost of products (goods, works, services) in full in the reporting year of their recognition as expenses for ordinary activities;

- recognize all borrowing costs as other expenses (without inclusion in the value of the investment asset).

Organizations using the simplified tax system have the right to use simplified accounting. How to organize accounting under this special regime, read the material “Procedure for maintaining accounting records under the simplified tax system (2020).”

In addition to accounting concessions, SMEs have the right to reduce their costs when preparing reports:

- reduce the volume of reports by filling out only the balance sheet and income statement;

- refuse to detail indicators by article, generalizing them by group;

- disclose information to a lesser extent, without reporting related parties, discontinued activities, etc.;

- correct significant errors at the time they are discovered, without using retrospection.

At the same time, the accounting of a small enterprise must be organized in such a way that its reporting is reliable and useful for its users, truthfully reflecting in all material aspects the financial position of the enterprise and the financial results of its work.

Bookkeeping in a simplified way

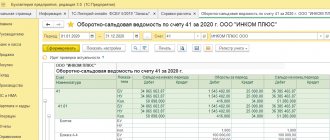

For accounting purposes, an organization using simplified methods can still reduce the number of synthetic accounts in its working chart of accounts (see Table 2).

table 2

How to legally cut bills

| Accounts that can be replaced | Accounts that can be used to replace them |

| 07 “Equipment for installation”, 10 "Materials", 11 “Animals in cultivation and fattening” | 10 "Materials" |

| 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General business expenses”, 28 “Defects in production”, 29 “Service industries and farms” | 20 “Main production”, 44 “Sales expenses” |

| 41 "Products" 43 “Finished products” | 41 "Products" |

| 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Translations on the way” | 51 “Current accounts” |

| 62 “Settlements with buyers and customers”, 71 “Settlements with accountable persons”, 73 “Settlements with personnel for other operations”, 75 “Settlements with founders”, 76 “Settlements with various debtors and creditors”, 79 “Intra-economic settlements” | 76 “Settlements with various debtors and creditors” |

| 80 “Authorized capital”, 82 “Reserve capital”, 83 “Additional capital” | 80 “Authorized capital” |

| 90 "Sales", 91 “Other income and expenses”, 99 "Profits and losses" | 99 "Profits and losses" |

The fine for failure to keep accounting records will cost a tidy sum: at least 10,000 rubles for a gross violation of the rules for accounting for income and (or) expenses (Article 120 of the Tax Code of the Russian Federation), at least 2,000 rubles per official (Article 15.11 of the Administrative Code), and also 200 rubles for each document not submitted (clause 1 of article 126 of the Tax Code of the Russian Federation).

Organization of simplified accounting: recommendations of the Ministry of Finance

Organizing accounting for a small enterprise is a procedure that requires good knowledge of legal requirements in the field of accounting and taxation. The main assistant in this case can be the Ministry of Finance - on its website there are standard recommendations for organizing accounting for small and medium enterprises, approved by order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n.

Based on these recommendations, SMP:

- will not be able to do without drawing up an accounting policy;

- must organize complete documentation of all business transactions;

- can choose from three proposed systems of accounting registers (a single journal-order system, approved by letter of the Ministry of Finance dated 03/08/1960 No. 63, journal-order system for small companies, approved by letter of the Ministry of Finance dated 06/06/1960 No. 176, or an abbreviated form of accounting).

A merchant has the right to organize a simplified accounting procedure in one of three proposed ways:

- organize accounting in full (generally accepted accounting system);

- keep records in a combined accounting register - a book (journal) recording facts of economic activity (a simple form of accounting);

- build an accounting system using NSR property registers.

The articles on our website will tell you what other recommendations the Russian Ministry of Finance issues for businessmen:

- “The traditional recommendations of the Ministry of Finance on the annual audit have been released - there are useful clarifications”;

- “How to flash the required documents - the Ministry of Finance gives recommendations”.

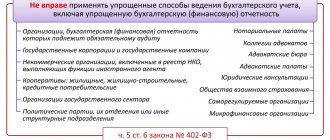

Entities that do not have the right to use simplified methods

Exceptions are made for economic entities specified in paragraph 5 of Article 6 of Law No. 402-FZ. In particular, Federal Law No. 344-FZ dated November 4, 2014 “On amendments to certain legislative acts of the Russian Federation and invalidation of certain provisions of legislative acts of the Russian Federation” (hereinafter referred to as Law No. 344-FZ) established additional restrictions. So, from November 16, 2014, they do not have the right to use simplified methods:

- issuers of publicly offered securities;

- organizations whose accounting (financial) statements are subject to mandatory audit (regardless of the nature and scale of activity).

In a letter from the Ministry of Finance of Russia dated November 19, 2010 No. 03-11-06/2/131, officials expressed the opinion that an organization that applies two special tax regimes for different types of activities, one of which, according to the law, is not exempt from accounting, should maintain accounting records, prepare and submit financial statements to the tax authority for the entire organization.

The preparation of financial statements for organizations that apply special tax regimes is significantly different from tax reporting, since it involves taking into account all the facts of economic activity.

Results

Features of accounting in small enterprises include the ability to choose between traditional accounting (in full) and simplified accounting methods.

To take advantage of this option, a merchant must meet special criteria that give him the opportunity to obtain the status of an SMP.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.