Payment of VAT in 2018: payment deadlines

Companies and individual entrepreneurs on the general tax system are payers of value added tax and must pay it to the budget.

In some cases, the obligation to pay this tax also arises for those legal entities or entrepreneurs who are not VAT payers due, for example, due to the application of a special regime.

The timing of VAT payment for certain cases will be discussed in our article.

Payment of VAT in the general mode

Firms and individual entrepreneurs that are taxpayers within the framework of the general taxation system pay the budget for value added tax according to the same rules.

The tax base and the amount of tax payable are determined based on the results of each of the four quarters of the year. An important point: unlike, for example, income tax and a number of other budget payments, VAT is not considered a cumulative total during the year, that is, the tax period in this case is precisely a single quarter.

The transfer of the tax amount occurs according to the principles prescribed in Article 174 of the Tax Code. VAT payable is divided into three parts and paid during the next quarter, by the 25th day of each of its three months.

Thus, payment of VAT, for example, for the 3rd quarter of 2021 will occur on dates before October 25, November 27 and December 25, respectively.

In November, the “last” 25th, which falls on a Saturday, is traditionally moved to the next working day.

“General regime” VAT: payment deadlines – 2018

| Tax period for VAT | Transfer deadline |

| 1st quarter 2021 | April 25, 2021 |

| May 25, 2021 | |

| June 25, 2021 | |

| 2nd quarter 2021 | July 25, 2021 |

| August 27, 2021 | |

| September 25, 2021 | |

| 3rd quarter 2021 | October 25, 2021 |

| November 26, 2021 | |

| December 25, 2021 | |

| 4th quarter 2021 | January 25, 2021 |

| February 25, 2021 | |

| March 25, 2021 |

When to pay VAT to a tax agent

The deadline for paying VAT by tax agents in general cases is the same - until the 25th day of each of three consecutive months after the end of the quarter.

Let us recall that the duties of a tax agent for VAT, that is, for determining the amount of tax and transferring it to the budget, arise in cases specified in Article 161 of the Tax Code.

Among them there are also very exotic ones, such as the sale of a sea vessel or the sale of confiscated goods, or slightly more common situations, such as the lease of state or municipal property.

An exception to the rules is the purchase of goods, works or services on the territory of the Russian Federation from foreign persons who are not registered for tax purposes in Russia. In this case, the Russian buyer also becomes a tax agent for VAT.

But he is obliged to pay tax to the budget simultaneously with the transfer of funds to a foreign counterparty.

Moreover, the bank through which settlements are carried out does not have the right to execute a payment order if a payment order with completed details for paying VAT is not simultaneously drawn up (clause 4 of Article 174 of the Tax Code of the Russian Federation).

Until when to pay VAT on import transactions?

Those businessmen who import goods, that is, purchase them abroad and then import them into the territory of the Russian Federation, also face the payment of VAT, regardless of the taxation system used. In this case, the country of origin of the product plays a role.

So, if we are talking about participants of the Eurasian Economic Union, then the issue of VAT calculations is regulated, in addition to the Tax Code, also by the Treaty on the Eurasian Economic Union, which was signed in Astana on May 29, 2014.

Paragraph 1 of Article 72 of this document states to which budget VAT is paid on goods that are the subject of a transaction between representatives of the member countries of the union, namely Russia, Belarus, Kazakhstan or Armenia. The principle of tax calculation is based on the country of destination.

That is, Russian companies and entrepreneurs, when concluding transactions to import goods within the EAEU, will pay VAT with their Federal Tax Service according to the rules of Russian legislation.

And for this situation, the Tax Code provides for a separate period for paying VAT: no later than the 20th day of the month following the month in which imported goods were registered.

https://www.youtube.com/watch?v=O_VNoN6ts6c

If goods are purchased in a country not related to the EAEU, then VAT is paid as part of customs duties directly at customs. Thus, in this case there is no need to talk about certain periods or special deadlines for submitting VAT. Payment is collected before completion of all necessary customs procedures for the release of goods.

VAT based on invoice

Companies and individual entrepreneurs under special tax regimes, for example, the simplified tax system or the unified agricultural tax, are not payers of value added tax by default.

But it happens that in transactions with a special-regime supplier, the buyer, using the general taxation system, insists on the allocation of VAT in the price of goods or services.

This is recorded in the invoice, that is, in the document that for businessmen on the OSN is the basis for charging VAT on sales.

An invoice issued with allocated VAT leads to the need to pay tax to the budget, including by those persons who are exempt from VAT in their ordinary life. The deadline for paying VAT in such a situation is until the 25th day of the month after the end of the quarter to which the issued document relates. Unlike the standard rules for transferring tax, this payment is not divided into three parts, but is paid as a total amount.

Source: https://spmag.ru/articles/uplata-nds-v-2018-godu-sroki-uplaty

VAT payment deadline in 2019. Table

According to the current tax legislation, value added tax must be paid by legal entities that are on the general taxation system and legal entities that work with issuing invoices, as well as tax agents. Below we will take a closer look at the deadlines for paying VAT in 2021.

Next year, it is planned to increase this type of tax levy to 20%, but the procedure for its payment has not changed.

More detailed information about the VAT increase in 2021 and what this change will affect can be found at the link - https://fincan.ru/articles/57_povyshenije-nds-s-1-janvarya-2019-goda/.

As before, the payment period for the tax in question is considered to be a quarter. According to Article 174 (clause 1) of the Tax Code of the Russian Federation, taxpayers must transfer the tax amount calculated for the quarter in the form of three equal payments made before the 25th day of every three months.

Let's give an example. Tax accrued for the fourth quarter of 2018 must be paid 1/3 of the total amount by January 25, February 25 and March 25, 2021 (1/3 for each date):

If a legal entity was charged VAT for the 4th quarter of 2021 in the amount of 180 thousand rubles, then he will have to pay 60 thousand rubles (180,000/3=60,000) before January 25, February 25 and March 25, 2019.

Table. VAT payment deadlines in 2021:

Time period Total share of value added tax for the quarter Must be paid by

| 4th quarter 2018 | one third | 25 Jan 2019 |

| one third | 25 Feb 2019 | |

| one third | 25 Mar 2019 | |

| 1st quarter 2019 | one third | 25 Apr 2019 |

| one third | May 27, 2019 | |

| one third | 25 Jun 2019 | |

| 2nd quarter 2019 | one third | 25 Jul. 2019 |

| one third | Aug 26 2019 | |

| one third | 25 Sep. 2019 | |

| 3rd quarter 2019 | one third | Oct 25 2019 |

| one third | 25 Nov. 2019 | |

| one third | 25 Dec 2019 | |

| 4th quarter 2019 | one third | 27 Jan 2020 |

| one third | 25 Feb 2020 | |

| one third | 25 Mar 2020 |

It should be noted that if one of the specified dates is a holiday or weekend, then payment is allowed to be made on the next working day after it.

So, for example, May 25 is a Saturday, so in the table above the next working day, that is, May 27, is indicated as the payment date. Likewise, August 25 has been moved to August 26.

Consequently, the VAT payment deadline in 2021 will be postponed twice: in May and in August. However, it is worth noting that payment should not be postponed until the last day, since as a result of completing the accompanying documentation, errors or other delays may occur, which may result in late payment and further imposition of a late fine.

The Tax Department does not prohibit paying VAT early, but not before the end of the quarter.

Deadlines for payment of VAT by a tax agent

For the type of taxpayer in question, exactly the same legislative norms for payment of tax apply, that is, also one-third in a separate payment.

If this Russian tax agent pays for services or other goods and materials to a foreign legal entity that is outside the purview of the Federal Tax Service of Russia, then he should pay VAT with a simultaneous payment to the foreign legal entity. (Article 174 / paragraph 4 of the Tax Code).

Features for special regime operators

Legal entities operating under a special tax regime are required to pay value added tax if they use invoices in their activities in which the tax fee is indicated as a separate figure.

These taxpayers are required to pay taxes by the 25th day of the month following the quarter in which the invoice was generated.

According to Article 174 (clause 4) of the Tax Code of the Russian Federation, the amount of the tax payment must not be divided into three parts, but must be paid in full.

Deadlines for filing a VAT return

The declaration must be submitted to your tax authority by the 25th day of the month following the end of the reporting quarter:

- for the 1st quarter – until April 25;

- for the 2nd quarter – until July 25;

- for the 3rd quarter – up to 25 Oct;

- for the 4th quarter – until January 25.

Source: https://fincan.ru/articles/63_sroki-uplaty-nds-2019/

What is the deadline for paying VAT for the 1st quarter of 2021? – all about taxes

The VAT payment deadline for the 1st quarter of 2021 for most companies and individual entrepreneurs falls on the 25th of April, May and June. But these dates do not always apply. In our material you will find hint diagrams and examples - they will help you understand the nuances of VAT payment deadlines.

Visual aid on VAT payment deadlines in 2021 and their postponement

VAT from a special regime officer: what deadlines to meet?

We pay VAT for the 1st quarter: payment options with examples

How not to pay VAT (examples of erroneous transfers)

Results

Visual aid on VAT payment deadlines in 2021 and their postponement

Take a look at the diagram below to understand the VAT payment deadlines (including the VAT payment dates for the 1st quarter of 2018):

Are you late with a payment or don't have enough funds? Sometimes you have the option to delay the VAT payment deadline. We remind you of the basic scheme for postponing tax payments (using VAT as an example):

How the ranks of tax agents have expanded since 2021 will be described in the publication “From 01/01/2018, scrap metal buyers are tax agents!”

See how the above rule works for VAT payment in 2018 (the postponed VAT payment deadlines are highlighted in bright color):

We see from the table that when paying VAT based on the results of the 1st and 4th quarters of 2021, all payment deadlines remained without postponement. This means that it will not be possible to delay the date of VAT remittance (or part of it) due to the coincidence of the last established payment date with a weekend or holiday. At the same time, the opportunity to pay VAT 1-2 days later than the 25th in 2021 exists in the 3rd and 4th quarters.

A little more often in 2021, you can postpone the deadlines for paying VAT when importing goods from the EAEU countries:

VAT from a special regime officer: what deadlines to meet?

Usually, special regime employees do not receive VAT into the budget, since they are exempt from paying this tax.

Find out tax innovations and explanations from officials for special regime residents on our website:

But there are cases when it is necessary to transfer VAT to companies and individual entrepreneurs using special regimes. In such cases, what do you (as a special regime officer) need to take into account regarding payment terms?

We have prepared a hint diagram for you:

If you apply the Unified Agricultural Tax, be prepared for VAT obligations starting next year.

Find out more in the publication “Starting 2021, Unified Agricultural Tax payers will pay VAT”.

We pay VAT for the 1st quarter: payment options with examples

Let's look at the procedure for paying VAT for the 1st quarter of 2018 using examples.

Example 1

Based on the results of the 1st quarter of 2021, Harmony Lux PJSC calculated VAT payable in the amount of RUB 709,374. When distributing amounts and deadlines for paying VAT for the 1st quarter, specialists of PJSC “Harmony Lux”:

- calculated the monthly payment: 709,374 rubles. / 3 = 236,458 rubles;

- distributed payment terms based on the characteristics of receipt of revenue to the company’s accounts.

The accountant of Harmony Lux LLC compiled a payment table with the deadlines for paying VAT for the 1st quarter:

| The date of payment of VAT according to the Tax Code of the Russian Federation is no later than | Scheduled payment date | VAT, rub. |

| 25.04.2018 |

Source:

Procedure and deadline for paying VAT for the 1st quarter of 2021

Who must pay VAT

What are the deadlines for paying VAT for the 1st quarter of 2021?

For whom there are different deadlines for paying VAT?

VAT on imports of goods from EAEU countries

Fines for non-payment of VAT

Who must pay VAT

VAT payers are:

- Everyone who applies the general taxation system (OSNO).

ATTENTION! The Tax Code provides for transactions that are not subject to VAT. If you mistakenly issued an invoice for such a transaction, highlighting a non-zero tax in it, then, despite the exemption, you will have to pay the tax (subclause 2, clause 5, article 173 of the Tax Code of the Russian Federation).

- Tax agents (organizations and individual entrepreneurs) in cases where the place of sale is Russia, and the counterparty under the contract is a foreign organization that is not registered with the Russian tax service. Or when an individual entrepreneur or legal entity acts as a tax agent when renting or purchasing state property.

- Taxpayers exempt from payment and non-payers of VAT in the event of presenting to their counterparties an invoice with the allocated amount of tax.

This is an important point. Often, “big” clients ask for an invoice, without going into much detail about the consequences of such actions for the seller - a VAT evader. The business entity believes that, not being a VAT payer, it does not owe anything to the budget. This is an erroneous opinion, and the invoiced tax must be remitted.

Read us on Yandex.Zen

Yandex.Zen

What are the deadlines for paying VAT for the 1st quarter of 2021?

VAT is transferred based on the results of the tax period (quarter) in equal parts until the 25th day of each of the three months following the expired period (clause 1 of Article 174 of the Tax Code of the Russian Federation).

VAT payment deadline for the 1st quarter of 2021:

- 1/3 - until April 25;

- 1/3 - until May 25;

- 1/3 - until June 25.

In practice, the question often arises of how to correctly divide the tax into three equal parts. In this case, it is necessary to be guided by the information message of the Federal Tax Service of Russia dated October 17, 2008 and round the third part of the tax up. What if the situation turns out like in our next example?

Example:

The amount of VAT payable was 47,000 rubles; when divided into three parts, it turned out that 15,666.666... rubles must be transferred to the budget every month.

The tax is transferred in full rubles. In this case, pennies must be rounded.

Guided by the explanation of the tax authorities, we divide the tax (47,000 rubles) by 3, round up the kopecks and get the following amounts:

- RUB 15,667 — until 04/25/18 (inclusive);

Source:

Deadlines for payment of VAT for the 1st quarter of 2021 (1/3 each)

Pay quarterly VAT on time to avoid penalties and blocking of accounts. See the table with VAT payment deadlines for the 1st quarter of 2021 - this way you won’t miss the first quarterly payments.

Deadlines for payment of VAT for the 1st quarter of 2021 according to the Tax Code of the Russian Federation

General terms. Organizations and tax agents pay tax based on the results of each quarter in equal parts - 1/3 of the quarterly amount.

Such payments are transferred no later than the 25th day of each of the three months following the expired quarter (clause 1 of Article 174 of the Tax Code of the Russian Federation). If the deadline falls on a weekend or holiday, it is postponed to the next working day (clause

7 tbsp. 6.1 Tax Code of the Russian Federation). As a rule, deadlines are not postponed by more than one or two days.

According to the Tax Code, you can transfer all VAT for a quarter or unequal amounts at once. If in the first two months of a quarter you transfer tax in the amount of more than 1/3 of the quarterly amount, then there is no violation. The tax authorities will offset the excess amount against future payments. But if in each month or in one of them less than 1/3 of the quarterly tax is paid, then penalties and collection of arrears are possible.

The deadlines for paying VAT for the 1st quarter of 2021 are as follows:

- first 1/3 - no later than April 25, 2021;

- second 1/3 - no later than May 25, 2021;

- third 1/3 - no later than June 26, 2021 (postponed by one day).

Deadlines for payment by foreign persons. If a Russian company purchases work (services) from a foreign organization, it becomes a tax agent and is obliged to remit VAT for it. In this case, the tax must be paid to the budget of the Russian Federation simultaneously with the payment for these works (services) to a foreign person (clause 4 of Article 174 of the Tax Code of the Russian Federation).

Deadlines for imports from EAEU countries. When importing into the Russian Federation, the tax is paid along with customs duties.

VAT when importing from the EAEU countries must be paid no later than the 20th day of the month following the one in which the goods were accepted for accounting or the payment deadline under the leasing agreement arrived (clause 19 of Annex 18 to the EAEU Treaty).

For example, for March 2021, when the imported goods were registered, you must pay tax no later than April 20.

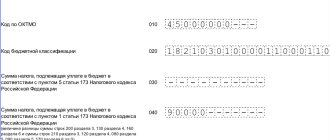

What is the deadline for paying VAT in the payment for the 1st quarter of 2018?

If you are transferring VAT, indicate 10 characters in the tax period details (field 107) of the payment order.

- The first two characters are the payment frequency (PF).

- The next two are the quarter number (01-04).

- The last four are the year for which tax is paid. When paying off the arrears, write down the payment deadline from the request.

Source: https://nalogmak.ru/transportnyj-nalog/kakov-srok-uplaty-nds-za-1-kvartal-2018-goda-vse-o-nalogah.html

Where can I find the OKTMO code?

The OKTMO code must be entered in field 105 of the payment order (clause 6 of Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013).

Finding out the code assigned to your municipal territory is not difficult at all. There are several options for this:

- Through the Rosstat website. On it you need to find the page of your territorial service of this department and find your OKTMO code there. The difficulty is that each regional statistical service has an individual design, so the link leading to the required code can be located anywhere. In addition, the user may be required to take additional actions, such as entering his personal data (TIN, OGRN, etc.).

- Download the table of correspondence between old and new classification codes from the Ministry of Finance website.

- Find out the required code on the Federal Tax Service website. This is the simplest way: the taxpayer only needs to indicate his old OKATO code or select his region (if the tax code is not known to him for some reason).

VAT payment deadline for the 4th quarter of 2021: table for legal entities and individual entrepreneurs

For the payment of VAT for the 4th quarter of 2021, the deadlines are from January to March 2021. The article contains a table of deadlines taking into account transfers, as well as reference books for 2021, sample documents and useful links.

To find out the new VAT payment deadlines, use our personal calendar. It is created specifically for accountants. Just click the button below.

Find out the new VAT payment deadlines

The following will help you report on time and correctly, as well as pay VAT to the budget:

Not only companies that operate under the general tax regime have to pay VAT. VAT payers are also considered to be entrepreneurs who have not switched to the special regime, tax agents, as well as firms and individual entrepreneurs working under special regimes and accruing tax by mistake. In all these cases, VAT is payable to the budget, and the accountant has to draw up a payment order.

Correct execution of a payment document allows you to avoid financial losses in the form of penalties and fines that the inspectorate charges if the tax payment is not received as intended on time.

In order to correctly format a document containing dozens of specific fields, you must strictly follow the rules established by the Bank of Russia.

In order to have no doubts when making a payment, it is more convenient to have at hand a reminder on how to fill out the details of a payment document - for example, such as is shown in the window below (it can be downloaded):

Other documents for paying taxes

After reviewing the VAT payment deadline for the 4th quarter of 2021, do not forget to look at the following documents, they will help in your work:

VAT payment deadline for the 4th quarter of 2021

At the end of the quarter, taxpayers transfer the calculated VAT amount in three equal payments by the 25th day of each month of the next quarter. As with any tax payments, the unified rule of the Tax Code of the Russian Federation on postponing the deadline that falls on a non-working day applies to the timing of VAT transfers. It is moved to the next business day.

According to the deadline for paying VAT for the 4th quarter of 2021, the transfer does not apply, since all payment deadlines are working:

- January 25th,

- February 25th,

- March 25th.

However, the 25th of the month does not always fall on a working day.

Example

For payments for the 1st quarter, the deadlines are April 25, May 25 and June 25. However, May 25, 2021 - this is Saturday, so the payment deadline is shifted to a future working day - May 27th.

Firms and entrepreneurs are required to submit the declaration by the 25th day of the month following the end of the quarter.

VAT: deadlines for submission and payment, taking into account postponements

Table 1 shows the VAT deadlines for submission and payment for the following companies and entrepreneurs.

- Legal entities operating under the general tax regime.

- Entrepreneurs who have not switched to the special regime and pay personal income tax.

- Tax agents.

- Firms and entrepreneurs in special regimes who have accrued tax by mistake.

Table 1.

VAT: deadlines for submission and payment

Payment of VAT in 2021: current BCC

KBK is a necessary detail of the payment document; it is indicated in field 104 of the payment document. If you make a mistake in the KBK, the transfer will not be received as intended, and the legal entity or individual entrepreneur will be listed as arrears.

BCC tax differs for cases of domestic shipments and foreign economic transactions. Currently there are three groups of codes:

- for tax on shipments within the country, as well as penalties and fines on it;

- for tax on imports from EAEU member countries, as well as penalties and fines on it;

- for tax on imports from outside the EAEU, as well as penalties and fines for it.

The current BCCs for all transfers by the VAT payment deadline for the 4th quarter of 2021 are shown in Table 2.

Table 2.

KBK on the VAT payment deadline for the 4th quarter of 2021

| Operation | Payment administrator | KBK | ||

| Tax | Penya | Fine | ||

| Shipment within Russia | Federal Tax Service | 18210301000011000110 | 18210301000012100110 | 18210301000013000110 |

| Import into Russia from outside the EAEU | FCS | 15310401000011000110 | 15310401000012100110 | 15310401000013000110 |

| Import to Russia from the territory of the EAEU | Federal Tax Service | 18210401000011000110 | 18210401000012100110 | 18210401000013000110 |

For a current example of filling out a VAT payment, see the window below, this document can be downloaded.

Deadline dates for VAT reporting for 2021

In addition to VAT reporting, taxpayers in certain situations must send to the tax office:

- notice for tax exemption;

- notice to extend tax exemption;

- application for claiming tax refund.

In addition, intermediaries acting in the interests of VAT taxpayers are required to submit to the inspectorate a log of issued and received invoices. Read Table 3 when to submit all these documents.

Table 3.

Deadline dates for VAT reporting for 2021.

| Document | When to take it in 2021 |

| Declaration in file or on paper | January 25 April 25 July 25 October 25 |

| Journal of issued and received invoices | January 21 April 22 July 22 October 21 |

| Notice for tax exemption | January 21 February 20 March 22 April 20 May 20 June 22 July 20 August 20 September 21 October 20 November 20 December |

| Notice for extension of tax exemption | January 21 February 20 March 22 April 20 May 20 June 22 July 20 August 20 September 21 October 20 November 20 December |

| Application for claiming tax refund | January 31st April 30th July 31st October 31st |

New deadline for VAT payment for the 4th quarter of 2021

Source: https://www.BuhSoft.ru/article/1692-srok-uplaty-nds-4-2018

Results

Taxpayers should fill out payment orders for VAT very carefully, since if an error is made in some details, the transferred funds will not reach the addressee and will “get stuck” in some treasury account. In the meantime, the taxpayer realizes that he made a mistake and begins to look for his lost payment, the tax office will charge him a fine and penalties for late paid tax.

That is why you should carefully check not only the correct spelling of all the required details, but also their relevance at the moment.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for VAT payment in 2019 table

According to the current tax legislation, value added tax must be paid by legal entities that are on the general taxation system and legal entities that work with issuing invoices, as well as tax agents. Below we will take a closer look at the deadlines for paying VAT in 2021.

Next year, it is planned to increase this type of tax levy to 20%, but the procedure for its payment has not changed.

As before, the payment period for the tax in question is considered to be a quarter. According to Article 174 (clause 1) of the Tax Code of the Russian Federation, taxpayers must transfer the tax amount calculated for the quarter in the form of three equal payments made before the 25th day of every three months.

Let's give an example. Tax accrued for the fourth quarter of 2018 must be paid 1/3 of the total amount by January 25, February 25 and March 25, 2021 (1/3 for each date):

If a legal entity was charged VAT for the 4th quarter of 2021 in the amount of 180 thousand rubles, then he will have to pay 60 thousand rubles (180,000/3=60,000) before January 25, February 25 and March 25, 2019.

Table. Deadlines for paying VAT in 2021 as a tax agent to the budget:

Time period - Total share of value added tax for the quarter - Must be paid before

| 4th quarter 2018 | one third | 25 Jan 2019 |

| one third | 25 Feb 2019 | |

| one third | 25 Mar 2019 | |

| 1st quarter 2019 | one third | 25 Apr 2019 |

| one third | May 27, 2019 | |

| one third | 25 Jun 2019 | |

| 2nd quarter 2019 | one third | 25 Jul. 2019 |

| one third | Aug 26 2019 | |

| one third | 25 Sep. 2019 | |

| 3rd quarter 2019 | one third | Oct 25 2019 |

| one third | 25 Nov. 2019 | |

| one third | 25 Dec 2019 | |

| 4th quarter 2019 | one third | 27 Jan 2020 |

| one third | 25 Feb 2020 | |

| one third | 25 Mar 2020 |

It should be noted that if one of the specified dates is a holiday or weekend, then payment is allowed to be made on the next working day after it.

So, for example, May 25 is a Saturday, so in the table above the next working day, that is, May 27, is indicated as the payment date. Likewise, August 25 has been moved to August 26.

Consequently, the VAT payment deadline in 2021 will be postponed twice: in May and in August. However, it is worth noting that payment should not be postponed until the last day, since as a result of completing the accompanying documentation, errors or other delays may occur, which may result in late payment and further imposition of a late fine.

The Tax Department does not prohibit paying VAT early, but not before the end of the quarter.

Deadlines for payment of VAT by a tax agent in 2021

For the type of taxpayer in question, exactly the same legislative norms for payment of tax apply, that is, also one-third in a separate payment.

If this Russian tax agent pays for services or other goods and materials to a foreign legal entity that is outside the purview of the Federal Tax Service of Russia, then he should pay VAT with a simultaneous payment to the foreign legal entity. (Article 174 / paragraph 4 of the Tax Code).

Features for special regime officers in 2021

Legal entities operating under a special tax regime are required to pay value added tax if they use invoices in their activities in which the tax fee is indicated as a separate figure.

These taxpayers are required to pay taxes by the 25th day of the month following the quarter in which the invoice was generated.

According to Article 174 (clause 4) of the Tax Code of the Russian Federation, the amount of the tax payment must not be divided into three parts, but must be paid in full.

Deadlines for filing a VAT return in 2021

The declaration must be submitted to your tax authority by the 25th day of the month following the end of the reporting quarter:

- for the 1st quarter – until April 25;

- for the 2nd quarter – until July 25;

- for the 3rd quarter – up to 25 Oct;

- for the 4th quarter – until January 25.

Responsibility

For failure to submit a VAT return on time, liability is provided under Art.

119 of the Tax Code of the Russian Federation. For each full or partial month of delay in the declaration, a fine of 5 percent of the tax not paid on time is collected. The maximum penalty is 30 percent of the tax not paid on time on a late return. If the company did not pay the tax on time or violated the deadline for submitting the “zero” declaration, then the fine will be collected in the minimum amount - 1 thousand rubles. Do not forget that if the taxpayer submits a return on paper, it will be considered unsubmitted. In this case, a sanction will follow under Art. 119 of the Tax Code of the Russian Federation. Please note: an error in the VAT return format is not punishable by a fine. In the Resolution of the Arbitration Court of the North Caucasus District dated December 2, 2016 No. F08-9002/2016, the judges noted that clause 1 of Art. 119 of the Tax Code of the Russian Federation provides for a fine for failure to submit a declaration as such. Violation of the declaration format does not fall under this rule.