The report on the intended use of funds (hereinafter referred to as the Report) is included in the financial statements only by public organizations (associations) that do not carry out entrepreneurial activities and do not have turnover in the sale of goods (works, services), with the exception of disposed property.

The Report reflects the amounts received in the reporting and previous years as entrance, membership, voluntary contributions, and amounts of other income.

In addition, the amount of money spent in the reporting and previous years is deciphered.

Report on the intended use of funds received or Form 6: which is correct?

As part of the current forms of annual financial statements recommended for use (approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), there is a document called a report on the intended use of funds.

It is often also called Form 6, despite the fact that the serial numbering of the forms for reports given in Order No. 66n is not used, and only five report forms are given in this document. Where did the name come from, referring to the form number, and is its use legal? The origin of the name, Form 6 of the report on the intended use of funds, is due to Order No. 67n of the Ministry of Finance of Russia dated July 22, 2003 - a document that is no longer in force, which, before Order No. 66n came into force (and it became mandatory for use in reporting for 2011), approved recommendations for use accounting forms. Order No. 67n contained 6 report forms, and in each of them, under the official text name, there was an indication of the serial number of the form. The numbers were distributed as follows:

- No. 1 - balance sheet;

- No. 2 - profit and loss statement;

- No. 3 - statement of changes in capital;

- No. 4 - cash flow statement;

- No. 5 - appendix to the balance sheet;

- No. 6 - report on the intended use of the funds received.

The forms approved by Order No. 66n do not have an indication of the form number, and only five forms themselves are given in this document: the form corresponding to the appendices to the balance sheet is excluded from them. However, for accountants who compiled reports for the years preceding 2011, the use of numbering of the compiled forms, which simplifies the indication of their name, remained common. However, such a reference can only be used informally, since the current document approving the accounting forms does not contain report numbers.

IMPORTANT! When preparing reports for 2021, keep in mind that accounting forms, incl. Forms 6 have changed. Key differences: reporting can only be prepared in thousands of rubles; millions can no longer be used as a unit of measurement. OKVED has been replaced by OKVED 2. For other changes, see here.

Reporting on the intended use of funds: who submits it?

So who is required to submit a report on the intended use of funds?

In Order No. 67n, the answer to this question was unambiguous: Form 6 was recommended to be drawn up by non-profit organizations (clause 4 of the instructions on the scope of accounting forms). A similar recommendation (albeit with a slightly different wording, referring to public organizations that do not conduct entrepreneurial activities) was also in the original version of Order No. 66n (subparagraph “c”, paragraph 1). But at present (Order of the Ministry of Finance of Russia dated December 4, 2012 No. 154n) there is no indication in the text of Order No. 66n as to who is affected by the preparation of a report on earmarked funds. Thus, this form must be drawn up by all recipients of targeted funding, i.e. not only non-profit structures, but also commercial organizations receiving targeted funds.

Organizations that do not receive targeted funds do not prepare a report on them, since they do not have the data to fill it out.

If you use the simplified tax system, find out from ConsultantPlus which forms of accounting in addition to Form 6 you need to submit to the Federal Tax Service. If you do not have access to the K+ system, get trial online access to the system for free.

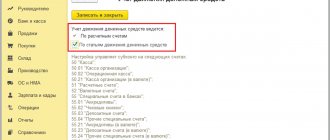

Example of business transactions

Targeted funds of 10,000 rubles were received from the source “Targeted Contributions” for the purpose of “Project TO COMPREHEND LIFE THROUGH GAME.”

During the month, expenses of 6,000 rubles were reflected for the purpose of “Project TO COMPREHEND LIFE THROUGH GAME.”

The costs for the purpose of “Project No. 1” were also reflected

At the end of the month, the “Month Closing” operation was performed - closing the 26th account

Options for a report form on the intended use of funds

The report form recommended for use on the use of targeted funds does not exist in a single version. Order No. 66n approved two of its forms:

- complete, given in Appendix No. 2.1;

- simplified, contained in Appendix No. 5.

Simplification implies a reduction in the number of lines in the report by combining data on a number of indicators (subparagraph “a”, paragraph 6 of Order No. 66n) and the absence in the form of a column intended to indicate the number of explanations.

The simplified form can be used by persons who have the right to simplify accounting and the formation of simplified accounting records. These persons include (Clause 4, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- small businesses that meet the criteria specified in the law “On the development of small and medium-sized businesses...” dated July 24, 2007 No. 209-FZ;

- non-profit organizations subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project who received this status in accordance with the law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ.

The simplified form 6 can be downloaded from ConsultantPlus. To do this, just get a trial demo access to the K+ system. It's free.

Simplification of reporting is not available (Clause 5, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- for legal entities required to audit their accounting records;

- housing and housing-construction cooperatives;

- credit consumer cooperatives and microfinance organizations;

- public sector organizations;

- political parties;

- associations of lawyers and notaries, legal consultations;

- non-profit structures acting as a foreign agent.

Procedure for filling out the intended use report

The procedure for filling out a report on the intended use of funds is not separately described anywhere. The logic for entering data into it follows from the content of the report itself and the notes available under the main table.

The main table is preceded by data about the reporting entity (its name and codes characterizing basic information about it: OKPO, INN, OKVED, OKOPF, OKFS), as well as information about the year for which the report is being prepared, the date of creation and the applied unit of measurement of the entered indicators.

The purpose of filling out the main table is to reflect, taking into account the analytics of receipts and disposals, the process of changing the balance of target financing funds accounted for in the organization (when applying the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, they are shown on account 86). In this case, a comparison of data from the current and previous years is provided.

The top and bottom rows of the table indicate information about fund balances, respectively, at the beginning and end of the year. Intermediate lines are divided into two groups: with information about receipts and about the expenditure of funds received. For each of the groups, the forms given in Order No. 66n offer a specific breakdown of analytical lines, focused on the most frequently occurring reasons for receipts and expenditures. In full form, for these reasons, the following are highlighted:

- in receipts - lines: for entrance, membership and target fees;

- voluntarily contributed funds;

- income resulting from the activities of the reporting entity;

- other funds received;

- for the purposes for which the legal entity received appropriate funding, highlighting information about expenses for charity and social assistance, informational events, and other procedures;

In a simplified form, revenues combine data on contributions and voluntarily contributed funds, and in expenditures there is no detailing of the four main groups of lines. In addition, the simplified form is distinguished by the absence of total figures related to income and expenses.

At the same time, if necessary, the report writer can supplement the form proposed by Order No. 66n with the required number of lines (clause 3 of Order No. 66n).

Explanations and an example from ConsultantPlus will help you fill out the new Form 6. If you do not yet have access to this legal system, sign up for a free trial.

How to fill out Sheet 07 (income tax)

Targeted funds with a specified period of use are reflected separately for each agreement (counterparty). If deadlines are not established, funds received can be grouped by each type.

If the report of the previous tax period contains data on unspent target funds for which the period of use is missing or has not expired, they must be transferred to the current report. When wrapping, you must indicate the following on separate lines:

- In column “2” - the date of receipt of funds (receipt of property, work, services) with the period of use;

- in column “3” - the amount of funds (cost of property, work, services) with an unexpired period of use, or unused revenues that do not have such a period (taken from column “6” of the report of the previous period).

The following lines contain data on revenues received in the reporting year (a sample of filling out Sheet 07 is given at the end of the article):

- For each item of funds received, a specific code for the type of income is selected from Appendix No. 3 to the Procedure for filling out the declaration (Sheet 07, column “1”), which is reflected in the corresponding line of the report.

- Columns “2” (date of receipt) and “5” (until what date should be used) are filled in only for receipts with a set deadline. Data in these columns is entered by charitable organizations, non-profit organizations and commercial companies that received targeted funds in accordance with clause 1 of Art. 251 Tax Code of the Russian Federation.

- In column “3” the amount of money received or the cost of the property (work, services) received is entered.

- Funds used (for their intended purpose!) in the reporting year are indicated in column “4”.

- If at the end of the reporting year there are funds left that have not expired, they are reflected in column “6” (calculated as the difference between columns “3” and “4”).

- In column “7” you need to reflect funds that were used for other purposes or that were not used within the allotted time. The amounts indicated in this column are included in non-operating income at the time of their misuse (violation of the terms of receipt).

- In the “Report Total” line, the result is calculated for all lines of columns 3, 4, 6 and 7.

Example of Sheet 07 income tax (declaration)

The non-profit organization received two grants in 2021:

- the first (550 thousand rubles) was received on March 1, 2018, the period of use was August 30, 2018;

- the second (600 thousand rubles) was received on 10/08/2018, the period of use was 04/08/2019, at the end of the year 450 thousand rubles were used.

The funds were used for their intended purpose, the deadlines were not violated.

We will reflect the income in the Profit Declaration (Sheet 07). Filling out should begin with column “1”, for which we select code “010” (grants). We will indicate each grant on a separate line (“01” and “02”).

Since the period of use has been established, we fill in columns “2” and “5”, and for an unused grant, also column “6”. The amount in column “6” will be 150 thousand rubles. (600000 – 450000).

For the total amounts of Sheet 07 (profit), the filling will be as follows:

- 1,150,000 rub. – funds received (sum of lines in column “3”);

- 1000000 rub. – used for its intended purpose (sum of lines in column “4”);

- 150,000 rub. – unused amount for which the deadline has not expired (the sum of the lines in column “6”).

An example of filling out a report on intended use

Let's look at an example of filling out a report on the intended use of funds using specific figures.

Example

For the Nadezhda charitable foundation, which is engaged in helping people who find themselves in difficult life situations, the main source of funds that allows them to carry out the activities provided for in the charter are voluntary donations from legal entities and individuals. The balance of unused funds at the beginning of the year amounted to 30,000 rubles. In 2021, the fund received 7,000,000 rubles as voluntary donations.

In addition, the foundation organizes educational events that generate income from the sale of entrance tickets to them. The net profit from this activity for 2021 amounted to RUB 1,000,000.

The expenses incurred by the fund in 2021 were as follows:

- for charitable payments to people who find themselves in difficult life situations - 6,400,000 rubles;

- for wages, taking into account insurance premiums accrued on the amount of the employee’s income - 1,400,000 rubles;

- for business trips to check the reality of difficult life circumstances for people who need help - 70,000 rubles;

- for cosmetic repairs of premises occupied by the foundation on a lease basis - 100,000 rubles.

The situation was similar in 2021. That is, there were two types of income: voluntarily donated amounts (5,500,000 rubles) and profit from business (900,000 rubles). Funds were used for charitable payments to people in need (5,200,000 rubles), wages and insurance premiums (1,100,000 rubles) and business trips (80,000 rubles). Unused funds at the beginning of the year amounted to 10,000 rubles.

In the main table of the report, fund balances at the beginning of the year will be shown in line with code 6100, and balances at the end of the year - in line 6400. Moreover, the data in line 6100 for 2021 (at its beginning) and line 6400 for 2021 (at its end ) must be the same.

Receipts will be reflected in lines 6230 (voluntary donations) and 6240 (profit from business). Their total amount will appear in line 6200.

In relation to expenses for targeted activities, lines 6310 will be used (it will show their total value) and 6311 (it is intended for expenses in the form of charitable assistance).

As for the costs of maintaining the fund itself, lines 6320 will be used (their total amount will be reflected here), 6321 (expenses related to wages), 6323 (travel expenses) and 6325 (property repair expenses).

The total amount of expenses incurred, equal to the sum of lines 6310 and 6320, will fall into line 6300.

The balance of funds at the end of each year is calculated from the amount of their balance at the beginning of the year by adding the total amount of receipts and subtracting the total amount of expenses from this term, i.e. according to the formula (if compiled using report line codes): 6100 + 6200 - 6300 = 6400.

Please see the completed report on our website.

Opening balance

Line 6100 “Balance of funds at the beginning of the reporting year”

This line reflects the amount of targeted financing at the beginning of the reporting year and at the beginning of the previous year.

This is the incoming credit balance for account 86 “Targeted financing”.

If the organization carried out business activities and received profit from this activity, the remainder of the profit should also be reflected on line 6100.

The profit received by a non-profit organization after the accrual of income tax is added to the funds for targeted financing.

This operation is reflected by the posting:

Debit 99 Credit 86 - reflects the amount of profit received from business activities, which is added to targeted financing funds.

Section “Received funds”

This section reflects income in the form of entrance, membership and voluntary contributions, as well as income from business activities and other income in the reporting and previous years.

Line 6210 “Entry fees”,

line 6215 “Membership fees”,

line 6220 “Targeted contributions”,

line 6230 “Voluntary property contributions and donations”

These lines reflect the amounts of contributions received in the reporting year and in the previous period from the budget from participants and founders of the organization, sponsors, etc., according to analytical accounting data for account 86 “Targeted financing”.

Please note: contributions can be transferred to a public organization not in cash, but in the form of property.

Such receipts are reflected in the debit of the accounts of material assets (08 “Investments in non-current assets”, 10 “Materials”, etc.) in correspondence with the credit of account 86 “Targeted financing”.

The amount of contributions received in kind should be reflected on line 6230.

Line 6240 “Profit from income-generating activities”

This line reflects the amount of profit received from business activities in the reporting year and in the previous period.

Line 6240 is filled out in the Report only by those non-profit organizations that carried out entrepreneurial activities in the reporting and (or) previous years.

Let us remind you that such organizations use this form when preparing explanations for the annual financial statements.

Line 6250 “Other”

This line reflects other receipts not reflected in lines 6210 - 6230.

These may be amounts of state assistance, amounts received for the implementation of any specific goals (if they are not entrance, membership, targeted or voluntary property contributions), amounts received as a result of the sale of fixed assets and other property, etc.

When forming the indicator for line 6250, it is necessary to remember the principle of materiality.

Amounts that are significant quantitatively or qualitatively must be reflected in additional transcript lines or in an explanatory note.

Line 6200 “Total funds received”

This is the total line for the Funds Received section. It reflects the sum of the indicators of lines 6210 - 6250.

For public organizations that do not carry out entrepreneurial activities (except for the sale of property), the line indicator 6200 must coincide with the credit turnover in account 86 “Targeted financing” of the reporting and previous periods.

Section “Funds Used”

This section shows the directions for using the proceeds received by the public organization.

Lines 6310 - 6313 “Expenses for targeted activities”

These lines reflect the amounts of expenses incurred by the public organization in connection with the activities provided for by its charter.

To decipher the total amount reflected in line 6310, the Report on the intended use of funds received includes decoding lines 6311 “Social and charitable assistance”, 6312 “Conducting conferences, meetings, seminars, etc.” and 6313 “Other events”.

Initially, expenses for carrying out activities related to the statutory activities of the organization are formed by the debit of account 20 “Main production” in correspondence with the accounts of settlements with suppliers, contractors and other debtors (accounts 60 and 76). These expenses are then written off from targeted financing (Debit 86 Credit 20). Thus, line 6310 and decryption lines reflect analytical data of debit turnover on account 86 in correspondence with account 20.

When forming the “Use of Funds” section, it is necessary to remember the principle of materiality.

If the amount in line 6313 “Other activities” is significant, you need to add additional lines that will decipher the indicator in line 6313.

They should reflect exactly what activities were carried out. The decoding of the indicator for line 6313 can be given in the explanatory note.

Lines 6320 - 6326 “Expenses for maintaining the management apparatus”

These lines reflect the amount of expenses for maintaining a public organization. The Report form approved by the Ministry of Finance of Russia contains the following decoding lines for line 6320:

- line 6321 “Expenses related to wages (including accruals).” It reflects the amounts of accrued wages of employees (including administrative personnel and workers such as cleaners, secretaries, etc.) together with the amounts of accrued contributions for compulsory pension insurance, compulsory health and social insurance;

- line 6322 “Payments not related to wages”, which reflects other payments to employees of a non-profit organization. If the organization did not make such payments in the reporting and previous periods, then this line in the form is not filled in;

- line 6323 “Expenses for official travel and business trips”;

- line 6324 “Maintenance of premises, buildings, vehicles and other property (except for repairs)”;

- line 6325 “Repair of fixed assets and other property”;

- line 6326 “Other”.

Expenses for the maintenance of a non-profit organization are accounted for in the debit of account 26 “General business expenses” in correspondence with the corresponding settlement accounts.

Expenses for the maintenance of a non-profit organization at the expense of targeted financing are written off to the debit of account 86 “Targeted financing” from the credit of account 26 “General business expenses” (Debit 86 Credit 26). Thus, when generating indicators for line 6320 and decryption lines, analytical data from debit turnover on account 86 in correspondence with account 26 is used.

Line 6330 “Acquisition of fixed assets, inventory and other property”

This line reflects the amounts of targeted financing used in connection with the acquisition of fixed assets and other inventory items.

The indicator of this line is formed according to the analytical data of the debit turnover of account 86 “Targeted financing”.

Line 6350 “Other”

This line reflects the amounts of targeted funding used that are not included in other lines in the “Funds Used” section.

Line 6300 “Total funds used”

This line is the final line for the “Funds Used” section.

It reflects the entire amount of targeted financing used by the organization in the reporting and previous years.

The indicator of this line is formed as the sum of the indicators of lines 6310 “Expenses for targeted activities”, 6320 “Expenses for maintaining the management apparatus”, 6330 “Acquisition of fixed assets, inventory and other property” and 6350 “Other”.

If the organization did not carry out business activities in the reporting and (or) previous years, the indicator in line 6300 should coincide with the debit turnover in account 86 “Targeted financing” for the reporting and previous years.

Results

A report reflecting information on the dynamics of targeted financing funds is generated if the reporting entity has such funds. When creating it, the form recommended by the Ministry of Finance of Russia is usually used, which has two forms (full and simplified) and, if necessary, can be supplemented with the necessary lines. Simplification of the report is achieved by combining indicators and is not available to all users of this form. There are no special instructions for filling out the current form, so you need to enter data into it based on the logic of the report form itself.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.