Objects of work in progress include raw materials, goods, products, semi-finished products, the processing of which has begun but is not completed.

Correct calculation of the volume of work in progress of an organization is necessary to determine the adequate cost of finished products. Let's look at the main accounting entries for work in progress.

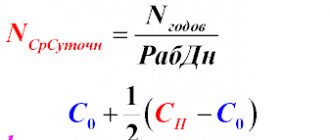

Rice. 1 - Process for estimating work in progress

Work in progress - account in accounting

According to clause 63 of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on accounting…” in accounting, work in progress in accounting is considered to be products or work that have not completed the full cycle or all stages of the technological process.

In addition, unfinished products include manufactured products that have not yet passed the necessary tests and technical acceptance or are not fully equipped. According to paragraph 64 of the same order, the value of work in progress is reflected in accounting in several ways, namely by:

- planned or actual production cost;

- direct cost items;

- cost of used raw materials, semi-finished products and materials.

These methods relate to serial or mass production, and in single production, cost estimation is carried out on the costs actually incurred to manufacture the product.

According to paragraph 1 of Art. 319 of the Tax Code of the Russian Federation, work in progress is a product that is partially ready, that is, it has not gone through all the stages of technological processing that are provided for by the applied production process. Work in progress for tax accounting purposes includes not only products, but also semi-finished products of own production, as well as materials transferred to production if they have undergone any processing.

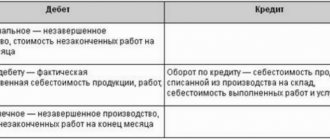

When accounting for work in progress, account 20 “Main production” is used, the debit of which collects all costs incurred during the production process. At the end of the month, the cost of finished products is written off from the credit of account 20, and the balance that remains in debit is work in progress.

If you have access to ConsultantPlus, check whether you correctly account for work in progress in accounting. If you don't have access, get a free trial of online legal access.

Main aspects of assessing work in progress and calculation formula

The method that was chosen in the organization to determine the cost of products must be enshrined in the accounting policy. The financial result of the reporting period, as well as the amount of corporate income tax, largely depends on it.

Attention! From 01/01/2021, work in progress is included in inventories, the accounting procedure for which is regulated by the new FSBU 5/2019 “Inventories”. PBU 5/01 has been cancelled.

How to take into account work in progress according to the new rules, read the Ready-made solution from ConsultantPlus. Trial access is available for free.

Let's take a closer look at the methods for assessing work in progress that are used in accounting:

1. Valuation at planned (standard) cost (clause 27 of FSBU 5/2019).

This method is based on the Standard Guidelines for the Application of the Standard Accounting Method dated January 24, 1983 No. 12, which reflects specific recommendations for application. It can be used in the production of complex products related to clothing, furniture, metalworking, engineering and similar industries with a long production cycle.

The accounting method at planned (standard) cost involves accurate accounting of available quantitative data on the balances of work in progress (hereinafter referred to as WP). It is based on the use of standards to account for all costs incurred, as well as deviations from standards in order to identify the causes and location of their occurrence.

Standard cost is a kind of accounting price, which is calculated for each group or type based on product cost calculations. In this case, the cost of work in progress is calculated as follows:

Cost of IR = Number of IR × Unit cost of IR.

2. Valuation at actual cost (clause 23 of FSBU 5/2019).

With this method, a complete calculation of the cost of manufactured products is carried out, according to which the assessment of work in progress in accounting is done based on direct and indirect costs. This method should be applied to all types of products, and therefore it should be used if the enterprise has a fairly small range of products or works.

The actual cost of work in progress, as well as finished products, will be calculated using the formula:

Actual cost = direct costs + production overhead + general operating expenses.

ATTENTION! FSBU 5/2019 does not provide for the assessment of work in progress at the cost of raw materials, materials and semi-finished products. That is, from 2021 this assessment method cannot be used.

Before 2021, the raw material method was most often used when production was considered material-intensive. At the same time, direct costs of raw materials and materials had the greatest share in costs.

Read about accounting methods in the article “Basic methods of accounting for production costs.”

Evaluation of work in progress at standard cost

In order to evaluate work in progress at standard cost, the accountant at the end of the month only needs to know the total number of unfinished (unfinished) products.

Well, and, of course, you need to know the value of the standard cost, but it is determined in advance based on plans and established standards, that is, this value does not depend on the actual results of the current month. In principle, it is not even the accounting department that can determine the standard cost, but the planning and economic department of the enterprise, if there is one, and then it is even easier for the accountant.

Typically, the standard cost of work in progress is determined in the same way as the standard cost of finished products - either by direct costs or by all production costs (based on established standards).

Example 4. Let us turn again to the data of example 1, but assume that the accounting policy provides for the assessment of finished products and work in progress at standard cost, which, according to the economic planning department, is 56 rubles. per unit of production.

Since the quantity of work in progress is 200 units, the accountant estimates the “work in progress” in the amount of: 56 rubles. x 200 units = 11,200 rub.

And the actual cost of finished products in this case will be determined as follows: 0 = 549,800 rubles.

At the same time, in accounting, these finished products are already reflected at standard cost in the amount of 56 rubles. x 9800 units = 548,800 rub.

Cost increase factor

It is necessary to talk separately about the cost increase coefficient, which is a characteristic of the increase in costs per unit of production as the technological cycle progresses. It is used when it is necessary to determine how certain costs that have dynamics increase, for example, wages, electricity, depreciation of fixed assets.

The rise factor (K) is calculated using the following formula:

K = Cost of a unit of production in NP / Total amount of production costs.

This is the most general formula that reflects the basic essence of the coefficient.

IMPORTANT! In practice, more complex calculations based on the above formula can be used for different types of production. This depends on the purpose of the calculation and the characteristics of the production process itself.

Work in progress account: what is the method for generating entries and writing off expenses for losses

At the end of the month, in order to identify the balance on account 20, you should take into account the costs that were incurred during the production process. It is necessary to understand that it accumulates all costs, both direct (attributable directly to the technological process) and indirect, also associated with production (general production and general economic).

The amount received in the debit of account 20 is the cost of manufactured products. It can be of 2 types:

- full, including direct, general production and general economic costs;

- reduced, including direct and general production costs.

IMPORTANT! The method for determining the cost of production must be enshrined in the accounting policy of the enterprise.

Then the generated cost of finished products is transferred to account 40 “Product Output”, account 43 “Finished Products” or account 90 “Sales”. Account balance 20 is work in progress.

Remains of work in progress can be used next month or written off to account 91.2 “Other income and expenses.” An example of such a situation is management’s decision that unfinished material assets in the future will not be used in the manufacture of products due to the abandonment of their production. Another situation may be the liquidation of the enterprise itself, and therefore the remaining unfinished products are written off as company expenses.

For more information about writing off work in progress, read the material “Procedure for writing off work in progress (nuances).”

Practical examples of WIP assessment

In order to make an informed choice of methods for assessing WIP and WIP, it is necessary to analyze exactly how they are applied and what consequences they lead to. And to make the difference obvious, within the framework of this article we will consider different options using the same initial numerical example.

Example 1. An enterprise produces canned vegetables. At the beginning of the month there was neither work in progress (in the workshop) nor remains of unsold products (in the warehouse).

Within a month, 10,000 units were put into production. products, in fact, during the month 9,800 units were produced and recorded in the warehouse, of which 9,500 units were sold during the month. at a price of 90 rub. per unit (assume that the company does not pay VAT).

Thus, work in progress at the end of the month is 200 units. (in the workshop), and the balance of unsold finished products is 300 units. (in warehouse).

The workshop's costs for the current month were:

- raw materials, materials, semi-finished products - 400,000 rubles;

- workers' wages and insurance premiums - 65,000 rubles;

- depreciation of equipment - 6,000 rubles;

- shop expenses (salaries of maintenance and management personnel of the shop with insurance premiums, depreciation of the shop building, utility bills, etc.), distributed at the end of the month for this type of product - 90,000 rubles.

The total amount of actual production costs for the month amounted to 561,000 rubles.

Administrative (general business) and commercial expenses are not considered in this example (we will assume that, according to the accounting policy, they are considered conditionally constant and are included in the reduction of the financial result, that is, they do not participate in the formation of production costs).

In accounting, cost collection is reflected in the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| Reflects the cost of raw materials, materials, semi-finished products transferred from the warehouse to production | 20 | 10 | 400 000 |

| The wages of the main production workers, as well as insurance premiums from it, have been calculated | 20 | 70, 69 | 65 000 |

| Depreciation of production equipment has been calculated | 20 | 02 | 6 000 |

| General production (shop) expenses were collected (the amount is reflected in the part of expenses attributed at the end of the month to the type of product in question) | 25 | 02, 10 60, 69, 70, etc. | 90 000 |

| General production expenses written off at the end of the month | 20 | 25 | 90 000 |

It is more convenient to move according to the principle “from simple to complex”, in our case - from the minimum set of costs included in the calculation to the maximum. After all, of course, the smaller the range of costs taken into account when assessing work in progress, the easier it is to make the necessary calculations, but, on the other hand, the more costs will be included in the cost of finished products and ultimately the cost of sales will be higher and the financial result lower ( the profit is less and the loss is more).

Work in progress in accounting - transactions transactions

As mentioned earlier, for accounting of work in progress, account 20 “Main production” is used. To account for all transactions, the following entries are made:

- Dt 20 Kt 02, 10, 23, 25, 26, 60, 69, 70 - costs attributable to the production of products or performance of work are taken into account;

- Dt 40, 43, 90 Kt 20 - the cost of finished products or work performed is written off.

The balance resulting from the debit of account 20 after write-offs is the amount of work in progress.

Read more about account 20 in the material “Costs in work in progress - main account.”

Comparison of calculation methods

Comparative costs in the income statement for February, calculated using both methods, are shown in the table.

| Cost item | First option | Second option |

| Materials | 13 407 (17 386 – 3 979) | 13 528 (15 000 – 1472) |

| Salary | 7 089 (9193 – 2104) | 7 215 (8000 – 785) |

| Payments to funds | 2 410 (3 125 – 715) | 2 453 (2720 – 267) |

| Depreciation | 2 094 (2716 – 622) | 1 804 (2000 – 196) |

In general, it is preferable to use the second option because it is simpler, although it gives a rougher estimate.

In what account are balances recorded and how is work in progress from previous periods reflected?

So, from all of the above it is clear that the balance of work in progress is the balance of account 20, which is transferred from the end of the previous period to the beginning of the next. Thus, this amount does not leave the specified account if further use of work in progress in the technological process is planned.

It should be noted that if production has a long cycle, for example several months, then work in progress will move from one month to another until it reaches the readiness stage.

Valuation of work in progress in tax accounting

In accordance with Art. 319 of the Tax Code of the Russian Federation, work in progress in tax accounting means:

- products or work that have been produced but not yet accepted by the customer;

- balances of unfulfilled orders;

- semi-finished products of own production;

- raw materials or materials that have been sent to production and have undergone any processing.

The assessment of work in progress in tax accounting is carried out at the end of the month, using data on balances in quantitative terms by type of product, as well as the amount of direct costs incurred this month. Work in progress balances identified at the end of the tax period are carried forward to the beginning of the next one and are included in direct costs.

This transformation of work in progress into direct costs is possible if certain conditions are met, namely:

- The costs incurred must necessarily correspond to the products for the manufacture of which they were made. It is necessary to relate costs to a specific type of product, but if this is not possible, a mechanism for allocating costs across different types of products should be developed.

- The mechanism for allocating costs by type of product and the method for estimating work in progress balances must be enshrined in the accounting policy.

- This procedure for distributing costs by type of product must be used for at least 2 tax periods.

ConsultantPlus experts explained in detail how to take into account work in progress in income tax expenses. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

We take into account and sell “unfinished”

Sometimes, due to current circumstances, organizations have to sell not finished products, but obvious unfinished products. For example, this is possible when the contract with the buyer is suddenly revised and the latter sets the condition that the product be completed at another plant, or when it becomes impossible to obtain raw materials for the further production of this product. Unfortunately, such a situation is not directly provided for either in accounting standards or in the Tax Code of the Russian Federation...

I. Makalkin, AKDI “Economics and Life”

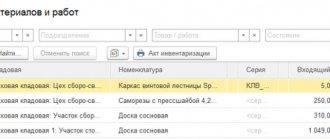

The peculiarity of this situation is that the accounting rules do not provide for quantitative and total accounting of unfinished items (products). Calculation of the actual production cost of a unit of production, as a rule, is carried out after the process of “collecting” all the costs that form the cost is completed. Until the completion of the production process and receipt of finished products (accounts 40 and 43), these costs are accounted for as work in progress (in cost accounting accounts 20, 23, 29), which in principle does not imply quantitative accounting.

Clause 4 of the Accounting Regulations “Accounting for inventories” PBU 5/01 (approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n) expressly states that this Regulation does not apply to assets characterized as work in progress.

However, from an economic point of view, work in progress in many cases can be considered a component of inventories (IP). And when selling unfinished products, enterprises have to keep quantitative records of them and determine the cost per unit of “unfinished work.” In this article, we will try to show, using a specific example, how to reflect all this in accounting and tax accounting.

Briefly about accounting for work in progress

According to the method of inclusion in the cost of production, costs are divided into direct and indirect (or overhead).

Direct are those that can be directly (directly) attributed to a specific type of product. Such costs include, in particular, the cost of raw materials and supplies used in the production of a specific type of product; wages of workers employed in this production; depreciation on fixed assets used exclusively for this production.

Direct costs, as soon as the possibility of their monetary expression arises, are immediately reflected in the debit of account 20 “Main production” (account 23 “Auxiliary production”, if we are talking about production that is auxiliary to the main production, or 29 “Service production and farms”, if we are talking about non-core activities of the organization) in correspondence with the credit of accounts for accounting for inventories, wages and depreciation.

Indirect costs cannot be directly attributed to a specific type of product. They apply to all (or several) types of products at once. Therefore, they are collected during the month in special accounts (25, 26), and at the end of the month, in a special order, they are distributed by type of product and written off as a debit to account 20 (23, 29). Why at the end of the month? Because in addition to quarterly and annual reporting, the organization must prepare monthly interim financial statements on an accrual basis from the beginning of the reporting year (clause 29 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n). In addition, most of these expenses are reflected at the end of the month (rent and wages, utilities and other similar payments).

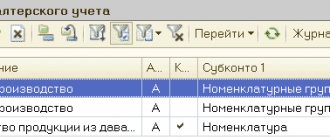

Information on the costs of servicing the main and auxiliary production of the organization is summarized on account 25 “General production expenses”.

This account, in particular, reflects: costs for heating, lighting and maintenance of production premises; rent for these premises; expenses for maintenance, operation and repair of equipment used in the production of various types of products; remuneration of workers engaged in servicing production (for example, shop manager, repair workers, cleaners and watchmen).

The methodology for distributing overhead costs (OPC) according to the cost of various types of products may be different. For example, in proportion to the number of main workers employed directly in the production of a particular product, or in proportion to depreciation on fixed assets that are used exclusively for the production of a specific type of product, etc. The most commonly used method is to distribute ODA in proportion to the wages of key workers.

Whatever method of distribution of ODA is used at the enterprise, it must be recorded in the order on accounting policies.

To summarize information about expenses for management needs not directly related to the production process, account 26 “General business expenses” is intended. This account may, in particular, reflect: labor costs for the management, accounting and economic planning department of the enterprise; rent for administrative and management premises; depreciation charges and expenses for repairs of office equipment; expenses for payment of information, auditing, consulting, etc. services.

Note that in the terminology of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, general business expenses (OHR) are called management expenses.

In the order on the accounting policy of the organization, one of two options for accounting for environmental protection can be selected.

OPTION 1.

Implies the distribution of OCR in order to include their corresponding part in the full production cost of a specific product in a manner similar to the distribution of ODP.

If this option is chosen, then the accounting policy of the organization must also describe the method of such distribution.

OPTION 2.

Provides that at the end of each month the full amount (without distribution on accounts 20, 23, 29) is immediately debited to account 90 “Sales” (Instructions for using the Chart of Accounts... (account 26); clause 9 of PBU 10/99 ).

In fact, this method means the formation of an incomplete production cost per unit of production. In management accounting, this method is also called direct-costing.

Example.

Krug LLC is engaged in the production of musical instruments, including classical guitars made of valuable wood. The full production cycle of such a guitar is 2 months. The accounting policy provides for the distribution of OCR (option 1). At the same time, the distribution of technical and experimental work in order to form the full production cost of products is carried out in proportion to the wages of the main production workers. To simplify the example, let’s assume that at the beginning of December there was no work in progress for guitars on account 20 (i.e., a new production cycle for a batch of guitars began on December 1). To reflect the costs of guitar production, the accounting department of Krug LLC uses account 20/2.

In December, materials worth 500,000 rubles were supplied for the production of guitars. The workers directly manufacturing this product were paid a salary in the amount of 700,000 rubles. Unified social tax and insurance premiums related to this salary amounted to 182,000 rubles. The total salary of production workers (for all products) is 7,000,000 rubles. In December, OPR in the amount of 900,000 rubles and OCR in the amount of 800,000 rubles were also accrued.

Work in progress for guitars at the end of December is calculated as follows.

The part of OPR attributable to the cost of the batch of guitars is determined:

(700,000: 7,000,000) x 900,000 = 90,000 rub.

The part of the technical and technical work related to the cost of the batch of guitars is determined:

(700,000: 7,000,000) x 800,000 = 80,000 rub.

Thus, the work in progress production of a batch of guitars (account balance 20/2) at the end of December is the amount:

500,000 + 700,000 + 182,000 + 90,000 + 80,000 = 1,552,000 rub.

In December, in particular, the following transactions were made:

Debit 20/2 – Credit 10

– 500,000 rub. – materials were released for the production of guitars;

Debit 20/2 – Credit 70

– 700,000 rub. – employees involved in the production of guitars are paid wages;

Debit 20/2 – Credit 69

– 182,000 rub. – unified social tax and insurance premiums have been accrued;

Debit 25 – Credit 02, 10, 60, 69, 70, 76, etc.

– 900,000 rub. – reflect the December ODA (depreciation of general fixed assets, heating, lighting, wages of workers serving all production, etc.);

Debit 26 – Credit 02, 10, 60, 69, 70, 76, etc.

– 800,000 rub. – reflected the financial and operating expenses of December (depreciation of office equipment, salaries of management personnel, payment for information and consulting services, etc.);

Debit 20/2 – Credit 25

– 90,000 rub. – part of the operational development work is allocated to the production of guitars;

Debit 20/2 – Credit 26

– 80,000 rub. – part of the OCR is allocated to the production of guitars.

If the organization, according to the conditions of the example, used option 2 (writing off the OHR at the end of the month in full from account 26 to the debit of account 90), and not option 1, then instead of the last posting there would be a posting:

Debit 90/2 – Credit 26

– 800,000 rub. – the entire amount of maintenance at the end of the month is included in expenses for ordinary activities of the reporting period.

Tax accounting of work in progress and PBU 18/02

As in accounting, in tax accounting expenses are divided into direct and indirect (Clause 1, Article 318 of the Tax Code of the Russian Federation). However, these are completely different concepts.

If in accounting, direct costs are understood as those expenses that are directly (in particular, without distribution) included in the cost of production, then in tax accounting, direct expenses are understood as all expenses that are included in the tax cost of products.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services) (clause 1 of Article 318 of the Tax Code of the Russian Federation). Accordingly, they relate to the expenses of the current reporting (tax) period as products are sold (clause 2 of Article 318 of the Tax Code of the Russian Federation). The procedure for including direct expenses in the balances of work in progress, balances of finished products, and shipped goods is established by Art. 319 of the Tax Code of the Russian Federation.

For the purposes of Chapter 25 of the Tax Code of the Russian Federation, work in progress (WIP) means products (work, services) of partial readiness, i.e. not having undergone all processing (manufacturing) operations provided for by the technological process. Work in progress includes completed but not accepted by the customer works and services.

WIP also includes the balances of unfulfilled production orders and the balances of semi-finished products of own production. Materials and semi-finished products in production are classified as work in progress provided that they have already been processed.

The assessment of WIP balances at the end of the current month is carried out by the taxpayer on the basis of data from primary accounting documents on the movement and balances (in quantitative terms) of raw materials and materials, finished products by workshop (production and other production divisions of the taxpayer) and tax accounting data on the amount of goods carried out in the current month. month of direct expenses.

The taxpayer independently determines the procedure for distributing direct expenses for work in progress and for products manufactured in the current month (work performed, services rendered), taking into account the correspondence of the expenses incurred for manufactured products (work performed, services rendered). This procedure is fixed in the order on the organization’s accounting policy for tax purposes (UNP) and is subject to application for at least two tax periods.

The amount of WIP balances at the end of the current month is included in the direct expenses of the next month.

Thus, the rules for the formation of work in progress in tax accounting may, in principle, not differ from similar rules in accounting. The determining factor is the composition of expenses included in the cost of production.

In accounting, indirect costs are understood as expenses that relate to production as a whole (accounts 25 and 26). They are also included in the cost of a specific type of product, but not directly, but after calculating (distributing) the corresponding share.

In tax accounting, all remaining expenses are included in indirect costs of production and sales, i.e. those that are not taken into account in the tax cost of products (do not relate to direct ones) and are not recognized as non-operating expenses in accordance with Art. 265 of the Tax Code of the Russian Federation, but in principle they are recognized as expenses for the purposes of Chapter 25 of the Tax Code of the Russian Federation (clause 1 of Article 318 of the Tax Code of the Russian Federation). At the same time, the amount of indirect expenses of the reporting (tax) period is allocated in full to the reduction of profit for this period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

It turns out that part of the indirect expenses of accounting in tax accounting may relate to direct expenses. For example, this happens when general production and general business expenses reflected in accounts 25 and 26, or a certain part of them, according to the UNP, are classified as direct expenses. The taxpayer chooses the mechanism for distributing ODP and OHR to direct expenses in tax accounting independently (using economically justified indicators) and also records it in his accounting policy for tax purposes (paragraph 5, paragraph 1, Article 319 of the Tax Code of the Russian Federation).

Note that such a discrepancy in the classification of expenses is not so significant for tax purposes if, ultimately, expenses, called differently in tax and accounting, are included in the cost and, accordingly, form work in progress in both accounts.

On the contrary, such discrepancies in the classification of expenses are very significant, which lead to a discrepancy between the actual cost in tax and accounting.

For example, part of the direct accounting expenses in tax accounting may be classified as indirect expenses. In particular, according to the accounting policy for accounting purposes (hereinafter referred to as UBP), rent for an item of fixed assets used exclusively for the production of one type of product is recognized as a direct expense and is immediately reflected in account 20, and according to the accounting policy for tax purposes, this expense is not included to direct costs.

The most common case of discrepancies in cost is when operational and chemical works in accounting are included in the cost of production (i.e. account 26 is distributed to account 20) and, accordingly, in work in progress, and in tax accounting these same expenses are recognized as indirect, immediately written off and, accordingly, not in work in progress turn on.

Of course, in order to simplify the accounting of the income tax payer, the provisions of the accounting policy for accounting and tax accounting purposes should provide for the same composition of expenses included in the cost of production. But this is not always feasible (for example, due to the concept of enterprise management accounting).

For organizations applying PBU 18/02, if there are discrepancies between the amount of work in progress in accounting and tax accounting, there are discrepancies in the amount of expenses recognized in the reporting period, and it becomes necessary to reflect permanent or temporary differences in accordance with PBU 18/02.

Example (continued).

Let’s assume that LLC “Krug”, for profit tax purposes, recognizes those expenses that in accounting relate to OPR as direct, and those expenses that in accounting relate to OPR, recognizes as indirect expenses. Let us also assume that there are no other discrepancies between accounting and tax accounting in terms of composition, procedure for recognition, distribution and write-off of expenses.

Then in December the entire amount of OHR in tax accounting is included as part of indirect expenses to reduce profits. If we assume that in December there were no sales for all types of musical instruments, then at the end of December in the accounting records the entire amount of OMR (800,000 rubles) turned out to be distributed either to work in progress or to finished products in the warehouse.

It turns out that in December expenses in tax accounting exceed expenses in accounting (or accounting profit exceeds tax profit) by the amount of the December OHR, i.e. for 800,000 rubles. In this regard, it is necessary to reflect in accounting the taxable temporary difference and the corresponding deferred tax liability (DTL) (clauses 12, 15, 18 of PBU 18/02). In this case, at the end of December the posting is made:

Debit 68 – Credit 77

– 192,000 rub. (RUB 800,000 x 24%) – IT is reflected.

We are implementing the “unfinished work”

Sales of goods on the territory of the Russian Federation are recognized as subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). For tax purposes, a good is any property that is sold or intended for sale (Clause 3, Article 38 of the Tax Code of the Russian Federation).

In the Tax Code of the Russian Federation, property refers to types of objects of civil rights (with the exception of property rights) related to property in accordance with the Civil Code of the Russian Federation (clause 2 of Article 38 of the Tax Code of the Russian Federation).

According to Art. 128 of the Civil Code of the Russian Federation, property is understood primarily as things. In legal practice, things are understood as objects of the material world that are in a solid, liquid, gaseous or other physical state.

Thus, material objects, referred to as work in progress in accounting, are recognized as property and, if sold, are subject to VAT.

The question arises: if the work in progress is sold, then is it necessary to take into account the distributed (in accounting - indirect) expenses of the current month in its cost?

This is not an idle question. Traditionally, the distribution of costs from accounts 25 and 26 to account 20 is made by the final transactions of the month. After all, only at the end of the month is the distribution base determined (in our example, the wages of the main workers). And if you make a distribution, say, in the middle of the month, then what base should you use? In principle, an organization can come up with a method for such “premature” distribution for the purposes of both accounting and tax accounting and record this method in orders on UBP and UNP. It can also provide for the unnecessaryness of such a distribution.

In our opinion, if an organization has not specifically provided for in its accounting policies for accounting and tax purposes the need and method of such “premature” distribution, then it is not necessary. We also note that such a distribution is very difficult to implement in practice and will greatly complicate further accounting and tax accounting of work in progress.

Example (continued).

On January 10, it became known that the supplier who was supposed to supply Krug LLC with beech blanks for making guitar necks was liquidated by court decision. The LLC does not anticipate any other beech suppliers in the near future. Guitar production stopped on January 10th. A wholesale buyer of guitars, having learned about the current situation, offered to buy part of the unfinished batch (guitar decks without necks, pegs and frets).

Let's assume that at the time of production stop there were 500 unfinished guitars in the batch, and on January 17 the buyer bought 300 guitars at a price of 4,720 rubles, including VAT - 720 rubles. Until the stop of guitar production, materials worth 80,000 rubles were supplied for its needs in January, and wages in the amount of 200,000 rubles were paid to workers directly manufacturing guitars. Unified social tax and insurance contributions related to this salary amounted to 52,000 rubles.

The accounting policy for accounting and taxation purposes stipulates that the distribution of distributable expenses (alternative in accounting - OPR and OHR, in tax accounting - only OPR) is carried out not as these expenses arise, but at the end of the month. Taking into account the above, the amount of work in progress for a batch of guitars at the time of production stop is:

1,552,000* + 80,000 + 200,000 + 52,000 = 1,884,000 rub.

Therefore, the cost of one unfinished guitar is:

RUB 1,884,000 : 500 pcs. = 3768 rub.

At the beginning of January, the accounting department of Krug LLC made, in particular, the following entries:

Debit 20/2 – Credit 10

– 80,000 rub. – materials were released for the production of guitars;

Debit 20/2 – Credit 70

– 200,000 rub. – employees involved in the production of guitars are paid wages;

Debit 20/2 – Credit 69

– 52,000 rub. – unified social tax and insurance premiums have been accrued;

Debit 62 – Credit 90/1

– 1,416,000 rub. (RUB 4,720 x 300 pcs.) – revenue from the sale of 300 unfinished guitars, including VAT, is reflected;

Debit 90/3 – Credit 68

– 216,000 rub. (RUB 720 x 300 pcs.) – VAT added;

Debit 90/2 – Credit 20/2

– 1,130,400 rub. (RUB 3,768 x 300 pcs.) – the cost of the realized “underproduction” was written off as expenses from ordinary activities.

Since the equipment in tax accounting was written off in December, then in January the cost of sold work in progress in tax accounting is less than in accounting. To calculate the difference between these amounts, you need to multiply the amount of OCR allocated to the production of guitars by the ratio of the number of sold unfinished guitars to the total quantity in the unfinished batch:

80,000 rub. (see the beginning of the example) x 300 pcs. : 500 pcs. = 48,000 rub.

Consequently, an entry should be made in accounting for the partial write-off of the IT accrued at the end of December:

Debit 77 – Credit 68

– 11,520 rub. (RUB 48,000 x 24%.) – IT has been written off.

Results

The following can be said about work in progress in accounting: these are material costs that have already gone into production, but have not yet gone through all stages of the production process, and therefore cannot be considered finished products. The value of work in progress balances can be assessed using one of several methods, which must be enshrined in the accounting policies of the enterprise.

Sources:

- Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n “On approval of the Federal Accounting Standard FSBU 5/2019 “Inventories”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.