Subordinate to the “Goods shipped” account (45).

Account type: Active.

Account type:

- Quantitative

- Tax

Analytics for account “45.01”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Counterparties | No | Yes | No |

| Nomenclature | No | Yes | No |

| Parties | No | Yes | No |

Definition of finished products and goods

Upon completion of the production process, the company obtains a finished product from the raw materials used. This product is fully stocked, transferred to the warehouse and is ready for sale.

Finished products should be perceived as part of the inventory that will subsequently be sold and meet the required technical parameters and quality standards.

Goods that were received or purchased from business entities or citizens for subsequent sale can also be perceived as part of production inventories.

If we consider the flow diagram of the finished product, it consists of the following stages:

- receipt of a batch of product at the warehouse;

- shipment of the finished batch to consumers.

When maintaining accounting records, a unit of a finished product is determined by the company in such a way that the company's management can obtain adequate information about the status of these inventories, as well as ensure adequate control over their movement and balances. Finished products enter the warehouse from the production workshop under the responsibility of the material person.

Inventories. Line 1210

This line of the Balance Sheet reflects information about the organization’s reserves, namely (clause 20 of PBU 4/99):

— about raw materials, supplies and other similar valuables;

— costs in work in progress;

— finished products;

— goods for resale and goods shipped;

— expenses of future periods.

At what cost are inventories recorded?

- Raw materials, materials and other similar values are taken into account at actual cost, which is determined in the manner established by clauses 6 - 11, 13 PBU 5/01, clauses 16, 17, 63 - 71 of the Accounting Guidelines inventories (clause 5 of PBU 5/01, clauses 15, 62 of the Guidelines for the accounting of inventories, clause 11 of the Guidelines for the accounting of special tools, special devices, special equipment and special clothing) .

The specified material assets, accounted for in separate subaccounts of account 10 “Materials,” can be listed on this account at actual cost or at accounting prices. In the latter case, the difference between the cost of these assets at accounting prices and their actual cost of acquisition (procurement) is reflected in account 16 “Deviation in the cost of materials” (clauses 80, 83, 85 of the Guidelines for accounting of inventories, p. 13 Guidelines for accounting of special tools, special devices, special equipment and special clothing, Instructions for using the Chart of Accounts).

If the receipt of materials is reflected using account 15 “Procurement and acquisition of material assets”, the balance of account 15 shows the availability of goods in transit at the end of the month (at the agreed value) (Instructions for using the Chart of Accounts, clause 26 of PBU 5/01, clause 85 of the Guidelines for accounting of inventories).

Attention!

Since raw materials, materials and other assets used to create non-current assets of the organization do not meet the characteristics of inventories given in paragraph 2 of PBU 5/01 (are not used as raw materials and supplies in the production of products intended for sale (when performing works, provision of services), are not intended for sale, are not used for the management needs of the organization), they cannot be recognized as part of inventories and reflected in the Balance Sheet on line 1210 “Inventories”. Such assets are reflected in the Balance Sheet as part of non-current assets (Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

- Finished products are accepted for accounting at the actual production cost, which is determined in the manner established by clause 7 of PBU 5/01, para. 5 clause 16, clause 203 of the Guidelines for accounting of inventories. At the same time, the balances of finished products in the warehouse (other storage places) at the end (beginning) of the reporting period can be assessed in the analytical and synthetic accounting of the organization at accounting prices, in particular at standard (planned) cost (clause 5 of PBU 5/01, para. 2 clause 203, clause 204 of the Guidelines for accounting of inventories).

Information about the availability and movement of finished products is reflected in account 43 “Finished products”.

If accounting for finished products is carried out at accounting prices, then the difference between the actual cost and the cost of finished products at accounting prices is reflected in account 43 in a separate subaccount “Deviations of the actual cost of finished products from the accounting cost” (clause 206 of the Guidelines for accounting of material and production stocks).

When accounting for finished products at standard (planned) cost, account 40 “Output of products (works, services)” (Instructions for using the Chart of Accounts) can be used to identify the difference between the actual cost and the cost of finished products at standard cost. Account 40 is closed monthly to account 90 “Sales” and has no balance at the reporting date.

Thus, if deviations from the accounting value of finished products are accounted for on account 43, then in the Balance Sheet finished products are reflected at actual cost, and if on account 40, then finished products are reflected at standard (planned) cost (clause 59 of the Regulations on maintaining accounting and financial statements, clause 24 PBU 5/01).

Attention!

If, on the reporting date, an organization has entered into an agreement for the sale of finished products at a price below its cost, then a reserve is created to reduce the cost of these finished products (clause 25 of PBU 5/01, Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/ 01).

- Goods are accepted for accounting at actual cost, which is determined in the manner established by clauses 6, 8 - 11 of PBU 5/01 (clause 5 of PBU 5/01). Organizations engaged in trading activities can account for goods at the cost of their acquisition. Organizations engaged in retail trade can account for goods at their sales price (clause 13 of PBU 5/01, clause 60 of the Regulations on Accounting and Financial Reporting).

Account 41 “Goods” is intended to summarize information about the availability and movement of goods.

In organizations engaged in retail trade and keeping records of goods at sales prices, information about trade margins (discounts, markups) on goods is reflected in account 42 “Trade margin”.

The receipt of goods and containers can be reflected using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets” or without their use in a manner similar to the procedure for accounting for relevant transactions with materials (Instructions for using the Chart of Accounts).

In general, the actual cost of inventories (including raw materials, materials, finished products and goods) is not subject to change (clause 12 of PBU 5/01). But for inventories, the market price of which has decreased or they have become obsolete or have completely or partially lost their original qualities, a reserve is accrued in accounting for a decrease in the value of material assets . To account for such a reserve, account 14 “Reserves for reducing the value of material assets” is intended (clause 25 of PBU 5/01, clause 20 of the Methodological Guidelines for Accounting for Inventories, Instructions for the Application of the Chart of Accounts). Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

- Goods shipped are accounted for in account 45 “Goods shipped” at a cost consisting of the actual production cost (or standard (planned) cost) and costs of selling (selling) products (goods, work, services, etc.) (with partial write-off expenses) (Instructions for the use of the Chart of Accounts, clause 61 of the Regulations on accounting and financial reporting).

Attention!

A reserve for a decrease in the value of goods listed as shipped goods on the reporting date is not created (Letters of the Ministry of Finance of Russia dated January 29, 2008 N 07-05-06/18, dated January 29, 2009 N 07-02-18/01). An exception is the situation when an agreement has been concluded for the sale of goods at a price below the book value of these goods. In this case, the organization creates a reserve for reducing the value of material assets for the difference between the book value and the selling price of goods (clause 25 of PBU 5/01, Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01, Explanation 11- 05 “Reserve for inventories under concluded contracts” (Committee on Interpretations. 02.25.2011)).

Attention!

The property transferred to the buyer is removed from the organization’s fixed assets (clause 29 of PBU 6/01). If the moment of writing off the accounting records of a real estate object, the ownership rights to which are subject to state registration, does not coincide with the moment of recognition of income and expenses from the disposal of an object of fixed assets, then the residual value of the disposed object of fixed assets can be taken into account on account 45 “Goods shipped”, and in the balance sheet is reflected as part of current assets (Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

In our opinion, as alternative options for accounting for the cost of retiring real estate, account 97 “Fixed assets” and the subaccount “Retirement of fixed assets” to account 01 “Fixed assets” can be used. In this case, regardless of the chosen accounting option, the cost of such objects is shown in the Balance Sheet on line 1210.

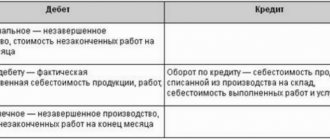

- Work in progress (WIP) is taken into account in the assessment determined by one of the methods established by clause 64 of the Regulations on accounting and financial reporting.

To reduce the value of work in progress, a reserve can be created, which is accounted for in account 14 “Reserves for reducing the value of material assets” (Instructions for using the Chart of Accounts). Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

- Animals for growing and fattening are accounted for on account 11 “Animals for growing and fattening” (on the corresponding sub-accounts). Animals purchased from other organizations and persons are accounted for at the actual cost of acquisition (actual costs) or accounting prices; transferred from the main herd - at residual value or initial (replacement) cost; offspring, weight gain and growth of animals - at the planned cost with adjustment at the end of the year to the actual cost of rearing (clauses 9, 10, 12, 13, 14 of the Methodological Recommendations for the accounting of animals for growing and fattening, Instructions for using the Chart of Accounts) .

The acquisition of animals from other organizations and persons can be reflected using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviations in the cost of material assets” (when using accounting prices) (paragraph 2 of clause 45 of the Methodological Recommendations for the Accounting of Farmed Animals and fattening, Methodological recommendations for the use of the Chart of Accounts of organizations of the agro-industrial complex, Instructions for the use of the Chart of Accounts, Methodological recommendations for the correspondence of accounts of agricultural organizations). Animals for growing and fattening, owned by the organization, but in transit, are taken into account in accounting in the assessment provided for in the contract, with subsequent clarification of the actual cost (clause 62 of the Methodological Recommendations for Accounting for Animals for Growing and Fattening).

- Expenses associated with the sale of products, goods, works, services, as well as expenses associated with the procurement of agricultural raw materials, livestock and poultry (if the organization’s accounting policy provides for their partial write-off from account 44 “Sales expenses”) are subject to distribution as follows (Instructions for the use of the Chart of Accounts, Guidelines for the use of the Chart of Accounts of enterprises and organizations of the agro-industrial complex, paragraph 2 of clause 228 of the Guidelines for the accounting of inventories):

1) in organizations engaged in industrial and other production activities - packaging and transportation costs (between individual types of shipped products on a monthly basis, based on their weight, volume, production cost or other relevant indicators);

2) in organizations engaged in trading and other intermediary activities - transportation costs (between the goods sold and the balance of goods at the end of each month);

3) in organizations that procure and process agricultural products - expenses for the procurement of agricultural raw materials and expenses for the procurement of livestock and poultry.

- Expenses of future periods are taken into account in the amount of actual expenses incurred minus their part attributed to expenses of expired periods (clause 65 of the Regulations on accounting and financial reporting, paragraph 2, paragraph 39 of PBU 14/2007, paragraph 16 of PBU 2/2008 , Letter of the Ministry of Finance of Russia dated January 12, 2012 N 07-02-06/5, Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

3.1.2.1.2. What accounting data is used?

when filling out line 1210 “Inventories”

This line of the Balance Sheet indicates the cost of inventories, determined based on the methods used by the organization to evaluate inventories, minus the created reserve for reducing their value (clauses 58, 59, 61, 62, 64, 65 of the Regulations on Accounting and Financial Reporting , pp. 24, 25 PBU 5/01, pp. 60, 61 Methodological recommendations for accounting of animals for growing and fattening, pp. 20, 35 PBU 4/99).

Line 1210 “Inventories” = Debit balance on account 10 + Debit balance on account 11 + Debit balance on account 41 - Credit balance on account 42 + Debit balance on account 43 + Debit balance on account 15 +/- Balance on account 16 - Credit balance on account 14 + Debit balance on account 45 + Debit balance on accounts 20,21,23,28,29 + Debit balance on account 97 (analytical expense account with a write-off period not exceeding 12 months + Debit balance on account 44)

Organizations independently determine the detail of the indicator on line 1210 “Inventories”. For example, the Balance Sheet may contain separate information on the cost of materials, finished products and goods, costs in work in progress, if such information is recognized by the organization as significant (paragraph 2 of clause 11 of PBU 4/99, clause 3 of Order of the Ministry of Finance of Russia N 66n).

The indicators in line 1210 “Inventories” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year.

The “Explanations” column provides an indication of the disclosure of the indicator in line 1210 “Inventories”. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1210 “Inventories” tables 4.1 and 4.2 are indicated .

Example of filling out line 1210 “Inventories”

Indicators for accounts 10, 14, 20, 23, 41, 43, 97 in accounting as of December 31, 2014 (indicators for accounts 15 and 16, 21, 28, 29, 42, 44, 45 in accounting for this date absent): rub.

| Index | As of the reporting date (December 31, 2014) |

| 1 | 2 |

| 1. By debit of account 10 | 2 469 600 |

| 2. On the credit of account 14 (in terms of reserves for reduction in the cost of materials) | 48 000 |

| 3. On the debit of account 20 | 4 000 000 |

| 4. By debit of account 23 | 54 200 |

| 5. By debit of account 41 | 5 160 000 |

| 6. By debit of account 43 | 3 030 000 |

| 7. By debit of account 97 | 38 000 |

Fragment of the Balance Sheet for 2013

| Explanations | Indicator name | Code | As of December 31, 2013 | As of December 31, 2012 | As of December 31, 2011 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| II. CURRENT ASSETS | |||||

| 4.1, 4.2 | Reserves | 1210 | 22 437 | 18 632 | 15 487 |

| including: | |||||

| raw materials and supplies | 1211 | 8622 | 6480 | 7600 | |

| costs in work in progress | 1212 | 9634 | 8200 | 4372 | |

| finished products and goods for resale | 1213 | 4120 | 3862 | 3415 |

Solution

The cost of the organization's inventory is:

as of December 31, 2014 - RUB 14,704 thousand. (RUB 2,469,600 - RUB 48,000 + RUB 4,000,000 + RUB 54,200 + RUB 5,160,000 + RUB 3,030,000 + RUB 38,000);

as of December 31, 2013 - RUB 22,437 thousand;

as of December 31, 2012 - RUB 18,632 thousand.

Including:

the cost of materials for the organization is:

as of December 31, 2014 - RUB 2,422 thousand. (RUB 2,469,600 - RUB 48,000);

as of December 31, 2013 - 8622 thousand rubles;

as of December 31, 2012 - 6,480 thousand rubles;

costs in work in progress are:

as of December 31, 2014 - 4054 thousand rubles. (RUB 4,000,000 + RUB 54,200);

as of December 31, 2013 - 9634 thousand rubles;

as of December 31, 2012 - 8,200 thousand rubles;

The cost of finished products and goods for resale is:

as of December 31, 2014 - 8190 thousand rubles. (RUB 5,160,000 + RUB 3,030,000);

as of December 31, 2013 - 4120 thousand rubles;

as of December 31, 2012 - 3862 thousand rubles.

A fragment of the Balance Sheet in Example 2.1 will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| II. CURRENT ASSETS | |||||

| 4.1, 4.2 | Reserves | 1210 | 14 704 | 22 437 | 18 632 |

| including: | |||||

| raw materials and supplies | 1211 | 2422 | 8622 | 6480 | |

| costs in work in progress | 1212 | 4054 | 9634 | 8200 | |

| finished products and goods for resale | 1213 | 8190 | 4120 | 3862 |

Goods shipped are...

This definition should be understood as those inventories, the proceeds from the sale of which cannot be recorded in the appropriate accounting records.

If we talk about Form No. 1 of financial statements, then the price of finished products shipped to customers is recorded on line 080 of the balance sheet. In this line, the accountant enters the debit balance of account 45 at the end of each reporting period.

In general, property rights to certain inventories are transferred to the customer after their delivery last. However, there are some exceptions to this general rule:

- in the case of transfer of goods in accordance with an exchange agreement (in this case, the buyer acquires property rights only after the counter shipment has been made;

- if the goods are transferred under a purchase and sale agreement, which provides for a special procedure for transferring ownership. According to such documents, the person purchasing the goods receives ownership of it only after certain conditions are met, for example, payment of its cost or delivery to the designated point;

- in case of transfer to an intermediary for further sale. In this case, we are talking about a commission, commission or agency agreement.

Account 45 in accounting

Products and inventory items that have already been transferred to sellers for direct sale or shipped to buyers, as well as transferred for export abroad, but for which the recipient has not yet paid, should be accounted for in a separate account.

In this article we will tell you how to properly organize accounting. ConsultantPlus FREE for 3 days

Get access

The debit of this account should reflect the cost of products sent for sale or shipped to purchasing clients, but for which payment has not yet been received. In addition to the cost price, special account 45 accumulates the costs of transporting these products.

When transferring inventory items, account. 45 is debited while simultaneously crediting accounts 41 or 43. Such an accounting transaction must be confirmed by appropriate documentation: invoices, acts of acceptance and transfer of valuables. In the recipient's accounting, such inventory items are taken into account off the balance sheet, until all the terms of the contract are fully fulfilled.

We note that in accordance with current recommendations and Order of the Ministry of Finance No. 94n, the company has the right to use the account. 45 in the following cases:

- When concluding a commission agreement.

- During the transfer, shipment of valuables before the transfer of ownership.

- When taking into account value added tax.

Account characteristics

As we noted above, an increase in cost indicators for goods shipped, account 45 is debited, therefore, this is an active accounting account. To organize complete and reliable accounting, the opening of special sub-accounts is provided:

- Subaccount 45-01 is intended to account for the cost of shipped inventory items, for which revenue is received after a certain period of time. This subaccount 45 is mainly used when exporting products.

- Subaccount 45-02 reflects the cost of containers and packaging for shipped goods and materials, the proceeds from which cannot be reflected in accounting at the time of shipment.

- Subaccount 45-03 generates information about the costs of delivery and transportation of material assets, which the buyer, client, or recipient must pay.

- Subaccount 45-04 shows the company’s costs for insurance of shipped goods and inventory items, which are paid to a third party.

- Subaccount 45-05 is suitable for forming the cost of inventory items, which are transferred to selling companies under commission agreements. When the transferred product is sold, its value goes into the debit of accounting account 90 “Sales”. Write-off is carried out at the moment of receipt of payment and recognition of revenue.

For large-scale production and sales volumes, it is recommended to strengthen analytical accounting. In other words, organize the detailing in a section:

- types of goods shipped;

- separately for each counterparty;

- by type of contract.

Typical accounting entries

Let's consider the features of compiling accounting records subject to the conclusion of a commission agreement.

Vesna LLC entered into a commission agreement with Zima LLC for the sale of inventory and materials in the amount of 500,000 rubles. The final sales price is 826,000 rubles, including VAT of 126,000 rubles. According to the terms of the commission agreement, the remuneration amount is 20%. The accountant of Vesna LLC compiled the following entries:

| Operation | Debit | Credit | Amount, rub. |

| Inventory assets have been transferred for sale. | 45 | 41 | 500 000 |

| VAT charged | 76 | 68 | 126 000 |

| Revenue from the sale of inventory items transferred to the commission is reflected in accounting | 62 | 90-01 | 826 000 |

| The debt of the recipient of goods and materials is reflected | 76 | 62 | 826 000 |

| VAT charged on goods sold | 90-3 | 68 | 126 000 |

| VAT is accepted for deduction | 68 | 76 | 126 000 |

| The cost of valuables sold through the seller has been written off | 90-02 | 45 | 500 000 |

| Remuneration accrued to the seller | 44 | 76 | 165 200(826 000 × 20 %) |

| Payment received from the seller company | 51 | 76 | 660 800(826 000 – 165 200) |

Source: https://ppt.ru/info/plan-schetov/45

Sale of shipped goods

The reflection of transactions for the sale of the shipped lot will depend on the conditions reflected in the contract, including such points as:

- how the goods are transferred to the buyer, i.e. is there an intermediary or is the work carried out directly;

- at what stage the ownership of the goods passes to the buyer, for example, at the time of shipment or after the transfer of funds as payment for the products received.

Let us assume that the contract concluded with the buyer includes special conditions for the transfer of ownership and disposal of purchased products. The terms of such an agreement should also provide for the risk of accidental damage to the goods received after receiving payment for them.

Necessity and significance of position 45

45 account is necessary in order to summarize data on available shipped products and their movement, the proceeds from the sale of which cannot be recognized at this stage. For this item, companies also keep records of finished products transferred to the commission for subsequent sale.

The specified account is active. Accounting reflects the cost of the shipped consignment based on its actual cost and the cost of shipping the goods.

Account 45 is debited in correspondence with positions 41 and 43.