What are the costs from an accounting point of view?

If you focus on Art. 318 and 319 of the Tax Code of the Russian Federation, the law divides all expenses into two types. Moreover, it is legally correct to call expenses “costs.”

Indirect costs

This is money that cannot be directly counted in the cost of a specific product; it forms the cost of several products at once. But without these expenses, the business will not be able to produce the product. Typically, this category includes payments for rent and housing and communal services, expenses for marketing, advertising, secretariat, and accounting.

Direct costs

These are the costs that form the cost of a particular product. For example, this includes raw materials, semi-finished products, components and other production supplies. Direct costs also include wages and social benefits that are directly involved in production, and depreciation of equipment.

Direct costs also include payment for work performed by contractors - if they directly affect the cost of the product. So, if you order packaging for products, then these are direct costs. If a contractor is involved in servicing computers and repairing other equipment in your office, then these are rather indirect costs, because they affect the entire process as a whole.

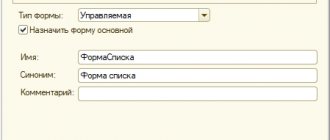

Convenient service for dividing expenses into direct and indirect

Try it

You yourself must determine which expenses are classified as direct and which as indirect. If in your accounting policy you did not classify costs as direct, then they will be classified as indirect.

Non-operating expenses

There is a third type of costs - non-operating costs. They do not form the cost of production, either for a specific product or as a whole, and generally have no direct connection with production and sales.

For example, non-operating expenses are usually called the costs of servicing a loan, expenses for legal fees, and penalties. A detailed list is contained in Art. 265 Tax Code of the Russian Federation.

How to take into account expenses when changing accounting policies?

This question may arise if:

- the expenses collected on account 25 are then decided to be considered indirect rather than direct;

- expenses for services are intended to be written off without leaving them in the work in progress.

These changes can be applied only to costs generated already during the period of validity of the new provisions of the accounting policy. WIP created before the introduction of the new accounting policy will have to be written off according to the old rules (letters of the Ministry of Finance of the Russian Federation dated September 15, 2010 No. 03-03-06/1/588 and May 20, 2010 No. 03-03-06/1/336).

Read about the basic principles of drawing up accounting policies in the material “How to draw up an organization’s accounting policies (2020)?”

Other types of costs for financial accounting

For financial accounting, expenses are divided into two more types.

- Constant - they are not directly related to the volume of production. If output is increased or decreased, fixed costs will not change. For example, an accountant’s salary will not change if you start producing not 100, but 200 cakes per month. So it's a constant waste.

- Variables - depend on the quantity of products produced or sold and change proportionally. For example, if you increase the production of cakes from 100 to 200 per month, then the amount of spending on sugar also increases.

Cost types can be combined. Typically, direct costs affect the cost price, so they are classified as variables. For example, the cost of semi-finished products: the more we produce, the more we spend, so this is a direct variable category.

There are exceptions - for example, advertising costs are not directly reflected in the cost of production and are indirect costs. But with the help of web analytics, we can calculate how much advertising money is needed to sell one unit of product - for example, using retargeting. If we want to sell more, we will have to increase the budget. Therefore, it is an indirect variable expense.

Check where the money is going so you can make the right management decisions

Fixed and variable costs are usually used for financial accounting and business planning - these are conventional concepts; the law does not regulate or oblige you to track them. Direct and indirect are needed for accounting; they are based on other criteria. If you determine income and expenses on an accrual basis, then they need to be tracked and determined, this is a legal requirement.

Who should handle the cost sharing?

According to Art. 318 of the Tax Code of the Russian Federation, all legal entities on OSNO that operate on the accrual basis must divide costs into direct and indirect. Indirect costs are distributed across all types of products. To do this, choose a base, which can be variable costs.

In accounting and tax accounting, the accrual method is understood as a method where income is taken into account at the time of documentary confirmation of the transaction. There is also the cash method - income is taken into account at the moment the money is received at the cash desk. The cash method is usually used by organizations using the simplified tax system, as it is simpler and helps to avoid cash gaps.

If you are on OSNO and the average revenue excluding VAT in each of the previous four quarters is no more than 1 million rubles, you have the right to keep tax records using the cash method. Exceptions are specified in Art. 273 of the Tax Code of the Russian Federation: despite compliance with the revenue requirement, the cash method cannot be used by banks, consumer credit cooperatives and microfinance organizations, companies extracting carbon raw materials and companies owned by foreign organizations.

How to account for expenses in the absence of revenue

In the absence of sales, direct expenses remain in the work in progress, and indirect ones are taken into account in the financial result, forming a loss for the current period (letter of the Ministry of Finance of the Russian Federation dated March 6, 2008 No. 03-03-06/1/153).

The consequences of a loss are described in the article “What are the consequences of reflecting a loss in the income tax return?” .

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to maintain direct and indirect costs in tax accounting

In accounting, the division into indirect and direct costs is important for the formation of cost. Do not forget that indirect costs cannot be attributed directly to the cost of one product. Instead, choose a reasonable allocation basis and add a note to that effect in your accounting policy.

In tax accounting, costs are also divided into indirect and direct, but for different purposes - they affect the reduction of the tax base. It is important to consider at what point specific costs affect the cost of production.

- Indirect expenses reduce the tax base in the same reporting period in which they arise.

- Direct expenses are charged to the current tax period only after you have sold the products to which they were charged. No implementation - no reduction. For example, if a product is in a warehouse, then the direct costs of its production are not deducted from income.

Please note: the amount of taxable profit will decrease if the organization's indirect costs exceed direct ones, and costs will be taken into account earlier. Therefore, you need to carefully monitor the rationale for your decisions: if you underestimate direct expenses or incorrectly account for them, the tax office may perceive this as a way to evade taxes.

As Art. 318 of the Tax Code of the Russian Federation requires expenses to be divided into direct and indirect?

The issue of dividing costs into direct and indirect, which is the main topic of Art. 318 of the Tax Code of the Russian Federation, is very important for determining the tax base for profits. After all, direct costs can be taken into account only if the products to which they relate are sold. Indirect expenses reduce the profit base during the period of their implementation (clause 2 of Article 318 of the Tax Code of the Russian Federation), i.e. immediately. The obligation to separate is provided for by the text of Art. 318 Tax Code of the Russian Federation. The list of direct expenses must be recorded in the accounting policy.

The taxpayer is given the right to independently assign expenses to one or another group. Accordingly, he can make the best choice for himself, guided by the following:

- Justification, including economic validity, for classifying expenses as direct (see, for example, letter of the Ministry of Finance of Russia dated August 30, 2013 No. 03-03-06/1/35755). This list needs to be optimized with an eye to reality, because... The Federal Tax Service will check it first (see “Rent of industrial premises may not be recognized as an indirect expense” ).

- Rational organization of accounting operations.

- The ability to optimally quickly check the difference between accounting and tax accounting data.

- The reasonableness of determining the amount of income tax.

For small production organizations with simple accounting, in which only two cost accounts are involved (20 and 26), the choice is quite simple: what is collected on account 20 are direct expenses, and on account 26 are indirect. Similarly for trading companies: the cost of goods (with TKR) is direct expenses, account 44 is indirect. This approach will bring accounting and tax accounting as close as possible, because in accounting, costs from accounts 26 (using the direct costing method) and 44, just like in tax accounting, can be closed monthly to sales accounting accounts. In this case, accounting will be extremely simple and clear, and income tax will be determined in a fair amount.

Organizations with complex cost accounting (which also use accounts 23 and 25) are tempted to consider in tax accounting the costs collected on account 25 as indirect expenses and write them off regardless of the fact of sales of products. It is not advisable to do this, because... accounting rules do not provide for the possibility of such a write-off of general production (shop) costs. As a result, this approach creates very serious discrepancies between accounting and tax accounting, which makes it extremely difficult to identify errors and explain the difference. It is more logical to consider direct costs the cost of production at the level of shop cost (including the costs collected on account 25). This will allow you to correctly correlate the cost of goods sold and work in progress in accounting and tax accounting and make a fairly simple scheme of accounting operations.

Dividing costs into direct and indirect has many nuances and often leads to disputes with tax authorities. Check whether you are dividing your expenses correctly with the help of advice from ConsultantPlus experts:

If you do not have access to the K+ system, get a trial online access for free.

The gain due to the write-off of everything accumulated on account 25 in the amount of accrued income tax will take place only in the first tax period. Further, the amounts of costs related to it will be quite comparable (but not the same). At the same time, the loss in accounting transparency and analysis capabilities will become irreparable. So, for a complex cost accounting scheme, the following option is desirable: accounts 20, 23, 25 are direct costs, accounts 26 and 44 are indirect. At the same time, in accounting, expenses from account 26 are written off using the direct costing method.

How to write off expenses

To avoid confusion, try to minimize differences in accounting and tax accounting. Reflect and justify all expenses in documents, otherwise you will have to prove your position to the tax inspectorate.

Write off direct expenses in the same period in which you sold the products, even if the buyer has a deferred payment until the next reporting periods. Do not write off expenses for finished products in warehouses. Do not distribute indirect expenses in tax accounting. They are written off at a time, in the same period in which you produced them. At the same time, reduce your taxable income.

To bring accounting data closer together, try to balance the amount of cost in accounting with direct costs in tax accounting.

Do all service costs need to be written off at once?

Article 318 of the Tax Code of the Russian Federation allows for the possibility of writing off direct expenses when providing services by analogy with indirect ones.

See also “When services are provided, direct costs are not allocated to refinery balances .

However, this possibility should be approached with some caution. If the services provided do not require preliminary preparation and, at the junction of tax periods, the occurrence of situations where there are already costs for them, but have not yet been realized, is excluded or extremely rare, then such a write-off of expenses is justified. If it is possible to regularly generate work in progress for services and its amounts can be significant, then in order to avoid significant discrepancies between accounting and tax accounting, it is better to write off the expenses collected in account 20 for services in the usual manner for direct expenses with reference to the fact of sale.

Find out how recent judicial practice is developing on the application of Art. 318 of the Tax Code of the Russian Federation, available from the analytical selection from ConsultantPlus. If you don't have access to the system, get a free trial online.