We will look at what work in progress consists of and how to reflect in 1C 8.3, how accounting for work in progress in 1C is organized and how the inventory of work in progress occurs. An example for us will be the 1C:ERP system, which implements the latest developments of the 1C company in terms of production accounting.

NP in 1C:ERP can consist of:

- Materials sent to production but not yet processed;

- Finished goods/semi-finished products produced but not transferred to the finished goods warehouse;

- Direct costs (for example, wages of employees, depreciation, rental of industrial equipment, etc.) not included in the cost of manufactured products;

- Other costs not included in the cost of production.

Let us note as a conclusion that NP costs are divided into two types:

- Nomenclature costs (materials/semi-finished products);

- Itemized expenses.

Quick transfer of accounting to BukhSoft

At the end of the month in 1C 8.3 Accounting, account 20 is automatically closed to accounts 43, 40, 90. To close the month without errors, you must:

- Set up an accounting policy in 1C 8.3 Accounting to account for production of products and performance of production work and services;

- Configure payroll parameters for employees producing products;

- Correctly indicate item groups and divisions in production documents (invoice requirements, production reports for a shift);

- It is correct to take into account the balance of work in progress in 1C 8.3.

Nomenclature costs in NP

All costs of the first type are included in direct production costs and are taken into account as part of the NP in the context of production divisions. That is, if workshop storerooms were used during production, then detailing the costs to the storerooms will not be a problem.

The key differences between the above types of costs are that the first ones represent a regular item with the Product/Work type, i.e. essentially an object for which not only cost accounting is carried out, but also accounting in natural units (pieces, kilograms, etc.). This allows you to track the movement of inventory items and work in 1C:ERP from the moment of occurrence (receipt, capitalization, release) until transfer to the production stage, as well as analyze the composition of the RP not only in terms of the items themselves, but also their quantities.

Inventory of NP in terms of item costs is implemented through “Distribution of materials and work” (monitor or workplace/RM).

Fig.1 Workplace for distributing materials/works

The values entered in the columns can be viewed as a primary value using the “Decipher” button.

In addition to analyzing materials/semi-finished products/works as part of the NP, from here it is also possible to close work in progress in 1C:

- Perform cost redistribution/production cost;

- Return the item from the NP to the warehouse;

- Allocate costs/expenses not related to the production unit.

Based on the results of the work, you can also print out an inventory report from here in the context of organizations and workshop storerooms in which goods and materials and work are listed.

Additionally, the system contains the report “Movement of Inventory and Materials and Costs in Production”, which can be called without opening a workspace from the summary list of production reports.

Fig. 2 Example of a report on deciphering the movement of inventory items in an NP

Free expert consultation

Pavel Aleksanyan

Project manager

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

Production accounting in 1C – 1C:ERP program settings

Setting up in 1C 8 - accounting in production

To configure the parameters of the “Production” subsystem in the “Master data and administration” section there is a section of the same name - “Production”.

System settings allow you to determine the model used.

Production accounting in the 1C program makes it possible to apply the following techniques:

- Without planning the production schedule - the schedule is not applied, production stages are carried out by departments according to the queue. Dates for the start of the production cycle and its completion are not set.

- Planning based on material resources - the production schedule is calculated based on material support, taking into account needs, and deadlines are assigned for production stages, without taking into account the availability of production capacity.

- Planning for material and production resources - when calculating the production schedule, not only material support is taken into account, but also the production capacity of the enterprise and the accessibility of work centers.

1C ERP “Production Accounting” contains the following blocks of information:

- Regulatory reference information describing the production capacity and structure of the enterprise - “Structure of the enterprise”, “Types of workers.

- Regulatory reference information describing production technology - “Nomenclature”, “Resource Specifications”, “Routing Maps”.

Enterprise structure - production divisions

In the section “Master data and administration” - “Enterprise structure”, the user creates a structure and sets the parameters of production departments.

To keep track of product production in 1C, each department has its own settings.

By clicking “Edit”, the user sets the settings for each structural unit.

“Unit Type” settings —define the role of the unit in the production process:

- “Dispatcher unit” is a unit responsible for fulfilling production orders. There may be several such divisions, and the dispatching division may also produce products. When creating orders for production, it is the dispatcher unit that is indicated, and not the production workshop, as the responsible unit.

Manufactures products:

- “By orders for production” - methods of planning and monitoring the provision of production are used. Such a department carries out the stages of the production process schedule.

- “No production orders” - does not use planning and control mechanisms, does not apply production orders, and does not adhere to production stages. The production process is not planned and product release is reflected in fact.

For each department you can set your own work schedule:

- according to the production calendar;

- according to an individual schedule;

- changeable schedules.

When using the “Production by orders” option, the following settings are made on the tab of the same name:

- Specify the planning interval (hour, day, week, month). This setting is used when planning the production schedule.

- The use of production sites is an additional detail of production capacity. The program identifies types of work centers, work centers, and additionally creates a classification by production areas.

- Setting up operational management of production stages.

The “Employee Work Accounting” tab allows you to configure who is indicated as the performer of the work:

- a specific employee;

- team of workers.

When a team performs work, earnings are distributed among its employees. In this case, the KTU (labor participation rate), hours worked and the employee’s tariff rate are taken into account.

Nomenclature groups in production documents

Particular attention should be paid to the item groups that you indicate for the debit and credit of account 20. Because if they do not match, then at the end of the period there will be a balance on account 20.

Let's give a conditional example. Typically, materials are transferred to production using the “Requirement-invoice” document in the “Production” section.

So in this document, in addition to the name and quantity of raw materials, the cost account, the department to which the material is transferred and the nomenclature group are indicated.

And it is very important to indicate the same product group when releasing finished products in the document “Production Report for a Shift” in the “Production” section.

If you have many item groups, then a situation may arise that you transferred materials to the production of goods with the item group “Shoes”, but in the end produced goods under the item group “Shoes”. And for the program these are different groups. Accordingly, in this case, the cost of finished products will be incorrectly calculated and account 20 will remain open.

Another nuance is the composition of nomenclature groups.

There are often situations where the same type of product is listed in different product groups. For example, the product “Shoes” is used in the product groups “Men’s Footwear” and “Women’s Footwear”. In this case, the program does not know what to attribute certain costs to and therefore does not do this at all or displays an error when closing the month.

Author of the article: Vera Aleksandrovna Pikuren

She has been working at the Razdolye Exhibition Center since 2005. Currently – Project Manager. She started with the implementation of the 1C:UPP configuration, and since 2015 she has been implementing 1C:ERP. During this time, I successfully launched 6 factories on 1C:ERP. The last project (JSC NPO LEMZ) became the winner of the Corporate Automation Competition “1C: Project of the Year” in the category “Best Project of the Year in the subject area Accounting and Tax Accounting” (

Link

).

The article complements the online course “Practical aspects of implementing regulated accounting and cost calculation in 1C:ERP at large industrial enterprises” - //infostart.ru/public/1216732/

I wrote this article due to the fact that both in our projects and in the projects that we see in the 1C:ERP implementation market, I often encounter issues with the correct entry of initial balances, especially in difficult situations. Currently, I have released a lot of methodological materials on entering initial balances, including a rather convenient table with summary information on which document should be used to enter this or that type of opening balance:

https://its.1c.ru/db/erp24doc#bookmark:remnanttypes:RemnantTypes.

However, some sections of accounting contain a number of nuances that not all consultants know.

In this regard, we have prepared a series of articles on entering balances, where we will analyze them in more detail.

I will consider examples based on the 1C:ERP 2.4.10.93 configuration.

Let's start with the most difficult block - work in progress.

Here is what is written in the table on the ITS:

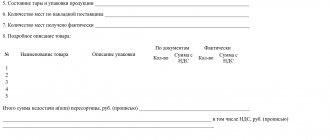

| Account number | Account name | Documents for entering balances | More details |

| 20 | Primary production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 23 | Auxiliary production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 25 | General production expenses | Documents for entering initial balances ( Other expenses ) | Balances of unallocated itemized expenses |

| 26 | General running costs | Documents for entering initial balances ( Other expenses ) | Balances of unallocated itemized expenses |

| 28 | Defects in production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 29 | Service industries and farms | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

In fact, the technology for entering initial balances will depend on two things: what exactly the client can give you from the old system and what scheme for working with the cost block is chosen for the current project.

The first question is the key one. It is often left at the start of the project development project, but in fact, the issue of residuals should be worked out by consultants at the very initial stage of the project (functional modeling, conceptual design, etc., it is called differently in different companies).

Let's start with material costs, namely, leftovers in the pantries. It is very rare that someone has them in the required 1C:ERP form: name of materials, their quantity and cost. Usually this is still a kind of “cauldron” with some options for maintaining additional records by masters in Excel.

The ideal option for the project is if the customer agrees to conduct an inventory of work in progress and collects the necessary data. But this decision is a big risk for the project, which consultants must, for their part, very carefully plan and monitor. What I mean: production inventory is a complex and slow process. No one will stop the plant just so that our program can be launched easily. A good inventory takes several weeks (and sometimes months), and is usually carried out by workshop: some workshop is stopped for several days and recalculated. You, as IT specialists, need to literally take the production manager by the hand and together with him, step by step, discuss the procedure for each workshop and its deadlines. Convey to him that it will be necessary not only to evaluate work in progress based on the percentage of orders completed, but to recalculate materials and semi-finished products in the workshops.

The peculiarity of the WIP inventory is that usually the members of the commission cannot always independently determine what exactly lies in front of them in the workshop. This is not a warehouse; there are usually no packages with names. Thus, first, the production workers themselves recalculate the work in progress, write labels with the article number, name and quantity on the materials and semi-finished products, which also takes some time. Then the commission members walk around the workshop, collecting these labels, selectively counting the parts. And then this information will still need to be manually entered directly into the program or into Excel for downloading.

I describe the process only to make clear its complexity and, as a consequence, duration. It’s impossible to cover the entire plant at once, so for some workshops you will have balances, for example, on December 20th, and for some – on January 15th. And, accordingly, you, as consultants, will need to come up with a work plan in ERP taking into account such deviations.

And you need to understand that in the end, at the output you will only receive the quantity of the item, according to which you will also need to determine the cost. And this cost will have to coincide with the balances according to regulated accounting that the accountants will give you. You and your economists or accountants need to come up with a scheme to “spread” the amount received from outside over the calculated quantity. At the same time, we should not forget that the amount will most likely be different for accounting and tax accounting, which must be taken into account in the distribution rules. And then, in March, when the accounting department closes the year, you will need to do this exercise again, with the adjusted amount.

Any scheme, be it “distribute according to the planned cost” or “distribute according to the price of the last purchase” will be based on certain assumptions that can lead to distortions in cost when you start writing off inventory items from the workshop storerooms into production. Thus, in order to secure the project, I recommend writing a separate technical specification for the transfer of WIP balances, which should be agreed upon with all services. Among other things, the technical specifications should include an inventory schedule.

After receiving the quantitative and total balances in the system, it is imperative, together with economists, to conduct an audit of 20% of the item items with the highest cost to determine the adequacy of their prices.

Additionally, it is worth noting that with 100% accuracy, WIP is unlikely to be recalculated. There will always be deviations, and even before starting, you need to decide what you will do in the event that workers in the workshop try to write off in the program something that is not listed in the storeroom. A simple and fast reaction mechanism is definitely needed, otherwise the start of the project will be bogged down in unaccomplished “production stage” documents. It’s a bad idea to delete something that interferes with the document, because then the problem will no longer be caught, and as a result of the first cost calculation, you may end up with a part costing 100 rubles instead of 10 thousand, which will undermine confidence in the program.

We usually temporarily allow shop managers to bring inventory items to their storerooms (on the 1st day of the launch month). This, firstly, gives us specific quantitative data on the quality of incoming residues, and secondly, it gives us some time to deal with them without stopping the process.

The point I'm trying to convey is that although formally issuing incoming balances for loading into the new system is the customer's task, it can easily ruin the entire project, so both parties need to take care of this problem.

For enterprises that fulfill government orders, the issue of assigning inventory balances in storerooms to contract numbers should be additionally worked out. Here, too, various options are possible, depending on the enterprise. Usually, if the client did not have such a division in his accounting, then at the entrance to the new system we consider all the materials in the storerooms to be the remainder of the organization, and we already do normal separate accounting from the moment the program is launched.

A more adequate option for the project is if the shop managers still maintain inventory balances somewhere, which can be relied upon when receiving balances. But the problem with the amount of BU and NU that will need to be distributed among them will still remain.

The best option is if, in the old information system, workshop storerooms were maintained in the form of warehouses on 10 units. That is, everything we need is already there: nomenclature, quantity, and cost. If the client is ready to transfer them to the new system at 20k for ease of work, then the balances are first entered precisely as balances to the auxiliary warehouse at 10k on December 31st according to the scheme that will be described below, and on January 1st a document “Transfer of goods” is created, which will transfer leftovers from the auxiliary warehouse to the workshop storerooms. The amount on 20k will appear after the close of January.

So, let’s say that you still received the necessary balances of materials. Now let's look at the technology, how exactly to introduce them into the program.

Balances in warehouses (regular and storerooms) are entered using the document “Entering initial balances”. They are located in the section “Master data and administration” - “Initial filling” - “Documents for entering initial balances”. Documents are entered with the transaction type “Own goods”.

The header of the document indicates the warehouse and division. The department is indicated for reference. In the event that the balances are entered into the workshop storeroom, then the unit will be put into motion precisely from the storeroom details, and not from the department that you indicated in the header of the document.

The document also indicates the type of activity for VAT purposes and the batch. If the first one is clear, then let's look at the game in more detail.

A batch can be either an internal invoice or a supplier invoice.

If an organization keeps records using FIFO, then the purpose of the batch is clear - it determines the date of receipt of inventory items at the warehouse. If in the old system there is where to get this information, then for each receipt it will be necessary to create a separate document for entering initial balances. If we are dealing with storerooms, then usually the information about the batch has already been lost, and then, in principle, it is possible to “plant” the balances into one batch, having previously discussed this with the chief accountant.

If an organization maintains average accounting, then the issue of specifying batches will depend on whether it maintains separate VAT accounting.

For cost accounting purposes, in the case of an average batch, a batch is not needed; balances can be entered in one batch. But for the purposes of separate VAT accounting, data on the batch is written to the accumulation register “Detailing of batches of goods for VAT and simplified tax system”, on the basis of which VAT will be restored in the event that inventory items are transferred between different types of activities. If such a situation is possible, then it is necessary to enter balances in the context of invoices, even in the case of accounting using the average. We will consider entering balances for VAT purposes in more detail in a separate article.

Now let's consider the option when the company is not ready to conduct an inventory. All you have as input are several cost items with amounts. For ERP, this is a very complex situation that requires step-by-step elaboration not so much from the point of view of the technology for entering balances, but from the point of view of the further operation of the system.

It’s good if material costs have already been assigned to some order for 20k. Then the balances for them are entered as a regular itemized expense, which I will talk about later. In this case, work with stages in the new system is built only according to the new nomenclature, which will begin to be transferred to the storerooms, and itemized costs hang on the order, awaiting releases. At the same time, it is necessary to understand that in reality the total 20k in accounting are specific inventory items that are in the workshop. And it is unlikely that a worker who will reflect in 1C the consumption of materials at the production stage will be able to distinguish what he received according to the new scheme from the initial balance. Thus, you, together with economists and production workers, need to immediately agree on what the operator will do in the program when some inventory items in the storerooms are not enough in the accounting, although in fact they are. Here you can consider the option of deleting such lines (assuming that the consumed inventory items have actually already been written off as costs in the previous IS), but you must understand that this decision will inevitably lead to large imbalances between the costs of the stages. If the production cycle is short, and the transitional stages will close within a few months, then this situation can be tolerated.

As an option, you can propose to allow all missing inventory items to be sent to the shop managers, and at the end of the month they will figure out from which stages the “extra” inventory items should be removed - here it all depends on the specific enterprise. But in any case, it is better to start working on this issue at the very start of the project, so that the operators in the workshop have two instructions at once: for the transition period and permanent.

The most difficult option for a project is when the WIP at the input is the notorious “boiler”, which now somehow needs to be transferred to the program logic. Here I would take this path (in terms of material costs):

- Enter the entire cost of materials as itemized expenses using a manual operation Dt 20 <Item entry of remaining materials> KT 000.

- Allow shop managers to capitalize inventory items that are missing in accounting. Receive inventory at the price of the last purchase or the average cost under the old program. In the “Capitalization” document, manually set the postings Dt 20 <storeroom, item> Kt 20 <Item for entering remaining materials>, because the program, of course, does not automatically allow you to receive materials at the expense of work in progress.

Such a scheme requires further elaboration from the point of view of maintaining management accounting (managerial balance sheet, etc.), but here everything will depend on the type of enterprise and project.

In addition, let me remind you about reports. We must not forget to discuss with the customer that he will be able to obtain a normal plan-actual cost analysis only after the transitional stages in the system are closed. Until this point, part of the material costs can be compared with the specification, and part will be shown by the system in the form of itemized costs. Usually customers are fine with this, otherwise they would have to give us not just the materials that are in production, but those that were installed on the products in the work in progress. I have not yet come across factories that kept such records. But if you suddenly come across them, then in ERP you can enter the following balances too:

Such balances in 1C:ERP are entered into the program by the document “Initial WIP balances by production batches” on the “Materials and Works” tab.

The document indicates the batch, nomenclature, its quantity and cost.

The document generates movements in the “Cost of Goods” register in the “Work in Progress” accounting section.

The document is entered separately for each division and area of activity. Since I usually implement ERP at factories that carry out state defense orders, the area of activity there is a Contract with the customer. Stages of production are usually carried out under certain Contracts, and, accordingly, belong to a certain area of activity. That is, my input of initial balances will be divided not only into divisions, but also into contracts.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When performing a month-end closing, the task to generate a financial result will still appear after reflecting the initial balances in regulated accounting. You will need to go to the list of documents “Routine operation”, mark the December ones for deletion and then again clear the entries in the PC “Tasks for closing the month”.

Now let's return to the document, namely the production batch. For 1C:ERP, this is a “Stage” document generated on the basis of a Production Order. One of the most creative challenges when entering WIP balances is to figure out how to transfer the cost collection object in the old system into our stages. It is impossible to give any universal solutions here. The main recommendation is to make this retranslation as transparent and simple as possible. It is better to avoid any complex distributions of incoming amounts between stages, because any distributions will lead to cost imbalances between stages, which will then be difficult to explain to the customer. It is much easier to attribute incoming WIP, for example, to the last stage (to the finished product itself), and leave semi-finished products without WIP, highlighting them in batches in accounting. But, I repeat, it all depends on the specific enterprise.

Now let's move on to labor costs. We typically enter these as itemized expenses. Even if the customer has information in the old system about how much and what types of work have already been spent on completing a particular order, this data rarely coincides with the balances of work in progress according to regulated accounting.

However, if you come across an enterprise with ideal accounting, then you can also enter the labor costs spent on the order using the document “Initial WIP balances by production batches” on the “Labor costs” tab.

The document indicates the batch, type of work, quantity, price, and actual cost.

A separate document is introduced for each division, as well as for each area of activity.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When executed, the document generates entries in the RN “WIP Labor Costs” with filling in the quantity, standard and actual cost.

Debit entries to the document are established according to the department's accounting account with details by type of work.

The last block of costs is itemized costs. And here again, in customer accounting, two different options are possible: he may have costs already tied to order numbers. Or again an incomprehensible “boiler” that must somehow be made to work in the system.

In our projects, fortunately, the first option is mostly encountered.

Itemized costs that have already been allocated to orders are also entered using the document “Initial balances of work in progress by production batches” on the “Other expenses” tab.

A separate document is introduced for each division, as well as for each area of activity.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When carried out, movements are generated in the RN “Other expenses of work in progress”

Debit entries in the document are established according to the department's accounting account, and not according to the expense item.

If you are faced with a “boiler”, then the best option is to first “scatter” the costs across open orders. Here the options for the development of events depend on the enterprise. For example, on one of the projects we took the following route: we collected the entire list of orders that were listed in the work in progress and calculated their cost based on the planned cost. We asked the production manager for the percentage of completion for each order. Based on it and the planned cost, we calculated the current estimated cost of the order, and distributed the WIP in proportion to it. Here I note that since this procedure is rather unobvious from the point of view of regulated accounting, it is reasonable for the consultant to request such balances of work in progress in paper form, signed by some responsible person.

Another option for analyzing the “boiler” that may occur is also based on the planned cost: in the system we begin to work with rolling orders, as usual. And at the time of production of the stage, the accumulated costs are compared with the planned cost. And if the amount for some expense items is less, then it is taken from the incoming boiler. I would like to note right away that this option is being implemented through the modification of 1C:ERP, and in principle it is not recommended by me, because it is an adjustment of the actual cost of production to the planned one.

So, I hope that this article has given you an idea of how to work with the initial balances of 1C:ERP, what problems you may have to face, and why this issue needs to be worked out from the very beginning of the project.

Next, we plan to continue the series of articles with other problematic accounts: VAT, reserves, etc.

We discuss many other complex issues of implementing regulated accounting and cost calculation at industrial enterprises in the course: “Practical aspects of implementing regulated accounting and cost calculation in 1C:ERP at large industrial enterprises” - //infostart.ru/public/1216732/

Itemized costs

Expenses with the posting option “For production costs” are included in itemized costs. Registration of such expenses in 1C ERP is no different from registration of all other expenses; the differences lie in the settings of the expense item distributed to production costs.

Fig. 3 Methods of posting itemized costs

As can be seen from the diagram above, the system implements the following distribution methods:

- “By divisions and stages/by rule”: Step 1. In accordance with the instructions in the distribution setup, costs are transferred from the original division to other divisions (there may be several divisions);

- Step 2. Costs are entered in accordance with the autonomous distribution rule within the departments where they were transferred in step No. 1.

Additionally, for each item, you can specify a costing item in the context of which the costs will be included in the cost of the issue.

For the purpose of inventorying itemized costs, you need to go to the RM “Distribution of expenses / cost of production”.

Fig.4 RM of cost distribution/cost of goods

Here you can not only analyze the composition of costs, but also distribute costs, thereby closing the NP.

Product release options

There are two alternative product release options.

- Without using account 40 “Output of products (works, services)”.

- Using account 40 “Output of products (works, services)”.

The most commonly used option is without using account 40 “Output of products (works, services)”. It is simpler and has no restrictions, unlike the option using a score of 40.

According to methodologists of the company 1C, it is possible to use account 40 “Output of products (works, services)” when there are no remaining finished products in the enterprise’s warehouse at the end of the reporting period. The rationale for this position is set out in the article “Methods of accounting for finished products in 1C Accounting 8”. It is not always possible to fulfill this condition.

Accounting for defects

The program allows you to work with two types of defects in production.

- A fixable marriage . The document “Demand-invoice” writes off the necessary materials and semi-finished products for correcting defects to the debit of account 28 “Defects in production”. The salaries of employees involved in repairing marriages are also written off to this account. Using, for example, SALT on account 28, we determine the costs of defects. Then, using the “Operation” document, we write them off as the debit of account 96.09 “Reserves for future expenses, other.”

- An irreparable marriage . The release of incorrigible (defective) products is registered with the document “Requirement-invoice” at the planned cost. The cost account is account 28 “Defects in production” and the corresponding analytics. Then, using the “Operation” document, you need to write off the costs of the marriage to the debit of account 91.02 “Other expenses”. Actual scrap costs will have to be estimated manually.

Multi-process production – Accounting for semi-finished products

Multi-process production involves the presence of two or more technological stages, each of which is characterized by intermediate output. The outputs of intermediate stages are semi-finished products. They are used in the production of the next stage. At the last stage, the finished product is produced.

Semi-finished products can also be sold externally. Warehouse accounting of semi-finished products and automatic calculation of their cost are supported.

Automatic determination of the sequence of production stages (reprocessing stages) is provided. This option is also recommended by 1C methodologists. If necessary, the user can manually set the sequence of repartitions.

Accounting for work in progress (WIP)

In tax accounting, the calculation of the actual cost of products is determined by the costs accumulated on account 20 “Main production”, excluding the balances of work in progress.

Completed work and services that have not yet been delivered to the customer and/or not accepted by him, the contractor is obliged to include in the balances of the work in progress, clause 1 of Art. 319 of the Tax Code of the Russian Federation.

There is an exception to this rule for services. The Contractor has the right to attribute the amount of direct costs for the provision of production services carried out in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress; para. 3 p. 2 art. 318 Tax Code of the Russian Federation

This right is implemented in the 1C Accounting 3.0 program. True, it is very important to keep in mind the following circumstance. In the configuration, there is no formal distinction between work and production services. Therefore, if the contractor performs work and provides services, then in no case can you set the option to write off work in progress for a decrease in income. Because it will also be used for work. But for work, the legislation does not provide such a right.

The essence of the WIP write-off operation

Work in progress is a set of expenses that have already been sent to the production process, but the result of the process, for example, finished products, has not yet been received (clause 63 of the order of the Ministry of Finance of Russia “On approval of the Regulations on accounting…” dated July 29, 1998 No. 34n ).

In the normal course of the process, the work in progress recorded at the end of the reporting period then, in the usual manner, forms the cost of products manufactured with its participation. However, in this process, deviations from its usual course may arise, and then the accountant is faced with the question of what to do with the “stuck” WIP?

Returnable waste accounting

When releasing products, there may be returnable waste: fabric scraps, chipboard, sawdust, etc. If the “Returnable waste” tab in the product release document is not filled in, this means that they either do not exist, or they are not taken into account and are not used in the future.

Returnable waste can be capitalized either in the form of materials or in the form of goods and only at the planned cost. At the same time, production costs are reduced by the cost of returnable waste.

Returnable waste can be used for your own needs or sold. Revenue from the sale of returnable waste is reflected in other income.