Report form 4-FSS for the first quarter of 2021

In a letter dated March 9, 2021. No. 02-09-11/05-03-5777 FSS reported that it is necessary to use the current form, which was approved on September 26, 2016. order No. 381, but with nuances:

- there is no need to fill in the indicators of line 15 “Expenses for compulsory social insurance” in table 2 “Calculations for compulsory social insurance against industrial accidents and occupational diseases”;

- there is no need to fill out and submit Table 3 “Expenses for compulsory social insurance against industrial accidents and occupational diseases.”

Otherwise, the procedure for filling out the report has not changed. Full requirements for filling out the report are contained in Appendix No. 2 to Order No. 381 of the Social Insurance Fund of the Russian Federation dated September 26, 2016.

General filling rules

- Form 4—FSS can be filled out on a computer or by hand. If by hand, use only black and blue ink.

- The rule applies: one line or column - one indicator. If there is nothing to enter, put a dash.

- If there is nothing to enter into tables 1.1, 4, do not fill them out and do not submit them.

- Correct errors in the paper version of the report by striking them out. At the top, enter the correct information, the date of correction, certify the correction with the signature of an authorized person and seal, if any. Corrective agents cannot be used.

- Number all pages in continuous order, starting with the title page.

- On each page, fill in the fields “Policyholder Registration Number” and “Subordination Code”. At the end of each page, please include the signature of the authorized person and the date the report was signed.

- All policyholders, without exception, must fill out:

- title page;

- table 1;

- table 2;

- table 5.

- Your policyholder registration number can be found in the extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, if you download it from the official website of the Federal Tax Service. Subordination code is on the FSS website.

To the subordination code you need to add a fifth digit, which indicates the type of policyholder:

- “1” - organization;

- “2” - separate division;

- “3” – individual entrepreneur.

For example, an individual entrepreneur registered with the FSS branch of the city of Abakan (Republic of Khakassia) will indicate the code 19003. An organization from Abakan will write 19001.

What is the FSS subordination code and its decoding

The subordination code is assigned by the FSS when registering a company as an insurer. The fund must do this within 3 days from the moment the tax authority receives information about the emergence of a new legal entity (255-FZ). As for individual entrepreneurs, the period for them is 30 days from the date of submission of the contract with employees. After this, the policyholder receives a notification from the FSS containing the code of subordination, as well as the registration number under which the insurance took place. The main thing that the subordination code shows is which department of the fund the company belongs to. The company will have to submit reports to this department.

The decoding of the code is as follows (Order 959):

- The first four digits are the FSS code to which the organization belongs.

- The fifth digit indicates which category the policyholder belongs to.

For example, for entrepreneurs this figure is 3, for legal entities - 1, and for separate divisions - 2.

In addition, the subordination code can mean the following:

- The first four digits are the FSS code that registered the organization.

- The fifth digit is the reason for registration.

The first four digits can also mean a branch of the FSS, and not just a department.

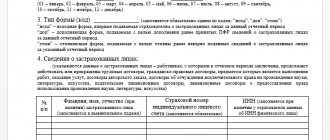

General information about the policyholder

All information on the title page is filled out by the policyholder. Only the section “To be filled out by an employee of the territorial body of the Fund” must be left blank. In the sample it is highlighted with a blue frame. In the “Adjustment number” field, enter “000” if you are submitting a report for this period for the first time. If you find an error and send the report again - “001”. With each subsequent version of corrections, the correction number will increase - “002”, “003”, etc.

Important! If you are correcting a report for previous periods, prepare it according to the form that was in force at that time. Even if now that the error is discovered, a new form is applied.

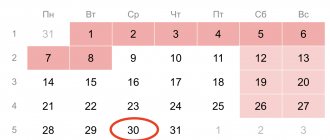

In the “Reporting period” field, enter the code:

- “03” — report for the first quarter;

- “06” - half-year report;

- “09” - report for nine months;

- "12" - annual report.

The “Cessation of activity” field is filled in only when the organization is liquidated or the individual entrepreneur ceases business activities. In this case, you need to indicate “L”. Enter the name of the organization or full name of the individual entrepreneur in full. As indicated in the constituent documents or extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

When filling out the organization’s TIN, enter “0” in the first two cells, then enter the 10-digit number. In the “Checkpoint” field, if you are filling out information for a separate subdivision, indicate the checkpoint of the separate subdivision. When filling out the OGRN of the organization, put “0” in the first two cells. In the “OKVED Code” field, indicate the code of the main type of activity.

For newly registered policyholders in the first year of activity, the main one will be the OKVED that was indicated as the main one in the constituent documents; it is indicated in the extract from the Unified State Register of Legal Entities. Starting from the second year of activity, you must indicate the code that is declared to be the main one for establishing the rate of contributions for accidents and occupational diseases.

Let us remind you that in order to establish the rate of contributions for accidents, all organizations must send to the Social Insurance Fund an application confirming the main type of activity and a confirmation certificate by April 15 of each year.

In the “Registration Address” field of the organization, indicate your legal address, which is recorded in the Unified State Register of Legal Entities. Entrepreneurs indicate the registration address at their place of residence. Fill out the fields “Average number of employees”, “Number of working disabled people”, “Number of employees engaged in work with harmful and (or) hazardous production factors” in accordance with the explanations of the Social Insurance Fund. After filling out the form, indicate the total number of report sheets and the number of application sheets, if any.

When signing the report, select the desired status in the field “I confirm the accuracy and completeness of the information specified in this calculation”:

- “1” - signed by the policyholder himself (the head of the organization, individual entrepreneur or an individual who is not recognized as an individual entrepreneur);

- “2” – signed by an authorized representative (you must additionally indicate the details of the power of attorney in the “Document confirming the authority of the representative” field);

- “3” – signed by the legal successor if the insured organization is liquidated.

The logic for filling out the required tables is generally intuitive. Therefore, we will not dwell on each of the indicators, but we will note points that need to be paid attention to.

Table 1

The first column of row 1 is always filled with a running total. If the report is generated for the first quarter, indicate the amount of payments for the first three months of the year, if for six months - the amount of payments for six months, if for nine months - the amount of payments for nine months, etc. In the second, third and fourth columns, indicate payments for each of the last three months of the reporting period.

For example, in a half-year report - the amounts of payments for April, May, June, in a report for nine months - payments for July, August and September, respectively.

Section I, Table 3.

The data in Table 3 contains the amounts of payments (and other remuneration) to individuals, including those for which contributions to the Social Insurance Fund are not accrued.

The column “Total since the beginning of the billing period” indicates the total amounts for 2013.

The columns “Including for the last three months of the reporting period” reflect the monthly amounts of payments made, respectively, in the last three months of the reporting period. 1st month – October, 2nd – November, 3rd – December.

The line “Amounts of payments and other remuneration accrued in favor of individuals, in accordance with Article 7 of Federal Law No. 212-FZ of July 24, 2009” indicates the amounts of all payments in favor of individuals, including:

- remuneration of employees;

- benefits;

- gifts for employees;

- financial assistance to employees;

- and so on.

The line “Amounts not subject to insurance contributions in accordance with Article 9 of Federal Law No. 212-FZ of July 24, 2009” indicates the amounts of payments not subject to contributions. These amounts include:

- benefits at the expense of the Social Insurance Fund (both paid at the expense of the employer and paid at the expense of the Social Insurance Fund);

- gifts for employees;

- financial assistance to employees;

- and so on.

In the line “Amounts exceeding the maximum base for calculating insurance premiums established in accordance with Art.

8 of the Federal Law of July 24, 2009 No. 212-FZ” - indicates the amount of payments exceeding the limit established for calculating contributions to the Social Insurance Fund. In accordance with the Decree of the Government of the Russian Federation dated December 10, 2012. No. 1276 “On the maximum value of the base for calculating insurance contributions to state extra-budgetary funds from January 1, 2013”, in 2013. it is 568,000 rubles. per year per employee.

table 2

The amount of debt on line 1 must match the amount on line 19 of the report for the previous billing period. Let us remind you that the billing period is a year, the reporting period is a quarter, half a year and nine months. In our sample, the policyholder had no debts to pay premiums for 2021. Therefore, there is a dash in line 1 for the first quarter of 2021.

The indicator on line 12 must be equal to the indicator on line 9 of the calculation for the previous billing period, that is, for the previous year. Leave line 15 blank. In the sample it is highlighted with a blue frame. In line 19, the debt can change at the end of each reporting (quarter, half-year, nine months) and billing (annual) periods. The annual report indicator will then “migrate” to the next year - it will be indicated in line 1 of Form 4-FSS for the next year.

For example, in the annual report 4-FSS for 2021, the organization indicated a debt to pay contributions in the amount of 240 rubles. The same indicator must be indicated in line 1 of all reports for 2021.

Table 5

In line 1, column 3, indicate the total number of jobs. It does not matter whether or not a special assessment of working conditions (SAL) was carried out on them. In line 1, columns 4–6, indicate information about the workplaces for which the SOUT was actually carried out. If the SOUT was not carried out, enter 0.

In our example, the SOUTH assessment was carried out for all ten workplaces (column 4), while the organization does not have workplaces in the 3rd and 4th classes. We put a dash.

You can compile and send a report to the Social Insurance Fund in Form 4-FSS in the “My Business” online accounting service. The service will pull up the necessary data from the accruals and generate a report for sending electronically or printing. Now you can get up to six months of use for free!

Personal appeal to the FSS

One way to find out your code is to personally contact the fund. In this case, reliable information is provided and there should be no problems when preparing and submitting reports. If the code is incorrectly determined, the company may face large fines. Particularly large fines threaten those companies that employ a large number of employees. Therefore, the best way to find out the code would be to personally contact the FSS. To do this, you will need to have the following documents with you:

- TIN;

- representative's passport;

- an order confirming that a company representative has the right to request such information.

Please remember that other documents may be required. For more information, please contact your FSS branch.