Selling and general business expenses: how to differentiate

Selling expenses are also called selling expenses.

In accounting they are reflected in account 44. General business expenses are recorded in account 26.

Commercial expenses are characterized by a connection with production and sales, and general business expenses are associated with the maintenance of general-purpose property and general issues of company management.

What the company refers to as commercial and what to general expenses is determined independently in its accounting policies.

Accounting policy for income tax purposes?

Setting up the main parameters of tax accounting for income tax is carried out in the Accounting Policy of the organization (section “Regulatory and Reference Information”, navigation panel command “Organizations”, in the organization card, navigation panel command “Accounting Policy”).

Setting up accounting policies

Tax system

In the Accounting Policy, you should set the “Taxation system” switch to the “General (income tax is paid)” position.

The established taxation system is applied from the effective date to the expiration date of the accounting policy.

Procedure for distribution of total costs

To distribute total costs in tax accounting, the same procedure is used as in accounting.

The procedure for distributing general production and general business costs is established in the organization’s Accounting Policy on the “Production” tab using the “Distribute general production costs”, “Distribute general business costs” checkboxes and the methods of their distribution specified in the “Methods for distributing indirect costs” form.

Methods for determining the direct costs of hydrocarbon production

On the “Income Tax” tab of the organization’s accounting policy, the hyperlink Methods for determining direct production costs in NU specifies the rules for determining direct production costs for tax accounting purposes.

If methods for determining direct expenses have not previously been established for a given organization, you will be asked to fill them out automatically in accordance with the recommendations in Article 318 of the Tax Code of the Russian Federation.

Other accounting policy parameters for NU purposes

The remaining parameters of the accounting policy for NU purposes are set on the “Income Tax” tab of the organization’s Accounting Policy:

- Method of calculating depreciation in tax accounting: “linear” or “non-linear”;

- Retail trade has been transferred to the payment of UTII.

Setting up income and expense accounting elements

Types of costs

The directory “Types of Costs” (section “Regulatory and Reference Information”, command of the navigation panel “Types of Costs”) is used to classify production costs and distribution costs. Analytical accounting by type of cost is carried out both in accounting - on accounts 106.00 and 109.00, and in tax accounting - on the corresponding accounts N08, N20-26, N44.

For an institution’s expenses for income-generating (taxable) activities, it is necessary to create a unified classification and enter a list of cost elements in the “Types of Costs” directory. For accounting purposes, in each element of the directory it is necessary to fill in the “KEC” attribute; for tax accounting purposes, fill in the “Type of expenses (NU)” attribute and establish the type of activity in accordance with the taxation procedure for these expenses.

Establishing correspondence between cost elements of accounting and tax accounting

According to paragraph 134 of the Instructions for the application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, accounting for operations to form the cost of finished products, work performed, services provided is maintained on account 10900 “Costs for the manufacture of finished products, performance of work, services."

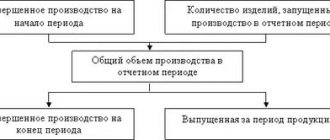

The institution's costs in the production of finished products, performance of work, and provision of services are divided into direct and overhead.

When producing one (single) type of finished product, work, or service, all costs directly related to the production of finished product, performance of work, or services are considered direct costs.

Direct costs are directly included in the cost of manufacturing a unit of finished product, performing work, or providing a service.

The distribution of overhead costs is carried out in one of the following ways: in proportion to direct costs of wages, material costs, other direct costs, the volume of revenue from the sale of products (works, services), and other indicator characterizing the results of the institution's activities.

The institution organizes cost accounting by economic elements and by costing items (depending on industry specifics), by the method of inclusion in the cost (direct and invoices), in connection with technical and economic factors (conditionally constant and conditionally variable (invoices) in order to rationing, limiting, etc.).

The choice of the method for calculating the cost of a unit of production (volume of work, service) and the base for the distribution of overhead costs between the objects of calculation is carried out by the institution independently or by the body exercising the functions and powers of the founder in such a way as to optimize the degree of usefulness of accounting data for management purposes with an acceptable level of labor intensity of accounting procedures.

To generate information in monetary terms about the costs of manufacturing finished products, performing work, services and business transactions carried out with them, the following groups of accounts under the Unified Accounting Standards are used:

- 10960 “Cost of finished products, works, services”;

10970 “Overhead costs of production of finished products, works, services”;

10980 “General business expenses”;

10990 “Distribution costs”.

According to the Instructions for the Application of the Unified Chart of Accounts, analytical accounting for account 10900 “Costs on the production of finished products, performance of work, services” is carried out in the context of the types of finished products produced by the institution, work performed, services by type of expense.

In the BGU2 program, for accounts of group 10900 “Costs for the manufacture of finished products, performance of work, services”, analytical accounting is maintained for economic elements - for the subaccount “KEC” and “Types of costs”.

Under account 10960 “Cost of finished products, works, services”, analytical accounting is also kept for the sub-account “Nomenclature”. This allows you to formulate the cost of products, works, and services by type of cost.

Subconto “Types of Costs” - additional user detailing of costs (directory “Types of Costs”), in the context of which production costs are taken into account both in accounting and in tax accounting for income tax. If “KEK” is a regulatory classifier of cost items, then “Types of costs” is a user level of classification.

The “Types of Costs” directory is a link between accounting and tax accounting.

Attention

. You should not create cost types separately for accounting and separately for tax accounting. It is necessary, if possible, to use one type of cost for both accounting and tax accounting.

In each element of the “Types of Costs” directory, in addition to the name, the corresponding KOSGU code (the “KEK” requisite) is indicated, as well as the type of activity in accordance with the taxation procedure, that is, to which taxation system the type of cost belongs within the framework of taxable (income-generating) activity :

- “For activities with the main taxation system (general or simplified)” - the type of cost relates entirely to activities with the main taxation system. The amount of costs accumulated for this type of cost fully participates in the formation of the tax base for income tax.

- “For certain types of activities with a special taxation procedure (UTII, etc.)” - the type of cost entirely relates to individual types of activities, the taxation system of which does not coincide with the main one, for example, UTII, Unified Agricultural Tax. According to paragraph 2 of Article 274 of the Tax Code of the Russian Federation, the taxpayer is obliged to keep separate records of such expenses. The amount of costs accumulated for this type of cost is not taken into account when calculating the tax base for income tax.

This type should also be established for types of activities that are not subject to income tax, for example, for which, according to Article 284.1 of the Tax Code of the Russian Federation, a zero tax rate can be applied.

- “For different types of activities (distributed in proportion to income according to Article 272 of the Tax Code of the Russian Federation)” - the type of costs cannot be attributed to a specific type of activity. The amount of costs accumulated for this type of cost will reduce the tax base only in that part that relates to the main tax system. The distribution is made in proportion to the share of income from activities with a general taxation system in the total volume of all income within the framework of taxable (income-generating) activities.

For each type of expense, the type of expense in tax accounting is also indicated according to the classification established by the Tax Code of the Russian Federation (the “Type of expense in NU” detail). The type of expenses in tax accounting allows you to:

- identify the type of accounting costs from the point of view of tax accounting;

- take into account specific tax accounting requirements for certain types of expenses (standardized expenses, transportation expenses);

- classify expenses as direct or indirect.

Note

. Production costs in tax accounting are divided into direct and indirect (Article 318 of the Tax Code of the Russian Federation). Direct expenses form the cost of manufactured products. Indirect costs do not take part in the formation of product costs and are written off as expenses of the current period.

The table provides a list of types of NU expenses that can be matched to the types of costs used in accounting.

| Type of expenses in tax accounting | Chapter 25 of the Tax Code of the Russian Federation “Organizational Profit Tax” |

| Depreciation bonus | Paragraph 2, paragraph 9, Article 258 of the Tax Code of the Russian Federation |

| Depreciation | Articles 256-259 of the Tax Code of the Russian Federation |

| Rental of federal and municipal property | Clause 1 of Article 264 “Other expenses associated with production and (or) sales” |

| Voluntary personal insurance, which provides for payment of medical expenses by insurers | Clause 16 of Article 255 “Labour costs” |

| Voluntary personal insurance in case of death or disability | Clause 16 of Article 255 “Labour costs” |

| Voluntary insurance under long-term life insurance contracts for employees, pension insurance and (or) non-state pension provision for employees | Clause 16 of Article 255 “Labour costs” |

| Travel expenses | Clause 12, clause 1 of Article 264 “Other expenses associated with production and (or) sales” |

| Material costs | Article 254 “Material expenses” |

| Taxes and fees | Clause 1, clause 1 of Article 264 “Other expenses associated with production and (or) sales” |

| Not taken into account for tax purposes | Article 270 “Expenses not taken into account for tax purposes” |

| R&D | Article 262 “Expenditures on scientific research and (or) development” |

| Compulsory and voluntary property insurance | Article 263 “Expenses for compulsory and voluntary property insurance” |

| Salary | Article 255 “Labour costs” |

| Development of natural resources | Article 261 “Expenses for the development of natural resources” |

| Entertainment expenses | Clause 2 of Article 264 of the Tax Code of the Russian Federation “Other expenses associated with production and (or) sales” |

| other expenses | Article 264 “Other expenses associated with production and (or) sales” |

| Expenses for reimbursement of employee interest costs | Clause 24.1 of Article 255 “Labour costs” |

| Advertising expenses (standardized) | Clause 4 of Article 264 of the Tax Code of the Russian Federation “Other expenses associated with production and (or) sales” |

| Repair of fixed assets | Article 260 “Expenses for repairs of fixed assets” |

| Insurance premiums | Clause 1, clause 1 of Article 264 “Other expenses associated with production and (or) sales” |

| Fare | Article 320 of the Tax Code of the Russian Federation “Procedure for determining expenses for trade operations” |

According to Article 253 of the Tax Code of the Russian Federation, expenses associated with production and sales include:

- expenses associated with the manufacture (production), storage and delivery of goods, performance of work, provision of services, acquisition and (or) sale of goods (work, services, property rights);

- expenses for maintenance and operation, repair and maintenance of fixed assets and other property, as well as for maintaining them in good (up-to-date) condition;

- expenses for the development of natural resources;

- research and development expenses;

- expenses for compulsory and voluntary insurance;

- other costs associated with production and (or) sales.

Costs associated with production and (or) sales are divided into:

- material costs;

- labor costs;

- the amount of accrued depreciation;

- other expenses.

The list of material expenses is given in Article 254 of the Tax Code of the Russian Federation. Material expenses, in particular, include the following taxpayer costs:

- for the purchase of raw materials and (or) materials used in the production of goods (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of goods (performance of work, provision of services);

- for the purchase of materials used:

- for packaging and other preparation of manufactured and (or) sold goods (including pre-sale preparation);

- for other production and economic needs (testing, control, maintenance, operation of fixed assets and other similar purposes);

- for the purchase of tools, devices, equipment, instruments, laboratory equipment, workwear and other personal and collective protective equipment provided for by the legislation of the Russian Federation, and other property that is not depreciable property. The cost of such property is included in material costs in full as it is put into operation;

- for the purchase of components undergoing installation and (or) semi-finished products undergoing additional processing from the taxpayer;

- for the purchase of fuel, water, energy of all types spent on technological purposes, production (including by the taxpayer himself for production needs) of all types of energy, heating of buildings, as well as costs of production and (or) acquisition of power, costs of transformation and transmission energy.

Works (services) of a production nature include the performance of individual operations for the production (manufacturing) of products, performance of work, provision of services, processing of raw materials (materials), monitoring compliance with established technological processes, maintenance of fixed assets and other similar work.

Works (services) of a production nature also include transport services of third-party organizations (including individual entrepreneurs) and (or) structural divisions of the taxpayer itself for the transportation of goods within the organization, in particular the movement of raw materials, tools, parts, workpieces, and other types of goods with base (central) warehouse to workshops (departments) and delivery of finished products in accordance with the terms of agreements (contracts).

As well as those associated with the maintenance and operation of fixed assets and other property for environmental purposes (including costs associated with the maintenance and operation of treatment facilities, ash collectors, filters and other environmental facilities, costs for the disposal of environmentally hazardous waste, costs for the purchase of services from third-party organizations for the reception, storage and destruction of environmentally hazardous waste, wastewater treatment, the formation of sanitary protection zones in accordance with current state sanitary and epidemiological rules and regulations, payments for maximum permissible emissions (discharges) of pollutants into the natural environment and other similar expenses).

Other income and expenses

The directory “Other income and expenses” (section “Regulatory and reference information”, navigation panel command “Other income and expenses”) is used to classify other income and expenses of an institution not related to its main activity. Analytical accounting for items of other income and expenses is carried out in tax accounting on account N91 “Other income and expenses.”

Items for other income and expenses can be pre-filled or added to the directory as needed.

For tax accounting purposes, in each article it is necessary to fill in the details “Type of other income and expenses” and establish the type of activity in accordance with the procedure for taxation of these incomes (expenses).

What are business expenses?

Business expenses typically include costs for:

- packaging of products intended for sale;

- delivery of goods to customers' warehouses;

- carrying out advertising campaigns;

- marketing research.

In an industrial enterprise, commercial expenses may also include expenses for:

- maintenance of warehouses and equipment in places where manufactured products are sold;

- wages of personnel hired in connection with the sale;

- entertainment expenses;

- travel expenses for sales employees, etc.

For trading companies, this list is even wider; it can include:

- remuneration of salespeople and other personnel in stores and other points of sale;

- rental of trading floors, warehouses;

- depreciation deductions;

- payment for housing and communal services, etc.

And for agricultural producers - maintenance and service costs:

- procurement units;

- reception points;

- facilities intended for raising domestic animals and birds.

The procedure for entering cost items in 1C 8.3

Let's study the algorithm for entering a list of cost items in 1C 8.3. Unlike other 1C programs, where each cost account has its own directory of cost items, in 1C 8.3 all items are collected in one directory, common for the following cost accounts:

Subconto Cost Items for the above accounts is negotiable, that is, there should be no balance under the cost item in SALT for these accounts, but only turnover.

You can find the directory for Cost Items in 1C 8.3 in the section Directories – Cost Items:

Or in the Directories and accounting settings section - in the Income and Expenses subsection.

At the very beginning of working with an empty 1C 8.3 Accounting information base, even one created from scratch, the directory will be automatically filled in with a list of the main expense items upon initial launch. Opposite such articles there is a yellow dot. It is not recommended to change such cost items, since they are predefined elements of the directory:

While working with the 1C 8.3 database, you can add new cost items to the directory and change existing ones. You can delete them only if there is no yellow dot next to the article. You can add new cost items immediately when entering documents where the Cost Item attribute is present.

Selling expenses in cost

Selling expenses are the cost:

- goods along with the purchase price;

- products produced along with the cost of production.

They enter the cost price by transferring from account 44. Postings can be as follows:

- Debit 44 credit 10

- expenses for packaging materials and containers are reflected;

- the cost of delivering goods to customers' warehouse facilities or to intermediate departure points is taken into account;

- paid for third party services (delivery, packaging, sale of finished products);

- salaries were accrued to sellers, sales department employees, workers involved in packaging, loading and selling products, etc.

Business expenses must be written off by the end of each reporting period. The wiring is like this:

- Debit 90-2 Credit 44

- expenses for the sale of products (goods, works, services) are written off.

Accounting

According to accounting rules, expenses are recognized in the reporting period in which they occurred (clause 18 of PBU 10/99).

Expenses in accounting are recognized under the following conditions (clause 16 of PBU 10/99):

- the expense is made in accordance with the contract, the requirements of laws and regulations, and business customs;

- the amount of expenditure can be determined;

- there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity.

In this case, each fact of economic life is subject to registration with a primary accounting document (Clause 1, Article 9 of the Federal Law of December 6, 2011 N 402-FZ).

Thus, accounting legislation makes the need to draw up a primary document dependent on the fact of economic life, and not vice versa, which means the services should have been taken into account in December last year, for example, on the basis of an accountant’s certificate.

Find out more about the Pass in the accounting of the primary document

If the organization knew that the service was provided, but the document was not received, not reflecting the service in accounting should be considered an error.

The date of amendments will depend on (clause 5-9 PBU 22/2010):

- the moment the document is received by the organization: before the approval of the financial statements;

- after approval of the financial statements;

Learn more about correcting accounting errors

Additional payment before salary when paying vacation pay

When paying vacation pay, sometimes the employer (organization) pays extra up to the salary. The employment contract then stipulates that when paying vacation pay, if the income received during the month is less than the amount of the monthly salary, the organization guarantees the employee an additional payment up to the amount of the monthly salary. How to account for these funds?

The taxpayer has the right to take into account the amount of such additional payment as part of expenses that reduce taxable profit, in accordance with the provisions of paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, that is, as other types of expenses incurred in favor of the employee, provided for by the labor and/or collective agreement.

Attention should be paid to the fact that the employer’s attribution of the amounts of the above additional payments to expenses when calculating income tax is possible only when such additional payments are provided for by labor and/or collective agreements in accordance with Art. 255 of the Tax Code of the Russian Federation and meet the requirements of Art. 252 of the Tax Code of the Russian Federation.

Simplified accounting

Some organizations have the right to use simplified accounting methods, including simplified accounting (financial) reporting. They can establish for themselves the following procedure for recognizing sales revenue: not as the rights of ownership, use and disposal for the delivered products/goods sold/work performed/services rendered are transferred, but after the receipt of money and other forms of payment.

In this case, expenses are recognized after the debt is repaid.

Also see “Accounting on the simplified tax system”.

General provisions

1. These Regulations establish the rules for the formation in accounting of information on the expenses of commercial organizations (except for credit and insurance organizations) that are legal entities under the legislation of the Russian Federation. In relation to this Regulation, non-profit organizations (except for budgetary institutions) recognize expenses for business and other activities.

2. Expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the emergence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property).

3. For the purposes of these Regulations, the following assets are not recognized as expenses of the organization:

- in connection with the acquisition (creation) of non-current assets (fixed assets, construction in progress, intangible assets, etc.);

- contributions to the authorized (share) capitals of other organizations, acquisition of shares of joint-stock companies and other securities not for the purpose of resale (sale);

- transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

- under commission agreements, agency and other similar agreements in favor of the principal, principal, etc.;

- in the order of advance payment of inventories and other valuables, works, services;

- in the form of advances, deposits to pay for inventories and other valuables, works, services;

- to repay a loan received by the organization.

For the purposes of this Regulation, the disposal of assets is referred to as payment.

4. The expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into:

- expenses for ordinary activities;

- operating expenses;

- non-operating expenses.

For the purposes of these Regulations, expenses other than expenses for ordinary activities are considered other expenses. Other expenses also include extraordinary expenses.