The meaning of account 26 in accounting

Active account 26 is used in accounting for enterprises of any industry in order to reflect and write off costs not directly related to production activities. The list of general business expenses differs by type of organization and is not closed, that is, it can be supplemented by the company independently. In particular, management costs include:

- Administrative and management costs - representation expenses, travel expenses, consulting services, salaries of the accounting department, company administration, marketing, etc.

- Deductions for depreciation and repair of non-production fixed assets.

- Rent for non-production areas.

- Other similar expenses.

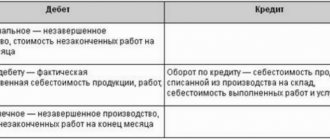

Costs are reflected in the debit of the account. 26 in correspondence with the corresponding accounts - , , 05, 04, , , , 71, , 21, , , , 79, , etc. Closing of account 26, the transactions on which can be very diverse, due to the difference in expenses, is carried out on a loan in correspondence with accounts - 20, 29, 23, , 28, 99, etc. To obtain reliable and complete information about cost items for each type of cost, as well as the places of their occurrence, analytical accounting is organized.

Features and characteristics of 26 accounts

General business expenses are subject to reflection on active accounting account 26. Debit turnover accumulates the cost of all expenses incurred, and credit turnover reflects the closure of account 26.

Account 26 is considered a transaction account. This means that this accounting account is not reflected in the annual balance sheet, or as part of other reporting forms. Consequently, the account at the end of the reporting period cannot have a closing balance. All turnover must be distributed to the appropriate accounting accounts.

The current standards of PBU require the organization of analytical accounting for account 26. Provide detail in the context of cost items, according to the approved cost estimate. Conduct additional analytics by structural divisions - places where costs arise, by intended purposes and other accounting features.

Account 26 cannot have a final balance at the end of the reporting period. This means that the account is subject to monthly closure.

How the 26th account is closed at the end of the month

Reasonable closure of account 26 at the end of the month is carried out according to the method approved in the accounting policy of the enterprise. There are two ways to form the cost of products:

- Full - this option implies a detailed write-off of expenses for main, servicing or auxiliary production through expense accounts: 20, 29 or 23. Accordingly, closing account 26 - postings D 20 (29, 23) K 26.

- Reduced - with this option, the total amount of incurred expenses is written off directly to the account. 90 posting D 90 K 26, cost accounts are not used.

The first method is optimal for large organizations, while the second is more convenient for small enterprises. If not one type of product is produced, but several, for proper distribution, you can take the value of revenue or volume of product output, data on material costs, payroll, etc. as the base indicator.

Expenses in tax accounting

The list of direct expenses attributed to production is located in the section “Main/Accounting policies/Setting up taxes and reports/Income tax/List of direct expenses”.

Figure 13 Setting up taxes and reports

Figure 14 “List of PR”

If you need more detailed advice on maintaining 1C in terms of setting up taxes and reports, as well as automating other areas of accounting, contact our specialists.

Figure 15 Methods for determining production output in NU

Figure 16 Setting up PR production in NU

Expenses not listed among direct expenses will be considered indirect in tax accounting and will be written off on 90.08, and direct expenses will be written off on 40. If you still have questions about closing accounts, contact our 1C 8 support specialists, we will be happy to help you.

How to close account 26 if there is no revenue

Is it possible and how to close account 26 if there is zero revenue from the sale of goods, products or services/work? According to accounting rules, this cannot be done, since indirect expenses need to be written off only if there is revenue, but also the final balance on the account. 26 should not accumulate. There is a way out - you need to carry out a minimum sale of 0.01 rubles. with a technical counterparty, after which account 26 will be automatically closed to account 20 (WIP), and at the end of the year the extra penny will be allocated through a manual operation.

Closing accounts 25 and 26 (indirect costs) from 2021 according to FAS 5/2019 “Inventories”

Published 05/13/2021 09:03 Author: Administrator In connection with the entry into force of FSBU 5/2019 “Inventories” in 2021, the algorithm for closing cost accounts in 1C software products has changed. And this again and again raises a bunch of questions for accountants. Let's try to figure them out in this article.

So, let us recall that cost accounting accounts include accounts 20, 23, 25, 26, 44.

All costs, in turn, are divided into direct and indirect.

Direct costs are those that are directly related to the production of products, performance of work, and provision of services. For example, the cost of raw materials and materials, rental of production facilities, depreciation of production equipment, wages of workshop workers.

Indirect costs cannot be attributed to any specific product, for example, salaries of administrative and management staff, depreciation of an accounting printer, rent of office space.

Based on the above, you might have falsely concluded that all costs associated with production are direct, but this is not the case. For example, you may have equipment in production that is not used for a specific type of product, and then the costs associated with the acquisition and maintenance of such production will be indirect.

Therefore, the first thing you need to determine for yourself is which expenses are direct and which are indirect for you.

Closing 26 accounts

Account 26 is usually used to reflect indirect costs broken down by cost items.

And if previously we could reflect expenses associated with the production process on account 26, now we can’t. The new procedure implies that it reflects only management expenses.

At the end of each month, using the “Closing the month” processing, the program, according to a certain algorithm, closes account 26 in such a way that there is no final balance on it. The only question is to what account and on what principle it is closed.

According to the new FSBU 5/2019, the actual cost of finished products does not include management costs, unless these costs are direct.

That is, until 2021, account 26 could be closed either to account 90, or to accounts 20, 23 or 29. Now the second method is not provided for by the program!

Let's look at the settings first.

In the software product 1C: Enterprise Accounting 8, edition 3.0, go to the “Main” section and select the “Accounting Policy” item.

Until 2021, there was a switch “General business expenses are included” and two options: “In the cost of sales” or “In the cost of products, works, services.”

Now there is no such switch and closing the 26th account depends on the flags “Production of products” and “Performance of work, provision of services”.

If at least one of these checkboxes is checked, then account 26 in both accounting and tax accounting will be closed to account 90.08.1.

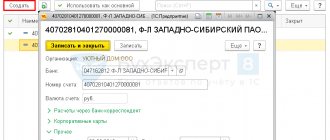

Let's consider a conditional example: we enter a document that registers indirect costs, for example, an act for renting an office.

Let's go to the "Purchases" section and select the "Receipts (acts, invoices, UPD)" item. In the window that opens, click on the “Receipt” button and from the drop-down menu click on “Services (act, UPD).”

In the new document, we will enter the data from the act: number, date, name of the counterparty, contract. Then we will add line c to the tabular part of the document and assign it to account 26. Let's review the document.

Then go to the “Operations” section and select the “Month Closing” item.

In the window that opens, select the month we need and click on the “Close the month” button. When all processing steps are completed (the font turns green), click on the operation “Closing accounts 20, 23, 25, 26” and in the new window select “Show transactions”.

In the postings we will see that the amount we allocated to account 26 will be written off in full to account 90.08.1.

But, it should be remembered that there are organizations that do not produce products and provide services in their activities.

For such enterprises, setting up accounting policies will not include the flags “Product output” and “Performance of work, provision of services to customers.”

With this setup, account 26 in accounting will be closed to account 90.02.1, and in tax accounting according to the information register “Methods for determining direct production costs in OU”.

Let's look at these settings.

Let’s return to the “Main” - Accounting Policies section and clear the flags associated with production.

Then go to the “Main” section and select “Taxes and reports”.

In the window that opens, go to the “Income Tax” tab and follow the link “List of direct expenses”.

Let's add a new line in which we indicate that expenses for account 26 from the subaccount “Other expenses” should be closed to account 90.02.1.

Attention! This adjustment should only be made if these costs are direct. In this case, we would recommend including such costs in account 25. But as an example, let's look at this setting.

Let’s close the month again and look at the entries made in the “Closing accounts 20, 23, 25, 26” operation.

According to our setup, the costs we previously entered will be closed to account 90.02.1.

If in the accounting policy the flags relating to production are cleared, and in the settings of the list of direct costs there is no line with correspondence for account 26, the program will close the costs of account 26 in accounting to account 90.02.1, and in tax account to 90.08.1, and The wiring will look like this:

Closing 25 accounts

On account 25 it is customary to reflect indirect costs associated with the production process.

At the end of each month, expenses from account 25 are closed to account 20 by distributing general production expenses into types of products, works, and services. This distribution is made in proportion to the indicators provided for by the organization’s accounting policy.

Let's turn to the accounting policy settings (“Main” - “Accounting policy”).

In the “Distribution base” column, select an indicator in proportion to which the 25th count will be assigned to the 20th. These may be direct costs, labor costs, and others.

At the same time, some organizations need the costs of departments, for example, Shop No. 1 to be distributed relative to wages, and Shop No. 2 - according to the planned cost of production.

This setting can be made by clicking on the link “Special distribution rules - not installed.” The setup will look like this:

We've sorted out the accounting. In tax accounting, the distribution of costs occurs by setting up the list of direct costs, which we discussed above.

Let's look at an example. Let us establish in the accounting policy the basis for the distribution of indirect costs of the 25th account - wages. We will not fill out any special distribution rules.

Then we enter the costs for account 25.

To do this, go to the “Purchases” section and select the “Receipts (acts, invoices, UPD)” item. In the window that opens, click on the “Receipt” button and from the drop-down menu click on “Services (act, UPD).”

In the new document, we will enter the data from the act: number, date, name of the counterparty, contract. Then we will add line c to the tabular part of the document and assign it to account 25. Let's review the document.

Before moving on to closing the month, let’s take a look and analyze the cost distribution base. We will create a balance sheet for account 20 with selection under the cost item “Payment” by department. To do this, go to the “Reports” section and select the “Account balance sheet” item.

In the report window that opens, set the period and select the score 20, and then click on the “Settings” button. On the first tab “Grouping” we will set the “Division” flag, and on the “Selection” tab we will indicate “Cost Items - equals - Payroll” and generate a report.

It turns out that the costs on account 25 will be distributed on account 20 in the proportion of 1/3 and 2/3. Let's go to the "Operations" section and select the "Month Closing" item.

In the window that opens, select the month we need and click on the “Close the month” button. When all processing steps are completed (the font turns green), click on the operation “Closing accounts 20, 23, 25, 26” and in the new window select “Show transactions”.

In the postings we will see that the amount of costs on account 25 (in our example, 20,000 rubles) was distributed among the workshops in proportion to the accrued wages. This is easy to check; you need to divide 20,000 rubles by 3 to get the amount for Workshop No. 1 and multiply by 2/3 to calculate the amount for Workshop No. 2.

Please note that in tax accounting these amounts became a temporary difference. This happened due to the fact that we did not set up “Taxes and reports”, namely “List of direct expenses”. Therefore, the program closed account 25 as indirect expenses to account 90.08.1.

In order for the program to close account 25 in tax accounting, as well as in accounting, go to the “Main” section and select the “Taxes and reports” item.

In the window that opens, go to the “Income Tax” tab and follow the link “List of direct expenses”.

Let's add a new line in which we indicate that costs with the type of expenses in tax accounting "Other costs" are classified as direct. This setup will look like this:

Let's repeat the month-end closing and analyze the transactions.

There are no differences between accounting and tax accounting; costs are distributed in proportion to wages in both accounts.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Closing account 26 – postings:

- D 26 K 02 – reflects the accrual of depreciation on fixed assets for non-production purposes.

- D 26 K 10 – reflects the write-off of inventories for management needs.

- D 26 K 70 – reflects the accrual of salaries for the company administration.

- D 26 K 68, 69 – reflects the accrual of taxes and fees.

- D 26 K 94 – reflects the write-off of the shortage of inventories without identifying the culprits.

- D 20, 21, 29, 90 K 26 – reflects the write-off of general business costs for main production, semi-finished products, servicing, and cost.

How does account 26 correspond with other accounts?

It corresponds with other accounts in the chart of accounts, both in debit and credit. Basic debit entries:

Dt26

Dt26

Correspondence with loan accounting accounts:

Kt26