Transport tax rates in the Kostroma region

Transport tax benefits in the Kostroma region

The procedure, rates and deadlines for paying transport tax in the Kostroma region for 2019-2020 are established by the Law of the Kostroma Region dated November 28, 2002 No. 80-ZKO “On Transport Tax” (with appropriate amendments in force in 2021). It applies to all cities in the region. The administrative center is Kostroma. Large cities and towns in the region: Bui, Sharya, Nerekhta, Volgorechensk, Galich, Manturovo, Vetluzhsky, Neya, Krasnoe-on-Volge, Makaryev, Soligalich, Chukhloma, Ostrovskoye, Ponazirevo, Sudislavl.

Procedure and deadlines for paying transport tax in the Kostroma region

Taxpayers pay tax at the location of the vehicles.

taxpayers-organizations pay advance tax payments calculated at the end of each reporting period in the amount of one-fourth of the product of the corresponding tax base, tax rate and tax benefits. Tax reporting periods for taxpayer organizations are the first quarter, second quarter, third quarter, after which taxpayers make advance tax payments no later than May 1, August 1 and November 1

Payment of tax based on the results of the tax period by taxpayers who are organizations is made no later than February 2 of the year following the expired tax period. For more information about the procedure for paying taxes by legal entities, read the article at the link.

Starting with the payment of tax for the tax period 2021, the tax must be paid by taxpayers-organizations no later than March 1 of the year following the expired tax period. Advance tax payments are subject to payment by taxpayer organizations no later than the last day of the month following the expired reporting period.

From 01/01/2021, tax returns for transport tax are not submitted to the tax authorities for the tax period of 2021 and subsequent tax periods.

Important. In connection with the measures taken to combat the spread of coronavirus infection, the Government of the Russian Federation adopted Resolution No. 409 dated 04/02/2020 “On measures to ensure sustainable development of the economy.”

In accordance with this resolution, for organizations and individual entrepreneurs engaged in areas of activity most affected by the worsening situation due to the spread of the new coronavirus infection (the list was approved by Decree of the Government of the Russian Federation dated April 3, 2020 No. 434), and included as of 1 March 2021, in accordance with the Federal Law “On the Development of Small and Medium-Sized Enterprises in the Russian Federation” in the unified register of small and medium-sized businesses, the following deadlines for payment of advance payments have been established:

- for the first quarter of 2021 - no later than October 30, 2020;

- for the second quarter of 2021 - no later than December 30, 2020.

For reference. Transport tax for 2021 is paid by organizations until March 1, 2021

Citizens pay transport tax on a car based on a tax notice sent by the tax authority.

Deadline for payment of transport tax by individuals

Starting from 2021, the deadline for paying car tax for individuals has changed - now the tax must be paid before December 1 (previously, the payment deadline was set until October 1).

Individuals must pay transport tax in the general manner no later than December 1 of the year following the expired tax period. That is, the car tax for 2021 must be paid by December 1, 2021, for 2021 by December 1, 2021, and for 2021 by December 1, 2022. If December 1 is a non-working day, the payment deadline is postponed to the next working day.

The deadline for paying transport tax on a car in the Kostroma region in 2021 is until December 1, 2021 (the tax is paid for 2021)

Failure to pay taxes on time will result in penalties being assessed in accordance with current legislation.

Transport tax rates in the Kostroma region

For a year

| Name of taxable object | Rate (RUB) for 2021 |

| Passenger cars | |

| up to 70 hp (up to 51.49 kW) inclusive | 13 |

| over 70 hp up to 100 hp (over 51.49 kW to 73.55 kW) inclusive | 15 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 30 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 45 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 71 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 10 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 13 |

| over 35 hp up to 100 hp (over 25.74 kW to 73.55 kW) inclusive | 26 |

| over 100 hp (over 73.55 kW) | 50 |

| Buses | |

| up to 200 hp (up to 147.1 kW) inclusive | 40 |

| over 200 hp (over 147.1 kW) | 100 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 40 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 65 |

| over 250 hp (over 183.9 kW) | 85 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 23 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 50 hp (up to 36.77 kW) inclusive | 53 |

| over 50 hp up to 100 hp (over 36.77 kW to 73.55 kW) inclusive | 57 |

| over 100 hp (over 73.55 kW) | 200 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 126 |

| over 100 hp (over 73.55 kW) | 400 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 146 |

| over 100 hp (over 73.55 kW) | 500 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 114 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 116 |

| Airplanes with jet engines (per kilogram of thrust) | 110 |

| Other water and air vehicles without engines (per vehicle unit) | 1052 |

FILES

Note to the table: the values are given in the Kostroma region for 2021, 2021, 2021, 2021, 2021, 2021. To select rates for a specific year, use the selector. These rates are applied in the cities: Kostroma, Bui, Sharya, Nerekhta, Galich, Volgorechensk, Manturovo and other settlements of the Kostroma region.

According to data from registration authorities, in the Kirov region the rights of citizens and legal entities for 260 thousand vehicles that fall under the definition of taxable objects are properly formalized. The rules for collecting transport tax from their owners in the region are regulated by Law No. 80-ZKO of November 28, 2002.

Prospects for amendments

Many expected drastic amendments in 2021, but they never happened. But the question of what might still happen worries many. And then about the forecasts.

Many say, including in the State Duma, that it would be more expedient to replace the fuel tax with an excise tax, which all motorists already pay when purchasing gasoline. This fee should also be used for the development of highways. And this is quite logical.

Such proposals are justified by the fact that each driver will pay money in proportion to how often the car is driven and the roads are used. But in order for the TN to be abolished, the excise tax must be raised quite substantially, which will greatly increase the cost of fuel.

But for now these are just discussions. Maybe there will be some adjustments already in 2021, we just have to wait.

Similar articles

- Calculation of car tax from 2018

- Increasing factor: transport tax

- Calculation of transport tax 2017

- The current increasing transport tax coefficient

- Transport tax when selling a car

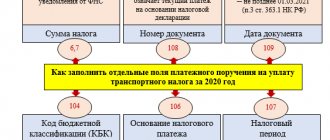

Tax calculation and payment deadlines for organizations

For legal entities, transport tax is calculated separately for each vehicle owned by the organization. The legal entity independently calculates the tax. Payment is made in installments - advance payments are transferred throughout the year at the end of each quarter. To determine the amount of the advance, the tax base is multiplied, the number of months in the reporting period during which ownership is registered, as well as the accepted rate of 1/4 of the value established by law.

Advance payments are made before May 1, August and November. The final payment must be made by February 2 of the following year.

Deadline for payment of transport tax for legal entities in 2021:

- for 2021 - no later than March 1, 2021

- for the 1st quarter of 2021 - no later than May 1, 2021

- for the 2nd quarter of 2021 (6 months) - no later than August 1, 2021

- for the 3rd quarter of 2021 (9 months) - no later than November 1, 2021

- for the 4th quarter and the whole of 2021 - no later than March 1, 2022

Features of payment and accrual with adopted amendments

TN must be entered by everyone without exception, regardless of whether the car is used or not. And it was precisely this calculation algorithm that disappointed many, since the car could simply be sitting in a garage, no longer in satisfactory technical condition, but you still need to pay for it.

Car owners were expecting that such wishes would be taken into account. But the transport tax changes from 2021 do not include gradation based on the use of the vehicle. Everyone has paid and will continue to pay.

Also, many hoped that on the issue of “2018 transport tax changes” the rates in the regions would level out and become more equal, but in fact no such amendments were adopted. But the increasing coefficients have changed.

Table - Transport tax 2021 changes, increasing the coefficient

| Vehicle cost | Age, number of years | Coefficient in 2017 | Coefficient in 2018 |

| From 3 to 5 million rubles | 2-3 | 1,1 | 1,1 |

| From 1 to 2 | 1,3 | ||

| Up to 1 | 1,5 | ||

| From 5 to 10 | Up to 5 | 2 | 2 |

| From 10 to 15 | From 5 to 10 | 3 | 3 |

| From 15 | From 10 to 15 | 3 | 3 |

Thus, the cost of the vehicle for which such an increasing indicator is used has not changed and starts from 3 million rubles. The amendments affected only vehicles whose estimated value is in the range from 3 to 5 million rubles.

It is important to note: such increasing criteria are not applied to all vehicles whose price exceeds 3 million. The list of such cars is constantly updated on the website of the Ministry of Industry and Trade.

The most interesting question arises: do the changes to the car tax in 2021 provide benefits for specific payers? Oddly enough, yes. So, starting from 2021, owners of freight transport are exempt from TN. This law was adopted by the State Duma. The norm will apply to trucks weighing more than 12 tons. TN and owners of agricultural machinery are also exempt from enrollment in the regional budget. These measures are aimed at reducing the tax burden on this category of persons. Since owners of precisely these two categories have long been paying not only the TN itself, but also a fee for compensation for the damage they cause to the road surface.

Regarding benefits, it is impossible to say in general for the entire Russian Federation. Since the 2021 transport tax changes in Moscow will be one, and in St. Petersburg will be different. Each region can approve its own list of beneficiaries. But in general, benefits are provided for the preferential category for vehicles with low engine power - a maximum of 100 horsepower.

Rules and deadlines for paying taxes for individuals

Citizens pay the entire tax period – a year – at once. Upon completion, independent calculations are not required; it is enough to wait for a notification from the Federal Tax Service. The document displays a list of taxable objects, the period of ownership, as well as the amount to be paid. If there are doubts about the correctness of the calculations, you can multiply the given figures by the tax rate established in the region.

The payment deadline for these notices is December 1.

Deadline for payment of transport tax for individuals in 2021:

- for 2021 - no later than December 1, 2021

- for 2021 - no later than December 1, 2022

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

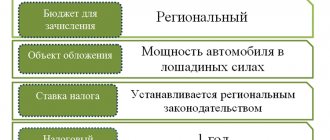

Transport tax: highlights

What is transport tax (TN)? From the very name it becomes clear that this is the payment that is charged to everyone who owns such a facility. According to the current Tax Code, it is paid by all those to whom cars are registered. In this case, the status of the person is not important: it is an individual or a legal entity.

Transport tax calculator in Moscow and the Moscow region

In this regard, nothing has changed, and the change in car taxes in 2018 did not lead to a significant reduction in those entities that must pay it. Also, such amendments did not specifically affect the categories of vehicles for the ownership of which such a fee should be charged. True, some amendments have been made. But more on this a little later.

The amount of such payment is calculated in accordance with the law. The general algorithm is as follows: the base is multiplied by the tax rate established for a specific vehicle, as well as by the increasing factor, if it is provided in each specific case.

Conveniently, individuals do not calculate such a fee on their own, which relieves them of responsibility for incorrectly calculated and paid TN. The calculations are made by the Federal Tax Service itself based on the data provided to them by the state vehicle registration authority.

When determining the base itself, the following car indicators are taken into account:

- The power of the engine itself;

- Vehicle age. It is not the age of actual operation that is taken into account, but from the date of release;

- For air transport, thrust is also taken into account, and for water transport, capacity is also taken into account.

But such characteristics are taken into account when determining technical parameters, and the size of the increasing factor depends on the estimated cost of the vehicle and the year of its manufacture.

Also speaking about TN, it is important to note: such a fee is regional in nature, the rates are set by the regions, and not by the Government of the Russian Federation. Revenues should be accumulated in the regional budget and used to repair road surfaces and ensure road safety.

Transport tax when selling a car

Benefits for individuals

Partially or completely exempt from tax:

- Heroes of the USSR, Russian Federation, Labor, holders of the Order of Glory;

- liquidators of the Chernobyl accident, and citizens affected by radiation during the emergency;

- disabled people;

- adoptive parents, as well as family-type orphanages;

- citizens who have reached retirement age calculated according to the rules in force as of December 31, 2018;

- residents of rural areas who own self-propelled vehicles and caterpillar vehicles;

- guardians of disabled children.

FILESOpen the table of transport tax benefits in the Kostroma region

Preferential category for transport tax

As for the preferential category, it also remained the same.

Before paying transport tax, you need to inquire whether the vehicle may be in the group of beneficiaries (exempt from paying tax). This issue is regulated by the Tax Code of the Russian Federation (Article 358). Here is a list of vehicles for which you do not need to make deductions:

- Boats with oars (all without exception).

- All motor boats (power less than 5 hp).

- Personal transport of disabled people (if the car is a passenger car and received through social protection, and its power is up to 100 hp).

- Fishing vessels (all sea and river).

- Cargo and passenger vessels intended for transportation (river and sea, registered by private entrepreneurs or legal entities).

- Agricultural vehicles (combines, tractors and other special vehicles for agricultural purposes; they must be used for their intended purpose, and their owner must be an agricultural enterprise).

- All transport (if it is registered with executive authorities).

- Any transport (if it belongs to paramilitary structures).

- Stolen cars (the vehicle must be officially wanted).

- Transport belonging to medical services (helicopters and airplanes).

- All vessels (if they are included in the international register of the Russian Federation).

It is important to remember that if the owner of the car for some reason does not drive the car, the car is not “running” (being repaired), then the vehicle is still subject to taxation. If you do not plan to use the car in the near future, it is better to deregister it

Why the Russian government did not abolish the transport tax in 2018

A transport tax was introduced in our country in 2003. However, it soon became clear that this tax payment had much more negative aspects, because even those people who practically do not use their vehicle are required to pay large amounts of tax.

At the same time, we should not forget that now the excise tax on gasoline also includes a portion that should go towards road repairs. Therefore, in fact, Russians pay double tax, and it is not surprising that they do not like this situation at all.

However, the transport tax for 2021 will remain unchanged, because the authorities believe that the loss of almost 150 billion rubles, which this tax brings annually, could have a detrimental effect on the already poor state of the Russian economic system.

Based on the information described above, we can say for sure that the information regarding the fact that the transport tax may be abolished in 2021 is untrue. However, the authorities do not rule out that the system for calculating transport tax may be changed, or an alternative tax will be introduced.

Tax amnesty for vehicles in 2021

According to the law adopted last year, if the owner of a vehicle had a transport tax debt in the period from 2015 to 2021, then a recalculation will be automatically performed for him and the debt will be cancelled.

There is no need to go anywhere special. If the motorist paid all the bills on time and did not develop a debt, then Law No. 436-FZ does not apply to him. That is, the return of funds from the budget is not possible. Also, Law No. 436-FZ applies only to individuals and individual entrepreneurs.

Legal entities will still need to pay off the debt, if any. Since Putin only gave an amnesty for this type of taxation, it is necessary to understand the timing of payments in 2021. For example, payment for 2021 must be made by December 1, 2018. You can calculate the tax using a specific calculator on the Federal Tax Service website.