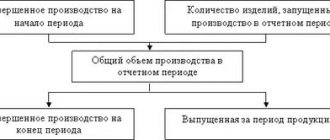

Formula for work in progress standard

Notation in formulas

:

WIP

– work in progress standard

Naverage daily

– volume of average daily output in monetary terms

t

– duration of the production cycle

k

– cost increase factor

Nyears

– volume of annual production in monetary terms

WorkDay

– the number of working days per year according to the enterprise’s work schedule

Co

– initial costs for launching the product into production

Sp

– total production cost of the product

Explanation

.

The volume of work in progress is equal to the average daily cost of manufactured products, multiplied by the duration of the production cycle and by the cost increase factor. (Formula 1)

Each of the multipliers below will be considered separately, and the disadvantages of this formula will also be indicated.

Vote:

The article was published in the journal "Economist's Handbook" No. 9 September 2021. All rights reserved. Reproduction, subsequent distribution, broadcast or cable communication, or bringing to the public attention of articles from the site is permitted by the copyright holder only with a mandatory link to the printed media indicating its name, number and year of issue.

There is a general methodology for calculating the standard of own working capital for work in progress. Depending on the nature of the activity of an industrial enterprise, there are features of its application. For example, for an enterprise with a seasonal nature of work, it is necessary to calculate the monthly working capital standards for work in progress.

To calculate the standard of own working capital for work in progress, it is necessary to determine the standard of working capital for work in progress and the volume of one-day costs for production.

The rate of working capital is determined based on the duration of the production cycle and the rate of increase in costs.

The production cycle time includes the time spent on:

- direct processing process (technological stock);

- waiting for processed products at workplaces (transport stock);

- the presence of processed products between individual operations and individual workshops due to differences in the rhythms of equipment operation, etc. (working stock);

- the presence of products during mass production in the form of safety stock in case of interruptions (safety stock).

The period during which processed products are in transport, working and safety stocks is the waiting time for products in the production process, as opposed to the time of direct processing .

Let's consider an example of calculating the duration of a production cycle (Table 1).

So, the average duration of the production cycle is 14.08 days (Tav = 0.52 × 16 + 5 × 0.27 + 21 × 0.21).

To determine the rate of working capital for work in progress, in addition to data on the duration of the production cycle, it is necessary to know the degree of readiness of the products. It is reflected by the so-called cost increase coefficient . At enterprises where processing costs are uniform, the cost increase coefficient (Rnar) is determined by the formula:

Rnar = (Ce + 0.5 × Sp) / (Ce + Sp), (1)

where Ce is the costs incurred at a time at the beginning of the production process;

Sp - subsequent costs until the end of production of products.

For example, if the monthly costs according to the plan are 3,200 thousand rubles, including one-time costs of 2,600 thousand rubles, and subsequent costs of 600 thousand rubles, then the cost increase coefficient will be equal to:

(2600 thousand rubles + 0.5 × 600 thousand rubles) / (2600 thousand rubles + 600 thousand rubles) = 0.906.

If costs increase unevenly, then the coefficient Rnar is determined according to the graph of the sequence of increase in costs for the main products. In our example, the rate of working capital for work in progress (NAWP), defined as the product of the average duration of the production cycle in days and the cost increase factor, will be

14.08 days × 0.906 = 12.76 days.

The working capital standard for work in progress is defined as the product of the cost of one-day expenses according to the cost estimate for production and the working capital standard.

If the monthly cost estimate for the plan is 3,200 thousand rubles, then the one-day expense is 106.6 thousand rubles. (3200 thousand rubles / 30). In this case, the standard for work in progress (WIP) will be equal to:

106.6 thousand rubles. × 12.76 days = 1360.22 thousand rubles.

The general formula for calculating the standard of working capital for work in progress (NVWIP) is as follows:

NVNZP = (C × Tav × Rnar) / T, (2)

where C is the cost of production of products for the period being calculated (month, quarter, half-year, etc.);

T - duration of the period in days (month, quarter, half-year, etc.);

Tav — average duration of the production cycle, days.

The working capital standard for work in progress in certain industries can be calculated by other methods, depending on the nature of production. Let's consider this situation. Let's take an enterprise with a pronounced seasonal nature. The main peak of sales and production occurs in May–September. The production plan is presented in table. 2.

As with any manufacturing enterprise, there are limitations on production capacity, in this case on the production of blanks. The maximum possible operating time of equipment at the procurement site is 600 hours.

Accounting

During the reporting period, the cost of finished products (work performed) is formed by the following transactions:

Debit 20 (23, 29) Credit 10 (02, 05, 23, 25, 26, 70, 69...) – costs of production (work performance) are written off.

As finished products are released (work is completed), the costs accumulated on account 20 are written off:

- debit account 43 (account 90), if the organization keeps records of actual costs;

- to the debit of account 43 (accounts 90 or 40), if the organization records costs according to the standards:

Debit 43 (40, 90) Credit 20 – the cost of finished products (work performed) of the main production delivered to the warehouse is written off.

As finished products (work are performed) are produced by auxiliary or service production (farms), write off their cost from the credit of account 23 or 29. Depending on who their consumer is, credit them to the debit of the accounts for recording production costs or financial results (Instructions for chart of accounts (accounts 23 and 29)). For more information, see:

- How to reflect the costs of auxiliary production in accounting;

- How to reflect the expenses of service industries and farms in accounting.

The cost of balances of raw materials and materials not written off to the cost of finished products (work performed) (debit balance on accounts 20, 23 and 29 at the end of the reporting period) is recognized as the cost of work in progress.

Cost increase factor

Cost escalation factor formula

shown in the figure above (Formula 3). Let us first consider the economic meaning of calculating this coefficient.

The accumulation of production costs does not begin at all from “zero”. No one will begin the production process, at a minimum, without first purchasing raw materials, materials or components that are subject to further processing. That is why many authors mistakenly designate the amount of material costs as initially accumulated costs. In fact, materials are involved in the production of a product gradually, as it is produced (assembled), and the initially accumulated costs may include, for example, design documentation if we are dealing with individual production.

At the point when production is completed and the semi-finished product has become a finished product, all costs that are subject to accumulation are collected as the production cost of the product (the top point of the schedule).

If we return to the formula for calculating work in progress (Formula 1), then to calculate the monetary equivalent of the cost of work in progress, the assumption is made that production costs increase evenly, so if you find the average cost of a product in work in progress, you can calculate the entire volume of work in progress.

Since we have reduced the problem to finding the average value on the cost increase graph, we can now explain Formula 3 ( cost increase coefficient

). To the initial accumulated costs at the time of production of the product, we add exactly half of the difference between the full and the original cost of the product. Thus, we find ourselves exactly at the point indicated on the graph. Dividing the obtained value by the total production cost of the product, we obtain the required coefficient in relation to the cost for calculation using Formula 1.

Liquidity management | Course Description | Tests (1)

What are the standards for fixed assets in inventories or work in progress?

Any working capital standard (hereinafter - OS) is a characteristic that reflects the optimal value of fixed assets in the form of enterprise assets (represented by inventories or work in progress), which, on the one hand, is sufficient to maintain a continuous production cycle, on the other hand, is minimal in terms of expenses for the purchase and maintenance of these assets.

In the context of inventories and work in progress, the economic role of the working capital standard will be to determine the required volume of fixed assets based on the objective characteristics of the business model that have developed at a certain point in time (recorded in a certain period).

These characteristics can be presented, for example:

1. For MPZ:

- cost of assets;

- dynamics of asset consumption;

- duration of the asset processing cycle in production;

- the degree of reliability of supplies of goods and materials (for example, in the context of the duration of possible delays in deliveries, the likelihood of supply interruptions).

2. For work in progress items:

- the cost of production of finished goods (the production of which at a certain stage forms objects of work in progress);

- duration of the production cycle;

- the ratio of the value of production costs for the production of work in progress objects to the cost of the finished product.

Later in the article we will look in detail at how the specified characteristics of the business model influence the determination of the value of standards for working capital in inventories or work in progress.

But first of all, let’s determine how these standards can be used in practice from the point of view of enterprise managers making management decisions.

Results

The standard for working capital in inventories, as well as the standard for working capital in work in progress, are among the key criteria for assessing the effectiveness of an enterprise’s business model. The lower they are, the more efficient production can be considered.

You can get acquainted with other significant economic indicators that characterize the efficiency of an enterprise in the articles:

- “Determining return on equity (formula)”;

- "Ratio of accounts receivable and accounts payable."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rationing of working capital (concept, essence, objectives)

Every enterprise has working capital (WCA), because they are simply necessary for carrying out daily activities. Security services are required to organize efficient uninterrupted supply, production, sales, as well as settlements, payment of wages, etc.

Actually, production efficiency is ensured by the optimal volume of obs. We are talking about a certain “golden mean”, when their number is minimal, but sufficient for the adequate functioning of production. And, importantly, it does not lead to such extremes as rising costs, the formation of excess reserves, freezing of accounts, etc.

Take our proprietary course on choosing stocks on the stock market →

training course

Establishing a minimum volume of obs, which is constantly required to carry out normal household activities. activities and is called rationing. English – valuation of current assets.

Enterprises independently develop standards (standards) for each element of Obs. As a rule, they are used for a number of years. But if necessary, the developed standards (standards) are clarified. For example, when technologies, production volumes, demand, credit policy and other components change.

Important!

The consumption rates for ObS developed by the enterprise are calculated in days. The norm calculated in monetary terms is the ObS standard. They are established: for a quarter, a year or a longer period.

Rationing affects the efficiency of the enterprise, as well as the stability of its financial position. Based on this, the management of the enterprise must productively manage not only material and financial resources, but also safety equipment and inventories.

An irrational reduction in OSA can lead to disruptions in production, product release and, as a result, to a decrease in profits. And this, in turn, negatively affects financial stability. An excessive, unjustified increase in the volume of fixed assets (raw materials, materials, inventories, etc.) leads to the freezing of any funds, which prevents their investment in production.

Methods for assessing work in progress

Work in progress can be assessed:

- at the cost of raw materials, materials and semi-finished products;

- by direct cost items;

- at actual or standard cost.

The chosen method for assessing work in progress must be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

This procedure is provided for in paragraph 64 of the Regulations on Accounting and Reporting.

For information on valuing work in progress when calculating income tax, see How to estimate the value of work in progress in tax accounting.

Methods for rationing working capital

So, the enterprise independently makes a decision on standardization of safety equipment and determines the need for them for the corresponding period. It also sets the planning frequency and selects calculation methods. For standardization purposes, several methods are used. Let us consider them further in detail.

Analytical method

It is used when the structure of the ObS is dominated by production. stocks. The essence of the method comes down to determining the standard for the actual volume of obs for a specific period and taking into account ongoing changes in conditions and volume of production (supply).

Coefficient method

Provides for dividing OS elements into groups. One of them depends on changes in production volumes and involves determining the need for safety equipment in an analytical way. The calculation is made taking into account their value in the previous period and the expected growth of production volumes.

The second group includes all OBS that do not depend on any changes in production volumes. This includes, for example, subsequent expenses. Rationing of OBS is carried out according to the actual average balances of the previous period.

Direct counting method

Calculating the need for a safety system using this method is quite cumbersome, since it is carried out for each element of the safety system separately. The following are subject to rationing:

- prod. stocks;

- money kept in the cash register;

- finished products in warehouses;

- expenses of subsequent periods;

- work in progress.

But the result is the most accurate. The method is used by new enterprises that have practically nothing yet. That is, there are no statistics, no full-fledged production. programs, the production process has not been established, etc.

Experimental laboratory method

The optimal method for chemical manufacturing, mining, construction. Everything happens in laboratories. First, the required measurements are made on OBS and product volumes, then consumption rates are determined. Within the framework of the applied method, the most accurate results are selected and the average value is calculated using a standard mathematical method.

Reporting and statistical method

This method is used to determine individual and group consumption rates of raw materials, materials, as well as fuel and energy resources. Based on the study of statistics from accounting. reporting. Information about the actual expenditure of resources for research and calculations is taken for the previous (base) period.

Average daily production

The average daily output is found as the quotient of the annual output volume and the number of working days during which the enterprise operates (Formula 2). Moreover, the number of working days depends on the individual operating mode of a given, specific enterprise.

Let's assume that there are two enterprises with a production volume of one million dollars per month. Moreover, one works seven days a week, and the second five. As a result, in April the first average daily output will be equal to

1,000,000 / 30 = $33,333

and the second one

1,000,000 / 21 = $47,619.

As you can see, the operating mode of the enterprise radically affects the calculated average daily output.

The main pitfall of this calculation method lies in the very assumption that the enterprise produces products rhythmically and evenly. In all my many years of experience managing the finances of large enterprises, this has never happened (!). What follows from this? It’s very simple - at the time of peak production, there simply won’t be enough working capital and you’ll stop production! It’s like a joke about the “average temperature in the hospital” - some of the patients are in the morgue, and some are +42.

When planning the required amount of financial resources, it is necessary to take into account precisely the “peak” periods of production and accumulate financial resources in a timely manner. Teachers often do not explain these nuances to students and focus their attention on solving problems that distort the real state of affairs and have little relation to reality.

More found about the cost increase factor

- Planning of current production assets of an enterprise Khj cost increase coefficient - the ratio of the average cost of a product in work in progress to the total amount of production costs

- Sources of formation and methodology for calculating the need for working capital K coefficient of increase in costs in work in progress 4 You can calculate the standard of current assets for work in progress

- Methods of regression analysis when planning and forecasting the need for working capital K N coefficient of uneven increase in costs defined as K N MZ S – MZ 2 2, where

- Problems of the financial condition of diamond cutting and jewelry enterprises in the region Secondly, the increase in the total volume of production of jewelry products from Yakut manufacturers leads to an expansion of the sales network. However, the expansion of ... Yakut Diamond Company LLC, which is associated with the company’s cost management strategy, therefore it is incorrect to take this indicator into account. The highest profitability indicator for net profit has LLC... Fifthly, the value of the ratio of competitors' receivables and payables indicates that the organization of production activities in

- The influence of human capital on labor productivity in the post-crisis period Many researchers of economic development processes note that if we consider the long-term period, the most effective are the costs of human capital. Thus, the return on investment in human capital compared to ... At the same time, there is an increase in the influence of the level of education of the employed population and the decline in the impact of the capital-labor ratio on productivity Based on ... Elasticity coefficients of labor productivity were established by the level of education of the employed population of Russia in 2008-2011 Presented by temporary

- Formation of the financial policy of the organization, taking into account the stages of the life cycle Internal production and financial and economic conditions are stable, although there is an increase in extensive factors in the state and use of resources High production risk is explained in particular by ... M V Kuranov 8 to assess the financial condition of the organization uses such criteria as the dynamics of profit from sales share of own funds current liquidity ratios provision of reserves with sources of autonomy formation The work of VL Pozdeeva 14 in ... GK Talya 1 characterizes the features of the formation of costs and product costs at each stage of the life cycle. The inception stage is characterized by high initial investment

- Working capital management of a business entity as an important direction of its short-term financial policy Other inventories and costs 52,333 26.18 124 -10.09 Value added tax 36 ... However, a shortage of inventories can cause a reduction in production volume and a drop in profits, which may be due with rising prices for urgent supplies of resources, reduction in production due to downtime, increasing sensitivity to rising prices for resources, also affecting the deterioration of financial condition Taking this into account... Return on current assets % -9.1 -15 Current liquidity ratio 0.75 0.72 Provision of own working capital -0.33 -0.39 Tendency towards a negative value

- Financial security of the company: analytical aspect In the conditions of a modern market economy characterized by a high level of financial risks, changes in factors of the external and internal environment of the functioning of organizations and an increase in threats to their financial interests are one of the current areas of economic analysis based on management information... To calculate this indicator, all production costs and sales of products are divided into variable materials, components, tools, wages... In the absence of changes aimed at improving this situation, the financial security of the company may be at risk. The current liquidity ratio of 11 demonstrates the insufficiency of funds for the urgent repayment of short-term obligations to a significant extent

- A model for the valuation of capital assets as a tool for assessing the discount rate T 17, 2021 In modern conditions of increasing risks in the national and global economy, issues of correct investment assessment become relevant In this... Rf - risk-free return β - beta coefficient ERP - premium for investing in shares Let's consider the individual components CAPM model Risk-free ... There is a certain combination of complementary factors of production at which the maximum volume of output per unit of cost is achieved 6 therefore, other things being equal, there are no prerequisites for the profitability of small companies

General standard of working capital (concept, calculation formula)

In simple words, the standard is the minimum volume of obs that the enterprise must constantly have. There are specific and general standards. The first ones are established according to individual elements, articles of the OSB. The second, general, or aggregate, is the sum of all particular standards.

Thus, NORtotal (general standard) is a set of private standards. Expressed in money (Russian rubles). Calculated upon completion of rationing. Its value is calculated as follows:

NORtotal=NORpz+NORgp+NORnp+NORbr (1)

The formula uses abbreviations of various standards: NORpz - production. stocks, NORgp – finished products; NORnp - incomplete. production, NORbr - future expenses.

Inventory standard

To calculate NORpz you need: SRdn (average daily consumption) in Russian. rub. and Нз – the stock norm for the corresponding element of the ObS in days. Calculation - according to the generally used formula:

NORpz=SRdn*Nz (2)

The stock norm (Nz) is the totality of the current (Nt), insurance (Nst), transport (Ntrans), technological (Ntech), preparatory (Npod) stock.

Current stock

This is the main stock on which the continuity of the production process between deliveries depends. Ztek norm is half the interval between two deliveries. It is self-evident: its value is affected by the frequency of deliveries and the volumes of resources consumed. The maximum size of the Ztek is determined by the formula:

Ztek=SDS * PMP (3)

Abbreviations: SDS – average daily requirement for the corresponding material, PMP – interval between deliveries.

Insurance (warranty) stock

Provided for in case of short deliveries, supply disruptions, etc. unforeseen circumstances. The Zstr norm is set within 30–50% of the Ztek norm. The amount of safety stock (SAS) depends on the location of the supplier and failures. It can be calculated using the following formula:

Zstr=Norma Zstr*SDP (4)

Abbreviations: ADP – average daily requirement for the corresponding material.

Transport stock

It is formed when there is a discrepancy between the timing of document flow, payment of fees and the time spent in transit of the delivered cargo. It is calculated in two ways based on actual data for the past period.

Direct counting method. It is used when there is an insignificant range of resources coming from a small number of suppliers. It is assumed that payments arrive and are paid before the cargo arrives. Accordingly, the amount of Zt (transport stock) is equal to the interval between payment and arrival of the cargo.

Analytical method. Suitable for significant product ranges and when there are many suppliers. The cost norm is determined based on last year's data on the balances of inventory items in transit (at the beginning of each quarter), minus the price of resources in transit beyond the deadlines.

Technological stock

This stock (Ztech) is formed during the preparation of materials (raw materials) for production. Taken into account when not included in production. process. This includes analysis as well as testing in laboratories.

Preparatory stock

It is formed when received materials with resources undergo preprocessing. For example, sorting, drying, picking, etc. preparatory operations. When determining the norm of this stock (Zpod), the corresponding industries are taken into account. conditions and time for preparation. That is, the time of unloading, acceptance, documentation, etc. The size of the 3D is calculated using the formula:

Zpod = SDS * PTC (5)

Abbreviations: PTC – duration of the technological cycle (days).

An example of rationing in industrial inventories

Conditional data used in normalization:

- number of suppliers =36;

- delivery cycle = 1800 days;

- Norm Zstr = 35% of norm Ztek;

- SDS (need) = 47 kg;

- cost 1 kg = 47 RUS. rub.;

- Norm Ztech = 10 days.

Task: determine NORpz (standard OBS in production inventories). Costing sequence:

- Material consumption per day: 47*47=2,209 RUR. rub.

- Norm Ztek=1800/36/2=25 days.

- Norm Zstr=25*0.35=9 days.

- The cumulative norm of all stocks: 25+9+10=44 days.

- NORpz = 44 * 2,209 = 97,126 RUR. rub.

How to determine working capital standards for inventories (calculation formula)

The common formula for the working capital standard for industrial inventories has the following structure:

Refinery = SEB × (TEK + STR + TR + TECH),

Where:

Refinery - working capital standard for production inventories;

SEB - cost (cost of purchase, release) of production inventory (in rubles);

TEK - the volume of the current stock (in a given unit of measurement - for example, in tons);

STR - volume of safety stock;

TR - volume of transport stock;

TECH - volume of technological stock.

The oil refinery indicator is thus expressed in monetary terms.

Each of these components of the formula depends on the specifics of the organization of production at a particular enterprise and can depend on a wide range of factors.

1. The SEB indicator corresponds to the actual cost of a specific inventory, everything is obvious here.

2. The TEK indicator (necessary to ensure a full cycle of uninterrupted production) is calculated using the formula:

TEK = SUT × BP,

Where:

SUT is the average volume of consumption of inventory per day;

BP is the duration of the full production cycle in days.

2. The TFR indicator (necessary in case of interruptions in the supply of goods) is calculated using the formula:

0.5 × SUT × RP,

Where:

RP is the expected average difference between the planned and actual delivery time of materials.

3. The TR indicator (necessary in case of delay of a vehicle en route carrying goods from the supplier) is calculated using a similar formula:

0.5 × SUT × ZTS,

Where:

ZTS is the expected average delay of a vehicle from the supplier.

4. The TECH indicator (reflecting the amount of technological losses in production and, as a consequence, the need to replenish the inventories by the corresponding amount) is calculated using the formula:

(TEK + STR + TR) × NORM,

Where:

NORM - established standard for technological losses.

Example

The company produces concrete, and for this it uses a type of concrete material such as sand. Let's agree that:

- the company purchases sand at a price of 2,000 rubles per ton (SEB);

- the full concrete production cycle is 10 days (BP);

- the average daily sand consumption is 3 tons (AD);

- the expected average difference between planned and actual sand supplies is 2 days (DP);

- the expected average delay of the supplier's vehicle in transit is 1 day (ZTS);

- The standard for technological sand losses is 2% (NORM).

We calculate the volumes of reserves:

TEK = 3 × 10 = 30 tons;

STR = 0.5 × 3 × 2 = 3 tons;

TR = 0.5 × 3 × 1 = 1.5 tons.

TECH = (30 + 3 + 1.5) × 0.02 = 0.69 tons.

The standard for working capital in production inventories will be:

Refinery = (30 + 3 + 1.5 + 0.69) × 2,000 = 70,380 rubles.

The standard for work in progress in monetary terms is found using the formula [p.294]

It is necessary to achieve efficient use of working capital at each of the three stages of the procurement, production and sales circuit. Therefore, along with general turnover indicators, it is advisable to determine specific control indicators for the procurement stage - the standard for industrial inventories, for the production stage - the standard for work in progress, for the sales stage - the standard for finished products in the warehouse. [p.212]

Therefore, for this case, the work in progress standard is 80 thousand rubles. is illegal and production should be organized in the form of piece production, not serial production. [p.68]

NNP - work in progress standard [p.74]

Determine the work in progress standard in monetary terms based on the following data. A machine-building plant produces one product in 5 days at a quarterly cost of 80 thousand rubles, another product in 3 days at a cost of 60 thousand rubles. and the third - in 12 days at a cost of 55 thousand rubles. [p.100]

We calculated the standard based on the entire amount of production costs. However, many factories with a long production cycle do not immediately involve the entire mass of auxiliary and other materials into it. The most expensive and labor-intensive processes do not occur immediately. As a result, production costs increase unevenly. Having studied their dynamics, it is necessary to determine the coefficient of increase in costs and, using it, establish a standard for work in progress I according to the formula [p.240]

The standard for work in progress (in days) D in the main production is determined by the formula [p.180]

The standard for work in progress (in days) in auxiliary workshops can be determined in aggregate based on the analysis of reporting data for a number of previous periods [p.180]

Work in progress standard 180 [p.323]

With a long production cycle, the work in progress standard is absolutely necessary. It has not only organizational but also economic significance. Compliance with this standard is important not only for ensuring high production efficiency, but also for the formation of working capital of the enterprise. [p.90]

Standard batch sizes Frequency of repetition in production Duration of the production cycle Standard work in progress + 1 1 [p.396]

The standard for work in progress will be Yn = 4 5 x x 0.8 = 16 million rubles. [p.183]

An important part of the regulated funds is work in progress, the value of which primarily depends on the duration of production of products (production cycle) and the degree of increase in costs. The standard for work in progress is established based on the average daily output, the duration of the production cycle and the cost of production. The longer the production [p.64]

In the balance sheet under consideration, the standard for work in progress is maintained, but its share in the normalized funds is lower, which is mainly due to the increase in stocks of raw materials, materials and finished products. [p.66]

Work in progress at the end of the month is periodically (sometimes once a quarter) calculated based on actual availability (using inventory and standard cost data). Product output is also assessed at standard cost. Therefore, the work in progress standard at the beginning of the month plus the costs of the reporting month minus production and write-offs must always be equal to the work in progress at the standard cost at the end of the month. Such a coincidence of the theoretically derived residual with the actual data should be considered normal. However, there are often discrepancies among enterprises. If we exclude from the discrepancies the shortages and surpluses identified by the inventory of work in progress, then discrepancies will remain due to incorrect accounting of deviations, including incorrect documentation of deviations (for example, the replacement of materials was not properly documented), material was issued for correction of defects without proper assessment in the document, orders were issued for work that was practically not carried out (postscripts), etc. [p.352]

Actual expenses for the maintenance and operation of equipment, shop and general plant expenses are within the approved limits, but there are deviations for certain types of expenses (see p. 110). The actual cost of work in progress balances is reflected in the balance sheet. In our example, the balance of work in progress (balance on the Main production account) as of 01.02 is 77,721 rubles. The balance sheet also reflects the standard for work in progress (required reserve). Let’s say that the standard for unfinished production for a merger is set at 100,000 rubles. In this case, the actual balances will be lower than the standard balances by 22,279 rubles. (100000—77721). [p.116]

The standard for work in progress will be 16 million rubles, i.e. [p.260]

Task 4. Determine the coefficient of increase in costs and the standard of work in progress, if the total value of all costs ZP is 100 thousand rubles, the initial daily costs ZP are 70 thousand rubles. the remaining costs are carried out uniformly, the duration of the production cycle is 6 days. [p.266]

The work in progress standard (WIP) is calculated using the formula [p.231]

The standard for work in progress (based on cost and material costs) is 0.5 (4857 + 1700) 90 x 15 = 546.4 thousand rubles. [p.89]

Standardized working capital includes those types of material assets and costs that are necessary to ensure the uninterrupted operation of the enterprise - inventories, work in progress and self-made semi-finished products, deferred expenses and finished products on salaries (in containers) of enterprises. For each of these groups of working capital, an upper limit for fixed inventories (costs) is established. or working capital standard, i.e. the minimum amount of working capital required by the enterprise. [p.179]

Unfinished production. The standard for work in progress I can be calculated using the following formula [p.209]

The regulated funds are the enterprise's own funds. They are intended to create the necessary reserves in the plant's warehouses, create a stock of semi-finished products and work in progress in production shops, as well as invest in expenses for future years. The standard for normalized working capital is differentiated by year of the five-year plan. Every year, when developing a technical industrial financial plan, the amounts of own turnover are specified [p.323]

As can be seen from the balance shown in table. VI.3, work in progress amounted to 240 thousand rubles at the beginning of the month. and it was less than the standard by 8 thousand rubles. Within a month it increased to 262 thousand rubles. and exceeded the standard by 14 thousand rubles. [p.170]

Each enterprise is provided with its own working capital, which it needs to fulfill the established plan. The standard of own working capital is calculated based on the cost of the minimum required reserves of raw materials, basic and auxiliary materials, fuel, spare parts, low-value and wearable items, containers, work in progress, semi-finished and finished products and the amount of expenses of future reporting periods. The additional need for working capital, arising, as will be shown below, from the normal settlement relationships of the enterprise, is covered by loans from the State Bank. In addition, the State Bank issues loans to enterprises to cover the need for funds necessary to create seasonal reserves of raw materials, fuel and for other temporary needs, if these needs are due to the normal course of production and are not caused by mismanagement. State Bank loans are strictly targeted, urgent and [p.245]

Each enterprise is provided with its own working capital, which it needs to fulfill the established plan. The standard of own working capital is calculated based on the cost of the minimum required reserves of raw materials, basic and auxiliary materials, fuel, spare parts, low-value and wearable items, containers, work in progress, semi-finished and finished products and the amount of expenses of future reporting periods. The additional need for working capital arising from the normal settlement relationships of the enterprise is covered by bank loans. In addition, the bank issues pre- [p.271]

The standard of working capital as a whole for the element Work in progress is equal to the sum of the standards for all n products [p.56]

The standard for work in progress is calculated based on technological data for individual installations. Due to the fact that the vast majority of them are equipped with continuous operation equipment, the duration of the production cycle is short. For this reason, the volume of work in progress is also insignificant. On average, the standard for this article is 1.2-1.5% of the cost of commercial products of the enterprise. [p.265]

The increase in the standards of own working capital is included in the amount determined by the calculation. In the reporting year, the standard was 6,370 thousand rubles. According to the plan, production volume increases by 3.6%; accordingly, the size of stocks of raw materials, auxiliary materials and semi-finished products, work in progress, containers, and finished products should increase in proportion to production volume. The standard was equal to 5,000 thousand rubles, and for the planned year it will increase by 5,000,000 -0.036 = = 180,000 rubles. [p.273]

The rate of working capital is established for each item or group of material resources in days of average daily consumption or in the form of material and monetary unit costs per employee, team (tools, equipment, special clothing, etc.) the percentage of replacement of parts and assemblies during repairs, the rate of increase in costs by work in progress. Based on the norms, the planned amount of standardized working capital, called the standard, is determined. With the established norm, the standard is found as the product of the one-day consumption of material resources in monetary terms by the stock norm in days. The standard is established when drawing up a plan for the financial and economic activities of an enterprise (association) at the end of the planned period for individual items of working capital, taking into account the need for these funds for the production of a certain type of product (work). [p.190]

The basic principle of rationing working capital is linking standards with technical and economic conditions of production. In the new economic conditions, the rights of enterprises (associations) in the field of rationing working capital have been significantly expanded. The enterprise (association) is approved only by the general standard of working capital. The standards for own working capital by type, their increase or decrease are determined and established by the enterprises (associations) themselves and are not subject to approval by higher organizations. In the new economic conditions, the necessary prerequisites are created for the development of scientifically based standards of working capital and the reduction of excess inventories of inventories at enterprises (in associations). To strengthen economic accounting at enterprises (associations), current private standards should be differentiated by individual types of raw materials, basic and auxiliary materials, work in progress, finished products, etc. [p.191]

Then the working capital standard for work in progress [p.215]

From the data in table. 110 it can be seen that in fact the standardized working capital is generally reduced compared to the standard. The reduction was caused mainly by the items work in progress and semi-finished products of own production (RUB 1,046 thousand) and spare parts for repairs (RUB 112 thousand). Both of these are apparently associated with an improvement in the organization of production or with an overestimation of the standard under the first article. Specific reasons can be established through a more detailed analysis of standard calculations. At the same time, for a number of items there is an excess of the standard. The excess is especially large for raw materials - 575 thousand rubles, auxiliary materials - 139 thousand rubles. and finished products - 60 thousand rubles. All this could be caused by an increase in production volume due to exceeding the production plan. Therefore, before comparison, the direct cost standard must be recalculated to the percentage of exceeding the plan. Let's assume that the production plan is 105% fulfilled. Then the standard for raw materials should be (7339-105) = 7700 thousand rubles, for auxiliary materials - 1030 thousand rubles, for finished products - 605 thousand rubles. Comparison of these figures with the actual availability of working capital shows that the norm is [p.211]

The contractor sets a standard for work in progress (approximately 10% of the annual volume of contract work), on top of this - a bank loan, but within the limits of construction and installation work established for each construction project by year of the five-year plan. The loan is provided to pay for construction and installation work and to pay for incoming equipment. [p.200]

In this example, the total amount of quarterly costs for the production of three types of products is 210 thousand rubles, and therefore, in one day 2.33 thousand pyi6. and the work in progress standard in monetary terms will be equal to (210 thousand rubles x 6.57 days)/90 days = 15.3 thousand rubles. [p.240]

N0b.s = N r.3 + Nnp + Ngp + NrbP, where Nprz is the standard for production inventories Nnp is the standard for work in progress Nsh is the standard for inventories of finished products Nrbp is the standard for deferred expenses. [p.161]

Scientific and technical potential 213 Scientific and technical progress 199, 214 Work in progress 56, 92 New economic conditions 174 Normative planning method 74 Working capital standard 52, 53, [p.297]

Working capital standard for work in progress

Work in progress is products that are at the processing stage. For example, at the stage of launching materials and raw materials into production.

As part of the technological process, the enterprise invests in materials, electricity, fuel, and incurs other related expenses. As a product moves through the processing stages, these costs increase. Their value characterizes work in progress.

The standard is determined using the following indicators: OVsds (average daily, planned production volume), PPV (production cycle duration), Knz (cost increase coefficient). Formula for calculation:

NORnp=OVsds*PPC*Knz (6)

Knz characterizes the readiness of products in work in progress. With a uniform increase in costs, the costs are calculated as follows:

Knz=(PMZ+0.5*PT)/SBpl (7)

Abbreviations (in Russian rubles): PMZ – planned costs, PT – other costs, SBpl – cost of 1 unit. planned.

If there is an uneven increase in spending, KZ is calculated as follows:

Knz=SSi/Psi (8)

Abbreviations: CCi – average price of a product in a refinery (work in progress), Psi – production. cost price of the product.

An example of rationing in work in progress

Let's assume there is one product left in the refinery. It is necessary to determine NORnp. Calculation formula: OVsds*PPS*Knz. Conditional data for calculation:

- OVsds=450 100 ros. rub.

- PPC = 4 (production cycle for manufacturing this product).

- Knz (with the same increase in spending) = 0.66: (PMZ + 0.5 * PT) / SBpl =

(850 000+0,5*830 000)/1 900 135.

It follows: NORnp = 450 100 * 4 * 0.66 = 1,188,264 RUR. rub.

Cost escalation factor formula

Cost increase factor = Product cost in work in progress / Product production cost

The cost increase coefficient is used by enterprises when determining the optimal need for working capital for work in progress.

Two methods are used to calculate the cost increase factor:

- when manufacturing products with a uniform increase in costs, the coefficient is defined as the ratio of 100% of one-time material costs and 50% of increasing costs (wages, overhead costs) to the production cost of products;

- with an uneven increase in costs - as the ratio of the amount of increasing costs per unit of a product during its manufacture to the product's production cost times the duration of the production cycle.

The weighted average cost increase coefficient when calculating the standard or optimal need for working capital (working capital) in work in progress for the enterprise or organization as a whole is determined based on the share of each product or group of products in the total production output in the planned (forecast) period.

Working capital standard for future expenses

NORbr is determined using the following indicators:

- PSbp (carryover amount of subsequent periods);

- Rb (upcoming, upcoming expenses in the next year according to the enterprise’s scientific and technological progress plan);

- Rbs (upcoming expenses written off to cost next year).

Formula for calculation:

NORbr=PSbp+Rb-Rbs (9)

Alternatively, you can calculate NORbr in one more way:

NORbr=Rnp+Rpg-Rsp (10)

The formula uses abbreviations for the following expenses: Rnp – at the beginning of the period; Rpg - planned for the year, Rsp - which need to be written off in the plan year.