Cost accounts and their number

Cost accounts in accounting are a list of accounts that collect the costs of a company's business activities with their subsequent transfer to the financial result, and also collect costs for the production of products and work performed.

There are 11 main cost accounts. These include: 20, 23, 25, 26, 28, 29, 44.1, 44.2, 44.3, 90, 91.

In this case, accounts 90 and 91 should not be considered as group accounts, but only their specific subaccounts. For a score of 90, these are 90.2, 90.7, 90.8. For a score of 91 it is 91.2.

As a result, the total number will be 13 accounts. These are - 20, 23, 25, 26, 28, 29, 44.1, 44.2, 44.3, 90.2, 90.7, 90.8, 91.2

It should be noted that each group account from the list can be represented in subaccounts. It depends on the requirements in a particular enterprise for a particular activity. This phenomenon is clearly visible in the chart of accounts, for example for 20 accounts. Let's take, for example, the 1C Accounting and 1C Accounting programs for agricultural enterprises. These are the settings for account 20 “main production”.

20 account in 1C Accounting

20 account in 1C Accounting for an agricultural enterprise

And here are the settings for account 44 – “Sales expenses”

In the 1C Accounting program

Once again - 1C Accounting

So, the minimum number of cost accounts in accounting is 13.

Reflection of shipped goods in accounting

In accounting, the cost of shipped products belongs to the inventory section, where finished products of other types are also reflected. Reflection (according to account 45) is carried out at actual or planned cost, taking into account sales costs.

The moment of receipt of revenue (payment) is recorded by the seller upon shipment of the product with the transfer of ownership of the subject of the transaction. For companies using a simplified taxation system, revenue is recorded after actual payment for the product.

At the time of recognition of revenue, expenses associated with the manufacture and sale of the product are subject to accounting (PBU 10/99; Order of the Ministry of Finance of the Russian Federation No. 119n, December 28, 2001).

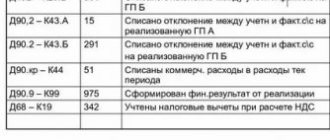

When transferring ownership of a product after final settlement and determining the VAT base after shipment of the subject of the transaction, accounting transactions look like this:

- Debit account 45 / Credit account 41 (shipment of the product based on its actual cost).

- Debit account 45 / Credit account 44 (writing off other expenses incurred on shipment).

- Debit account 90 / Credit account 45 (recognition of the fact of sale after payment).

- Debit account 45 / Credit account 68 (VAT accrual on shipped products).

When ownership changes and its transfer to the acquirer, a sale takes place, and accordingly, receipts and expenses are subject to accounting on the account. 90 based on primary documents (Federal Law No. 402, December 6, 2011).

When selling products for cash, the following posting is made in accounting: Debit account. 50 / Credit account 90.1 , for non-cash payments: Debit account. 62 / Credit account 90.1.

Cost accounts in the chart of accounts, their classification

Cost accounts in accounting can be classified as follows:

The first classification is Types of costs in an enterprise. The variety of cost items and expenses of any company is divided into two types. Some expenses relate to core activities, others - to other expenses. Various accounting accounts are used to record these types of costs and expenses.

Costs and expenses for core activities use our entire list of accounts, except 91.2 Other expenses use only account 91.2

Sometimes a company uses account 84, although it is not a cost account at all. But it is assumed that the company can take into account expenses that, by law, cannot be used for accounting for profit. In this case, they are called “expenses from own profit”.

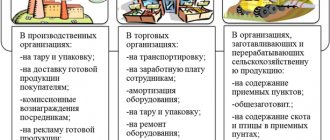

The second classification is the specific type of activity of the company. Whatever the company does, it is based on only four types of activities. For each type of activity in accounting, there is a separate list of cost accounts. There will be one list for production and completed work. For trading enterprises it is different. And for companies providing services - the third. We'll talk more about this later.

Each accounting account, being an accounting tool, contains a number of properties. The account code, as well as its subaccount, determines the purpose of the account and the type of information stored on it. The subconto of the account shows “how in detail” the information is stored. Look at the master list of cost accounts.

A common feature among the accounts will be a subconto that says that the name of the cost item should be indicated in the transactions. For accounts:

— 20 — “Main production costs” — 25 — “General production costs” — 26 — “General business expenses” — 44 — “Distribution costs” — 91.2 — “Other income and expenses”

But for accounts 90.2, 90.7 and 90.8 there is no subaccount that is in any way related to cost items. Because account 90 refers to the formula for the financial result for the main activity. It is often carried out in the context of the names of types of activities - subconto “nomenclature groups”.

Look at completed SALTs for some costly accounts.

Double entry method

The concepts of correspondence of accounts and accounting entries are based on the principle of double entry. The essence of this principle is to record each business transaction twice: as a debit to one account and a credit to another. With non-automated accounting, there were two methods of accounting - memorial and journal-order. Currently, accounting programs allow you to reflect transactions in any convenient form.

From the double entry method, it logically follows that the property of business transactions is to change simultaneously the indicators of both sides of the balance sheet. Most often, typical households. operations produce movements on the “opposite” sides of the balance sheet.

How do expense accounts work in accounting?

The essence of how “cost accounts” work can be understood from its definition at the beginning of the article. It shows that cost accounts work in two directions:

Direction 1: Some accounts collect information about the costs incurred and expenses of the company in the course of its activities. These accounts include: 26 for services, 44.X for trade or production, 91.2 for all types of activities.

Direction 2: Other accounts are used to obtain the cost of products or work performed by the company.

For manufacturing enterprises, a whole bunch of accounts work for this: 20, 23, 25, 26, 28, 29. For companies performing simple work, the list of accounts is simpler and is represented mainly by 20 and 26 accounting accounts.

The essence of the work of accounts in this direction is to “accumulate” the full cost of the costs and expenses incurred by the company, in order to then see the resulting cost of the finished product or work. Accounting account 20 is the final account, where all costs and expenses for manufactured products or work are collected.

Costs are collected according to the names of cost items (sub-accounts of the account). Thanks to this, it becomes possible to generate a detailed report, for example, a balance sheet for an account.

Accounting entries for shipment and sale of finished products

Everything that any enterprise strives for is the very notorious “finished product”. In other words, this is the final product, the result of all previous production processes, a product that has undergone all types of processing, packaged, tested by all types of control and meets the standards. After the technical control department, the finished product “settles” in the warehouse.

Cost Accounts and Activities

Cost accounts in accounting are scattered throughout the chart of accounts. But at the same time, they still have their own grouping, which is revealed in relation to nearby accounts.

For example, the 20th invoices clearly show that they relate to production. For any manufacturing enterprise, we can safely say that its specificity is its production accounts.

However, for companies performing simple work, there are no clearly visible and specific accounts in the chart of accounts. And these will also be 20th counts, only part of them: 20, 26, sometimes 25.

The 26th score will be interesting. He stands, as it were, on the border. On the one hand, it is included in the group of 20 accounts, which relate to production or performance of work. But what if the company does not produce or perform work, but provides services?

For service firms, account 26 will be the most important account where costs and expenses are collected.

What about a trading company? Should he use a count of 26 or 44? Or maybe only 44? (since account 26 strictly refers to services) The answer is: “For trading enterprises, the main account of costs and expenses will be only 44.”

As you can see, accounting for activities has defined its lists of cost accounts. Moreover, each account has its own set of rules for how it should work within itself, as well as in relation to the financial result.

But do not forget that for any type of activity there is a general expense account called “other expenses”. This is account 91, namely, a specific sub-account - 91.2

Look in the table at the list of cost accounts for activities.

| Activities | Cost and Expense Accounts |

| production | 20, 23, 25, 26, 28, 29; 44, 91.2, 90.2, 90.7 |

| provision of services | 26, 91.2, 90.8 |

| trade | 44; 91.2, 90.2, 90,7 |

| execution of work | 20, 26, 44, 91.2, 90.2, 90,7 |

Some features of the sale of the shipped product

The shipment of commercial products is accompanied by a change and transfer of ownership of it. A change of owner takes place in a situation where goods are sold when (Article 223 of the Civil Code of the Russian Federation):

- the product is delivered to the buyer by the seller;

- delivery of valuables to the buyer is carried out by a third-party carrier;

- The transfer of products by the manufacturer is made to the seller directly.

The fact of sale is accompanied by documents (contracts, invoices, acceptance certificates). It is not prohibited by law to use in a contract the moment of changing ownership of the commodity mass upon its receipt or during a certain period, including after making partial payment, immediately at the time of transfer of the product to the buyer’s warehouse. But any condition must necessarily be reflected in the agreement of the parties to the transaction.

Payment for the commodity mass is made by the buyer at the time of receipt or within a certain period agreed upon by the parties. After making the payment, the recipient of the product becomes its full owner.

If money for the delivered product is not transferred within the time period previously agreed upon by the parties, the goods must be returned to the seller. If the payment deadline is missed, the seller has the right to demand the return of the product or payment for it.

For your information! Such conditions are indicated in the agreement of the parties, as well as the criteria for changing the copyright holder of the subject of the contract or the right of disposal by the acquirer before the end of the settlement procedure.

Impact of Cost Accounts on Accounting Areas

The purpose of accounting implies the generation of two main types of reports:

Form No. 1 - “Balance”. The report shows the state of the enterprise at a point in time. Indicators of this state are two types of information: what the company owns (Assets) and debts/liabilities (Liabilities) of the company.

Form No. 2 - “Report on financial results” (profit and loss statement). The report shows Profit/Loss for main and non-core activities for the period.

Accounting areas that are all interconnected work to achieve accounting goals. A change in one area or account will certainly result in a change in another area. Most changes affect the final accounting results. Cost accounts are no exception.

The main “influences of cost accounts” on areas of accounting: 1. Incorrect assignment of a cost item to a specific account. 2. The incorrect formulation of the cost item was chosen, which resulted in an erroneous attribution to the formation of the cost of production. 3. An incorrect or suboptimal method was used to transfer the collected costs to the main production to obtain the full cost of the product or work. 4. Changes in the amounts of primary documents in previous periods when the financial result was calculated.

Results

So, in the article we talked about the purpose of accounting entries, who needs to make them and why, and who is exempt from such obligations, and also gave examples of entries involving various accounting accounts and reminded that the formation of accounting entries occurs only on the basis documents.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Return of shipped products

The purchaser, who discovers upon acceptance of receipt a discrepancy between the shipped products and the terms of the agreement, draws up a report on the identified discrepancies, issues a written claim to the seller, and an invoice with a return note. The second copy of the document is recorded by the consumer in the sales book, the seller enters the received invoice into the purchase book as the right to a tax deduction is formed (letter of the Ministry of Finance of the Russian Federation No. 03-07-15/29, 03/07/2007).

If the return of the defective material occurred in one tax period, the seller makes adjustments to sales (account 90); if the return occurred in the next calendar year, then the cost of the returned object is included in the accounts of non-operating costs as a loss of the past period, which was determined in the reporting period. year (count 91):

- Debit account 91 / Credit account 62 (loss of the past period discovered in the reporting period);

- Debit account 43 / Credit account 91 (restoration of the cost of returned goods, previously written off);

- Debit account 68 / Credit account. 91 (profit of previous years calculated in the reporting year in the amount of VAT paid).

Defects identified before the end of production are accounted for in the main production: Debit account. 28 (manufacturing defect) / Credit account. 20, and defects detected upon completion of production - in finished products: Debit account. 28 / Credit account 43.

For your information! When returning goods, the seller has the right to deduct the VAT amount (Article 171 of the Tax Code of the Russian Federation). A deduction is allowed no later than 12 months from the date of return and in full after reflecting adjustment entries for the return (rejection) of the product.

The amount of VAT sent by the seller to the budget upon sale is deducted for the period in which there are adjustment entries due to returns. In this case, when sending a replacement to the buyer, the seller issues an invoice to him.

If the defect returned in the next tax period, then the profit tax base is subject to recalculation for the period when the goods were sold, or the costs of the cost of the returned product can be attributed to expenses in the form of damage from the defect (Article 264 of the Tax Code of the Russian Federation; letter from the Ministry of Finance RF No. 03-03-05/47, 04/29/2008).

If a defective product can be used in production, perform the following operations:

- Debit account 28 (marriage) / Credit account. 43 (reflection of the cost of marriage);

- Debit account 10 (materials) / Credit account. 28 (posting of the product at the price of possible use);

- Debit account 20 (production) / Credit account. 28.

Therefore, damage from defects will be reduced by the price of a spoiled product suitable for use.

Accounting in the presence of special contract conditions

The right of ownership may remain with the seller even after the actual transfer of the product to the buyer until the occurrence of certain circumstances provided for by the relevant agreement of the parties to the transaction (Article 491 of the Civil Code of the Russian Federation). In such situations, there is a discrepancy between the periods of product shipment and recognition of receipt of funds.

Therefore, if there is a special moment in the transaction (change in ownership), VAT will be charged at the time of shipment without taking into account the fact of receipt of payment. Revenue will be recognized only after receipt of additional payment from the buyer (Article 39, 271 of the Tax Code of the Russian Federation). Deferment of VAT obligations from the time of shipment of the product until the receipt of payment for it is not permitted.

Due to the time difference between the date of shipment and the date of payment, the reflection of VAT on the sales invoice (Dt) to the tax settlement accounts (Kt) is incorrect. As an option, you can use an account for settlements with debtors and creditors:

- Debit account 76 / Credit account 68 – upon shipment.

- After the change of owner and recognition of payment (revenue) – Credit account. 76 / Debit account. 90 (sales).

But in this option, there is the formation (Dt account 76) of fictitious receivables. It would be more correct to use account 97 for VAT accounting for expenses expected in future periods.

If there is a special point in the agreement between the parties to the transaction regarding the change of the holder of ownership of the product, the shipped goods (from accounts 41 (goods) or 43 (finished products)) cannot immediately be taken into account in the debit of the sales account (90). Until the owner changes, the product is listed on account 45, intended for accounting for shipped products. Accounting is carried out not at the sales price, but at the cost used for accounting on the account. 41(43).