Organizations and entrepreneurial employers who pay income to their employees are insurers in relation to them and are obliged to pay insurance contributions to extra-budgetary funds. This fully applies to employers using the simplified tax system.

All employers (including entrepreneurial employers) calculate and pay insurance premiums from payments to employees in the manner established by Article 15 of the Law of July 24, 2009 No. 212-FZ, entrepreneurs for themselves - in the manner established by Article 16 of the Law of July 24, 2009 2009 No. 212-FZ.

Unlike organizations, entrepreneurs-employers pay contributions not only from the income of their employees, but also from their own income.

Insurance premiums are calculated and paid separately to each state extra-budgetary fund, namely:

- for compulsory pension insurance - in the Pension Fund of Russia;

- for compulsory social insurance in case of temporary disability and in connection with maternity - in the Social Insurance Fund;

- for compulsory health insurance - in the FFOMS.

How to calculate contributions from employee income

In 2021, insurance premiums to extra-budgetary funds should be calculated as follows.

- If payments in favor of the employee, calculated on an accrual basis from the beginning of the year, do not exceed the income limit for calculating contributions to the Pension Fund, then the contribution rate to the Pension Fund is 22%.

In 2021, the maximum base for calculating contributions to the Pension Fund is 796,000 rubles (Resolution of the Government of the Russian Federation of November 26, 2015 No. 1265). Contributions to the Pension Fund for amounts that exceed the limit (RUB 796,000) are charged at a rate of 10%.

- If payments in favor of the employee, calculated on an accrual basis from the beginning of the year, do not exceed the income limit for calculating contributions to the Social Insurance Fund of the Russian Federation, then the social security contribution rate is 2.9%.

In 2021, the maximum base for calculating contributions to the Social Insurance Fund of the Russian Federation (in case of temporary disability and in connection with maternity) is 718,000 rubles (Resolution of the Government of the Russian Federation of November 26, 2015 No. 1265). Social security contributions are not paid from the amount exceeding the maximum base.

- From January 1, 2015, insurance contributions to the Federal Compulsory Medical Insurance Fund must be paid on all payments in favor of employees at a rate of 5.1%. The maximum base for calculating insurance premiums to the Federal Compulsory Medical Insurance Fund has been cancelled.

In 2021, the following general tariffs are established for calculating insurance premiums:

| Base for calculating insurance premiums | Insurance premium rate | ||

| Pension Fund | FSS | FFOMS | |

| Within the established limit base | 22% | 2,9% | 5,1% |

| Above the established limit base | 10% | 0% | |

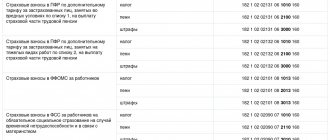

Contributions should be transferred to KBC for payment of the insurance pension - 392 1 0200 160.

The Pension Fund independently distributes insurance contributions for funded and insurance pensions, transferring the amount of contributions to finance the funded pension to a separate account of the Pension Fund (clause 2 of Article 20.1 of the Law of December 15, 2001 No. 167-FZ).

Accounting for contributions received for the payment of a funded pension is carried out on the basis of personalized accounting data, depending on which pension option the person has chosen.

Let us note that the Pension Fund recommends, in particular, to use the Pension Fund’s electronic service “Cabinet of the Payer of Insurance Contributions” to issue a payment order and calculate the amount of insurance premiums (PFR information dated January 5, 2015). This service is posted on the official website of the Pension Fund of Russia in the “Electronic Services” section.

Contribution rates in 2021 for compulsory pension, social, and health insurance

General rates for employers

Reduced tariffs for employers

Additional tariffs for employers regarding payments for work in hazardous conditions

Tariffs for entrepreneurs, lawyers, arbitration managers, notaries (other persons engaged in private practice), heads of peasant (farm) farms for their own insurance

Tariffs for FEZ participants on the territory of the Republic of Crimea and the city of Sevastopol

Tariffs for policyholders who make payments to citizens and do not have the right to apply reduced tariffs

| Conditions for applying the tariff | Fund | Limit value of the calculation base for calculating insurance premiums (rub., per year) | Tariff, % | Base |

From payments:

| Pension Fund | Up to 796,000 rub. inclusive | 22,0 | Art. 58.2 of the Law of July 24, 2009 No. 212-FZ, part 2.1 art. 22 and Art. 33.1 of the Law of December 15, 2001 No. 167-FZ |

| Over 796,000 rub. | 10,0 | |||

| FSS of Russia | Up to 718,000 rub. inclusive | 2,9 | ||

| Over 718,000 rub. | 0 | |||

| FFOMS | Not installed | 5,1 | ||

| From payments to foreigners (stateless persons) who are temporarily staying in Russia and are not highly qualified specialists Exception: citizens of EAEU member states | Pension Fund | Up to 796,000 rub. inclusive | 22,0 | Part 2 Art. 12 and art. 58.2 of the Law of July 24, 2009 No. 212-FZ, part 1 of Art. 7, part 2.1 art. 22, part 1 art. 22.1 and art. 33.1 of the Law of December 15, 2001 No. 167-FZ |

| Over 796,000 rub. | 10,0 | |||

| FSS of Russia | Up to 718,000 rub. inclusive | 1,8 | ||

| Over 718,000 rub. | 0 | |||

| FFOMS | Not installed | 0 | ||

| From payments to foreigners (stateless persons) who permanently or temporarily reside in Russia and are highly qualified specialists | Pension Fund | Up to 796,000 rub. inclusive | 22,0 | clause 15, part 1, art. 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 1 of Art. 7, art. 22.1 of the Law of December 15, 2001 No. 167-FZ, subp. 1 and 2 tbsp. 2 of the Law of December 29, 2006 No. 255-FZ |

| Over 796,000 rub. | 10,0 | |||

| FSS of Russia | Up to 718,000 rub. inclusive | 2,9 | ||

| Over 718,000 rub. | 0 | |||

| FFOMS | Not installed | 0 | ||

| There is no need to pay insurance premiums on payments to foreigners (stateless persons) who are temporarily staying in Russia and are highly qualified specialists - they are not recognized as insured persons under any type of compulsory insurance. The exception is highly qualified specialists from the EAEU with the status of temporary residents. For payments to such employees, charge only contributions for social (at a rate of 2.9%) and medical insurance (at a rate of 5.1%). At the same time, do not accrue contributions to pension insurance. The fact is that such highly qualified specialists are not insured in the compulsory pension insurance system. This is stated in paragraph 1 of Article 7 of the Law of December 15, 2001 No. 167-FZ. Similar clarifications are provided in letters of the Ministry of Labor of Russia dated November 18, 2015 No. 17-3/B-560 and OPFR for Moscow and the Moscow region dated November 20, 2015 No. 11/61408 | ||||

Reduced tariffs for certain categories of insurers who make payments to citizens

| Conditions for applying the tariff | Insurance premium rates, % | Base | ||

| Pension Fund | FSS of Russia | FFOMS | ||

Business companies and partnerships that practically apply (implement) the results of intellectual activity, the exclusive rights to which belong to their founders (participants):

| 8,0 | 2,0 | 4,0 | clauses 4, 5, 6, part 1 and parts 2 and 3 of Art. 58 of the Law of July 24, 2009 No. 212-FZ, clauses 4, 5, 6, part 4 and parts 5 and 7 of Art. 33 of the Law of December 15, 2001 No. 167-FZ |

Organizations and entrepreneurs who have entered into agreements on the implementation of technology innovation activities and who make payments to employees working:

| ||||

| Organizations and entrepreneurs who have entered into agreements on the implementation of tourism and recreational activities and who make payments to employees working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster | ||||

Russian organizations that work in the field of information technology and are engaged in:

| ||||

| Organizations and entrepreneurs with payments and remunerations for the performance of labor duties to crew members of ships registered in the Russian International Register of Ships (except for ships for storage and transshipment of oil and petroleum products in Russian seaports) | 0 | 0 | 0 | clause 9 part 1 and part 3.3 art. 58 of the Law of July 24, 2009 No. 212-FZ, clause 9, part 4 and part 11 of art. 33 of the Law of December 15, 2001 No. 167-FZ |

| Organizations and entrepreneurs using simplification and engaged in certain types of activities | 20,0 | 0 | 0 | clauses 8, 10, 11, 12, 14, part 1 and part 3.4 of Art. 58 of the Law of July 24, 2009 No. 212-FZ, clauses 8, 10, 11, 12, 14, part 4 and part 12 of Art. 33 of the Law of December 15, 2001 No. 167-FZ |

| UTII payers: pharmacy organizations and entrepreneurs licensed to conduct pharmaceutical activities, with payments to citizens who have the right or are allowed to carry out pharmaceutical activities | ||||

Non-profit organizations that use the simplified approach and operate in the field of:

Exception – state (municipal) institutions | ||||

| Charities that use simplification | ||||

Entrepreneurs applying the patent taxation system, except for:

| ||||

| Organizations participating in the Skolkovo project | 14,0 | 0 | 0 | Part 1 Art. 58.1 of the Law of July 24, 2009 No. 212-FZ, paragraph 6 of Art. 33 of the Law of December 15, 2001 No. 167-FZ |

| Commercial organizations and entrepreneurs who have received the status of residents of the territory of rapid socio-economic development in accordance with the Law of December 29, 2014 No. 473-FZ | 6,0 | 1,5 | 0,1 | Part 1 Art. 58.5 of the Law of July 24, 2009 No. 212-FZ, paragraph 15 of Art. 33 of the Law of December 15, 2001 No. 167-FZ |

| Commercial organizations and entrepreneurs having the status of residents of the free port of Vladivostok in accordance with the Law of July 13, 2015 No. 212-FZ | 6,0 | 1,5 | 0,1 | Part 1 Art. 58.6 of the Law of July 24, 2009 No. 212-FZ, paragraph 16 of Art. 33 of the Law of December 15, 2001 No. 167-FZ |

Additional tariffs for insurance contributions to the Pension Fund

If a special assessment of working conditions has not been carried out and classes of working conditions have not been defined

| Conditions for applying the tariff | Contribution rate to the Pension Fund, % | Base |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in paragraph 1 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (according to List 1, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10 ) | 9,0 | Part 1 Art. 58.3 of the Law of July 24, 2009 No. 212-FZ, part 1 of Art. 33.2 of the Law of December 15, 2001 No. 167-FZ, clause 1, part 1, art. 30 of the Law of December 28, 2013 No. 400-FZ |

| Organizations and entrepreneurs who make payments to employees engaged in work specified in paragraphs 2–18 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (approved lists of professions, positions and organizations in which work gives the right to appointment early old age pension) | 6,0 | Part 2 Art. 58.3 of the Law of July 24, 2009 No. 212-FZ, part 2 of Art. 33.2 of the Law of December 15, 2001 No. 167-FZ, clause 2–18, part 1, art. 30 of the Law of December 28, 2013 No. 400-FZ |

If a special assessment of working conditions has been carried out. The given tariffs are applied depending on the established class of working conditions (instead of 9 and 6%)

| Conditions for applying the tariff | Working conditions | Contribution rate to the Pension Fund, % | Base |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in paragraphs 1–18 of part 1 of Article 30 of Law No. 400-FZ of December 28, 2013 (taking into account list 1, approved by the resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10, and other lists of professions, positions and organizations, work in which gives the right to an early old-age pension) | class – dangerous subclass – 4 | 8,0 | Part 2 Art. 58.3 of the Law of July 24, 2009 No. 212-FZ, part 2.1 art. 33.2 of the Law of December 15, 2001 No. 167-FZ, clauses 1–18, part 1, art. 30 of the Law of December 28, 2013 No. 400-FZ |

| class – harmful subclass – 3.4 | 7,0 | ||

| class – harmful subclass – 3.3 | 6,0 | ||

| class – harmful subclass – 3.2 | 4,0 | ||

| class – harmful subclass – 3.1 | 2,0 | ||

| class – valid subclass – 2 | 0,0 | ||

| class – optimal subclass – 1 | 0,0 |

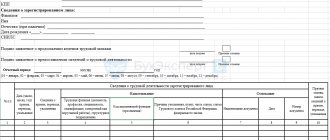

Tariffs for calculating contributions for own insurance (in a fixed amount) by entrepreneurs, lawyers, arbitration managers, notaries (other persons engaged in private practice), heads of peasant (farm) farms

| Conditions for applying the tariff | Tariffs for calculating insurance premiums, % | Base | ||

| Pension Fund | FSS of Russia | FFOMS | ||

| Mandatory pension and health insurance | 26.0 If income for a calendar year does not exceed 300,000 rubles, insurance premiums are calculated using the formula: 1 minimum wage × 26% × 12 months. If your income exceeds RUB 300,000. the amount of contributions increases depending on the amount of income and is calculated as 1% of income exceeding RUB 300,000, but up to a limit determined by the formula: 8 minimum wage × 26% × 12 months. | – | 5,1 | Parts 1 and 2 art. 14, part 2 art. 12 of the Law of July 24, 2009 No. 212-FZ, clauses 2.1–2.2 art. 22, sub. 2 p. 1 art. 6 of the Law of December 15, 2001 No. 167-FZ, part 3 of Art. 4.5 of the Law of December 29, 2006 No. 255-FZ |

| Voluntary social insurance | – | 2,9 | – | |

Tariffs for participants of the free economic zone on the territory of the Republic of Crimea and Sevastopol

| Conditions for applying the tariff | Insurance premium rates, % | Base | ||

| Pension Fund | FSS of Russia | FFOMS | ||

| Organizations and entrepreneurs - participants of the SEZ in the territory of Crimea and Sevastopol (in relation to payments to individuals) | 6,0 | 1,5 | 0,1 | Clause 14 Art. 33 of the Law of December 15, 2001 No. 167-FZ, Art. 58.4 of the Law of July 24, 2009 No. 212-FZ |

1 In 2021, different maximum amounts of the calculation base have been established for the calculation of insurance contributions to the Pension Fund of the Russian Federation (RUB 796,000) and the Social Insurance Fund of Russia (RUB 718,000). The limit value is determined by the cumulative total from the beginning of the year in relation to each insured person (Resolution of the Government of the Russian Federation of November 26, 2015 No. 1265).

2 There is no need to accrue contributions to the Social Insurance Fund of Russia for remuneration under civil contracts (Clause 2, Part 3, Article 9 of Law No. 212-FZ of July 24, 2009).

3 Insurance premiums at reduced rates are charged only for payments within the limit of RUB 796,000. for the Pension Fund and within 718,000 rubles. for the Federal Social Insurance Fund of Russia for the year for each insured person. Payments exceeding the established limit are not subject to contributions. Since there is no limit for the FFOMS, contributions must be calculated regardless of the amount of payments to the insured person.

4 Additional tariffs for insurance contributions to the Federal Social Insurance Fund of Russia and the Federal Compulsory Medical Insurance Fund are not provided.

5 The income of citizens of the EAEU member states, regardless of their status (permanent resident, temporary resident, temporary resident) is subject to insurance premiums according to the same rules (tariffs) as the income of Russian citizens. They are recognized as insured in the compulsory insurance system (social and medical) and have the right to all types of social security, except for pensions (clause 3 of Article 98 of the Treaty on the Eurasian Economic Union, letter of the Ministry of Labor of Russia dated March 13, 2015 No. 17-3/ OOG-268, dated December 5, 2014 No. 17-1/10/B-8313).

6 Preferential tariffs are valid for 10 years from the date the organization (entrepreneur) received the status of a FEZ participant, starting from the first day of the month following the month in which this status was received. Preferential rates do not apply when calculating contributions for entrepreneurs’ own insurance. This is stated in Article 58.4 of the Law of July 24, 2009 No. 212-FZ.

To obtain the status of a FEZ participant, you need to be registered for tax purposes in the Republic of Crimea or the city of Sevastopol and have an investment declaration. The conditions for obtaining the status of a SEZ participant are given in Article 13 of the Law of November 29, 2014 No. 377-FZ.

7 Additional contributions to the Pension Fund of the Russian Federation must be paid by participants of the FEZ in the territory of Crimea and the city of Sevastopol according to the general rules.

8 Reduced tariffs are applied if the conditions specified in Article 58.5 of the Law of July 24, 2009 No. 212-FZ are met. Territories of rapid socio-economic development are created by decision of the Government of the Russian Federation (Clause 1, Article 3 of Law No. 473-FZ of December 29, 2014).

Letter dated December 14, 2020 No. BS-4-11/ [email protected]

The Federal Tax Service reports in connection with incoming requests from territorial tax authorities and insurance premium payers regarding the application of reduced insurance premium rates by non-profit organizations.

In accordance with the provisions of subparagraph 7 of paragraph 1 and subparagraph 3 of paragraph 2 of Article 427 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) for non-profit organizations (with the exception of state (municipal) institutions) registered in the manner established by the legislation of the Russian Federation, applying a simplified taxation system and those carrying out, in accordance with the constituent documents, activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and mass sports (except for professional sports), reduced rates of insurance premiums are applied in the aggregate at the rate of 20% during 2017-2024.

According to paragraph 7 of Article 427 of the Code, the above non-profit organizations apply reduced rates of insurance premiums, provided that at the end of the year preceding the year the organization switched to paying insurance premiums at reduced rates, at least 70 percent of the amount of all income of the organization for the specified period consists of the following types in total: income:

- income in the form of targeted revenues for the maintenance of non-profit organizations and their conduct of statutory activities in accordance with subparagraph 7 of paragraph 1 of Article 427 of the Code, determined in accordance with paragraph 2 of Article 251 of the Code (hereinafter referred to as targeted receipts);

- income in the form of grants received for carrying out activities in accordance with subparagraph 7 of paragraph 1 of Article 427 of the Code and determined in accordance with subparagraph 14 of paragraph 1 of Article 251 of the Code (hereinafter referred to as grants);

- income from carrying out the types of economic activities specified in paragraphs forty-seven, forty-eight, fifty-one - fifty-nine of subparagraph 5 of paragraph 1 of Article 427 of the Code (hereinafter referred to as the implementation of activities).

The total amount of income is determined by insurance premium payers by summing up the income specified in paragraph 1 and subparagraph 1 of paragraph 1.1 of Article 346.15 of the Code.

Thus, non-state non-profit organizations registered in the manner prescribed by the legislation of the Russian Federation, applying a simplified taxation system and carrying out activities in socially oriented areas in accordance with constituent documents, in order to determine the share of income, sum up income in the form of targeted income, income in the form of grants and income from carrying out activities.

Moreover, if an organization at least 70 percent of the total income from only one type of income, named in paragraph 7 of Article 427 of the Code, then such an organization has the right to apply reduced rates of insurance contributions.

This position has been agreed upon with the Russian Ministry of Finance.

Bring this letter to the territorial tax authorities and insurance premium payers.

Acting State Advisor of the Russian Federation, 2nd class S.L. Bondarchuk

Insurance premiums for individual entrepreneurs and self-employed

The self-employed population in Russia includes properly registered individual entrepreneurs (IP), heads of peasant and farm enterprises, as well as other citizens engaged in private activities in performing work and providing services.

Such citizens independently pay insurance contributions for compulsory pension insurance. Contributions are paid separately for pension insurance and separately for compulsory medical insurance.

The payment schedule for contributions is not strictly regulated - they can be paid in one or several payments. The main requirement is that this must be done before December 31 of the current year. For late non-payment of contributions, a businessman faces a fine of 26% of the amount payable for pension insurance and 5.1% for health insurance.

As for determining the amount of contributions to be paid, there are several calculation methods.

So, for those whose annual income does not exceed 300 thousand rubles. The amount of mandatory contributions to pension insurance is 18,610.8 rubles per year; for compulsory medical insurance – 3,650.58 rubles per year.

For those whose turnover is more than 300 thousand rubles per year, contributions under compulsory pension insurance: will be 18,610.8 +1% of the amount exceeding 300 thousand (but not more than 148,886.40 rubles). The amount of the contribution for compulsory health insurance will be the same - 3,650.58 rubles.