We distribute direct production costs

According to tax legislation, direct expenses can be taken into account when calculating income tax as goods are sold. And this obliges the enterprise to distribute them between sold finished products, stock balances and work in progress. How to do this is in the article. What is the difference between direct and indirect costs?

For the purpose of calculating income tax, expenses during the reporting (tax) period for the production and sale of products are divided into direct and indirect. An approximate list of direct expenses is given in Article 318 of the Tax Code of the Russian Federation. However, the enterprise determines their specific composition independently in its accounting policies. The amount of indirect expenses incurred in the reporting period is fully taken into account when calculating income tax for this period. And direct expenses reduce taxable profit as products, works and services are sold, in the cost of which they are taken into account (clause 2 of Article 318 of the Tax Code of the Russian Federation). That is, even if products are produced but not sold, the direct costs related to them are not taken into account when calculating income tax in a given reporting period.

Procedure for distribution of direct expenses

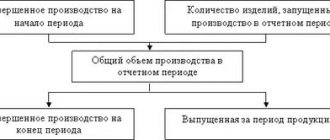

The following sequence should be followed in tax accounting. Direct costs are distributed between: 1) work in progress and finished products; 2) finished and shipped products; 3) shipped, but not sold and sold products.

First step

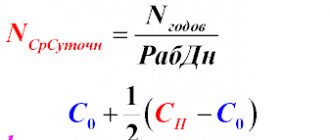

Currently, tax legislation provides taxpayers with the freedom to choose methods for assessing work in progress and released finished products. Each organization must determine for itself the most economically feasible procedure so that direct costs correspond to the size of products sold. What evaluation indicators can be used? In addition to raw materials, to evaluate work in progress, enterprises can use another type of resource, the costs of which constitute the largest part of direct costs. For example, for organizations with labor-intensive production (for example, microelectronics), the indicator will be labor force, and for organizations with capital-intensive production (for example, the oil and gas industry) - fixed assets. In addition, not only the quantity of a resource, but also the cost of spending on it can serve as evaluation indicators. In case of single production, estimates can be made based on actual costs. And in serial industrial production - according to the ratio of the standard cost of work in progress and the planned cost of costs of the current period. Currently, many organizations continue to use the procedure for distributing direct costs in proportion to the quantitative expression of raw materials and supplies. In a material-intensive process, the cost of production consists mainly of material costs, so this method, of course, is the most appropriate. Based on the data from the primary accounting documents, the amount of raw materials that was written off during the month for the production of various types of products is determined. This is stated in paragraph 1 of Article 319 of the Tax Code of the Russian Federation. Then, based on the results of the inventory in the workshops, the amount of raw materials remaining on the last day of the month that have already been processed is determined. Then the work-in-progress ratio (Knzp) is calculated: Knzp = Amount of raw materials in work-in-progress at the end of the reporting period: (Amount of written-off raw materials in the reporting period + Amount of raw materials in work-in-progress at the beginning of the reporting period).

Using this coefficient, the amount of direct costs attributable to work in progress is calculated:

Direct costs in work in progress at the end of the reporting period = (Direct costs in the reporting period + Direct costs in work in progress at the beginning of the reporting period) x KZP.

Then the accountant acts like this.

Calculates the amounts of direct costs that relate to finished products produced in the corresponding reporting period: Direct costs for manufactured products = Direct costs in work in progress at the beginning of the reporting period + Direct costs in the reporting period – Direct costs in work in progress at the end of the reporting period.

Most often, several types of raw materials are required to produce a product. In this case, the enterprise accountant has the right to select the main component of the manufactured product and evaluate work in progress based on the remainder of this type of raw material.

Second step

The amount of direct costs that falls on finished products manufactured per month must be distributed between its balances in the warehouse and the shipped batch. The quantity of goods in the warehouse and shipped products will be determined by the enterprise accountant based on data from primary accounting documents (clause 1 of Article 319 of the Tax Code of the Russian Federation). With this data, the appropriate coefficient can be determined. So, the coefficient of shipped products (Kop) is determined as follows: Kop = Number of products shipped in the reporting period: (Quantity of finished products at the beginning of the reporting period + Number of finished products released from production).

To distribute direct costs between shipped products and their balances in the warehouse, the following formulas are used.

To calculate costs for shipped products: Direct costs for finished products shipped in the reporting period = (Direct costs for the balance of products at the beginning of the reporting period + Direct costs for manufactured products in the reporting period) x Kop.

To determine the costs that relate to the balance of goods listed in the warehouse:

Direct costs for the balance of products at the end of the reporting period = Direct costs for the balance of products at the beginning of the reporting period + Direct costs for products released in the reporting period – Direct costs for those shipped in the reporting period finished products. Table 1 Distribution of direct costs between work in progress and finished products

| No. | Indicator name | Meaning |

| 1 | The amount of raw materials in work in progress at the beginning of the reporting period | 100 kg |

| 2 | Amount of written-off raw materials in the reporting period | 1900 kg |

| 3 | The amount of raw materials in work in progress at the end of the reporting period | 300 kg |

| 4 | Knzp | 0,15 (300 kg: (100 kg + 1900 kg)) |

| 5 | Direct costs in work in progress at the end of the reporting period | 162,000 rub. ((RUB 80,000 + RUB 1,000,000) x 0.15) |

| 6 | Direct costs for manufactured products | 918,000 rub. (80 000 + 1 000 000 – 162 000) |

Third step

Direct costs attributable to shipped products are distributed between its sold and unsold parts.

To do this, the product sales ratio (Kr) is calculated: Kr = Number of products sold in the reporting period: (Quantity of products shipped but not sold at the beginning of the reporting period + Number of products shipped in the reporting period).

And then, on its basis, direct costs are distributed between sold and shipped but not sold products.

Expenses on products sold are determined as follows: Direct expenses on products sold = (Direct expenses on products shipped but not sold at the beginning of the reporting period + Direct expenses on products shipped in the reporting period) x Cr.

And the amount of expenses for unsold goods is obtained based on the following formula:

Direct expenses for the balance of products shipped, but not sold = Direct expenses for products shipped, but not sold at the beginning of the reporting period + Direct expenses for products shipped in the reporting period – Direct expenses for products sold .

If all products shipped at the end of the month are sold, then the coefficient does not need to be calculated.

In this case, the amount of direct expenses attributable to shipped products and the amount of direct expenses related to sold products will coincide. At the end of the reporting period, the organization, having determined the cost of direct expenses attributable to finished products sold during the reporting period, includes this indicator in line 010 of Appendix No. 2 to sheet 02 of the income tax return. Table 2 Distribution of the amount of direct costs between products shipped and in warehouse

| No. | Indicator name | Meaning |

| 1 | Quantity of finished products at the beginning of the reporting period | 300 units |

| 2 | Quantity of finished products released from production | 3700 units |

| 3 | Quantity of products shipped in the reporting period | 3000 units |

| 4 | Coefficient of shipped (sold) products | 0,75 (3000 : (300 + 3700)) |

| 5 | Direct costs for finished products shipped in the reporting period | RUB 752,250 ((RUB 85,000 + RUB 918,000) x 0.75) |

| 6 | Direct costs for the balance of production at the end of the reporting period | RUB 250,750 (85 000 + 918 000 – 752 250) |

Example.

The company Rechitsa LLC produces porcelain products.

For the first half of 2010, the amount of direct costs for production, reflected in the debit of account 20, amounted to 1,000,000 rubles. The balance of work in progress as of January 1, 2010 is equal to 80,000 rubles. The accountant allocated direct costs to work in process and finished goods in proportion to the quantities of the main materials used in production (kaolin, feldspar, quartz and clay). The calculation of the work in progress ratio, as well as the distribution of direct costs between work in progress and finished products based on data on the amount of materials in work in progress as of January 1 and June 30, 2010, are shown in Table 1. Let us assume that as of January 1, 2010, the balance of finished products in the warehouse was 300 units worth 85,000 rubles. In the first half of 2010, 3,700 units of products were received at the warehouse, and 3,000 units were shipped. All products shipped in the first half of 2010 were sold. This means that the sales coefficient does not need to be calculated. It is only necessary to distribute the amount of direct costs between the products shipped and those in the warehouse. The calculation is presented in Table 2. Thus, the amount of direct expenses in the amount of 752,250 rubles is included in the income tax return. It is important to remember that

the enterprise chooses methods for assessing work in progress and released finished products independently, registering them in the accounting policy.

The article was published in the journal “Accounting in Production” No. 8, August 2010.

What is WIP?

The answer to this question is presented in paragraph. 1 clause 1 art. 319 of the Tax Code of the Russian Federation: work in progress is products (work, services) of partial readiness, that is, those that have not undergone all processing (manufacturing) operations provided for by the technological process. Work in progress includes completed but not accepted by the customer works and services. In addition, WIP includes the balances of unfulfilled production orders and the balances of semi-finished products of own production. Please note that materials and semi-finished products in production are considered WIP only if they have already been processed. If materials and semi-finished products transferred to production have not yet been processed at the end of the month, the amount of material expenses of the current month should be reduced by their cost (clause 5 of Article 254 of the Tax Code of the Russian Federation).

The cost of work in progress and finished products depends primarily on the composition of direct costs, so let’s find out which costs relate to them.

Development of costing methodology

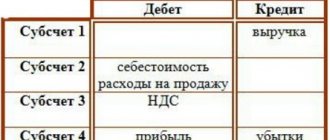

Direct expenses are accounted for in the debit of accounts 20 “Main production”, 23 “Auxiliary production” and 29 “Servicing production and facilities” (see Instructions for using the Chart of Accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). In “1C: Accounting 8” edition 3.0, until recently, direct expenses accumulated on these accounts were “direct” only in relation to item groups. Within each product group, “direct” costs had to be distributed between individual items of manufactured products. This distribution was carried out in proportion to the planned cost.

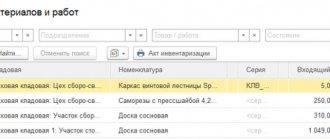

Starting from version 3.0.53 of the program, the cost of finished products can be calculated taking into account the specific costs of producing specific types of products or semi-finished products. For this purpose, account 20.01 “Main production” now has a subaccount Products.

When calculating product costs, the program allows you to combine direct costs:

- distributed within the nomenclature group (direct in relation to the nomenclature group);

- related to specific products (direct in relation to the product).

In the tabular part of production documents (Production report for the shift, Receipt from processing, Request invoice, etc.), where the materials used are indicated, the Products column has appeared. This field can be filled in (manually or automatically), or can be left blank for those expenses for which it is unknown or impractical to determine in the cost of which specific product (semi-finished products) they were included. In this case, direct costs are distributed across the product group in proportion to the planned cost, as before.

Read more about options for calculating product costs in “1C: Accounting 8” edition 3.0 here.

Refusal of planned cost

Calculating the planned cost of production causes difficulty for users, especially in small organizations where there is no planning department.

Starting from version 3.0.61.37 in 1C: Accounting 8, direct costs can be distributed without using the planned cost. The cost distribution option is selected in the form of an accounting policy (Fig. 1).

Rice. 1. Accounting policy settings

If the flag Use the planned cost of production is not set, then in documents for the release of finished products and the provision of services, planned prices are not required (the Planned Price and Planned Amount fields are absent in the document).

Direct costs allocated to specific products will be taken into account in its cost. And costs that are direct in relation to the product group will be distributed in proportion to costs that are direct in relation to a specific product.

In any case, the actual cost is determined at the end of the month when performing a routine operation to close cost accounts as part of the Month Closing processing.

Table

| No. | User account | Settings "1C: Accounting 8" (rev. 3.0) |

| 1 | No records are kept of the release of finished products (services) | Planned cost is disabled by default (see Fig. 1) |

| 2 | Records are kept of the release of finished products (services) | Planned cost is enabled by default |

| 3 | Start of accounting | Planned cost is disabled by default |

| 4 | The planned cost was used, then a decision was made to abandon its use | You can disable it at any time, but it is recommended to make a change to the organization’s accounting policy and switch to a new accounting option from the beginning of the year |

| 5 | The planned cost was not used, then a decision was made to use it | You can enable it from the next month, but it is recommended to make a change to the organization’s accounting policy and switch to a new accounting option from the beginning of the year. |

Is it possible to start allocating expenses without using planned costs now, without waiting for the end of the year? Possible options are shown in the table. Let's look at an example.