The goal of any business is to make a profit, so the vast majority of companies either sell goods or provide services. This means that in the accounting department of any company, one way or another, an account is used to record settlements with buyers and customers. In the chart of accounts it is designated as number 62.

This article is intended for novice accounting specialists, as well as novice users of the 1C: Accounting 8.3 program, since it is what is most often used in practice. All information provided is general and does not depend on the accounting program used, but examples of postings, reports and other illustrations are shown specifically for enterprise accounting from 1C.

Accounting for accounts receivable on account 62

The rules that need to be kept in mind when working with account 62 “Settlements with buyers and customers” are indicated in the chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Count 62 is used to reflect:

- accounts receivable (hereinafter referred to as receivables) of buyers and customers for goods, works, services sold (hereinafter referred to as GWS);

- accounts payable in the form of advances received.

Turnover in the debit of account 62 occurs when reflecting the debt of buyers when the sale of goods and services takes place. The second side of the posting will be income accounts 90.1, 91.1 or account 46 for the gradual reflection of income from long-term work. Thus, receivables are reflected simultaneously with revenue. In accordance with the accounting rules, revenue is shown in accounting if a number of conditions are met (clause 12 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n):

- existence of a legally valid right to receive proceeds;

- availability of total revenue value;

- having confidence in receiving payment;

- a transfer of ownership was carried out, i.e. the buyer accepted the GWS;

- the presence of the total value of the corresponding expenses incurred to obtain this revenue.

If at least one condition is not met, then the payment received by the organization should be reflected as accounts payable, and not repay accounts receivable.

When payment is received from the buyer, account 62 is credited, and a debit entry is made in the cash accounts.

Analytics of 62 accounts should allow checking its balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices, and payment terms. To ensure transparency of reporting, overdue debt must be reserved by posting Dt 91.2 Kt 63 (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In the balance sheet, receivables are shown minus reserves. Debts that cannot be repaid and debts with an expired statute of limitations must be written off (clause 77 of the PBU) at the expense of the reserve by posting Dt 63 Kt 62, and if they were not reserved, then they are written off to the financial results of Dt 91.2 Kt 62. When In this case, for another 5 years, the written off debt is reflected on the balance sheet (account 007) in order to track changes in the financial condition of the debtor and the possibility of repaying the debt.

How is account 62 used in accounting?

Since the account is active-passive, the balance on it can be either positive or negative. A debit balance indicates that companies or private clients have debts to the organization, and a credit balance indicates that the company has not made payments to third-party companies.

The remaining amount of the account is determined taking into account the initial balance. The debit turnover is added to the positive balance, and then the credit turnover is subtracted. If a negative balance is obtained, then it is transferred to the account credit, but without the minus sign. The situation is similar with the credit balance.

Accounting for advances received

Payment of goods and materials prior to their shipment or transfer is accounted for separately on account 62; subaccount 62.2 “Advances received” is usually used, while subaccount 62.1 “Settlements with buyers and customers” is used to account for receivables from buyers. In the balance sheet, advances received are included in accounts payable, that is, they are shown as a liability; it is impossible to show advances minimized from accounts payable. In addition, upon receipt of an advance payment, the supplier must charge VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Example:

In July, Pchelka LLC (buyer) and Vasilek LLC (seller) signed an agreement for the purchase of paving slabs worth RUB 944,590. In the same month, Pchelka LLC made a full prepayment. The following entries are made in the accounting of Vasilek LLC:

Dt 51 Kt 62.2 - 944,590 rub. — an advance payment from Pchelka LLC has been received into the bank account;

Dt 76 subaccount “VAT on advances received” Kt 68 subaccount “VAT” 144,090 rub. (944,590 × 18/118) - VAT is charged upon receipt of an advance payment.

In August, Vasilek LLC shipped all the paving slabs to the buyer and recorded the following entries:

Dt 62.1 Kt 90 — 1,944,590 rub. — revenue accrued;

Dt 90.3 Kt 68 subaccount “VAT” - 144,090 rubles. — VAT is charged on sales;

Dt 68 subaccount “VAT” Kt 76 subaccount “VAT on advances received” 144,090 rubles. — previously accrued VAT on the prepayment received is accepted for deduction;

Dt 62.2 Kt 62.1 - 944,590 rub. — the previously received prepayment has been offset.

For more information about the actions of the seller when receiving an advance payment, read the article “What is the general procedure for accounting for VAT on advances received?”

Turnover balance sheet for account 62 using an example

Let's consider an example of generating a balance sheet for account 62 from the 1C program:

What do we see from this SALT?

For example, the counterparty LLC Horns and Hooves made a payment in our favor for 2021 in the amount of 61,114.56 rubles, and we shipped him goods or provided services in the amount of 27,110.68 rubles. The final accounts payable to the buyer is 34,004.88 rubles.

Payments by bill of exchange

The instructions for the chart of accounts also pay attention to the peculiarities of settlements with bills of exchange. If the buyer issues his own bill of exchange to the supplier, then the debt is not repaid, but by this action a deferred payment is issued and a guarantee of payment is issued. To account for bills received, it is recommended to allocate a separate sub-account, for example, 62.3 “Bills received”. The following entries are made in the seller's accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 62.3 | 62.1 | Received own bill from buyer |

| 51 | 62.3 | Received funds upon presentation of a bill of exchange |

| 51 | 91.1 | Interest received on the bill |

Another situation arises if the debt is paid by a bill of exchange from third parties. Such a bill of exchange is recognized as a financial investment and is accounted for in account 58. The entries shown in the table are made in the supplier’s accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 58.2 | 62.1 | Received a third party promissory note as payment |

D 62 to 41

Dt 51 Kt 51 is a common entry in accounting that reflects non-cash receipts and expenses of a business entity. We will tell you in our article which accounts account 51 can correspond with and which transactions using it are most popular.

What is count 51 used for?

What does the entry Debit 51 Credit 51 mean?

In which transactions is account 51 found?

Results

What is count 51 used for?

Account 51 “Current accounts” accumulates all non-cash cash flows of the company in rubles. The debit of account 51 characterizes the amount of funds entering the current account of a business entity. A loan, on the contrary, records the outflow of money from a company to pay for goods, work or services.

In accordance with the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities...” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), account 51 can be paired with a large number of accounts, both debit and credit:

- 50 "Cashier";

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 66 “Calculations for short-term loans and borrowings”, etc. (according to the instructions for the chart of accounts).

In this case, correspondence with account 51 itself is allowed (posting Dt 51 Kt 51).

For more information about the chart of accounts, see the article.

What does the entry Debit 51 Credit 51 mean?

Posting Dt 51 Kt 51 is often used to reflect the movement of money from one company current account to another.

Let me explain. The company has 2 current accounts: one in bank 1, the second in bank 2. To detail the flow of funds in both accounts, the company can open sub-accounts to account 51:

- 51.01 - settlements on account in bank 1;

- 51.02 - settlements on bank account 2.

Then, when transferring funds from an account in bank 2 to an account in bank 1, instead of the not very clear posting Debit 51 Credit 51, you can make an entry: Dt 51.01 Kt 51.02.

We should not forget that the subaccounts that will be used by your organization should be indicated in the working chart of accounts approved in the accounting policy.

Important! Analytical accounting for 51 accounts can be built not only using subaccounts, but also subaccounts, which, in particular, are used in a number of accounting programs (for example, 1C).

In which transactions is account 51 found?

The most common uses of account 51 debit are found in the entries:

- Debit 51 Credit 62.

- Debit 51 Credit 66.

- Debit 51 Credit 91.

Let's look at a few examples.

Example 1

The buyer transferred payment for the goods to the supplier.

In the supplier's accounting, this will be reflected using the posting: Dt 51 Kt 62. In the buyer's accounting: Dt 60 Kt 51.

Example 2

The company received a payment to repay the previously borrowed funds.

In this case, you can write: Dt 51 Kt 66.

You will find detailed information about borrowed funds in the article “Borrowed funds are…”.

Example 3

Interest on the deposit was received in the LLC's current account: Dt 51 Kt 91.

For the credit of account 51, the following entries are often used:

- for salary transfer: Dt 70 Kt 51;

- for payment to suppliers: Dt 62 Kt 51;

- for payment of taxes: Dt 68 Kt 51;

Other postings are also possible, the use of which does not contradict the chart of accounts.

Results

Analysis of account 51 will allow us to determine bank balances on ruble accounts of a business entity. In posting Dt 51 Kt 51, it is better to use subaccounts to account 51 in order to see the balances for each current account of a company or entrepreneur.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Account 90 in accounting. Accounting for the sale of finished products, goods, services. Postings

To account for the sale of finished products, goods, services, account 90 “Sales” is used. Account 90 is complex, having several sub-accounts. In this article, we will look at how this account is structured and what postings to account 90 are made when selling products, goods and services.

The account structure is similar to it. 91 “Other income and expenses”, which we will discuss shortly.

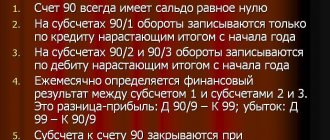

Structure of account 90 “Sales”, subaccounts

Account 90 “Sales” consists of several subaccounts, the main subaccounts that are always used are:

- subaccount 1 - the credit of this subaccount reflects the proceeds from the sale.

- 2 - debit reflects the cost of finished products, goods, services, that is, what we sell.

- 3 - the debit reflects VAT accrued on products sold.

- 9 - this subaccount calculates the total financial result for the month, the debit reflects the profit for the month, and the credit reflects losses.

An accounting account is a table with two columns Debit and Credit, let's present account 90 in the form of a table:

On the topic of the article! VAT on products sold is reflected in the transaction

During the month, all sales made are reflected in the account. 90.

-lesson. Account 90 in accounting: postings, examples

The video lesson explains in detail account 90 accounting, typical entries and examples. The lesson is taught by a consultant, expert of the site “Accounting for Dummies”, chief accountant Gandeva N.V. ⇓

You can download the slides and presentation for the video using the link below.

Download the presentation “Account 90 in accounting: entries, examples” in PDF format

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Postings to account 90 “Sales”

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

D62 K90/1 - revenue from the sale of products, goods, services is reflected.

D90/2 K41 (43, 45, 20) - reflects the cost of goods sold, products, services.

D90/3 K68 - VAT is charged on products sold.

At the end of the month, based on the account data. 90 is considered a financial result.

For this:

- The debit turnover for the month is calculated (the values of subaccounts 2 and 3 are summed up)

- The loan turnover for the month is calculated (subaccount 1).

- From the debit turnover we subtract the credit turnover:

a) if the result is a negative number, then this is a profit, we reflect it in the debit of subaccount 9 of account 90 in correspondence with the account. 99 “Profit and loss”, posting D90/9 K99,

b) if the result is a positive number, then these are losses reflected on the credit of subaccount 90/9 in correspondence with account 99, posting D99 K90/9.

At the end of the year in December, the account is completely closed in such a way that the balance for each subaccount becomes equal to 0. All subaccounts are closed to the 90/9 subaccount.

Subaccount 1: all entries are reflected only on credit, accordingly, the balance on this subaccount is always credit, to make it equal to 0, you need to calculate the loan balance and make an entry for this amount D90/1 K90/9. As a result, the ending balance on this subaccount becomes 0.

2: all entries are reflected only in debit, the balance is always debit. This means we count the turnover and debit balance and make the entry D90/9 K90/2 for this amount. As a result, the debit and credit balances are the same, and the ending balance is 0.

3: similar to subaccount 2.

9: as a result of the above transactions, the balance on this subaccount also becomes equal to 0.

Account 90 is closed, its balance is 0, from January of the new year we will re-open account 90 “Sales” and again begin accounting for the sale of products, services and goods.

In order for the principle of accounting for sales on the account. 90 has finally become clear, I propose to consider an example in numbers. Let's take 3 months as an example: October, November and December. Let's see what transactions we make on the account during the months. 90, and how the account will close. 90 at the end of the year in December.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Example of sales accounting on account 90

The organization sells its products, for example, lamps.

October:

Sales:

first batch: cost 80,000 rubles, revenue 100,000 rubles, VAT for ease of calculation, let’s assume 15,000 rubles. (in fact, in this case, VAT should have been calculated as revenue * 18 / 118 = 15,254 rubles, but we will round for simplicity; you can read more about this in the article “How to calculate VAT?”; you can also use an online VAT calculator for the calculation ).

second batch: cost 120,000 rubles, revenue 200,000 rubles, VAT 30,000 rubles.

Postings to account 90 in October:

| Sum | Debit | Credit | Operation name |

| 80000 | 90/2 | 43 | The first batch was sent for sale, the cost was written off |

| 100000 | 62 | 90/1 | Revenue from the sale of the first batch is reflected |

| 15000 | 90/3 | 68 | VAT charged on the first batch |

| 120000 | 90/2 | 43 | The cost of the second batch is written off |

| 200000 | 62 | 90/1 | Revenue from the sale of the second batch is reflected |

| 30000 | 90/3 | 68 | VAT charged on the second batch |

| 55000 | 90/9 | 99 | The financial result for this month is reflected |

Algorithm:

- Within a month, we record all sales and charge VAT.

- At the end of the month, we calculate the financial result. Financial result = debit turnover - credit turnover = (80,000 + 120,000) + (15,000 + 30,000) - (100,000 + 200,000) = - 55,000 rubles. made a profit. The profit received is reflected by posting D90/9 K99.

For clarity, let's imagine the count. 90 and counting 99 in the form of a table and reflect all sales transactions (the final balance is highlighted in red, current transactions are highlighted in black):

November:

We are opening a new account in November. 90, we transfer the final balance for each subaccount from October; in November it will be the opening balance.

Sales:

1st batch: cost 90,000, revenue 150,000, VAT 23,000.

2nd batch: cost 180,000, revenue 300,000, VAT 46,000.

Algorithm:

Account 90 and counting 99 at the end of the month will look like this (the beginning balance is marked in green, the ending balance in red, the current transactions in black):

December:

We transfer the ending balance for each subaccount from November, it will be the beginning balance for December.

Sales:

On the topic of the article! Goods received from the supplier, posting with VAT

1st batch: cost 75,000, revenue 100,000, VAT 15,000.

Algorithm:

- We carry out the necessary sales transactions and calculate VAT.

- Financial result for the month = 75,000 + 15,000 - 100,000 = - 10,000 - profit.

- We close account 90. Let me remind you that we close each subaccount to subaccount 9; in the figure, account closure is shown in blue. As a result of closing, the balance for all subaccounts is 0.

I hope that now the issue of accounting for the sale of finished products, goods, and services does not cause difficulties. In the next article we will continue the topic of accounting for financial results, consider accounting for other income and expenses on the account. 91.

Working with the score 90 is often linked to other scores, click on the link and read:

→ Account 99. Accounting for financial results “Profit and loss”. Basic postings + examples→ Account 68. Accounting for calculations of taxes and fees. Examples of transactions and postings

→ Account 62. Accounting for settlements with customers + postings

Results

For different types of debt, the chart of accounts provides for special accounts. One of them is account 62, which can be either active or passive, since it is used to account for both debt from buyers and customers, and creditors in the form of advances and prepayments received.

Read about accounting for accounts receivable in the article “Keeping records of accounts receivable and accounts payable.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

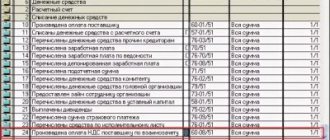

Accounting entries for account 62

To operate account 62, standard transactions are used. The most common ones include the following:

| Debit correspondence | Loan correspondence | the name of the operation |

| 57.03 | 62 | Transfer of advance amount |

| 76 | 68.02 | Value added tax calculated on the advance amount |

| 57.03 | The proceeds are credited to the company's account | |

| 62 | 90.01.1 | Accounting for sales revenue |

| 90.03 | 68 | Accounting for VAT on shipment |

| 90.02.1 | 41.11 | Write-off of goods sold, services provided |

| 62 | 62 | Settlement of received advance |

| 68 | 76 | VAT deduction on advance received |

Balances on account 62 should be reflected in different sections of the balance sheet. The debit balance is indicated in the asset, and the credit balance in the liability.

Postings for Accounts Receivable Accounting

Let's look at the main transactions with accounts receivable and the postings that should be made in each case.

The supplier's receivables have arisen and been repaid:

- Dt 60 Kt 51, 50, 52 - an advance is transferred to pay for future supplies of goods (work, services);

- Dt 08, 10, 41, 91-2, etc. Kt 60 - goods (work, services) in advance are accepted for accounting

The buyer's receivables have arisen and been repaid:

- Dt 62 Kt 90-1 - goods (work, services) were shipped;

- Dt 51, 50, 52 Kt 62 - amount received in payment of accounts receivable for shipped goods (work, services).

Employees' wages receivables have arisen and been repaid:

- Dt 70 Kt 50, 51 - advance payment was paid to employees for the first half of the month;

- Dt 20, 26, 91-2, etc. Kt 70 - monthly salary accrued.

Accounts receivables of accountable persons arose and were repaid:

- Dt 71 Kt 50, 51.52 - accountable funds have been paid;

- Dt 60.76 Kt 70 - the expenditure of accountable funds is reflected;

- Dt 50, 51, 52 Kt 71 - a refund was received of the unspent amount of the accountables.

Employees' receivables for material damage arose and were repaid:

- Dt 73 Kt 94, 28 - reflects the employee’s debt for damages;

- Dt 52, 51, 70 Kt 73 - full or partial compensation for damage received.

The receivables of the founders arose and were repaid:

- Dt 75 Kt 80 - reflects the debt of the founder for the contribution to the management company;

- Dt 51, 52, 08 Kt 75 - a contribution to the authorized capital was received.