Bookmarked: 0

What are production costs? Description and definition of the concept.

Production costs are the amount of costs an enterprise incurs in the direct production of services and goods.

Production costs include direct costs that are associated with the production of services and products, indirect costs (for security and management), auxiliary costs and losses from product defects. Production costs are grouped into three blocks.

The first is based on the place of their appearance (workshop, division). Such costs are recorded in reports on economic activities. The second block is costs based on the cost of product types. And the third - by calculation items and cost elements.

Let's take a closer look at what production costs mean.

Manufacturing costs are the direct costs of materials, labor, and various manufacturing overheads.

Non-productive (periodic or reporting time expenses) are commercial and administrative expenses.

Direct and indirect costs

Direct costs are direct material costs and labor costs. They are accounted for by debit and are attributed directly to a specific product.

Description of direct material costs:

Each industrial product consists of certain materials. Basic materials are those materials that become part of the finished product, and their cost can be directly and economically attributed to a specific product without much expense.

In some cases, it is not economically feasible to take into account the material consumption for each type of product produced. For example: nails in furniture or rivets in airplanes. Such materials are classified as auxiliary, and the costs for them are classified as indirect general production costs, which are usually taken into account as a whole for the reporting time period, and then distributed using special methods between certain types of marketable products.

Direct labor costs include all labor costs that can be directly and economically attributed to a particular type of finished product. Labor costs for a job that cannot be directly and economically attributed to a specific type of finished product are called indirect labor costs. These expenses include remuneration of such specialists as mechanics, supervisors and other support personnel. Like the costs of auxiliary materials, indirect labor costs are usually classified as indirect general production costs.

The size of direct costs per unit of production is independent of the volume of production, and it can be reduced by increasing production efficiency, labor productivity, and introducing new resource- and energy-saving technologies.

Indirect costs are a set of costs that are associated with production and which are not usually attributed to specific types of products. These are also called overhead costs.

Indirect costs are distributed among individual goods in accordance with the methodology chosen by the enterprise (in proportion to the basic wages of production workers, hours worked, etc.). This methodology is indicated in the production accounting policy.

Types of indirect costs:

production – these are general shop expenses associated with the organization, maintenance and management of production;

non-production costs are used for production management purposes. They are not directly related to the production activities of the organization and are recorded on the balance sheet account.

The peculiarity of general business expenses is that within the scale base they remain unchanged. They change with the help of management decisions, and the degree of their coverage is changed by sales volume.

Research journal

Review of the article

Shvetsova Yu. S. Pochekaeva O. V. 1. Master's student of the Moscow State University named after M.V. Lomonosov", Faculty of Economics, 2nd Ph.D. in Economics, Associate Professor, Associate Professor of the Department of Accounting, Analysis and Audit of the Federal State Budgetary Educational Institution of Higher Education "VSUVT"

Shvetsova JS Pochekaeva OV

1. Master student of FSBEI of HE "Moscow State University named after MV Lomonosov", Faculty of Economics 2. Ph.D., Associate Professor, Associate Professor, Chair of Accounting, Analysis and Audit, "Volga State University of Water Transport"

Abstract: The article discusses regulatory documents regulating cost accounting by industrial enterprises. It has been established that there are normative documents in force in a limited edition that do not meet the requirements of modern legislation. The influence of tax accounting requirements when setting up accounting for production costs at an enterprise, distorting the real level of cost, has been confirmed. Abstract: The article discusses the regulatory documents governing the cost accounting of industrial enterprises. The presence of regulatory documents in force in a limited edition that does not meet the requirements of modern legislation is established. The influence of tax accounting requirements when setting up accounting of production costs at the enterprise that distort the real level of cost is confirmed.

Keywords: accounting , regulation, costs, cost

The legal regulation of cost accounting and calculating the cost of products of domestic economic entities is represented by a four-level system, where any legal document adopted and put into effect specifically affects the calculation process, and each subsequent level of the regulatory system is responsible for specifying the previous level. The system of legal regulation of cost accounting and calculation of the cost of production of economic entities in the Russian Federation is represented by four levels.

Level I is responsible for regulating cost accounting and calculating the cost of production of economic entities in the Russian Federation at the level of federal accounting standards. The effect of regulatory legal acts related to this level is aimed at introducing uniform legal standards for accounting in the country. The list of documents that determine the procedure for organizing and maintaining cost accounting and calculating the cost of production of economic entities in the Russian Federation includes the following:

— parts I-II of the Civil Code of the Russian Federation;

— Labor Code of the Russian Federation;

— Federal Law “On Accounting”.

Part I of the Civil Code of the Russian Federation [1] legally establishes a set of key requirements for economic entities, i.e.:

1) the presence of an independent balance sheet as a formal sign of an economic entity formed in the form of a legal entity;

2) obligation associated with the approval of the annual report.

In this regard, it is worth noting paragraphs 1-3 of Article 48 of Part I of the Civil Code of the Russian Federation, which clearly defines the criteria for legal entities, namely:

- according to paragraph 1, a legal entity is recognized as an economic entity that has separate property and is responsible for its corporate obligations, has the opportunity on its own behalf to receive and exercise civil rights and bear the corresponding responsibilities, to act as a plaintiff and defendant in lawsuits;

- according to paragraph 2, a legal entity must be registered in the Unified State Register of Legal Entities in any of the organizational and legal forms of business that are provided for by the current norms of the Civil Code of the Russian Federation;

- according to paragraph 3, legal entities whose property complex their founders have proprietary rights include organizations in the organizational and legal forms of business MUP and FSUE.

Part II of the Civil Code of the Russian Federation [2] is intended to regulate legal relations that arise in the course of conducting the financial and economic activities of economic entities. For example, relationships for sales of goods and services with determination of the moment of recognition of income and expenses for transactions. In this regard, as an example, we can note paragraphs 1-5 of Article 454 of Part II of the Civil Code of the Russian Federation “Purchase and Sale Agreement”:

- according to paragraph 1, under the purchase and sale agreement, the seller’s party bears the obligation associated with the transfer of the thing (goods and/or services) into the possession of the buyer’s party, who bears the obligation associated with accepting the product and paying a specific amount of money for it;

- according to paragraph 2, transactions for the purchase and sale of securities and currency values are regulated by this paragraph in the absence of special rules for their purchase and sale in accordance with the current domestic legislation;

- according to paragraph 3, in situations that are provided for by the current norms of the Civil Code of the Russian Federation or other legal acts, the specifics of transactions for the purchase and sale of goods and/or services are determined by laws and other legal acts;

- according to paragraph 4, its provisions apply to transactions related to the sale of property, incl. digital rights, in the absence of other content or nature of this type of rights;

- according to paragraph 5, in relation to certain types of purchase and sale agreements, its provisions are applied in the absence of other rules in accordance with the Civil Code of the Russian Federation on the types of agreements (purchase and sale agreements in the field of retail trade, purchase and sale agreements related to the supply of goods and/or services, purchase and sale agreements in the form of contracting, purchase and sale agreements on issues related to energy supply to individuals and legal entities, etc.).

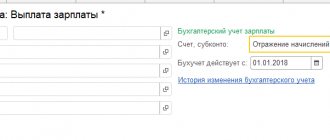

The next most important regulatory document is the Labor Code of the Russian Federation [3]. Its provisions regulate the procedure related to the determination of rules and regulations of labor protection, aspects of labor relations between all categories of workers within economic entities, as well as aspects related to bringing to liability in the event of damage due to shortages or damage to property. The inclusion of the Labor Code of the Russian Federation in the first level of the system is associated with the large role of labor costs. When calculating wages and insurance premiums, you must rely on the current norms of the Tax Code of the Russian Federation. In particular, when calculating the amounts of insurance premiums, it is worth paying attention to Article 425 of Chapter 34 of Part II of the Tax Code of the Russian Federation [4].

Keeping records of costs and calculating the cost of production of economic entities on the territory of the Russian Federation is regulated by the Federal Law “On Accounting” [5].

The documents of the first level of the domestic system of legal regulation of accounting in the country include the Accounting Regulations (PBU), approved by orders of the Ministry of Finance of the Russian Federation.

In terms of cost accounting, PBU 10/99 “Organizational expenses” is decisive. The Regulations provide a definition of expenses and their classification into expenses for ordinary activities and other expenses. According to the Regulations, expenses for ordinary activities include expenses associated with the manufacture of products, performance of work, provision of services and their sale, as well as reimbursement of the cost of depreciable assets; expenses associated with the acquisition of inventories; expenses arising directly in the process of processing or finalizing inventories for the purposes of production, performance of work and provision of services.

According to paragraph 8 of PBU 10/99 “Expenses of the organization” [6], costs when conducting ordinary types of economic and financial activities in the RAS system should be reflected in the context of the following groups:

— material costs (expenses);

— labor costs;

— insurance premiums (contributions to extra-budgetary funds for the payment of personnel);

— depreciation (depreciation deductions from depreciable property);

- other (other) costs.

This grouping is used by all commercial organizations and answers the question “what was spent on production.” The grouping allows us to draw a conclusion about the nature of production - material-intensive, labor-intensive, capital-intensive.

Recognition of costs in accordance with the current rules and principles of RAS occurs even in the absence of a desire to generate income and regardless of the form of incurring costs by economic entities (monetary, in-kind, etc.). Also, when recognizing costs, the fact of monetary coverage of costs is not taken into account, but only the time aspect of the actual incurrence of costs is taken into account. A similar requirement is contained in PBU10/99.

Accounting for material costs is carried out in accordance with PBU 5/01 “Accounting for inventories” [7], according to which a particular economic entity can choose one of the following options for writing off costs:

— the option of writing off material costs at the cost of each unit;

— option to write off material costs at average cost;

— an option for writing off material costs at the cost of the first inventory items acquired (FIFO method).

According to PBU 10/99, depreciation of depreciable property is recognized as expenses according to the calculated depreciation amounts in accordance with their original cost, SPI and the method of calculating depreciation adopted at the micro level, on which the amount of monthly accrued depreciation depends, affecting production and total cost.

Fixed assets are a key type of depreciable property. According to paragraph 18 of PBU 6/01 “Accounting for fixed assets” [8], at the micro level it is allowed to use the following methods for calculating depreciation for various groups of their homogeneous fixed assets:

— linear method of calculating depreciation of depreciable property;

— reducing balance method;

— method of writing off the cost by the sum of the numbers of years of SPI;

- method of writing off value in proportion to the volume of goods and services.

The calculation of depreciation of fixed assets in accounting and tax accounting occurs in different ways. The differences here begin with the number of depreciation methods that can be used in accounting and tax accounting: in the first case there are four, in the second - two. But the key difference here is that there is a different limit on the value of depreciable property. According to paragraph 5 of PBU 6/01 “Accounting for fixed assets”, this limit is 40 thousand rubles, i.e. It is from this value of the book value that assets are recognized as part of fixed assets.

According to paragraph 28 of PBU 14/2007 “Accounting for intangible assets” [9], at the micro level it is allowed to use the following methods for calculating depreciation for various groups of their homogeneous intangible assets:

— linear method of calculating depreciation of depreciable property;

— reducing balance method;

- method of writing off value in proportion to the volume of goods and services.

Cost data must be reflected in the company's annual accounting (financial) statements. What is said in the following Orders of the Ministry of Finance of Russia: in the Order of the Ministry of Finance of Russia “On the forms of financial statements of organizations [10]; in the Order of the Ministry of Finance of Russia “On approval of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99)” [11].

For this purpose, the following forms of accounting (financial) statements are used: “Balance Sheet”, “Statement of Financial Results” and “Explanations to the Balance Sheet and Statement of Financial Results”. Any economic entity must formulate its accounting policy on an annual basis, reflecting, in particular, the working chart of accounts, as well as the method of calculating the cost of goods and services, etc. The above obligation for economic entities is regulated by PBU 1/2008 “Accounting policies of an organization” [12].

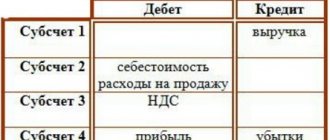

Federal standards also include the Chart of Accounts for accounting financial and economic activities and instructions for its application [13]. To account for costs, the Chart of Accounts provides active accounts “20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General business expenses”, 28 “Losses from defects”, 29 “Service production and facilities” [ 13]. Costs in these accounts are reflected on a functional basis. For example, production costs are reflected on account 20, and management costs on account 26. Level II is aimed at standardizing the process associated with accounting of business transactions and the process associated with determining general rules for aspects of registration of completed transactions.

This level is represented by industry standards. Currently, industry standards have been developed for non-credit financial organizations, credit organizations, and non-state pension funds. Currently, industry standards for cost accounting have not been developed; organizations are guided by current industry instructions (guidelines). For example, mechanical engineering enterprises can be guided by methodological materials “on planning, accounting and calculating the cost of production at mechanical engineering and metalworking enterprises” [14], in part that does not contradict current regulatory documents. This document focuses on the use of the standard cost accounting method in enterprises in this industry.

The third level of the system of legal regulation of cost accounting and calculating the cost of production of economic entities in the Russian Federation is represented by recommendations in the field of accounting, namely methodological guidelines, explanations and instructions on certain (narrow) accounting issues. Such regulatory documents are approved and put into effect in the country at the level of ministries, departments, professional associations of accountants, auditors and various government executive bodies.

Documents at this level that affect cost accounting include guidelines for accounting of inventories, accounting of fixed assets, accounting of special clothing, as well as recommendations for the use of accounting registers in enterprises. These documents develop the norms laid down in documents of levels I and II.

In addition to the above documents, the “Basic provisions for planning, accounting and calculating production costs at industrial enterprises” have not been canceled and are in force in a limited edition [15]. This document shows the composition of the costs that form the cost of products (works, services), provides a classification of costs by the place where costs arise (productions, workshops, sites, etc.), by types of products, works and services, by types of expenses (items and cost elements and their content). Explanations are given regarding the main and auxiliary productions. A separate section is devoted to cost planning. This document forms the basis of accepted industry instructions for cost accounting and calculating the cost of products (works, services).

Also not about, which reveal accounting for standard costs, accounting for deviations from standards and accounting for changes in standards [16].

Level IV makes it possible to approach detailed solutions to various organizational issues directly at the level of business entities. Documents at this level can be used, for example, in the form of instructions for developing accounting policies. They are developed and put into effect by orders of the heads of economic entities. The organization's accounting policy regarding cost accounting should disclose:

— a system of accounts for accounting costs for the production of products (works, services);

— method of accounting for production costs;

— a method for grouping production costs and writing them off;

— costing items used by the organization;

— method of assessing work in progress;

— method of distributing indirect costs between individual accounting and costing objects;

— the procedure and timing of repayment of future expenses;

— the procedure and timing for writing off other production expenses;

- option for consolidated accounting of production costs.

Concluding the compilation of a general description of the system of legal regulation of cost accounting and calculation of the cost of production of economic entities in the Russian Federation, it is necessary to note the inadmissibility of legal contradictions between each next level relative to the previous one.

Thus, the calculation of cost at the present time is strictly regulated within the framework of the development and implementation of a general market strategy by economic entities.

The management of economic entities must be guided, first of all, by the norms of the Civil Code of the Russian Federation, the Tax Code of the Russian Federation, the Labor Code of the Russian Federation, the Federal Law “On Accounting” and orders of the Ministry of Finance of the Russian Federation. But here it is necessary to take into account the lack of industry standards for cost accounting and calculating the cost of products (works, services) and the instructions adopted in the 80s of the 20th century, which gives domestic business entities quite broad powers to choose methods for calculating the cost of products (works, services).

Bibliography

1. “Civil Code of the Russian Federation (Part One)” dated November 30, 1994 N 51-FZ (as amended on December 16, 2019, as amended on May 12, 2020) 2. “Civil Code of the Russian Federation (Part Two)” dated January 26, 2019 .1996 N 14-FZ (as amended on March 18, 2019, as amended on April 28, 2020) 3. “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on April 24, 2020) 4. “Tax Code of the Russian Federation (part two)" dated 08/05/2000 N 117-FZ (as amended on 05/21/2020) 5. Federal Law dated 12/06/2011 N 402-FZ (as amended on 07/26/2019) "On Accounting" ( with amendments and additions, entered into force on 01/01/2020) 6. Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n (as amended on 04/06/2015) “On approval of the Accounting Regulations “Organization Expenses” PBU 10/99 ″ (Registered with the Ministry of Justice of Russia on 05/31/1999 N 1790) 7. Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n (as amended on 05/16/2016) “On approval of the accounting regulations “Accounting for inventories” PBU 5/01″ (Registered with the Ministry of Justice of Russia on July 19, 2001 N 2806) 8. Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (ed. dated 16.05.2016) “On approval of the Accounting Regulations “Accounting for fixed assets “PBU 6/01” (Registered with the Ministry of Justice of Russia on 04.28.2001 N 2689) 9. Order of the Ministry of Finance of Russia dated 12.27.2007 N 153n (as amended on 16.05. 2016) “On approval of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2007)” (Registered with the Ministry of Justice of Russia on January 23, 2008 N 10975) 10. Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n (as amended on April 19, 2019 ) “On the forms of financial statements of organizations” (Registered with the Ministry of Justice of Russia on 08/02/2010 N 18023) (as amended and additionally, came into force with the reporting for 2021) 11. Order of the Ministry of Finance of the Russian Federation dated 07/06/1999 N 43n (as amended dated 08.11.2010, as amended on 29.01.2018) “On approval of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99)” 12. Order of the Ministry of Finance of Russia dated 06.10.2008 N 106n (as amended on 07.02. 2020) “On approval of accounting regulations” (together with the “Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008)”, “Accounting Regulations “Changes in Estimated Values” (PBU 21/2008)”) ( Registered with the Ministry of Justice of Russia on October 27, 2008 N 12522) 13. Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n (ed. dated 08.11.2010) “On approval of the Chart of Accounts for accounting financial and economic activities of organizations and Instructions for its application” 14. Letter of the State Planning Committee of the USSR N AB-162/16-127, Ministry of Finance of the USSR, State Committee for Prices of the USSR N 10-86/1080, CSB USSR dated June 10, 1975 “On methodological materials for planning, accounting and calculating the cost of production at mechanical engineering and metalworking enterprises” 15. “Basic provisions for planning, accounting and calculating the cost of production at industrial enterprises” (approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance USSR, Central Statistical Office of the USSR 07/20/1970) (as amended on 01/17/1983). 16. “Standard guidelines for the application of the standard method of accounting for production costs and calculating the standard (planned) and actual cost of products (work)” (approved by the USSR Ministry of Finance, the USSR State Planning Committee, the USSR State Committee for Prices, the USSR Central Statistical Office dated January 24, 1983 N 12).

Basic and overhead costs

Basic costs include all types of resources (raw materials, basic materials, purchased semi-finished products, depreciation of equipment, etc.), the consumption of which is associated with the production of goods. In every production, basic costs constitute the most important part of costs.

Overhead costs are caused by management functions, which are different in nature, purpose and role from production functions. These expenses, as a rule, are associated with the organization of the enterprise’s activities and its management. Under the carrier cost allocation method, overhead costs are indirect.

How to take into account material expenses when calculating income tax

Before we talk about the features of accounting for an organization’s material expenses, it is necessary to decide which expenses are considered material. So, material costs include the following costs in the form of cost (clause 1 of Article 254 of the Tax Code of the Russian Federation)...

Before we talk about the features of accounting for an organization’s material expenses, it is necessary to decide which expenses are considered material. So, material costs include the following costs in the form of cost (clause 1 of Article 254 of the Tax Code of the Russian Federation):

- Purchased raw materials and materials that are used in the production of goods (works, services);

- Materials intended for packaging and other preparation of goods for sale;

- Tools, devices, inventory, workwear and other non-depreciable property;

- Components and semi-finished products;

- Fuel, water, energy used for technological needs;

- Works and services of a production nature that are performed by third-party organizations and individual entrepreneurs or structural divisions of the company;

- Maintenance and operation of OS and other environmental property.

A complete list of material expenses can be found in Article 254 of the Tax Code of the Russian Federation. Moreover, the given list is not closed. The fact is that material costs can include any costs associated with the production process. The main thing is that they are economically feasible and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Take advantage of all the features of Kontur.Externa

Send a request

Also, the following types of costs are equated to material costs (clause 7 of Article 254 of the Tax Code of the Russian Federation):

- Expenses for land reclamation and other environmental measures.

- Losses from shortages or damage to inventories during their storage and transportation within established standards.

- Technological losses during production and transportation.

- Expenses for mining and preparatory work during mining.

Raw materials purchased by the company should be accounted for at their actual cost, which includes not only their price, but also transportation costs, duties and fees, intermediary fees, the cost of non-returnable packaging and other costs associated with their acquisition (clause 2 , 3 Article 254 of the Tax Code of the Russian Federation).

Raw materials and supplies released into production can be written off in one of three ways provided for by current legislation (clause 8 of Article 254 of the Tax Code of the Russian Federation):

- At the cost of a unit of inventory, that is, at the actual cost of each unit of raw materials.

- Based on the average cost of materials by type.

- At the cost of the first materials purchased (FIFO method).

The chosen method should be fixed in the tax accounting policy.

Variable, fixed, semi-fixed costs

Variable costs increase or decrease in proportion to the volume of commodity production, in other words, they depend on the business activity of the company. Both production and non-production costs can be variable. Examples of manufacturing variable costs are direct material costs, direct labor costs, auxiliary materials costs, and purchased intermediates.

Variable costs characterize the cost of the product itself, all others (fixed costs) characterize the cost of production itself. The market is not interested in the cost of production, it is interested in the cost of the product itself.

Total variable costs have a linear dependence on the indicator of business activity of production, and variable costs per unit of production are a constant value.

Non-production variable costs include the cost of packaging manufactured products for shipment to the consumer, costs associated with transport that are not reimbursed by the buyer, and commission to the intermediary for the sale of products, which directly depends on the total sales volume.

Production costs, which ultimately remain unchanged during the reporting period, are not dependent on the business activity of production and are called “fixed production costs”. Even if production (sales) volumes change, they do not change. Fixed production costs include expenses associated with the rental of production space and depreciation of fixed production assets.

Total fixed costs are a constant value and do not depend on the volume of business activity, however, they may change under the influence of other reasons. For example, if prices rise, then total fixed costs also rise.

A type of variable costs are proportional costs. They are growing at the same rate as business activity in manufacturing.

Another type of variable costs are digressive costs. Their growth rate is less than the growth rate of the company's business activity.

In reality, it is practically impossible to encounter costs that, in their essence, will be exclusively constant or variable. Economic factors and associated costs are much more complex from a maintenance point of view, and therefore, in most cases, costs are semi-variable or semi-fixed. In this case, fluctuations in the business activity of the enterprise are also accompanied by changes in costs, while, unlike variable costs, the relationship is not direct. Conditionally variable or conditionally fixed costs include both variable and fixed elements. As an example, we can cite payment for using a telephone, which consists of a fixed subscription fee, which is a constant part, and payment for long-distance calls, which in this case will be a variable component.

What does workshop cost include?

Shop cost includes expenses that were incurred by one department for the manufacture of a specific type of product. They include:

- direct costs that are necessary to implement the main technological process;

- general production expenses associated with organizing the work of the workshop.

What costs form the total cost of finished products ?

Production costs include payment for the cost of raw materials, semi-finished products necessary for the manufacture of goods. This group also includes the costs of remuneration of hired personnel involved in technological work (including insurance premiums), depreciation charges for equipment operated in the workshops.

FOR REFERENCE! The basis for including costs in the workshop cost is the presence of direct affiliation with the production of a specific type of product.

The category of shop costs includes expenses associated with:

- heating of the production premises, its lighting (utility costs are calculated at current market prices with reference to the region where the unit is located, they include costs for electrical and thermal energy, costs associated with the transformation and transmission of energy);

- allocation of funds for the salaries of the workshop's management personnel, auxiliary and service specialists;

- accrued depreciation on fixed assets in the form of real estate used in the manufacturing process.

How is the cost of production determined using the direct costing method ?

Each expenditure amount can be included in the cost, provided that the costs incurred are economically justified and there is documentary evidence for each operation with them. It is allowed to take into account technological losses in the cost price. The rule applies to losses that were recorded within the standard values established at the enterprise. If the loss standards approved by the company’s local act for the manufacture of a specific type of product were not met, then:

- the amount of excess of the standard is calculated;

- the causes and circumstances of the occurrence of unforeseen expenditure of enterprise resources are identified;

- the perpetrators are identified;

- if there is proven guilt of individual officials, the amount of excessively spent funds is attributed to the account of these employees.

The allocated amount of the wage fund as part of the shop cost should take into account the basic and additional forms of workers' salaries. It is advisable to include in the basic salary payment for time worked at a tariff or at piece rates, incentive accruals and compensation for overtime hours, for work at night or on holidays.

REMEMBER! Given the rules for the application of mandatory regional coefficients and surcharges in the area where the production unit is located, their size must also be taken into account in the shop cost.

In planned calculations, it is allowed to use average indicators for each type of cost. The consumption of materials and raw materials with semi-finished products is included in the cost according to approved production standards. For the wage fund, one must focus on the indicators of the reporting and previous periods.

The following expense items should not be included in the workshop cost:

- entertainment expenses;

- expenses associated with advertising activities, participation in trade fairs, presentations and symposiums;

- transfer of funds under voluntary medical or pension insurance contracts.

Costs taken into account and not taken into account in estimates

In the process of making a management decision, it is assumed that several alternative options are compared with each other with a specific goal - choosing the best one.

option. The indicators compared in this way can be divided into two categories: the first remain unchanged under all alternative options, the second fluctuate depending on a particular decision. When considering a large number of alternatives that differ from each other in many respects, the decision-making process becomes significantly more difficult. This means that it is advisable to compare not all indicators in full, but only the indicators of the second group, and these are precisely those that vary from option to option. These costs, which distinguish one alternative from another, are usually called relevant costs in management accounting. They are taken into account when making certain decisions. Indicators of the first group, on the contrary, are not taken into account when searching for options.

The accountant-analyst provides management with initial information for choosing the optimal solution, preparing his reports in such a way that they contain only relevant information.

Opportunity costs

This category is present only in management accounting. The financial accountant cannot afford to “imagine” any costs, since he strictly follows the principle of their documentary validity.

In management accounting, in order to make a decision, it is sometimes necessary to accrue or attribute costs that may not actually occur in the future. Such costs are called imputed. Essentially, this is lost profit for the enterprise. It is an opportunity that is lost or sacrificed in favor of an alternative management decision.

The concept of workshop cost of production

The basic indicator of production costs is the workshop cost. It is formed from the expenses of departments that are directly related to the manufacture of products. This type of calculation is designed to show the bulk of material investments in goods.

How to calculate the cost of production ?

NOTE! The size of the workshop cost is always expressed in monetary terms.

In management accounting, analysis of the value of this type of cost helps:

- identify key factors influencing the occurrence of deviations from the projected cost volume;

- compare the efficiency of different workshops;

- assess the degree of negative impact of external factors on the results of core activities (including price fluctuations for raw materials).

What are the methods of cost formation ?

Incremental and marginal costs

Incremental costs are additional and arise as a result of manufacturing or selling an additional batch of products. Incremental costs may or may not include fixed costs. If fixed costs change as a result of a decision, then their increase is considered as incremental costs. If fixed costs do not change as a result of the decision, then incremental costs will be zero. A similar approach is applied in management accounting to income.

Marginal costs and revenues represent additional costs and revenues per unit of output (good).

Regulated and non-regulated costs

Regulated expenses depend on the influence of the responsibility center manager. However, it cannot influence non-regulated expenses. A manager's performance is assessed by his ability to manage regulated costs.

For example, a manufacturing department overused material. Are these costs regulated by the shop manager? The answer is unclear. In the case where overexpenditure is associated with a violation of labor or technological discipline in the department, then these costs are controllable. When the reason is the low quality of the purchased materials, then these unproductive expenses are considered as not regulated by the head of the production department, and the head of the supply department will be responsible for this.

We briefly examined what production costs are, their types and their impact on the state of production. Leave your comments or additions to the material.