Costs of purchasing vouchers at the expense of the organization’s own funds

Accounting Costs for the purchase of vouchers are recognized as other expenses of the organization (clauses 2, 4, 11 of the Accounting Regulations (PBU 10/99) “Costs of the Organization”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n (hereinafter referred to as PBU 10 /99).Please

note: in practice, there are three possible options for accounting for the costs of purchasing vouchers for employees and members of their families.

This means that the organization needs to develop and approve its own version of the accounting policy (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

Option 1

Purchased vouchers, issued on a strict reporting form, until they are transferred to employees, can be accounted for as monetary documents (in the amount of actual costs for their acquisition) in the debit of account 50 “Cashier”, subaccount 3 “Cash documents”, in correspondence with the credit of the settlement account with the travel seller.For settlements with the seller of vouchers, account 76 “Settlements with various debtors and creditors” can be used (Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

Then, to account 76 “Settlements with various debtors and creditors”, you should open a subaccount “Settlements for the purchase of sanatorium and resort vouchers for employees” (Instructions for using the Chart of Accounts, clause 4 of PBU 1/2008).

Thus, when accepting vouchers for accounting, an entry is made in the debit of account 50 “Cashier”, subaccount 3 “Cash documents”, in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

The transfer of funds for vouchers is reflected by an entry in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 51 “Settlement accounts” (Instructions for using the Chart of Accounts).

Therefore, purchased vouchers, issued with strict reporting forms, will be accounted for in account 50 “Cashier”, subaccount 3 “Cash documents” until they are transferred to employees.

Further, the cost of the voucher, paid at the expense of the organization, will be recognized in accounting as part of other expenses at the time the voucher is issued to the employee.

When transferring vouchers to employees, their cost, paid to the seller at the expense of the organization, is reflected in the debit of account 91 “Other income and expenses”, subaccount 2 “Other expenses”, in correspondence with the credit of account 50 “Cash”, subaccount 3 “Cash documents” ( paragraphs 11, 16 PBU 10/99, Instructions for using the Chart of Accounts).

Option 2

Expenses are recognized when the conditions provided for in clause 16 of PBU 10/99 are met, one of which is the certainty that as a result of a specific transaction there will be a decrease in the economic benefits of the organization.This certainty arises when the organization has transferred an asset or there is no uncertainty regarding the transfer of an asset (paragraph 4 of clause 16 of PBU 10/99).

As a result of purchasing vouchers, the organization does not acquire an asset, since the purchased vouchers will not bring it economic benefit.

Consequently, the costs of paying for vouchers must be recognized as expenses at the time of their implementation, i.e., when purchasing vouchers. In this case, the vouchers are not reflected as an asset, i.e. account 50, subaccount 3 “Cash documents” (paragraph 4 of clause 19 of PBU 10/99) is not used.

If the voucher is completely free for the employee, that is, if the employer bears the entire cost of purchasing the voucher, then these expenses must be immediately written off as a debit to account 91 “Other expenses” in accordance with the norms of PBU 10/99 “Organizational expenses”.

To control the availability and movement of vouchers, you need to organize their off-balance sheet accounting.

In order to ensure control over the safety of vouchers until they are issued to employees, the organization should organize the accounting of vouchers in a separate off-balance sheet account, for example, in account 018 “Vouchers purchased for employees and members of their families.”

Option 3

In practice, another option is possible when the employer does not purchase vouchers and does not issue them to employees, but fully or partially compensates employees for their own expenses for purchasing vouchers.Settlements with the employee for the payment of such compensation should be reflected using account 73.

In this case, the amounts of compensation must be debited to account 91 (and not taken into account in income tax).

Compensation for the cost of a trip to an employee

It is possible for the employer to pay for the trip in the form of compensation for the person’s expenses. The employee independently purchases a voucher at his own expense, which is subsequently compensated by the enterprise. Payment is made for vouchers purchased at recreation and recreation institutions, with the exception of tourist destinations.

Example of compensation for the cost of a trip ⇓

Employee V. of the enterprise Snezhok LLC purchased at his own expense a trip to a sanatorium worth 35,500 rubles. According to the terms of the labor and collective agreements, the enterprise pays the cost of purchasing the voucher. The following entries are made in the accounting of Snezhok LLC:

- The amount of the cost of the voucher is reflected: Dt 91/2 Kt 73 in the amount of 35,500 rubles;

- The payment of the amount through the cash register is taken into account: Dt 73 Kt 50 in the amount of 35,500 rubles;

- The accrual of insurance premiums is reflected: Dt 91/2 Kt 69 in the amount of 10,721 rubles;

The amount received from the employer is subject to personal income tax.

Tax accounting

Income tax

The employer's expenses for summer holidays for the children of employees are of a social nature and are not related to production activities. Therefore, such expenses, even on the basis of collective or labor agreements, are not recognized for profit tax purposes (Clause 29, Article 270 of the Tax Code of the Russian Federation). This is indicated in the letter of the Ministry of Finance of Russia dated February 16, 2012 No. 03-03-06/4/8. This position was also expressed by the Constitutional Court of the Russian Federation in its Determination No. 1216-O dated July 16, 2013.

This position is also valid for “simplified people”.

For a single tax, such expenses are not accepted - they are not named in the closed list contained in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

Application of PBU 18/02

Since the costs of paying for travel packages for the children of employees form the accounting profit (loss) of the reporting period, but are not taken into account when determining the tax base for income tax for both the reporting and subsequent reporting periods, a permanent difference and a corresponding permanent tax liability arise in the organization’s accounting ( PNO) (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” (PBU 18/02), approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

What documents are needed

To receive a voucher from the Social Insurance Fund, you must fill out a certificate at the clinic using the unified template No. 070/u (Appendix No. 12 to the order of the Ministry of Health dated December 15, 2014 No. 834n):

When issuing vouchers, the Social Insurance Fund is guided by the Administrative Regulations, the provisions of which were approved by Order No. 271n of the Ministry of Health and Social Development dated March 27, 2012.

The FSS considers applications for referral to sanatorium institutions only if a complete set of documents is available:

- application (you should use the form recommended by the fund as a sample);

- a certificate from clinic No. 070/u, which contains the doctor’s instructions on the need for specialized treatment or a course of rehabilitation in the appropriate profile of the sanatorium;

- document confirming the identity of the applicant.

Also see “Employee’s Application for Reimbursement of Travel Cost.”

Personal income tax

According to paragraph 9 of Art.

217 of the Tax Code of the Russian Federation, children's vouchers are exempt from personal income tax. However, when applying this rule, the following points should be taken into account.

1. Vouchers are exempt from personal income tax only if services are provided to children under 16 years of age by sanatorium-resort or health-improving organizations. These include:

sanatoriums, sanatoriums, dispensaries; rest houses and recreation centers; boarding houses; medical and health complexes; sanatorium, health and sports camps for children.

Please note:

firstly, to apply this benefit, it is necessary that the sanatorium-resort or health-improving organization be located on the territory of the Russian Federation; from the cost of a trip to a foreign sanatorium or camp, personal income tax must be deducted in full; secondly, the voucher should not be a tourist one (even if the company is Russian).

2. In the case of purchasing a voucher or paying compensation at the expense of the employer, the condition for exemption from personal income tax is that these expenses are not taken into account when determining the tax base for corporate income tax.

For special regime residents, a similar rule is that expenses should not be taken into account when calculating the single tax.

There is also no need to withhold personal income tax if compensation or payment for the cost of vouchers is made at the expense of the budgets of the budgetary system of the Russian Federation.

3. Of no small importance is who the voucher is intended for.

A closed list of persons whose payment for the cost of vouchers is not subject to personal income tax:

employees who, at the time of provision of a voucher or payment of compensation, are in an employment relationship with the organization; family members of such workers, including their children, regardless of age; former employees who left due to retirement due to disability or old age; disabled people who do not work in this organization; children under 16 years of age, regardless of the existence of an employment relationship with their parents.

Family members of former employees of the organization are not subject to this rule, unless they are disabled people or children under 16 years of age.

Consequently, if the provision of free or discounted vouchers to children of former employees over 16 years of age was provided for by local regulations, then personal income tax must be paid on the cost of such vouchers paid at the expense of the organization.

Travel with a voucher

Those who have presented coupon No. 2 or a referral to the FSS can apply for free travel to the location of the sanatorium institution:

If the results of the review of documents are positive, applicants will be issued free FSS vouchers and the right to preferential (free) travel to the location of the sanatorium and in the opposite direction.

A voucher along with a voucher for travel expenses is issued in compliance with the following deadlines:

- in a standard situation – there must be at least 18 days before the arrival date;

- the period for preliminary allocation of places in sanatoriums has been increased to 21 days if vouchers are issued through the Social Insurance Fund for disabled children or persons with disabilities resulting from identified diseases of the brain and/or spinal cord.

The frequency of sanatorium treatment is regulated by law. An annual interval has been approved for the provision of such social services to the population. This makes it possible to receive referrals for treatment or rehabilitation in a sanatorium no more than once a year.

Insurance premiums

From January 1, 2017, Law No. 212-FZ loses force.

Many of its norms were transferred unchanged to two laws: to part two of the Tax Code of the Russian Federation - to the new chapter 34 “Insurance premiums”. It now concentrates everything related to the calculation and payment of contributions (payers, objects of taxation, tariffs, benefits, etc.); to Law No. 125-FZ. Since control over contributions “for injuries” was retained by the Social Insurance Fund, everything related to the payment of contributions, fines, penalties, collection of arrears, conducting office and on-site inspections, offsets and refunds, etc. was transferred to it.

Let us note that the object of levying contributions for compulsory health insurance, VNiM, compulsory medical insurance, and “for injuries” has not changed.

For employers, these are payments to individuals within the framework of labor relations and under the State Labor Code, the subject of which is the performance of work, provision of services (clause 1 of Article 420, clause 1 of Article 421 of the Tax Code of the Russian Federation; clauses 1, 2 of Article 20.1 of Law No. 125- Federal Law).

Thus, the object of taxation with insurance premiums is payments and other remuneration accrued in favor of individuals, in particular, within the framework of labor relations (clause 1 of Article 420 of the Tax Code of the Russian Federation).

Children of employees do not have an employment relationship with their parents' employer. Therefore, it would seem that the indicated insurance premiums should not be charged on the cost of vouchers to health camps.

However, vouchers are not issued directly to children. Therefore, if the employer pays for the voucher itself or the voucher was purchased by the employee himself, and the employer compensates him for its cost (or part), insurance premiums will have to be charged.

This position was confirmed by the Russian Ministry of Labor in letter No. 17-3/ОOG-82 dated February 18, 2014, where it explained that compensation by the employer for the cost of a voucher initially purchased by an employee on his own (even for his child) is a payment within the framework of the labor relationship. Therefore, insurance premiums must be collected from her.

Thus, the cost of vouchers is included in the tax base for calculating insurance premiums in accordance with Art. 420 of the Tax Code of the Russian Federation and the letter of the Ministry of Health and Social Development of Russia dated May 17, 2010 No. 1212–19.

Please note that the calculation and payment of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases are still regulated by Federal Law No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” (hereinafter referred to as Law No. 125-FZ).

The cost of vouchers is subject to insurance contributions for compulsory social insurance against industrial accidents and occupational diseases (Clause 1, Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” "(hereinafter referred to as Law No. 125-FZ), letter of the Federal Insurance Service of the Russian Federation dated November 17, 2011 No. 14-03-11/08–13985).

Amounts of monetary compensation issued to employees for the independent purchase of vouchers are subject to insurance contributions, including contributions for compulsory social insurance against industrial accidents and occupational diseases in the same manner as vouchers purchased by the organization itself.

Example 1

Purchased vouchers, issued on a strict reporting form, are accounted for as monetary documents until they are handed over to employeesThe company, in accordance with the collective agreement, purchases sanatorium and resort vouchers for children of employees under the age of 15, which are transferred to them on preferential terms:

70% of the cost of the trip is paid by the employer; 30% is paid by the employee.

Part of the cost of the voucher is paid by the employee in cash to the organization's cash desk upon receipt of the voucher.

The organization purchased a voucher worth 25,000 rubles. and issued to the employee.

The following entries must be made in accounting:

Dt 50, subaccount “Cash documents”, Kt 76 (60) - 25,000 rubles. — the purchased voucher has been accepted for accounting; Dt 60, Kt 51 - 25,000 rub. — paid trip; D-t 50, K-t 73 - partial payment of the cost of the voucher was received from the employee - 7,500 rubles. (RUB 25,000 x 30%); D-t 73, K-t 50, sub-account “Cash documents” - 7,500 rubles. — the transfer of the voucher to the employee in terms of the cost of the voucher paid by him is reflected; D-t 91–2, K-t 50, sub-account “Cash documents” - part of the cost of the voucher transferred to the employee, which is financed from the employer’s funds, is written off as other expenses - 17,500 rubles. (RUB 25,000 x 70%). This amount is not subject to personal income tax, and insurance premiums in the amount of 5,443 rubles. (RUB 17,500 x 31.1%) will have to be charged: D-t 91-2, K-t 69 - insurance premiums are charged for the cost of the issued voucher - 5,443 rubles. (RUB 17,500 x 31.1%).

These expenses are not taken into account in tax accounting, so a permanent tax liability should be reflected in accounting:

D-t 99, K-t 68, subaccount “Calculations for income tax” - reflects the permanent tax liability - 3,500 rubles. (RUB 17,500 x 20%).

Example 2

Costs for paying for a voucher are recognized as an expense at the time of their implementation (purchase of the voucher)According to the employee’s application, the organization purchased a ticket to a children’s health camp for his 14-year-old child worth 40,000 rubles. (excluding VAT) directly at the health facility. The voucher is issued on a strict reporting form.

The purchase of vouchers for employees and members of their families at the expense of the organization is provided for by the collective agreement.

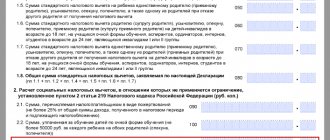

In the organization's accounting, the purchase of a ticket to a health camp for an employee's 14-year-old child and its issuance to the employee must be reflected as follows (see table).

Accounting for the purchase of a trip to a health camp for an employee’s child Debit Credit Amount, rub. Contents of operations Primary document On the date of purchase of the ticket 76-5 51 40 000 Paid travel for an employee's child Bank account statement 91-2 76-5 40 000 The cost of the trip is included in other expenses Travel voucher, accounting certificate 99 68 8000 PNO reflected (RUB 40,000 x 20%) Accounting certificate-calculation 018 40 000 The cost of the trip is reflected in the balance Travel logbook On the date of issue of the voucher to the employee 018 40 000 The cost of the issued voucher has been written off Travel logbook 91-2 69 12 440 Insurance premiums were charged for the cost of the issued voucher in the amount of

40,000 rubles. x (22% +5.9%+2.1%+1.1)Accounting certificate-calculation

Example 3

Partial compensation for the cost of a tripAn employee of an organization applying the general taxation regime independently purchased a children's voucher for 30,000 rubles.

The company compensates him for 30% of the cost of the trip.

The following entries should be made in accounting:

D-t 91-2, K-t 73 - part of the cost of the trip is taken into account, which is paid by the enterprise - 9,000 rubles. (RUB 30,000 x 30%); Dt 73, Kt 50 - 9000 rub. — compensation was paid to the employee; D-t 91–2, K-t 69 - insurance premiums were charged for the amount of compensation for the cost of the tour - 2799 rubles. (RUB 9,000 x 31.1%).

Since the organization does not take into account the amount of compensation for the cost of the trip when calculating income tax, a permanent difference arises, on the basis of which a permanent tax liability is formed:

D-t 99, K-t 68, sub-account “Calculations for income tax” - a permanent tax liability is reflected - 1800 rubles. (RUR 9,000 x 20%).

Purchasing vouchers at the expense of the Federal Social Insurance Fund of the Russian Federation

Some types of vouchers can be paid not only from the organization’s own funds, but also from the funds of the Federal Social Insurance Fund of the Russian Federation.

Federal Law No. 417-FZ dated December 19, 2016 “On the budget of the Social Insurance Fund of the Russian Federation for 2021 and for the planning period of 2021 and 2021” (hereinafter referred to as Law No. 417-FZ) defines the procedure for purchasing vouchers from the funds of the Social Insurance Fund of the Russian Federation .

There is a list of categories of citizens who can be paid for a trip at the expense of the Federal Social Insurance Fund of the Russian Federation. Moreover, funds from compulsory social insurance can be used to fully or partially pay the cost of children's vouchers only.

At the expense of the funds of the Federal Social Insurance Fund of the Russian Federation, vacation packages for the recreation and rehabilitation of children of only insured citizens are paid for.

At the expense of the Federal Social Insurance Fund of the Russian Federation, vouchers can be paid for:

health improvement for children in children's sanatoriums and year-round sanatorium camps located on the territory of the Russian Federation, duration of stay is 21–24 days. These vouchers are paid in full or in part at the rate of 400 rubles. per child per day; health improvement of children in country stationary children's health camps for no more than 24 days of stay during school holidays in the manner and under the conditions determined by the Government of the Russian Federation. Depending on the conditions established by the Government of the Russian Federation, these vouchers can be paid in full or in part.

The procedure for full or partial payment for children's vouchers at the expense of the Social Insurance Fund of the Russian Federation is established by Order of the Government of the Russian Federation dated April 1, 2005 No. 335-r “On the organization and conduct of a children's health campaign in 2005” (hereinafter referred to as Order No. 335-r).

h2>Terms of payment for vouchers In accordance with the established procedure, the following conditions must be met to pay for vouchers:

1) children aged from 4 to 14 years (inclusive) can be sent to children's sanatoriums, and children up to 15 years old (inclusive) can be sent to year-round sanatorium camps. At the same time, the maximum payment for the cost of a voucher per child per day in sanatoriums and health camps located in regions and localities in which regional coefficients are applied to wages in accordance with the established procedure is determined taking into account these regional coefficients;

2) when sent to country stationary children's health camps, the period of stay of children must be at least 7 days - during the spring, autumn, winter school holidays and no more than 24 days - during the summer school holidays for school-aged children up to 15 years (inclusive) .

In this case, payment for vouchers is made in the amount of up to 50% of the average cost of a voucher established by executive authorities of constituent entities of the Russian Federation based on the actual prices for vouchers to such camps located on the territory of this constituent entity of the Russian Federation, and up to 100% of the average cost of a voucher for children of employees of budgetary organizations , financed from budgets of all levels, and organizations whose financial situation does not allow them to pay the cost of a trip to such camps.

FSS: voucher to a sanatorium - 2021

A queue of people applying for a free trip to a sanatorium-resort holiday is formed in an electronic register. Insured persons can check the progress of their application in this queue on the website of the regional office of the Social Insurance Fund in the “Queue for sanatorium-resort treatment” tab. To search for applications in the register, you must enter the SNILS number in the search field - the code is indicated without spaces or hyphens, compliance with the indicated data entry order is mandatory.

When rehabilitation or treatment is paid for by the Social Insurance Fund, the preferential queue for vouchers may change not only in the direction of moving the application forward, but the option of deferring the application is also possible. The reasons for changes in the order of receipt of vouchers (moving forward or backward) may be:

- providing insured persons with travel vouchers;

- restoration of those on the waiting list;

- placing beneficiaries arriving from other regions on the queue;

- exclusion from the queue by voluntary expression of the insured persons.

Tax accounting

Income tax

In accordance with paragraph 29 of Art. 270 of the Tax Code of the Russian Federation, expenses for purchasing a voucher for an employee’s child are not taken into account for profit tax purposes.

With regard to the income that the organization receives in the event of reimbursement of part of the cost of vouchers from the local budget, the following should be kept in mind.

On the one hand, these amounts should not relate to taxable income, since they do not fall within the definition of income from sales or non-operating income (Articles 249, 250 of the Tax Code of the Russian Federation).

On the other hand, the amounts reimbursed by the budget for children’s (or any) vouchers are not included in income in the form of targeted financing, excluded from the tax base in accordance with Art. 251 Tax Code of the Russian Federation.

The Tax Code of the Russian Federation recognizes as targeted financing only payments to non-profit organizations for their maintenance and conduct of statutory activities.

Therefore, in tax accounting on the date of reimbursement of expenses for vouchers from the budget, the amount of the cost of children's vouchers reimbursed from the budget should be included in non-operating income and taken into account when taxing profits.

The Social Insurance Fund of the Russian Federation provides free travel to and from the place of treatment

Preferential travel on public intercity vehicles to the health resort (in both directions) is provided by the FSS. Russian citizens can get tickets with a discount on the train, which does not apply to sleeping cars with double compartments and luxury class cars. Beneficiaries can arrive at the resort by watercraft (exclusively category III). Social insurance will pay for travel by public car and by plane (economy class).

The FSS pays free of charge for travel to the health resort using a voucher issued by the territorial Fund or the executive body of the Russian Federation. Also, in order to get to the sanatorium without spending money, you will need a special coupon and a medical report, which are issued by employees of the Ministry of Health.

Application of PBU 18/02

As follows from paragraphs.

4, 7 PBU 18/02, due to the fact that the organization’s expenses for purchasing a voucher are taken into account in accounting, but not in tax accounting, the organization has a permanent difference and a corresponding permanent tax liability. Instruction No. 94n stipulates that the occurrence of a permanent tax liability is reflected by an entry in the debit of account 99 “Profits and losses”, the subaccount “Permanent tax liabilities”, and the credit of account 68 “Calculations for taxes and fees”.

Since compensation received from the budget is taken into account by the organization in income when calculating income tax, no differences with accounting arise.

Personal income tax

By virtue of clause 9 of Art.

217 of the Tax Code of the Russian Federation are not subject to taxation (exempt from taxation) the amount of full or partial compensation (payment) by employers to their employees and (or) members of their families, former employees who resigned due to retirement due to disability or old age, disabled people, not working in this organization, the cost of purchased vouchers, with the exception of tourist vouchers, on the basis of which these persons are provided with services by sanatorium-resort and health-improving organizations located on the territory of the Russian Federation, as well as the amount of full or partial compensation (payment) for the cost of vouchers for children under age 16 years, on the basis of which the specified persons are provided with services by sanatorium-resort and health-improving organizations located on the territory of the Russian Federation, provided, in particular, at the expense of the budgets of the budgetary system of the Russian Federation. Consequently, the organization does not have obligations as a tax agent for personal income tax in this situation.

Contributions for travel packages issued to third parties

In addition to the enterprise employees themselves, vouchers can be issued to third parties - dismissed employees who have contributed to the organization, family members of employees. Third parties do not have a contractual relationship with the enterprise; the obligation to charge contributions does not apply to the amounts received by them to pay for vouchers. The basis for the absence of obligations is the fact that the employer is not responsible for insuring persons not bound by employment contracts with the enterprise.

An employer can pay for a trip in several ways: (click to expand)

- Transfer the amount directly to the institution providing spa services.

- Pay the cost directly to the person

- Issue the amount to a staff member.

The occurrence of the obligation to charge contributions depends on the method of carrying out the payment procedure. The amount received for family members by the employee himself is the person’s income and is subject to contributions (

Insurance premiums

The situation is not so clear in the case of compensation to employees for the cost of children's vouchers, if such compensation is provided for by local legislation (Clause 2, Part 1, Article 9 of Law No. 212-FZ, and since 2017 - Clause 2, Part 1, Article 422 of the Tax Code of the Russian Federation) .

There is a possibility that tax authorities will object to the exclusion of such compensation from the calculation base for insurance premiums (the norm of Law No. 212-FZ and the Tax Code of the Russian Federation refers to compensation established by Russian legislation).

However, there is judicial practice when the court recognizes compensation established by local authorities as compensation provided for by the legislation of the Russian Federation (see resolution of the Federal Antimonopoly Service of the Ural District dated November 20, 2013 No. F09-5634/13).

At the same time, the judges noted that by reimbursing employees for part of the cost of children's vouchers, the company complied with the requirements of local legislation on compensating employees for such expenses.

In addition, the disputed payments are not elements of remuneration, do not have signs of wages, and their size does not depend on the complexity, quantity and quality of the work performed or on the employee’s length of service.

Partial reimbursement of the cost of children's vouchers is one-time in nature and is a way of social partnership between the state (represented by the municipality), the employer and the child's parents.

Accounting for funds received from the budget

Based on paragraphs.

5, 7 PBU 13/2000, as well as Instruction No. 94n, after the provision of funds from the relevant budget (which occurs on the basis of the relevant agreement), the amount of compensation is reflected in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 86 “Targeted financing” . By virtue of clause 10 of PBU 13/2000, budget funds provided to finance expenses incurred by the organization in previous reporting periods are reflected as the occurrence of debt on such funds and an increase in the financial result of the organization as other income.

Instruction No. 94n stipulates that this operation is reflected in the debit of account 86 and the credit of account 91, subaccount 91–1 “Other income” (this is evidenced by clause 7 of the Accounting Regulations “Income of the Organization” (PBU 9/99), approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

Upon actual receipt of budget funds, an entry is made in the debit of account 51 “Current accounts” and the credit of account 76 (clause 7 of PBU 13/2000).