Sanatorium as a non-core asset

Modern large manufacturing enterprises originally from the Soviet Union, as a rule, have non-core assets as part of their property complex that they inherited from “those times”: kindergartens, sanatoriums, recreation centers, cultural centers, etc.

Such assets were once created for the purpose of social support for the company’s employees, and not for the purpose of making a profit. Therefore, now in a market economy, managing such assets has become a problem for business managers. On the one hand, these are the losses that the activity of this asset brings to the enterprise, on the other hand, this is property, the disposal of which will also worsen sustainability indicators, and on the third, there is a trade union that demands kindergartens and sanatoriums for employees.

Decisions made regarding such property may be subject to different circumstances at different times. In this regard, non-core assets are in constant movement in relation to their parent enterprises.

Registration of a separate division

The appearance in management orders of such concepts as “separate division”, “allocation to a separate balance sheet”, “intra-business calculations” always causes considerable concern among the company’s accountants. It was in this situation that one of the largest aircraft manufacturing enterprises in Russia found itself - a branch of PJSC Novosibirsk Aviation Plant named after V.P. Chkalov" (hereinafter - NAZ). In 2015, it was decided to return a non-core asset from leasing back to the enterprise in order to create a separate division allocated to a separate balance sheet - the Chkalovets sanatorium and health camp. Accordingly, NAZ's accounting department faced a number of problems.

- Setting up accounting in a separate division based on the accounting policy of an aircraft production holding.

- Organization of on-farm payments for the sanatorium and NAZ.

- Selecting an accounting system for a separate division.

- Preparation and consolidation of regulated reporting.

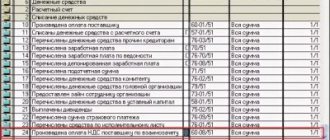

Accounting at NAZ is built on a significantly modified configuration “1C: Manufacturing Enterprise Management” and is characterized by order-based formation of costs, production of finished products at planned cost using account 40 “Product Output”, separate VAT accounting, and a variety of regulated accounting and tax accounting registers. Accounting in the sanatorium was organized on the basis of a bunch of standard configurations “1C: Enterprise Accounting”, “1C: Public Catering” and “1C: Salaries and Personnel Management”, and was limited to the most simple methods and methods of accounting for the general taxation system: gross cost accounting , the minimum required set of reports, etc.

conclusions

Analyzing the provisions of Art. 48 of the Civil Code, we can conclude that the standard provides 3 mandatory characteristics of an economic entity:

- Economic. It assumes that the company has separate assets. This, in turn, means that the enterprise has created a material base for conducting activities and paying off obligations.

- Material and legal. It indicates the ability of economic entities to bear responsibilities and acquire property and non-property personal rights.

- Legal. This sign indicates the company’s ability to act as a defendant/plaintiff when considering disputes in court.

Solutions

Three options were proposed as solutions to the problem of choosing an accounting system:

a) organize the maintenance of records of a separate unit in the same information base in which NAZ records are kept with the development of additions to implement the accounting features in the sanatorium;

b) organize the accounting of a separate division using the previous link “1C: Enterprise Accounting”, “1C: Public catering”, “1C: Salary and Personnel Management” with modifications to the configurations to implement the requirements of the accounting policy of PJSC “;

c) organize the maintenance of records of a separate division in a separate information base, but based on a configuration similar to the configuration of the NAZ accounting system.

The NAZ accounting department immediately rejected the first option, since the already complex structure of regulatory and reference information of an aircraft production enterprise would be replenished with food products, dishes, medical equipment, and the production of aircraft would coexist with the production of borscht.

For the remaining options, an assessment of labor costs for improvements and further support was carried out. Due to the desire of PJSC “to improve its accounting system, constant updating and addition of accounting and tax accounting registers, as well as due to increased activity in the field of regulated reporting on the part of legislators, it was decided to implement the third option as it is less expensive to develop and further accompanied.

Separate division: accounting in the sanatorium

After choosing an accounting system, the question arose of how to organize accounting for sanatorium-resort services and catering plant production in a separate division based on the configuration of an aircraft manufacturing enterprise. A sanatorium, allocated to a separate balance sheet, is obliged to keep records within the framework of the methods specified in the accounting policy of the parent enterprise, that is, in the described case, this is the accounting policy of PJSC ".

If we consider the activities of the sanatorium from the point of view of production, we can divide it into two components:

- the main production is the production and release of the final object of sale of the sanatorium, that is, the sanatorium and resort services themselves;

- auxiliary production is the production and release of food plant products.

Based on this approach to the activities of the sanatorium, accounting was able to be implemented using the current configuration of the aircraft manufacturing enterprise, with virtually no modifications to it. The main improvements were related to the implementation of the specific features of the food processing plant: specifications of parts were replaced with recipes for dishes, changes were made to the selection of analogues of raw materials, and the seasonality of food consumption was taken into account.

Results

The property of an enterprise and the sources of its formation are the two most important categories of accounting. Property includes fixed assets, intangible assets, inventories, cash and non-cash money of the company, accounts receivable, financial investments and a number of other assets. Sources of property formation are capital and reserves, loans, credits, accounts payable, profit. The company's assets and liabilities must be equal.

What is this article about?

In the article “Control of collateral (reservation) for orders” we have already reviewed the main changes in the control of collateral (reservation) for orders in the new release UT 11.1.4.1. But the program also contains a useful functionality called separate order support.

Separate order support appeared in earlier releases of UT 11 (i.e. before the release of UT 11.1.4.1), but I would still like to draw attention to this functionality and consider it in more detail in the new release of the program.

Applicability

The article was written for the editors of UT 11.1. If you use this edition, great - read the article and implement the functionality discussed.

If you are working with older versions of UT 11, then this functionality is relevant. The most noticeable difference between UT 11.3/11.4 and 11.1 edition is the Taxi interface. Therefore, in order to master the material in the article, reproduce the presented example on your UT 11 base. Thus, you will consolidate the material with practice