Article 431 of the Tax Code of the Russian Federation establishes that all payers whose average number exceeds 25 people are required to report digitally. Other policyholders with fewer than 24 employees report electronically if desired. For electronic reports, this condition is established in Art. 8 of Law No. 27-FZ of 04/01/1996 (as amended).

IMPORTANT!

Submitting reports electronically to the Pension Fund, Social Insurance Fund and Federal Tax Service via the Internet is mandatory for budget organizations with a staff of more than 25 people.

Services for submitting reports to the Pension Fund of Russia

Each accountant uses the services that are most convenient for him. Many programs are installed based on the 1C version. This is one of the most extensive and popular network programs for servicing the accounting departments of companies in various fields of activity.

The next most popular is the SKB “Kontur” program for submitting reports to the Pension Fund via the Internet. The developers offer their program as .

Online accounting “My Finances” has appeared on the market. This is a version that also has a mobile version and is offered for small companies where all reporting is carried out by the director himself.

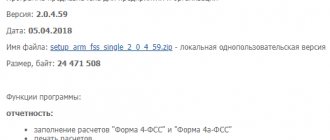

You can find very simple programs that are downloaded and installed on a personal computer. These are “Bukhsoft”, “My Business”, and many others.

The main rule for those who want to make their task easier and transmit reports via the Internet is the following:

- Installing the program on an individual computer (personal director or accountant)

- Concluding an agreement on sending reports to the Pension Fund via the Internet indicating the operator, technical characteristics of the software and the name of the program.

- Formation of an electronic signature that will be used to certify the report.

- When choosing a program, check its functions. If the program is for reporting, then it will not send the report. A reporting program is required.

1C-Reporting for the Moscow region (Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, RosStat, Rosalkogol) in Zelenograd

Possibilities

“1C-Reporting” is the sending of reports and additional types of electronic document flow with regulatory authorities (Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat) directly from the programs of the 1C:Enterprise 8 system. The functionality of “1C-Reporting” also provides users with a convenient way to install cryptocurrencies and register applications for EOKS directly at the workplace, from the familiar interface of the 1C program using the step-by-step “Connection Wizard”.

You can download a regulated report prepared in another program into the 1C:Enterprise program in order to send it to the regulatory authority using 1C-Reporting.

1C:Enterprise programs, in addition to sending all types of reporting established by law, built-in checks for the correctness of filling out reports and delivery monitoring, additionally support electronic document flow with the Federal Tax Service and the Pension Fund of the Russian Federation:

- exchange of letters between the taxpayer and the Federal Tax Service, Pension Fund;

- receiving newsletters from the Federal Tax Service and the Pension Fund of Russia;

- support for the translation of the paper archive of the Pension Fund of Russia reports into electronic form (retroconversion).

“1C-Reporting” includes the ability to work with the “Information Services for Taxpayers” service (ION FTS), including the execution of requests to receive from the Federal Tax Service:

- certificates of account status;

- statements of transactions for settlements with the budget;

- act of reconciliation of calculations;

- certificates of fulfillment of obligations to pay taxes and fees, penalties, insurance premiums and tax sanctions.

The 1C-Reporting functionality is included in the following standard application solutions on the 1C:Enterprise 8 platform:

| "1C: Accounting 8", edition 2.0 (versions KORP, PROF, basic) |

| "1C: Accounting 8", edition 3.0 |

| "1C:Manufacturing Enterprise Management", edition 1.3 |

| "1C: Integrated Automation", edition 1.1 |

| “1C: Public Institution Accounting”, edition 1.0 (PROF version, basic) |

| “1C: Salary and personnel management” (versions KORP, PROF, basic) |

| “1C: Salaries and personnel of a budgetary institution” |

| "1C:Taxpayer" |

| “1C: Accounting of an Autonomous Institution” (versions KORP, PROF, basic) |

1C-Reporting capabilities are available to registered users of the listed standard 1C:Enterprise 8 configurations, as well as many industry applications developed based on these standard solutions. To use 1C-Reporting, users of all versions except the basic ones must also have a valid 1C:ITS agreement. Users of the 1C:ITS information technology support complex at the PROF level are granted the right to use the 1C-Reporting service without additional payment.

To draw up an agreement for the use of the 1C-Reporting service and assistance in setting up the 1C:Enterprise program for submitting electronic reporting, the user only needs to contact the partner franchisee company that services the 1C:Enterprise 8 program. A 1C:Enterprise specialist will prepare all the necessary documents for working with electronic reporting directly in the user’s office.

To start working with electronic reporting using the 1C-Reporting functionality, a company using the 1C:Enterprise 8 program needs only:

- conclude an agreement with a partner (the usual term of an agreement is 12 months), transfer to the partner’s representative a completed application for a participant in electronic document flow and a signature key certificate;

- with the support of a 1C:Enterprise specialist using the Connection Wizard directly in the 1C:Enterprise 8 program, prepare cryptocurrencies, fill out and send an application for registration of a signature key certificate;

- in the “Application for connection to electronic document management” screen form of the program, click the “Update application status [from the Internet]” button;

- if the application is approved, the 1C:Enterprise 8 program will complete the setup of the electronic reporting system.

From this moment on, the user will be able to use the 1C-Reporting service. Updating the settings for electronic exchange of documents with regulatory authorities in the 1C:Enterprise program is performed automatically. The original signature key certificate, signed by the certification center, and a copy of the agreement, after registration, will be handed over to the user by the partner’s representative either by hand or by mail.

The important stages of the procedure for connecting an enterprise to 1C-Reporting are:

- identification (identity and passport data verification) of the enterprise employee responsible for signing and sending reports;

- drawing up and transmitting to the special communications operator an application for an electronic document flow participant and a signature key certificate; These documents must be signed by the director of the enterprise.

The partner’s specialist carries out identification and receives documents completed by the user to connect to the service.

The 1C-Reporting distribution scheme provides that a partner specialist in the user’s office helps set up the 1C:Enterprise program for working with electronic reporting. It is important to keep in mind that a number of actions related to the distribution of cryptocurrencies, namely: obtaining and installing CIPF, generating the private part of an electronic signature key, sending a request to register a signature key certificate with a certification center, can only be performed by the user personally. The partner’s specialist must explain to the client the stages of working with the Connection Wizard to 1C-Reporting, built into 1C:Enterprise. But the user must perform the steps to install and configure cryptographic tools on his computer independently in accordance with the requirements of current legislation.

To renew the contract for the 1C-Reporting service, the user only needs to:

renew the contract for the next period; no later than 14 days before the expiration of the electronic signature key certificate, using the “Connection Wizard” directly in the 1C:Enterprise program, generate the private part of the new signature key for the next period and click the button to send a registration application to the certification center new signing key certificate; obtain a new identifier for a participant in electronic document flow with regulatory authorities using the “Update application status [from the Internet]” button.

See also:

- Video instructions for connecting to the 1C-Reporting service

Rules for working with programs

The main requirements have been formed and presented in the table:

| No. | Name | Characteristic |

| 1 | Availability of a personal computer with Internet access | Necessarily |

| 2 | Information transfer rate | High |

| 3 | Availability of additional functions | Electronic digital signature |

| 4 | Access to the Pension Fund | Agreement with the Pension Fund for the transmission of reports via electronic communication channels |

Be sure to check with providers about the possibility of reporting.

Self-respecting providers know that minimum tariffs, which are ideal for entrepreneurs, often create difficulties in downloading and sending files. This can lead to freezing of the reporting program and rejection of the report. That is, penalties.

List of documents for obtaining an electronic signature required from an individual: a copy of the certificate of registration with the tax authorities, a passport and its copy, an application for issuing a certificate and an electronic signature key.

One of the ways to verify the authenticity of an electronic signature is to provide a certificate confirming that the signature and certificate at the time of submitting the documents are current and have not lost their validity. Read more here.

If everything is done, installed, and there is a digital signature, this does not mean that the report will be accepted. You must obtain written permission from the pension fund.

This is a document that will indicate all the parameters of your equipment (what will be indicated in the application for online reporting), certified by the pension fund and a password for entering the pension fund systems.

If this is not the case, then it is impossible to prove that the report was sent. Again, these are penalties for failure to submit. A copy of the agreement signed by the head of the pension fund is your admission to the pension fund system.

Regions where you only need an application to connect to electronic document management (EPED)

From mid-2021, the pension fund will move to a new reception complex. Here is a list of regions where you will need a single application in electronic form:

- 03 Republic of Buryatia

- 20 Chechen Republic,

- 23 Krasnodar region,

- 27 Khabarovsk region,

- 32 Bryansk region,

- 35 Vologda region,

- 45 Kurgan region,

- 47 Leningrad region,

- 50 Moscow region,

- 58 Penza region,

- 59 Perm region,

- 63 Samara region,

- 64 Saratov region,

- 71 (081-) Tula region,

- 72 Tyumen region,

- 77 Moscow,

- 78 St. Petersburg,

- 86 Khanty-Mansiysk Autonomous Okrug - Ugra.

In Elbe, complete the task “Send an application to the Pension Fund to submit the SZV-TD electronically.” It would be enough.

We check reports to the Pension Fund using programs

The pension fund, as the receiving party of the reports, is interested in their correct and timely submission. Therefore, it also offers software services for checking generated reports. It's quite simple and very convenient.

When such a service was introduced, the number of errors decreased. This is reported by sources from the pension fund. The fund also provides technical support for online reports.

Those persons who in companies are responsible for generating and sending reports, for example, chief accountants or simply an accountant, have the opportunity to directly contact the technical support service, which exists in each regional branch of the pension fund.

In case of any problems in the program or technical failures when generating and sending reports, any company will be able to receive qualified advice.

For those who are just planning to switch to a modern type of reporting, or are just starting their activities, we offer step-by-step instructions, without which the question “how to submit reports to the Pension Fund via the Internet” may take a lot of time to find an answer.

Setting up the service

When you first log into the service, you must fill out registration data, which will be used in the future when transferring information. To do this, just do the following:

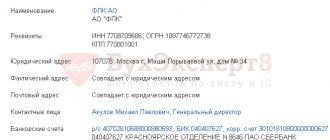

In Kontur.Extern, select the menu “PFR” > “Registration with the PFR” > “PFR Registration Information”. Or the page will open automatically if it is not yet filled out or there are errors in the data.

Check the completed data and enter the missing ones:

- “UPFR” is the code of the PFR branch to which the organization reports.

- “UPFR for pension cases” - appears if the “UPFR” field contains the code of the branch of the region in which it is possible to send layouts of pension cases through Kontur.Extern. Enter the UPFR code to which the layouts will be sent.

- “Registration number” is the registration number of the policyholder assigned by the Pension Fund of Russia.

- “Agreement number” and “Agreement date” - the number and date of the “Agreement on the exchange of electronic documents in the electronic document management system of the Pension Fund of Russia via telecommunication channels,” which is concluded with the territorial office of the Pension Fund of the Russian Federation at the place of registration. Not required to be filled out - this is only reference information and is not sent to the Pension Fund.

- “Certificate for signing Pension Fund documents” - select the certificate that will be used to sign reports to the Pension Fund. According to the requirements of the Pension Fund of Russia, the information sent must be signed either by the head of the insured organization or by a person acting on the basis of a power of attorney with the right to sign reports to the Pension Fund of Russia.

Click on the “Send information to the Pension Fund” button.

After submitting your registration information, you can immediately begin reporting.

If you change your registration information or signature certificate, make the appropriate changes in the “PFR Registration Information” menu and resubmit the registration information.

Electronic work books

In order to send information about employees’ work activities using the SZV-TD form, you must connect to the new PFR information system. To do this, you need to send an “Application to connect the policyholder to the Pension Fund EDF (ZPED)” according to the instructions.

How to submit a report to the Pension Fund via the Internet

Initially, you should prepare your computer by installing an anti-virus program, checking the system for viruses, and that there are no failures in the operation of programs, then perform the following steps:

- We check with the provider the data transfer speed to be able to quickly send reports.

- we buy or download a free program for generating and sending reports to the Pension Fund.

- We acquire an electronic digital signature.

- We enter into an agreement with the Pension Fund.

Results

If you are required to submit reports to the Pension Fund electronically, then you should enter into an agreement on electronic document management with the fund. To do this, you need to write an application to the Pension Fund with a request to connect your company to the electronic document management system. The form for such an application can be downloaded from the Pension Fund website.

Sources: Law “On individual (personalized) registration in the compulsory pension insurance system” dated April 1, 1996 No. 27-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

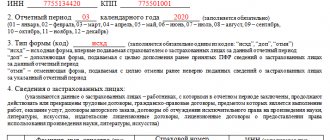

Filling out the RSV-1 report for the Pension Fund online

An example of changing the procedure for submitting documents is the RSV-1 form. Back in 2013, this report was submitted using the old form, but since the 1st quarter of 2014 the new one has already been in effect. Several changes:

- there is no longer a SZV form - it is now included in the appendices to the main form;

- One form is submitted per person, which must contain indications of several insurance rates;

- The classifier of employee length of service codes is being expanded;

- Payments under the additional tariff are now calculated based on a special assessment of working conditions.

RSV-1 reporting can be submitted either in printed form or electronically using telecommunication channels. Printed form is allowed if the organization has up to 50 employees. Large enterprises need to take care of electronic document processing by choosing a suitable system that can generate a report to the Pension Fund via the Internet.