Accounting for main and auxiliary production

The production process aimed at producing products that form the main activity, according to the constituent documents of an economic entity, is called main production.It is associated, first of all, with the use in the production or processing of products of certain resources such as raw materials, materials, fuel, energy, fixed assets, labor resources, as well as other costs. Taken together, these costs form production costs, which include costs directly associated with a specific technology and organization of production.

These include:

- direct material costs;

- direct labor costs;

- indirect costs, including manufacturing overhead.

In accordance with the economic content, costs included in the production cost of products are grouped into the following elements:

- production material costs;

- production labor costs;

- contributions to social insurance of employees;

- depreciation of fixed assets and intangible assets for production purposes;

- other production costs.

The following items are included in the material costs included in the production cost of products:

- raw materials and supplies purchased externally;

- purchased materials necessary in the production process in order to ensure a normal technological process;

- purchased components and semi-finished products;

- works and services of a production nature performed by third-party enterprises or individuals.

As for production labor costs, these include:

- wages of production workers accrued for work actually performed, according to piece rates, tariff rates and official salaries;

- an increase in tariff rates and salaries for professional excellence and mentoring;

- compensatory payments related to working hours and working conditions, namely: bonuses for overtime and night work, etc.

Contributions for social needs related to production, calculated according to the norms of accrued wages. They are transferred by the state insurance authority and the pension fund.

An enterprise can make contributions to non-state pension funds, voluntary health insurance and other types of voluntary insurance.

Production costs also include the amount of depreciation of fixed assets and intangible assets used for production purposes. These include depreciation charges for production fixed assets and intangible assets.

Other production costs include various costs associated with servicing production and organizing the technological process, and others, which are detailed in the Regulations on the composition of costs.

Other expenses related directly to the production of products, performance of work and provision of services, as well as expenses associated with the management and maintenance of the main production are reflected in account 2010 “Main production”.

In industries with complex technology for processing products, at the end of each month in the shops, the balances of work in progress are determined, which are identified using inventory and reflected at standard (planned) cost and displayed as a balance in the debit of account 2010 “Main production”.

Accounting for auxiliary production. In order to ensure the normal and efficient functioning of the main production, a number of auxiliary production facilities are created at enterprises, which are designed to provide energy, tools, packaging, repair, and transport services.

The main types of auxiliary production are:

- energy, producing and distributing electrical, thermal and other energy, water supply, steam supply; providing compressed air, wastewater treatment, ventilation, installation and repair;

- transport, performing the functions of loading and unloading, transport work, forwarding and escorting cargo along the way, servicing vehicles, etc.;

- repair, providing installation, modernization, maintenance of fixed assets, production and restoration of spare parts, building parts and structures;

- instrumental, which are responsible for the manufacture, repair and restoration of tools, fixtures, dies, molds, models, etc. For example, a woodworking plant creates a workshop for the production of canopies, latches, screws, nails;

- containers, for the manufacture and repair of containers;

- quarries for the extraction of stone, gravel, sand and other materials;

- workshops for salting, drying and canning agricultural products. products, primarily in trade and catering establishments, etc.

Accounting for the costs of auxiliary production servicing the main production is reflected in account 2310 “Auxiliary production”. This account is a calculation account and is maintained for each type of auxiliary production. During the reporting period, all expenses directly related to the production of products, provision of services, performance of work in auxiliary workshops, as well as indirect expenses associated with the maintenance and management of auxiliary production are accumulated here (on account 2310).

Direct costs associated directly with the production of products, performance of work and provision of services are written off to account 2310 “Auxiliary production” from the credit of inventories, settlements with personnel for wages, depreciation of fixed assets and intangible assets. For example,

- when releasing materials for auxiliary production needs:

- debit 2310 “Auxiliary production”

- credit 1010 “Raw materials and supplies”

- when calculating wages to employees of auxiliary production:

- debit 2310 “Auxiliary production”

- loan 6710 “Settlements with personnel for wages”.

Indirect costs associated with the management and maintenance of auxiliary and other productions are written off to account 2310 “Auxiliary production” from account 2510 “General production expenses”:

- debit 2310 “Auxiliary production”

- credit 2510 “General production expenses”

During the production process, there may be cases of product defects. In this case, the amount of loss from defects from the credit of account 2610 “Defects in production” is written off to the debit of account 2310 “Auxiliary production”

The credit of account 2310 “Auxiliary production” reflects the amounts of the actual cost of finished products. These amounts are written off from account 2310 “Auxiliary production” to the debit of the accounts:

— 2010 “Main production” - when releasing products to the main production or main type of activity For example: the services of the transport department for transporting goods for the main production were written off (D-t 2010 K-t 2310);

- 2510 “General production expenses” - when releasing products (work, services) for general production purposes: For example, steam boiler services consumed by the plant management are written off (D-t 2510, K-t 2310);

- 9130 “Cost of sold work and services” - when selling work and services to third-party organizations: For example, a transport workshop provides services for the transportation of goods externally (D-t 9130, K-t 2310);

- 9420 “Administrative expenses” – when releasing products (works and services) for general administrative purposes; For example, the cost of major repairs of an administrative building carried out by repair shops is reflected (D-t 9420, K-t 2310).

The balance on account 2310 “Auxiliary production” (the same as on account 2010) at the end of the month shows the value of work in progress.

MATERIALS MANAGEMENT

If we delve a little deeper into financial accounting, we will understand where the materials for production come from. Firstly, a sales plan for finished products is drawn up, and from there the following are drawn up:

- production plan;

- procurement plan for this production of materials;

- labor cost plans;

- and other company plans and budgets.

That is, the plan for the purchase of raw materials and supplies is taken based on the production plan! Next, the company's suppliers select suitable suppliers according to their parameters and order raw materials for the production of products.

Structure of auxiliary facilities

Auxiliary production consists of the following elements:

- service facilities (warehouses, transport, etc.), services in the main workshops;

- auxiliary shops (energy, mechanical repair, tool) depending on the nature of the industries;

- regulation of loading and unloading and transport and storage operations.

Increasing labor productivity is an important factor contributing to increased efficiency of the entire production process. Workers who service auxiliary production are classified as auxiliary workers. Almost all large enterprises have a complex of areas, services and auxiliary workshops. The main and auxiliary production are comparable in size and specificity of the industry.

METHODS FOR RECORDING MATERIALS INTO PRODUCTION

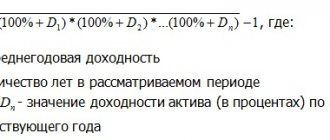

When materials are released into production, they can be assessed in three ways:

- at the cost of each unit;

- at average cost;

- using the FIFO method.

Let's talk about each:

At the cost of each unit - this method is used quite rarely, and in certain types of activities. For example, when writing off precious stones in jewelry production. Since it is difficult to evaluate two different diamonds based on their average cost

( 2 ratings, average 5 out of 5 )

RECEIPT OF MATERIALS

Materials arrive at the warehouse. An organization may have several warehouses. This may be one common warehouse, or it may be a division of warehouses into production workshops. Depending on the number of warehouses, responsible material persons for the receipt and release of materials must be identified and documented. This will be useful to the accountant at the end of the month to calculate the actual cost, based on the results of the inventory.

So, the materials have arrived at the warehouse, the MOL (materially responsible person) accepts this material into the warehouse and signs the receipt on the delivery note. One copy of the invoice is returned to the supplier, and the other to the accounting department. This is the arrival of raw materials to the warehouse. There may be several receipts within a month. Accordingly, these receipts are reflected in the accounting and storekeeper records.

Accounting for materials in production - accounting entries:

1) Dt 10 Kt 60 – receipt of materials from the supplier.

2) If you work with VAT, then separate out from the amount of VAT receipts: Dt 19 Kt 60 – VAT on materials is reflected

3) And if the supplier gave you an invoice that you can accept for deduction, then you accept this VAT for deduction: Dt 68.2 Kt 19 – we accept VAT for deduction.

Example A supplier shipped us materials worth 120,000 rubles, including 20% VAT. Based on the invoice, the accountant makes the following entries: Dt 10 Kt 60 – 100,000 rubles (we take into account the material without VAT); Dt 19 Kt 60 – 20,000 rubles (we reflect VAT on receipt); Dt 68.2 Kt 19 – 20,000 rubles (we accept VAT for deduction based on the invoice).

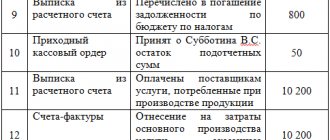

Task for independent solution:

Prepare accounting entries.

The supplier shipped material in the amount of 162,000 rubles, including 20% VAT.

Examples of transactions and postings on account 23

Example 1. Carrying out work for the needs of a third party

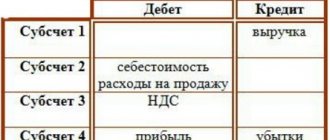

Let's say the repair organization Vesna LLC has auxiliary production. Based on the results of the work for Leto LLC, the revenue of the auxiliary workshop amounted to 59,000 rubles, incl. VAT – 9,000 rubles, expenses for performing work – 29,000 rubles.

In Vesna LLC, the performance of work for the needs of a third-party organization is reflected in the following entries in account 23:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 23 | 10/70/69 | 29 000 | Costs for work performed are taken into account | 261-APK, 264-APK, 267-APK, 265-APK, 136-APK, 137-APK, T-49, Accounting certificate |

| 62 | 90.01 | 59 000 | Sales revenue taken into account | Repair work acceptance certificate |

| 90.02 | 23 | 29 000 | Expenses written off | Report on the distribution of auxiliary production services, 301-APK |

| 90.03 | 68 VAT | 9 000 | VAT charged | Repair work acceptance certificate |

| 90.09 | 99 | 21 000 | Reflection of the financial result (profit) from sales at the end of the month | Repair Work Acceptance Certificate, Accounting Certificate |