List of objects subject to assessment

The list of objects subject to insurance premiums includes funds transferred by policyholders in accordance with labor-related relations.

- Employment contracts.

- Civil contracts, for example, receiving remuneration for work performed. With this type of agreement, employees do not have the opportunity to receive sick leave and go on vacation. He usually receives his salary in the form of a commission.

- Agreements on human copyright, alienation of the exclusive right of the author for art, science, and literature, that is, agreements that will be related to human intellectual property.

- Agreements on licensing rights for the use of data from science, art, literature, etc.

You may be interested in: How to live on retirement: ways of survival, advice and revelations from retirees

You may be interested in:How to check your Sberbank account: hotline, Internet, SMS and other ways to check your account and bonuses

Previously, only contracts were subject to insurance premiums, now – relationships. This means that all benefits that are related to the employment relationship must be subject to contribution, except for those that are considered exceptions.

The object of taxation of insurance premiums is payment in favor of employees who are subject to compulsory insurance. Based on federal laws, exceptions include individual entrepreneurs, notaries, and lawyers. If the employee did not enter into an agreement with the employer, then there will be no payments.

Cash will not be considered subject to insurance contributions to extra-budgetary funds if:

- No contract or agreement was concluded.

- An agreement relates to rights to a specific property, such as a lease agreement.

- Dividends were purchased as a shareholder of the company.

- There was a material benefit from the loan with benefits.

You may be interested in: How a girl can make money: types and list of jobs, ideas for making money on the Internet and approximate payment

If during the period of transfer of wages the employer received information that his employee had died, then such funds will also not be subject to contributions. When a person dies, the employment relationship ends. There will also be no point in compulsory insurance for such an employee.

WHAT IS ACCIDENT INSURANCE

Compulsory social insurance against industrial accidents and occupational diseases is a type of social insurance and provides for:

- ensuring social protection of the insured and economic interest of insurance subjects in reducing professional risk;

- compensation for harm caused to the life and health of the insured during the performance of his duties under an employment contract and in other cases established by law, by providing the insured in full with all necessary types of insurance coverage, including payment of expenses for medical, social and professional rehabilitation;

- application of preventive measures to reduce industrial injuries and occupational diseases.

The legislation of the Russian Federation on compulsory social insurance against industrial accidents and occupational diseases consists of:

- Federal Law No. 125-FZ dated July 24, 1998 (as amended on December 8, 2020) “On compulsory social insurance against industrial accidents and occupational diseases”;

- federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with it.

NOTE

Insurance premiums for pension insurance, medical insurance and in case of temporary disability are paid to the tax authorities, insurance premiums for accidents are paid to the Social Insurance Fund of the Russian Federation.

Contribution rates for injuries are provided for by Federal Law No. 179-FZ dated December 22, 2005 (as amended on December 22, 2020) “On insurance rates for compulsory social insurance against industrial accidents and occupational diseases for 2006” (hereinafter referred to as Federal Law No. 179-FZ). They range from 0.2 to 8.5% depending on the type of activity.

The validity of this regulatory document is extended by separate regulatory acts. Thus, Federal Law No. 445-FZ dated December 27, 2019 “On insurance tariffs for compulsory social insurance against industrial accidents and occupational diseases for 2021 and for the planning period of 2021 and 2022” establishes that in 2021 and in the planned period 2021 and 2022 Insurance premiums for OSS against industrial accidents and occupational diseases are paid by the insured in the manner and at the rates approved by Federal Law No. 179-FZ for 2006.

Rules for taxation of funds

Payments that are subject to insurance premiums are calculated for each employee individually from the beginning of the billing periods by accrual. Moreover, an amount that is not subject to contribution, if any, will be deducted from the salary. The objects of taxation of insurance premiums are:

- wage;

- various types of allowances - for additional shifts, combining several positions in the workplace, for length of service, etc.;

- the use of an increasing coefficient, for example, regional regulation, for work in high mountainous areas;

- payment to an employee in the form of certain goods.

Employee benefits

Some organizations provide their employees with various benefits, for example, a New Year's gift for a child, financing of health resort vouchers for an employee and his family, payment of expenses for a kindergarten. Will such benefits become subject to insurance premiums? If an organization transfers funds personally to an employee, for example, returns money for a vacation in a sanatorium, then they will become such an object.

If an enterprise transfers money to institutions (a travel agency, a kindergarten), then the payment does not become subject to taxation, the employee does not receive anything, but at the same time uses the service or assistance of the employer. Not all organizations provide such assistance to employees; in most cases, the employee receives remuneration for his work.

Payments made to a person who is not considered an employee of the organization cannot be subject to contribution.

Powers of the Federal Tax Service, state funds

Tax authorities have the right:

- monitor the actions of entrepreneurs and employers (checking the correctness of the calculation, timely payment of the contribution);

- to accept payments, contributions, return funds, based on the decision of the Social Insurance Fund or the Pension Fund of the Russian Federation;

- decision to provide an installment plan for the employer or a deferment;

- establishment of penalties and fines.

You may be interested in: Is it possible to refuse a mortgage: conditions for concluding an agreement, how to terminate

The Pension Fund of the Russian Federation and the Social Insurance Fund have the right to take similar actions related to insurance premiums, the period of which expired before January 2021, or was clarified or recalculated. The Pension Fund of the Russian Federation is also responsible for maintaining records in the compulsory insurance program, and the Social Insurance Fund is considered the administrator for maintaining insurance amounts for compulsory social insurance. The FSS retained the right to verify the declared amounts for payments for temporary disability of employees and maternity.

General and differences between taxes, fees and contributions

Taxes, fees and mandatory insurance contributions are mandatory cash payments to the state by citizens and organizations.

From the government's point of view, the difference between taxes, fees and contributions is very significant. Taxes, fees and contributions are collected by various government agencies. They are also spent by different government agencies (not necessarily the same ones that collect them) and for different needs.

Relationships arising regarding the collection of taxes, fees and compulsory insurance contributions between payers and government agencies are regulated by various legislative acts. For taxes and fees, the main legislative act is the Tax Code. And for compulsory insurance contributions - the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Despite the fact that the Tax Code of the Russian Federation regulates the calculation of not only taxes, but also fees, fees are not mentioned in the title of the code. This is due to the fact that for the state fees are of secondary importance, and for the payer the difference between taxes, fees and contributions is small.

The purpose of collecting a payment, the state needs for which this or that tax, fee or contribution will be spent, is perceived by the payer as an abstraction. The main significance for the payer is the size of the amount of money withdrawn from him. Usually the payer treats all these payments as inevitable and is interested in paying less.

Regarding taxes and fees, the payer most often interacts with the tax inspectorate, a territorial division of the Federal Tax Service. The Federal Tax Service itself is subordinate to the Russian Ministry of Finance, which, in turn, is subordinate to the Government of the Russian Federation.

When paying mandatory insurance premiums, the payer interacts with the following extra-budgetary state funds:

- Pension Fund of the Russian Federation;

- Social Insurance Fund of the Russian Federation. Mandatory insurance premiums are also paid to the Federal Compulsory Health Insurance Fund. However, the payer of contributions does not interact directly with the specified fund. The state side in paying contributions to these funds is represented by the Pension Fund.

This can be explained as follows:

- the scheme for calculating contributions to the Federal Compulsory Medical Insurance Fund is similar to the scheme for calculating contributions to the Pension Fund, and the amount of contributions to the health insurance fund is significantly less;

- the state is trying to simplify the interaction of citizens and organizations with government bodies.

Despite the fact that regarding the payment of taxes and fees, on the one hand, and mandatory insurance contributions, on the other, the payer interacts with different government agencies and on the basis of different legislative acts, the technique of this interaction is similar. The measures of coercion and punishment applied to a payer who evades his obligations are also similar.

Accounting for insurance premium payments

The employer pays the employee. At the same time, he must pay insurance premiums. In order for payment to be made correctly, it is necessary to have information from the accounting organization. All necessary information is specified in the order of the Ministry of Health of Social Development of the Russian Federation No. 908n (hereinafter referred to as order). Based on this order, payers are required to keep records of their actions to transfer funds:

- accrued fines and penalties;

- received money for transfer;

- expenses incurred to pay certain amounts of insurance;

- in case of employee maternity or disability.

There should also be information about funds received from the Social Insurance Fund. Accounting for objects subject to insurance premiums is carried out in a special manner, since the employer does not transfer all accrued funds. It is possible to reduce the calculated contribution to the SS through benefits provided by the fund itself. Only the amount of funds should not be higher than the FSS established. The transfer of funds that can be reduced is described in the order.

- Benefits paid due to a worker's disability.

- Payment to women due to pregnancy and childbirth.

- A one-time payment to women who registered with medical institutions in the early stages of pregnancy.

- Payments upon birth of a child.

- Payment to the parent for the child every month for one and a half years.

- Social payment for funerals or financing of necessary funeral services from a specialized organization.

- Payment for four days off per calendar month when caring for disabled children.

The enterprise must keep records for each employee and systematize the information. Once a certain amount of payment has been reached for an individual employee, the accrual of funds is allowed to stop.

Taxable base by type of activity

For certain categories of payers, preferential criteria for calculating insurance premiums apply depending on the type of activity used. Entities using the simplified tax system and engaged in the production of food products, textiles, woodworking and other types of production have the right to use only a 20% rate in the Pension Fund when calculating insurance premiums. Enterprises that have been assigned participant status in the Skolkovo project pay only 14% in the Pension Fund.

Other categories of preferential payers are listed in Law No. 212 - Federal Law.

Individual accounting

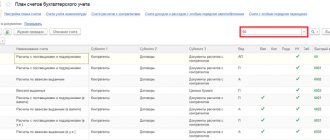

Inspectors conduct audits and review the information on each worker's record card against the accounting list and then compare the information. Accounting for an object subject to insurance premiums requires an individual approach, but the guidelines for using the chart of accounts do not provide for this. The accruals are reflected collectively.

In order to facilitate the work and avoid making mistakes, a decision was made by the Pension Fund and the Social Insurance Fund in January 2010. This solution recommends the use of cards; they contain additional pages that will need to be filled out only if tariffs that differ from the basic indicators are used.

Accounting

Accounting is controlled using general rules. For these purposes, you need to use the chart of accounts No. 69. After the reform of compulsory social insurance, the system of accounts has become simpler for enterprises.

The order of the Ministry of Health and Social Development specifies an algorithm for accounting for objects subject to insurance premiums. It is necessary to separate contributions, benefits, and fines. You cannot include travel information in expenses.

The amounts of contributions are indicated in rubles, and charges and expenses are carried out in rubles and kopecks. The FSS decided to return the funds that were overpaid. They must be entered in the accounting records and the information must be entered in the month in which they were received.

Payers of taxes, fees and insurance premiums

The same payer of mandatory cash payments may be called a tax payer, a fee payer or a payer of insurance premiums, depending on what he pays. For brevity, the payer of taxes and fees is called the taxpayer, and the payer of insurance premiums is called the policyholder.

The Tax Code and legislation on insurance premiums distinguish two main categories of taxpayers and contributors:

- individuals;

- organizations.

Moreover, in the legislation on insurance premiums, individuals are also considered as recipients of income from the state - insured persons.

An individual is a citizen of the Russian Federation, a foreign citizen or a stateless person. In other words, an individual is a person who is capable of being legally responsible for his actions.

The Tax Code of the Russian Federation and the legislation on insurance premiums distinguishes categories of individuals who are engaged in entrepreneurial activities and private practice. These include:

- individual entrepreneurs - individuals who are registered in accordance with the procedure established by law and carry out entrepreneurial activities;

- heads of peasant (farm) households;

- notaries engaged in private practice;

- lawyers who have established law offices.

State registration and registration are provided for such individuals. The methods of registration and registration depend on the category to which the individual belongs. The differences in the calculation and payment of taxes and insurance contributions for these categories of individuals are not so significant.

The listed categories of individuals can also be called self-employed citizens.

Notaries and lawyers, represented by relevant professional organizations, have ensured that in the legislation they cannot be equated with individual entrepreneurs, arguing that their activities are not aimed at generating income from clients.

Therefore, in the current tax legislation, notaries and lawyers are referred to separately from individual entrepreneurs, also using the term individuals engaged in private practice.

But doctors engaged in private practice did not defend such a right. Therefore, they are forced to register as individual entrepreneurs.

Organizations

The Tax Code and the legislation on insurance premiums only consider those organizations that are registered as legal entities.

A legal entity is an organization that has separate property and is liable for its obligations with this property. Just like an individual, a legal entity can be a plaintiff and defendant in court.

A legal entity is an abstract construct that allows people and property to unite to engage in a specific activity. To the outside world, a legal entity looks like a mechanism that is responsible for its actions.

The connection between a legal entity, on the one hand, and property and people working for it, on the other, is not rigid. Property and people may change, but the legal entity will remain the same. Conversely, a legal entity may disappear, but people and property will remain.

In interaction with the outside world, its executive body and legal representatives act on behalf of the legal entity.

An executive body is a structural unit of an organization (for example, a directorate) that is responsible for the organization’s interaction with regulatory authorities. And legal representatives are individuals, who can be the sole leaders of the organization: a director, his deputies, etc. In addition, the legal representatives of a legal entity can be groups of individuals - collegial managers (board, board of directors, etc.).

In case of violation of tax laws, sanctions can be applied both to a legal entity (fines, seizure of accounts) and to its managers (up to and including criminal prosecution).

A taxpayer who is an individual may also have a legal representative. In particular, these are parents and guardians of minor children.

The Tax Code of the Russian Federation distinguishes the following categories of taxpayer organizations:

- Russian organizations;

- foreign organizations.

Russian organizations are understood as legal entities formed in accordance with the legislation of the Russian Federation. Registration of legal entities is carried out by government bodies, which are called differently in different regions.

Foreign organizations mean foreign legal entities, companies and other corporate entities created in accordance with the legislation of foreign states, international organizations, their branches and representative offices created on the territory of the Russian Federation.

In addition, organizations are divided into:

- commercial;

- non-profit.

The main purpose of a commercial organization is to make a profit. The means of making a profit is entrepreneurial activity, i.e. business. A commercial organization may also be referred to as an enterprise.

The purpose of a non-profit organization is not related to making a profit. In particular, non-profit organizations include political parties and public associations, religious organizations, and charitable foundations.

But if a non-profit organization additionally engages in a profit-generating activity, i.e. commercial activity, this type of activity will be considered by the state separately and without discounting the fact that the organization is non-profit.

The legislation on insurance premiums does not distinguish between Russian and foreign organizations, between commercial and non-profit organizations. This is due to the fact that these differences do not in any way affect the subject of insurance premiums.

Separate divisions of organizations

Insurance premiums are divided into separate divisions within organizations.

A separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped for a period of more than one month.

For the calculation of both taxes and insurance premiums, the following classification of separate divisions is important:

- separate divisions on a separate balance sheet;

- separate divisions without a separate balance sheet.

Typically, a separate division on a separate balance sheet corresponds to a branch. Such a separate division may have its own accountant, who is entrusted with accounting and reporting. Therefore, the legislation considers it possible to assign additional responsibilities for calculating taxes and insurance premiums to such a separate division.

Insurance premiums for individual entrepreneurs

From 2021, the amount of individual entrepreneur contributions no longer depends on the minimum wage. Now the legislation fixes the exact amount of payments made by individual entrepreneurs “for themselves” for compulsory pension insurance. See “Insurance premiums for individual entrepreneurs since 2018”.

For individual entrepreneurs whose income does not exceed 300 thousand rubles, the amount of contributions for compulsory pension insurance is 26,545 rubles, for compulsory medical insurance - 5840 rubles. However, individual entrepreneurs whose annual income is more than 300 thousand rubles must still pay additional pension contributions at a rate of 1%. That is, if the income of an individual entrepreneur for a year exceeds 300 thousand rubles, then in addition to fixed contributions, the entrepreneur must transfer to the Federal Tax Service an additional amount in the amount of 1% of the amount exceeding the limit (clause 1 of Article 430 of the Tax Code of the Russian Federation). Here is a table with the new values:

Income not considered subject to taxation

Specialists involved in contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation should be aware that not all funds are subject to mandatory taxation and transfer to the funds. Whether a certain payment is subject to insurance premiums or not can be found out using Art. 422 NK. It contains a list of payments that should not be taxed.

Income that is not subject to insurance premiums:

- Government payments, such as unemployment benefits.

- Providing employees with food, fuel for work, housing at the expense of the employer, partial payment of utilities.

- Compensation for dismissal, except for funds for unused vacation to the employee.

- Expenses for the employment of employees, dismissal due to reduction, due to the reorganization of the company or due to its closure.

- One-time cash assistance to subordinates, transferred due to the occurrence of natural disasters, the death of a close relative, at the birth of children in an amount not exceeding 50 thousand rubles.

- Transfers for compulsory health insurance.

- Transfer of money for voluntary health insurance for a period of more than 12 months.

- Pension payments under agreements concluded with non-state funds.

- Transfer of additional contributions to the funded part of workers' pensions, but not more than twelve thousand rubles per employee per year.

- Financial assistance to company employees, but not more than four thousand rubles.

- Providing employees with specialized clothing necessary to perform assigned tasks in the workplace.

- Money spent on additional training for employees.

Calculation of fixed contributions

The amount of insurance payments is not always affected by the income received. For individual entrepreneurs, the amounts of fixed payments of insurance premiums are maintained until a certain amount of income is reached. The amount of required contributions is approved annually and depends on the minimum wage.

In 2021, individual entrepreneurs pay 26% to the Pension Fund of the minimum wage amount monthly and 5.1% to the FFOMS of the minimum wage. Considering that the value of this indicator at the beginning of 2021 was 6,204 rubles, all individual entrepreneurs must transfer 6,204 rubles * 12 months * 26% = 19,356.48 rubles to the Pension Fund during the year, and 6,204 rubles * 5.1 to the Federal Compulsory Medical Insurance Fund. %*12 months=3796.85 rubles.

If you reach an income level for the year in excess of 300,000 rubles, you will need to pay another 1% of the difference in the pension fund, but not more than the amount of 154,851.84 rubles, calculated based on the minimum wage of 8 times.

Example . For 2021, individual entrepreneur V.M. Azarenko received income from his activities in the amount of 545,650 rubles. How much money does he need to transfer to the funds?

Based on the current amount of fixed payments, it is necessary to transfer 19,356.48 rubles and 3,796.85 rubles, respectively, to the Pension Fund and the Federal Compulsory Medical Insurance Fund. Considering that the income exceeded the generally established limit for calculation by 245,650, you will need to pay an additional 245,650 * 1% = 2,456.50 rubles to the Pension Fund.

Is sick leave subject to taxation?

You may be interested in: United Traders: reviews. Trading company United Traders

The question often arises among employees of the accounting service: is sick leave subject to this type of taxation? For most cases, sick leave is not subject to taxation.

But there is an exception to the rule. Sometimes the employer independently pays the employee additional money in accordance with the salary he received. In this case, sick leave is subject to insurance premiums, but this is rare.

Cash not subject to taxation

In 2021, the calculation form for contributions has been updated. Now you need to enter information about payments that are not subject to such contributions. Although they will not affect the total amount of the transfer.

For this purpose, a separate line appeared in the documents. Information about the amount that is not subject to taxation must be indicated not only for each quarter, but also monthly. Initially, all funds should be reflected on one page of the calculation, then on another - information about funds that do not need to be subject to contributions.

Responsibility for non-payment of insurance premiums

Company managers manage accounts payable in order to optimize the cash flow system and expand the business. Previously, employers could “defer” payment of contributions, since previously the liability for such actions was not so great. Thus, reporting on funds for transfers to funds in the organization was carried out, accruals were made, but no funds were received into the country's budget. Funds raising funds did not have the ability to seek payment from all employers. Therefore, the government decided to redirect the rights and obligations of keeping records of contributions to the Federal Tax Service. As a result, changes took place in the Tax Code.

The Federal Tax Service, after receiving all the information on debtors of insurance premiums, suggested that employers apply debt restructuring with subsequent repayment. In case of evasion and unwillingness to pay debts, criminal liability arises.

Updates to the Criminal Code came into force in 2021. They indicate liability for non-payment of funds, for lack of transfers to the fund, as well as for deliberately reducing the amount required for payment.

Previously, there was also criminal liability for non-payment of money, but in 2003 they were transferred to an administrative violation. From 2003 to 2021, employers faced a fine of 20% of the entire unpaid amount for such acts. At the moment, criminal liability arises for the same actions. Imprisonment for up to six years is possible. The objects of taxation with insurance premiums are set out in Articles 198, 199, and 199.2. There have been changes in the Criminal Code, and new articles have also appeared - 199.3, 199.4.

Insurance premiums in 2021: what's new?

06.06.18

The article was published in the newspaper “First Page” No. 04 (099), June 2018

More than a year has passed since the transfer of part of the functions for administering insurance premiums to the tax authorities. Companies are faced with a lot of problems related to the transfer of settlement balances, discrepancies in the data of the tax office and funds, differences in approaches to reporting, and many others. In order to resolve them, we will understand the nuances of the changes.

Regulatory framework for changes

Chapter 34 Tax Code of the Russian Federation “Insurance premiums” section. XI “Insurance premiums in the Russian Federation”. Now the concept of insurance premiums, the rights and obligations of payers, elements of taxation of insurance premiums, benefits and features of payment of insurance premiums by certain categories of payers are defined in Section. XI Tax Code of the Russian Federation.

The following amendments were also adopted in Law No. 250FZ of 07/03/2016: - dated 03/21/1991 No. 943-1 “On the tax authorities of the Russian Federation”; — dated December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation”; — dated July 16, 1999 No. 165-FZ “On the fundamentals of compulsory social insurance”; — dated November 29, 2010 No. 326-FZ “On compulsory health insurance in the Russian Federation”; — dated 04/01/1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”; - dated July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases.”

Payers of insurance premiums

Was: Art. 5 of Federal Law No. 212-FZ. Became: Art. 419 of the Tax Code of the Russian Federation. According to sub. 1 clause 1 art. 419 of the Tax Code of the Russian Federation, the following are recognized as payers of insurance premiums: - organizations; - individual entrepreneurs; - individuals who are not individual entrepreneurs.

Subp. 2 p. 1 art. 419 of the Tax Code of the Russian Federation contains a more detailed list of payers who do not make payments to individuals: - individual entrepreneurs; — lawyers, notaries engaged in private practice; — arbitration managers; — appraisers; - mediators; — patent attorneys and other persons engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation.

If the payer of contributions belongs to several categories simultaneously, he calculates and pays insurance premiums separately for each basis. The Tax Code of the Russian Federation does not contain provisions according to which federal laws on specific types of compulsory social insurance may establish other categories of policyholders who are payers of insurance premiums (clause 2 of Article 5 No. 212-FZ).

| All employers (except individual employers) are required to keep work books for each employee (Article 309 of the Labor Code of the Russian Federation) |

Object of taxation of insurance premiums

Was: Art. 7 of Federal Law No. 212-FZ. Became: Art. 420 Tax Code of the Russian Federation.

Clause 1 Art. 420 of the Tax Code of the Russian Federation provides that the following payments are recognized as the object of taxation of insurance premiums for organizations and individual entrepreneurs:

1) within the framework of labor relations and under civil contracts, the subject of which is the performance of work, the provision of services;

2) under copyright contracts in favor of the authors of works;

3) under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including remunerations accrued by organizations for managing rights on a collective basis in favor of the authors of works according to contracts.

The following are not subject to insurance premiums:

1) payments under civil contracts, the subject of which is the transfer of ownership or other real rights to property, and contracts related to the transfer of property (property rights) for use, with the exception of the contracts listed in subparagraph. 2, 3 p. 1 art. 420 of the Tax Code of the Russian Federation (clause 4 of Article 420 of the Tax Code of the Russian Federation);

2) payments in favor of individuals who are foreign citizens or stateless persons under employment contracts; contracts must be concluded with a Russian organization for work in its separate division located outside the territory of the Russian Federation (clause 5 of Article 420 of the Tax Code of the Russian Federation);

3) payments to volunteers as part of the execution of contracts concluded in accordance with Art. 7.1 of the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations” civil contracts for reimbursement of volunteers’ expenses, with the exception of food expenses in an amount exceeding the daily allowance provided for in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation (clause 6 of Article 420 of the Tax Code of the Russian Federation);

4) payments to foreign citizens and stateless persons under employment contracts or civil contracts, the subject of which is the performance of work, provision of services, in connection with participation in events for the preparation and holding of the 2021 FIFA World Cup and the 2017 FIFA Confederations Cup in the Russian Federation year (clause 7 of article 420 of the Tax Code of the Russian Federation).

Base for calculating insurance premiums

Was: Art. 8 of Federal Law No. 212-FZ. Became: Art. 421 Tax Code of the Russian Federation.

The base for calculating insurance premiums for payers of employer insurance contributions is determined at the end of each calendar month as the amount of payments and other remunerations accrued separately in relation to each individual from the beginning of the billing period on an accrual basis.

The base for calculating insurance premiums does not include payments exempt from contributions (their list is given in Article 422 of the Tax Code of the Russian Federation).

Calculation of insurance premiums

According to paragraph 3 of Art. 421 of the Tax Code of the Russian Federation for payers making payments to individuals, the following is established: - the maximum value of the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity; this limit value is subject to annual indexation from January 1 of the corresponding year, based on the growth of average wages in the Russian Federation (clause 4); — the maximum value of the base for calculating insurance contributions for compulsory pension insurance; For the period 2017–2021, such a limit value is established taking into account the average salary in the Russian Federation determined for the corresponding year, increased by 12 times, and the increasing coefficients applied to it for the corresponding calendar year (clause 5).

For 2021, the restrictions were: - for compulsory social insurance - 815,000 rubles; — for compulsory pension insurance — 1,021,000 rubles.

Provision of paragraph 5 of Art. 421 of the Tax Code of the Russian Federation does not apply when calculating insurance premiums: - for compulsory pension insurance at additional rates established by Art. 428 Tax Code of the Russian Federation; — for additional social security for flight crew members of civil aviation aircraft, as well as certain categories of employees of coal industry organizations in accordance with Art. 429 Tax Code of the Russian Federation.

Amount of insurance premiums

Insurance premium rates in 2017–2018: 1) for compulsory pension insurance - 22%; over the established maximum base for calculating insurance contributions for compulsory pension insurance - 10%; 2) for compulsory social insurance in case of temporary disability and in connection with maternity, within the established maximum value of the base for calculating insurance premiums for this type of insurance - 2.9%; 3) for compulsory health insurance - 5.1%.

| In paragraph 1 of Art. 422 of the Tax Code of the Russian Federation provides a list of payments that are not subject to insurance premiums |

The amounts of reduced and additional tariffs remained unchanged. The 30% rate will be valid until 2021 inclusive (Articles 425, 426 of the Tax Code of the Russian Federation). The tariff extension is provided for by Federal Laws No. 361-FZ dated November 27, 2017 and No. 428-FZ dated December 28, 2017.

Simplified organizations are entitled to reduced contributions. But after updating OKVED from 2021, the names of preferential activities have changed. Because of this, policyholders doubted whether they would still have the benefit. For example, there was uncertainty with travel agencies.

Now Art. 427 of the Tax Code of the Russian Federation was rewritten in a new way by OKVED. It will retain all benefits and will apply retroactively to relationships from January 1, 2017, which means that companies will not lose the preferential rate of insurance premiums due to the new classifier.

Amounts not subject to insurance premiums

Was: Art. 9 of Federal Law No. 212-FZ. Became: Art. 422 of the Tax Code of the Russian Federation. In paragraph 1 of Art. 422 of the Tax Code of the Russian Federation provides a list of payments that are not subject to insurance premiums.

This list almost completely duplicates the list from Art. 9 of Federal Law No. 212-FZ. However, there are some nuances. First of all, they relate to restrictions on the amount of daily allowance for the purpose of exemption from insurance premiums. So, according to paragraph 2 of Art. 422 of the Tax Code of the Russian Federation, when employers pay expenses for business trips of employees both on the territory of the Russian Federation and abroad, the daily allowance provided for in paragraph 3 of Art. 217 Tax Code of the Russian Federation. In addition, in para. 10 subp. 2 clause 1 of this article also contains a reference to clause 3 of Art. 217 in relation to compensation in foreign currency in lieu of daily allowances paid by Russian shipping companies to crew members of ships sailing abroad.

Billing and reporting periods

Was: Art. 10 of Federal Law No. 212-FZ. Became: Art. 423 Tax Code of the Russian Federation.

Clause 1 Art. 423 of the Tax Code of the Russian Federation stipulates that the calculation period is the calendar year, and paragraph 2 of this article establishes the following reporting periods: - I quarter; - half a year; - nine months of the calendar year.

Earlier in Art. 10 of Federal Law No. 212-FZ contained clarification as to what constitutes a settlement period for reorganization, liquidation, as well as in a situation where an organization was created after the start of the calendar year. Now the general procedure established by the Tax Code of the Russian Federation applies to insurance premiums.

Determining the date of payments and other remuneration

Was: Art. 11 of Federal Law No. 212-FZ. Became: Art. 424 Tax Code of the Russian Federation.

Provisions of Art. 424 of the Tax Code of the Russian Federation duplicate the norm of Art. 11 of Federal Law No. 212FZ: for organizations and individual entrepreneurs, the date of payments and other remunerations is defined as the day of accrual of payments and other remunerations in favor of the employee (the individual in whose favor payments and other remunerations are made).

| The amount of insurance premiums to be transferred is calculated in rubles and kopecks (Clause 5 of Article 431 of the Tax Code of the Russian Federation) |

The procedure for calculating and paying insurance premiums

According to the rules of paragraph 1 of Art. 431 of the Tax Code of the Russian Federation, based on the results of each calendar month during the billing period, the following are carried out:

— calculation of insurance premiums based on the base for their calculation from the beginning of the billing period until the end of the corresponding calendar month and insurance premium rates; at the same time, payers are required to keep records of the amounts of accrued payments and other remunerations, the amounts of insurance premiums related to them, in relation to each individual in whose favor the payments were made (clause 4 of Article 431 of the Tax Code of the Russian Federation); — payment of insurance premiums minus the amounts of contributions calculated from the beginning of the billing period to the previous calendar month inclusive.

When should insurance premiums be paid?

The amount of insurance premiums calculated for payment for a calendar month must be paid no later than the 15th day of the next calendar month (clause 3 of Article 431 of the Tax Code of the Russian Federation).

The amount of insurance premiums to be transferred is calculated in rubles and kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

What is the deadline for reporting?

Employers must submit a calculation of insurance premiums no later than the 30th day of the month following the billing (reporting) period.

Calculations for insurance premiums are submitted to the tax authority: - at the location of the organization; — at the location of separate divisions of the organization; — at the place of residence of the individual making payments and other remuneration to individuals.

Penalty for failure to submit reports

Payers of insurance premiums are fined for violating the deadline for submitting calculations in accordance with the norms of the Tax Code.

In particular, according to paragraph 1 of Art. 119 of the Tax Code of the Russian Federation, failure to submit a tax declaration to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees entails the collection of a fine in the amount of 5% of the amount of tax not paid within the period established by the legislation on taxes and fees, subject to payment (additional payment) on the basis of this declaration, for each full or partial month from the day provided for its submission, but not more than 30% of the specified amount and not less than 1,000 rubles.

| An organization that does not agree with the amount of the balance can submit an application for its adjustment not only to the funds, but also to the tax office. |

Results of work with insurance premiums for 2017

Summing up the results of 2021 regarding the practice of calculating insurance premiums, we can state the following:

1. Companies and individual entrepreneurs are faced with the problem of correctly transferring balances of insurance premiums as of January 1, 2021 when transferring from funds to the Federal Tax Service. When contacting the tax authorities, most received the answer that the tax authorities received such information from the funds. Upon subsequent contact with the funds, it turned out that no debt existed.

The Federal Tax Service has agreed with the Pension Fund of the Russian Federation and the Social Insurance Fund where a legal entity can apply to correct the balance of contributions as of January 1, 2021: an organization that does not agree with the amount of the balance can submit an application for its adjustment not only to the funds, but also to the tax office. A similar procedure can be applied if a legal entity wants to clarify information about pension and medical contributions, penalties and fines for billing periods before January 1 of the current year. Thus, the information will be clarified faster (Letter of the Pension Fund of the Russian Federation No. NP-30-26/13859, Federal Tax Service of Russia No. ZN-4-22 / [email protected] dated 09/06/2017, Letter of the Federal Tax Service of the Russian Federation No. 02-11-10/06- 02-3959P, Federal Tax Service of Russia No. ZN-4-22 / [email protected] dated September 15, 2017).

2. In turn, the Ministry of Finance spoke about how to deal with overpayments and arrears of insurance premiums for periods before 2017. From the department’s clarification it follows: overpayment of insurance premiums, penalties and fines for periods that expired before 2021: - cannot be offset against the repayment of arrears of insurance premiums, arrears of penalties and fines for the first quarter of the current year and later periods; - can be returned, but only if there is no arrears on insurance premiums for periods before 2021 and corresponding penalties and fines.

If an organization has arrears on insurance premiums for periods before 2021, as well as arrears on the corresponding penalties and fines, then they cannot be repaid by overpayment of insurance premiums for periods from 2021. The policyholder needs to deposit funds, otherwise the tax authority may collect them forcibly (Letter of the Ministry of Finance of Russia dated March 1, 2017 No. 0302-07/2/11564).

3. Tax authorities now have more reasons not to accept payment of contributions. Until 2021, payments for insurance premiums were refused due to incorrect personal data and discrepancies in the amounts of contributions in section. 1 and 3 (clause 7 of article 431 of the Tax Code of the Russian Federation). However, starting from 2021, the amounts of payments to employees and the contribution base for all employees and for the company as a whole should also converge. Otherwise, the calculation will not be accepted (Federal Law No. 335-FZ dated November 27, 2017).

4. One cannot help but be glad that the Ministry of Finance and the Federal Tax Service have come to a consensus on blocking the current account for failure to submit a single payment for insurance premiums on time - such blocking is illegal (Letter of the Ministry of Finance of Russia dated January 12, 2017 No. 0302-07/1/556, Letter Federal Tax Service of Russia dated May 10, 2017 No. AS-415/8659).

5. Tax officials spoke about the procedure for paying the minimum fine for failure to provide a single calculation for insurance contributions on time - it must be paid to three addresses at once: - for pension contributions - 733.33 rubles; — medical contributions — 170 rubles; - contributions in case of temporary disability and in connection with maternity - 96.67 rubles. (Letter of the Federal Tax Service of Russia dated 05.05.2017 No. PA-411/8641) How can one not be nostalgic for the days of the Unified Social Tax, when all payments for contributions went to one address, and the controlling body itself distributed them among the funds.

6. The Criminal Code has been supplemented with another “tax” article 199.3. The mildest punishment under the new law is a fine of 100 thousand rubles. The most severe is imprisonment for up to six years. Punishment threatens those who “accumulate” arrears on at least a large scale (Federal Law of July 29, 2017 No. 250-FZ).

7. The Supreme Court and the Ministry of Finance made a number of positive decisions in favor of insurance premium payers, allowing companies to reduce insurance premium payments for certain payments: - Premiums for holidays are not stimulating, but social in nature, and do not depend on the qualifications of workers, complexity, quality, quantity and working conditions. Such bonuses are not an element of remuneration (Definition of the Supreme Court of the Russian Federation dated December 27, 2017 No. 310-KG17-19622). — Costs for food do not depend on the qualifications of workers, complexity, quality, quantity, conditions of work, are not incentive or compensatory payments and are not included in the remuneration system. Accordingly, they are not subject to insurance premiums (Definition of the SCES of the RF Armed Forces dated September 4, 2017 No. 303KG17-6952). — The court found it unlawful to charge additional insurance premiums to the amount of rent for housing for a nonresident employee. He considered that these payments were of a social nature. The Supreme Court of the Russian Federation also stated that compensation for housing costs for an employee is not subject to insurance premiums (Letter of the Ministry of Finance of Russia dated February 19, 2018 No. 0304-06/10129).

Prospects for 2021

1. The increase in insurance premium rates to 34% in 2021, previously provided for by the Tax Code, has been cancelled. Rates of 30% are left until 2021. This fact cannot but rejoice for two reasons: first, the tax burden on business does not increase, and second, companies do not need to reconsider their relationships with employees.

2. The special assessment of working conditions must be completed before the end of 2018 and, based on its results, the class of working conditions must be indicated in employment contracts. Companies have just over six months left to do this.

3. There will be no new regions in the FSS pilot project. The validity period of the Social Insurance Fund pilot project for direct benefit payments has been extended until 2020 inclusive. However, starting from 2021, no new regions will join its membership. Thus, from 2021, direct payments of benefits from the Social Insurance Fund are available in 33 regions of Russia. In the rest, as in 2021, there is an offset mechanism (Resolution of the Government of the Russian Federation of December 11, 2017 No. 1514).

4. Significant changes in the procedure for calculating and paying insurance premiums for individual entrepreneurs. Now all payments for contributions from individual entrepreneurs are “tied” not to the minimum wage, but to the minimum payment amount, which is determined for the period from 2018 to 2021. Up to the threshold value of 300,000 rubles, the established minimum payment is paid, and above this amount - 1% of income, but not more than eight times the minimum payment. The deadline for payment of contributions from “excess” has been postponed to July 1 (Federal Law of November 27, 2017 No. 335FZ).

Summing up all the changes in 2021 and plans for 2021 and beyond, we can say that they are all aimed at gradually increasing the tax burden on business, although the government is trying in every possible way to disguise this increase with various minor relaxations. This situation, unfortunately, leads to the fact that many companies and individual entrepreneurs continue to put the wages of their employees into the “shadow”, trying to somehow even out the difficult financial situation in small and medium-sized businesses.

| Edin Konstantin Viktorovich, Accredited teacher of the Institute of Taxation of the Russian Federation and the Chamber of Tax Consultants, member of the Presidential Council of the Institute of Taxation of the Russian Federation, member of the Public Council of the Ministry of Finance and Tax Policy of the NSO, member of the Public Council of the Federal Tax Service for the Taxation of Taxation. |

Attention! The use of any materials from the publication is possible only with the written permission of the editors. When copying, a link to the newspaper “First Page” is required.

Back

Forward

Calculus rules

For payers and employers, the conditions for paying such contributions have not changed. They must make calculations and payments by the fifteenth day of the calendar month. The general period is a year; quarterly, half-year, and nine months are recognized as reporting periods. The employer can reduce the total amount of money transferred in the event of temporary disability, as well as in the event of maternity of the employee.

If, after calculating contributions for a certain period of time, it turns out that the organization has made payments for temporary disability of a person and maternity more than the total amount of contributions for this type, then the difference in the amount will be counted into future contributions under the same conditions. This will reduce the amount of future payments.

Source

Date of payments and other rewards

For organizations and individual entrepreneurs, the date of payments and remunerations is the day of accrual of payments and other remunerations in favor of the employee (the individual in whose favor the payments and other remunerations are made). For individuals who are not recognized as individual entrepreneurs - the day of making payments and other remuneration in favor of the individual.

Where are insurance premiums paid?

Payment of insurance premiums occurs simultaneously in several instances (in separate payments):

- to the Federal Tax Service at the place of registration of the company / at the place of residence of the individual entrepreneur - contributions for pension insurance, as well as medical and social insurance;

- in the Social Insurance Fund - contributions for injuries and accidents at work.

Employing companies and individual entrepreneurs with hired employees transfer insurance premiums monthly no later than the 15th day of the month following the billing month.

Individual entrepreneurs without employees pay contributions only for themselves, and do this monthly, quarterly or in a lump sum.

In this case, the specific amount that the policyholder - the company or individual entrepreneur - is obliged to transfer, i.e. the amount of contributions payable depends on whether the maximum base for calculating contributions has been exceeded or not.

The maximum value of the base for calculating insurance premiums is discussed in detail in the next section.

Limit value of the base for insurance premiums

Every month, all employers - companies and entrepreneurs - pay their employees various amounts: salaries, vacation pay, bonuses, compensation, additional payments, allowances instead of travel allowances, etc. All these payments may or may not be subject to insurance premiums. So, payments, all amounts that are subject to contributions, form the basis for calculating contributions.

At the same time, limits on payments are approved annually at the Government level, if exceeded, the contribution rates will be lower or completely reset to zero. The maximum value of the base for calculating contributions for 2021 was approved by Government Decree No. 1378 dated November 15, 2017.

In particular, the regressive scale of contributions applies to insurance contributions to the Pension Fund, i.e. when calculating contributions for compulsory pension insurance. Thus, the maximum base for calculating insurance contributions for pension insurance from 01/01/2018 is 1,021,000 rubles. Until this amount is exceeded, contributions are charged at a rate of 22%. After exceeding - at a rate of 10%.

As for social security contributions, the situation there is somewhat different. The maximum value of the insurance contribution base is 815,000 rubles. Until the amount of taxable payments has reached the specified amount, contributions are charged at a rate of 2.9%. Once the limit is exceeded, contributions are not charged at all.

There are no limits on health insurance contributions. Therefore, regardless of the total amount, contributions are paid at a rate of 5.1%.

For compulsory pension and social insurance, the limits have been increased. Therefore, policyholders will have to pay more. See table for new base values. 4

In 2021, the maximum value of the insurance premium base has increased. The table below clearly shows from what amounts insurance premiums for employees should be calculated.

Table 4

Limit value of the base for calculating insurance premiums in 2021

| Insurance type | Base, rub. | Rates % | |

| 2017 | 2018 | ||

| Mandatory pension | 876 000 | 1 021 000 | 22% 10% - when exceeding the base |

| Mandatory social benefits in case of temporary disability and in connection with maternity | 755 000 | 815 000 | 2.9% if the base is exceeded - no need to pay |

| Medical | The entire amount of income | 5,1 | |

It is important to note that due to increased payment limits, you will have to pay more pension and social contributions in 2021. Additionally, there are still no limits on medical and injury payments. These insurance premiums in 2021 must be calculated from all employee income.

Insurance premium rates

Insurance premiums in 2021: rates (Table 4)

Insurance premiums are calculated based on accruals to “physicists”, established limits on the taxable base and rates. The interest rate of contributions directly depends on the amount of insurance premiums.

So, the amount of insurance contributions (for pension, social, medical insurance) depends on:

- payer categories (the company charges contributions at general rates or has the right to apply reduced contribution rates);

- category of employee in whose favor payments are made;

- the amount of payments accrued to the employee during the year (the maximum value of the insurance premium base is exceeded or not).

The general contribution rate is 30% (see Articles 425, 426 of the Tax Code of the Russian Federation): 22% - for pension insurance; 5.1% - for health insurance; 2.9% - for social insurance.

As for individual entrepreneurs who do not make payments to individuals, they pay only for themselves - fixed insurance premiums. The amount of insurance premiums paid by individual entrepreneurs in a fixed amount no longer depends on the minimum wage.

In 2021, individual entrepreneurs will pay the following fixed contributions for themselves (see Table 5).

Table 5

Insurance premiums for individual entrepreneurs in 2021

| Fund | Payment amount |

| Contribution to compulsory pension insurance if the individual entrepreneur’s income is less than 300 thousand rubles. | RUB 26,545 |

| Compulsory medical insurance contribution if income is over 300 thousand rubles. | RUB 26,545 + 1% of income |

| Compulsory medical insurance contribution | 5840 |

Reduced insurance premium rate

There are several categories of beneficiaries - companies and individual entrepreneurs - who pay contributions at lower rates than everyone else. The full list of beneficiaries is given in Art. 427 Tax Code of the Russian Federation. Among them are participants in special economic zones and the Skolkovo project, IT organizations, ship crews, etc. Reduced contribution rates are also provided for companies and individual entrepreneurs on the simplified tax system. At the same time, they are subject to additional conditions that give them the right to the benefit:

1. Income should not exceed 79 million rubles. per year (while in the general case this limit is 150 million rubles).

2. The share of revenue from the preferential type of activity must be at least 70%.

Table 6

Reduced insurance premium rates (STS and other categories of employers)

| Payer category | Contributions to community pension insurance, % | Contributions to OSS, % | Compulsory medical insurance contributions, % |

| Organizations and individual entrepreneurs on the simplified tax system that carry out types of preferential activities (see Article 427 of the Tax Code of the Russian Federation). | 20 | 0 | 0 |

| Individual entrepreneur on a patent, except for retail, trade, real estate rental | 20 | 0 | 0 |

| Non-profit and charitable organizations on the simplified tax system | 20 | 0 | 0 |

| Pharmacies operating on UTII | 20 | 0 | |

| IT organizations | 8 | 2 | 4 |

| Companies and individual entrepreneurs conducting technical innovation and tourism and recreational activities on the basis of an agreement with the SEZ management bodies | 13 | 2,9 | 5,1 |

| Business entities and partnerships on the simplified tax system engaged in the implementation of intellectual property owned by budgetary and autonomous institutions | 13 | 2,9 | 5,1 |

| Participants of the Skolkovo project | 14 | 0 | 0 |

| Participants of the SEZ in Crimea and Sevastopol | 6 | 1,5 | 0,1 |

| Residents of the territory of rapid socio-economic development and the free port of Vladivostok | 6 | 1,5 | 0,1 |

| Insurers making payments to crew members of ships that are registered in the Russian International Register of Ships | 0 | 0 | 0 |

Insurance premium rates for injuries: how not to overpay?

Insurance premium rates for injuries depend on how dangerous or safe the type of activity the company conducts. The tariff is assigned according to the main type of activity in accordance with OKVED. However, when registering a business, several types of activities are indicated at once. At the same time, the FSS does not have information about what type of activity the company has as its main one.

To receive the correct rate for contributions for injuries, companies must annually confirm their main type of activity with the Social Insurance Fund. The application form for confirmation of the type of activity was approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55.

To confirm the main type of activity in the Social Insurance Fund in 2021, the following documents are required:

- Application for confirmation of the main type of activity (Appendix 1 to the Procedure, approved by order of the Ministry of Health and Social Development No. 55).

- Certificate confirming the main type of activity (Appendix 2 to the Procedure).

- A copy of the explanatory note to the balance sheet for the previous year, drawn up in any form (this document is not submitted by small business companies).

Documents are submitted to the Social Insurance Fund at the place of registration of the company/individual entrepreneur by mail or electronically.

Confirmation of the main type of activity in 2021 must be done no later than April 16.

If you miss the deadline for confirming the main type of activity in 2018, the Social Insurance Fund will independently set a tariff for the most dangerous type of activity that the company has in the Unified State Register of Legal Entities.

And the company will pay insurance premiums at this rate, overpaying, throughout 2021.

Accident contribution rates range from 0.2 to 8.5%. How much the Social Insurance Fund can increase the tariff if the main type of economic activity is not confirmed depends on the variety of types of activities specified in the Unified State Register of Legal Entities.

Additional rates for 2021

Employers pay additional insurance premiums from the salaries of employees who work in harmful and dangerous conditions. Tariffs depend on the results of the special assessment or their absence (clause 3 of Article 428 of the Tax Code of the Russian Federation). If a special assessment of working conditions was not carried out and classes of working conditions as of 2021, then apply the following additional tariffs:

| Who pays | Pension insurance contribution rate, % |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in clause 1, part 1, art. 30 of the Law of December 28, 2013 N 400-FZ (according to list 1, approved by Resolution of the USSR Cabinet of Ministers of January 26, 1991 N 10) | 9,0 |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in clause 2-18, part 1, art. 30 of the Law of December 28, 2013 N 400-FZ (approved lists of professions, positions and organizations, work in which gives the right to an early old-age pension) | 6,0 |

If a special assessment of working conditions was carried out, then additional tariffs are distributed by class:

| Working conditions | Pension insurance contribution rate, % | Base |

| Class - dangerous subclass - 4 | 8,0 | clause 3 art. 428 Tax Code of the Russian Federation |

| class - harmful subclass - 3.4 | 7,0 | |

| class - harmful subclass - 3.3 | 6,0 | |

| class - harmful subclass - 3.2 | 4,0 | |

| class - harmful subclass - 3.1 | 2,0 | |

| class - valid subclass - 2 | 0,0 | |

| class - optimal subclass - 1 | 0,0 |

If it is possible to apply different additional tariffs for payments in favor of one employee, then contributions must be calculated at the highest. For example, a special assessment (certification) was not carried out, and the employee is simultaneously employed in the work specified in clause 1 of part 1 of Art. 30 of Law N 400-FZ, and on the work specified in clause 2-18, part 1, art. 30 of Law N 400-FZ. This means that contributions from his payments must be calculated at an additional rate - 9%.