To whom and when should land tax advances be transferred to the budget?

Land tax must be paid to the budget by both legal entities and individuals if they own land.

In this case, the site must be subject to taxation. Find details about land tax payers in this material.

Individuals pay the amount of tax calculated by the tax authorities once a year before December 1 of the year following the reporting year. Advance payment of tax for them is not provided for by tax legislation.

Legal entities calculate the tax themselves and show the calculated amount in the declaration submitted at the end of the year. The deadline for submitting the declaration and the deadline for transferring the tax are usually set by municipal authorities, but these deadlines should not be set earlier than February 1 of the year following the reporting year. Local authorities also have the right to establish an advance tax payment system. In this case, in those municipalities where a similar system has been introduced, land tax is payable 4 times a year - once each at the end of the first, second and third quarters and at the end of the tax period - year.

IMPORTANT! From 2021, land tax for legal entities will be calculated by the Federal Tax Service. If the tax office does not send a message with the calculated amount of tax, the taxpayer is obliged to send the department a notification about the availability of taxable property. If this is not done, a fine will be imposed on the legal entity. See here for details.

Thus, the deadline for paying land tax for the 3rd quarter is not regulated by federal legislation; its establishment is the prerogative of local authorities. Land owners should carefully monitor local regulations to ensure they are not late with the advance payment.

You can find out whether you need to pay advance payments on your land plot on the website of the Federal Tax Service of Russia.

We’ll talk about the amount of quarterly payment you need to make in the next section.

Privileges

Any taxation scheme implies preferential conditions for certain categories of citizens and organizations.

The right to use exemptions is regulated by Article 395 of the Tax Code of the Russian Federation. This applies to the following institutions:

- Organizations related to the Federal Penitentiary Service of the Russian Federation.

- Enterprises that own areas where public highways are located.

- Organizations with a religious orientation.

- Centers for the disabled, where the number of people with disabilities prevails (at least 80% of the total number of participants).

If we talk about individuals, a reduction in the tax rate is provided for the following categories of citizens:

- persons with confirmed disabilities of groups 1 and 2;

- disabled children;

- participants in hostilities and local conflicts;

- WWII veterans;

- victims of man-made disasters;

In addition, municipal authorities have the right to independently determine the categories of citizens and organizations for which taxation will be carried out according to a preferential schedule.

Download for viewing and printing:

Tax Code of the Russian Federation (part two) dated 08/05/2000 N 117-FZ (as amended on 04/03/2017) (with amendments and additions, entered into force on 05/04/2017)

How are advance payments for land calculated?

The calculation of advance payments for land tax for the 3rd quarter of 2020 is carried out in several stages:

- The cadastral value of the land plot as of 01/01/2020 is being determined according to Rosreestr information.

- The tax rate is determined based on the legislative framework of the municipality where the site is located.

- Advance tax is calculated. For this, the formula is used:

Advance tax for the 3rd quarter of 2021 = ¼ × Cadastral value × Tax rate

EXAMPLE of calculating an advance payment for land tax from ConsultantPlus The organization owns a land plot. Its cadastral value as of January 1 of the current year is 10,000,000 rubles. The tax rate is 1.5%. The advance payment amounted to... Read the continuation of the example in the K+ legal reference system, having received a free trial access.

When calculating the tax and advance payments on it, it is necessary to take into account the purpose of the land plot, the possibility of applying benefits, the number of months of ownership, etc. Using special coefficients that take into account the above points, the amount of tax and advance payments payable on it can be adjusted either upward , and in the direction of decrease.

Our readers can learn more about calculating tax and advance payment from this article.

Changes in 2021

The key change that has occurred with land tax is the calculation procedure.

In particular, previously the book value of the plot was taken as a basis, now it is the cadastral value. You can get acquainted with the basic amount for taxation on the Rosreestr website.

These calculation rules came into force in January 2021. It should be noted that the changes affected only 29 constituent entities of the Russian Federation. This is a kind of test of the pen, after successful completion of which the optimal calculation formula will be derived.

The new principle of collecting land tax is not yet ideal, so further improvements and changes will be made. One thing is certain, it is planned to increase the rate annually for 5 years . Thus, the final amount will be set in 2021.

Results

Advances on land for the third quarter are paid exclusively by legal entities - owners of land that is a taxable object, and only in those municipalities in which the authorities have established an advance tax payment system. The responsibility of organizations is to independently calculate advance payments for each quarter and then transfer them within the period determined by the municipality where the land plot is located.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The essence of tax

The Land Code determines that land must be used by physical persons. and legal entities on a paid basis. Payment for the use of land plots implies payment of the corresponding tax.

This tax is paid by all firms and entrepreneurs who own land, as well as individuals. Tax must be paid in the following cases:

- The plot of land is located in the place where the tax applies;

- The land is the property of the payer or is in his perpetual use;

- The grounds for acquiring land are provided for by current legislation.

Legislative regulation

Responsibility for failure to fulfill tax obligations is established at the legislative level using the main document in force in the fiscal system of the Russian Federation - the Tax Code.

Specific penalties for land tax are not allocated - they are the same for different categories of payers and are divided only by a specific type of offense.

In particular, Art. 122 of the Tax Code of the Russian Federation, which provides data

measures. It is worth considering that in addition to this type of liability, which applies to all categories of payers, some of them (namely individual entrepreneurs and legal entities) are subject to more severe measures within the framework of criminal legislation established by the Criminal Code of the Russian Federation.

In the event of particularly serious offenses in the tax sphere, these types of liability may be applied to these categories of payers. The most important requirement in this case is the presence of compelling reasons for their use.

In some situations, criminal liability can also be established for individuals, but the amount of debt must be very large, which in practice is quite rare.

Calculation of the penalty amount and its payment

As already noted, a special formula approved by law is used to calculate penalties:

P = N * k * 1/300* SR, where

P is the amount of the penalty, k is the number of days of delay, SR is the refinancing rate, which is set by the Central Bank of Russia.

As an example, consider a situational problem:

Ivanov I.I., who owns a land plot, did not receive a tax notice in 2021 due to its theft from the mailbox. Payment for 2015 was made late - December 23, 2021. The tax amount was 8.3 thousand rubles. Since the payer had to pay the tax before December 1, 2016, the number of days of delay will be 21 days. The refinancing rate of the Central Bank of Russia in 2021 was at 10%.

Therefore, the amount of the penalty will be:

P = 8300 * 21 * 1/300 * 10% = 58.1 rub.

Thus, the fine will be 58 rubles and 10 kopecks. As for the fine, its amount, depending on the absence or presence of the payer’s fault in non-payment of tax, will be equal to 1660 and 3320 rubles. respectively.

You can also use the online calculator below to calculate the penalty:

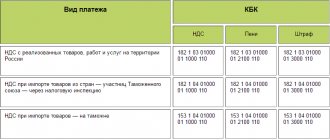

The penalty is paid in the same way and on the same day as the land tax, but using a separate payment slip (it will have a different BCC).

Details for debt repayment are sent in a notification from the tax authority or can be obtained there as a result of a personal visit to the inspectorate.

To pay, you can contact any bank or do it non-cash using online banking. A receipt confirming the fact of depositing funds must be kept, as it may be needed in the event of any tax disputes.

A public easement is established in the interests of the public (for example, if it is necessary to establish a passage, passage, or provide access to a watering hole). Do you need to sell a house with land? Our article contains a detailed algorithm for this procedure.

There are several types of survey plans depending on the purpose of the survey procedure. Read more about this here.

How much will the fine be?

Article 122 of the Tax Code of the Russian Federation specifies the procedure for calculating fines and penalties in case of late payment of taxes, including land tax.

According to this provision, tax is paid as follows:

- 20% of the total amount of unpaid tax, this fine is imposed on those citizens who paid incompletely or unintentionally;

- 40% of the total amount of unpaid tax, such a fine is imposed on citizens who knew about the need to pay tax and deliberately did not do so.

Calculation

For example, if the tax amount is 9 thousand rubles, then you will have to pay:

- 1,800 - if unintentionally;

- 3,600 - if intentional.

Specific measures of responsibility

The procedure for calculating penalties is the same regardless of the violation for which it is applied - non-payment of tax, failure to submit a declaration or violation of deadlines.

It is charged for each day of the violation committed and is calculated as the product of the number of these days, the amount of the tax liability and 1/300 of the refinancing rate. As for the fine, its size differs depending on the grounds for application. In case of non-payment of tax, the amount of penalties will be:

- 20% of the debt amount - if this happened unintentionally;

- 40% - in case of intentional non-payment.

If you violate the deadlines for submitting reports (that is, declarations) or completely ignore this obligation, the fine will be:

- 5% of the debt amount monthly (minimum 1 thousand rubles and maximum 30% of the amount) - this fine will be applied to the violating company in accordance with Art. 119 Tax Code of the Russian Federation;

- 300-500 rub. — a fixed fine is established for an official obliged to submit reports (this measure is already administrative and is applied within the framework of Article 15.5 of the Code of Administrative Offenses).

The tax authority sends the accrued amounts of penalties and fines to debtors in the form of a special request, which must be fulfilled within 8 business days from the date of its receipt (unless a different period is specified in the document).

Otherwise, the Federal Tax Service has the right to claim funds in court, as a result of which the property of a company, entrepreneur or citizen may be seized.

As for criminal liability, it applies in the event of a large amount of debt to the budget (its size must be classified as large or especially large).

Depending on the specific circumstances of the case, criminal measures can be in the form of a fine, forced suspension of the company's activities, removal of an official from work, arrest and even imprisonment.

They can only be applied on the basis of a court decision.

How to find out the amount of debt?

To find out the amount of tax you need to pay, you don’t have to wait for a receipt. There are other ways to do this, for example:

- on the Federal Tax Service website;

- at the tax office at the place of land registration;

- on the State Services website;

- on the bailiffs website (only if a large debt has accumulated).

On the tax website you can not only see the amount of tax and debt, but also print out a receipt yourself. Accordingly, if the receipt is lost somewhere, you don’t have to go to the tax office to sort it out. Just print it out and pay at a Sberbank branch.

Where to pay?

Let's look at the most convenient payment methods and some of their disadvantages:

| Payment method | Flaw |

| Via post office | Very slow customer service, long queues possible |

| Through the electronic cash desk of Sberbank | There is a risk that someone will steal your PIN code |

| Via a bank terminal using a card | You may have to pay bank interest |

| Using the State Services website | You will need to go through official registration on the site (this is a little more difficult than on many other resources since you need to confirm your identity( |