Deferred expenses (hereinafter referred to as FPR) are expenses that were incurred in the current period and relate to future reporting periods. Let's study step by step, using an example, how to post deferred expenses in 1C 8.3 Accounting 3.0.

What are deferred expenses? For example, the acquisition of software in which the exclusive rights of the organization are not transferred (1C programs, Consultant Plus, Garant, etc.).

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

In which account are deferred expenses accounted for in 1C 8.3?

All future expenses are accounted for on account 97 in accordance with the instructions for using the chart of accounts. We can see the same information in the 1C 8.3 program:

Go to Account Description:

In 1C 8.3 the description of the account is displayed:

Where are deferred expenses reflected in 1C 8.3

In the 1C 8.3 Accounting 3.0 program, a special reference book has been created to reflect certain BPOs:

This directory stores cards of already created BPOs, and also has the ability to:

- Create a new type of RBP;

- Group existing cards into “folders” (groups);

- Or find the required RBP:

How to reflect deferred expenses in 1C 8.3 - step by step

Step 1

For example, let’s create a card of this type of BBP as “1C Basic Enterprise Accounting Program” and place it and other software products in the Software group. To do this, let's create a Software group:

Step 2

After this, we will transfer the BPOs already on the list to this group. This can be done in several ways:

- Drag each RBP card into the group by holding down the left mouse cursor:

- By selecting several cards with the left mouse button while holding down the Ctrl button and dragging them to the required group:

- Selecting several cards with the left mouse button with the Ctrl button pressed, calling up the context menu, select Move to group and select the required group:

Select a group of deferred expenses:

Step 3

After this operation, it is better to change the directory viewing mode to the Tree view so that you can see the BPO in the Software group and other BPO cards:

The composition of the Software group is reflected:

Or other RBP cards:

Step 4

Next, let's create a new card for deferred expenses in 1C 8.3:

Enter data in the Name and Group fields:

After this, we begin to fill out the RBP card. Select the type for tax accounting. In our case – Others:

Select the type of asset on the balance sheet. In our case – Other current assets:

Next, we indicate the cost of the RBP from the receipt document (excluding VAT). It is indicated for reference. This is the amount from which the write-off of the RBP will begin:

After this, we begin to fill out the parameters for writing off the RBP and select the procedure for recognizing expenses:

- By month;

- By calendar days;

- In special order:

Next, we set the start and end dates for writing off the RBP. We select a cost account to which the RBP amounts should be written off in the prescribed manner, as well as a cost item for itemizing expenses:

If there is no suitable cost item in the directory of cost items, then in 1C 8.3 you can create it without leaving the BPO directory:

Set the type of expense:

Then we see the result in the RBP card:

Step 5

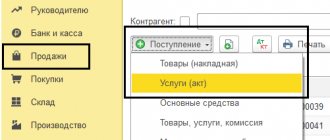

During initial capitalization, information about the RBP in 1C 8.3 can be filled out directly from the receipt document. For example, let’s purchase an electronic digital signature and seal. Since this is an intangible asset, it will be capitalized using the document receipt of services - Act:

In the document that opens, fill in the service provider, number and date, and then proceed to filling out the tabular part of the document:

If a card of the purchased product or service has already been created in the item, you can use the Selection button, which will allow you to select the desired product/service from the required group:

We indicate the number of services/products purchased:

After this, at the bottom of the item selection we see the selected item of the item, the specified quantity and unit cost of the purchased service:

Step 6

If an organization purchases a service for the first time, it must be created in the nomenclature. To do this, click the Add button in the receipt document and fill out the item card that opens:

The name of the nomenclature in the 1C 8.3 program is used to search for goods/services. It is more convenient to make it short and informative, so that it is easier to use the quick search in the program. And the full name is the name of the item from the receipt document. Both of these names may coincide (then select the name from the receipt document):

It is very important for the integrity of accounting in 1C 8.3 Accounting 3.0 to create one card for one type of item. That is why, when creating a new type of product/service, it is more correct to use standard/established names, or those accepted at the enterprise.

Also, special attention should be paid to such a parameter as Item Type, since it is this parameter that is used to set up automated accounting entries in 1C 8.3 and to correctly reflect purchased/sold goods, works or services in accounting:

After filling out the item card, to save the data and transfer it to the document, click the Save and close button.

How to fill out a nomenclature item of the type Service in 1C 8.2 (8.3), see our video lesson:

Step 7

In the document Receipt of Services: Act we see the purchased RBP and indicate its quantity. And in order to correctly reflect the price, you should pay attention to the upper right corner of the document:

Depending on what receipt document is on hand (the price is “with VAT”, or “Without VAT, or “Including VAT”) the choice depends:

- If the price of the purchased GWS in the document is already indicated with VAT, then you must select VAT in the amount in the Document Prices parameters so that the 1C 8.3 program does not re-charge VAT on the cost of the GWS.

- If in the incoming document the prices are indicated without VAT, but the supplier and your organization are VAT payers, then you must select VAT on top so that the 1C 8.3 program automatically charges VAT on the cost of the goods and services.

- If we purchase goods without VAT, then there is no need to go to the Document Prices. You can remove VAT as in the receipt document itself:

So it is in the nomenclature card - provided that the GWS data is always exempt from VAT:

Step 8

Now let's move on to one of the most important points when purchasing a BPO - an accounting account:

To correctly reflect the capitalization of RBP, as well as to automatically write them off when closing the month in 1C, you need to change the accounting account to 97:

Fill in the Future expenses field:

After this, if a RBP card has already been created in the 1C 8.3 program, then select it from the directory. If we purchase a new type of RBP, then we need to create a card for it (this is discussed in detail at the beginning of the article). We indicate the cost division to which the BPR and VAT account will be written off monthly (in our case - 04/19):

After posting the document in 1C 8.3, you can see the accounting entries:

We will defer expenses for the future

The list is open in accounting

Future expenses are expenses that were incurred today, and they relate to tomorrow. In accounting, they are collected in a special account 97 “Future expenses”. Then they are gradually taken into account over the period to which such “long” expenses relate.

The accountant chooses the method of writing off deferred expenses independently and establishes it in the accounting policy. In particular, you can choose a uniform write-off or write-off in proportion to any indicator - for example, production volume or revenue (clause 65 of the Regulations approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n).

Examples of such costs are given in the instructions for using the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n). These are expenses associated with mining and preparatory work, with the development of new production facilities and installations, expenses for the repair of fixed assets, which firms produce unevenly and without creating a reserve. The list is open. Therefore, to those listed, you can add, for example, the costs of purchasing licenses, certificates, software products, databases, and vacation pay costs.

In tax accounting - attention to the contract

In tax accounting there is no concept of “deferred expenses”. It simply lists cases when a company does not have the right to write off certain costs at the same time, but must do this over a period of time.

For example, these are expenses for compulsory and voluntary insurance, for pension provision under contracts for a period of more than one year (clause 6 of Article 272 of the Tax Code). They are taken into account in proportion to the number of calendar days the contract is valid.

Gradually, it is necessary to distribute losses from the sale of depreciable property (clause 3 of Article 268 of the Tax Code). The period for write-off is determined simply. This is the difference between the useful life of a fixed asset and the actual operating time.

Not at once, but over a certain period of time, tax accounting also recognizes such “continuing” expenses as costs for the development of natural resources (Articles 261, 325 of the Tax Code) and for R&D (Article 262 of the Tax Code). The duration depends on the type of expenditure and the results obtained. It can be equal to 12 months (clause 2 of Article 261 of the Tax Code), or maybe five years.

“Taking into account the principle of uniform recognition of income and expenses,” costs are distributed among those contracts that provide for the receipt of income for more than one reporting period, and the phased delivery of work is not provided for (clause 1 of Article 272 of the Tax Code). The company independently decides on the methodology for writing off costs under such an agreement and consolidates it in its accounting policy.

The Tax Code does not directly indicate other cases of equal distribution of costs. However, paragraph 1 of Article 272 of the Tax Code states that expenses in tax accounting are recognized “in the reporting (tax) period to which they relate.” Therefore, experts from the Ministry of Finance believe: expenses “extended” over time cannot be written off immediately, “if on the basis of the contract it is possible to reliably determine which specific period they relate to” (letter of the Ministry of Finance dated August 26, 2002 No. 04-02-06/3/62 ). If an unambiguous conclusion about the terms to which expenses relate cannot be drawn from the terms of the contract, then they are recognized at the time of occurrence.

Hence the conclusion: if it is profitable for a company to write off expenses immediately, then it is enough not to indicate in the contract the period to which the expenses relate. This trick can be used, for example, when purchasing a computer program. Without specifying the period of its use in the contract, expenses are written off at a time.

Costs of a “zero” company

Let's figure out how to take into account the costs of organizations that have just registered in the state register, but have not yet started working, as well as the costs of companies that temporarily do not receive income from their activities.

Such companies may incur costs for rent and staff salaries. If the company is new, then there will also be added costs for the production of seals and letterheads, for the purchase of office furniture and office equipment.

In accounting, such expenses are not written off immediately. “Two options are possible. If the company is sure that activities will not begin in the current month, then the costs can be immediately taken into account on account 97 “Future expenses,” says Alla Bazarova, a specialist at BKR-Intercom-Audit CJSC. – If the accountant does not know whether there will be income this month, expenses can first be collected on account 26 “General business expenses” (for trading organizations - on account 44 “Sales expenses”). If work does not begin by the end of the month, these expenses must be debited to account 97 “Future expenses.”

In the future, accumulated expenses of future periods are written off gradually (clause 19 of PBU 10/99 “Expenses of the organization”) over several reporting periods. The write-off method must be established in the accounting policy. “Expenses can be written off evenly or in proportion to any indicator, for example, production volume or revenue,” Alla explained.

Expenses can be recognized in tax accounting only if they are aimed at generating income (Article 252 of the Tax Code). Then, officials believe, costs can be taken into account when calculating income tax, even if there is no income (letter of the Ministry of Taxes and Taxes dated September 27, 2004 No. 02-5-11/162).

For example, the costs of a new firm during a period when there were no revenues will be indirect. After all, they are not directly related to production. The amount of indirect expenses incurred in the current period is taken into account in the same period (clause 2 of Article 318 of the Tax Code). In this situation, such expenses form a loss for the current reporting (tax) period. Starting from the next tax period, the loss can be carried forward to the future (Article 283 of the Tax Code).

But there is another opinion. A specialist from BKR-Intercom-Audit CJSC explained that while the company is not operating, it is difficult to unambiguously confirm the connection between expenses and income, as well as to distinguish indirect expenses from direct ones. This means that they can be assessed only after income appears. However, officials do not support this position, and they will have to defend it in court.

We will take vacation pay into account in the future

Let's look at another example of future expenses - payment of vacation pay to an employee. The costs of paying for the next vacation are classified as expenses for ordinary activities (clauses 5, 8 of PBU 10/99 “Expenses of the organization”). Accounting for such costs depends on the month for which vacation pay is accrued.

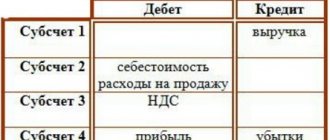

If for the current month, then the amount of vacation pay is reflected on the credit of account 70 “Settlements with personnel for wages” in correspondence with the cost account, for example 20 “Main production” (section VI of the instructions for using the Chart of Accounts, approved by order of the Ministry of Finance dated 31 October 2000 No. 94n).

But if an employee goes on another paid vacation next month, what to do in this case? In accounting, the amount of such vacation pay (as well as the unified social tax and the contribution for insurance against accidents at work) can be taken into account as an expense for future periods (letter of the Ministry of Finance dated December 24, 2004 No. 03-03-01-04/1/190).

Example

The head of the sales department is granted regular annual paid leave from April 1 to April 16, 2006 (16 calendar days). The average daily salary of an employee is 675.7 rubles. The amount of vacation pay paid in March (Article 136 of the Labor Code) is 10,811.2 rubles.

The accountant will make such entries.

In March:

Debit 97 Credit 70

– 10,811.2 rub. – accrued vacation pay;

Debit 70 Credit 68-1 “Calculations for personal income tax”

– 1405.5 rub. – personal income tax withheld;

Debit 97 Credit 69 “Settlements under Unified Social Tax”

– 2810.9 rub. (RUB 10,811.2 x 26%) – UST accrued;

Debit 97 Credit 69-1

– 21.6 rub. (RUB 10,811.2 x 0.2%) – the accident insurance premium has been charged;

Debit 70 Credit 50

– 9405.7 rub. – vacation pay was paid from the cash register.

In April:

Debit 20 Credit 97

– 13,643.7 rub. (10,811.2 + 2810.9 + 21.6) – deferred expenses are written off.

In tax accounting, the amount of vacation pay is included in labor costs (clause 7 of Article 255 of the Tax Code). Moreover, vacation pay for a specific month reduces the income tax base “in the reporting (tax) period to which they relate” (Clause 1, 4, Article 272 of the Tax Code). That is, in the month in which the vacation falls. In this case, the rules of accounting and tax accounting are the same.

Only the unified social tax and insurance premiums are taken into account differently. The fact is that in tax accounting the amount of social tax and accident insurance contributions is included in other expenses (subclause 1, 45 clause 1 of article 264 of the Tax Code). The date of recognition of such expenses is the date of their accrual (subclause 1, clause 7, article 272 of the Tax Code).

As a result, a taxable temporary difference arises and, accordingly, a deferred tax liability (clauses 8, 9, 12, 15 of PBU 18/02).

Example

The accountant will make such entries in the accounting.

For March:

Debit 68 Credit 77

– 679.8 rub. ((RUB 2810.9 + RUB 21.6) x 24%) – deferred tax liability recognized.

For April:

Debit 77 Credit 68

– 679.8 rub. – the deferred tax liability is repaid.

We will stretch out the license costs

Another type of expense that can be classified as long-term: licensing costs. There are many types of activities where work without a license is impossible. For example, tourism, passenger transportation, production of medical equipment and medicines.

In accounting, costs associated with obtaining licenses are classified as expenses for ordinary activities (clause 5 of PBU 10/99). After all, a license is a necessary condition for work.

A company license is issued for several years. Consequently, the costs for it also need to be extended over the entire period of its validity. Despite the fact that they are produced now. Such costs are first included in deferred expenses (account 97). And then they are transferred evenly to cost during the license period. Licensing costs are recognized when calculating income tax, since they are economically justified. “Licensing costs are included among other costs associated with production and sales,” says Alla Bazarova. They are written off during the reporting period to which they relate (clause 1 of Article 272 of the Tax Code). That is, gradually, during the validity period of the license. It turns out that there is no difference with accounting.

Advance payment is not recognized as an expense

In the course of their activities, companies are often faced with the need to pay for any services or work in advance. We are talking, for example, about rent paid in advance or paid subscriptions to periodicals. How to take into account such advance payments in accounting and tax accounting?

Deferred expenses include only incurred expenses. That is, work already completed or services provided. And according to the accounting rules, “disposal of assets in the order of prepayment” cannot be recognized as an expense (clause 3 of PBU 10/99 “Organizational expenses”). Therefore, advance payments are not included in account 97 “Deferred expenses”.

They should be accounted for as accounts receivable. It turns out that the fee transferred in advance must be taken into account on account 60 of the subaccount “Advances issued”.

In tax accounting, prepayment is also not included in expenses (Clause 14, Article 270 of the Tax Code). Indeed, with the accrual method (clause 1 of Article 272 of the Tax Code), expenses are recognized in the period to which they relate, regardless of the actual transfer of money.

The full text of the documents used can be found in SPS ConsultantPlus.

advice

Vladimir Meshcheryakov, author of the book “Annual Report – 2005”:

“It is more profitable to write off some expenses in accounting according to tax accounting rules. In particular, this applies to the costs of developing natural resources, costs of compulsory and voluntary insurance, costs of pension provision under contracts for a period of more than one year, as well as costs under “long-term” contracts. The appropriate procedure for writing off these expenses in accounting must be fixed in the accounting policy. This will avoid differences between accounts.”

L. Izotova

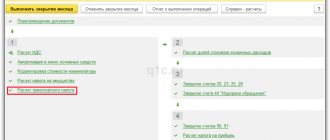

Write-off of deferred expenses in 1C 8.3

The write-off of the cost of RBP in 1C 8.3 occurs automatically when performing routine operations at the end of the month:

The Month Closing Assistant in 1C 8.3 allows you to immediately perform all the necessary routine operations to close the month.

To launch the assistant, click the Perform month closing button, after which the 1C Accounting 3.0 (8.3) program sequentially performs all the necessary operations to close the month:

If any errors are detected in accounting, the 1C 8.3 program will issue an information message about the content of the error and the document in which it was made:

Also a way to quickly open a document and fix it:

Typical errors in 1C 8.3 Accounting 3.0, how to find and correct them during the month-end closing procedure, are discussed in our article.

After correcting errors in accounting, you must once again close the month in 1C 8.3.

After completing month closing in 1C 8.3:

You can see the accounting entries for writing off expenses of future periods:

Help-calculation of write-off of deferred expenses in 1C 8.3

In 1C 8.3, you can use a certificate for calculating the write-off of RBP:

A statement of calculation regarding the write-off of RBP in 1C 8.3 can be called from the month-end closing assistant. This can be done by accessing the Calculation References function in the upper right corner of the assistant, where the 1C 8.3 program shows the entire list of calculation references that it can make:

Tax accounting RBP

such concept as “deferred expenses” in the tax code . However, it reflects the taxation of certain types of costs that can be classified as BPR.

According to Tax legislation, these are the following costs:

- produced for the development of natural resources (Article 261 of the Tax Code of the Russian Federation);

- for various engineering or development projects (Article 262 of the Tax Code);

- for compulsory or voluntary medical insurance for their employees (Article 263 of the Tax Code of the Russian Federation).

According to paragraph 6 of Art. 272 of the Tax Code of the Russian Federation, expenses of an enterprise that appeared after insuring employees under compulsory medical and voluntary medical insurance are considered expenses of the reporting period in which they arose.

If the contract was concluded for a period longer than the reporting period, and the contribution was a one-time payment, then the costs are distributed over the entire period of validity of the insurance contract.

If, according to the insurance contract, the insurance premium is paid in installments , then expenses are taken into account according to the periods of making payments to repay the installments, for example, a quarter or half a year.

RBP under simplified tax system

If an enterprise applies a preferential tax regime - the simplified tax system, then the accountant must reflect the RBP in the book of income and expenses. Also, an enterprise that applies the simplified tax system can reduce the amount of single tax payable by the amount of the RBP. But this is only possible if the tax base is “Income reduced by expenses.”

Normative base

Regulatory acts that relate to the accounting of intangible assets:

- PBU 10/99 “Expenses”;

- Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34 n (taking into account changes to the order of the Ministry of Finance of Russia dated December 24, 2010 N 186 n);

- PBU 14/2007 “Accounting for intangible assets”;

- Instructions for using the chart of accounts;

- Other PBUs, which directly stipulate the procedure for accounting for assets/expenses as part of the RBP.

Accounting RBP

Deferred expenses in the balance sheet

In the balance sheet, RBP are reflected in accordance with the conditions for recognition of assets . And these conditions are established by various regulatory documents on accounting.

Since 2011, the position of these expenses has changed significantly. Previously, deferred expenses included the same costs that were supposed to be written off in the future. Now, according to the new standards, the accountant must confirm the validity of attributing certain costs to BPR.

Depending on which asset item the RBPs belong to, they are reflected in that line of the balance sheet. For example, licenses that are issued for more than a year are reflected in “inventories” (line 1210), and the insurance amount paid to the insurance agent is reflected in “accounts receivable”.

The issue of accounting for insurance amounts is controversial. If an insured event does not occur during the validity period of the insurance contract, the insured amount is not returned to the policyholder. According to clause 19 of PBU 10/99, these amounts can be written off gradually during the validity of the insurance contract.

But, also, these amounts are nothing more than an advance payment. Therefore, they can be accounted for in account 76 and in balance sheet line 1230 “Accounts receivable”.

The write-off of insurance amounts must be reflected in the company's accounting policies.

BPO inventory

If an enterprise uses account 97 in its activities, then at the end of each reporting year an inventory of the BPO must be carried out. Upon completion of the inventory process, an act is drawn up in the INV-11 form . The form of the act was approved by GosKomStat in 1998, however, an enterprise can develop its own form of inventory act and adhere to it. Since 2013, enterprises must independently approve primary documents.

The amount of RBP after inventory must correspond to the debit balance of account 97, which will subsequently be reflected in line 1210 and line 1230 of the balance sheet at the end of the year.

How are deferred expenses written off?

Until 2011, RBPs were written off in several ways:

- in equal parts;

- If costs were incurred to produce products or provide services in the future, then they will be written off in proportion to the volume of products produced or services provided.

The write-off of the BRP occurs in accordance with the conditions under which the value of assets can be written off. Such rules are specified in the Letter of the Ministry of Finance of the Russian Federation dated December 24, 2010 No. 186N.

Expenses for the acquisition of intellectual property under a licensing agreement will be written off as long as this agreement is in force (clause 39 of PBU 14/2007).

This provision should be adopted if the entire cost was paid at once for the use of an object of intellectual property. If payment occurs in periodic payments, then such expenses are recognized as expenses of the reporting period.

Calculation of the current liquidity ratio will show the degree of solvency of the enterprise.

Read this article on how to calculate advance payments under the simplified tax system.

Example of BPR calculation

The cost of the object is 29,880 rubles. The contract period is 3 years. Thus, the accountant must write off monthly (29,880 / 3) / 12 = 830 rubles.

Speaking about a construction contract , you need to remember that expenses will be taken into account precisely in the period in which they were incurred. Costs that relate to work already completed under the contract are recorded as production costs.

And the expenses that a legal entity incurred in connection with upcoming work are deferred expenses. These expenses will be written off as profits from the work performed are received. This procedure for writing off expenses is established in clause 16 of PBU 2/2008.

If the contract does not provide for receipt of revenue or delivery of work longer than the reporting period, or delivery in stages, then the enterprise independently distributes these costs.

Application of account 97 in accounting for BPO

In the chart of accounts there is account 97, which is called “Future expenses”. This account takes into account those costs that will pay off in future periods .

It is possible to take into account RBP on account 97 if these expenses form an asset, that is, they will bring economic benefits to the company in the future. Therefore, according to Letter of the Ministry of Finance No. 07-02-06/5 dated January 12, 2012, the use of account 97 in accounting is appropriate.