The simplified system is a special preferential regime, the declaration for which is submitted only once a year. Payment of the single tax on the simplified tax system also occurs once a year - no later than March 31 for an LLC and April 30 for an individual entrepreneur. However, these are not all the payments that the simplifier must transfer to the budget. At the end of each reporting period, if there is income, advance tax payments must be calculated and paid.

Get a free consultation

What are advance payments on the simplified tax system?

Let us repeat, the tax period for the simplified system is a calendar year, so the final payment to the state occurs at the end of the year. But in order for budget revenues to be uniform throughout the year, the Tax Code of the Russian Federation established the obligation of simplified taxpayers to pay tax in installments, based on the results of the reporting periods. In essence, this is how the budget is advanced using earlier revenues.

The reporting periods for calculating advance payments under the simplified tax system are the first quarter, half a year and nine months of the year. If a businessman received income during the reporting period, then within 25 days following it, he must calculate and pay 6% (for the simplified tax system Income) or 15% (for the simplified tax system Income minus expenses) of the tax base. If no income was received, then there is no need to pay anything.

Advance payments are called that way because the tax is paid as if in advance, in advance, without waiting for the end of the year. At the same time, all advance payments under the simplified tax system are taken into account in the declaration and accordingly reduce the total annual amount.

Prepare a simplified taxation system declaration online

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

When to pay if the right is lost or activity on the simplified tax system is terminated

The Tax Code establishes the procedure for paying tax in special cases (Article 346.23):

1. If the taxpayer has lost the right to use the simplified system, then the final payment under the simplified system is carried out at the end of the quarter in which this happened, until the 25th day of the next month.

2. In the event of termination of an activity for which the simplification was applied, the calculation is also made before the 25th, but after the expiration of not the quarter, but the month when this activity was completed.

In accordance with the letter of the Ministry of Finance dated July 18, 2014 No. 03-11-11/35495, the taxpayer is obliged to notify the Tax Inspectorate no later than 15 days after the termination of activities that allow the application of the simplified system.

Deadlines for payment of advance payments

Please note - due to the coronavirus pandemic, for some individual entrepreneurs and organizations the deadlines for paying taxes and filing reports may be postponed, brief information in the summary table from the Federal Tax Service, details are described in this article.

Article 346.21 of the Tax Code of the Russian Federation establishes the deadlines for making advance payments under the simplified tax system in 2021. Taking into account the postponement due to weekends, these are the following dates:

- no later than April 26 for the first quarter;

- no later than July 26th for the half-year;

- no later than October 25th for nine months.

If these deadlines are violated, a penalty in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation is charged for each day of delay. There is no penalty for late payment of advances, because the deadline for paying the tax itself expires only on March 31 for an LLC and April 30 for an individual entrepreneur. But if you are late to pay the balance of tax before these dates, then a penalty of 20% of the unpaid amount will be imposed.

There is no need to submit any documents confirming the correctness of advance payments to the Federal Tax Service; simply reflect these amounts in KUDiR and keep the documents confirming payment. Information about these amounts based on the results of the reporting periods must also be indicated in the annual declaration.

Deadlines for paying advances under the simplified tax system in 2021

According to the deadlines established by the Tax Code of the Russian Federation, advances under the simplified tax system are paid no later than the 25th day of the month following the reporting period (clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

If the 25th falls on a weekend, the payment deadline is postponed to the next working day. The generally established deadlines for paying advances under the simplified tax system are:

- for the first quarter of 2021 - on April 27 (the 25th is a Saturday, a day off);

- for the half-year - on July 27 (25th - Saturday, day off);

- for 9 months – on October 26 (the 25th is Sunday, a day off).

KBK for payment of simplified tax system in 2021

Read more…

Reduction of tax on the amount of insurance premiums

Insurance premiums that an individual entrepreneur pays for himself, as well as contributions for employees of organizations and individual entrepreneurs, reduce the calculated tax amounts. The order of reduction depends on which tax object is selected:

- on the simplified tax system for income, the calculated payment itself is reduced;

- on the simplified tax system Income minus Expenses, contributions paid are taken into account in expenses.

For individual entrepreneurs working on the simplified tax system of 6%, there is another important condition - the presence or absence of employees. If an individual entrepreneur has employees hired under an employment or civil contract, then tax payments can be reduced by no more than 50%. At the same time, to reduce the tax, insurance premiums paid both for yourself and for employees are taken into account.

If there are no employees, then payments to the budget can be reduced by the entire amount of contributions paid for oneself. With small income of an individual entrepreneur without employees, a situation may arise that there will be no tax to pay at all, it will be completely reduced due to contributions.

The simplified taxation system 6% and simplified taxation system 15% regimes are radically different in tax base, rate and calculation procedure. Let's look at examples of how to calculate an advance payment according to the simplified tax system for different tax objects.

Calculate the advance payment according to the simplified tax system

Calculation for simplified taxation system Income

Tax base, i.e. The amount on which the tax is calculated for the simplified tax system Income is the income received. No expenses under this regime reduce the tax base; tax is calculated on the received sales and non-sales income. But due to the contributions paid, the payment to the budget itself can be reduced.

As an example of calculations, let’s take an individual entrepreneur without employees, who received income in the amount of 954,420 rubles in 2021. Individual entrepreneurs' insurance premiums in 2021 consist of a fixed minimum amount of 40,874 rubles. plus 1% of income exceeding RUB 300,000. We count: 40,874 + (954,420 – 300,000 = 654,420) * 1% = 6,544) = 47,418 rubles.

Pay additional fees in the amount of 6,544 rubles. possible both in 2021 and after its end, until July 1, 2022. Our entrepreneur has paid all fees in 2021. Individual entrepreneurs paid insurance premiums for themselves every quarter in order to immediately be able to reduce payments to the budget:

- in the 1st quarter - 10,000 rubles;

- in the 2nd quarter - 10,000 rubles;

- in the 3rd quarter - 17,000 rubles;

- in the 4th quarter - 10,418 rubles.

| Month | Income per month | Reporting (tax) period | Income for the period on an accrual basis | Contributions of individual entrepreneurs for themselves on an accrual basis |

| January | 75 110 | First quarter | 168 260 | 10 000 |

| February | 69 870 | |||

| March | 23 280 | |||

| April | 117 200 | Half year | 425 860 | 20 000 |

| May | 114 000 | |||

| June | 26 400 | |||

| July | 220 450 | Nine month | 757 010 | 37 000 |

| August | 17 000 | |||

| September | 93 700 | |||

| October | 119 230 | Calendar year | 954 420 | 47 418 |

| November | 65 400 | |||

| December | 12 780 |

An important condition: we count the income and contributions of individual entrepreneurs for themselves not separately for each quarter, but as a cumulative total, i.e. year to date. This rule is established by Article 346.21 of the Tax Code of the Russian Federation.

Let's see how to calculate an advance payment under the simplified tax system Income based on these data:

- For the first quarter: 168,260 * 6% = 10,096 minus paid contributions of 10,000, 96 rubles remain to be paid. Payment deadline is no later than April 26th.

- For half a year we get 425,860 * 6% = 25,552 rubles. We subtract the contributions for the half-year and the advance for the first quarter: 25,552 – 20,000 – 96 = 5,456 rubles. You will have to pay extra no later than July 26th.

- For nine months, the calculated tax will be 757,010 * 6% = 45,421 rubles. We reduce by all paid fees and advances: 45,421 – 37,000 – 96 – 5,456 = 2,869 rubles. They must be transferred to the budget no later than October 25th.

- At the end of the year, we calculate how much the entrepreneur must pay extra no later than April 30: 954,420 * 6% = 57,265 – 47,418 – 96 – 5,456 – 2,869 = 1,426 rubles.

As we can see, thanks to the ability to take into account insurance payments for oneself, the tax burden of individual entrepreneurs on the simplified tax system Income in this example amounted to only 9,847 (96 + 5,456 + 2,869 + 1,426) rubles, although the calculated single tax is equal to 57,265 rubles.

Let us remind you that only entrepreneurs who do not use hired labor have this opportunity, and individual entrepreneurs have the right to reduce the tax by no more than half. As for LLCs, the organization is recognized as an employer immediately after registration, so legal entities also reduce payments to the treasury by no more than 50%.

Advance payment according to the simplified tax system - calculation of income for the 2nd (first) quarter of 2021 for individual entrepreneurs, LLCs, and other organizations. Calculation of insurance premiums. The deadline for making the advance payment under the simplified tax system for the 2nd quarter of 2021 is no later than July 25, 2021. Qualified accounting assistance in filling out payment orders. Preparation and submission of reporting documents and declarations to the tax office. Services in St. Petersburg from the Peterbukh company. , example on our website.

Advance payment according to the simplified tax system - due date, payment

When should I submit the calculation and pay the advance payment under the simplified tax system “for income” for the 2nd quarter of 2020? How to correctly calculate the advance payment? To which BCCs should it be paid? Answers to frequently asked questions, step-by-step instructions, sample payment order.

How to calculate the advance payment under the simplified tax system for the 2nd quarter?

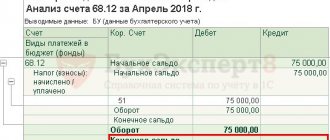

All advance payments paid during 2020 for the reporting period ( for the 2nd quarter, half a year and 9 months ) and tax for the year (tax period) must be calculated based on the information on income specified in the first section of the Income and Expense Book.

Step-by-step instructions for calculating the amount of the advance payment under the simplified tax system for the 2nd quarter of 2021.

Step 1. Set amounts that reduce the advance payment

First, you need to determine the amount that reduces the advance payment under the simplified tax system for the 2nd quarter of 2021 . It includes payments transferred during the entire 2nd quarter, namely (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation):

- Insurance premiums paid for employees (including persons working under civil contracts);

- Temporary disability benefits paid at the expense of the employing organization for the first three days of illness

To reduce the advance payment under the simplified tax system for the 2nd quarter of 2020, take into account only the amounts paid during the 2nd quarter of 2021. For example, insurance premiums for June paid in July of the year no longer reduce the advance payment for the 2nd quarter. You will take these contributions into account when calculating the advance payment for the 3rd quarter. However, insurance premiums for March paid in April can be taken into account when calculating the advance payment for the 2nd quarter.

Step 2. Determine the maximum amount to reduce the down payment

In order to determine the maximum amount by which the advance payment can be reduced , it is necessary to apply the formula (clause 1 of article 346.20, clause 3.1 of article 346.21 of the Tax Code of the Russian Federation).

Example. Let's assume that for the 2nd quarter of 2021, the organization received income in the total amount of 1,450,000 rubles. In this case, the maximum amount by which the advance payment can be reduced under the simplified tax system will be 43,500 rubles (1,450,000 x 6% / 2).

Step 3. Calculate the advance payment

Based on the results of the 2nd quarter of 2021, calculate the advance payment using the following formula (clauses 3, 3.1, 5 of Article 346.21 of the Tax Code of the Russian Federation):

Amount of advance payment for the 1st quarter of 2020 = Amount of income for the 1st quarter XTax rate - Amount by which the advance payment can be reduced

Let's give an example of calculating the advance payment for the “simplified” tax for the 2nd quarter . Let's assume that income for the 2nd quarter is 1,450,000 rubles. In the same quarter, insurance premiums for December, January and February were paid in the amount of 89,000 rubles, and sick leave benefits were paid at the expense of the employer in the amount of 17,000 rubles.

The amount reducing the advance payment is 106,000 rubles. (RUB 89,000 + RUB 17,000). It exceeds the maximum amount by which the advance payment can be reduced - 43,500 rubles. (RUB 1,450,000 x 6% / 2). Consequently, the advance payment due for the 2nd quarter will be 43,500 rubles. (RUB 1,450,000 x 6% – RUB 43,500).

A payment order for the payment of an advance payment under the simplified tax system (income) is formed in accordance with the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P and taking into account the Rules approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

The advance payment must be made to an account in the territorial department of the Treasury of Russia according to the details of the Federal Tax Service, to which the company is attached at its location. This refers to the address at which the organization was registered according to the Unified State Register of Legal Entities (clause 2 of Article 54 of the Civil Code of the Russian Federation).

Even if the organization has separate divisions, the single tax and advance payments according to the details of the inspectorate in which the head office is registered (clause 6 of Article 346.21 of the Tax Code of the Russian Federation). If we talk about individual entrepreneurs, then the advance payment must be transferred to the details of the tax office at his place of residence (Clause 2 of Article 11 of the Tax Code of the Russian Federation).

KBK for payment of an advance payment according to the simplified tax system

The following codes are valid for the simplified tax system with the object of taxation “income” :

- KBK for tax –18210501021011000110 ;

- KBK for penalties – 18210501021012100110

- KBC on fines – .18210501021013000110

Phone number for accounting assistance in St. Petersburg +7 (812) 626-02-67

Calculation for simplified taxation system Income minus Expenses

In this mode, contributions can only be taken into account as part of other expenses, i.e. The calculated advance payment itself cannot be reduced. Let’s figure out how to calculate an advance payment under the simplified tax system with the tax object “income reduced by the amount of expenses.”

For example, let’s take the same entrepreneur without employees, but now we will indicate the expenses incurred by him in the process of activity. Contributions are already included in general expenses, so we will not list them separately.

| Month | Income per month | Reporting (tax) period | Income for the period on an accrual basis | Cumulative expenses for the period |

| January | 75 110 | First quarter | 168 260 | 108 500 |

| February | 69 870 | |||

| March | 23 280 | |||

| April | 117 200 | Half year | 425 860 | 276 300 |

| May | 114 000 | |||

| June | 26 400 | |||

| July | 220 450 | Nine month | 757 010 | 497 650 |

| August | 17 000 | |||

| September | 93 700 | |||

| October | 119 230 | Calendar year | 954 420 | 683 800 |

| November | 65 400 | |||

| December | 12 780 |

The standard rate for the simplified tax system Income minus Expenses for 2021 is 15%, let’s take it for calculation.

- For the first quarter: (168,260 – 108,500) * 15% = 8,964 rubles. Payment must be made no later than April 26th.

- For half a year: (425,860 – 276,300) * 15% = 22,434 rubles. We subtract the advance payment paid for the first quarter (22,434 - 8,964), we find that 13,470 rubles will remain to be paid no later than July 26th.

- For nine months, the calculated tax will be (757,010 – 497,650) * 15% = 38,904 rubles. We reduce by advances for the first quarter and half of the year: 38,904 – 8,964 – 13,470 = 16,470 rubles. They must be transferred to the budget no later than October 25th.

- Based on the results of the year, we calculate how much more must be paid no later than April 30: (954,420 – 683,800) * 15% = 40,593 minus all advances paid 38,904, we get 1,689 rubles.

Now we check whether there is an obligation to pay the minimum tax, i.e. 1% of all income received: 954,420 * 1% = 9,542 rubles. In our case, we paid more into the budget, so everything is in order.

Let's compare whose financial burden was higher:

- at the simplified rate of 6%, the entrepreneur paid 9,847 (tax) plus 47,418 (contributions), a total of 57,265 rubles.

- at the simplified 15% tax rate was 40,593 rubles plus 47,418 (contributions), a total of 88,011 rubles.

In this case, the load on the simplified tax system Revenues minus expenses turned out to be higher, although the share of expenses in revenue is quite high (71.65%). If the share of expenses turns out to be even lower, then the simplified tax system of 15% becomes completely unprofitable.

Before choosing a tax regime, we recommend that you receive a free consultation from 1C:BO, where they will help you choose the best option for you.

Free tax consultation

KBK for payment documents

KBK is a budget classification code that is indicated on receipts or bank documents for tax payment. The BCC of advance payments for the simplified system is the same as for the single tax itself. In 2021, the budget classification codes approved by Order of the Ministry of Finance of Russia dated November 29, 2019 N 207n (as amended on October 22, 2020) are in effect.

If you indicate an incorrect BCC, the tax will be considered paid, because Article 45 of the Tax Code of the Russian Federation indicates only two significant errors in the payment document:

- incorrect name of the recipient's bank;

- incorrect Federal Treasury account.

However, paying with an incorrect classification code will result in an incorrect distribution of the amounts paid, which will result in you being in arrears. In the future, you will have to search for the payment and communicate with the Federal Tax Service, so be careful when filling out the details.

- KBK simplified tax system 6% (tax, arrears and debt) – 182 1 0500 110;

- KBK simplified tax system 15% (tax, arrears and debt, as well as minimum tax) – 182 1 05 01021 01 1000 110.