Determining the date of actual receipt of income for personal income tax purposes

| Type of income | Income form | Date of actual receipt of income | Base |

| Income in the form of wages | In cash or in kind | The last day of the month for which the employee is paid If the employee is fired before the end of the calendar month - the last working day for which the employee was paid | clause 2 art. 223 Tax Code of the Russian Federation |

| Non-salary income | Cash income | 1. Day of payment of money from the cash register 2. The day the money is transferred to the bank account 3. Day of transfer of money on behalf of the recipient of income to third party accounts | subp. 1 clause 1 art. 223 Tax Code of the Russian Federation |

| Income in kind | 1. Day of transfer of inventory items 2. The day of completion of work (services) in the interests of a person 3. The day of payment (in whole or in part) per person for goods, works, services or property rights | subp. 2 p. 1 art. 223 Tax Code of the Russian Federation | |

| Income in the form of material benefits | 1. When using borrowed funds: the last day of each month during the period for which the loan (credit) was provided, if the interest rate on it is less than:

2. When purchasing securities:

3. When purchasing goods (works, services) from interdependent persons:

| subp. 3 and 7 clause 1 art. 223 Tax Code of the Russian Federation | |

| Income arising from the offset of similar counterclaims | Day of offset of counter homogeneous claims | subp. 4 paragraphs 1 art. 223 Tax Code of the Russian Federation | |

| Income as a result of writing off a citizen’s bad debt from the organization’s balance sheet | The day this debt is written off | subp. 5 p. 1 art. 223 Tax Code of the Russian Federation | |

| Income arising in connection with reimbursement of travel expenses (for example, if expenses are not confirmed or are reimbursed in excess of current standards) | The last day of the month in which the advance report is approved after the employee returns from a business trip | subp. 6 clause 1 art. 223 Tax Code of the Russian Federation | |

| Income in the form of budget funds received for the implementation of activities related to reducing tensions in the labor market* | 1. Date of recognition of expenses for the implementation of measures related to reducing tensions in the labor market (in terms of income spent in accordance with their intended purpose during three tax periods (starting from the tax period in which the income was received)) 2. The last day of the tax period in which the conditions for disbursing income were violated (if such a violation was committed) 3. Last day of the third tax period (in terms of income that was not used in accordance with its intended purpose) | clause 3 art. 223 Tax Code of the Russian Federation | |

| Income from a controlled foreign company | December 31 of the year following the year in which the profit of the controlled foreign company is realized | clause 1.1 art. 223 Tax Code of the Russian Federation |

* The norm was put into effect by paragraph 4 of Article 1 of the Law of April 5, 2010 No. 41-FZ, came into force on April 7, 2010 (clause 2 of Article 5 of the Law of April 5, 2010 No. 41-FZ) and applies to legal relations that arose from January 1, 2009 (clause 4 of article 5 of the Law of April 5, 2010 No. 41-FZ).

When other cash payments and income in kind are recognized

For other payments made in money or in any other way, the date of receipt of income will be considered the day on which the corresponding event occurred (clause 1 of Article 223 of the Tax Code of the Russian Federation):

- payment of money (subparagraph 1);

- issuance of income in kind (subclause 2);

- offset of mutual claims (subclause 4).

That is, for the purposes of reflection in section 2 of form 6-NDFL, the date of receipt of income will coincide with the day of payment for such income as:

- vacation pay (letters of the Federal Tax Service of Russia dated May 11, 2016 No. BS-3-11/ [email protected] , dated May 11, 2016 No. BS-4-11/8312), while justified recalculations of vacation pay in section 1 of form 6-NDFL are taken into account in the period recalculation (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248);

- sick leave (letter of the Federal Tax Service of Russia dated February 25, 2016 No. BS-4-11/ [email protected] );

- financial assistance (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-4-11/ [email protected] );

- one-time bonuses (letters of the Federal Tax Service of Russia dated October 6, 2017 No. GD-4-11/20217, dated June 8, 2016 No. BS-4-11/ [email protected] , Ministry of Finance of Russia dated September 29, 2017 No. 03-04-07/63400, dated September 29, 2017 No. 03-04-07/63400);

For more information about the specifics of the moment of recognition of income received in the form of a bonus, read the articles:

For information on how dividends are reflected in the 6-NDFL form, read the article “How to correctly reflect dividends in the 6-NDFL form?”

- income issued in kind (letter of the Federal Tax Service of Russia dated March 28, 2016 No. BS-4-11/ [email protected] ).

Read about the specifics of filling out a report if it is impossible to withhold tax for payments in kind in the article “An example of filling out 6-NDFL for the 1st quarter of 2021 with sick leave .

For the nuances of filling out the 6-NDFL form, see the material “Checklist for filling out 6-NDFL for 2021.”

data_fakticheskogo_polucheniya_dohoda.jpg

Related publications

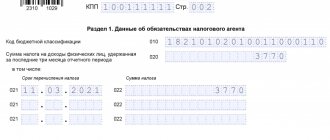

In 6-NDFL, the date of receipt of income is displayed in Section 2 in the context of the last three months of the reporting period. According to Art. 223 of the Tax Code of the Russian Federation, this parameter is usually tied to the periods for which accruals were made, or to the day the income was paid. The rules for filling out the report are prescribed in the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10/14/2015.

Which day is considered the date of receipt of income for other payments, both cash and in kind?

For bonuses, sick leave, vacation pay, financial assistance above the established limit, payments in kind, the day of actual receipt of income is considered the date of their direct receipt in hand.

Note! Despite the fact that the date of receipt of income in the form of 6-NDFL cash and in-kind payments will be the day of their issuance, the deadline for paying the tax may not coincide (see the table below).

The only exception here is the calculation upon dismissal, when the date of disbursement of funds falls on the last working day. But if an employee decides to take a vacation before dismissal, then the following options are used:

- Date of receipt of vacation pay – day of issue;

- The date of receipt of the payment upon dismissal is the last working day before the vacation.

If the company issued vacation pay and dismissal benefits at the same time, then in the 6-NDFL certificate you will have to divide these amounts into two blocks, since the actual date of issue is different.

Date of tax withholding on “in kind” income

Since personal income tax on income in kind cannot be withheld upon receipt, the tax agent must withhold tax from any cash income. Those. the date of payment of cash income from which “non-monetary” personal income tax is withheld must be shown on line 110 “Date of tax withholding” of form 6-NDFL. At the same time, the withheld amount of personal income tax should not exceed 50% of the amount of paid cash income (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

Final personal income tax results for lines 130 and 140 of personal income tax-6

In order to highlight in the reporting the total amount of income actually received (including taxes), it must be marked in column 130.

To indicate the amount of personal income tax that was actually withheld, the second section contains line 140. If the income was received in kind, a zero value is entered. If deductions for children exceeded income, “0” is also entered. The amount in line 140 corresponds to the date in column 110.

It is impossible to allocate personal income tax from natural income and gifts, so in such cases the tax amount is transferred to the budget from any cash income of the taxpayer. It should not exceed half of the total amount of income in cash - this is what the Tax Code says.

Independent check of the correctness of filling out the calculation

To clarify the correctness of filling out form 6-NDFL, the Federal Tax Service has released the necessary control ratios, which can be found in more detail in a special document dated March 10, 2016 N BS-4–11/ [email protected] It, in particular, explains one compliance for which special attention should be paid. The payment deadline, that is, the date of tax transfer indicated in line 120, does not occur earlier than the deadline specified in line 110, which indicates the fact of its withholding.

Sometimes such a discrepancy is revealed. In this case, inspectors have the right to suspect the tax agent of recording false data. To prevent this from happening, it is important to notice the discrepancy yourself by simply checking the records of two lines: 110 and 120.

The date indicated in line 120 (deadline for transfer to the budget) cannot be less than the date from line 110 (date of tax withholding)

How to calculate the cost of a gift in the 1C program

To accrue income in the amount of the price of the gift, you need to create a new type of accrual (section “Salaries and Personnel”

–

“Salary settings”

– Section

“Payroll calculation”

–

“Accruals”

).

To create an accrual, fill in the name and income code. Then we move on to the accrual settings:

- In the “Personal Income Tax”

, set the switch to the taxable position and in the “income code” field, indicate code 2720 “Cost of gifts.”

In the “Income Category”

o

. - Oh

, because the specific accrual will not be paid to the employee in cash, but will be taken into account for tax purposes and will fall into the appropriate section of the salary reports. In addition, accounting entries for such accruals are not generated, but entries for personal income tax and insurance premiums are generated if this accrual is subject to them. - In the “Insurance premiums”

select

“Income that is not subject to insurance premiums”

. - In the section “Income tax, type of expense under Art.

255 of the Tax Code of the Russian Federation” , set the switch to the

“not included in labor costs”

. - In the “Reflection in accounting”

in the

“Reflection method”

, we indicate the method of reflecting accruals in accounting for generating accrual transactions.

We will select the value from the reference book “Salary accounting methods”

(section

“Salary and personnel”

–

“Salary settings”

– section

“Reflection in accounting”

–

“Salary accounting methods”

). This field must be filled in when the accrual is reflected in accounting using the same method for all employees of the company. - O

and

"Northern surcharge"

is set by default. If necessary, the checkbox can be cleared. - Then click the “Save and close”

.

Sequence of filling out tax data in the form

The calculation form and procedure for drawing up the 6-NDFL certificate are fixed by the provisions of the Order of the Federal Tax Service of the Russian Federation MMV-7-11/450 of 2015:

- Title page. Lines “submission period”, “at the location of accounting”

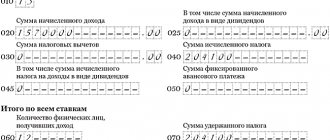

- The first section where generalized indicators are entered. Tax rates and withholding amounts. The amount of fixed advance payment 6 personal income tax for foreign employees will be reflected here;

- The second section contains information on the income actually received by employees from 2-NDFL.

The main difference between the certificates is that the second form is filled in with personalized data for each employee, and the sixth is filled in with consolidated income values for all employees of the enterprise.

Withholding tax amounts – when?

Information about withholding is shown in column 110 of the reporting form.

Table 2. Differences in date depending on the type of payment

| Name | Hold date |

| Payments for vacation and sick leave | Day of settlement with the employee |

| Material aid | Day of receiving financial assistance |

| Excessive daily allowances/unconfirmed travel allowances/debt write-offs/income in kind | Earliest cash payment date |

| Contractors' compensation/dividends/severance monies | Income payment date |

When sick leave, vacation pay or dividends are accrued, the dates in lines 100 and 110 are identical. If a salary is issued, these dates do not coincide, since column 110 represents the day the money was actually received.

Despite the apparent simplicity and availability of instructions from the Federal Tax Service dated October 14, 2015, in practice, filling out the certificate by authorized employees raises questions. According to the information contained in the official document, this column should indicate when the tax was actually withheld from the employee.

The law says: there should be no blank space in this line of the personal income tax form. Is the organization operating and operating at a loss or has zero income? If she pays wages, tax is withheld from the employee in any case. Otherwise, she is not an agent if no income has been paid to anyone during the year.

The Tax Code gives a clear indication of the time of withholding personal income tax in Article 226. According to the general approach, this date is the day the funds are issued. From this day on, they can go to the budget.

The tax agent uses exclusively employee funds as a resource. Other sources are not permitted to be involved in this process.

If income is issued in kind and personal income tax cannot be withheld, a zero value is entered in line 110.