Calculation of penalties for taxes, fees and insurance premiums

The amount of penalties for taxes and contributions is equal to 1/300 of the refinancing rate. This value is valid for individuals and individual entrepreneurs, as well as for legal entities whose overdue period does not exceed 30 days. The fact is that from October 1, 2021, the calculation of the fine for organizations has changed: starting from the 31st day of delay, the amount of penalties will already be 1/150 of the key rate.

If the key rate was changed during the period of delay, it is necessary to calculate penalties separately for each period, before and after the change.

The mechanism for calculating penalties is described in Article 75 of the Tax Code. Sometimes disputes arise as to whether it is necessary to include the day of payment in the period of arrears. In practice, the Tax Service always includes this day and our calculator is designed taking this practice into account.

Why will penalties be charged?

According to the rules, insurance premiums, including penalties, are paid to the territorial tax office using the established details before the 15th day (inclusive) of the month following the reporting month. The exception is those months when the 15th calendar day falls on a weekend, then the deadline is the next working day. To avoid late payments, pay in advance.

To avoid sanctions, we recommend reading articles about when to pay and to whom to transfer insurance premiums.

Payment of all penalties is regulated by the Tax Code of the Russian Federation (Article 34 of the Tax Code of the Russian Federation). The policyholder bears administrative responsibility and pays penalties for non-payment of insurance premiums in 2021 for late principal payments. See the table for what else sanctions will follow:

| Violation | Fine |

| Violation of payment deadlines | Penalty 5% of the amount of unpaid contributions for each overdue month within the following limits: no less than 1000 rubles and no more than 30% of the total amount of deductions (Article 119 of the Tax Code of the Russian Federation). An additional fine for missed deadlines is 300-500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation) |

| Deliberate understatement of the tax base or erroneous calculation of mandatory payments | 20% of the unpaid amount of SV (clause 3 of article 120, clause 1 of article 122 of the Tax Code of the Russian Federation) |

| Partial payment or non-payment of contributions at all | 40% (clause 3 of article 122 of the Tax Code of the Russian Federation) |

| Deliberate violation of deadlines or complete disregard for the obligation to pay for SV in the Social Insurance Fund | From 20% to 40% of the amount of unpaid deductions (Article 19 125-FZ), an additional 300-500 rubles are collected (15.33 Code of Administrative Offenses of the Russian Federation) |

| Submitting information on paper rather than in an established electronic system | 200 rubles (clause 2 of article 26.30 125-FZ) |

| If the total number of employees is over 100 people, the report is provided on paper and not in an electronic system | 200 rubles (Article 119.1 of the Tax Code of the Russian Federation) |

| Violation of filing deadlines or provision of distorted individual information to the Pension Fund of Russia | 500 rub. for 1 employee (Article 17 27-FZ), an additional 300-500 rubles are charged (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation) |

| Submission of personalized accounting information in paper rather than electronic form when the number of employees is more than 25 people | 1000 rubles (Article 17 27-FZ) |

Tax violators for non-payment of contributions in especially large amounts (from 5 million rubles) are brought to criminal liability on the basis of Part 1 of Art. 10 of the Criminal Code of the Russian Federation. If an organization deliberately does not pay, then the Investigative Committee opens a criminal case under Art. 199 of the Criminal Code of the Russian Federation for failure to provide reporting or indicating false information in it.

The maximum fine for the above crime is 500,000 rubles, the maximum prescribed criminal term is 6 years. When the total amount is paid along with penalties after the penalty for late payment of insurance contributions in 2021 to the Pension Fund and other authorities is calculated, criminal liability from the offender is removed, but only on the condition that this was the first violation of this nature.

IMPORTANT!

Higher authorities do not have the right to fine an organization for violating deadlines, provided that the established payment forms are submitted on time (letter of the Ministry of Finance of Russia No. 03-02-07/1/31912 dated May 24, 2017). The inspector's duties include only calculating penalties.

How to calculate the amount

Tax officials calculate sanctions for late payments as 1/300 of the refinancing rate for each day of delay (clause 4 of article 75 of the Tax Code of the Russian Federation).

IMPORTANT!

If an organization is overdue for a monthly payment by 1 calendar day, then no sanctions should follow. Tax inspectors assess penalties from the day following the payment deadline, taking into account that the payment day is not a settlement day (letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 No. 03-02-07/39318).

Here's how to calculate penalties for insurance contributions to the Pension Fund and the Social Insurance Fund using the formula:

P = S × D × SR × 1/300,

Where:

- P - penalty;

- C - the amount of deductions payable;

- D - calendar days of delay;

- CP is the key refinancing rate.

Calculation example

Children's and youth sports school SDYUSSHOR "Allur" violated the deadline for payment of CB for January 2021 (02/15/2020 - Saturday, deadline - 02/17) and transferred a sum of money in the amount of 103,420 rubles to the established funds on 02/24/2020.

Breakdown of unpaid amount, in rubles:

- 73,226 - for compulsory pension insurance;

- 22,650 - for compulsory health insurance;

- 7544 - in case of temporary disability and in connection with maternity.

The delay from 02/17/2020 to 02/24/2020 was 7 calendar days - excluding the day of payment. The refinancing rate at the time of funds transfer is 6.0%. Eventually:

- OPS: 73,226 × 7 × 6.0% / 300 = 102.52 rubles;

- Compulsory medical insurance: 22,650 × 7 × 6.0% / 300 = 31.71 rubles;

- VNiM: 7544 × 7 × 6.0% / 300 = 10.56 rubles.

How to avoid sanctions

Company leaders must be well aware of their rights in order to assert them when necessary.

You can avoid the accrual of sanctions under the following conditions:

- If the payer of contributions promptly handed over to the employees of the Federal Tax Service a report with a correctly calculated payment, but was unable to transfer the contributions on time, then a fine under Art. 75 Tax Code, although you will have to pay a penalty for each day of delay;

- a fine is charged for incomplete payment due to an underestimated tax base or for other illegal actions, for example, if an entrepreneur is inactive and therefore simply refuses to pay contributions;

- if the employer urgently pays the missing amount or submits an updated report to the Federal Tax Service department, then this sometimes allows one to avoid sanctions, but this must be done before a direct inspection by the inspection body;

- the head of the company is exempt from liability if his actions are related to official explanations of the authorized authorities.

Reference! The report on insurance premiums is submitted quarterly by the 30th day of the month following the quarter, and premiums must be transferred every month.

Changes in KBK

Starting from 2021, the list of KBK codes will be determined by a new order of the Ministry of Finance dated 06/08/2020 No. 99n, and in 2021 the order dated November 29, 2019 No. 207n is in effect. Fortunately, these regulations did not introduce changes to the BCC regarding contributions.

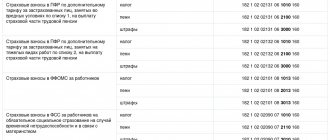

From 01/01/2019, the values of the BCC were determined by departmental order dated 06/08/2018 No. 132n. Immediately after its adoption, he made changes to the BCC on penalties for insurance premiums for compulsory health insurance paid at additional rates. Thus, from 01/01/2019 to 04/13/2019 there is no separate BCC for a tariff depending on the results of the SOUT. There are only two codes during this period, and not four, as there were in 2021. And they are:

- for list 1 - 182 1 0210 160;

- for list 2 - 182 1 0210 160.

But as of April 14, 2019, everything was returned back to the 2018 division.

The current BCCs for insurance premiums for 2020-2021, including those changed from April 14, 2019, can be seen by downloading our table.

You can double-check all KBK using a ready-made solution from ConsultantPlus. And the analytical material ConsultantPlus will help you fill out the payment form correctly for the transfer of penalties and fines on insurance premiums. You can get trial access to K+ for free.

Previous procedure for calculating penalties

The procedure for calculating penalties is determined by Article 75 of the Tax Code.

For debts incurred before October 1, 2021, penalties were calculated based on the refinancing rate of the Bank of Russia using the following formula. The amount of tax not paid on time was multiplied by 1/300 of the refinancing rate of the Bank of Russia during the period of delay and by the number of days of delay.

For debts incurred since October 1, 2021, a different calculation applies, which is still used today. Penalties are calculated based on 1/300 of the current refinancing rate of the Bank of Russia only if the delay in taxes or contributions is up to 30 calendar days inclusive. For late payment of taxes or contributions over 30 calendar days, the interest rate of the penalty is taken equal to 1/300 of the refinancing rate of the Bank of Russia, valid for the period up to 30 calendar days (inclusive) of such delay, and 1/150 of the rate, valid for the period starting from the 31st th calendar day of such delay.

The number of days of delay in taxes and contributions is determined from the day following the due date for payment of the tax until the day of its payment.

Before the new rules came into force, only the start date for accrual of penalties was directly stated in the Tax Code. This is the day following the due date for tax payment. And the actual day of payment of taxes or contributions was not taken into account when calculating penalties (letter of the Ministry of Finance of Russia dated July 5, 2021 No. 03-02-07/39318).

New procedure for calculating penalties

From December 28, 2021, the procedure for calculating penalties has changed. Federal Law No. 424-FZ of November 27, 2021 made adjustments to paragraph 3 of Article 75 of the Tax Code.

Firstly, the amount of penalties accrued on tax arrears should not be greater than the amount of the arrears itself.

Secondly, penalties for late payment of taxes are accrued up to and including the day of actual payment of the tax, and not the day of its payment, as before.

Please note These rules apply to arrears arising from November 28, 2021. As for the procedure for dividing refinancing rates depending on the periods of delay (1/300 before 30 calendar days and 1/150 after), it continues to apply under the new rules.

If the refinancing rate that was in effect during the period of delay changed, then penalties must be calculated separately for each rate.

Example. Calculation of penalties

Let’s assume that the deadline for paying contributions for compulsory insurance in case of temporary disability and in connection with maternity for September is October 16. The amount of contributions payable to the budget is 200,000 rubles. The company transferred insurance premiums late – on December 25. The period of delay is 70 calendar days (from October 17 to December 25). From September 18, the refinancing rate is 8.5%. Let's assume that the refinancing rate has not changed in 70 days. To calculate penalties, you need to divide the days of delay into two periods: delay up to 30 calendar days inclusive and delay from 31 calendar days to the day including the day of payment of insurance premiums. The period of delay is up to 30 calendar days – from October 17 to November 15 inclusive. Calculation of penalties for this period: (RUB 200,000 x 8.5% / 300) x 30 days. = 1700 rub. The period of delay from 31 calendar days is from November 16 to December 25 inclusive. Calculation of penalties for this period: (RUB 200,000 x 8.5% / 150) x 40 days. = 4533.33 rub. In total, for the entire period, the amount of penalties amounted to 6233.33 rubles. (RUB 1,700 + RUB 4,533.33).

Deadlines for payment of insurance premiums

Insurance premiums are paid at the end of each month no later than the 15th day of the following month. Contributions for compulsory pension, medical insurance, in case of temporary disability and in connection with maternity (VNiM) must be transferred to the tax authorities, and “traumatic” contributions - to the Social Insurance Fund of the Russian Federation. If the payment deadline falls on a weekend or non-working holiday, it is postponed to the next working day. Companies must pay insurance premiums for May, taking into account holidays, no later than June 17, 2019.

Remaining deadlines for payment of insurance premiums in 2021:

- for May - 06/17/2019

- for June - 07/15/2019

- for July - 08/15/2019

- for August - 09/16/2019

- for September - 10.15.2019

- for October - 11/15/2019

- for November - 12/16/2019

- for December - 01/15/2020

Which BCCs to indicate in 2021

Now let’s look at where to pay penalties on insurance premiums and what budget classification codes to indicate in the payment order. Payment is made as follows: penalties issued for compulsory medical insurance, compulsory medical insurance and for cases related to temporary disability and maternity are credited to the Federal Tax Service. The resulting penalties for deductions “for injuries” are transferred to the territorial social insurance funds.

And here are the BCCs that should be included in the payment slip for the payment of penalties to the tax office:

- for compulsory pension insurance: 182 1 0210 160;

- for compulsory health insurance: 182 1 0213 160;

- for temporary disability and maternity: 182 1 02 02090 07 2110 160.

Transfer penalties for injuries to the Social Insurance Fund using the following code: 393 1 02 02050 07 2100 160.

Amount of penalty for late payments for mandatory fees

So, the penalty is charged at the key interest rate (in force during the period of non-payment) of the Central Bank of the Russian Federation for each overdue day (i.e. day of non-payment). The key rate for 2021 remains unchanged to this month - 7.50% per annum. For individual entrepreneurs and legal entities, when calculating penalties, depending on the number of overdue days, its application may be different.

| Payer category (penalty for all fees, except for injuries) | Applicable rates |

| IP | Delay up to 30 days: 1/300 of the key rate of the Central Bank of the Russian Federation |

| Entity | As for individual entrepreneurs, if the payment is overdue by up to 30 days: 1/300 of the Central Bank key rate. But if payment is not made for more than 30 days. this tariff for legal entities increases and already from 31 days of delay is equal to 1/150 of the key rate of the Central Bank of the Russian Federation |

Penalties for fees for injuries are invariably calculated as 1/300 of the Central Bank rate for the unpaid amount, and so on for each day of delay. The terms of non-payment and the category of the payer do not affect anything here.

Important! The general formula for calculating: the amount of unpaid fees * the number of days of non-payment * 1/300 of the rate of the Central Bank of the Russian Federation (or 1/150 of the rate of the Central Bank).

To calculate penalties for contributions for injuries, the period is taken from the first day of non-payment until the day of payment of the fees, inclusive. As for other fees, for calculation purposes the period from the first day of non-payment until the day preceding the insurance payment is taken into account.

The accounting department displays the penalty on the day of calculation (or the day when the decision of the regulatory body took effect) using the following entries: DT 99 KT 69 - accrual, as well as DT 69 KT 51 - its payment. Basis - Instruction approved by order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000.

Example 1. Determining the period for calculating penalties for compulsory health insurance and injuries

Situation one. The organization was supposed to pay OPS contributions by October 31, 2020, but in fact the money was transferred on November 6, 2020. The total delay was 5 days (from 11/01/2020 to November 5 inclusive).

Situation two. The organization did not pay the injury fees on 10/15/2020 (as required), but later on 10/19/2020. Here you should take into account the first day of non-payment (10/16/2020) and the actual day of payment (10/19/2020). Thus, the period of delay was 4 days (October 16 - 19).

Calculation of penalties for mandatory pension insurance and social insurance contributions

So, in order to calculate the penalty for unpaid compulsory medical insurance, compulsory medical insurance, VNiM contributions, you need to adhere to the general calculation scheme, according to which the payer should:

- Set the period for which the penalty will be calculated (see example 1). For all fees other than personal injury fees, it starts on the first day of delinquency and ends on the day before the day the fees are due.

- Find out the interest rate of the Central Bank of the Russian Federation. The refinancing rate (also the key rate) may change; for 2021 it is 7.50%.

- Determine the formula for calculation taking into account overdue days. As is customary, if the number of days of delay is up to 30, then the indicator 1/300 of the key rate is substituted into the standard calculation formula. When the delay exceeds 30 days, then a penalty, starting from 31 days, is charged at 1/150 of the Central Bank key rate; accordingly, this indicator is substituted.

A general version of the formula: amount of fees * number of days of non-payment * 1/300 of the Central Bank of the Russian Federation rate (or 1/150 of the Central Bank rate).

If during the period for which the penalty is calculated, the key rate of the Central Bank changes, then this fact is taken into account. Accordingly, the required current rate indicators are substituted when calculating.

For example, the first 3 days of delay fall during the period of validity of the increased key rate (7.75%), and the remaining 10 days of delay do not fall within the period of validity of the rate of 7.50%. From here, the penalty for 3 days is calculated taking into account the rate of 7.75%, and for 10 days - at the rate of 7.50%.

As a result, the policyholder pays the entire amount of insurance premiums plus a penalty for overdue days.

How to pay dues

Individual entrepreneurs pay mandatory contributions for themselves. The amount of these payments is fixed

- pension contribution - 32,448 rubles;

- medical fee - 8,426 rubles.

They are paid within a year. You can pay in different amounts and at different periods; it is important to pay the entire amount before December 31 of the current year.

It is more convenient to pay quarterly. This will allow individual entrepreneurs using the simplified tax system to reduce the tax by the amount of insurance premiums paid in the same tax period.

If an individual entrepreneur’s income was above 300 thousand rubles, then he additionally pays a contribution to the Pension Fund in the amount of 1% of the amount exceeding 300 thousand. This fee must be paid by July 1 of the following reporting year.

If there are employees, then the individual entrepreneur pays contributions for them, and also submits all the required reporting on them. In this case, the deadline for payment of contributions and the deadline for submitting each report are strictly specified.

How to fill out a payment order for payment of insurance premiums

When filling out payment slips for the transfer of insurance premiums to the tax authorities, in field 101, companies making payments to individuals must indicate payer status “01”.

Individual entrepreneurs indicate one of the following values in this field:

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 10 - taxpayer (payer of fees) - a notary engaged in private practice;

- 11 - taxpayer (payer of fees) - lawyer who established a law office;

- 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise.

These provisions are provided for by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

When transferring contributions for accident insurance, “08” is entered in field 101.

The BCC is entered in field 104. In this field you need to indicate the value of the budget classification code of the Russian Federation established for the payment of the corresponding type of insurance premiums.

The purpose of payment and other necessary information are indicated in field 24. This field should reflect the type of insurance premiums and the period for which they are paid. When paying “traumatic” premiums, you can indicate the registration number of the policyholder in the Federal Social Insurance Fund of the Russian Federation.

In fields 106–109 of the payment order for the transfer of accident insurance contributions, “0” must be entered.

When transferring contributions to the tax authorities, you must reflect on the payment slip:

- “TIN” and “KPP” of the recipient of funds - the value of the “TIN” and “KPP” of the relevant tax authority that administers the payment;

- “Recipient” is the abbreviated name of the Federal Treasury authority and in brackets is the abbreviated name of the tax authority that administers the payment.

When transferring the current payment, the TP is entered in field 106, in field 107 - the month for which contributions are paid (for example, MS.05.2019).

How to pay correctly

The payer has the right to pay the penalty himself (if he knows that he is late in payment) or pay the fine upon request from the tax office. Here's how to pay penalties on insurance premiums in 2020:

- Receive a notification from the Federal Tax Service.

- Check the payment amount - calculate the payment using the formula.

- Fill out the payment order and transfer the required amount to the territorial tax office.

The amount of the penalty must be reflected in the accounting records. In the absence of regulatory documents regulating the type of recording of overdue deductions in accounting, the payer organization has the right to determine the type of accounting entry.

| Postings | Contents of operation | |

| For commercial organizations and non-profits | For budgetary institutions (instructions 157n, 174n) | |

| Dt 99, 91 Kt 68 | Dt 0.401.20.292 Kt 0.303.05.731 | Accrual of penalties and fines on insurance premiums |

| Dt 68 Kt 51 | Dt 0.303.05.831 Kt 0.201.11.610 | Payment of the resulting penalty |

What will happen for non-payment of fines?

If you do not pay the amount required by the tax authorities, there will be no penalty. The inspector will increase the amount of penalties until full payment is made. If the payer ignores all notifications, the Federal Tax Service has the right to file a claim and recover payment in court.

Fines

If an individual entrepreneur does not pay insurance premiums, then he does not fulfill his duties. And this is punishable by fines. Intentional non-payment will result in a double fine.

So, non-payment of contributions and underestimation of the calculation base are punished by 20% of the unpaid amount.

Intentional non-payment or under-payment is subject to a fine of 40% of the unpaid amount.

If a report is required for paid contributions, and it was not submitted on time, this is also punishable by a fine. The fine for such a violation is from 300 to 500 rubles. But if the individual entrepreneur not only forgot to submit the report, but also did not pay the fees, then another 5% of the unpaid amount for the last three months and for each full and partial month of delay is added to the fine.

If an individual entrepreneur must submit reports electronically, but for some reason submitted them in paper form, then this is punishable by a fine of 200 rubles.

Violation of the deadlines for submitting the SZV-M or errors in the report are fined in the amount of 500 rubles for each insured person. If this report is submitted in the wrong way, then the fine is 1000 rubles.

Failure to submit reports to the Pension Fund on time or in full is punishable by a fine of 300 to 500 rubles.

For failure to submit 4-FSS on time, you will have to pay 5% of the amount of deductions for injuries for the last three months, as well as a fine of 300 to 500 rubles. If this report is submitted in the wrong way, the fine will be 200 rubles.

Criminal penalty

Failure to pay mandatory contributions may result in criminal penalties. This threatens responsible persons if non-payment is the result of a crime.

When is a penalty charged?

Even if a penalty is imposed, this does not become a basis for exempting the entrepreneur from making insurance contributions. The decision to impose a fine or collect arrears is made by representatives of the Federal Tax Service during inspections, which can be desk or on-site.

Funds are collected in a forced manner, for which the money in the payer’s current account is written off . Initially, a written demand is sent to the head of the company, and if the employer refuses to voluntarily transfer funds, then the demand for collection is sent to the banking institution. The director of the enterprise receives the demand within three months after the violation or debt is discovered.

Taxpayers can be held liable for three years after the debt is incurred, since this period is represented by the statute of limitations. If a company has previously overpaid insurance premiums, it is impossible to impose a fine, since collection of sanctions is possible only if a debt to the budget arises.

Consequences of errors when paying penalties

Since the latest changes came into force, the Treasury and the Federal Tax Service have jointly organized work to independently clarify payments that were assigned the status of unclear in the system (letter from the Federal Tax Service dated January 17, 2017 No. ZN-4-1 / [email protected] ). Therefore, if funds are received into the budget account using incorrect details, the treasury will send the payment where it is needed. But this does not apply to all errors. For your convenience, we have prepared a table for determining further actions depending on the type of error made:

| Error in payment order | Consequences |

| TIN, KPP, recipient's name, field 104, 106, 107, 108, 109 | Payment is subject to automatic verification. To speed up the process, you can write a clarifying letter to the tax office. |

| Payment details (account number, BIC, bank name) | Payment will not be credited to your personal account. You need to write a letter to the bank to cancel the payment if it has not yet been executed, or contact the Federal Tax Service to return it. In the second case, it is recommended to duplicate the payment using the correct details to avoid arrears. |

| Amount of payment | If the payment is made for a large amount, then you need to write a letter to offset the overpayment to another cash register company. If you paid less than necessary, then you need to make an additional payment |

Sanction amount

The exact amount of the fine or penalty depends on the amount of insurance premiums. The company's accountant is responsible for the calculations, so if he makes a serious mistake, he is additionally subject to administrative liability in the form of a fine or disqualification. The employer may take disciplinary action for such errors.

Reference! Entrepreneurs do not need to independently calculate the amount of the sanction, since Federal Tax Service employees send a request that already contains information about the fine or penalty. If the head of the company does not agree with the amount of the fee, he can challenge it in court.

Answers to frequently asked questions

Question No. 1: Community pension contributions were transferred on time, but according to an erroneous BCC. Will a sanction be applied in this case?

An error under the KBK is not a violation and not a basis for charging a penalty. As a rule, the payment is updated automatically. In fact, if the payment went through and arrived at the correct account, despite the existing errors, the payment can be specified through the Federal Tax Service.

The policyholder, who independently and promptly noticed an error in the payment document, has the right to clarify the payment by submitting an appropriate application to the Federal Tax Service. The following are also subject to clarification: the status of the payer, the tax period, as well as the basis for payment, etc. in accordance with Art. 45 of the Tax Code of the Russian Federation.

Question No. 2: Penalties on compulsory pension insurance contributions are paid at the request of the tax authorities. How to display this in the “payment”?

You need to write down the details of this requirement in fields “108” and “109”. For your information, when paying voluntarily, zeros are entered here.

Results

The rules for calculating penalties on contributions from 2021 are subject to the requirements of the Tax Code of the Russian Federation. Compliance with the special requirements for payment documents for the transfer of fines is necessary when issuing a payment order for the payment of this payment. In some cases, errors made in the payment document do not prevent the payment from being credited to the correct treasury account.

Sources

- https://calcus.ru/kalkulyator-penej

- https://gosuchetnik.ru/bukhgalteriya/kak-platit-peni-po-strakhovym-vznosam

- https://nalog-nalog.ru/strahovye_vznosy/uplata_strahovyh_vznosov/kbk_peni_po_strahovym_vznosam/

- https://zen.yandex.ru/media/buhgalteria/novye-pravila-rascheta-penei-5c866ec446ebf300b3df0623

- https://www.klerk.ru/buh/articles/486523/

- https://online-buhuchet.ru/kak-rasschitat-peni-po-straxovym-vznosam-v-pensionnyj-fond/

- https://zen.yandex.ru/media/sovcom_pro/shtrafy-i-peni-ip-za-neuplatu-strahovyh-vznosov-5ec52e88033b1f6bec4cf0d4