The state is regulating volunteer activities in more and more detail, intending to make them more effective and socially significant.

One of the ways of such regulation is the introduction of various tax benefits, allowing volunteer organizations to direct the maximum of their funds received not as a result of entrepreneurial activities for the intended purposes, and for individual individuals - volunteers - to avoid tax payments on funds issued to them by these organizations.

In this regard, further amendments have been made to the legislation: Federal Law No. 98-FZ dated April 23, 2018 was adopted.

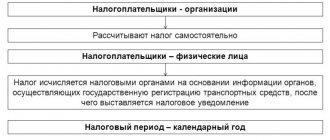

What income is not subject to personal income tax: general provisions

Income that is not subject to personal income tax is clearly defined in tax legislation.

The legislator may have several reasons for exempting various types of income from certain categories of individuals from paying tax. Such income is predominantly socially oriented or aimed at stimulating the development of lagging or unprofitable industries. 1. Socially oriented:

- social payments (pension, compensation or one-time payments, benefits, etc.);

- incentive payments (payments to donors, prize payments in connection with participation in competitions, assistance to government agencies, etc.);

- support for charity and volunteering;

- incentives for certain categories of socially vulnerable people (for example, remuneration for veterans).

https://www.youtube.com/watch?v=ytpressru

2. Intended for the development of “depressive” areas:

- conducting personal agriculture;

- consumption of banking and investment services.

Art. 217 of the Tax Code contains about 80 points (some of them have the same serial number and differ in the index to it), which provide the grounds that exempt the income of individuals from paying personal income tax. Their number changes almost every year due to the introduction of new grounds, the cancellation of previously valid ones, and the expiration of those that were established for a certain period.

Let's consider what amounts are not taxed according to the points included in Art. 217 Tax Code of the Russian Federation.

The bill exempting volunteers from personal income tax has already been adopted

The above-mentioned project was approved by the commission on legislative activities. The State Duma in the first reading adopted a bill exempting from income tax payments to reimburse volunteers for transportation and uniforms, rental housing and health insurance.

The government initiative was developed in pursuance of the president’s instructions and concerns the harmonization of various benefits for volunteers. The document offers a unified list of tax-free volunteer expenses.

With the adoption of the law, a uniform procedure will be applied both in the case of receiving such income in the form of compensation, and in the case of receiving income in kind. As Deputy Minister of Finance Ilya Trunin clarified, to receive this benefit, volunteers will not need to submit a declaration to the tax office.

Are alimony payments subject to income tax?

Gifts from individuals are not subject to taxes. Exceptions: real estate, cars and shares not from close relatives. If friends, relatives or colleagues give anyone a certificate, money, flowers, gold jewelry or a new iPhone, you don’t have to pay anything to the budget from these gifts. We wrote about this, and it's true.

A resident of Omsk received a gift from the administration. A certificate is also a gift. It could have been spent as money, but that doesn't matter. Since the gift is from a legal entity, the tax agent is obliged to charge personal income tax on the amount that exceeds 4 thousand rubles.

1. State benefits, except for payments due to temporary inability to work due to illness or when caring for a sick child. The exceptions are unemployment benefits and maternity benefits.

For more information about how personal income tax and maternity payments relate, read the article “Are maternity payments subject to income tax (personal income tax)?”

2. Pensions assigned by the Pension Fund of the Russian Federation, including labor pensions, as well as all social additional payments to them.

2.1. Monthly payments at the birth (adoption) of the 1st or 2nd child after 01/01/2018, provided that the average per capita family income does not exceed 1.5 times (from 2021 2 times) the subsistence minimum for the working population established in the region for the 2nd quarter of the year preceding the year of application for payment.

3. Compensation payments.

IMPORTANT! Until 01.01.2020, compensation not subject to personal income tax is listed in clause 3 of Art. 217 Tax Code of the Russian Federation. From 2021, it will no longer be in force, and the payments named in it will be moved to sub-clause. 3 p. 1 art. 217 Tax Code of the Russian Federation. See here for details.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

These are, in particular, compensation established at the federal and local levels within the limits of current restrictions:

- with compensation for damage caused by injury;

- free provision of housing, utilities or fuel (or paid in cash equivalent);

- issuance (or payment of the value equivalent) of the due allowance in kind;

- reimbursement of the cost of sports equipment, equipment, sports uniforms and meals provided to athletes and employees of specialized organizations (including judges) during training or participation in competitions;

- payment of severance pay, compensation to company management within the framework of triple monthly earnings (six times for those laid off in the Far North), average monthly earnings before employment;

- death of civil servants or military personnel in the performance of their official duties;

- increasing the professionalism of employees;

- with the use of personal property by employees for official purposes, subject to the availability of documents confirming the economic justification of such expenses;

We invite you to familiarize yourself with: What is the deadline for paying personal income tax upon dismissal

? Which ones, see here.

- performance of work duties, including reimbursement of travel allowances or when moving to another location for work;

- with field allowance, but not more than 700 rubles.

The maximum amount when paying for travel allowances, based on the exemption from personal income tax, is 700 rubles. per day in the Russian Federation and 2,500 rubles. equivalent abroad. Moreover, all justified targeted expenses during a business trip that are documented are exempt from taxation: travel to the destination, airport taxes, costs to the station (airport), luggage transportation, rental housing, telecommunications services, fees for obtaining visas, passports, currency exchange fees . Incl.

Read more about this in the material “Combine a business trip with a vacation, pay personal income tax.”

If documents confirming payment for renting housing were lost, then it is safe not to impose personal income tax only on amounts of 700 rubles per day in Russia and 2,500 rubles per day abroad. A similar procedure has been established for the taxation of payments made to members of the board of directors or any similar executive body of the company in connection with their arrival to hold a meeting of the board of directors or a similar body.

To learn whether it is necessary to tax expenses on documents issued by non-existent legal entities, read the article “The accountant confirmed expenses with documents from a non-existent company. Do I need to withhold personal income tax?

3.1. Payments to volunteers when they perform their duties free of charge, including rental of housing, travel to the place where their services are provided, food, purchase of personal protective equipment, payment of insurance for VHI for health risks. All within the limits of the amounts applicable for travel allowances specified in the paragraph above.

4. Payment for donated blood, milk and other assistance provided by donors.

5. Alimony payments.

6. Grants in the field of science, culture, education, provided by domestic and foreign organizations, the list of which is approved by the Government of Russia.

6.1. Grants, prizes and premiums received in competitions or competitions organized by non-profit institutions at the expense of grants from the President of the Russian Federation.

6.2. Income in cash or in kind to pay for food (up to 700 rubles in the Russian Federation and 2,500 rubles abroad), accommodation, as well as the cost of travel to the venue of competitions, contests, etc., held by non-profit organizations at the expense of grants from the President of the Russian Federation.

7. Awards (domestic and foreign) for achievements in the field of education, culture, art, technology and science, media according to the government list, as well as awards presented by regional senior officials for similar achievements.

8. One-time payments (including financial assistance, payment in kind) made:

- by the employer to the family of a deceased or retired (including in connection with the death of a family member) employee (for more details, see here);

- from the federal regional budget in the form of targeted assistance to the poor and socially vulnerable segments of the population;

- by the employer at the birth (taking into guardianship, adoption) of a child within 1 year within 50,000 rubles.

Find out how financial assistance to an employee is taxed with personal income tax here.

https://www.youtube.com/watch?v=ytcreatorsru

8.1. Award for assistance to government agencies in preventing and detecting terrorist acts, assistance to the FSB and operatives.

8.2. Charity.

8.5. One-time cash payment to pensioners made in January 2021.

9. Compensation by employers for the cost of vouchers to sanatoriums, dispensaries and other sanatorium-resort institutions (except for tourism) to employees or members of their families. Sources of payments can be funds from the organization itself, budget funds, or money from religious communities or NPOs.

Read more about personal income tax on vouchers provided at work here.

10. Payment by the employer for medical services (including medications) provided to employees or members of their families (from funds that remain at the disposal of the employer after paying income tax, as well as funds from organizations of the disabled, religious and charitable societies). A prerequisite is compliance with the non-cash form of payment or the issuance of cash to the individual taxpayer.

We suggest you read: The car is scrapped and the tax comes, what to do. Reasons why tax is calculated incorrectly. Before decisive action

11. Scholarships.

12. Remuneration from government agencies financed from the budget when sending workers abroad.

13. Income from the sale of self-grown crops or livestock products from subsidiary plots. Mandatory conditions are the non-use of hired labor and not exceeding the size of the land plot established for subsidiary plots. To be exempt from taxation, you will need a certificate issued by a local government body (chairman of a horticultural cooperative, etc.) confirming the origin of agricultural products.

13.1. Budget payments for the development of subsidiary farming.

14. Farmers' income from agricultural activities during the first 5 years.

https://www.youtube.com/watch?v=channelUCOFolRGr_AyirpnI5deRBsQ

14.1. Grants to farmers for creating a farm, initial equipment and for the development of a livestock farm.

14.2. Subsidies for farmers.

15. Income from the sale of forest products.

16. Income of registered members of family communities among the peoples of the North (small in number) engaged in ethnic activities.

17. Income from the sale of game and furs obtained by hunters.

17.1. Income from the sale of real estate (with certain restrictions established by Article 217.1 of the Tax Code of the Russian Federation and applied since 2016) and movable property owned for more than 3 years. From 01/01/2019, the clause applies to income received from the sale of property used in business activities.

17.2. Income from the sale of a part in the authorized capital of the company, shares that the taxpayer owned for over 5 years.

17.3. Income from the sale of waste paper by individuals.

18. Hereditary mass.

18.1. Property received as a gift from individuals, except for real estate, vehicles and securities (shares in the management company).

19. Income to shareholders during revaluation of assets and in other cases.

20. Sports prizes.

20.1. One-time incentive payments from sports non-profit organizations (introduced 07/03/2016).

20.2. Incentive cash and in-kind payments to participants of the 2016 Paralympic Games (introduced on November 30, 2016).

21. Tuition fees.

21.1. Fee for independent assessment of qualifications (introduced in 2017).

22. Purchase of technical equipment for the rehabilitation of disabled people, including payment for guide dogs, as well as for the prevention of disability.

23. Reward for treasure.

25. Interest on government bonds.

26. Charitable assistance to orphans, as well as from low-income families.

28. Any income not exceeding 4,000 rubles. per year in the form:

- gifts from legal entities and individual entrepreneurs;

- prizes at competitions;

- employer's financial assistance;

- reimbursement by the employer for the cost of medications prescribed by the attending physician (receipts are required);

- winnings in marketing campaigns;

- material assistance for disabled people;

- financial assistance provided by an organization carrying out educational activities in basic professional educational programs, students (cadets), graduate students, adjuncts, residents and assistant trainees (from 01/01/2020);

Possible innovations for 2018

Unfortunately, there is no talk of progressive income taxation yet. The Ministry of Finance, the Ministry of Economic Development and the Center for Strategic Research are discussing a completely different tax maneuver. Representatives of these departments are going to leave the flat scale, but at the same time believe that the tax burden on the population should be increased. The only way in which the “progressiveness” of the new tax system can be expressed is that a certain tax-free minimum income will be introduced. These innovations have been discussed in the government since the fall of 2021. Let us recall that according to the order of Vladimir Putin, the Federal Assembly must develop proposals for tax reform by December 2017. The President said that fiscal reforms are an important part of the implementation of the plan to accelerate Russia’s economic growth in the period 2018-2024. As for the proposals of individual departments, they can be expressed in the following theses:

- The Ministry of Finance insists that personal income tax should be increased to 15%, of which 6 to 8 percentage points should be redirected to the general federal budget. The increase in this fee can be compensated by reducing the insurance premium rate, reducing it to 21% (currently it is 30%);

- Representatives of the Ministry of Economic Development propose to increase the personal income tax rate to 15% and introduce the concept of a deduction equal to the amount of the subsistence minimum. At the same time, proposals are coming from this department to increase VAT to 21% (the current rate is 18%) and reduce insurance fees to 21%;

- The Center for Strategic Research says that personal income tax should be increased to 17%, but all or the poorest Russians should be given the right to a deduction in the amount of the subsistence minimum.

It is worth noting that some government experts suggest that each regional government should approve personal income tax rates independently. Russians can receive the right to a deduction in the amount of the subsistence minimum. Separately, it is necessary to mention the bill that was submitted for parliamentary consideration by an initiative group of deputies from the Liberal Democratic Party. This document proposes to exempt from paying income taxes those Russians who receive a salary of less than 15,000 rubles. But for all other categories it is proposed to introduce a progressive tax scale, which will force holders of excess income to fork out. The main theses and proposals of the bill are expressed as follows:

- people receiving an annual income of 180 thousand to 2.4 million rubles pay a tax of 13%. At the same time, it is proposed to subject to taxation only that part of the income that goes beyond the level of 180 thousand;

- individuals who managed to receive income from 2.4 million to 100 million rubles must pay a fixed tax in the amount of 289 thousand per year and another 30% of income amounts that go beyond 2.4 million;

- the category of persons receiving more than 100 million per year must pay a fixed personal income tax in the amount of 29.6 million rubles and additionally deduct 70% of income that exceeds 100 million.

According to Igor Shuvalov, who holds the post of first deputy prime minister of the country, the restructuring of the tax system is planned for 2021. Private experts express the opinion that such experiments with personal income tax may fail. First of all, they predict a widespread return of the gray salary payment scheme in commercial structures. Firms can use quite official loopholes - for example, register their employees as individual entrepreneurs in order to pay a 6% tax, or pay salaries disguised as interest on deposits. At the same time, today the shadow part of employee compensation is estimated at about 5 trillion rubles. V.L. Kiseleva, expert consultant at the Publishing House “Accountant Advisor”

| The literal translation of the word “volunteer” is “volunteer”. That is, people of their own free will and absolutely free of charge engage in any social activity. New explanatory dictionary of the Russian language T.F. Efremova gives the following concepts: “A volunteer is someone who voluntarily takes part in some activity,” and “A volunteer is someone who voluntarily takes on any work or any responsibilities.” |

The legal basis for the development of volunteerism in Russia was laid by a number of legislative acts.

For example, Federal Law No. 82-FZ of May 19, 1995 “On Public Associations” regulates social relations arising in connection with the exercise by citizens of their right to unite in organizations. Article 32 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations” contains indirect reference to the right to use the gratuitous labor of citizens by non-profit organizations. Charitable activities in Russia are also regulated by the provisions of the Constitution of the Russian Federation and the Civil Code. In the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations” (hereinafter referred to as Law No. 135-FZ), a definition of a volunteer was given for the first time: Volunteers (volunteers) are individuals who carry out charitable activities in the form of gratuitous work. , provision of services (volunteer activities) in the interests of beneficiaries. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Charitable activity is understood as the voluntary activity of citizens and legal entities in the disinterested (free of charge or on preferential terms) transfer of property, including money, to citizens or legal entities, the disinterested performance of work, the provision of services, and the provision of other support.

Note. Access to the full contents of this document is restricted. In this case, only part of the document is provided for familiarization and avoidance of plagiarism of our work. To gain access to the full and free resources of the portal, you just need to register and log in. It is convenient to work in extended mode with access to paid portal resources, according to the price list.

What has changed in the taxation of income from the sale of real estate from 2021 and in 2019-2020

Starting from 2021, exemption from personal income tax on citizens’ income from the sale of property is regulated according to new rules. This is due to the appearance of a new article 217.1 in the Tax Code and a change in the text of clause 17.1 of art. 217, which change the procedure for exempting income from the sale of real estate and other property from taxation.

In particular, property is now divided into 2 groups:

- real estate or shares in it;

- other property that was owned by the taxpayer for more than 3 years.

A new concept has been introduced into the Tax Code - the maximum minimum period of ownership of real estate (clause 2 of Article 217.1 of the Tax Code of the Russian Federation). According to the Tax Code of the Russian Federation, this period has 2 meanings: 3 years and 5 years. A 3-year period of ownership of real estate when determining income exempt from personal income tax is established for situations of sale (clause 3 of Article 217.1 of the Tax Code of the Russian Federation):

- real estate or a share in it received by the taxpayer by inheritance or as a gift from close relatives;

- privatized property;

- real estate received under a contract for the lifelong maintenance of a deceased dependent.

We invite you to read: Responsibility of the head of the organization for late payment of taxes

In other cases, income from the sale of real estate is exempt from personal income tax after a five-year period of ownership of this property (clause 4 of Article 217.1 of the Tax Code of the Russian Federation).

Particular attention is paid to the value of the property being sold. If the sale price is less than the cadastral value, then the tax base will be determined as the cadastral value at the beginning of the year of sale, multiplied by 0.7. An exception to the rules will be the sale of objects for which the cadastral value has not been determined (clause 5 of Article 217.1 of the Tax Code of the Russian Federation).

The right of subjects of the Federation has been introduced to make decisions on reducing the 5-year tenure period, which makes it possible to exempt income from the sale of real estate from personal income tax, and on reducing the coefficient applied to the cadastral value to determine the tax base when selling an object at a price lower than the cadastral value (clause 6 Article 217.1 of the Tax Code of the Russian Federation).

The innovations apply only to those objects that were owned by the taxpayer from 01/01/2016. For property acquired before 2021, the old rules for exempting real estate from personal income tax apply: a 3-year ownership period and the absence of dependence of the tax base on the ratio of the sale price and cadastral value.

For more information about the dependence of the applied rules on the year of ownership, see the article “Sale of real estate below cadastral value - tax consequences.”

An innovation for 2021 was the exemption from personal income tax on interest savings for the period of mortgage holidays.

We talked about it in more detail here.

From 01/01/2020, the Tax Code of the Russian Federation will specify the procedure for determining income from the sale of real estate acquired during the year for the purpose of property deduction. Income will need to be compared with the cadastral value of the object, determined as of the date the object was registered in the cadastral register, multiplied by a factor of 0.7.

Read more about the changes to Art. 217 of the Tax Code of the Russian Federation in 2021, find out from this publication.

Conditions for volunteer activities have been clarified

There is no benefit here, you just get yours. So you don’t have to inform the tax office about this. It doesn’t matter whether the money is returned to you in cash or transferred to a card, this is not income.

When selling plots, the same rules apply: the deduction is equal to 1 million rubles. (Article 220 of the Tax Code). A tax deduction is allowed only if the land is intended for building a house.

Whether such payments are provided for in the collective agreement does not matter. Insurance premiums will still have to be charged.

By the way, it became known earlier that students and graduate students who receive financial assistance of no more than four thousand rubles a year were also exempted from personal income tax. This is money paid by universities or colleges. The corresponding law also comes into force on January 1, 2020.

Whether such payments are provided for in the collective agreement does not matter. Insurance premiums will still have to be charged.

Federal Law No. 135-FZ, effective May 1, 2018, has been significantly amended precisely in terms of provisions on voluntary (volunteer) activities.

How much income of foreigners is not taxed?

- income of consuls and diplomats, as well as members of their families living with them on the territory of the Russian Federation (only income that is not related to the consular or diplomatic service and received in Russia from local sources is taxed);

- income of technical workers and service personnel of diplomatic missions represented by foreign citizens, as well as members of their families temporarily residing with them in Russia, with the exception of income received from other sources in Russia;

- income of employees of international organizations.

This article applies only to citizens of those countries with which Russia has concluded relevant international treaties establishing a similar procedure for Russians of the same rank.

Results

Tax legislation provides for the exemption of personal income from personal income tax in a number of cases. An exhaustive list of such cases is given in Art. 217 (for Russians) and Art. 215 (for foreign citizens) of the Tax Code. Most of the items for which the income of Russians is exempt are related to the social orientation of this income (state benefits, compensation payments, pensions, payments for children, financial assistance). The exemption also applies to the income of peasant and personal subsidiary plots, income from the sale of forest products and hunting trophies.

https://www.youtube.com/watch?v=ytdevru

From 2021, personal income tax will be assessed in a new way when selling real estate. The time limits for this property to be owned by the sellers have been changed. In addition, the sale price of property has been linked to its cadastral value for the situation of selling an object at a price lower than the cadastral valuation, and the constituent entities of the Russian Federation have the right to reduce the main deadline and reduce the coefficient involved in calculating the tax base from the cadastral value.