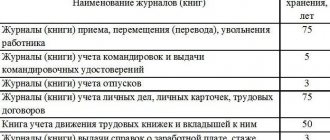

Storage periods for organizational documents

Please note: for periods that depend on the date of execution of documents, the designation “50/75 years” is used. A document drawn up after 2003 must be kept for 50 calendar years, and a document drawn up before 2003 for 75 years. The retention period means that after its expiration, the document can be selected for permanent storage.

| Documentation category | Type of documents | Previous terms | New terms |

| Tax accounting | Invoices | 4 years | 5 years |

| Tax accounting | Registers of information on the income of individuals submitted by tax agents | 75 years old | 5 years |

| Tax accounting | Books of accounting of income and expenses of individual entrepreneurs and organizations using the simplified tax system | Constantly | 5 years |

| Tax accounting | Calculations of insurance premiums for your employees | If there are personal accounts - 5 years If there are no personal accounts - 50 years (if documents were issued since 2003) / 75 years (if documents were issued before 2003) | 50/75 years |

| Tax accounting | Cards for individual accounting of accrued payments and insurance premiums | If you have personal accounts - 5 years If you have no personal accounts - 50/75 years | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Accounting | Documents (acts, certificates, correspondence) on misappropriations, shortages and embezzlement | 5 years, for some of this documentation - permanently | 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting | Documents on wages and other payments (payslips, payslips) | If you have personal accounts - 5 years If you have no personal accounts - 50/75 years | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Personnel accounting | Orders on disciplinary sanctions and documents that served as the basis for their issuance | 5 years | 3 years |

| Personnel accounting | Applications regarding the need for foreign employees | 5 years | 1 year |

| Personnel accounting | Documents on the status and measures to improve working conditions and labor protection and safety regulations | Constantly | 5 years |

| Personnel accounting | Account cards, books, magazines, vacation databases | 3 years | 5 years |

| Personnel accounting | Documents for recording accidents and incidents at work | Constantly | 45 years |

| Personnel accounting | Vacation schedules | 1 year | 3 years |

Document retention periods

With us all your documents are under reliable protection

Data transfer between your computer and the online accounting server is encrypted using the SSL level protocol, as in the largest banks. Every 15 minutes all data is copied to additional servers.

Get free access

Tax accounting and reporting: document retention period

The table below reflects the deadlines that apply to taxpayers and tax agents, as well as to payers of insurance premiums.

Reference table with new storage periods for tax accounting documents. table 2

| Document | Shelf life | Base |

| Documents required for the calculation and payment of taxes, incl. confirming the amounts of income/expenses and payment of taxes by taxpayers and tax agents | Minimum 4 years | Tax Code of the Russian Federation, paragraphs. 8 clause 1 art. 23, pp. 5 paragraph 3 art. 24 |

| Tax returns, calculations for all taxes | 5 years IP declarations earlier than 2003 – 75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 310 |

| Invoices | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 317 |

| Logs of received/issued invoices (paper and electronic) | Minimum 4 years from last entry date | Government Decree No. 1137 of December 26, 2011, Appendix No. 3, clause 13 |

| Purchase/sale books (paper and electronic) | Minimum 4 years from last entry date | Government Decree No. 1137 of December 26, 2011, Appendix No. 4, paragraph; Appendix No. 5, paragraph 22 |

| Documents on personal income tax (calculations, messages about the impossibility of withholding, tax registers), certificates of income and tax amounts for individuals | 5 years 50/75 years – in the absence of personal accounts or salary statements | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 311,312 |

| Documents confirming expenses for employee training, for the employee to undergo an independent qualification assessment (for income tax) | During the validity period of the relevant contract and 1 year of the employee’s work, but not less than 4 years | Tax Code of the Russian Federation, clause 3, art. 264, paragraph 4 of Art. 283 |

| Documents confirming the amount of loss incurred (for income tax) | During the entire period of reduction of the tax base of the current period by the amounts of previously received losses | |

| Documents confirming the amount of the loss incurred and the amount by which the tax base was reduced for each tax period (according to the simplified tax system, unified agricultural tax) | During the entire period of use of the right to reduce the tax base by the amount of the loss | Tax Code of the Russian Federation, clause 7, art. 346.18, paragraph 5 of Art. 346.6 |

| Documents required for calculation and payment of insurance premiums | 6 years | Tax Code of the Russian Federation, clause 3.4 art. 23 |

| Calculations for insurance premiums | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 308, 309 |

| Cards for individual accounting of amounts of payments and accruals of insurance premiums | 6 years 50/75 years – in the absence of personal accounts or payroll records | |

| 4-FSS calculations accepted by the FSS of the Russian Federation in electronic form, incl. receipts | Minimum 5 years from the date of acceptance of the calculation by the Fund | Order of the FSS of the Russian Federation dated February 12, 2010 No. 19, clause 6.2, 6.3 |

Table of storage periods for tax, accounting and personnel documents in 2021

The table shows the storage periods for the most common tax, accounting and personnel records, effective from 2021.

A complete list of standard management documents and their retention periods can be found here. You can find out from what point to calculate the storage period for documentation and what to do after the expiration of the temporary storage period from the instructions approved by the order of the Federal Archive No. 237 of December 20, 2019.

| Documentation category | Type of documents | Shelf life |

| Tax accounting | Documents on accrued and transferred amounts of taxes and debts on them | 5 years |

| Tax accounting | Tax returns and calculations for all types of taxes | 5 years |

| Tax accounting | Invoices | 5 years |

| Tax accounting | Documents accounting for amounts of income and employee income tax | 5 years |

| Tax accounting | Documents for accounting for the sale of goods, services and works, subject to and exempt from VAT | 5 years |

| Tax accounting | Certificates of fulfillment of the obligation to pay taxes, fees, contributions, penalties, penalties and the status of settlements with the budget | 5 years |

| Tax accounting | Books of accounting of income and expenses of organizations using the simplified tax system | 5 years |

| Tax accounting | Documents (correspondence, acts, objections, statements) regarding disagreements with the Federal Tax Service on issues of calculation and payment of taxes | 5 years |

| Tax accounting | Correspondence about tax debt restructuring | 6 years |

| Tax accounting | Calculations of insurance premiums for your employees | 50/75 years |

| Tax accounting | 2-NDFL certificates and calculations of personal income tax amounts | If there are personal accounts - 5 years If there are no personal accounts or salary slips - 50/75 years |

| Tax accounting | Registers of information on employee income submitted by tax agents to the Federal Tax Service | 5 years |

| Tax accounting | Cards for individual accounting of accrued payments and insurance premiums | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Accounting | Primary accounting documents and related supporting documents (orders, time sheets, invoices, receipts, acts of acceptance, delivery and write-off of property) | 5 years subject to inspection; if disputes arise, disagreements remain until a decision is made on the case |

| Accounting | Accounting registers (general ledger, transaction journals, account cards, orders, statements, inventory lists) | 5 years subject to inspection |

| Accounting | Accounting policy documents (accounting standards, working chart of accounts) | 5 years after replacement with new ones |

| Accounting Accounting (financial) statements and audit reports | Annual financial statements | Constantly |

| Accounting Accounting (financial) statements and audit reports | Interim financial statements | 5 years. In the absence of annual reporting - constantly |

| Accounting Accounting (financial) statements and audit reports | Documents on consideration and approval of financial statements (acts, conclusions, minutes) | Constantly |

| Accounting Accounting (financial) statements and audit reports | Audit reports on the accounting (financial) statements: a) of the audited entity; b) from an audit organization, an individual auditor | A). 5 years; for annual accounting (financial) statements - constantly b). 5 years, subject to external quality control testing 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting Accounting (financial) statements and audit reports | Documents (acts, certificates, correspondence) on misappropriations, shortages and embezzlement | A). 5 years; for annual accounting (financial) statements - constantly b). 5 years, subject to external quality control testing 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting Accounting (financial) statements and audit reports | Documents on wages and other payments (payslips, payslips) | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Personnel accounting | Documents on the personnel of the organization | 50/75 years |

| Personnel accounting | Collective agreements | Constantly |

| Personnel accounting | Lists of professions | At the place of approval - permanently, in other organizations - until new ones are approved. |

| Personnel accounting | Vacation schedules | 3 years |

| Personnel accounting | Originals of the employee’s personal documents (work book, diploma, certificate, etc.) | On demand, but not more than 50/75 years |

| Personnel accounting | Documents on employee bonuses | 5 years |

| Personnel accounting | Orders on personnel transfers | 50/75 years |

| Personnel accounting | Personal cards of employees | 50/75 years EPC |

| Personnel accounting | Books, magazines, accounting cards, databases of work record forms, vacations, issuance of official foreign passports, certificates of salary, place of work, length of service. | 5 years |

| Personnel accounting | Documents (conclusions, acts, protocols) on accidents, injuries and industrial accidents a) at the place of preparation; b) in other organizations | a) 45 years old; associated with major material damage and human casualties - constantly b) 5 years |

| Personnel accounting | Documents (orders, instructions) on disciplinary sanctions | 3 years |

| Personnel accounting | Applications regarding the need for foreign workers | 1 year |

| Personnel accounting | Documents on the status and measures to improve working conditions and labor protection (certificates, justifications, proposals) | 5 years |

| Personnel accounting | Applications from employees for the issuance of work-related documents and their copies | 1 year |

| Personnel accounting | Documents (magazines, books) recording labor safety training (introductory and on-the-job training) | 45 years |

Storage periods for the most common documents in 2021

These deadlines are established by order of the Federal Archive. At the same time, for some documents the deadlines are regulated by regulations of other departments. If regulations set different deadlines for the same documents, we recommend choosing a longer one for safety.

The same applies to documents that you created or received before the retention periods changed. Based on them, too, be guided by the longest period.

In the “My Business” service, all your documents are saved automatically

Accounts, acts, contracts and all reports are stored in your personal account, which you can access at any time

Free consultation on document storage

Storage periods for accounting and tax documents

For most accounting documents, the retention period is 5 years. This period is established in Article 29 of the Accounting Law No. 402-FZ.

The storage periods for most personnel, banking documents and documents on the assessment of fixed assets, intangible assets, etc. are established by order of the Federal Archive of December 20, 2021 No. 236.

The main storage periods for tax documents can be found in the Tax Code. Documents necessary for the calculation and payment of taxes and contributions, including documents confirming income and expenses, payment (withholding) of taxes, must be kept for five years after the end of the tax period in which the document was used.

Federal Law No. 6-FZ dated February 17, 2021 amended Article 23 of the Tax Code of the Russian Federation.

The tax law has increased the storage period for primary documents from four years to five years.

The storage periods for VAT accounting documents are established in accordance with subparagraph 8 of paragraph 1 of Article 23, subparagraph 5 of paragraph 3 of Article 24 of the Tax Code of the Russian Federation; documents that formed the basis for calculating the tax base and paying taxes must be stored for 5 years. by Government Decree of December 26, 2011 No. 1137 and is included in the order of the Federal Archive No. 236.

So that you don’t waste time searching for the right answer, we have collected all the shelf life in a single table.

Document storage periods in 2021

| Document | Shelf life | Base |

| ACCOUNTING DOCUMENTS | ||

| Primary accounting documents | 5 years If there are disputes or disagreements, documents must be kept until a decision is made on the case | P. 277 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236 Art. 29 of Law No. 402-FZ |

| Cash documents and books | ||

| Bank documents | ||

| Checkbook stubs | ||

| Orders, timesheets, bank notices and requests for funds transfers | ||

| Expense reports | ||

| Correspondence with the bank | ||

| Cash receipt and strict reporting form | 6 months from the date of issue on paper | Clause 8 art. 4.7 of the Law of May 22, 2003 No. 54-FZ |

| Cashier-operator's book and other documents confirming cash settlements with customers | 5 years | Part 1 art. 29 of the Law of December 6, 2011 No. 402-FZ |

| Accounting policy documents | 5 years | P. 267 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Accounting statements: balance sheet, financial results statement, report on the intended use of funds, appendices thereto | Annual - constantly Intermediate - 5 years | P. 268 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| CALCULATION AND PAYMENT OF TAXES AND CONTRIBUTIONS | ||

| Tax returns and calculations, except for the DAM | 5 years | P. 310, 311 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Certificates on the fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines, the status of settlements with the budget | 5 years | P. 305, 312, 313 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236, Clause 8, Art. 23 Tax Code of the Russian Federation |

| Documents required for calculating taxes and documents confirming expenses | 5 years | Clause 8 art. 23 Tax Code of the Russian Federation Art. 29 of Law No. 402-FZ |

| Documents confirming the amount of loss incurred | The entire period for which the tax is reduced | |

| Notifications, demands, decisions, resolutions, objections, complaints. | 5 years | |

| Documents used in preparing a complaint based on the results of an on-site or desk inspection | 10 years | |

| Electronic documents with UKEP, certificates of keys for verifying electronic signatures with which documents are endorsed. | 5 years | |

| Calculations for insurance premiums (annual and quarterly): | ||

| if the paperwork is completed before the end of 2002 | 5 years (75 years - if there are no personal accounts or payroll records) | P. 308 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| if the paperwork was completed after January 1, 2003 | 5 years (50 years - if there are no personal accounts or payroll records) | |

| Cards for individual accounting of payments and accrued insurance premiums | 6 years | P. 309 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Invoices | 5 years | P. 317 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236 Government Decree of 2612.2011 No. 1137 |

| Sales purchase books and additional sheets for them | 4 years since last entry | Government Decree No. 1137 dated 2612.2011 |

| Documents for applying tax benefits provided for regional investment projects | 6 years | Clause 3 art. 89.2 Tax Code of the Russian Federation |

| SALARY DOCUMENTS | ||

| Regulations on remuneration and bonuses for employees | 5 years | P. 294 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Cards for individual accounting of payments, rewards and insurance premiums | 6 years | P. 309 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Registers of information on the income of individuals | 5 years | P. 313 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Personal accounts of employees: for documents for which: | ||

| Office work completed by the end of 2002 | 75 years old | P. 296 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| The paperwork was completed after January 1, 2003 | 50 years | |

| Pay slips, payslips for the issuance of wages, benefits, fees, financial assistance and other payments | For 6 years, if the employer maintains personal accounts for employees. If he doesn’t lead, then 50 (75) years. | P. 295 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Writs of execution | 5 years | P. 299 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Time sheets | 5 years | P. 402 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Applications, lists of employees, certificates, extracts from protocols, conclusions, correspondence and other documents on the payment of benefits, bonuses, revision of wages, payment of sick leave and issuance of financial aid | 5 years | P. 401, 405, 406 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents confirming the calculation and payment of contributions | 6 years | Subp. 6 clause 3.4 art. 23 Tax Code of the Russian Federation |

| Documents for payment of benefits: certificates of incapacity for work, applications, contracts for medical and sanatorium-resort services for employees | 5 years | P. 618, 633 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Expense vouchers for sanatorium and resort vouchers | 5 years | Item 636 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| HR DOCUMENTS | ||

| Orders and instructions on the main activities: taking office, on assigning the duties of chief accountant to the head, on early resignation, on the appointment of responsible persons | Constantly | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Internal labor regulations | 1 year | P. 381 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Regulations or instructions for the processing of personal data | Constantly | P. 440 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Consent to the processing of personal data | 3 years after consent expires or after revocation | P. 441 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Vacation schedule Documents on disciplinary sanctions | 3 years | P. 453 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on disciplinary sanctions | 3 years | P. 383 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Applications regarding the need for foreigners | 1 year | P. 377 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on the status and measures to improve working conditions and safety | 5 years | P. 409 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Books, registration logs, databases of industrial accidents, accident records | 45 years | P. 424 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders and instructions on administrative and economic issues | 5 years | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders for sending on a business trip | 5 years | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders on the provision of annual leave, additional paid and educational leave | 5 years | P. 300, 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agreements on financial liability of the financially responsible person. Lists of responsible persons and sample signatures | 5 years | P. 279, 281, 282 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents (reports, acts, lists, schedules, correspondence) of periodic medical examinations | 3 years | Item 635 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Employment contracts and additional agreements thereto | If the paperwork was completed before January 1, 2003, then they must be stored for 75 years, if after - 50 years | P. 435 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| All orders for personnel: on hiring, transfer, relocation, combination, part-time work, dismissal, remuneration, certification, advanced training, assignment of ranks and titles, promotion, awards, parental leave, leave without pay A also: memos, certificates, statements to orders regarding personnel. | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| All original personal documents: work books, diplomas, certificates, certificates, certificates not required by employees upon dismissal | P. 449 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Civil contracts with individuals and acts on them | Clause 301 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Personal files and personal cards of employees | P. 444, 445 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Orders to change personal and biographical data | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Notifications, warnings to employees | 3 years | P. 436 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Employee applications for the issuance of work-related documents and their copies | 1 year | P. 451 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Magazines, books of record of labor safety briefings (introductory and on-the-job) | 45 years | P. 423 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents related to work in harmful and dangerous working conditions - time sheets and business trip orders | 50 (75) years | P. 410, 411, 414 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

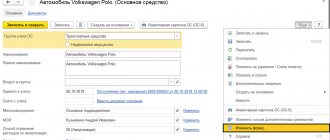

| FIXED ASSETS | ||

| Documents on revaluation of fixed assets and depreciation | 5 years after disposal of fixed assets or intangible assets | P. 323 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on write-off of fixed assets | 5 years after disposal of fixed assets or intangible assets. | P. 323 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Acts of acceptance and transfer of real estate to the new copyright holder, i.e. when transferring from balance sheet to balance sheet | 5 years after disposal of property | P. 325 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| simplified tax system | ||

| Books of accounting of income and expenses for the simplified tax system | 5 years | P. 318 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| EXPERT ANALYTICAL DOCUMENTS | ||

| Reports and conclusions of expert and analytical activities of the Accounts Chamber, regional and local control and accounting bodies | 10 years | P. 142 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| FINANCIAL AND ECONOMIC ACTIVITY PLAN | ||

| The financial and economic activity plan must be kept for as long as the budget estimate | ||

| at the place of approval | 5 years | P. 243 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| at the place of development | constantly | |

| Reports on the implementation of FCD plans | ||

| annual | constantly | P. 272 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| quarterly | 5 years | |

| period | 1 year | |

| Reports on the implementation of grant and subsidy agreements | 5 years | P. 262 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| CONTRACTS AND AGREEMENTS | ||

| Lease agreements, free use of: real estate; movable property | Upon expiration of the contract, after termination of obligations: 10 years and 5 years | P. 94 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agreement of gift (donation) of property | Before the liquidation of the organization | P. 90 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Leasing agreement | 5 years after expiration of the contract or redemption of the property. If there is a disagreement, the agreement must be kept until a decision is made on the case. | P. 96 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Real estate pledge documents | 10 years from the date of expiration of the contract. In case of a dispute, documents are kept until a decision is made on the case. | P. 98 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Real estate exchange agreement; movable property | Before the liquidation of the organization; 5 years upon expiration of the contract or upon fulfillment of obligations | P. 99 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agency agreement: for real estate; on movable property | 15 years; 10 years | Clause 101 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Credit or loan agreement with the condition of pledging property | 10 years | P. 261 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

If different regulations specify different retention periods for the same type of document, use the longer period as your guide.

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |

Storage periods for accounting documents

The storage periods for accounting documentation are regulated by the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011. Article 29 of this law establishes no less than a 5-year retention period for all accounting documents, with the exception of those that must be kept for the entire time the organization carries out its activities. At the same time, according to paragraph 1 of this article, specific deadlines for various types of documentation must comply with the rules for organizing state archival affairs. Therefore, in 2021 we must proceed from the deadlines established by the Federal Archive on February 18, 2020, but they should not be less than 5 years.

The storage period for documents in the organization is 2020-2021.

According to Art. Law “On Archival Affairs” No. 125-FZ of October 22, 2004, the safety of archival documents must be ensured within the time limits established by laws and other regulations, as well as lists of standard documents approved by Rosarkhiv and various federal departments.

Order of the Federal Archive No. 236 dated December 20, 2019 introduced new retention periods for most management, personnel, accounting, tax and other documents from February 18, 2020. The previously valid Order of the Ministry of Culture No. 558 dated August 25, 2010 has lost force and is no longer applicable. Also, some storage periods for documentation are established by the Tax Code of the Russian Federation, the Accounting Law No. 402 of December 6, 2011, and other regulatory documents.

The new periods for storing documents in the archive apply regardless of the legal form of the company, and they also apply to individual entrepreneurs. Subjects can ensure the safety of documentation on their own, or with the help of a specialized archival organization, which is especially important for large volumes of documents.

We present the current storage periods for a number of basic documents generated in the course of enterprise activities.

Retention periods for personnel documents

The storage periods for such documents from February 18, 2020 are regulated by clause 8 of section II of the order of the Federal Archive. For certain documents, the retention period depends on the date they were issued. The storage period for documents issued before 2003 is 75 calendar years, starting from the year following the year of their creation. Personnel documents created after 2003 must be kept for at least 50 years. The list of personnel documentation includes employment and civil law contracts, author's contracts, personal cards of employees, as well as unclaimed originals of their work books, diplomas, military IDs, identification cards, and certificates.

For some documents, a special storage period was established that did not exist before:

Personnel: document storage periods 2021 - table

Maintaining personnel records is mandatory for all employers, including individual entrepreneurs. Only micro-enterprises have the right to refuse to draw up some local acts, provided that the issues regulated by them will be included in employment contracts with employees (Article 309.2 of the Labor Code of the Russian Federation). But otherwise, the personnel document flow is the same for everyone.

For most HR documents in 2020-2021. Very long storage periods are established, and the employer must often provide appropriate conditions for their safety, because they contain personal data of employees.

Storage periods for personnel documents. Table 3

| Document | Shelf life | Base |

| Documents on personnel, except for those for which a different storage period is established | 50/75 years | Law “On Archival Affairs” No. 125-FZ of October 22, 2004, Art. 22.1 |

| Personal files, personal cards of managers and employees | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 435, 444, 445 |

| Employment contracts, service contracts, additional agreements to them | 50/75 years | |

| Orders and documents related to the application of disciplinary sanctions | 3 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 454 |

| Documents on the processing of personal data | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 440, 441 |

| Consent to the processing of personal data | 3 years after expiration of the consent or its revocation (the contract may provide otherwise) | |

| Personal documents in the original (work books, diplomas, certificates, certificates) | On demand by employees Unclaimed documents are stored for 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 449 |

| Information about work activity and work experience | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 450 |

| Staffing table | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 40 |

| Time sheets (schedules), working time logs | 5 years 50/75 years – under harmful and dangerous working conditions | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 402 |

| Vacation schedules | 3 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 453 |

| Trip reports | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 452 |

| Sick leave certificates and their registration logs | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 618, 619 |

| Orders, instructions and documents thereto | By core activity - constantly On administrative and economic issues – 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 19 |

| Orders, instructions for personnel and documents for them | 50/75 years - on admission, transfer, combination, part-time, dismissal, remuneration, advanced training, leave - to care for children, without pay 5 years - on annual and educational leaves, business trips (in the presence of harmful, dangerous working conditions - 50/75 years), on service inspections | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 434 |

| Job descriptions (regulations) | Typical – 3 years after replacement with new ones Workers' instructions – 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 442, 443 |

| Reports on industrial accidents (with investigation materials), accident logs | 45 years | Labor Code of the Russian Federation, art. 230, 230.1 |

| Internal labor regulations | 1 year after replacement with new ones | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 381 |

| Collective agreements | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 386 |

New fines for violating documentation storage rules

From October 26, 2021, amendments to Art. 13.20 Code of Administrative Offenses of the Russian Federation. Law No. 341-FZ of October 15, 2020 significantly tightened the punishment for violating the rules of storage, as well as recording, compiling and using archival documents. Now, violators of the document retention period in 2021, the tables of which are given above, face the following fines:

- for citizens 1 – 3 thousand rubles. (or warning);

- for officials – 3 – 5 thousand rubles;

- for an organization – 5 – 10 thousand rubles.

Let us recall that before amendments were made to the Code of Administrative Offenses of the Russian Federation, fines ranged from 100 to 300 rubles. for citizens and 300 - 500 rubles. for officials and for legal entities no sanction was provided at all.