Receipt for acquiring - is it necessary or not?

Discussions about whether a fiscal receipt is needed for online payment and whether there is a need to save it have been going on since the beginning of the 2000s.

In 2003, Law No. 54-FZ was adopted, which defined the use of cash registers when paying for goods or services with a bank card or cash. But this law did not take into account the main thing: technologies are constantly updated, in particular, the possibility of online payment appeared not so long ago. Until 2021, under this law, a fiscal receipt was not required when directly transferring funds to a company’s account. However, in 2021, Federal Law No. 290 was issued, which states in black and white that a receipt is required for any payment method, including when it comes to paying out winnings from lottery tickets and receiving paid content (games, books, software etc.)

Therefore, at present, checks are definitely needed for acquiring. However, not all of them need to be stored for many years.

Main differences from a cash receipt

It is a common mistake to think that a cashier's check and an acquiring check are interchangeable. According to Federal Law-290, each seller is obliged to punch and issue to the buyer a document confirming the fact of purchase. In fact, sellers often limit themselves to a receipt from a terminal. It is not right.

A cash receipt is a document confirming that the customer actually purchased a product or service. At the same time, it must indicate the name of the product, its quantity and price per unit of product. At the end, the full cost of the purchase is written down.

An acquiring receipt only confirms the fact of a commodity transaction between the organization and the buyer. It indicates only the final purchase amount.

When making non-cash payments, the bank acts as an intermediary between you and the client. This means that a document issued by a terminal cannot replace a cash register.

How long should fiscal receipts be kept?

All primary cash documents are required by law to be retained for 5 years. This rule has been in effect since 2007.

Meanwhile, the law provides an exception for copies of sales receipts and used cash receipts: they have a shelf life of only 10 days. The financially responsible person is responsible for storing checks for acquiring. It is worth considering that Z-reports from cash registers (including from POS terminals) refer to primary documents, the shelf life of which is 5 years.

As part of the standard acquiring agreement, the storage period for checks and all documents confirming the fact of a transaction or expenses is 3 years. In this case, checks (slips) are transferred to the bank no later than within 3 days from the date of receipt of the request from the bank.

Why do you need to keep payment documents?

Keeping receipts is the responsibility of the enterprise, which will help avoid litigation with the bank in the event of force majeure circumstances. Main reasons:

- loss of reporting prepared for the tax service according to Form Z;

- maintaining company accounting;

- to resolve disputes that may arise between the client and the seller;

- compliance with the client’s request for a refund of funds spent on the purchase of goods;

- to receive confirmation of successful payment for goods or services.

It is important to understand that the bank has the right to demand reporting from clients with whom agreements for acquiring services were concluded. According to the regulations, the company is obliged to provide checks to the bank within 3 business days.

The organization itself chooses where to store acquiring checks, because no additional requirements are set for this. The main thing is that the documents are readable and not damaged.

Useful article: Opening a current account in Vostochny Bank for individual entrepreneurs and LLCs. RKO tariffs.

How to properly store receipts?

Modern cash registers usually print receipts on thermal tape. The data printed on such a tape fades completely over time and nothing can be done about it. To prevent all important information from disappearing after a while, you must follow two simple rules.

- Make photocopies of receipts. In this case, the original is attached to a copy, which is certified by the responsible person and the company’s seal. Even if the check is completely faded, it is still valid in this form. A certificate report in form KM-6 must also be attached to the Z-report.

- Place receipts in a specific place, separating them by day or month for convenience.

Main types of documents

As of 2014, registration of any cash transactions is carried out on the basis of 6 main documents:

- receipt orders in form No. KO-1 , intended for registration of cash receipts to the cash desk;

- expense orders in form No. KO-2 , recording the issuance of cash from the cash register;

- cash book in form No. KO-4, which provides generalized information about the company’s cash transactions;

- book of accounting of funds accepted and issued by the cashier in form No. KO-5 , which is used to register the movement of funds between the main and other cashiers or proxies;

- payroll used for calculating and paying wages;

- payroll.

All these and other cash documents are subject to mandatory storage for the periods established by the archival legislation of the Russian Federation.

Is it necessary to record and store a Z-report for online cash registers?

› From July 1, 2021, all individual entrepreneurs and legal entities switched to online cash registers in accordance with Federal Law No. 54 of 2003. After the transition to the new system, individual entrepreneurs and organizations have the right to continue maintaining the old document flow or abandon it.

In this regard, the question arises: is it necessary to take a Z-report at the online cash register? Where to buy an online cash register Z-report or report with cancellation – this is the final document (check), which the cashier displays from the cash register when closing the shift.

The results are summed up, the data is reset, and after that you cannot perform cash transactions: returns, cancellations, etc. The cashier-operator takes out the cancellation report at the end of each shift, but at least every 24 hours, taking into account the following factors:

- When there is a day off and/or a pre-holiday day and the organization is not operating, reporting is not removed.

- If no trading operations were carried out on a certain business day, reporting is generated even with zero indicators. The cashier-operator puts dashes in the journal for the whole day. Does not make entries in the cash book.

Since all individual entrepreneurs and legal entities have switched to online cash register equipment, the new Z-reporting is slightly different from the usual one. The report on closing a shift in the online cash register lacks the following functions:

- Resetting data for each session;

- Recording the results in the fiscal memory of the cash register.

Z-reports from online cash registers are sent to the Federal Tax Service automatically. Important! In practice, when using a new type of cash register, the Z-report (final document) is called a shift closure report.

How to destroy expired documents

If cash documents have expired, they must be destroyed. It is necessary not only to get rid of documents, but also to arrange it correctly. For this purpose, an act “On the allocation for destruction of documents that are not subject to storage” is drawn up. It is signed by an expert commission, the composition of which must be approved by the head of the organization.

Acta – How to destroy expired documents

If there are a lot of documents to be destroyed, you do not need to indicate a complete list, but only their type. For example: advance reports for ____ year.

There are two ways to get rid of documents:

- on your own (if the volume of papers is small);

- with the help of a hired organization.

If you destroy papers yourself, you can use a shredder - it's quick and convenient.

What are the consequences of violating the storage period for cash documents?

If you get rid of a cash document confirming a business transaction ahead of schedule, tax authorities may deduct the corresponding expenses during audits. The result is additional taxes, penalties and fines.

In addition, for the absence of primary documents, inspectors can fine the taxpayer 10,000 rubles. (for primary violation) or 30,000 rubles. (if repeated) - in accordance with Art. 120 Tax Code of the Russian Federation.

There is also an administrative penalty for officials for violating the terms of storage of documents:

- fine under art. 15.11 Code of Administrative Offenses in the amount of 5,000-10,000 rubles. (for a primary offense), 10,000-20,000 rubles. or disqualification for a period of one to two years (for repeated violation);

- fine under art. 13.20 Code of Administrative Offenses in the amount of 300-500 rubles.

Regulatory regulation of the use of online cash registers

| Federal Law of May 22, 2003 N 54-FZ | use of cash registers |

| Directive of the Bank of Russia dated March 11, 2014 N 3210-U | procedure for conducting cash transactions |

| approved Ministry of Finance of the Russian Federation 08/30/1993 N 104 | operating rules for cash registers |

| Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132 | forms of primary documentation for accounting calculations |

| Letter of the Ministry of Finance of the Russian Federation dated January 25, 2017 N 03-01-15/3482 | is not subject to mandatory use of primary forms |

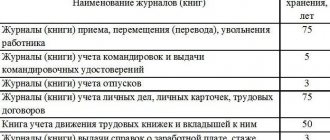

Storage periods and rules

According to current legislation, primary accounting documents, which include cash registers, have a retention period of 5 years. The countdown begins on January 1 of the year following the year in which their records are completed. Separately, it should be said about payroll statements. If employees do not have personal accounts, this type of cash documents must be stored for 75 years. After the established deadlines, all cash documentation can be destroyed or transferred to the archive, provided that there are no disputes, disagreements, investigative or judicial cases regarding it.

The prescribed procedure for storing cash documentation is based on the following basic rules:

- documents must be compiled and stitched for each day no later than the next working day or the first day off after the working day;

- control over the formation of cases is exercised either by the cashier or the head of the company;

- when creating a stitch, documents are selected in ascending order of personal account numbers (first by debit, then by credit);

- Before transferring cases to the archive, an inventory of documents is made.

The head of the organization is responsible for the safety of cash documentation. If the rules described above are not followed, he may be subject to administrative liability in the form of a fine from several thousand to hundreds of thousands of rubles.

That is why the organization of document storage at an enterprise should be treated with full responsibility. It is best to seek help from professionals - such as a large archival company with a good reputation and 10 years of experience in the market.

Corrections in cash documents

Strict reporting forms do not allow corrections. There should be no blots. The use of correctors is prohibited. Actions if there is an error:

- PKO/RKO . The cashier must cross out the damaged order and draw up another one. The crossed out form is attached to the cash register report for the day.

- Cash book . Eliminates erasers and correction fluids. The inscription with an error must be carefully crossed out, and a reliable number or text must be indicated above it. A note “Corrected” is made in the empty field next to it. Then the date of edit is put, the signature of the responsible persons with transcripts. Similar actions must be done with all copies.

Storage periods for cash receipts and fiscal storage in 2020

With the introduction of online cash registers, the seller does not need to save paper receipts, however, he is obliged to store the FN (fiscal drive) for 5 years from the moment its use is completed (Clause 2 of Article 5 of the Law of May 22, 2003 No. 54-FZ “On use of cash register equipment...").

Due to the fact that all information about purchases is recorded on the drive, the need to maintain and store the cashier-operator’s book has disappeared.

The situation is completely different when an organization acts not as a seller, but as a buyer - purchasing something for its needs and receiving a payment receipt issued by the supplier’s online cash register. In this case, the buyer keeps the check as the primary document confirming the transaction for 5 years after the end of the reporting year.

Paper checks fade quickly, so to fulfill the duty of storing them you can:

- ask the seller to send the check electronically (for this you need to provide an email address, phone number, read the QR code);

- Immediately make a copy of the check and file it with the original.

The data specified in the receipt or BSO must be readable for at least 6 months after the business transaction (Clause 8, Article 4.7 of Law No. 54-FZ).

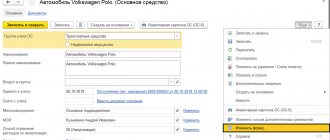

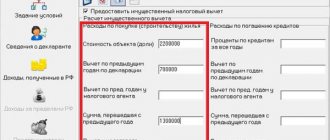

Features of 1C Accounting 8.3

Almost everywhere in organizations the 1c Enterprise program is used. One of its configurations was the 1C: Accounting 8.3 system. It allows you to automate accounting. The program generates a universal register “Cash Documents”. All basic money transactions are carried out from it. Registration of cash documents based on the register allows you to fully and accurately display information on transactions performed and postings on retail revenue.

Responsibility for storage

For failure to comply with storage periods for accounting documentation, administrative liability is provided:

| Code of Administrative Offenses | Offense | Fine (thousand rubles) | Who is punished |

| Article 15.11 | Absence of CD during storage periods at the time of the audit | 5–10 | Executive |

| Repeated offense | 10–20 or 1–2 years disqualification | ||

| Art.13.20 | Violation of the rules of storage, packaging, accounting or use | 0,1–0,3 | Citizens |

| 0,3–0,5 | Executive |

In 2021, the State Duma approved amendments to Article 15.15.6 of the Code of Administrative Offenses of the Russian Federation. The changes affected liability for violations related to budget reporting:

- failure to submit or submission in violation of deadlines – from 10,000 to 30,000 rubles;

- minor distortions of reporting data - from 1000 to 5000 rubles;

- significant distortion of reporting indicators – from 5,000 to 15,000 rubles;

- gross distortion of reporting data - from 15,000 to 30,000 rubles.

The main rules of cash discipline for individual entrepreneurs and LLCs

Here's what they include:

- Preparation of cash documents. For each receipt and each withdrawal of cash, relevant documents are drawn up.

- Compliance with cash limits. You cannot go beyond the designated maximum cash balance in the cash register at the end of the working day. The excess amount must be sent to the bank.

- Following the rules for issuing cash to employees. Simply put, you can only spend cash on certain purposes.

- Compliance with the limit on cash payments between two legal entities. The amount of 100 thousand rubles per contract is determined by the Directive of the Bank of Russia dated October 7, 2013 No. 3073-U.