Subordinate to the account “Settlements with suppliers and contractors” (60).

Account type: Passive.

Account type:

- Foreign exchange

- Tax

Analytics on the account “60.31”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Counterparties | No | Yes | Yes |

| Treaties | No | Yes | Yes |

| Documents of settlements with the counterparty | No | Yes | Yes |

Count 60

This account is used to summarize all transactions between the organization and its suppliers and contractors, such as:

- receipt of materials, goods or work;

- consumption of services, including data on used electricity, gas, water, etc.;

- payment for goods, works, services.

All delivery transactions are displayed regardless of whether payment has been made for them or not.

Attention! Account 60 is active-passive, that is, at the beginning and end of the analyzed time, both debit and credit balances can be displayed.

A more visual form of assessing interaction with suppliers for a period is the preparation of a balance sheet.

How to transfer a debt

To transfer an obligation, the original debtor and the organization to which the debt is transferred sign a corresponding agreement. And the creditor must put his mark on this agreement stating that he is not against the transfer. Such consent is required by paragraph 1 of Article 391 of the Civil Code of the Russian Federation.

Or you can enter into a tripartite agreement. The creditor's signature on it will mean his consent.

By default, the original and new debtors are jointly and severally liable to the creditor. That is, the creditor can demand that the debtors fulfill the obligation jointly. He also has the right to make such a demand to each of them separately.

At the same time, in the debt transfer agreement, the parties may also provide for subsidiary liability. It assumes that if the new debtor does not fulfill the demand, then the original debtor is obliged to fulfill it.

It is possible to completely release the original debtor from the obligation (clause 3 of Article 391 of the Civil Code of the Russian Federation).

Turnover - balance sheet for settlements with suppliers and contractors

Its formation is one of the key elements that makes it possible to control the document flow at the enterprise for further reporting to the tax authorities

Statement structure

In general, it is represented by the following figure:

Balance sheet for account 60

The first column contains the names of all sellers. The opening balance allows you to see debts and advances transferred previously. The debit balance indicates the transfers of funds made, for which there was no delivery of materials or the documents were not submitted to the accounting department on time; for a loan - the sum of all received inventory items, the purchase of which was not paid for.

During the period, current mutual settlements arise. Similarly to the balance, all payments are included in the debit turnover, and receipts are included in the credit turnover. The length of time for analysis is arbitrarily selected (from operations on one specific day to any arbitrarily chosen interval). The ending balance indicates any unresolved issues with supplies and allows you to clearly track document flow and payments.

Advice! When maintaining accounting in specialized software products, you can consider not only the general type of calculations, but also statements separately for advances paid and purchases.

Filling example

The organization purchased a new computer for 20,000 rubles. Under the terms of the agreement, payment can be made in installments of 5,000 rubles per month. In accounting, these actions are reflected in the following entries:

- Dt10 Kt 60 - 20000 received a computer from the supplier

- D60 Kt51 – 5000 transferred the first payment on the computer

Based on the results of checking mutual settlements, we see that the organization’s debt to the counterparty is 15,000 rubles at the end of the period. It is necessary to track debt data so that selling companies are interested in working with the company.

Errors that occur

In the era of active development of technology, the manual method of drawing invoices is almost never used, but various software products are widely used, the leaders of which are 1C developments. Accounting registers can be created in them to better analyze the status of all payments and receipts.

The advantage of using the balance sheet in 1C for control is the ability to analyze not only the general statement, but also to consider separately paid advances (60.02) and the resulting debt for received goods, works, services (60.01). In addition, from the statement you can go to account analysis specifically for transactions with a given counterparty and, if questions arise, immediately see the presence or absence of documents.

There are situations when the same amount falls into circulation at 60.01 and 60.02 and does not overlap. This may be due primarily to a violation of the sequence of documents. If re-execution does not change the situation, then you should pay attention to the possible linking of payments and receipts to various contracts or accounts.

How to create a balance sheet for account 60 in 1C can be seen in the video:

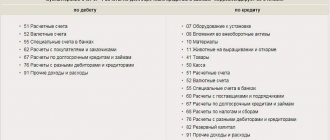

Debit correspondence

The account in question (76) by debit can correspond with the following: “Fixed assets” (01), “Equipment for installation” (07), “Income-generating investments in MC” (03), “Investments in non-current assets” (08), “ Intangible assets" (04). From the second section of the chart of accounts, it interacts with the items “Materials” (10), “Animals for growing and fattening” (11), “Procurement and acquisition of MC”.

Account 76 can correspond by debit with all items in the “Production Costs” section, as well as with accounts 44, 41, 45 and 43, in the “Finished Products and Goods” category. Postings are often made with cash accounts: 52, 50, 58, 51, 55, as well as with settlement accounts: 60, 67, 66, 62, 73, 70, 76, 71, 79. In addition, correspondence is carried out on debit with the following accounts : 99 (reflects profits and losses), 91 (records various income and expenses), 90 “Sales”, 97 “Deferred expenses”, 86 “Targeted financing”.

Settlements with buyers and customers

Buyers and customers for any organization are the key to receiving revenue. To expand their business and search for potential customers in a highly competitive market, sellers often resort not only to all kinds of discounts and promotions, but also to deferred payments. Here there is a need for daily checking of mutual settlements. All transactions with customers are recorded on account 62.

Attention! Account 62 is also active-passive, that is, at the beginning and end of the selected period of time, both debit and credit balances can be displayed.

Examples of business transactions (by debit)

Some examples from the table will help you understand the material presented in the article.

| Correspondence | Contents of a business transaction |

| D76 K20 | The cost of unfinished main production decreased due to debtors and creditors. This may be an accrual of debt to the insurance company due to an event (emergency or force majeure). |

| D76 K28 | Losses from defects are charged to the account for settlements with creditors and debtors. |

| D76 K60 | Receipt of debts to suppliers, according to documents confirming consent to the transfer of funds. |

| D76 K50 | Payment of funds to creditors in cash (from the cash register). |

| D76 K68-VAT | Identification of budget debt (for VAT) during the determination of revenue for taxation. |

| D76 K26 | General business expenses are compensated through various debtors and creditors. |

| D76 K43 | Accounting for debts from various debtors for finished products. |

| D76 K29 | The cost of work in progress servicing production decreased due to the transfer of funds to the organization from debtors. |

Score 62

All settlements with buyers and customers are formed on this account, namely:

- sold products of own production;

- goods sold;

- services provided;

- receiving advances against future deliveries;

- payment from buyers.

For a detailed consideration of settlements with customers, a balance sheet can also be used.

Subaccount 76.AV “Value added tax on advances and payments”

Account 76.AB allows you to summarize information on calculations for paying VAT from preliminary payments. Accounting is maintained with those customers and buyers from whom money has been received in advance for the planned shipment of goods or for the provision of various types of services.

Business transactions may be different. For example: D68.02 K76.AV – accounting for value added tax on payment received from the client in advance. D 76.AV K68.02 – VAT accrual on funds received in advance from customers. Account 76. AB has the following sub-accounts (analytical characteristics): “Counterparties”, “Invoices”.

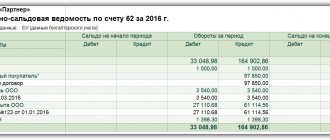

Turnover - balance sheet for settlements with customers

Allows you to summarize data for all customers to identify debts. As in settlements with suppliers, the balance sheet of 62 accounts makes it possible to analyze indicators for the period in a cross-section.

Structure

The debit balance at the beginning and end of the period indicates the unfulfilled terms of the agreement, i.e., obligations under the contract to customers were fulfilled, however, payment was not received. The credit balance indicates the presence of unshipped goods. Turnovers that record transactions during the selected time: by debit - shipment, by credit - incoming payments.

Filling example

The organization received an advance payment for its goods worth 10,000 rubles. The company shipped half of it. In accounting, movements under the terms of the contract can be represented by the following entries.

- Dt51 Kt 62 - 10000 advance payment received for future delivery

- D62 Kt 41 – 5000 first batch shipped

From the analysis of the statement, we can conclude that further shipment is necessary to close all obligations.

Video on how to create a balance sheet for account 62.

Account 76: subaccounts 3 and 4

Clause 76.3 controls dividends and other types of income due to the company that do not contradict the partnership agreement. D76 K91 – profit to be received (distributed). D51 K76 – funds received by the organization from debtors.

The fourth subaccount is intended to take into account amounts accrued to employees of the enterprise, but not paid within a certain period due to the non-appearance of recipients. In such cases, the following wiring is performed: D70 K76. When a worker receives money, an entry is made to the debit of account 76.

How to receive deposited salary?

If an employee of an enterprise missed the payment of wages, but wishes to receive it after returning to the workplace, he is obliged to declare his intentions in writing or orally to an accountant.

Wages are not always issued immediately after the employee’s application, so you can consider the following options:

- Receive a salary along with an advance.

- The disbursement of funds can occur on the day allocated at the enterprise for the payment of deposited salaries.

- Receive the deposited amount along with your next salary.

Problems with salary payments occur quite often. Many businesses strive to pay their employees on time. Depositing wages is a necessary condition for companies that pay their employees through the company's cash desk. Once you understand all the intricacies of depositing, you don’t have to worry about violations of the law.

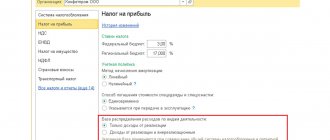

If you are a businessman and starting your own business, you will probably be faced with the need to pay VAT. What is VAT in simple words? Who pays this tax and at what rates? Read on our website.

We will discuss methods for calculating penalties at the refinancing rate in this material.

Example

Let's move from theory to practice, because after reading a lot of information, you don't always know exactly what to do.

In April 2013, employee I.P. Korneev 55,000 rubles were accrued. wages. Of these, 7,150 rubles. was deducted for personal income tax. Salaries are received within 3 working days. Payment deadlines are set for the 11th and 29th.

The company received the funds on April 29, but our employee fell ill and was not at work from April 27 to May 5. The following entries were made in the accounting department:

- D 44; To 70 – 55,000 rub. accrued wages.

- D 70; K 68 (sub-account “Calculation of personal income tax”) – 7,150 rubles. withholding for personal income tax.

- D 50; By 51 – 47,850 rub. salary as of April 29.

- D 68 (sub-account “Calculations for personal income tax”); K 51 – 7,150 rub. the personal income tax amount is transferred to the budget.

- D 70; K 76 (sub-account “Settlements on deposited amounts”) -47,850 rubles. deposited wages not received by employee (May 3).

- D 50; By 51 – 47,850 rub. the received amount to the cashier (May 6).

- D 76 (sub-account “Settlements on deposited amounts”); To 50 -47 850 – payment of wages to the employee (May 6).

It should be noted that personal income tax is transferred on the day the salary is paid if it is paid from cash proceeds.

Reports on accounts payable and receivable in the 1 C system

A company using the 1C: Enterprise 8 system must maintain a report on the amount of receivables from counterparties. You can get acquainted with the information if, after starting the program, you enter the “Counterparties” section. In the field that opens there is a list of organizations and individual entrepreneurs. Among them there are debtors and creditors. Contact information, invoices and contracts, work schedules - all this can always be viewed. It is from this menu that you can register a new organization that is part of the holding.

Finding out the exact debt of enterprises is not difficult. To do this, go to the “Debt under contracts” section, in the “Output debt” panel, select “Receivable” and set the required date. The user will see a list of all counterparties, from which you can select specific enterprises (with large debts). If there are many organizations and the entire list does not fit on one page, the information can be presented in a visual form. To do this, you will need to go to the “Diagram” section. Work with accounts payable is carried out in a similar way.

That's all you need to know about account 76, which reflects settlement transactions with debtors (creditors). Since the legislation of the Russian Federation is systematically changing, you should regularly use legal reference systems, which always have an up-to-date chart of accounts and PBUs. Then specialists will always be aware of any changes affecting their professional activities and will be able to make the right decisions when maintaining accounting records.

How to deposit salary?

Depositing has a number of features that you need to know.

This section presents the salary deposition algorithm:

- Check the period during which the company issues money. These deadlines are indicated in the manager’s order.

- If payment is not received on time, this must be noted in the documentation.

- If the enterprise uses a statement drawn up in form No. T-49, then in column 23 opposite the full name of the employee who missed the payments, you must leave the entry “Deposited”.

- If the company uses form No. T-52, then a similar mark must be made in column five.

- The statement must indicate the total amount deposited.

- After the end of the period for issuing money to employees, the remaining amount must be transferred to the bank. The deposited salary is reflected in the register.

It should be noted that there is no generally accepted registry form. You can compose it yourself in free form.

The employee, after returning to work, can demand his remuneration, and the company must pay it. The requirement can be expressed verbally or on paper. There is no specific deadline for a business to make a payment.

All transactions for the payment of deposited amounts of money are recorded in the register book, where the deposited amounts were previously reflected, next to the employee’s last name.

Employees of the enterprise have three years to receive their remuneration; after the expiration of this period, the entire deposited amount is transferred to the enterprise.

Deposit Features

Deposited salary is a monetary remuneration of an employee of an enterprise that was accrued for payment, but was not received by him within the period established by the organization.

Payroll escrow is simply keeping the employee's money in a company account.

This happens if the employee does not collect his money within the specified period. This may be due to employee illness, vacation or going on a business trip. The period for paying salaries to staff through the cash desk is determined by management. Depending on the number of employees, the period for issuing money may vary. However, it should not be more than 5 working days, this period includes the day of receiving cash from a bank account.

If after the expiration of the period there is money left in the cash register intended for payment of labor, it must be sent back to the company’s bank account. This is a mandatory requirement of the Central Bank.

Reflection in accounting

How to reflect deposited salary on the balance sheet? All transactions involving the distribution of funds must be reflected in the financial statements.

For this purpose, the principle of double entry is used. Accounting for deposited wages will consist of the following entries:

- Appearance of deposited funds Debit 70; Credit 76-4.

- Transferring money from the enterprise's cash desk back to the bank: Debit 51; Credit 50.

- Issuance of deposited payments to employees: Debit 76-4; Credit 50.

- If wage payments were not made after the deadline, then the entire amount is transferred to non-operating expenses: Debit 76-4; Credit 91.

All postings to deposited wages are made for the same amount.