By purchasing a patent, entrepreneurs receive permission for a certain type of activity in a specific territory. Patent activity is not subject to personal income tax, property tax and VAT (with the exception of the import of goods into the Russian Federation). There is no need to report “patent” income to the Federal Tax Service; it is enough to keep an accounting book for them.

What types of activities can you get a patent for? Their list is limited, mainly retail trade, catering, household and other services. We will talk in more detail about the types of patent activities in this article.

Fixed advance personal income tax payment for a work patent

As is known, visa-free foreign citizens working in Russia under a work patent must make monthly fixed advance payments on the patent - personal income tax tax, in order to extend its validity and be able to legally work in Russia further.

In other words, by paying for a patent a month in advance, a foreign citizen pays personal income tax on his work on the patent in the next month.

Thus, payment for a work patent by a foreign citizen must be made every month or several months in advance.

Important!

A fixed advance payment for a patent (personal income tax of a foreign citizen) must be made exactly within the allotted time. And in case of non-payment of personal income tax by a foreigner, as well as in the case of delay in payment of a patent even by 1 day, the work patent will be automatically revoked.

Important!

Be sure to keep all payment receipts for a work patent of a foreign citizen for each personal income tax payment for the entire period of validity of the document.

Cancellation of a patent in case of violation of the deadlines for payment of personal income tax under the patent

Today, the system for accounting for payment of income tax (fixed advance payments for a patent by foreign citizens) is fully automated, so the absence of an advance payment on a specific date leads to the automatic cancellation of a patent for work in the database of the Main Directorate for Migration of the Ministry of Internal Affairs.

Thus, if a fixed advance payment for a work patent in 2021 is made later than the date of receipt of the patent, even by one day, the document will be automatically canceled for late payment of the patent.

Monthly payment for a patent in 2021 - how much should you pay for a patent in 2021?

Many foreign citizens have already heard about changes in the cost of a patent for 2021, and therefore they are very interested in the question of whether it will change much and how much they need to pay for a patent in 2021.

We answer: the amount of payment for a patent in 2021 will change compared to 2021, since the deflator coefficient for 2017 for a patent has been changed, based on which the monthly patent tax for a foreign citizen is calculated.

Thus, on November 3, 2021, by order of the Ministry of Economic Development, the personal income tax deflator coefficient for 2021 was approved, which amounted to 1.625. Let us recall that last year, 2021, the personal income tax deflator coefficient was 1.514.

Accordingly, in 2021 the patent amount for foreign citizens has changed, and now the monthly payment for a patent in 2017 will be paid taking into account these changes.

The table below shows the monthly fixed cost of a patent for foreign citizens in 2021 for each region of the Russian Federation. How much NFDL should pay for a work patent to a foreign citizen in 2021 is displayed in the last column of this table.

In other words, in the last column of the table you can see the size of the fixed advance payment for a work patent for foreigners in 2021 by region of the Russian Federation.

You can download a table with information about how much a work patent will cost in 2021 using the link.

Which individual entrepreneur can switch to PSN?

- The number of employees does not exceed 15 people.

- The type of activity of an individual entrepreneur is allowed for the introduction of PSN. The list of activities is constantly updated and may differ in different regions. The most popular are hairdressing, tutoring and coaching services, tailoring and repair of clothes and shoes, repair of furniture and equipment, various production services, processing of agricultural products, catering, trade (sales area no more than 50 m²).

- The maximum income for all types of activities does not exceed 60 million rubles.

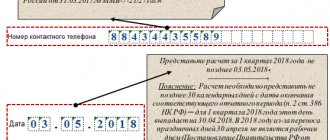

An example of calculating a patent for 2021 in Moscow

1200*1.623*2.1566=4200, Where 1200 is the base rate, 1.623 is the fixed personal income tax deflator coefficient for 2021, 2.1566 is the regional coefficient for Moscow for 2021, 4200 is the cost of paying for a patent in Moscow in 2021.

Now you know how to correctly calculate the cost of a patent for 2017 yourself and receive the amount of a fixed advance personal income tax payment to pay for the patent for the work.

If you found our article about changing the amount of advance personal income tax payment for a work patent in 2021 for foreign citizens useful, please like (+) the author or share with friends on social media. networks with information on how to correctly calculate the cost of a patent for 2021 and how much to pay for a patent for work in 2021.

Patent or UTII - which is more profitable for individual entrepreneurs?

To make the right choice between these two taxation systems, you must first understand how they differ from each other, what taxes they replace and under what conditions you can apply for them.

Patent tax system in 2021

This taxation system is suitable for individual entrepreneurs whose total number of employees is no more than 15 people (clause 5 of Article 346.43 of the Tax Code of the Russian Federation), and the total amount of annual income for all patents does not exceed 60 million rubles. (Clause 1, Clause 6, Article 346.45 of the Tax Code of the Russian Federation). In addition, there is one more significant limitation: the patent taxation system does not apply to types of business activities carried out under a simple partnership agreement (joint activity agreement) or a property trust management agreement (clause 6 of Article 346.43 of the Tax Code of the Russian Federation).

Types of activities and patent taxation system

In paragraph 2 of Art. 346.45 of the Tax Code of the Russian Federation includes 63 types of activities in respect of which this tax regime can be applied. These include hairdressing and beauty services, furniture repair, photo studio services, photo and film laboratories, home renovation, veterinary services, residential cleaning and housekeeping services, cook services for preparing dishes at home, etc.

What taxes does the patent system replace?

According to clause 10, clause 11 of Art. 346.43 of the Tax Code of the Russian Federation, those who make a choice in favor of the patent taxation system relieve themselves of the obligation to pay the following taxes:

- Personal income tax (in terms of income received from activities to which the patent system is applied);

- property tax for individuals (in terms of property used in carrying out activities to which the patent system is applied);

- VAT (exceptions: when carrying out activities in respect of which the patent tax system is not applied; when importing goods into the territory of the Russian Federation and other territories under its jurisdiction; when carrying out transactions taxed in accordance with Article 174.1 of the Tax Code of the Russian Federation).

Patent for individual entrepreneurs

To take advantage of the patent tax system, you need to obtain a patent. This document has several features:

- operates on the territory of the municipality, urban district, federal city or subject of the Russian Federation that is indicated in it (clause 1 of Article 346.45 of the Tax Code of the Russian Federation);

- with several types of entrepreneurial activity, an individual entrepreneur needs to acquire several patents - for each type of activity separately;

- the validity period of the patent is from 1 to 12 months (clause 5 of Article 346.45 of the Tax Code of the Russian Federation);

- an application for a patent is submitted no later than 10 days before the start of application of the taxation system - in person or through a representative. Can be sent by mail with a list of attachments or in electronic format;

- If a patent is issued for a period of less than a calendar year, the tax period is the period for which it was issued.

The patent form was approved by Order of the Federal Tax Service of Russia on November 26, 2014 No. ММВ-7-3/ [email protected]

How is tax calculated and paid under the patent tax system?

The cost of a patent is a fixed amount, which is calculated based on a tax rate of 6%.

However, the subjects of the Russian Federation, according to clause 3 of Art. 346.50 of the Tax Code of the Russian Federation, can establish a tax rate of 0% for newly registered individual entrepreneurs and individual entrepreneurs operating in the production, social, scientific spheres, as well as in the field of consumer services to the population. These tax holidays are valid until 2020.

If we assume that the patent validity period is 1 year, then the tax amount will be calculated according to the following formula:

tax amount = (tax base / 12 months X number of months of the period for which the patent was issued) X 6

If the validity period of the patent is less than 6 months, then payment is made in the amount of the full tax amount and no later than the expiration date of the patent.

If the patent validity period is from 6 to 12 months, then payment is made:

- in the amount of 1/3 of the tax amount and no later than 90 calendar days after the patent comes into effect;

- in the amount of 2/3 of the tax amount and no later than the expiration date of the patent.

The great advantage of the tax system is that it does not require the submission of a tax return, as stated in Art. 346.52 Tax Code of the Russian Federation.

In order to control the maximum amount of income, income is recorded in the income book. The Kontur.Elba service will generate a patent income ledger automatically. Use all the features of the service for 30 days free!

You can calculate the cost of a patent using a special service on the Federal Tax Service website.

Grounds for loss of right to regime

You can lose the right to the regime as a result of violating the established restrictions on the amount of annual income and the number of employees: if income exceeds 60 million rubles. and more than 15 employees.

In case of non-payment or incomplete payment of the tax, the tax authority, after the expiration of the established period, sends the individual entrepreneur a demand for payment of tax, penalties and fines.

UTII in 2021

Unlike the patent taxation system, the payers of which can only be individual entrepreneurs, UTII can be applied by both individual entrepreneurs and legal entities. At the same time, when calculating and paying UTII, they are guided by the amount of income imputed to them. That is, the amount of income actually received does not matter.

This taxation system applies to more than 10 types of business activities listed in clause 2 of Article 346.26 of the Tax Code of the Russian Federation. These include household and veterinary services, retail trade through the facilities of a stationary retail chain that does not have sales floors, public catering, etc.

To switch to UTII, an individual entrepreneur must meet a number of conditions (clause 2 of Article 346.26 of the Tax Code):

- the average number of personnel should not exceed 100 people;

- the activity is not carried out within the framework of a simple partnership agreement or a property trust management agreement;

- the regime was introduced on the territory of the municipality;

- leasing services for gas and gas filling stations are not provided;

- the local regulatory legal act mentions the type of activity being carried out.

In addition to those listed above, several other restrictions apply to legal entities:

- the share of participation of other persons is not more than 25%;

- the taxpayer does not belong to the largest category;

- the taxpayer is not an educational, health, or social security institution in terms of activities related to the provision of public catering services.

What taxes does UTII replace?

According to paragraph 4 of Art. 346.26 of the Tax Code of the Russian Federation, individual entrepreneurs who choose UTII do not pay, like those who are on a patent:

- Personal income tax (in relation to income received from business activities subject to a single tax);

- property tax for individuals, with the exception of cadastral tax (in relation to property used for business activities, subject to a single tax);

- VAT (in relation to transactions recognized as objects of taxation).

Calculation of individual entrepreneur tax on UTII

You can calculate the UTII tax for individual entrepreneurs using the formula:

UTII = basic yield X K1 X K2 X (F1+ F2+ F3) X 15%, where

BD - basic profitability (determined according to Article 346.29 of the Tax Code of the Russian Federation).

F1, F2, F3 - physical indicator. Each type of activity has its own.

K1 is a coefficient set by the government. In 2021 - 1.798, in 2021 - 1.868.

K2 is a coefficient set by local authorities.

15% is the UTII tax rate.

You can easily calculate the UTII tax for individual entrepreneurs using the Kontur.Elba service: just select the type of activity and indicate the size of the physical indicators. The system will automatically substitute the value of the base yield and coefficients.

Individual entrepreneurs on UTII can reduce the amount of tax calculated for the tax period by the amount of insurance premiums. However, the amount of such reduction cannot be more than 50% of the calculated tax. However, if an individual entrepreneur does not have employees, he has the right to reduce the amount of UTII by the amount of insurance contributions paid (for himself) in a fixed amount to compulsory health insurance and compulsory medical insurance without applying a limit of 50%.

The UTII declaration form was approved by Order of the Federal Tax Service of Russia dated July 4, 2014 N ММВ-7-3/ [email protected]

UTII or patent - which is better?

If we summarize all of the above, we end up with a large number of factors that influence the choice between UTII and a patent: from restrictions on the number of employees and turnover to types of activities and specifics of payment.

For example, if you are going to open your own business in Moscow or in the territories annexed to it, then UTII will not suit you at all. The fact is that this tax system has not been applied in Moscow since 2012 (Moscow Law No. 3 dated January 26, 2011). And in the territories annexed to Moscow, UTII has been abandoned since 2014 (part 2 of article 21 of the Moscow Law of September 26, 2012 No. 45).

You need to start your selection by checking the lists of activities that are subject to taxation systems. The authorities of the constituent entities of the Russian Federation “correct” them, so you need to take into account the peculiarities of regional legislation and clarify the information on the Federal Tax Service website. It is easy to see that many types of activities for UTII and patent overlap. However, there are subtleties in which they may differ. For example, the area of a sales area under UTII cannot exceed 150 square meters. m, and with a patent the area is limited to 50 square meters. m.

In addition, you need to take into account that the patent tax system has a turnover limit of 60 million rubles. per year, while no such restrictions are established for UTII.

But for individual entrepreneurs it is often important to minimize work with accounting documents. With a patent, everything seems simpler, but again, you need to pay attention to the subtleties. Firstly, the patent involves a flat tax, which is calculated based on a tax rate of 6%. That is, it has a value that does not depend on a number of indicators. But the cost of a patent is different in each region. Some regions provide tax holidays until 2021 for those who apply a patent. Therefore, information should be clarified locally.

As for the UTII tax, it depends on various physical indicators, including the number of employees, the area of retail premises, etc. The UTII tax is paid quarterly - until the 25th day of the month following the quarter.

An individual entrepreneur on UTII will have to prepare a tax return, while a business on a patent is relieved of this obligation, but must keep a book of income (Procedure for filling out the income book of individual entrepreneurs using the patent tax system).

The risk of losing a patent is associated with violation of the patent payment deadline. If the entrepreneur does not pay it on time, he will be subject to the general taxation system. Other difficulties arise with UTII - they are associated with calculations that frighten many entrepreneurs who have little understanding of such issues. But this work can always be entrusted to the electronic accountant Kontur.Elba - he will calculate the tax himself and prepare a report on UTII.

![My business [CPS] RU](https://nvvku.ru/wp-content/uploads/moe-delo-cps-ru-330x140.jpg)