How to determine the amount of damage

Before making a decision on compensation for damage by specific employees, the employer is obliged to conduct an inspection to establish the amount of damage and the reasons for its occurrence (Article 247 of the Labor Code of the Russian Federation).

For this purpose, a commission is created, which may, if necessary, include third-party specialists. To establish the cause of the damage, a written explanation is taken from the employee. If the employee refuses or evades providing an explanation, a report is drawn up.

The amount of damage is determined by actual losses based on market prices for the corresponding material assets operating in the area on the day the damage was caused. In this case, the amount of damage cannot be lower than the value of the property according to accounting data, taking into account the degree of its wear and tear (Article 246 of the Labor Code of the Russian Federation).

Damage caused by an employee to third parties includes all amounts paid by the employer to third parties to compensate for damage. In this case, the employee can be held liable only within these amounts and subject to the existence of a cause-and-effect relationship between his culpable actions (inaction) and causing damage to third parties (clause

The employee has the right to familiarize himself with the results of the inspection conducted by the employer and appeal them to the labor dispute commission or in court (Articles 247, 381, 382 of the Labor Code of the Russian Federation).

Let's look at specific examples of how the operations of causing and compensating for damage by an employee (in full and in the amount of average earnings), as well as the employer's refusal to compensate for damage, are reflected in accounting and what tax consequences they have.

Let's say there is a shortage of goods in a warehouse. The actual cost of missing goods, according to the organization’s accounting records, is 70,000 rubles. Their market value at the time the shortage was identified was 80,000 rubles. The commission created by the employer assessed the amount of damage at 80,000 rubles.

The average monthly salary of a storekeeper is 30,000 rubles. Since the amount of damage (RUB 80,000) exceeds this amount, the organization can recover damages only through the court.

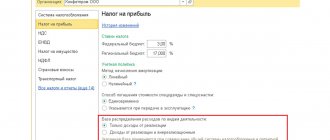

Tax accounting. For the purpose of calculating income tax, the amount of compensation by the employee for the damage caused is included in non-operating income on the basis of clause 3 of Art. 250 of the Tax Code of the Russian Federation on the date of entry into force of the court decision or on the date of recognition of the debt by the debtor (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

The Tax Code does not have a special rule for accounting for expenses in the form of shortages of material assets in the presence of culprits. According to the Ministry of Finance of Russia, in connection with the recognition of non-operating income in the form of amounts received from the guilty person to compensate for the loss, the taxpayer has the right to include in expenses the cost of lost property on the basis of subsection. 20 clause 1 art.

Thus, on the date of entry into force of the court decision, the organization will include in non-operating income the amount of compensation for damage by the employee in the amount of 80,000 rubles, and in non-operating expenses - the actual cost of disposed goods in the amount of 70,000 rubles.

VAT. In its letters, the Russian Ministry of Finance has repeatedly explained that if property is disposed of for reasons not related to sale or gratuitous transfer (for example, due to loss, damage, battle, theft, natural disaster, obsolescence of goods, etc.), VAT on this the property needs to be restored (see

We suggest you read: When debt collectors sue debtors

, for example, letter dated January 21, 2016 No. 03-03-06/1/1997). Financiers explain their position by saying that such disposal is not subject to VAT taxation. And since VAT on acquired property is deductible only if it is used in transactions subject to VAT, the previously deductible tax must be restored.

However, the Federal Tax Service of Russia has a different opinion on this matter. In a letter dated May 21, 2015 No. GD-4-3/ [email protected], the tax authorities indicated that on the issue of VAT restoration upon disposal of property for reasons unrelated to sale, one must be guided by the position of the Supreme Arbitration Court of the Russian Federation, set out in the decision dated October 23, 2006 No. 10652/06. It lies in the fact that in cases not listed in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts are not subject to recovery.

Thus, since in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation does not contain a requirement to restore VAT on identified shortages; it is not necessary to restore VAT on missing goods.

Debit 94 Credit 41

— 70,000 rub. — a shortage of goods in the warehouse was identified;

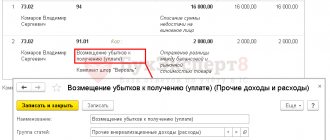

Debit 73-2 Credit 94

— 70,000 rub. — the warehouseman’s debt for damages in the amount of the actual cost of the missing goods is taken into account;

Debit 73-2 Credit 98

— 10,000 rub. — the warehouseman’s debt for damages is taken into account in the amount of the excess of the market price of the missing goods over their actual cost.

Please note that according to Art. 232 of the Labor Code of the Russian Federation, termination of an employment contract after causing damage does not entail the release of the party to this contract from financial liability provided for by the Labor Code of the Russian Federation or other federal laws. And if the employee leaves the organization, the amount of his debt for damages will still be listed as the debit of account 73, since it is his pledge as an employee of the enterprise;

Debit 98 Credit 91-1

— 10,000 rub. — other income is taken into account in the form of the excess of the market price of missing goods over their actual cost;

Debit 51 (50) Credit 73-2

— 80,000 rub. - compensation for damages has been received from the employee.

As you can see, in accounting, income arises only in part of the amount of damages attributable to the excess of the market price of the missing goods over their actual cost (10,000 rubles). At the same time, the organization does not have any expenses in connection with writing off the cost of missing goods. After all, their cost is fully covered by the amount of compensation for damage.

Debit 68 Credit 99

— 14,000 rub. — PNA was formed;

Debit 99 Credit 68

— 14,000 rub. — PNO was formed.

Postings are made on the date of recognition of income and expenses in tax accounting.

compensation for damage in the amount of average earnings

Let’s say that during the transportation of goods from one warehouse to another, a loss of goods in the amount of 70,000 rubles occurred. The market value of lost goods at the time the shortage was identified is RUB 80,000. A commission created by the employer found the driver of the organization transporting goods guilty of the shortage. The driver is not one of the persons with whom an agreement on full financial liability can be concluded, since such a position is not on the List. Therefore, the employer has the right to recover damages only in the amount of the driver’s average monthly earnings.

Let's assume that the average driver's earnings are 30,000 rubles. The driver admitted the duty to compensate for damages. Compensation for damage is made by deductions from the driver’s salary in the amount of 20% of the amount remaining after taxes are withheld. The driver’s salary minus personal income tax is 26,100 rubles. (RUB 30,000 – 13%).

We suggest you familiarize yourself with: What amount of interest should be indicated in 3 personal income taxes || What amount of interest should be indicated in 3 personal income taxes?

Tax accounting. The amount of damage to be compensated by the driver (RUB 30,000) is organized on the basis of clause 3 of Art. 250 of the Tax Code of the Russian Federation will be taken into account as part of non-operating income on the date of receipt from the driver of the entry in the order to recover damages that he recognizes the debt.

Now let's look at the cost of missing goods. In a letter dated August 27, 2014 No. 03-03-06/1/42717, the Russian Ministry of Finance explained that in a situation where the guilty person is discovered, the organization can present him with a claim for compensation for losses. At the same time, in connection with the recognition of non-operating income in the form of amounts received in compensation for losses, the taxpayer has the right to recognize as expenses the cost of lost property on the basis of subparagraph. 20 clause 1 art. 265 Tax Code of the Russian Federation.

As you can see, financiers link the right to recognize the cost of lost property as expenses with the fact of filing a claim against the guilty party for compensation for losses and receiving such compensation, but not with its amount. In the situation under consideration, the organization presented a demand to the guilty party for compensation for losses in the maximum possible amount permitted by law. Therefore, she has the right to include the cost of missing goods in non-operating expenses on the basis of subparagraph. 20 clause 1 art. 265 Tax Code of the Russian Federation.

Compensation for material damage. The procedure for reflection in accounting

Let's consider typical entries that reflect in the organization's accounting records the shortages (surpluses) of inventory items identified as a result of the inventory:

- Shortages, surpluses of goods - accounting entries;

- Shortages and surpluses of materials - the order of reflection in accounting.

If the amount of recovery from the guilty parties is greater than the book value of the missing property, then the difference between them is the organization’s income. According to clause 16 of PBU 9/99, these incomes are recognized in accounting as they are generated and identified, and in tax accounting, according to clauses. 4 p. 4 art. 271 of the Tax Code of the Russian Federation, as the debt is recognized by the debtor or on the basis of a court decision that has entered into legal force. Thus, we can consider the moment of recognition of income from compensation for damage in excess of the book value to be the same in accounting and tax accounting and reflect this income in the debit of account 73.02 from the credit of account 91.

Write-off of shortage within normal limits

Shortages within the limits of natural loss are written off as production or sales costs. Write-offs are carried out from accounts intended for recording material assets into expenses by type of production, using account 94:

- Dt 94 Kt 10 (41, 43..);

- Dt 20 (23, 44..) Kt 94.

By analogy with shortages, the write-off of losses from defects is reflected in the accounting entry in the debit of accounts 20, 23, 29, etc. and account credit 28, depending on in which production they are identified: main, auxiliary, servicing. If the culprit of the marriage is identified, the losses are attributed to the guilty person: Dt 73 Kt28.

The culprit of excess losses may or may not be identified. Let's consider how, depending on the result of the search for the culprits, shortages are written off.

If the culprit of the shortage is identified, he is obliged to compensate for the damage caused to the enterprise. When a shortage is written off in accounting to the guilty party, the posting is made as follows: Dt 73 Kt 94.

The difference between the amount recovered for the identified deficiency and the value recorded in the accounting records is applied to deferred income: Dt 73 Kt 98. Writing off the amount of the difference that is recovered from the culprit with the book value of the valuables is recorded in the accounting record: Dt 98 Kt 91-1.

If the amount of compensation for the shortfall exceeds the book value, the difference must be additionally reflected in other income:

- Dt 73-02 Kt 94 – compensation by the culprit for missing valuables within the book value;

- Dt 73-02 Kt 91-1 – the difference between the reimbursable amount and the value of the property on the balance sheet.

The procedure for writing off losses in the absence of the culprit is to attribute the identified shortage to the financial result by making an entry: Dt 91-02 Kt 94. The basis document is an accounting statement-calculation.

Shortages of property assets are written off in the financial results of an enterprise in the following cases:

- inability to identify the perpetrators;

- refusal of the court to recover damages.

Thus, the shortage of material assets at the enterprise can be written off as part of natural loss, to the identified culprit, or to the financial result if the culprit could not be identified.

We invite you to familiarize yourself with: Speed up the work of bailiffs sample and application form

Damage recovery procedure and special commission

If damage is detected, the employer is obliged to establish its size and cause (Article 247 of the Labor Code of the Russian Federation). In accordance with this article, before making a decision on compensation for damage by specific employees, the employer is obliged to conduct an inspection to establish the amount of damage caused and the reasons for its occurrence.

To conduct such a check, the employer has the right to create a commission with the participation of relevant specialists.

In the order to create a commission, drawn up in any form and signed by the head of the organization, positions and full names should be indicated. all inspectors, as well as the period within which they must complete the inspection.

The special commission must establish and confirm:

— the exact amount of damage;

— the possibility of bringing a specific employee to financial responsibility.

Written explanation from the employee

To establish the cause of damage, employees using damaged (destroyed) property must provide a written explanation, indicating all the circumstances of the incident. In case of refusal or evasion of the employee from providing this explanation, a report is drawn up.

If an employee of an enterprise does not admit his guilt in causing damage or refuses to compensate for it, then the organization should go to court.

Full financial responsibility

The employee’s financial liability is limited to his average monthly earnings (Article 241 of the Labor Code of the Russian Federation). And only in cases of full financial liability, the list of which is given in Art. 243 of the Labor Code of the Russian Federation, the employee is obliged to compensate for the damage caused in full. Cases of full financial liability, in particular, include the shortage of valuables entrusted to the employee on the basis of a special written agreement or received by him under a one-time document, causing damage as a result of an administrative violation established by the relevant government body, causing damage while intoxicated or intentionally.

Please note that an agreement on full financial liability can only be concluded with employees whose position or work is included in the List of positions and works replaced or performed by employees with whom the employer can enter into written agreements on full individual or collective (team) financial liability, approved by resolution of the Ministry of Labor of Russia dated December 31.

2002 No. 85 (hereinafter referred to as the List). This follows from the provisions of Art. 244 Labor Code of the Russian Federation. If the employee’s work or position is not included in the List, recovery of damage caused is carried out in the amount of average monthly earnings, even if an agreement on full financial liability has been concluded with the employee (Decision of the Supreme Court of the Russian Federation dated November 19, 2009 No. 18-B09-72).

The procedure for calculating the amount of deduction from an employee

The amount of damage caused to the employer in the event of loss and damage to property is determined by actual losses, calculated on the basis of market prices prevailing in the specified area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of wear and tear of this property (Article 246 Labor Code of the Russian Federation).

As a general rule, an employee bears financial responsibility within the limits of his average monthly earnings (Article 241 of the Labor Code of the Russian Federation). At the same time, the total amount of deductions cannot exceed 20% of the paid wages remaining after taxes are withheld (Article 138 of the Labor Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated August 14, 2018 No. AS-4-20/15707).

Thus, if, for example, the amount of damage caused by an employee was 45,000 rubles, and his salary was 50,000 rubles, then the employer will be able to deduct no more than 8,700 rubles from his salary every month. ((RUB 50,000 – (RUB 50,000 × 13%)) × 20%).

In this case, damage in the amount of average monthly earnings will be compensated for 6 months. In this case, the amount of the last deduction will be 1,500 rubles. (45,000 rub. – (8,700 rub. × 5 months)).

Calculations for the purpose of using CCP

The definition of the term “settlements” is given in Article 1.1 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Law No. 54-FZ).

This definition includes any non-cash payments, as well as operations to offset advances, “commodity” loans and barter.

Calculations include:

- acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, works, services;

- accepting bets, interactive bets and paying out funds in the form of winnings when carrying out activities related to organizing and conducting gambling, as well as accepting funds when selling lottery tickets, electronic lottery tickets, accepting lottery bets and paying out funds in the form of winnings when carrying out activities related to organizing and conducting lotteries;

- acceptance (receipt) and payment of funds in the form of advance payment and (or) advances, offset and return of advance payment and (or) advances;

- provision and repayment of loans to pay for goods, works, services (including pawnshops lending to citizens secured by things belonging to citizens and activities for storing things);

- providing or receiving other consideration for goods, works, services.

Thus, when receiving payment for operations related to the sale of goods, performance of work or provision of services, as well as other operations specified in this closed list, it is required to use cash register systems.